Key Insights

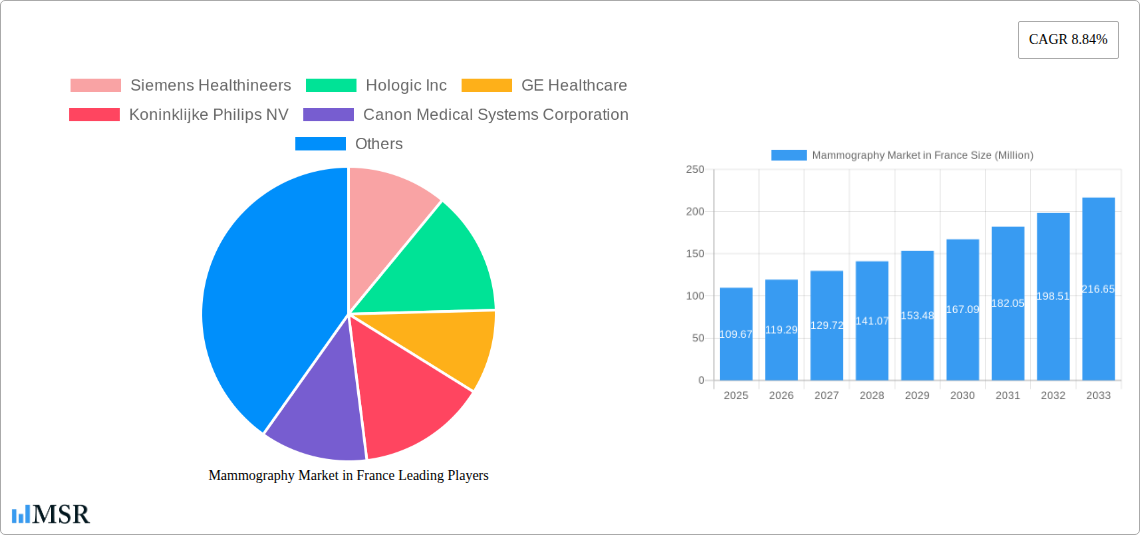

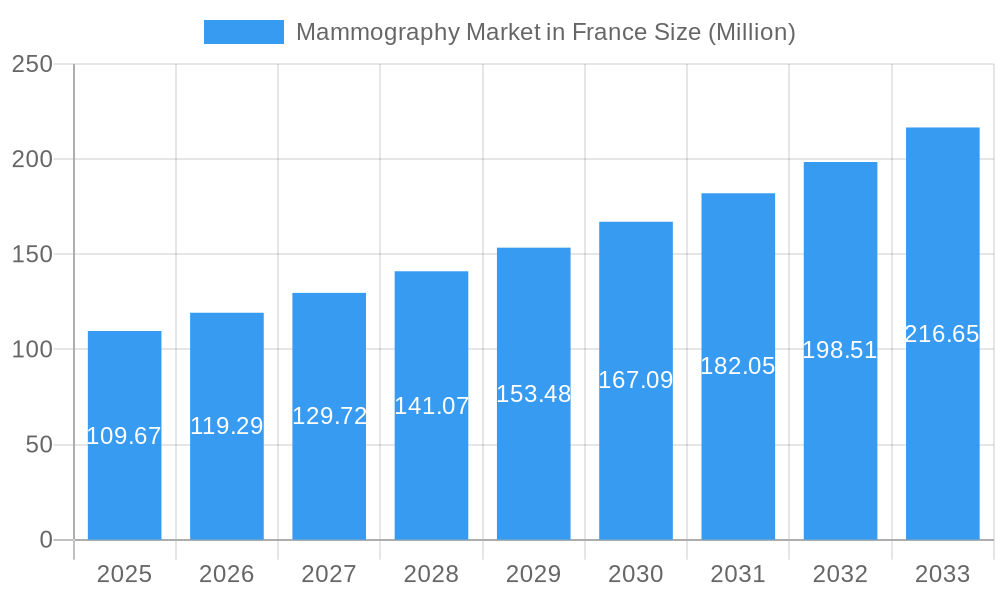

The mammography market in France is poised for significant growth, projected to reach approximately €109.67 million, driven by an impressive Compound Annual Growth Rate (CAGR) of 8.84% over the forecast period of 2025-2033. This robust expansion is largely fueled by increasing awareness surrounding breast cancer, advancements in imaging technology, and supportive government initiatives aimed at early detection and screening programs. The growing prevalence of breast cancer, coupled with an aging population, further amplifies the demand for sophisticated mammography solutions. France, being a leader in healthcare infrastructure and adoption of new medical technologies within Europe, presents a fertile ground for market players. The emphasis on digital mammography systems, including advanced features like Digital Breast Tomosynthesis (DBT), is a prominent trend. DBT, offering superior visualization of dense breast tissue, is increasingly being favored by radiologists and clinicians for its enhanced diagnostic accuracy, thereby driving the demand for these premium products. The market's trajectory is further supported by ongoing research and development efforts focused on improving image quality, reducing radiation exposure, and enhancing patient comfort.

Mammography Market in France Market Size (In Million)

The competitive landscape in France is characterized by the presence of global mammography giants alongside innovative local players, all vying for market share. Key companies such as Siemens Healthineers, Hologic Inc., GE Healthcare, and Koninklijke Philips NV are expected to play a crucial role in shaping market dynamics through their extensive product portfolios and strategic collaborations. The market is segmented by product type, with digital systems, particularly DBT, capturing a substantial share due to their superior diagnostic capabilities. End-user segments like hospitals and diagnostic centers are the primary consumers, driven by the need for advanced screening and diagnostic tools. While the market is experiencing robust growth, potential restraints could include the high initial investment cost for advanced mammography equipment and the need for skilled personnel to operate and interpret the complex imaging data. However, these are likely to be mitigated by favorable reimbursement policies and increasing healthcare expenditure in France, ensuring sustained market expansion.

Mammography Market in France Company Market Share

**Unlock critical insights into France's burgeoning mammography market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into market dynamics, industry trends, key segments, product innovations, challenges, growth drivers, and emerging opportunities. Essential for stakeholders in the medical imaging and healthcare sectors, this report provides actionable intelligence on the *French mammography market*, *breast cancer screening technologies*, and *diagnostic imaging solutions* in France.**

Mammography Market in France Market Concentration & Dynamics

The mammography market in France exhibits a moderately concentrated landscape, driven by a few dominant global players and a growing number of innovative local and international companies. Key contributors include Siemens Healthineers, Hologic Inc., GE Healthcare, Koninklijke Philips NV, Canon Medical Systems Corporation, Planmed Oy, Carestream Health Inc, Olea Medical, and Fujifilm Holdings Corporation. The innovation ecosystem is robust, fueled by continuous research and development in digital mammography and breast tomosynthesis, aimed at improving diagnostic accuracy and patient comfort. Regulatory frameworks, overseen by agencies like the HAS (Haute Autorité de Santé), emphasize stringent quality control and efficacy for mammography equipment and screening programs. Substitute products, such as MRI and ultrasound for specific diagnostic needs, exist but do not fully replace the role of mammography in routine screening. End-user trends indicate a growing preference for advanced digital mammography systems and 3D mammography (breast tomosynthesis) due to their superior diagnostic capabilities. Merger and acquisition (M&A) activities, while not overly frequent, have historically aimed at consolidating market share and acquiring innovative technologies, with an estimated xx M&A deals observed during the historical period. This dynamic environment necessitates continuous adaptation by market participants to maintain competitive advantage in the French medical imaging market.

Mammography Market in France Industry Insights & Trends

The mammography market in France is poised for significant growth, projected to reach an estimated market size of USD 5XX Million by 2033, with a Compound Annual Growth Rate (CAGR) of approximately X.XX% from the base year of 2025. This expansion is primarily fueled by increasing government initiatives to promote early breast cancer detection, rising awareness among women about the importance of regular mammography screenings, and the persistent need to address the growing incidence of breast cancer in the country. Technological advancements are acting as substantial market drivers. The transition from analog mammography to digital systems, and subsequently to the more advanced breast tomosynthesis (3D mammography), has been a pivotal trend. These technologies offer enhanced visualization of breast tissue, leading to improved detection rates of subtle abnormalities and reduced callback rates for unnecessary biopsies. Furthermore, the integration of Artificial Intelligence (AI) in mammography interpretation is revolutionizing diagnostic workflows, promising faster and more accurate readings. Evolving consumer behaviors, influenced by greater access to health information and a proactive approach to personal well-being, are also contributing to the demand for advanced mammography services. The focus on preventative healthcare, coupled with supportive reimbursement policies for screening programs, further solidifies the positive trajectory of the mammography market in France. The market is also witnessing a trend towards more patient-centric solutions, with manufacturers focusing on developing systems that minimize radiation exposure and enhance patient comfort during the examination. The overall industry landscape is characterized by a strong emphasis on innovation and the adoption of cutting-edge technologies to combat breast cancer effectively.

Key Markets & Segments Leading Mammography Market in France

The mammography market in France is predominantly led by the Digital Systems segment within the Product Type category, which is expected to maintain its leading position throughout the forecast period. This dominance is attributed to several key drivers, including the superior image quality, reduced radiation dose, and enhanced workflow efficiency offered by these systems compared to their analog counterparts. Economic growth within France and the continuous expansion of its healthcare infrastructure, particularly in urban centers, provide a fertile ground for the adoption of advanced digital mammography.

- Digital Systems: This segment holds the largest market share due to its widespread adoption in diagnostic centers and hospitals. The demand is further propelled by replacement cycles of older analog machines and the increasing preference for high-resolution imaging essential for early cancer detection.

- Breast Tomosynthesis (3D Mammography): While currently a smaller segment than digital mammography, breast tomosynthesis is the fastest-growing segment. Its ability to overcome the limitations of overlapping tissue in conventional 2D mammograms makes it invaluable for detecting cancers in dense breast tissue. Government and private healthcare providers are increasingly investing in this technology to enhance diagnostic accuracy.

- Hospitals: As the primary end-users, hospitals contribute significantly to the mammography market in France. Their large patient volumes, comprehensive diagnostic capabilities, and ability to invest in high-end equipment make them key consumers of advanced mammography solutions.

- Diagnostic Centers: These specialized centers are also crucial to the market, offering dedicated breast imaging services. Their focus on mammography and related diagnostic procedures drives the demand for efficient and accurate mammography equipment.

The dominance of these segments is further reinforced by continuous technological advancements and supportive healthcare policies aimed at improving breast cancer outcomes. The increasing prevalence of breast cancer, coupled with a proactive approach to screening, ensures sustained demand for these advanced mammography solutions across France.

Mammography Market in France Product Developments

Recent product developments in the French mammography market underscore a strong commitment to enhancing diagnostic accuracy and patient care. Innovations are primarily focused on improving imaging resolution, reducing radiation exposure, and integrating AI-powered analysis tools. For instance, the unveiling of the latest generation of ProFound AI for 2D Mammography at the Journées Francophones de Radiologie (JFR) meeting in Paris signifies a leap in performance, offering up to 4% increased sensitivity and 10% improved specificity, alongside a remarkable 40% faster processing time. This advancement highlights the trend towards smarter, more efficient AI-driven mammography solutions, which directly translate to quicker diagnoses and improved patient throughput. Companies are also focusing on developing more comfortable and accessible screening options, as exemplified by the introduction of 'Mammobus' services, mobile units that bring breast cancer screenings directly to underserved communities. These developments collectively enhance the market's competitive edge and contribute to better breast health outcomes in France.

Challenges in the Mammography Market in France Market

The mammography market in France faces several challenges that could temper its growth trajectory. High initial investment costs for advanced digital mammography systems and breast tomosynthesis equipment can be a significant barrier for smaller clinics and hospitals, particularly in resource-constrained regions. Stringent regulatory approvals and reimbursement policies, while crucial for patient safety, can also lead to longer product adoption cycles. Furthermore, a shortage of skilled radiographers and radiologists proficient in interpreting complex mammographic images, especially from newer technologies, poses an operational challenge. Competitive pressures among leading manufacturers for market share can also lead to pricing pressures, impacting profit margins.

Forces Driving Mammography Market in France Growth

Several key forces are driving the robust growth of the mammography market in France. A primary driver is the sustained and increasing prevalence of breast cancer, necessitating comprehensive screening and diagnostic programs. Government initiatives and public health campaigns promoting early detection play a crucial role, encouraging higher screening participation rates. The continuous technological evolution, particularly the adoption of digital mammography and 3D mammography (breast tomosynthesis), offers superior diagnostic capabilities, thereby increasing demand for these advanced systems. Economic stability within France allows healthcare providers to invest in advanced medical equipment, further bolstering market expansion. The growing awareness among women about the importance of regular breast cancer screenings is also a significant contributing factor.

Challenges in the Mammography Market in France Market

Addressing long-term growth in the mammography market in France hinges on overcoming specific hurdles and capitalizing on evolving trends. The continuous need for substantial capital investment in upgrading to the latest mammography technology, including AI-enabled systems, remains a significant consideration for healthcare providers. Ensuring equitable access to these advanced diagnostic tools across all regions of France, including rural and underserved areas, is crucial for a comprehensive national breast cancer strategy. Developing and retaining a skilled workforce capable of operating and interpreting complex mammographic data is another vital long-term catalyst. Furthermore, evolving diagnostic needs and the potential for emerging screening modalities necessitate ongoing research and development to maintain the relevance and efficacy of mammography.

Emerging Opportunities in Mammography Market in France

The mammography market in France presents several promising emerging opportunities for growth and innovation. The increasing integration of Artificial Intelligence (AI) in mammography analysis represents a significant frontier, offering enhanced accuracy, speed, and early detection capabilities. Expansion of mobile mammography units and screening programs, like the 'Mammobus' initiative, provides an opportunity to reach underserved populations and improve overall screening coverage. Growing demand for minimally invasive diagnostic procedures and personalized treatment pathways will also influence the development of advanced mammography imaging techniques and associated software. Furthermore, collaborations between technology providers, healthcare institutions, and research bodies can accelerate the development and adoption of next-generation breast imaging technologies tailored to the specific needs of the French population.

Leading Players in the Mammography Market in France Sector

- Siemens Healthineers

- Hologic Inc.

- GE Healthcare

- Koninklijke Philips NV

- Canon Medical Systems Corporation

- Planmed Oy

- Carestream Health Inc

- Olea Medical

- Fujifilm Holdings Corporation

Key Milestones in Mammography Market in France Industry

- October 2021: iCAD Inc. unveiled the latest generation of ProFound AI for 2D Mammography at the Journées Francophones de Radiologie (JFR) meeting in Paris, announcing performance improvements of up to 4% increased sensitivity, up to 10% improved specificity, and up to 40% faster processing.

- October 2021: The 'Mammobus,' a free mammography consulting bus, began providing breast cancer screenings in working-class Paris suburbs, increasing accessibility to essential healthcare services.

Strategic Outlook for Mammography Market in France Market

The strategic outlook for the mammography market in France is exceptionally positive, driven by a convergence of technological advancement, increased healthcare awareness, and supportive public health policies. The ongoing transition towards AI-integrated digital mammography and the widespread adoption of breast tomosynthesis will continue to shape the market, enhancing diagnostic precision and patient outcomes. Strategic opportunities lie in expanding access to these advanced technologies through innovative financing models and mobile screening solutions, particularly targeting underserved regions. Partnerships between medical imaging companies and research institutions will be crucial for developing next-generation breast cancer screening tools that cater to evolving clinical needs. The focus on preventative healthcare and early detection will remain a central growth accelerator, ensuring sustained demand for high-quality mammography services in France.

Mammography Market in France Segmentation

-

1. Product Type

- 1.1. Digital Systems

- 1.2. Analog Systems

- 1.3. Breast Tomosynthesis

- 1.4. Other Product Types

-

2. End User

- 2.1. Hospitals

- 2.2. Specialty Clinics

- 2.3. Diagnostic Centers

Mammography Market in France Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

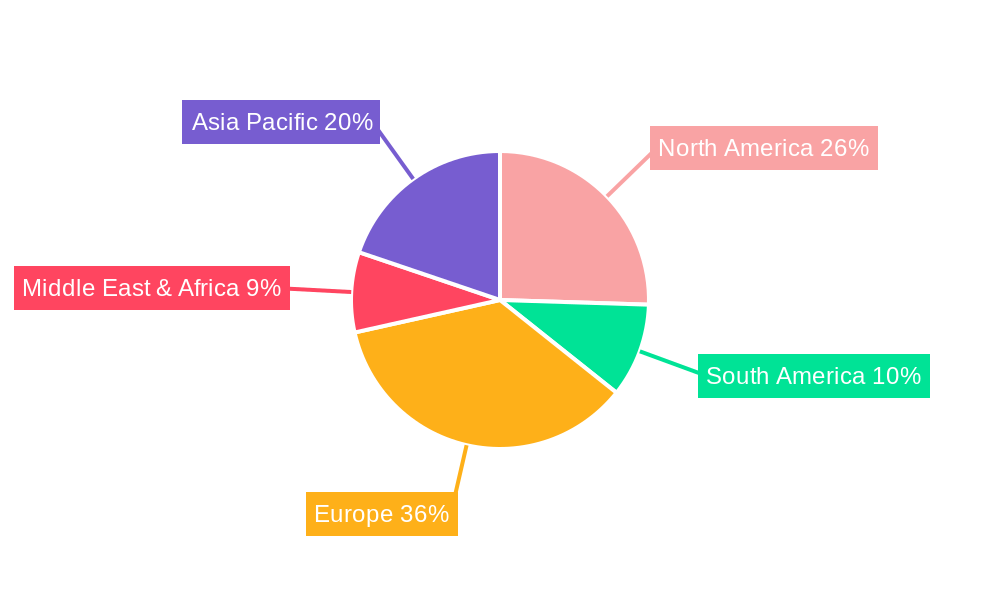

Mammography Market in France Regional Market Share

Geographic Coverage of Mammography Market in France

Mammography Market in France REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging

- 3.3. Market Restrains

- 3.3.1. Risk of Adverse Effects from Radiation Exposure

- 3.4. Market Trends

- 3.4.1. Breast Tomosynthesis is Expected to Witness Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mammography Market in France Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Digital Systems

- 5.1.2. Analog Systems

- 5.1.3. Breast Tomosynthesis

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Specialty Clinics

- 5.2.3. Diagnostic Centers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Mammography Market in France Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Digital Systems

- 6.1.2. Analog Systems

- 6.1.3. Breast Tomosynthesis

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Specialty Clinics

- 6.2.3. Diagnostic Centers

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Mammography Market in France Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Digital Systems

- 7.1.2. Analog Systems

- 7.1.3. Breast Tomosynthesis

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Specialty Clinics

- 7.2.3. Diagnostic Centers

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Mammography Market in France Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Digital Systems

- 8.1.2. Analog Systems

- 8.1.3. Breast Tomosynthesis

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Specialty Clinics

- 8.2.3. Diagnostic Centers

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Mammography Market in France Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Digital Systems

- 9.1.2. Analog Systems

- 9.1.3. Breast Tomosynthesis

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Specialty Clinics

- 9.2.3. Diagnostic Centers

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Mammography Market in France Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Digital Systems

- 10.1.2. Analog Systems

- 10.1.3. Breast Tomosynthesis

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals

- 10.2.2. Specialty Clinics

- 10.2.3. Diagnostic Centers

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Siemens Healthineers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hologic Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Koninklijke Philips NV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Canon Medical Systems Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Planmed Oy

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carestream Health Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Olea Medical*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fujifilm Holdings Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Siemens Healthineers

List of Figures

- Figure 1: Global Mammography Market in France Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Mammography Market in France Volume Breakdown (Piece, %) by Region 2025 & 2033

- Figure 3: France Mammography Market in France Revenue (Million), by Country 2025 & 2033

- Figure 4: France Mammography Market in France Volume (Piece), by Country 2025 & 2033

- Figure 5: France Mammography Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 6: France Mammography Market in France Volume Share (%), by Country 2025 & 2033

- Figure 7: North America Mammography Market in France Revenue (Million), by Product Type 2025 & 2033

- Figure 8: North America Mammography Market in France Volume (Piece), by Product Type 2025 & 2033

- Figure 9: North America Mammography Market in France Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Mammography Market in France Volume Share (%), by Product Type 2025 & 2033

- Figure 11: North America Mammography Market in France Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Mammography Market in France Volume (Piece), by End User 2025 & 2033

- Figure 13: North America Mammography Market in France Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Mammography Market in France Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Mammography Market in France Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Mammography Market in France Volume (Piece), by Country 2025 & 2033

- Figure 17: North America Mammography Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Mammography Market in France Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Mammography Market in France Revenue (Million), by Product Type 2025 & 2033

- Figure 20: South America Mammography Market in France Volume (Piece), by Product Type 2025 & 2033

- Figure 21: South America Mammography Market in France Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Mammography Market in France Volume Share (%), by Product Type 2025 & 2033

- Figure 23: South America Mammography Market in France Revenue (Million), by End User 2025 & 2033

- Figure 24: South America Mammography Market in France Volume (Piece), by End User 2025 & 2033

- Figure 25: South America Mammography Market in France Revenue Share (%), by End User 2025 & 2033

- Figure 26: South America Mammography Market in France Volume Share (%), by End User 2025 & 2033

- Figure 27: South America Mammography Market in France Revenue (Million), by Country 2025 & 2033

- Figure 28: South America Mammography Market in France Volume (Piece), by Country 2025 & 2033

- Figure 29: South America Mammography Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 30: South America Mammography Market in France Volume Share (%), by Country 2025 & 2033

- Figure 31: Europe Mammography Market in France Revenue (Million), by Product Type 2025 & 2033

- Figure 32: Europe Mammography Market in France Volume (Piece), by Product Type 2025 & 2033

- Figure 33: Europe Mammography Market in France Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Europe Mammography Market in France Volume Share (%), by Product Type 2025 & 2033

- Figure 35: Europe Mammography Market in France Revenue (Million), by End User 2025 & 2033

- Figure 36: Europe Mammography Market in France Volume (Piece), by End User 2025 & 2033

- Figure 37: Europe Mammography Market in France Revenue Share (%), by End User 2025 & 2033

- Figure 38: Europe Mammography Market in France Volume Share (%), by End User 2025 & 2033

- Figure 39: Europe Mammography Market in France Revenue (Million), by Country 2025 & 2033

- Figure 40: Europe Mammography Market in France Volume (Piece), by Country 2025 & 2033

- Figure 41: Europe Mammography Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Mammography Market in France Volume Share (%), by Country 2025 & 2033

- Figure 43: Middle East & Africa Mammography Market in France Revenue (Million), by Product Type 2025 & 2033

- Figure 44: Middle East & Africa Mammography Market in France Volume (Piece), by Product Type 2025 & 2033

- Figure 45: Middle East & Africa Mammography Market in France Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Middle East & Africa Mammography Market in France Volume Share (%), by Product Type 2025 & 2033

- Figure 47: Middle East & Africa Mammography Market in France Revenue (Million), by End User 2025 & 2033

- Figure 48: Middle East & Africa Mammography Market in France Volume (Piece), by End User 2025 & 2033

- Figure 49: Middle East & Africa Mammography Market in France Revenue Share (%), by End User 2025 & 2033

- Figure 50: Middle East & Africa Mammography Market in France Volume Share (%), by End User 2025 & 2033

- Figure 51: Middle East & Africa Mammography Market in France Revenue (Million), by Country 2025 & 2033

- Figure 52: Middle East & Africa Mammography Market in France Volume (Piece), by Country 2025 & 2033

- Figure 53: Middle East & Africa Mammography Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 54: Middle East & Africa Mammography Market in France Volume Share (%), by Country 2025 & 2033

- Figure 55: Asia Pacific Mammography Market in France Revenue (Million), by Product Type 2025 & 2033

- Figure 56: Asia Pacific Mammography Market in France Volume (Piece), by Product Type 2025 & 2033

- Figure 57: Asia Pacific Mammography Market in France Revenue Share (%), by Product Type 2025 & 2033

- Figure 58: Asia Pacific Mammography Market in France Volume Share (%), by Product Type 2025 & 2033

- Figure 59: Asia Pacific Mammography Market in France Revenue (Million), by End User 2025 & 2033

- Figure 60: Asia Pacific Mammography Market in France Volume (Piece), by End User 2025 & 2033

- Figure 61: Asia Pacific Mammography Market in France Revenue Share (%), by End User 2025 & 2033

- Figure 62: Asia Pacific Mammography Market in France Volume Share (%), by End User 2025 & 2033

- Figure 63: Asia Pacific Mammography Market in France Revenue (Million), by Country 2025 & 2033

- Figure 64: Asia Pacific Mammography Market in France Volume (Piece), by Country 2025 & 2033

- Figure 65: Asia Pacific Mammography Market in France Revenue Share (%), by Country 2025 & 2033

- Figure 66: Asia Pacific Mammography Market in France Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mammography Market in France Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Mammography Market in France Volume Piece Forecast, by Region 2020 & 2033

- Table 3: Global Mammography Market in France Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Global Mammography Market in France Volume Piece Forecast, by Product Type 2020 & 2033

- Table 5: Global Mammography Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Mammography Market in France Volume Piece Forecast, by End User 2020 & 2033

- Table 7: Global Mammography Market in France Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Mammography Market in France Volume Piece Forecast, by Region 2020 & 2033

- Table 9: Global Mammography Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Mammography Market in France Volume Piece Forecast, by Country 2020 & 2033

- Table 11: Global Mammography Market in France Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Mammography Market in France Volume Piece Forecast, by Product Type 2020 & 2033

- Table 13: Global Mammography Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Mammography Market in France Volume Piece Forecast, by End User 2020 & 2033

- Table 15: Global Mammography Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Mammography Market in France Volume Piece Forecast, by Country 2020 & 2033

- Table 17: United States Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 19: Canada Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 21: Mexico Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 23: Global Mammography Market in France Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Mammography Market in France Volume Piece Forecast, by Product Type 2020 & 2033

- Table 25: Global Mammography Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Mammography Market in France Volume Piece Forecast, by End User 2020 & 2033

- Table 27: Global Mammography Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Mammography Market in France Volume Piece Forecast, by Country 2020 & 2033

- Table 29: Brazil Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Brazil Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 31: Argentina Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Argentina Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 35: Global Mammography Market in France Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Mammography Market in France Volume Piece Forecast, by Product Type 2020 & 2033

- Table 37: Global Mammography Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 38: Global Mammography Market in France Volume Piece Forecast, by End User 2020 & 2033

- Table 39: Global Mammography Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Mammography Market in France Volume Piece Forecast, by Country 2020 & 2033

- Table 41: United Kingdom Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: United Kingdom Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 43: Germany Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Germany Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 45: France Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: France Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 47: Italy Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Italy Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 49: Spain Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Spain Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 51: Russia Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Russia Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 53: Benelux Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Benelux Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 55: Nordics Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Nordics Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 57: Rest of Europe Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Europe Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 59: Global Mammography Market in France Revenue Million Forecast, by Product Type 2020 & 2033

- Table 60: Global Mammography Market in France Volume Piece Forecast, by Product Type 2020 & 2033

- Table 61: Global Mammography Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 62: Global Mammography Market in France Volume Piece Forecast, by End User 2020 & 2033

- Table 63: Global Mammography Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Mammography Market in France Volume Piece Forecast, by Country 2020 & 2033

- Table 65: Turkey Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Turkey Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 67: Israel Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Israel Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 69: GCC Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: GCC Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 71: North Africa Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: North Africa Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 73: South Africa Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East & Africa Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East & Africa Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 77: Global Mammography Market in France Revenue Million Forecast, by Product Type 2020 & 2033

- Table 78: Global Mammography Market in France Volume Piece Forecast, by Product Type 2020 & 2033

- Table 79: Global Mammography Market in France Revenue Million Forecast, by End User 2020 & 2033

- Table 80: Global Mammography Market in France Volume Piece Forecast, by End User 2020 & 2033

- Table 81: Global Mammography Market in France Revenue Million Forecast, by Country 2020 & 2033

- Table 82: Global Mammography Market in France Volume Piece Forecast, by Country 2020 & 2033

- Table 83: China Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: China Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 85: India Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: India Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 87: Japan Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Japan Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 89: South Korea Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: South Korea Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 91: ASEAN Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: ASEAN Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 93: Oceania Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: Oceania Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

- Table 95: Rest of Asia Pacific Mammography Market in France Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Rest of Asia Pacific Mammography Market in France Volume (Piece) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mammography Market in France?

The projected CAGR is approximately 8.84%.

2. Which companies are prominent players in the Mammography Market in France?

Key companies in the market include Siemens Healthineers, Hologic Inc, GE Healthcare, Koninklijke Philips NV, Canon Medical Systems Corporation, Planmed Oy, Carestream Health Inc, Olea Medical*List Not Exhaustive, Fujifilm Holdings Corporation.

3. What are the main segments of the Mammography Market in France?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Breast Cancer; Technological Advancements in the Field of Breast Imaging.

6. What are the notable trends driving market growth?

Breast Tomosynthesis is Expected to Witness Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Risk of Adverse Effects from Radiation Exposure.

8. Can you provide examples of recent developments in the market?

In October 2021, iCAD Inc. unveiled the latest generation of ProFound AI for 2D Mammography at the Journées Francophones de Radiologie (JFR) meeting in Paris. The company announced that the latest version provides performance improvements of up to 4% increased sensitivity, up to 10% improved specificity, and up to 40% faster processing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Piece.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mammography Market in France," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mammography Market in France report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mammography Market in France?

To stay informed about further developments, trends, and reports in the Mammography Market in France, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence