Key Insights

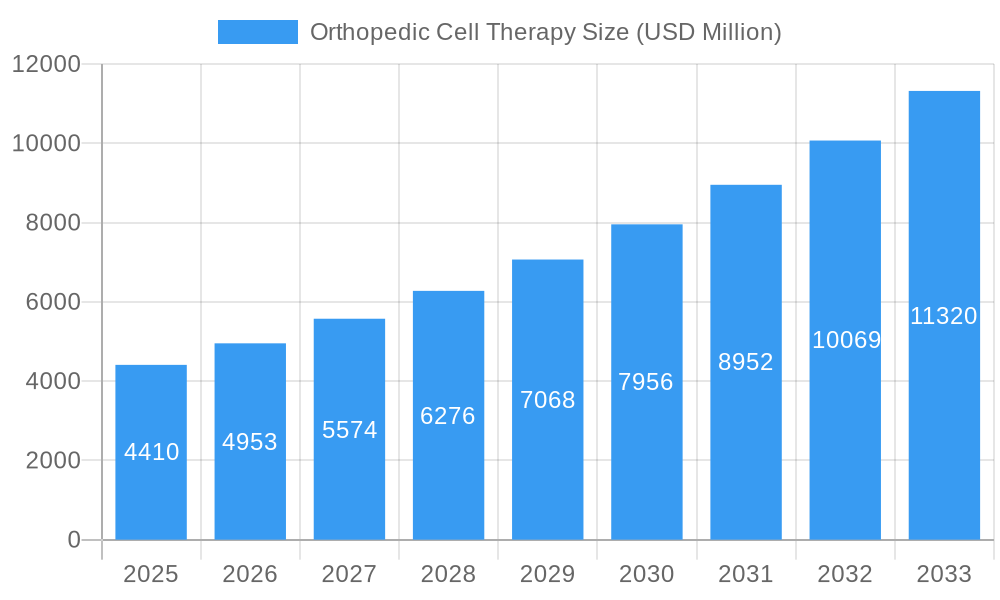

The global Orthopedic Cell Therapy market is poised for robust expansion, projected to reach an estimated $4.41 billion in 2025. Driven by a confluence of factors, including the increasing prevalence of orthopedic conditions, advancements in regenerative medicine, and a growing demand for minimally invasive treatment alternatives, the market is expected to witness a significant Compound Annual Growth Rate (CAGR) of 12.4% from 2025 to 2033. This strong growth trajectory is underpinned by the inherent potential of cell-based therapies to promote tissue regeneration and reduce pain and inflammation associated with musculoskeletal disorders. Key applications such as fractures, osteoarthritis, and soft tissue contusions are primary beneficiaries, with both Platelet-Rich Plasma (PRP) injections and bone marrow therapies emerging as leading treatment modalities. The market's expansion is further fueled by substantial investments in research and development by leading companies and an increasing acceptance of these innovative treatments by healthcare providers and patients alike, signaling a paradigm shift in orthopedic care.

Orthopedic Cell Therapy Market Size (In Billion)

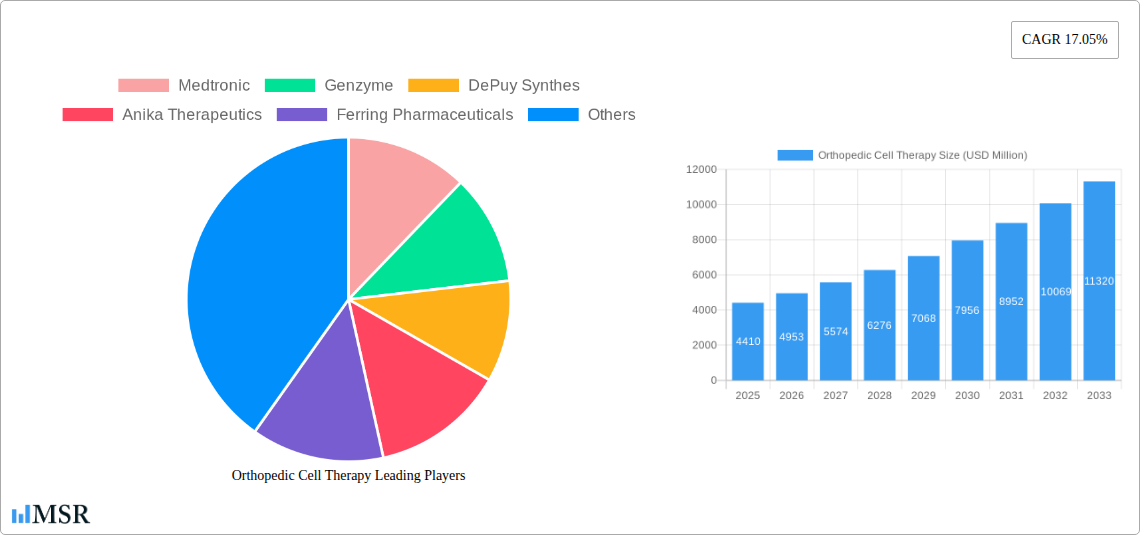

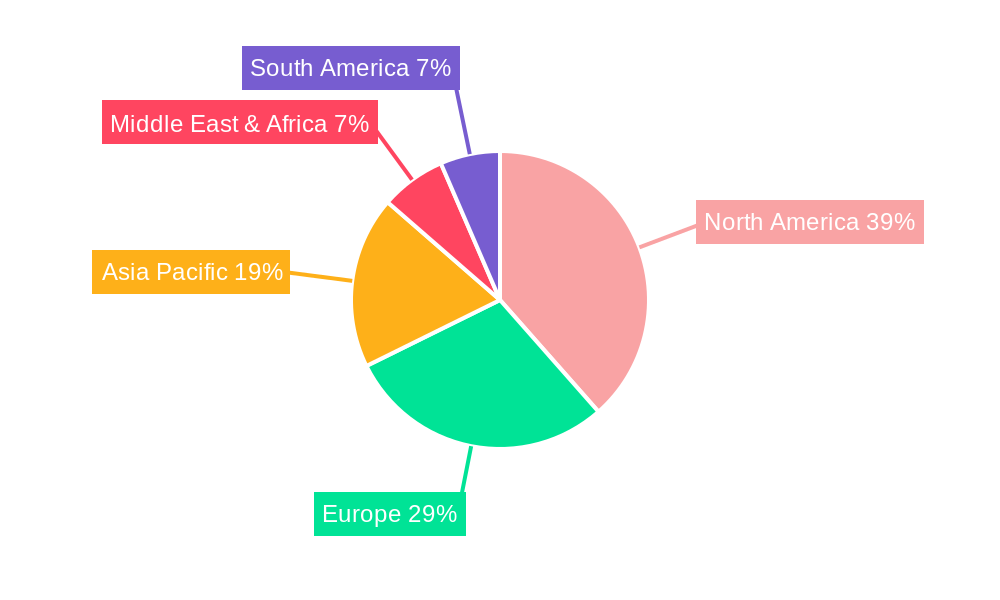

The competitive landscape for orthopedic cell therapy is characterized by the presence of major global players like Medtronic, Genzyme, Stryker, and Zimmer Biomet, alongside emerging innovative entities. These companies are actively engaged in developing novel cell-based therapies and expanding their product portfolios to address a wider spectrum of orthopedic ailments. Geographically, North America currently dominates the market, owing to its advanced healthcare infrastructure, high patient awareness, and favorable reimbursement policies. However, the Asia Pacific region is anticipated to exhibit the fastest growth rate due to its large patient pool, rising healthcare expenditure, and increasing adoption of advanced medical technologies. While the market is primarily driven by the need for effective treatments for chronic orthopedic conditions and sports injuries, restraints such as high treatment costs and regulatory hurdles for novel therapies, though diminishing, continue to influence market dynamics. Nevertheless, the overarching trend towards regenerative medicine and personalized treatment approaches strongly supports the sustained and accelerated growth of the orthopedic cell therapy market.

Orthopedic Cell Therapy Company Market Share

Unlock the Future of Musculoskeletal Regeneration: Comprehensive Orthopedic Cell Therapy Market Report (2019-2033)

Dive deep into the burgeoning Orthopedic Cell Therapy market with this definitive report. Discover critical insights into revolutionary regenerative medicine solutions for fractures, osteoarthritis, and soft tissue injuries. This in-depth analysis covers market dynamics, key trends, segmentation, product innovations, challenges, growth drivers, opportunities, and leading players, providing actionable intelligence for investors, researchers, and industry stakeholders. Examine the competitive landscape, including Medtronic, Genzyme, DePuy Synthes, Anika Therapeutics, Ferring Pharmaceuticals, Stryker, NuVasive, Bioventus, Zimmer Biomet, Integra LifeSciences, RTI Surgical, Fidia Pharmaceuticals, MTF, Orthofix, and Arthrex.

Orthopedic Cell Therapy Market Concentration & Dynamics

The Orthopedic Cell Therapy market is characterized by a moderate to high concentration, with a few dominant players holding significant market share, estimated to be around 60% in 2025. Innovation ecosystems are rapidly developing, driven by academic research and increased R&D investments from key companies like Medtronic and Stryker. The regulatory framework, while evolving, presents a significant hurdle, with stringent approval processes for novel cell-based therapies. Substitute products, such as traditional surgical interventions and viscosupplementation, continue to pose competition, but the superior efficacy and reduced invasiveness of cell therapies are shifting end-user preferences. Merger and acquisition (M&A) activities are on the rise, signaling consolidation and strategic partnerships to leverage technological advancements and expand market reach. Over 15 M&A deals were recorded in the historical period (2019-2024), with an estimated deal value exceeding $5 billion. Key areas of focus include stem cell therapies and advanced PRP formulations.

- Market Share: Estimated 60% held by top players in 2025.

- Innovation Ecosystems: Driven by academic-industry collaborations and substantial R&D funding.

- Regulatory Landscape: Evolving but presents significant approval challenges for new therapies.

- Substitute Products: Traditional surgery and viscosupplementation remain competitors.

- End-User Trends: Growing preference for less invasive, regenerative solutions.

- M&A Activities: Increasing consolidation, with over 15 deals and $5 billion+ deal value historically.

Orthopedic Cell Therapy Industry Insights & Trends

The Orthopedic Cell Therapy market is poised for exceptional growth, projected to reach a colossal value of $15 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 12.5% from the base year of 2025. This expansion is fueled by a confluence of factors, including a rapidly aging global population experiencing a higher incidence of degenerative joint diseases like osteoarthritis, coupled with an increasing demand for minimally invasive treatment options that offer faster recovery times and reduced pain. Technological disruptions are at the forefront, with significant advancements in cell isolation, culture, and delivery techniques enhancing the efficacy and safety of therapies. Platelet-rich plasma (PRP) injections and bone marrow aspirate concentrate (BMAC) therapies are leading this charge, demonstrating promising results in healing soft tissues, accelerating fracture repair, and alleviating the symptoms of osteoarthritis.

Furthermore, a growing awareness among both healthcare professionals and patients regarding the regenerative potential of cell-based treatments is a critical market driver. The inherent ability of these therapies to promote tissue regeneration, reduce inflammation, and restore function presents a compelling alternative to conventional treatments. The integration of advanced biotechnologies, such as CRISPR gene editing for enhanced therapeutic efficacy and the development of off-the-shelf cell products, is further accelerating market penetration. The increasing investment in R&D by major pharmaceutical and medical device companies, including Genzyme and Bioventus, is instrumental in bringing these innovative treatments to market. The economic impact is substantial, with the market size in the base year 2025 estimated at $8 billion. The shift towards value-based healthcare models also favors cell therapies, which can potentially reduce long-term healthcare costs associated with chronic musculoskeletal conditions. The forecast period (2025-2033) will witness a significant surge in the adoption of these advanced regenerative solutions, transforming the landscape of orthopedic care and offering renewed hope for patients suffering from debilitating conditions.

Key Markets & Segments Leading Orthopedic Cell Therapy

The Osteoarthritis segment is emerging as the dominant force within the Orthopedic Cell Therapy market, driven by the widespread prevalence of this degenerative joint disease globally and a growing unmet need for effective, long-term pain management and joint function restoration. In 2025, Osteoarthritis applications are projected to account for over 40% of the total market revenue, estimated at $3.2 billion. The primary type of cell therapy gaining traction for osteoarthritis is Platelet-rich Plasma (PRP) Injection, followed closely by therapies derived from Bone Marrow Therapy, including mesenchymal stem cell (MSC) injections.

The dominance of Osteoarthritis is underpinned by several key drivers:

- Epidemiological Factors: The aging global population is a significant contributor to the rising incidence of osteoarthritis, creating a vast patient pool actively seeking advanced treatment options.

- Increasing Healthcare Expenditure: Developed economies, particularly North America and Europe, exhibit high healthcare spending, enabling greater access to and adoption of novel regenerative therapies.

- Technological Advancements in PRP and MSCs: Continuous innovation in the isolation, concentration, and application of PRP and MSCs has led to improved clinical outcomes, boosting patient and physician confidence.

- Shift Towards Regenerative Medicine: A fundamental paradigm shift in the medical community towards regenerative approaches over palliative treatments fuels the demand for cell therapies.

- Favorable Regulatory Pathways (in select regions): While challenging, some regions are establishing clearer pathways for the approval of cell and gene therapies, facilitating market entry for innovative products.

North America currently represents the largest regional market, contributing approximately 45% to the global market share in 2025, with an estimated market value of $3.6 billion. This leadership is attributed to robust healthcare infrastructure, high disposable incomes, significant investments in R&D by leading companies like Zimmer Biomet and Integra LifeSciences, and a proactive approach to adopting cutting-edge medical technologies. The United States, in particular, is a hub for clinical trials and commercialization of orthopedic cell therapies.

Within the Type segmentation, Platelet-rich Plasma (PRP) Injection is expected to maintain its lead throughout the forecast period, driven by its relative ease of preparation, lower cost compared to some other cell therapies, and demonstrated efficacy in treating a range of orthopedic conditions. In 2025, PRP injections are estimated to capture $4.8 billion of the market. Bone Marrow Therapy, encompassing stem cell applications, is a rapidly growing segment, with significant potential for treating more severe conditions and promoting extensive tissue regeneration, projected to reach $3 billion in 2025. The "Others" category, which may include adipose-derived stem cells and other emerging cell sources, is also expected to witness steady growth.

Orthopedic Cell Therapy Product Developments

The Orthopedic Cell Therapy market is abuzz with innovation, focusing on enhancing the potency and versatility of regenerative treatments. Companies like Anika Therapeutics and Ferring Pharmaceuticals are at the forefront of developing advanced cell culture techniques and optimized delivery systems for mesenchymal stem cells (MSCs) and platelet-rich plasma (PRP). Recent product developments include novel formulations of PRP designed for prolonged therapeutic effects and the creation of bio-scaffolds that enhance cell engraftment and tissue integration for fracture repair and soft tissue regeneration. The emphasis is on achieving superior clinical outcomes, reducing treatment complexity, and expanding the applicability of cell therapies to a wider spectrum of orthopedic conditions beyond traditional indications.

Challenges in the Orthopedic Cell Therapy Market

Despite the immense potential, the Orthopedic Cell Therapy market faces significant hurdles. Regulatory complexities and lengthy approval processes are a major restraint, with inconsistent guidelines across different regions. The high cost of treatment and the need for specialized infrastructure and trained personnel limit widespread accessibility. Furthermore, challenges in standardization of cell processing, ensuring consistent product quality, and addressing potential immunogenicity or long-term safety concerns remain critical areas of focus for market growth. The market also grapples with reimbursement issues, as many insurance providers are still hesitant to cover novel cell-based therapies.

- Regulatory Hurdles: Stringent and time-consuming approval processes.

- High Treatment Costs: Limiting affordability and accessibility for many patients.

- Standardization & Quality Control: Ensuring consistent efficacy and safety of cell products.

- Reimbursement Challenges: Lack of comprehensive insurance coverage for many therapies.

- Skilled Workforce Shortage: Requirement for specialized training and expertise.

Forces Driving Orthopedic Cell Therapy Growth

The Orthopedic Cell Therapy market is propelled by several powerful forces. The increasing prevalence of age-related orthopedic conditions like osteoarthritis and the growing demand for minimally invasive treatments are significant demand drivers. Technological advancements in cell isolation, expansion, and delivery, coupled with substantial R&D investments from key players such as Stryker and NuVasive, are accelerating innovation. Furthermore, a growing body of clinical evidence demonstrating the efficacy and safety of cell therapies for conditions like fractures and soft tissue injuries is building physician and patient confidence. Supportive government initiatives and evolving regulatory pathways in select regions are also fostering market expansion.

Challenges in the Orthopedic Cell Therapy Market

Looking beyond immediate obstacles, the long-term growth catalysts for the Orthopedic Cell Therapy market lie in sustained innovation and strategic market expansion. The development of novel cell sources, such as induced pluripotent stem cells (iPSCs), and advancements in gene-editing technologies promise to enhance therapeutic efficacy and broaden treatment applications. Strategic partnerships between academic institutions, biopharmaceutical companies, and medical device manufacturers will be crucial for translating research breakthroughs into commercially viable products. Furthermore, the exploration of new geographic markets, particularly in emerging economies with a growing middle class and increasing healthcare access, represents a significant opportunity for sustained growth.

Emerging Opportunities in Orthopedic Cell Therapy

The Orthopedic Cell Therapy landscape is ripe with emerging opportunities. The development of off-the-shelf, allogeneic cell therapies that can be readily administered to patients without the need for individualized cell processing presents a significant market advantage in terms of scalability and cost-effectiveness. The integration of artificial intelligence (AI) and machine learning in cell therapy development, from optimizing cell selection to predicting treatment responses, is another frontier offering substantial promise. Furthermore, exploring the potential of cell therapies in combination with biologics and advanced biomaterials for synergistic regenerative effects is an exciting avenue. The increasing focus on personalized medicine will also drive the demand for tailored cell-based solutions for specific patient needs and genetic profiles.

Leading Players in the Orthopedic Cell Therapy Sector

- Medtronic

- Genzyme

- DePuy Synthes

- Anika Therapeutics

- Ferring Pharmaceuticals

- Stryker

- NuVasive

- Bioventus

- Zimmer Biomet

- Integra LifeSciences

- RTI Surgical

- Fidia Pharmaceuticals

- MTF

- Orthofix

- Arthrex

Key Milestones in Orthopedic Cell Therapy Industry

- 2019: Increased regulatory scrutiny on autologous cell therapies, leading to stricter guidelines.

- 2020: Significant R&D investment surge in stem cell therapies for osteoarthritis.

- 2021: First major clinical trial data published showing long-term efficacy of PRP for sports injuries.

- 2022: Several key acquisitions and partnerships aimed at expanding product portfolios and market reach.

- 2023: FDA approval of a novel cell-based therapy for specific bone defect indications.

- 2024: Emergence of advanced bio-printing techniques for tissue engineering in orthopedics.

Strategic Outlook for Orthopedic Cell Therapy Market

The strategic outlook for the Orthopedic Cell Therapy market is exceptionally promising, driven by an accelerating pace of innovation and a growing global demand for effective regenerative solutions. Future growth accelerators will include the widespread adoption of advanced manufacturing technologies for increased scalability and cost-effectiveness, the development of standardized regulatory frameworks that facilitate product commercialization, and deeper integration of cell therapies into multimodal treatment protocols for complex orthopedic conditions. The market's trajectory points towards a significant transformation of musculoskeletal healthcare, with cell therapy becoming a cornerstone of patient management for a vast array of injuries and degenerative diseases.

Orthopedic Cell Therapy Segmentation

-

1. Application

- 1.1. Fractures

- 1.2. Soft Tissue Contusions

- 1.3. Osteoarthritis

- 1.4. Others

-

2. Type

- 2.1. Platelet-rich Plasma Injection

- 2.2. Bone Marrow Therapy

- 2.3. Others

Orthopedic Cell Therapy Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Orthopedic Cell Therapy Regional Market Share

Geographic Coverage of Orthopedic Cell Therapy

Orthopedic Cell Therapy REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Orthopedic Cell Therapy Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Fractures

- 5.1.2. Soft Tissue Contusions

- 5.1.3. Osteoarthritis

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Platelet-rich Plasma Injection

- 5.2.2. Bone Marrow Therapy

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Orthopedic Cell Therapy Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Fractures

- 6.1.2. Soft Tissue Contusions

- 6.1.3. Osteoarthritis

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Platelet-rich Plasma Injection

- 6.2.2. Bone Marrow Therapy

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Orthopedic Cell Therapy Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Fractures

- 7.1.2. Soft Tissue Contusions

- 7.1.3. Osteoarthritis

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Platelet-rich Plasma Injection

- 7.2.2. Bone Marrow Therapy

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Orthopedic Cell Therapy Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Fractures

- 8.1.2. Soft Tissue Contusions

- 8.1.3. Osteoarthritis

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Platelet-rich Plasma Injection

- 8.2.2. Bone Marrow Therapy

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Orthopedic Cell Therapy Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Fractures

- 9.1.2. Soft Tissue Contusions

- 9.1.3. Osteoarthritis

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Platelet-rich Plasma Injection

- 9.2.2. Bone Marrow Therapy

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Orthopedic Cell Therapy Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Fractures

- 10.1.2. Soft Tissue Contusions

- 10.1.3. Osteoarthritis

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Platelet-rich Plasma Injection

- 10.2.2. Bone Marrow Therapy

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Medtronic

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Genzyme

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DePuy Synthes

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Anika Therapeutics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ferring Pharmaceuticals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Stryker

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NuVasive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bioventus

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zimmer Biomet

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Integra LifeSciences

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 RTI Surgical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Fidia Pharmaceuticals

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MTF

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Orthofix

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Arthrex

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Medtronic

List of Figures

- Figure 1: Global Orthopedic Cell Therapy Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Orthopedic Cell Therapy Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Orthopedic Cell Therapy Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Orthopedic Cell Therapy Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Orthopedic Cell Therapy Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Orthopedic Cell Therapy Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Orthopedic Cell Therapy Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Orthopedic Cell Therapy Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Orthopedic Cell Therapy Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Orthopedic Cell Therapy Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Orthopedic Cell Therapy Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Orthopedic Cell Therapy Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Orthopedic Cell Therapy Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Orthopedic Cell Therapy Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Orthopedic Cell Therapy Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Orthopedic Cell Therapy Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Orthopedic Cell Therapy Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Orthopedic Cell Therapy Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Orthopedic Cell Therapy Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Orthopedic Cell Therapy Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Orthopedic Cell Therapy Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Orthopedic Cell Therapy Revenue (undefined), by Type 2025 & 2033

- Figure 23: Middle East & Africa Orthopedic Cell Therapy Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Orthopedic Cell Therapy Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Orthopedic Cell Therapy Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Orthopedic Cell Therapy Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Orthopedic Cell Therapy Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Orthopedic Cell Therapy Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Orthopedic Cell Therapy Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Orthopedic Cell Therapy Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Orthopedic Cell Therapy Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Type 2020 & 2033

- Table 31: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Type 2020 & 2033

- Table 40: Global Orthopedic Cell Therapy Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Orthopedic Cell Therapy Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Orthopedic Cell Therapy?

The projected CAGR is approximately 12.4%.

2. Which companies are prominent players in the Orthopedic Cell Therapy?

Key companies in the market include Medtronic, Genzyme, DePuy Synthes, Anika Therapeutics, Ferring Pharmaceuticals, Stryker, NuVasive, Bioventus, Zimmer Biomet, Integra LifeSciences, RTI Surgical, Fidia Pharmaceuticals, MTF, Orthofix, Arthrex.

3. What are the main segments of the Orthopedic Cell Therapy?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Orthopedic Cell Therapy," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Orthopedic Cell Therapy report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Orthopedic Cell Therapy?

To stay informed about further developments, trends, and reports in the Orthopedic Cell Therapy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence