Key Insights

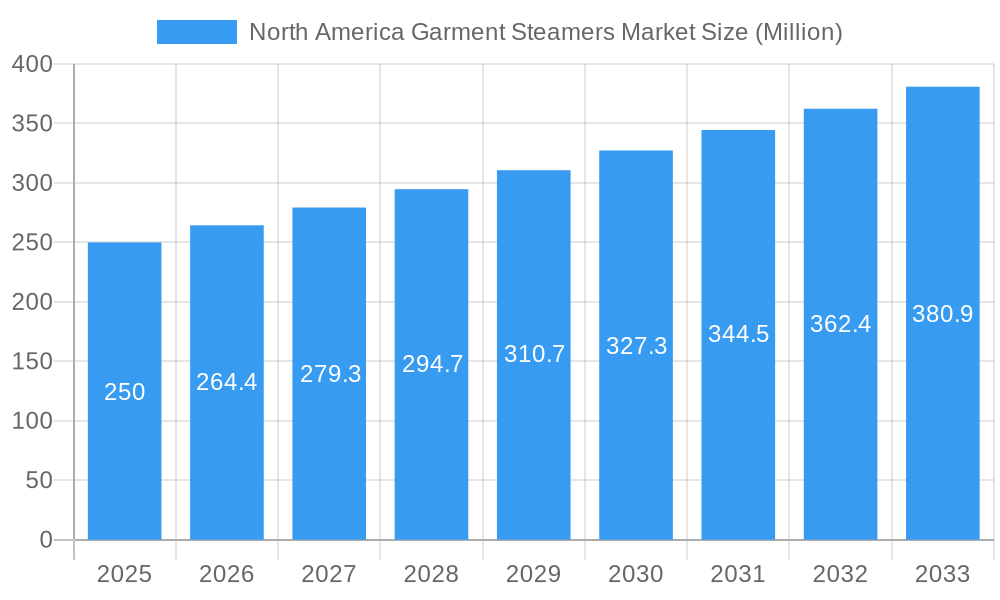

The North American garment steamer market, valued at approximately $250 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.67% from 2025 to 2033. This growth is fueled by several key drivers. The increasing popularity of fast fashion and the rising demand for wrinkle-free clothing are significantly contributing factors. Consumers are increasingly seeking convenient and efficient methods for garment care, making garment steamers a preferred alternative to traditional ironing, especially for delicate fabrics. The shift towards a more casual yet presentable work attire also boosts demand. Furthermore, advancements in steamer technology, such as increased portability and enhanced steam power, are attracting a wider range of consumers. The market is segmented by product type (handheld, upright, tank type: fixed, removable), distribution channel (multi-brand stores, specialty stores, online, other), and geography (United States, Canada, Rest of North America). The United States currently holds the largest market share within North America, driven by its higher disposable incomes and fashion-conscious population. The growth, however, might be slightly tempered by factors such as the relatively higher price point of premium garment steamers compared to traditional irons and the potential for increased competition from other apparel care solutions.

North America Garment Steamers Market Market Size (In Million)

The market's segmentation offers diverse opportunities. The handheld segment is expected to remain dominant due to its portability and ease of use, while the online distribution channel will likely experience significant growth driven by e-commerce expansion and consumer preference for convenient shopping. Key players like Panasonic, Groupe SEB SA, Philips, and Haier are actively investing in product innovation and strategic partnerships to strengthen their market positions. Future market expansion will likely be driven by technological advancements focusing on energy efficiency and user-friendliness, as well as targeted marketing campaigns emphasizing the convenience and benefits of garment steaming over traditional ironing methods. The Canadian market, while smaller than the US market, is also anticipated to show consistent growth, mirroring the broader North American trend towards efficient and convenient clothing care solutions.

North America Garment Steamers Market Company Market Share

North America Garment Steamers Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Garment Steamers Market, offering valuable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and opportunities. The report leverages a robust methodology and incorporates extensive data analysis to deliver actionable intelligence. The total market size is estimated at xx Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

North America Garment Steamers Market Market Concentration & Dynamics

The North America garment steamers market exhibits a moderately consolidated structure, with key players such as Panasonic, Groupe SEB SA, Philips, Haier Group Corporation, and Reliable Corporation holding significant market share. Market share is dynamically shifting due to continuous product innovation, aggressive marketing strategies, and strategic mergers and acquisitions (M&A). The innovation ecosystem is vibrant, with companies investing heavily in R&D to enhance steamer technology, focusing on features like improved steam output, portability, and ease of use. Regulatory frameworks, though relatively less stringent compared to other industries, still play a role in product safety and energy efficiency standards. Substitute products, like iron and dry cleaning services, present ongoing competition, necessitating continuous innovation and value proposition enhancement. End-user trends increasingly favor convenience and efficiency, driving demand for versatile, easy-to-use garment steamers.

- Market Concentration: Moderately Consolidated

- M&A Activity (2019-2024): xx deals, with a notable increase observed in recent years.

- Key Players' Market Share (2025 Estimate): Panasonic (xx%), Groupe SEB SA (xx%), Philips (xx%), Haier Group Corporation (xx%), Reliable Corporation (xx%), Others (xx%).

- Innovation Focus: Improved steam technology, portability, ease of use, smart features.

North America Garment Steamers Market Industry Insights & Trends

The North America garment steamers market is experiencing robust growth, propelled by rising disposable incomes, increasing fashion consciousness, and a preference for convenient clothing care solutions. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033. Technological advancements, such as the integration of smart features and improved heating systems, are disrupting the traditional landscape. Consumer behavior is evolving towards greater preference for handheld and upright steamers due to their increased portability and ease of storage compared to traditional ironing systems. The growing preference for online shopping and the rise of e-commerce platforms also represent significant growth catalysts. Furthermore, the increasing adoption of sustainable and eco-friendly products and the focus on energy efficiency are reshaping the market.

Key Markets & Segments Leading North America Garment Steamers Market

The United States dominates the North America garment steamers market, driven by high disposable incomes, a large population, and a strong preference for convenient apparel care solutions. Within product types, handheld steamers hold a significant market share due to their portability and ease of use. The removable tank type is gaining popularity over fixed tank types due to its increased convenience and versatility. Online distribution channels are witnessing exponential growth, surpassing specialty stores and multi-brand stores in recent years.

- Dominant Region: United States

- Dominant Product Type: Handheld

- Dominant Tank Type: Removable

- Dominant Distribution Channel: Online

- Drivers for US Market Dominance: High disposable incomes, large consumer base, strong e-commerce penetration.

- Drivers for Handheld Segment Dominance: Portability, convenience, ease of use.

- Drivers for Removable Tank Dominance: Refilling convenience, versatile usage.

- Drivers for Online Channel Dominance: Enhanced reach, convenience, competitive pricing.

North America Garment Steamers Market Product Developments

The North American garment steamer market is experiencing a wave of innovation, driven by a focus on enhanced performance, convenience, and smart features. Recent product developments highlight significant advancements in steam output, utilizing advanced heating technologies for faster and more efficient wrinkle removal. Manufacturers are incorporating features such as automatic shut-off for safety, variable steam settings for versatility across different fabrics, and precise temperature control for delicate materials. Smart features, including app connectivity for customized steaming cycles and remote control, are enhancing user experience and creating a more personalized approach to garment care. Beyond functionality, a growing emphasis on durability and long-lasting performance is evident, reflected in the use of higher-quality materials and robust construction. These combined improvements are crucial for manufacturers aiming to establish a competitive advantage in this dynamic market.

Challenges in the North America Garment Steamers Market Market

The North America garment steamers market faces challenges such as intense competition from established brands, the presence of substitute products (irons, dry cleaning), and potential supply chain disruptions. Fluctuations in raw material prices and changing consumer preferences also impact market dynamics. Regulatory compliance regarding energy efficiency and safety standards requires continuous adaptation. These challenges, while significant, are not insurmountable, with opportunities for innovation and strategic partnerships providing ways to mitigate their impact. The estimated impact of these challenges on overall market growth is approximately xx%.

Forces Driving North America Garment Steamers Market Growth

Several key factors are propelling the growth of the North American garment steamers market. The rising disposable incomes of consumers, particularly within the millennial and Gen Z demographics, are driving increased spending on home appliances and convenience-focused products. The escalating demand for quick and convenient clothing care solutions is a significant driver, as consumers seek time-saving alternatives to traditional ironing. Technological advancements, encompassing improved steam generation, energy efficiency, and smart functionality, are further enhancing the appeal of garment steamers. The expanding e-commerce landscape provides readily accessible purchasing options, boosting market penetration and driving sales growth, especially among younger demographics who prefer online shopping. Finally, a shift towards a more casual work environment and a growing preference for wrinkle-free clothing are contributing to increased market demand.

Long-Term Growth Catalysts in the North America Garment Steamers Market

Long-term growth in the North America garment steamers market will be driven by continuous innovation in steaming technology, strategic partnerships between manufacturers and retailers, and expansion into new market segments, such as commercial applications (e.g., hotels, dry cleaners). The increasing demand for eco-friendly and energy-efficient products will also stimulate market growth. Moreover, the development of smart and connected garment steamers will further enhance user experience and contribute to long-term expansion.

Emerging Opportunities in North America Garment Steamers Market

Significant opportunities exist for expansion and innovation within the North American garment steamers market. The commercial sector, including hotels, dry cleaners, and laundromats, presents a largely untapped market for specialized, high-volume steamers. The development of garment steamers tailored to specific fabric types, such as delicate silks and woolens, will cater to a niche consumer base demanding specialized care. The integration of advanced technologies, including AI-powered smart features for automatic fabric detection and optimized steaming settings, and IoT connectivity for remote monitoring and control, represent compelling avenues for product differentiation and enhanced user experience. The increasing consumer focus on sustainability is driving demand for energy-efficient and eco-friendly models, creating opportunities for manufacturers to showcase their commitment to environmentally conscious designs and production methods. Lastly, the penetration of untapped rural markets and the continued expansion of e-commerce into underserved regions offer significant growth potential.

Leading Players in the North America Garment Steamers Market Sector

- Panasonic

- Groupe SEB SA

- Philips

- Haier Group Corporation

- Reliable Corporation

- Pursteam

- Salav

- Maryant

- Jiffy Steamer Company

- Midea

Key Milestones in North America Garment Steamers Market Industry

- April 2022: Hillhouse Capital's acquisition of a significant portion of Philips' home appliances business signals a major investment in the sector, potentially leading to increased competition and reshaping market share dynamics through enhanced product development and marketing efforts.

- February 2023: Haier Group Corporation's launch of 83 new smart home products highlights a broader industry trend towards smart home integration. This move indirectly influences the adoption of complementary appliances, including garment steamers, by positioning them within a cohesive smart home ecosystem and potentially increasing consumer interest in connected devices.

- [Add another relevant milestone here with date and brief description]

Strategic Outlook for North America Garment Steamers Market Market

The North America garment steamers market presents significant growth potential over the next decade. Strategic opportunities include focusing on product innovation, strategic partnerships to expand distribution networks, and targeted marketing campaigns to reach specific consumer segments. Companies that prioritize sustainability, energy efficiency, and technological advancements are poised to gain a competitive advantage. Furthermore, expanding into new geographical markets and developing specialized products for niche applications will drive further growth.

North America Garment Steamers Market Segmentation

-

1. Product Type

- 1.1. Handheld

- 1.2. Upright

-

2. Tank Type

- 2.1. Fixed

- 2.2. Removable

-

3. Distribution Channel

- 3.1. Multi brands store

- 3.2. Speciality Store

- 3.3. Online

- 3.4. Other Distribution Channel

North America Garment Steamers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

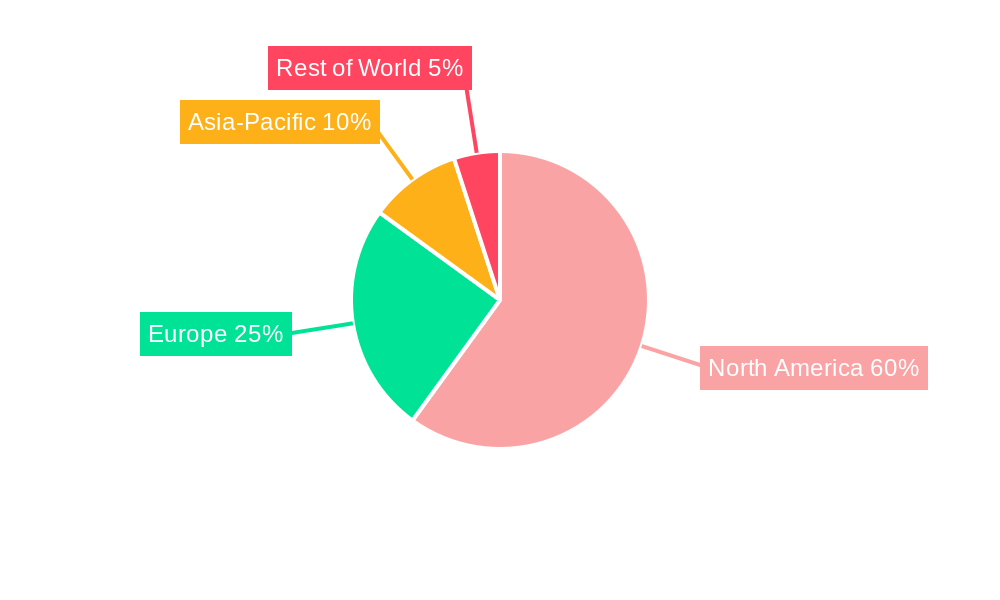

North America Garment Steamers Market Regional Market Share

Geographic Coverage of North America Garment Steamers Market

North America Garment Steamers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Gentle and Safe on Fabrics

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives

- 3.4. Market Trends

- 3.4.1. United States Leading the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Garment Steamers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Handheld

- 5.1.2. Upright

- 5.2. Market Analysis, Insights and Forecast - by Tank Type

- 5.2.1. Fixed

- 5.2.2. Removable

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi brands store

- 5.3.2. Speciality Store

- 5.3.3. Online

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Groupe SEB SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philips

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Haier Group Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Reliable Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pursteam

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Salav

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maryant

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jiffy Steamer Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: North America Garment Steamers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Garment Steamers Market Share (%) by Company 2025

List of Tables

- Table 1: North America Garment Steamers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Garment Steamers Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: North America Garment Steamers Market Revenue Million Forecast, by Tank Type 2020 & 2033

- Table 4: North America Garment Steamers Market Volume K Unit Forecast, by Tank Type 2020 & 2033

- Table 5: North America Garment Steamers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Garment Steamers Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Garment Steamers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Garment Steamers Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: North America Garment Steamers Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: North America Garment Steamers Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: North America Garment Steamers Market Revenue Million Forecast, by Tank Type 2020 & 2033

- Table 12: North America Garment Steamers Market Volume K Unit Forecast, by Tank Type 2020 & 2033

- Table 13: North America Garment Steamers Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Garment Steamers Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Garment Steamers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Garment Steamers Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States North America Garment Steamers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Garment Steamers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Garment Steamers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Garment Steamers Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the North America Garment Steamers Market?

Key companies in the market include Panasonic, Groupe SEB SA, Philips, Haier Group Corporation, Reliable Corporation, Pursteam, Salav, Maryant, Jiffy Steamer Company, Midea.

3. What are the main segments of the North America Garment Steamers Market?

The market segments include Product Type, Tank Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Gentle and Safe on Fabrics.

6. What are the notable trends driving market growth?

United States Leading the Market.

7. Are there any restraints impacting market growth?

Availability of Alternatives.

8. Can you provide examples of recent developments in the market?

February 2023: Haier Group Corporation expanded its product portfolio with the launch of 83 new-age products of smart home solutions. Among the products, it includes Android and Google-certified Smart LED TVs, Wi-Fi-enabled Washing Machines, the new Clean Cool Range of ACs with the largest indoor unit in the industry, and Smart Refrigerators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Garment Steamers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Garment Steamers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Garment Steamers Market?

To stay informed about further developments, trends, and reports in the North America Garment Steamers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence