Key Insights

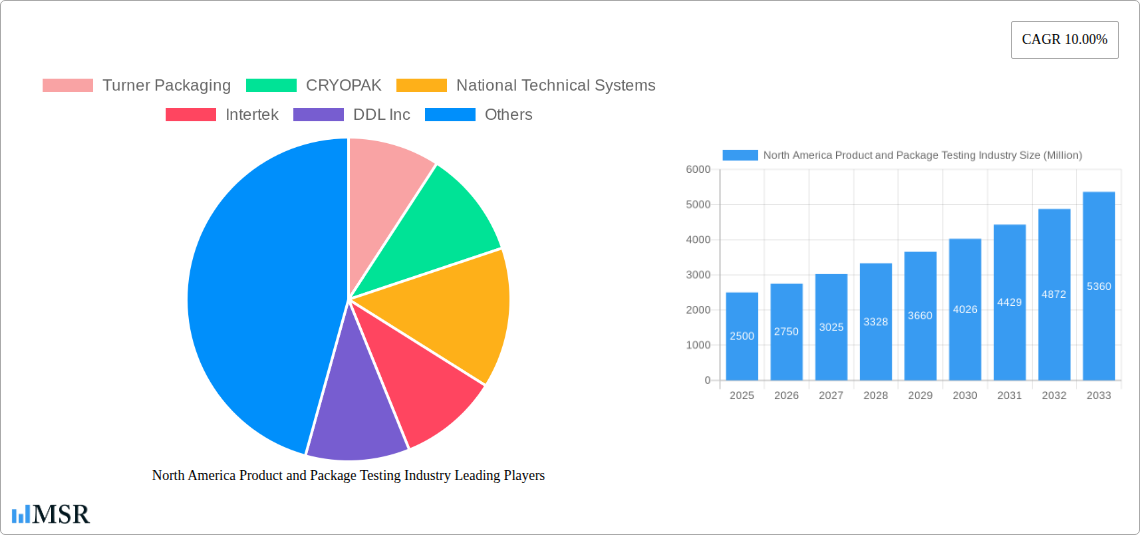

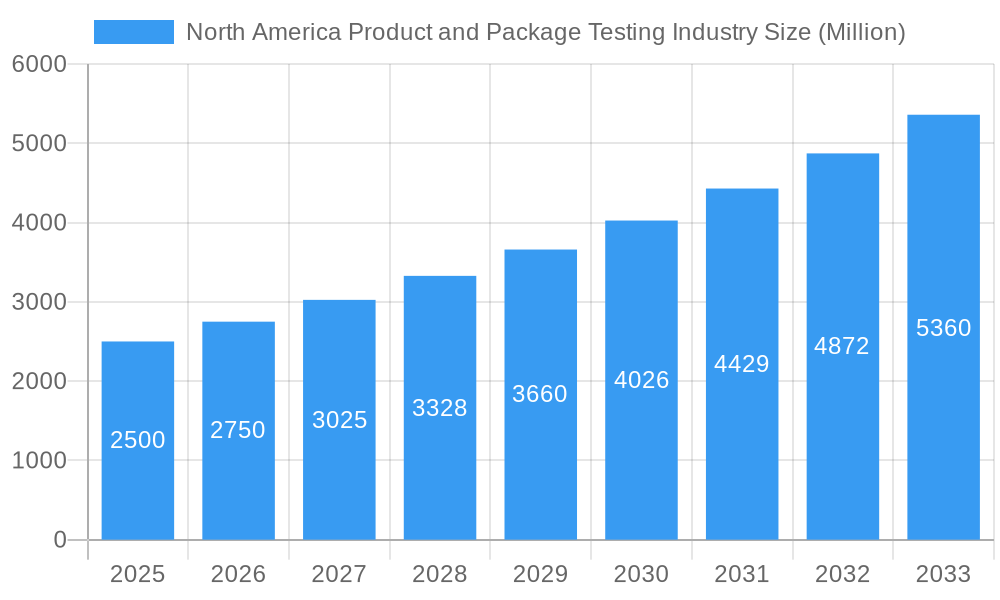

The North American product and package testing market is forecast to reach $2.5 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 10% from 2025. This growth is propelled by escalating consumer demand for safer, sustainable products, necessitating rigorous physical performance, chemical composition, and environmental impact assessments. North America's strict regulatory environment, especially for food and healthcare products, mandates substantial investment in comprehensive testing. Key end-user industries driving this expansion include food and beverage, healthcare, and industrial sectors. The burgeoning e-commerce landscape and the resultant need for resilient packaging solutions also significantly contribute to market expansion. Despite potential challenges like volatile raw material costs and high testing expenses, the market outlook remains robust, bolstered by continuous innovation in testing methodologies and the adoption of advanced analytical techniques.

North America Product and Package Testing Industry Market Size (In Billion)

Market segmentation highlights key trends. Demand for testing services across primary materials—glass, paper, plastic, and metal—is balanced, reflecting the diverse packaging materials used across industries. Physical, chemical, and environmental testing types are integral to comprehensive product and package assessment. Geographically, the United States leads the North American market due to its extensive manufacturing base and stringent regulations. Canada represents a substantial secondary market with consistent growth. Prominent market players, including Turner Packaging, CRYOPAK, National Technical Systems, Intertek, DDL Inc, SGS, Nefab, Advance Packaging, Caskadetek, and CSZ Testing Services Laboratories, are strategically broadening their service offerings and geographic presence to leverage these growth opportunities. This competitive environment stimulates innovation and elevates the quality of available testing services for manufacturers.

North America Product and Package Testing Industry Company Market Share

North America Product and Package Testing Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America product and package testing industry, covering market size, growth drivers, key segments, leading players, and future trends. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is crucial for industry stakeholders, investors, and businesses seeking to understand the dynamics and opportunities within this rapidly evolving market. The report utilizes data from 2019-2024 (historical period) to forecast market trends from 2025-2033 (forecast period).

North America Product and Package Testing Industry Market Concentration & Dynamics

The North American product and package testing industry is characterized by a moderately concentrated market structure. Major players such as Intertek, SGS, and National Technical Systems hold significant market share, estimated at xx% collectively in 2025. However, numerous smaller specialized firms contribute to a vibrant competitive landscape. Innovation is driven by the demand for sustainable and efficient packaging solutions, necessitating advanced testing methodologies.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately concentrated market.

- Innovation Ecosystems: Significant investments in R&D are focused on developing advanced testing techniques for emerging packaging materials and technologies.

- Regulatory Frameworks: Stringent regulations concerning product safety and environmental compliance necessitate comprehensive testing, driving industry growth. Compliance costs are estimated to represent xx Million annually.

- Substitute Products: Limited substitute products exist; however, advancements in testing technologies can make existing methods more cost-effective, resulting in moderate competitive pressure.

- End-User Trends: Growing consumer demand for sustainable packaging and product safety fuels market growth. E-commerce expansion further drives demand for robust packaging solutions.

- M&A Activities: The industry has seen xx M&A deals between 2019 and 2024, with larger firms acquiring smaller, specialized testing companies to broaden their service offerings.

North America Product and Package Testing Industry Industry Insights & Trends

The North American product and package testing market is experiencing robust growth, driven by increasing consumer awareness of product safety and sustainability. The market size was valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is fueled by factors such as rising e-commerce sales, stricter regulatory compliance requirements, and advancements in packaging technologies. The increasing adoption of automation and AI in testing processes is further enhancing efficiency and accuracy. The demand for specialized testing services in sectors such as healthcare and food & beverage is also a key contributor. Technological disruptions, including the increased use of digital testing methods and advanced analytics, are streamlining processes and improving data analysis capabilities. Changing consumer behaviors, prioritizing environmentally friendly and safer products, are driving demand for sustainable and reliable testing services.

Key Markets & Segments Leading North America Product and Package Testing Industry

The United States constitutes the largest segment of the North American product and package testing market, driven by its robust economy, advanced infrastructure, and large consumer base. Plastic packaging accounts for the largest share of primary materials tested, followed by paper and metal. Physical performance testing represents the dominant testing type, owing to its importance in ensuring product durability and safety. The food and beverage industry is the largest end-user segment due to stringent regulations and increasing consumer focus on food safety and quality.

- By Country:

- United States: Dominant market share due to large economy and high demand.

- Canada: Steady growth, driven by increased focus on regulations and e-commerce.

- By Primary Material:

- Plastic: Largest share due to extensive use in packaging.

- Paper: Significant share, driven by its environmentally friendly image.

- Metal: Growing share, driven by the use of metal in packaging for certain product types.

- Glass: Smaller share, due to higher cost and breakage risk.

- By Type of Testing:

- Physical Performance Testing: Largest share due to focus on product durability.

- Chemical Testing: Growing share due to environmental and health concerns.

- Environmental Testing: Increasing importance in line with sustainability goals.

- By End-user Industry:

- Food and Beverage: Largest segment due to stringent safety regulations and consumer focus.

- Healthcare: Significant growth potential due to stringent quality controls.

- Industrial: Steady growth, driven by demand for durable and reliable products.

- Personal and Household Products: Significant share driven by consumer safety concerns.

- Other End-user Industries: Includes a variety of industries with specific testing needs.

North America Product and Package Testing Industry Product Developments

Recent product innovations include the development of advanced testing instruments and methodologies, utilizing AI and automation to enhance accuracy and efficiency. Companies are also focusing on providing comprehensive testing solutions tailored to specific industry needs, incorporating sustainability assessment and lifecycle analysis. This development strategy emphasizes meeting the evolving regulatory landscape and consumer preferences for environmentally friendly products.

Challenges in the North America Product and Package Testing Industry Market

Key challenges include the high cost of advanced testing equipment and skilled labor, potentially limiting accessibility for smaller firms. Regulatory complexity and evolving standards require ongoing investments in compliance and training. Intense competition, particularly from larger multinational companies, poses a challenge for smaller players.

Forces Driving North America Product and Package Testing Industry Growth

Several factors drive industry growth: increasing consumer demand for safer products, stringent regulatory requirements, advancements in testing technologies (like automation and AI), e-commerce expansion requiring robust packaging, and a greater focus on sustainability.

Long-Term Growth Catalysts in the North America Product and Package Testing Industry Market

Long-term growth will be driven by the development and adoption of innovative testing methodologies, strategic partnerships between testing companies and packaging manufacturers, and the expansion into new markets and application areas, particularly concerning sustainable materials and packaging design.

Emerging Opportunities in North America Product and Package Testing Industry

Emerging opportunities lie in the development of specialized testing services for emerging packaging materials (e.g., biodegradable plastics), increased use of digital technologies to improve efficiency, and expanding into niche markets like medical devices and pharmaceuticals.

Leading Players in the North America Product and Package Testing Industry Sector

- Turner Packaging

- CRYOPAK

- National Technical Systems

- Intertek

- DDL Inc

- SGS

- Nefab

- Advance Packaging

- Caskadetek

- CSZ Testing Services Laboratories

Key Milestones in North America Product and Package Testing Industry Industry

- April 2021: SGS launched a new comprehensive footwear packaging testing technique, enhancing industry standards for footwear packaging quality and sustainability.

- July 2021: Cryopak introduced the PUR-Forma Long Range Duration line of polyurethane shipping solutions, expanding its cold chain packaging offerings with pre-qualified options.

Strategic Outlook for North America Product and Package Testing Industry Market

The North American product and package testing market exhibits significant long-term growth potential, driven by evolving consumer preferences, technological advancements, and stringent regulatory frameworks. Companies that successfully adapt to these changes and invest in innovation will be well-positioned to capitalize on emerging opportunities and achieve sustained growth. Strategic partnerships and mergers and acquisitions will play a crucial role in shaping the industry landscape.

North America Product and Package Testing Industry Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and Household Products

- 3.5. Other End-user Industries

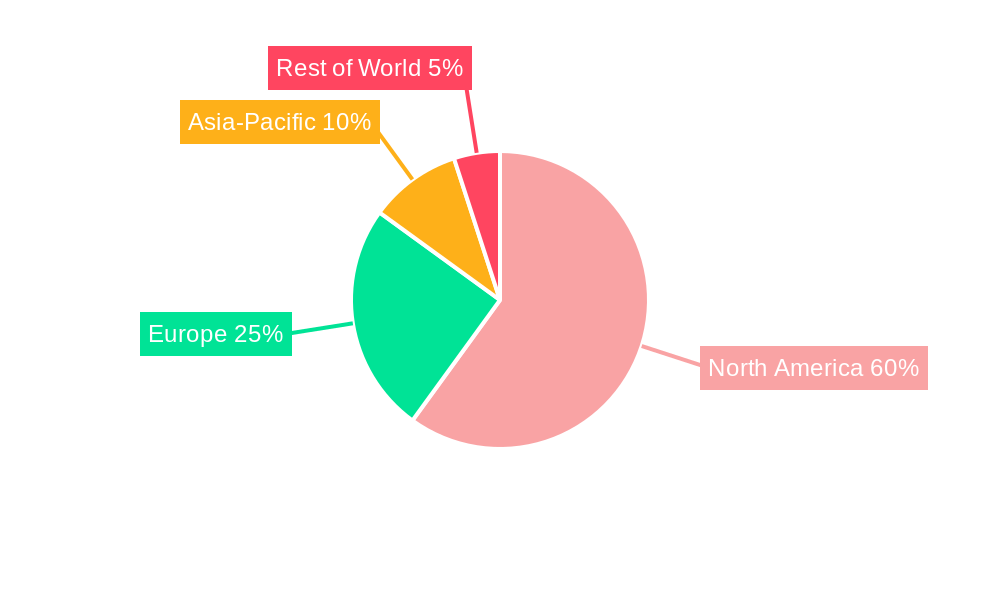

North America Product and Package Testing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Product and Package Testing Industry Regional Market Share

Geographic Coverage of North America Product and Package Testing Industry

North America Product and Package Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs of Equipment

- 3.4. Market Trends

- 3.4.1. Glass Segment Observing Gradual Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Product and Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and Household Products

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Turner Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CRYOPAK

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 National Technical Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intertek

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DDL Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SGS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nefab

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Advance Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Caskadetek

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CSZ Testing Services Laboratories

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Turner Packaging

List of Figures

- Figure 1: North America Product and Package Testing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Product and Package Testing Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Product and Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: North America Product and Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 3: North America Product and Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Product and Package Testing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Product and Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 6: North America Product and Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 7: North America Product and Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: North America Product and Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Product and Package Testing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Product and Package Testing Industry?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the North America Product and Package Testing Industry?

Key companies in the market include Turner Packaging, CRYOPAK, National Technical Systems, Intertek, DDL Inc, SGS, Nefab, Advance Packaging, Caskadetek, CSZ Testing Services Laboratories.

3. What are the main segments of the North America Product and Package Testing Industry?

The market segments include Primary Material, Type of Testing, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Glass Segment Observing Gradual Growth.

7. Are there any restraints impacting market growth?

High Costs of Equipment.

8. Can you provide examples of recent developments in the market?

In April 2021, SGS introduced a new comprehensive footwear packaging testing technique. The industry-first testing package assists brand owners and retailers, including e-commerce, in creating packaging that performs effectively, meets environmental and sustainability criteria, and ensures consumers receive quality footwear.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Product and Package Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Product and Package Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Product and Package Testing Industry?

To stay informed about further developments, trends, and reports in the North America Product and Package Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence