Key Insights

The Middle East and Africa (MEA) real-time payments market is poised for significant expansion, fueled by escalating smartphone adoption, expanding internet access, and the proliferation of mobile money services. With a projected Compound Annual Growth Rate (CAGR) of 27.2%, the market is forecasted to reach 1251.4 million by 2033, commencing from a base year of 2023. Key growth catalysts include government initiatives promoting financial inclusion, a growing consumer preference for contactless transactions, and the increasing demand for rapid and efficient payment processing. Market segmentation covers peer-to-peer (P2P) and peer-to-business (P2B) payment types, with notable growth anticipated in Saudi Arabia, the United Arab Emirates, Kenya, and Nigeria due to their advanced digital ecosystems and substantial populations. The emergence of super apps integrating financial services and the adoption of open banking APIs are further driving market evolution. Challenges such as cybersecurity threats, varying regulatory landscapes, and the necessity for enhanced financial literacy in specific regions are being addressed to ensure seamless market integration.

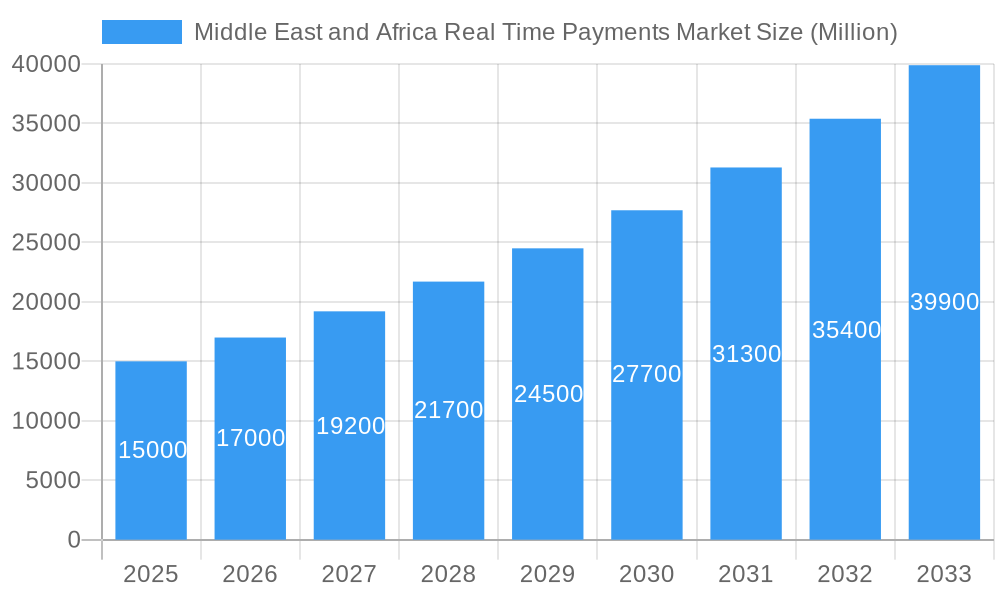

Middle East and Africa Real Time Payments Market Market Size (In Billion)

The MEA real-time payments market features a competitive environment with global leaders like Visa, Mastercard, and PayPal, alongside agile regional fintech innovators and mobile network operators. Continuous innovation, the introduction of advanced technologies, and strategic market expansion are central to their efforts. The successful integration of real-time payment systems with existing financial infrastructure, requiring substantial investment and collaborative efforts between public and private entities, is fundamental to the market's success. Strategic investments in digital infrastructure enhancement, financial literacy programs, and robust regulatory frameworks are critical for realizing the market's full potential and fostering sustainable, inclusive growth. Developing user-centric payment solutions tailored to MEA's diverse market needs will be paramount for sustained success.

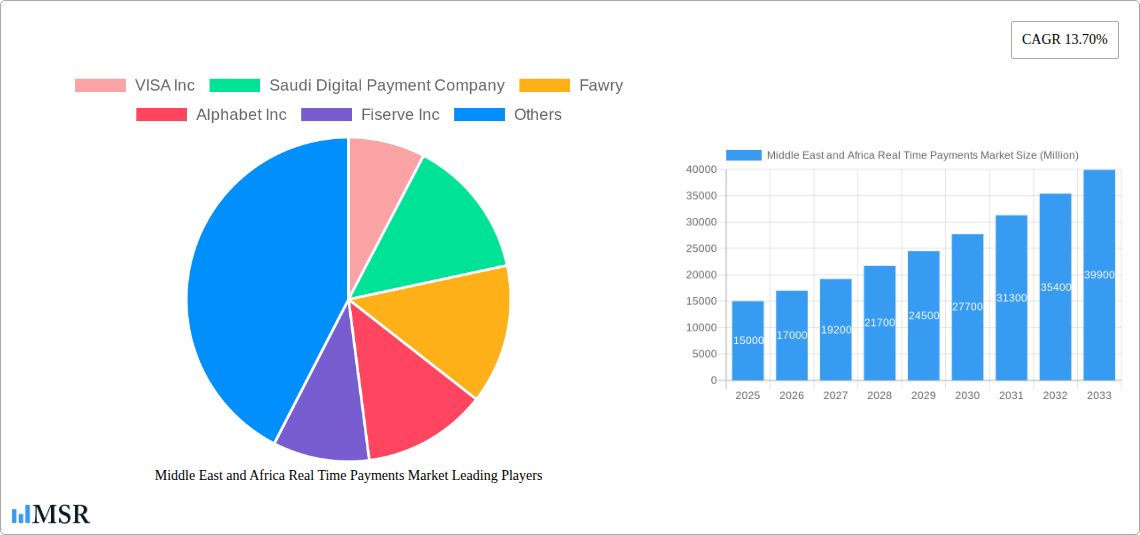

Middle East and Africa Real Time Payments Market Company Market Share

Middle East & Africa Real Time Payments Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa Real Time Payments market, offering invaluable insights for stakeholders across the financial technology landscape. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, key segments, leading players, and future opportunities. The market is projected to reach xx Million by 2033, showcasing substantial growth potential.

Middle East and Africa Real Time Payments Market Market Concentration & Dynamics

This section analyzes the competitive landscape, encompassing market concentration, innovation, regulatory frameworks, and market dynamics within the Middle East and Africa real-time payments sector. The market exhibits a moderately concentrated structure, with key players like VISA Inc, Mastercard Inc, and PayPal Holdings Inc holding significant market share. However, the emergence of fintech startups and regional players is increasing competition.

- Market Share: VISA Inc and Mastercard Inc collectively hold an estimated 40% market share, while regional players like Fawry and Saudi Digital Payment Company account for approximately 25%. The remaining share is distributed among other players, including Alphabet Inc, Fiserve Inc, and ACI Worldwide Inc.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, primarily focused on expanding regional presence and technological capabilities. The forecast period is expected to see an increase in M&A activity driven by consolidation and the pursuit of technological advancements.

- Innovation Ecosystem: The region boasts a vibrant fintech ecosystem, fostering innovation in mobile payments, digital wallets, and other real-time payment solutions. Regulatory support and government initiatives are further accelerating innovation.

- Regulatory Frameworks: Regulatory bodies in various countries across the MEA region are actively shaping the real-time payments landscape through policies promoting financial inclusion and interoperability. However, inconsistencies in regulations across different countries remain a challenge.

- Substitute Products: Traditional payment methods like cash and cheques still hold some relevance, but their usage is declining rapidly due to the convenience and efficiency of real-time payments. The rise of alternative payment methods such as cryptocurrencies also presents a potential, albeit currently limited, substitute.

- End-User Trends: The increasing adoption of smartphones and internet penetration is driving the rapid growth of real-time payments, particularly among younger demographics. The demand for seamless and secure transactions is further fueling market expansion.

Middle East and Africa Real Time Payments Market Industry Insights & Trends

The Middle East and Africa real-time payments market is experiencing robust growth, driven by several key factors. The market size reached xx Million in 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is fueled by increasing smartphone penetration, expanding internet access, burgeoning e-commerce activity, and government initiatives promoting financial inclusion. Technological advancements, such as the adoption of cloud-based solutions and artificial intelligence, are further accelerating market expansion. The rising preference for contactless payments and the increasing adoption of mobile wallets are reshaping consumer behavior, pushing the adoption of real-time payment systems. Government regulations aimed at promoting digitalization are creating a favorable environment for market growth. However, challenges like cybersecurity concerns and the digital divide in certain regions present hurdles to overcome.

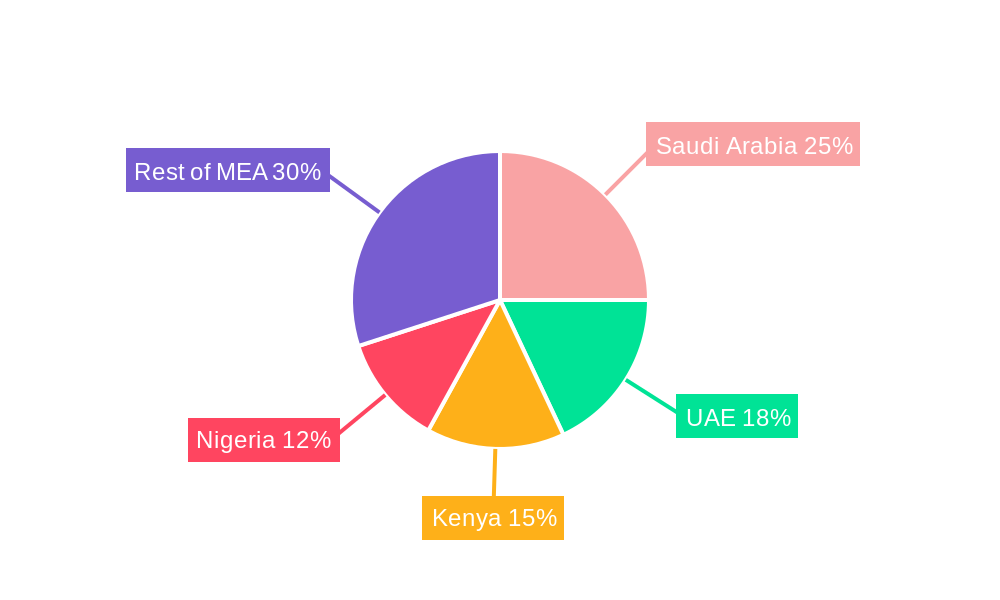

Key Markets & Segments Leading Middle East and Africa Real Time Payments Market

Saudi Arabia and the United Arab Emirates are currently the dominant markets within the MEA region, driven by robust economic growth, advanced infrastructure, and supportive government policies. Kenya and Nigeria also show significant growth potential due to increasing mobile penetration and a large unbanked population.

By Country:

- Saudi Arabia: High per capita income, government initiatives supporting digitalization, and a growing e-commerce sector are driving market growth.

- United Arab Emirates: Advanced infrastructure, a thriving fintech ecosystem, and a significant tourist inflow contribute to the high adoption rate of real-time payments.

- Kenya: High mobile penetration, the success of M-Pesa, and government efforts towards financial inclusion are contributing to the market’s expansion.

- Nigeria: Large population, increasing mobile usage, and the growing adoption of digital payment solutions are driving growth despite infrastructural limitations.

- Rest of Middle East & Africa: This segment presents a significant growth opportunity, as many countries are still in the early stages of developing their real-time payment infrastructure.

By Type of Payment:

- P2P (Person-to-Person): This segment dominates the market due to the widespread use of mobile money and digital wallets for peer-to-peer transactions.

- P2B (Person-to-Business): This segment is experiencing strong growth, driven by increasing e-commerce activity and the adoption of online payment gateways.

Middle East and Africa Real Time Payments Market Product Developments

Recent product innovations include the development of sophisticated mobile payment apps with enhanced security features, the integration of biometric authentication, and the introduction of cloud-based payment processing solutions. These advancements offer enhanced convenience, security, and scalability to businesses and consumers alike, driving market competitiveness.

Challenges in the Middle East and Africa Real Time Payments Market Market

The MEA real-time payments market faces challenges including inconsistent regulatory frameworks across different countries, limited internet and mobile penetration in certain areas, cybersecurity risks, and the need for improved financial literacy among consumers. These factors can hinder market expansion and widespread adoption of real-time payment systems. Furthermore, competitive pressure from established players and the emergence of new fintech firms can impact market profitability.

Forces Driving Middle East and Africa Real Time Payments Market Growth

Several factors are driving the market’s growth: increasing smartphone penetration, government initiatives promoting digitalization, expanding e-commerce activities, and the growing preference for contactless payments among consumers. The development of robust payment infrastructure and advancements in mobile money transfer technology are also contributing to market expansion. Furthermore, regulatory changes aimed at promoting financial inclusion are further fueling the market's growth.

Challenges in the Middle East and Africa Real Time Payments Market Market

Long-term growth hinges on overcoming infrastructural limitations, bridging the digital divide, strengthening cybersecurity measures, and promoting financial literacy. Strategic partnerships between fintech companies and traditional financial institutions will be crucial for driving wider adoption and creating a more inclusive financial ecosystem. Continuous innovation in payment technologies and expanding merchant acceptance are essential for sustaining market growth.

Emerging Opportunities in Middle East and Africa Real Time Payments Market

The market presents significant opportunities for businesses to leverage innovative technologies like blockchain and AI to enhance security and efficiency. The expansion into underserved markets and the development of tailored solutions for specific consumer segments, particularly within the unbanked population, hold substantial potential. Further advancements in cross-border payments and the integration of real-time payments with other financial services will also unlock significant opportunities.

Leading Players in the Middle East and Africa Real Time Payments Market Sector

- VISA Inc

- Saudi Digital Payment Company

- Fawry

- Alphabet Inc

- Fiserve Inc

- Mastercard Inc

- CIB Bank

- ACI Worldwide Inc

- Paypal Holdings Inc

- Samsung Corporation

- Denarii Cash

- Apple Inc

Key Milestones in Middle East and Africa Real Time Payments Market Industry

- February 2022: Accenture selected to lead the development of the UAE's National Instant Payment Platform (IPP), signaling a significant push towards real-time payments infrastructure.

- August 2021: Taxi 724 in Turkey pilots a software POS (sPOS) solution, enabling NFC-enabled contactless payments through an app, demonstrating innovation in point-of-sale technology.

Strategic Outlook for Middle East and Africa Real Time Payments Market Market

The Middle East and Africa real-time payments market presents a compelling growth story, with significant potential for expansion. Strategic investments in infrastructure development, fostering a supportive regulatory environment, and driving financial inclusion will be key to unlocking the market's full potential. The focus on innovation, strategic partnerships, and addressing existing challenges will shape the future of this dynamic sector, fostering a more efficient and inclusive financial ecosystem.

Middle East and Africa Real Time Payments Market Segmentation

-

1. Type of Payment

- 1.1. P2P

- 1.2. P2B

Middle East and Africa Real Time Payments Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Real Time Payments Market Regional Market Share

Geographic Coverage of Middle East and Africa Real Time Payments Market

Middle East and Africa Real Time Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Smartphone Penetration; Falling Reliance on Traditional Banking; Ease of Convenience

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulations in the Payments Industry

- 3.4. Market Trends

- 3.4.1. Increased Smartphone Penetration to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Real Time Payments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 5.1.1. P2P

- 5.1.2. P2B

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 VISA Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saudi Digital Payment Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fawry

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alphabet Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fiserve Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mastercard Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CIB Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ACI Worldwide Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Paypal Holdings Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Denarii Cash*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Apple Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 VISA Inc

List of Figures

- Figure 1: Middle East and Africa Real Time Payments Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Real Time Payments Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Real Time Payments Market Revenue million Forecast, by Type of Payment 2020 & 2033

- Table 2: Middle East and Africa Real Time Payments Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Middle East and Africa Real Time Payments Market Revenue million Forecast, by Type of Payment 2020 & 2033

- Table 4: Middle East and Africa Real Time Payments Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: Saudi Arabia Middle East and Africa Real Time Payments Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: United Arab Emirates Middle East and Africa Real Time Payments Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Israel Middle East and Africa Real Time Payments Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Qatar Middle East and Africa Real Time Payments Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Kuwait Middle East and Africa Real Time Payments Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Oman Middle East and Africa Real Time Payments Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Bahrain Middle East and Africa Real Time Payments Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Jordan Middle East and Africa Real Time Payments Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Lebanon Middle East and Africa Real Time Payments Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Real Time Payments Market?

The projected CAGR is approximately 27.2%.

2. Which companies are prominent players in the Middle East and Africa Real Time Payments Market?

Key companies in the market include VISA Inc, Saudi Digital Payment Company, Fawry, Alphabet Inc, Fiserve Inc, Mastercard Inc, CIB Bank, ACI Worldwide Inc, Paypal Holdings Inc, Samsung Corporation, Denarii Cash*List Not Exhaustive, Apple Inc.

3. What are the main segments of the Middle East and Africa Real Time Payments Market?

The market segments include Type of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD 1251.4 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Smartphone Penetration; Falling Reliance on Traditional Banking; Ease of Convenience.

6. What are the notable trends driving market growth?

Increased Smartphone Penetration to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Stringent Regulations in the Payments Industry.

8. Can you provide examples of recent developments in the market?

February 2022 - Accenture has been selected by the Central Bank of the UAE (CBUAE) to lead a consortium of companies to help execute its National Payment Systems Strategy. In collaboration with SIA, now part of Nexi Group, and G42, Accenture aims to build and operate the National Instant Payment Platform (IPP) in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Real Time Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Real Time Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Real Time Payments Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Real Time Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence