Key Insights

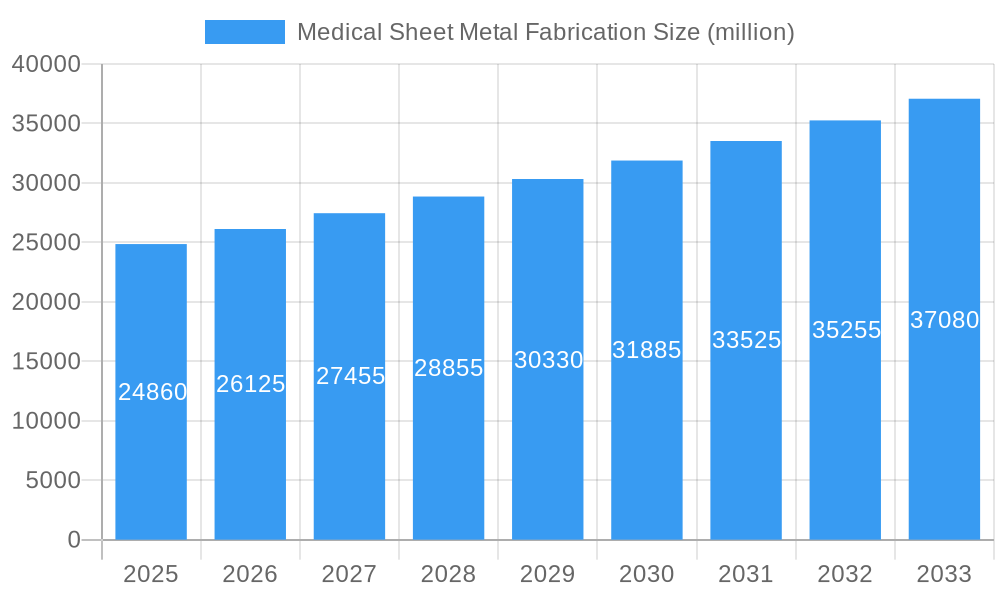

The Medical Sheet Metal Fabrication market is poised for robust expansion, projected to reach a significant USD 24,860 million by 2025, driven by an estimated Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period of 2025-2033. This growth is underpinned by the increasing demand for sophisticated medical devices and equipment, where precision, durability, and biocompatibility are paramount. Key drivers include advancements in healthcare technology, an aging global population necessitating advanced medical solutions, and a growing emphasis on minimally invasive surgical procedures that often rely on custom-designed metal components. The market’s expansion is also fueled by the continuous innovation in metal fabrication techniques, such as advanced laser cutting, bending, and finishing processes, enabling the creation of complex geometries and high-tolerance parts essential for cutting-edge medical applications. Furthermore, the integration of metal components in diagnostic equipment, therapeutic devices, and patient monitoring systems contributes significantly to market traction, reflecting the indispensable role of fabricated metal in modern healthcare infrastructure.

Medical Sheet Metal Fabrication Market Size (In Billion)

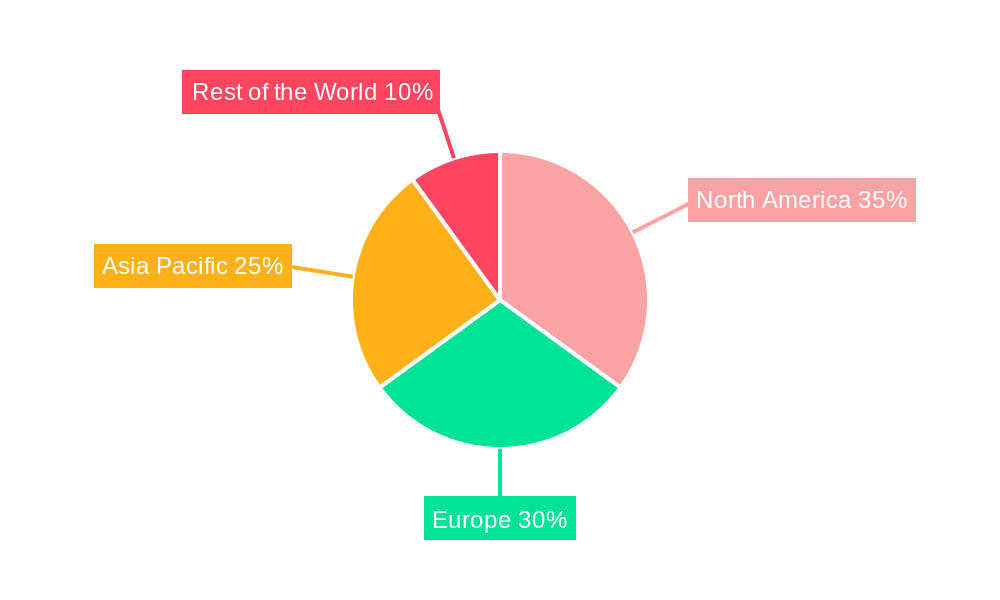

The market is segmented across various critical applications, with "Metal" and "Alloy" representing key material types, and "Design," "Manufacture," and "Detection" highlighting crucial application areas. The manufacturing segment, in particular, is expected to witness substantial growth as medical device manufacturers increasingly outsource their fabrication needs to specialized firms equipped with advanced technology and expertise. North America and Europe currently lead the market, owing to their well-established healthcare industries and high adoption rates of advanced medical technologies. However, the Asia Pacific region is emerging as a high-growth frontier, spurred by increasing healthcare expenditure, a burgeoning medical device manufacturing base, and government initiatives promoting domestic production. The market is characterized by a competitive landscape with key players like Protolabs, Xometry, and ZETWERK Manufacturing, alongside specialized medical fabrication firms, focusing on innovation, quality, and strategic collaborations to cater to the stringent requirements of the medical industry.

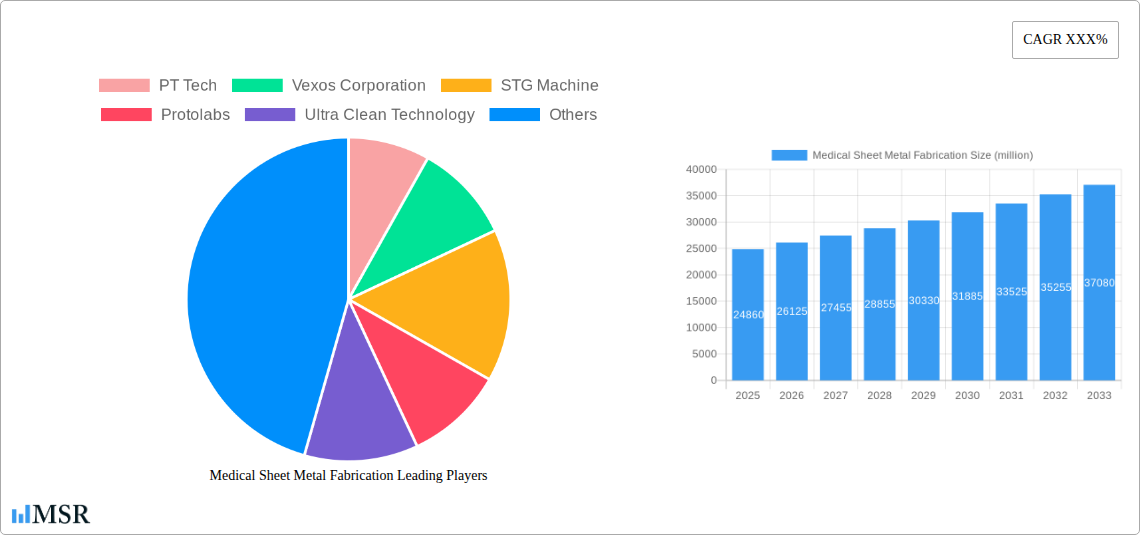

Medical Sheet Metal Fabrication Company Market Share

This in-depth market research report provides a thorough examination of the medical sheet metal fabrication industry, offering critical insights into its current landscape, future trajectory, and key growth drivers. Covering the historical period from 2019 to 2024, the base year of 2025, and extending through a robust forecast period of 2025 to 2033, this report is an indispensable resource for stakeholders seeking to understand market dynamics, identify emerging opportunities, and navigate the competitive environment of precision medical metal components.

Market Concentration & Dynamics

The medical sheet metal fabrication market exhibits a moderate to high concentration, with a significant portion of the market share held by a select group of leading medical device manufacturers and specialized sheet metal fabricators. Innovation ecosystems are thriving, driven by the relentless demand for high-precision, sterile, and biocompatible components. Regulatory frameworks, particularly those set by agencies like the FDA and EMA, play a pivotal role in shaping product development and manufacturing processes, often acting as both a barrier to entry and a driver of quality. Substitute products, such as plastics and advanced composites, present a growing challenge, but the inherent durability, sterility, and reusability of metals ensure their continued dominance in critical applications. End-user trends are increasingly leaning towards miniaturization, complex geometries, and integrated functionalities, pushing the boundaries of advanced sheet metal forming and laser cutting for medical devices. Merger and acquisition (M&A) activities have been steady, with approximately 25-35 deals observed annually in the last few years, indicating strategic consolidation and a pursuit of specialized capabilities. These M&A activities are crucial for companies seeking to expand their service offerings, gain access to new technologies, and strengthen their market position within the medical equipment manufacturing sector.

Medical Sheet Metal Fabrication Industry Insights & Trends

The medical sheet metal fabrication industry is poised for substantial growth, projected to reach a market size of over $45,000 million by the end of the forecast period, with a Compound Annual Growth Rate (CAGR) of approximately 7.5%. This growth is underpinned by several key market drivers, including the increasing global prevalence of chronic diseases, an aging population, and the continuous demand for advanced medical devices and surgical instruments. Technological disruptions are revolutionizing the sector, with the widespread adoption of 3D printing for medical prototypes, advanced CNC machining, and sophisticated automation enhancing precision, efficiency, and design flexibility. The integration of Industry 4.0 principles, such as the Industrial Internet of Things (IIoT) and artificial intelligence (AI), is optimizing production workflows, enabling real-time quality control, and facilitating predictive maintenance. Evolving consumer behaviors, particularly a growing preference for minimally invasive procedures and personalized medicine, are directly influencing the demand for complex and highly customized medical components fabricated from materials like stainless steel, titanium, and biocompatible alloys. The shift towards telehealth and remote patient monitoring also necessitates the development of smaller, more sophisticated, and often metal-encased diagnostic and therapeutic devices. Furthermore, the increasing focus on infection control and sterilization protocols drives the demand for materials and fabrication techniques that ensure utmost hygiene and durability, further bolstering the market for expertly manufactured medical grade sheet metal. The investment in research and development by key players to achieve tighter tolerances, cleaner finishes, and more intricate designs is a testament to the industry’s dynamic evolution. The demand for single-use medical devices, while seemingly counter to metal fabrication, is also driving innovation in specialized metal components for these devices, focusing on cost-effectiveness and rapid production.

Key Markets & Segments Leading Medical Sheet Metal Fabrication

The medical sheet metal fabrication market is experiencing robust growth across several key segments, with the Application of Metal and Alloy materials taking the forefront. Within this, stainless steel and titanium alloys dominate due to their exceptional biocompatibility, corrosion resistance, and mechanical strength, making them ideal for a wide array of medical implants, surgical instruments, and diagnostic equipment. The Type of Manufacture is a critical segment, witnessing significant expansion as advancements in precision machining, laser welding, and stamping for medical components enable the creation of highly complex and intricate designs.

Dominant Applications:

- Surgical Instruments: The enduring need for durable, sterilizable, and ergonomically designed surgical tools drives substantial demand for fabricated metal components.

- Medical Implants: Hip, knee, and spinal implants, alongside cardiovascular devices, rely heavily on high-grade metal alloys for their structural integrity and long-term integration with the human body.

- Diagnostic Equipment: Components for MRI machines, CT scanners, and portable diagnostic devices often require precisely fabricated metal housings, frames, and internal structures.

- Drug Delivery Systems: The intricate nature of insulin pumps, inhalers, and other drug delivery devices necessitates the precision fabrication of small, complex metal parts.

Dominant Segments by Type:

- Manufacture: This segment is leading due to ongoing technological advancements in CNC machining, laser cutting, stamping, and forming processes that allow for the production of highly complex and precise medical components. The ability to achieve extremely tight tolerances and intricate geometries is paramount.

- Design: The increasing sophistication of medical devices necessitates advanced design capabilities. Companies are investing in CAD/CAM software and simulation tools to optimize designs for manufacturability, functionality, and biocompatibility.

- Detection: While not a primary fabrication type, the demand for components used in medical detection and diagnostic equipment, requiring high-precision metalwork for sensors and intricate internal mechanisms, is a significant growth area.

Economic growth in developed and emerging economies, coupled with increasing healthcare expenditure, fuels the demand for advanced medical technologies, consequently driving the medical sheet metal fabrication market. Government initiatives promoting healthcare infrastructure development and technological adoption further accelerate this trend. The Alloy segment is particularly strong, with advancements in specialized alloys offering enhanced properties for demanding medical applications, such as shape-memory alloys and biocompatible titanium variants. The Metal segment, encompassing both ferrous and non-ferrous metals, continues its steady growth, driven by the inherent advantages of metal in sterile environments and for critical applications.

Medical Sheet Metal Fabrication Product Developments

Product innovations in medical sheet metal fabrication are consistently pushing the boundaries of what is possible. Recent developments include the creation of highly complex, miniaturized components for minimally invasive surgical tools, utilizing advanced micro-forming techniques and precision laser welding. The market relevance is amplified by the demand for components with enhanced biocompatibility and reduced allergenicity, leading to increased use of specialized titanium alloys and advanced stainless steels. Technological advancements in additive manufacturing integration with traditional fabrication methods are also enabling novel designs and faster prototyping cycles for orthopedic implants and custom medical devices.

Challenges in the Medical Sheet Metal Fabrication Market

The medical sheet metal fabrication market faces several significant challenges that can impact growth and profitability. Strict regulatory compliance, including adherence to ISO 13485 and FDA guidelines, necessitates rigorous quality control and extensive documentation, leading to increased operational costs. Supply chain disruptions, particularly for specialized medical-grade metals and components, can lead to production delays and increased lead times. Intense competition from both established players and emerging low-cost manufacturers exerts constant pressure on pricing, impacting profit margins. The capital investment required for advanced machinery and skilled labor also presents a barrier to entry for smaller companies.

Forces Driving Medical Sheet Metal Fabrication Growth

Several key forces are propelling the growth of the medical sheet metal fabrication market. The continuous innovation in medical device technology, driven by the need for more effective and less invasive treatments, is a primary driver. An aging global population and the increasing prevalence of chronic diseases are leading to a higher demand for medical equipment and implants. Technological advancements in precision sheet metal forming, laser cutting for medical applications, and automation are enabling the production of more complex and cost-effective components. Furthermore, favorable government policies and increased healthcare spending worldwide are creating a supportive environment for market expansion. The growing emphasis on patient safety and product reliability further solidifies the demand for high-quality medical metal fabrication services.

Challenges in the Medical Sheet Metal Fabrication Market

Long-term growth catalysts for the medical sheet metal fabrication market lie in continuous technological innovation and strategic market expansion. The development of new, more advanced biocompatible alloys and advanced manufacturing processes, such as those incorporating AI for defect detection and predictive maintenance, will be crucial. Strategic partnerships between fabrication companies and medical device OEMs can accelerate product development cycles and foster innovation. Expanding into emerging markets with growing healthcare infrastructures and increasing demand for advanced medical treatments presents significant opportunities. The adoption of sustainable manufacturing practices and circular economy principles can also enhance brand reputation and attract environmentally conscious customers.

Emerging Opportunities in Medical Sheet Metal Fabrication

Emerging opportunities in the medical sheet metal fabrication market are abundant, driven by new technological frontiers and evolving healthcare needs. The increasing demand for personalized medicine is creating a niche for custom medical implants and prosthetics fabricated with extreme precision. The burgeoning field of robotics in surgery requires highly sophisticated and durable metal components for robotic arms and instruments. Furthermore, the miniaturization trend in implantable devices, such as pacemakers and neurostimulators, necessitates expertise in micro-metal fabrication. The growing adoption of point-of-care diagnostics and portable medical equipment also presents significant opportunities for smaller, more integrated metal components.

Leading Players in the Medical Sheet Metal Fabrication Sector

- PT Tech

- Vexos Corporation

- STG Machine

- Protolabs

- Ultra Clean Technology

- Excelsior Metals

- Computer Age Engineering

- Qual - Fab Inc

- Northstar Metal Products

- Hutchinson Technology

- 5H Sheet Metal Fabrication

- Century Ty-Wood Manufacturing

- BCS Machine Company

- Elite Manufacturing Technologies

- MSP Aviation

- Atrenne Integrated Solutions

- Atlas Manufacturing

- Snowline Aerospace

- Heiden

- Arnprior Rapid Manufacturing Solutions

- Stanron Steel Specialties

- Source International

- ZETWERK Manufacturing

- Xometry

- Franklin Sheet Metal

- CSI Industries

- Stueken

- TWH Enterprises

Key Milestones in Medical Sheet Metal Fabrication Industry

- 2019: Increased adoption of advanced laser welding techniques for complex medical device assembly.

- 2020: Growing demand for sterile, single-use metal components in response to global health events.

- 2021: Significant investment in automation and robotics within fabrication facilities to enhance precision and throughput.

- 2022: Advancements in biocompatible alloy development and their integration into new implantable devices.

- 2023: Enhanced focus on Industry 4.0 integration, including IIoT and AI, for predictive quality control in fabrication.

- 2024: Proliferation of 3D printing integration with traditional sheet metal fabrication for rapid prototyping of intricate medical components.

Strategic Outlook for Medical Sheet Metal Fabrication Market

The strategic outlook for the medical sheet metal fabrication market is overwhelmingly positive, characterized by sustained growth and innovation. Key accelerators include the ongoing evolution of medical technology, the increasing global demand for healthcare services, and advancements in material science and fabrication techniques. Companies that invest in advanced capabilities, such as precision stamping for medical applications, micro-machining, and sophisticated quality assurance systems, will be well-positioned to capitalize on future market potential. Strategic partnerships and a commitment to regulatory compliance will be paramount for long-term success in this critical and evolving industry.

Medical Sheet Metal Fabrication Segmentation

-

1. Application

- 1.1. Metal

- 1.2. Alloy

-

2. Type

- 2.1. Design

- 2.2. Manufacture

- 2.3. Detection

Medical Sheet Metal Fabrication Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Sheet Metal Fabrication Regional Market Share

Geographic Coverage of Medical Sheet Metal Fabrication

Medical Sheet Metal Fabrication REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Sheet Metal Fabrication Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metal

- 5.1.2. Alloy

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Design

- 5.2.2. Manufacture

- 5.2.3. Detection

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Sheet Metal Fabrication Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Metal

- 6.1.2. Alloy

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Design

- 6.2.2. Manufacture

- 6.2.3. Detection

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Sheet Metal Fabrication Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Metal

- 7.1.2. Alloy

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Design

- 7.2.2. Manufacture

- 7.2.3. Detection

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Sheet Metal Fabrication Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Metal

- 8.1.2. Alloy

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Design

- 8.2.2. Manufacture

- 8.2.3. Detection

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Sheet Metal Fabrication Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Metal

- 9.1.2. Alloy

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Design

- 9.2.2. Manufacture

- 9.2.3. Detection

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Sheet Metal Fabrication Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Metal

- 10.1.2. Alloy

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Design

- 10.2.2. Manufacture

- 10.2.3. Detection

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PT Tech

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vexos Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STG Machine

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Protolabs

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ultra Clean Technology

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Excelsior Metals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Computer Age Engineering

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Qual - Fab Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Northstar Metal Products

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hutchinson Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 5H Sheet Metal Fabrication

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Century Ty-Wood Manufacturing

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BCS Machine Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Elite Manufacturing Technologies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 MSP Aviation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Atrenne Integrated Solutions

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Atlas Manufacturing

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Snowline Aerospace

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Heiden

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Arnprior Rapid Manufacturing Solutions

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Stanron Steel Specialties

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Source International

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 ZETWERK Manufacturing

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Xometry

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Franklin Sheet Metal

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 CSI Industries

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Stueken

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 TWH Enterprises

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.1 PT Tech

List of Figures

- Figure 1: Global Medical Sheet Metal Fabrication Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Medical Sheet Metal Fabrication Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Medical Sheet Metal Fabrication Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Medical Sheet Metal Fabrication Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Medical Sheet Metal Fabrication Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Medical Sheet Metal Fabrication Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Medical Sheet Metal Fabrication Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Medical Sheet Metal Fabrication Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Medical Sheet Metal Fabrication Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Medical Sheet Metal Fabrication Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Medical Sheet Metal Fabrication Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Medical Sheet Metal Fabrication Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Medical Sheet Metal Fabrication Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Medical Sheet Metal Fabrication Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Medical Sheet Metal Fabrication Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Medical Sheet Metal Fabrication Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Medical Sheet Metal Fabrication Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Medical Sheet Metal Fabrication Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Medical Sheet Metal Fabrication Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Medical Sheet Metal Fabrication Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Medical Sheet Metal Fabrication Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Medical Sheet Metal Fabrication Revenue (undefined), by Type 2025 & 2033

- Figure 23: Middle East & Africa Medical Sheet Metal Fabrication Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Medical Sheet Metal Fabrication Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Medical Sheet Metal Fabrication Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Medical Sheet Metal Fabrication Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Medical Sheet Metal Fabrication Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Medical Sheet Metal Fabrication Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Medical Sheet Metal Fabrication Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Medical Sheet Metal Fabrication Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Medical Sheet Metal Fabrication Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Type 2020 & 2033

- Table 31: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Type 2020 & 2033

- Table 40: Global Medical Sheet Metal Fabrication Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Medical Sheet Metal Fabrication Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Sheet Metal Fabrication?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Medical Sheet Metal Fabrication?

Key companies in the market include PT Tech, Vexos Corporation, STG Machine, Protolabs, Ultra Clean Technology, Excelsior Metals, Computer Age Engineering, Qual - Fab Inc, Northstar Metal Products, Hutchinson Technology, 5H Sheet Metal Fabrication, Century Ty-Wood Manufacturing, BCS Machine Company, Elite Manufacturing Technologies, MSP Aviation, Atrenne Integrated Solutions, Atlas Manufacturing, Snowline Aerospace, Heiden, Arnprior Rapid Manufacturing Solutions, Stanron Steel Specialties, Source International, ZETWERK Manufacturing, Xometry, Franklin Sheet Metal, CSI Industries, Stueken, TWH Enterprises.

3. What are the main segments of the Medical Sheet Metal Fabrication?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Sheet Metal Fabrication," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Sheet Metal Fabrication report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Sheet Metal Fabrication?

To stay informed about further developments, trends, and reports in the Medical Sheet Metal Fabrication, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence