Key Insights

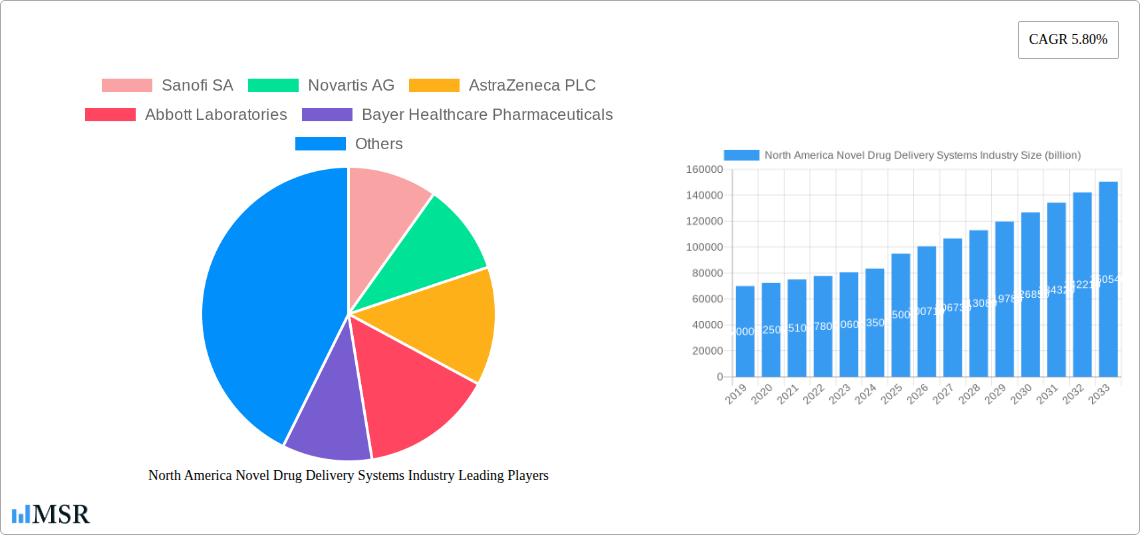

The North America Novel Drug Delivery Systems (NDDS) market is poised for robust expansion, projected to reach a significant market size of USD 95 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 5.80% through 2033. This growth is propelled by a confluence of factors, including the increasing prevalence of chronic diseases, a growing demand for more effective and patient-friendly drug administration methods, and substantial investments in research and development by leading pharmaceutical and biotechnology companies. Oral drug delivery systems and injectable drug delivery systems are expected to dominate the market due to their established utility and ongoing innovation in enhancing bioavailability and targeted delivery. Furthermore, advancements in nanotechnology and biomaterials are facilitating the development of sophisticated targeted and controlled drug delivery systems, addressing unmet medical needs and improving therapeutic outcomes. The North American region, specifically the United States, Canada, and Mexico, is a critical hub for this market, driven by a well-established healthcare infrastructure, high healthcare expenditure, and a strong presence of innovative pharmaceutical players.

North America Novel Drug Delivery Systems Industry Market Size (In Billion)

The market's trajectory is further shaped by evolving patient preferences for less invasive and more convenient administration routes, such as transdermal and pulmonary drug delivery systems, which are gaining traction for chronic condition management and rapid therapeutic effects. While the market benefits from these drivers, certain restraints like the high cost associated with the development and regulatory approval of novel drug delivery technologies, alongside potential reimbursement challenges, could temper the pace of growth. However, strategic collaborations between pharmaceutical giants and specialized NDDS technology providers, alongside increasing awareness and adoption of advanced therapies, are expected to largely offset these challenges. Key players like Sanofi SA, Novartis AG, AstraZeneca PLC, Pfizer Inc., and Johnson & Johnson are actively investing in and launching innovative NDDS to capture market share and address the escalating global healthcare demands, solidifying North America's position as a leader in this dynamic sector.

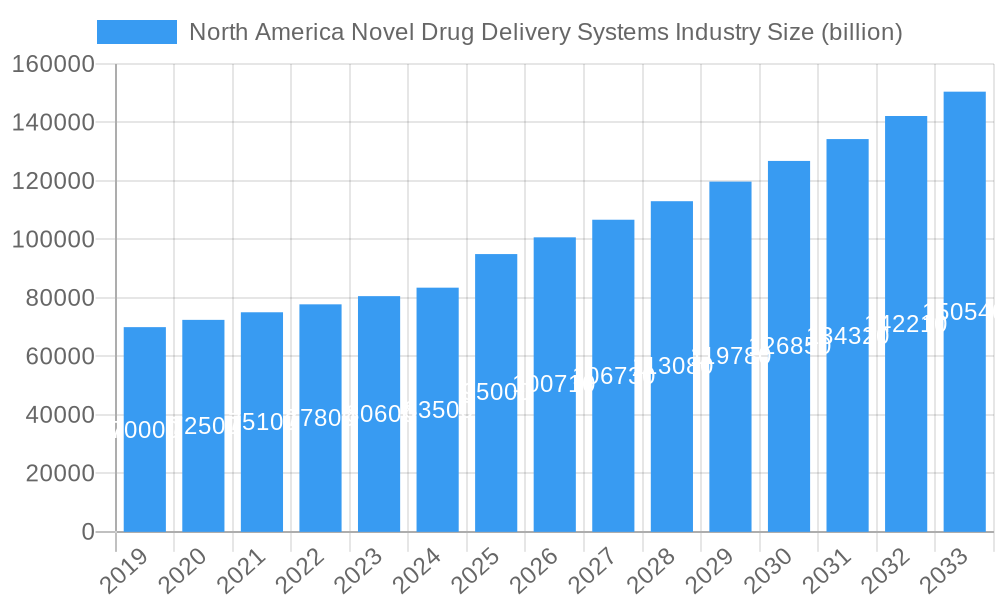

North America Novel Drug Delivery Systems Industry Company Market Share

North America Novel Drug Delivery Systems Industry: Market Insights, Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic North America Novel Drug Delivery Systems (NDDS) industry, providing an in-depth analysis of market dynamics, growth drivers, key players, and future opportunities. Examining the period from 2019 to 2033, with a base year of 2025, this report offers actionable insights for stakeholders seeking to capitalize on the evolving landscape of pharmaceutical delivery.

North America Novel Drug Delivery Systems Industry Market Concentration & Dynamics

The North America Novel Drug Delivery Systems (NDDS) market exhibits moderate to high concentration, driven by the significant R&D investments and market presence of global pharmaceutical giants and specialized NDDS technology developers. Innovation ecosystems are robust, fueled by collaborations between academia, biotech startups, and established players, leading to a steady pipeline of advanced drug delivery solutions. Regulatory frameworks, while stringent, are designed to foster innovation while ensuring patient safety and efficacy. The presence of substitute products, such as conventional drug delivery methods, presents a competitive challenge, but the superior therapeutic outcomes and patient compliance offered by NDDS are increasingly driving adoption. End-user trends are shifting towards minimally invasive and patient-centric delivery methods, impacting product development and market strategies. Mergers and acquisitions (M&A) activities are prevalent as larger companies seek to acquire innovative technologies and expand their product portfolios. The estimated number of M&A deals in the past five years stands at approximately 45, with an average deal value of over $1 billion. Key companies like Sanofi SA, Novartis AG, and Pfizer Inc. actively participate in strategic acquisitions and partnerships to maintain their competitive edge in this rapidly evolving sector.

North America Novel Drug Delivery Systems Industry Industry Insights & Trends

The North America Novel Drug Delivery Systems industry is poised for significant expansion, with the market size projected to reach over $150 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% through 2033. This growth is underpinned by a confluence of factors, including the escalating prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer, which necessitate more effective and patient-friendly treatment regimens. The increasing demand for personalized medicine and targeted therapies further propels the adoption of NDDS, enabling precise drug delivery to specific cells or tissues, thereby maximizing therapeutic efficacy and minimizing systemic side effects. Technological disruptions are at the forefront of this evolution. Nanotechnology-based drug delivery systems, for instance, offer enhanced drug solubility, bioavailability, and targeted delivery capabilities, revolutionizing treatment for complex diseases. Advances in polymer science have led to the development of sophisticated controlled-release formulations, ensuring sustained drug release and improved patient adherence. Biologics and gene therapies, with their inherent delivery challenges, are also major drivers for the development of specialized NDDS, including viral and non-viral vectors. Evolving consumer behaviors, influenced by a growing emphasis on convenience, reduced invasiveness, and improved quality of life, are compelling pharmaceutical companies to invest heavily in user-friendly NDDS. The shift towards home-based healthcare and remote patient monitoring further amplifies the need for devices that facilitate self-administration and reduce the frequency of clinical visits. Smart drug delivery systems, equipped with sensors and connectivity features, are emerging as a significant trend, offering real-time monitoring of drug release and patient response. The robust pipeline of innovative drug candidates, coupled with the expiration of patents for several blockbuster drugs, is also creating a fertile ground for NDDS as companies strive to differentiate their offerings and extend product lifecycles. The increasing investment in research and development by key players like AstraZeneca PLC, Bayer Healthcare Pharmaceuticals, and Johnson & Johnson underscores the optimistic outlook for this sector.

Key Markets & Segments Leading North America Novel Drug Delivery Systems Industry

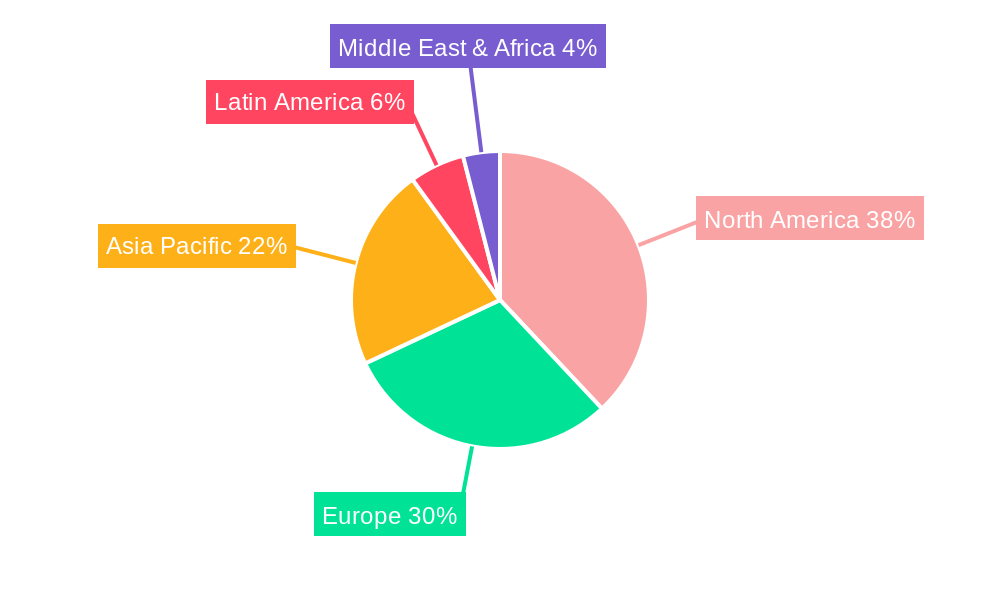

North America, specifically the United States, stands as the dominant geographical market for Novel Drug Delivery Systems (NDDS) in North America, contributing over 75% of the regional revenue. This dominance is fueled by a highly developed healthcare infrastructure, substantial R&D investments, a strong presence of leading pharmaceutical and biotechnology companies, and a high adoption rate of advanced medical technologies. Economic growth in the United States provides a strong financial base for healthcare expenditure, enabling widespread access to innovative treatments. The country's robust regulatory environment, while stringent, also fosters innovation through mechanisms like Fast Track and Breakthrough Therapy designations.

Within the Route of Administration segment, Injectable Drug Delivery Systems are the leading segment, commanding an estimated 40% of the market share. This is driven by the high efficacy of injectable formulations for a wide range of therapeutic areas, including biologics, vaccines, and oncology treatments. The development of advanced injection devices like pre-filled syringes, autoinjectors, and microneedle patches are enhancing patient convenience and reducing the need for clinical administration. Oral Drug Delivery Systems follow closely, with an estimated 30% market share, benefiting from their inherent ease of use and patient preference. Innovations in this segment focus on improving bioavailability, targeted delivery, and overcoming challenges associated with poorly soluble drugs.

In terms of Mode of NDDS, Controlled Drug Delivery Systems represent the largest segment, accounting for approximately 50% of the market. These systems are crucial for maintaining therapeutic drug levels over extended periods, reducing dosing frequency, and minimizing side effects. This is particularly vital for chronic disease management. Targeted Drug Delivery Systems are the fastest-growing sub-segment, with an estimated CAGR of 14%, driven by advancements in nanotechnology and precision medicine, allowing drugs to be delivered specifically to diseased cells or tissues, thereby enhancing efficacy and reducing off-target toxicity.

Canada and Mexico, while smaller markets, are also experiencing steady growth. Canada benefits from a universal healthcare system and a strong focus on pharmaceutical research. Mexico, with its growing population and increasing access to healthcare, presents significant untapped potential, particularly for cost-effective NDDS solutions.

North America Novel Drug Delivery Systems Industry Product Developments

Product innovations in the North America Novel Drug Delivery Systems (NDDS) industry are primarily focused on enhancing patient convenience, efficacy, and safety. Advancements in nanotechnology have led to the development of novel nanoparticles for targeted drug delivery in oncology, improving drug penetration and reducing systemic toxicity. Microneedle patch technology is gaining traction for painless transdermal delivery of vaccines and therapeutics, offering a user-friendly alternative to injections. Furthermore, smart drug delivery systems incorporating sensors for real-time monitoring and controlled release are emerging, promising personalized treatment regimens. Companies are also investing in biodegradable implants and long-acting injectables to reduce dosing frequency for chronic conditions, significantly improving patient adherence and quality of life.

Challenges in the North America Novel Drug Delivery Systems Industry Market

The North America Novel Drug Delivery Systems (NDDS) market faces several significant challenges. High research and development costs associated with novel technologies can deter smaller players and prolong time-to-market. Stringent regulatory approval processes, while essential for patient safety, can be time-consuming and resource-intensive, potentially delaying product launches. Manufacturing complexities and the need for specialized infrastructure for producing advanced NDDS can lead to higher production costs. Reimbursement policies for novel delivery systems can also be a barrier, with payers sometimes hesitant to cover the higher costs compared to conventional methods. Furthermore, intellectual property protection and patent cliffs can create competitive pressures, necessitating continuous innovation.

Forces Driving North America Novel Drug Delivery Systems Industry Growth

Several forces are significantly driving the growth of the North America Novel Drug Delivery Systems (NDDS) industry. The rising global burden of chronic diseases, such as diabetes, cardiovascular conditions, and cancer, necessitates more effective and patient-friendly treatment options. The increasing demand for personalized medicine and targeted therapies, which NDDS are uniquely positioned to fulfill, is a major catalyst. Technological advancements in areas like nanotechnology, biomaterials, and microfluidics are enabling the development of sophisticated delivery systems with enhanced efficacy and reduced side effects. Moreover, growing patient awareness and preference for convenient, minimally invasive drug administration methods are pushing the market towards innovative solutions. Favorable government initiatives and increased R&D investments by pharmaceutical companies further bolster growth prospects.

Challenges in the North America Novel Drug Delivery Systems Industry Market

Long-term growth catalysts for the North America Novel Drug Delivery Systems (NDDS) industry are firmly rooted in continuous technological innovation and strategic market expansions. The ongoing advancements in areas like artificial intelligence for drug discovery and formulation, coupled with the development of advanced biomaterials for sustained and targeted release, will unlock new therapeutic possibilities. Partnerships and collaborations between pharmaceutical giants and specialized NDDS technology developers will accelerate the commercialization of cutting-edge solutions. Furthermore, the expansion of NDDS applications into emerging therapeutic areas and the increasing adoption in underserved markets will fuel sustained growth. The development of cost-effective manufacturing processes for complex NDDS will also be crucial for broader market penetration and long-term sustainability.

Emerging Opportunities in North America Novel Drug Delivery Systems Industry

Emerging opportunities in the North America Novel Drug Delivery Systems (NDDS) industry are abundant, driven by evolving patient needs and technological breakthroughs. The growing market for biologics and gene therapies presents a significant opportunity for specialized delivery systems. The expansion of wearable drug delivery devices and smart inhalers catering to the increasing demand for at-home treatment and remote patient monitoring is another promising area. Furthermore, the development of novel delivery platforms for neglected diseases and rare conditions, where unmet medical needs are high, offers substantial growth potential. The increasing focus on preventative healthcare and vaccine delivery also opens avenues for innovative transdermal and oral delivery solutions.

Leading Players in the North America Novel Drug Delivery Systems Industry Sector

- Sanofi SA

- Novartis AG

- AstraZeneca PLC

- Abbott Laboratories

- Bayer Healthcare Pharmaceuticals

- Pfizer Inc.

- Johnson & Johnson

- Merck & Co

- Roche Holding AG

- GlaxoSmithKline PLC

Key Milestones in North America Novel Drug Delivery Systems Industry Industry

- 2019: Launch of several advanced insulin pen devices with enhanced connectivity features, improving diabetes management.

- 2020: Significant advancements in mRNA vaccine delivery systems, paving the way for rapid development of novel vaccines.

- 2021: FDA approval of a novel microneedle patch for transdermal drug delivery of a pain management therapy.

- 2022: Major pharmaceutical companies announce increased investment in nanotechnology-based drug delivery research.

- 2023: Introduction of smart inhalers with integrated sensors for real-time monitoring of respiratory conditions.

- 2024: Several strategic partnerships formed to develop novel controlled-release formulations for oncology treatments.

Strategic Outlook for North America Novel Drug Delivery Systems Industry Market

The strategic outlook for the North America Novel Drug Delivery Systems (NDDS) industry remains exceptionally positive, characterized by sustained growth driven by innovation and market demand. Key growth accelerators include the continued development of patient-centric solutions, such as long-acting injectables and advanced wearable devices, which cater to the increasing preference for convenience and reduced treatment burden. Strategic partnerships and collaborations will remain crucial for leveraging specialized expertise and accelerating product development. The industry is also expected to witness increased investment in developing delivery systems for emerging therapeutic modalities, including cell and gene therapies. Furthermore, the focus on personalized medicine will drive the demand for adaptive and responsive drug delivery platforms, creating significant future market potential.

North America Novel Drug Delivery Systems Industry Segmentation

-

1. Route of Administration

- 1.1. Oral Drug Delivery Systems

- 1.2. Injectable Drug Delivery Systems

- 1.3. Pulmonary Drug Delivery Systems

- 1.4. Transdermal Drug Delivery Systems

- 1.5. Others

-

2. Mode of NDDS

- 2.1. Targeted Drug Delivery Systems

- 2.2. Controlled Drug Delivery Systems

- 2.3. Modulated Drug Delivery Systems

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

-

3.1. North America

North America Novel Drug Delivery Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Novel Drug Delivery Systems Industry Regional Market Share

Geographic Coverage of North America Novel Drug Delivery Systems Industry

North America Novel Drug Delivery Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Need of Controlled Release of Drugs; Technological Advancements Promoting Development of NDDS

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Guidelines and Product Recalls; Stability Issues of the Devices

- 3.4. Market Trends

- 3.4.1. Oral Drug Delivery Systems is Expected to Grow Fastest during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral Drug Delivery Systems

- 5.1.2. Injectable Drug Delivery Systems

- 5.1.3. Pulmonary Drug Delivery Systems

- 5.1.4. Transdermal Drug Delivery Systems

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Mode of NDDS

- 5.2.1. Targeted Drug Delivery Systems

- 5.2.2. Controlled Drug Delivery Systems

- 5.2.3. Modulated Drug Delivery Systems

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. United States North America Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7. Canada North America Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8. Mexico North America Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Sanofi SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Novartis AG

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 AstraZeneca PLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Abbott Laboratories

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Bayer Healthcare Pharmaceuticals

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Pfizer Inc *List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Johnson & Johnson

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Merck & Co

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Roche Holding AG

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 GlaxoSmithKline PLC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Sanofi SA

List of Figures

- Figure 1: North America Novel Drug Delivery Systems Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Novel Drug Delivery Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 2: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 3: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Mode of NDDS 2020 & 2033

- Table 4: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 11: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Mode of NDDS 2020 & 2033

- Table 12: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 13: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United States North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Mexico North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Novel Drug Delivery Systems Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the North America Novel Drug Delivery Systems Industry?

Key companies in the market include Sanofi SA, Novartis AG, AstraZeneca PLC, Abbott Laboratories, Bayer Healthcare Pharmaceuticals, Pfizer Inc *List Not Exhaustive, Johnson & Johnson, Merck & Co, Roche Holding AG, GlaxoSmithKline PLC.

3. What are the main segments of the North America Novel Drug Delivery Systems Industry?

The market segments include Route of Administration, Mode of NDDS, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising Need of Controlled Release of Drugs; Technological Advancements Promoting Development of NDDS.

6. What are the notable trends driving market growth?

Oral Drug Delivery Systems is Expected to Grow Fastest during the Forecast Period.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Guidelines and Product Recalls; Stability Issues of the Devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Novel Drug Delivery Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Novel Drug Delivery Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Novel Drug Delivery Systems Industry?

To stay informed about further developments, trends, and reports in the North America Novel Drug Delivery Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence