Key Insights

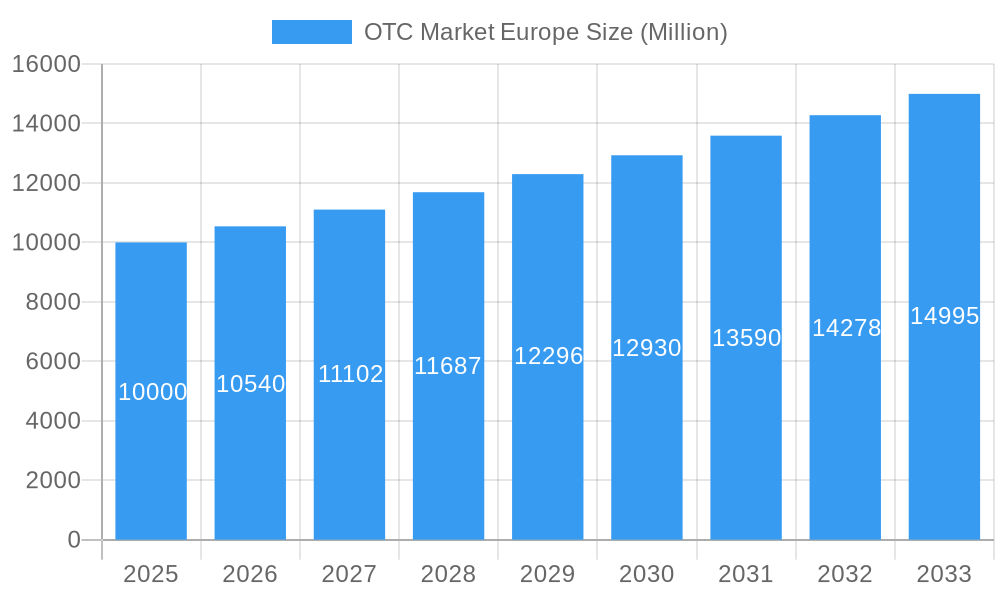

The European Over-the-Counter (OTC) pharmaceutical market is poised for substantial expansion, with an estimated market size of €27.71 billion in 2024. Projections indicate a compound annual growth rate (CAGR) of 5.3% from 2024 to 2033. This growth is propelled by escalating chronic disease prevalence, demanding greater self-management through OTC solutions. The aging European demographic and a growing preference for accessible healthcare further fuel market demand. Enhanced accessibility through online pharmacies and increased consumer focus on self-care also significantly contribute to this expansion. Despite some regulatory and pricing challenges, optimistic growth is anticipated, particularly in analgesics, dermatology, and Vitamins, Minerals, and Supplements (VMS) segments, driven by their broad utility and rising demand for preventative health measures.

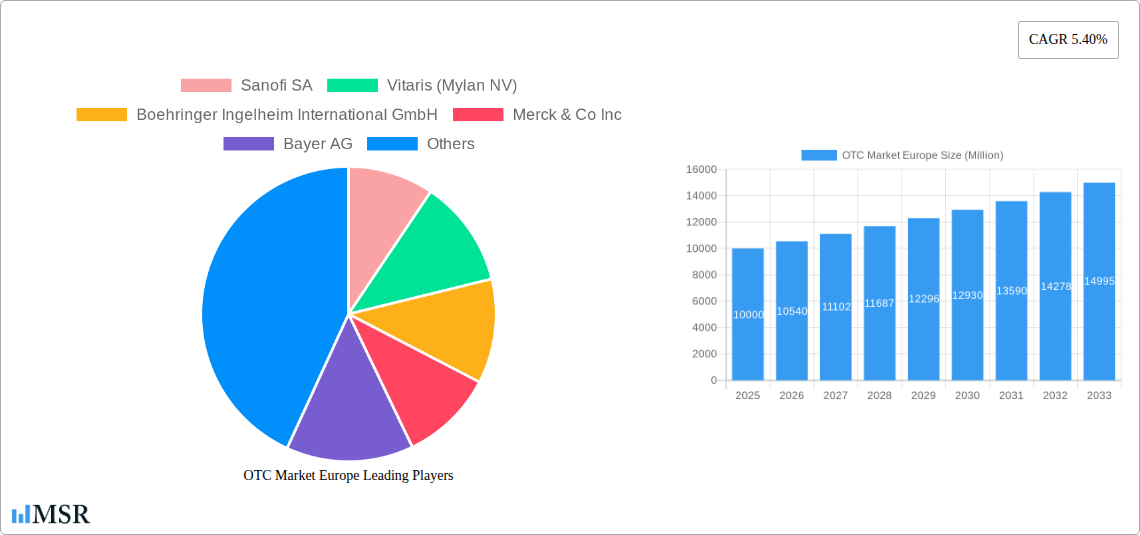

OTC Market Europe Market Size (In Billion)

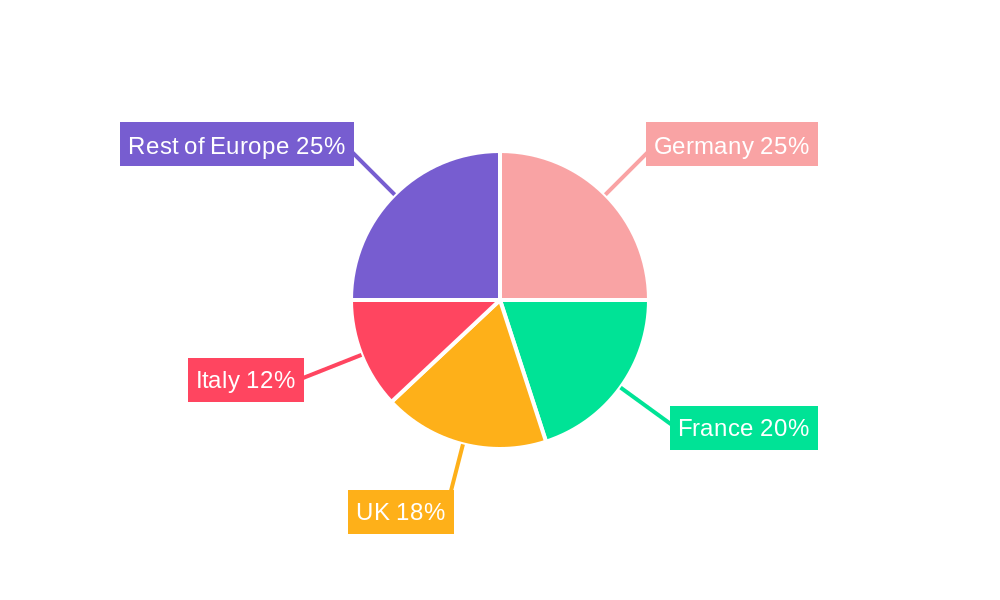

Market segmentation highlights distinct growth patterns. While cough, cold, and flu products exhibit cyclical demand, analgesics benefit from consistent use in chronic pain management. Dermatology products are increasingly sought after due to heightened awareness of skin health, and VMS are thriving with a health-conscious population prioritizing nutritional support. Online pharmacies are gaining prominence in distribution channels, increasingly challenging traditional retail pharmacies. Leading players such as Sanofi, Mylan, Boehringer Ingelheim, Merck, Bayer, Novartis, and Abbott are strategically investing in innovation, product diversification, and distribution networks to secure market share. Key markets, including Germany, France, the UK, and Italy, are expected to lead this growth trajectory.

OTC Market Europe Company Market Share

OTC Market Europe: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the OTC Market Europe, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, key segments, leading players, and future growth opportunities. The report projects a market size of €XX Million in 2025, with a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033.

OTC Market Europe Market Concentration & Dynamics

This section analyzes the competitive landscape, innovation, regulations, and market activities within the European OTC market. The market is characterized by a high level of concentration, with a few major players holding significant market share. For example, companies like Sanofi SA, Pfizer Inc, and Johnson & Johnson command substantial portions of the market. However, smaller companies and niche players also contribute significantly to specific segments.

Market Concentration Metrics:

- Top 5 players hold approximately XX% market share in 2025.

- Market share fragmentation amongst smaller players accounts for the remaining XX%.

Innovation Ecosystem:

- Significant investments in R&D by major players drive innovation in product formulations, delivery systems, and digital health integrations.

- Emerging companies focus on natural and specialized OTC products catering to specific consumer needs.

Regulatory Framework:

- Stringent regulations across European Union member states create a complex yet stable regulatory environment for OTC products.

- Variations in regulations across countries impact product distribution and marketing strategies.

Substitute Products & End-User Trends:

- The availability of substitute products (home remedies, alternative therapies) influences market dynamics.

- Growing consumer awareness of health and wellness fuels demand for premium and specialized OTC products.

M&A Activities:

- The report tracks M&A activities from 2019 to 2024, revealing an average of XX deals annually.

- These transactions highlight strategic expansion and consolidation within the European OTC market.

OTC Market Europe Industry Insights & Trends

The European OTC market demonstrates robust growth, driven by several factors. Increasing prevalence of chronic diseases, rising healthcare costs, and growing self-medication practices contribute to higher demand. Technological disruptions, such as e-commerce and digital health platforms, are reshaping distribution channels and consumer access. Evolving consumer preferences, including a shift towards natural and personalized health solutions, further fuel market growth. The report provides a detailed analysis of these trends, including specific market size projections and CAGR forecasts for various segments.

Key Markets & Segments Leading OTC Market Europe

This section identifies the leading regions, countries, and product segments within the European OTC market. The analysis distinguishes high-growth segments, which are crucial for strategic planning.

Dominant Regions/Countries:

- Germany, France, and the UK are major markets, driven by factors such as high population density, strong healthcare infrastructure, and higher disposable incomes.

- Specific regional variations, influenced by unique healthcare systems and consumer preferences, are analyzed in detail.

Dominant Product Types:

- Analgesics, Cough, Cold, and Flu Products, and Vitamins, Minerals, and Supplements (VMS) represent significant segments, contributing to the largest share of the market revenue.

- Growth in specific segments is influenced by factors such as increased disease prevalence (e.g., rising allergies impacting Dermatology products), changing lifestyle trends (e.g., increased fitness leading to higher VMS sales), and aging demographics.

Dominant Distribution Channels:

- Retail pharmacies maintain their dominance, but online pharmacies are experiencing substantial growth, driven by increased internet penetration and convenience.

- Hospital pharmacies cater to a niche market of patients requiring specific OTC medications under medical supervision.

Drivers of Growth:

- Strong economic growth in key European markets fuels consumer spending on healthcare.

- Expanding healthcare infrastructure enhances access to OTC medications.

- Government initiatives and public awareness campaigns promote self-care and responsible OTC medication usage.

OTC Market Europe Product Developments

Significant innovation drives the OTC market, with new product formulations, improved delivery systems, and digital health integrations enhancing product offerings. Companies are focusing on developing personalized and targeted treatments for specific health conditions, leveraging technological advancements to create more effective and user-friendly OTC products. This continuous product innovation contributes to market growth and competitive advantage.

Challenges in the OTC Market Europe Market

The European OTC market faces challenges, including regulatory hurdles in different countries that increase complexity and cost of product registration. Supply chain disruptions, intensified by recent geopolitical events, lead to delays and potential shortages. Strong competition from established and emerging players creates price pressures and necessitates continuous product innovation. These factors influence market growth and profitability for industry participants.

Forces Driving OTC Market Europe Growth

Several key drivers fuel growth in the European OTC market. Technological advancements lead to the development of innovative products and more efficient distribution channels. Favorable economic conditions in key European markets allow higher spending on healthcare. Supportive regulatory frameworks foster market stability and encourage innovation.

Long-Term Growth Catalysts in OTC Market Europe

Long-term growth hinges on continuous product innovation and strategic partnerships, such as collaborations with digital health platforms and telehealth providers. Market expansion into underserved regions and the development of personalized medicine solutions will continue to drive growth.

Emerging Opportunities in OTC Market Europe

Emerging trends create new opportunities, including increased demand for natural and organic OTC products, the growing popularity of personalized health solutions, and a rising interest in preventative healthcare. These trends open doors for companies to develop specialized products that cater to evolving consumer preferences.

Leading Players in the OTC Market Europe Sector

- Sanofi SA

- Vitaris (Mylan NV)

- Boehringer Ingelheim International GmbH

- Merck & Co Inc

- Bayer AG

- Novartis AG

- Abbott Laboratories

- Cardinal Health Inc

- Bristol Myers Squibb Company

- Perrigo Company PLC

- Johnson & Johnson

- GlaxoSmithKline PLC

- Pfizer Inc

Key Milestones in OTC Market Europe Industry

- January 2022: P&G launched its highest strength Omega-3 under the Seven Seas brand in the United Kingdom. This launch indicates a focus on premium products targeting specific health needs.

- March 2022: Cymbiotika launched an e-commerce store in the UK, showcasing the growing importance of online distribution channels for OTC products.

Strategic Outlook for OTC Market Europe Market

The European OTC market holds immense potential for future growth, driven by a combination of factors including technological advancements, demographic shifts, and evolving consumer preferences. Strategic partnerships, product diversification, and expansion into new market segments offer significant opportunities for companies to capitalize on this growth.

OTC Market Europe Segmentation

-

1. Product Type

- 1.1. Cough, Cold, and Flu Products

- 1.2. Analgesics

- 1.3. Dermatology Products

- 1.4. Gastrointestinal Products

- 1.5. Vitamins, Mineral, and Supplements (VMS)

- 1.6. Weight-loss/Dietary Products

- 1.7. Ophthalmic Products

- 1.8. Sleeping Aids

- 1.9. Other Product Types

-

2. Distribution Channel

- 2.1. Hospital Pharmacies

- 2.2. Retail Pharmacies

- 2.3. Online Pharmacies

- 2.4. Other Distribution Channels

OTC Market Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

OTC Market Europe Regional Market Share

Geographic Coverage of OTC Market Europe

OTC Market Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Self-medication Practices; Increasing New Product Launches

- 3.3. Market Restrains

- 3.3.1. High Probability of OTC Drug Abuse; Lack of Awareness

- 3.4. Market Trends

- 3.4.1 Cough

- 3.4.2 Cold

- 3.4.3 and Flu Products Expected to Register High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cough, Cold, and Flu Products

- 5.1.2. Analgesics

- 5.1.3. Dermatology Products

- 5.1.4. Gastrointestinal Products

- 5.1.5. Vitamins, Mineral, and Supplements (VMS)

- 5.1.6. Weight-loss/Dietary Products

- 5.1.7. Ophthalmic Products

- 5.1.8. Sleeping Aids

- 5.1.9. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hospital Pharmacies

- 5.2.2. Retail Pharmacies

- 5.2.3. Online Pharmacies

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cough, Cold, and Flu Products

- 6.1.2. Analgesics

- 6.1.3. Dermatology Products

- 6.1.4. Gastrointestinal Products

- 6.1.5. Vitamins, Mineral, and Supplements (VMS)

- 6.1.6. Weight-loss/Dietary Products

- 6.1.7. Ophthalmic Products

- 6.1.8. Sleeping Aids

- 6.1.9. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hospital Pharmacies

- 6.2.2. Retail Pharmacies

- 6.2.3. Online Pharmacies

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cough, Cold, and Flu Products

- 7.1.2. Analgesics

- 7.1.3. Dermatology Products

- 7.1.4. Gastrointestinal Products

- 7.1.5. Vitamins, Mineral, and Supplements (VMS)

- 7.1.6. Weight-loss/Dietary Products

- 7.1.7. Ophthalmic Products

- 7.1.8. Sleeping Aids

- 7.1.9. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hospital Pharmacies

- 7.2.2. Retail Pharmacies

- 7.2.3. Online Pharmacies

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cough, Cold, and Flu Products

- 8.1.2. Analgesics

- 8.1.3. Dermatology Products

- 8.1.4. Gastrointestinal Products

- 8.1.5. Vitamins, Mineral, and Supplements (VMS)

- 8.1.6. Weight-loss/Dietary Products

- 8.1.7. Ophthalmic Products

- 8.1.8. Sleeping Aids

- 8.1.9. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hospital Pharmacies

- 8.2.2. Retail Pharmacies

- 8.2.3. Online Pharmacies

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cough, Cold, and Flu Products

- 9.1.2. Analgesics

- 9.1.3. Dermatology Products

- 9.1.4. Gastrointestinal Products

- 9.1.5. Vitamins, Mineral, and Supplements (VMS)

- 9.1.6. Weight-loss/Dietary Products

- 9.1.7. Ophthalmic Products

- 9.1.8. Sleeping Aids

- 9.1.9. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hospital Pharmacies

- 9.2.2. Retail Pharmacies

- 9.2.3. Online Pharmacies

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cough, Cold, and Flu Products

- 10.1.2. Analgesics

- 10.1.3. Dermatology Products

- 10.1.4. Gastrointestinal Products

- 10.1.5. Vitamins, Mineral, and Supplements (VMS)

- 10.1.6. Weight-loss/Dietary Products

- 10.1.7. Ophthalmic Products

- 10.1.8. Sleeping Aids

- 10.1.9. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hospital Pharmacies

- 10.2.2. Retail Pharmacies

- 10.2.3. Online Pharmacies

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Cough, Cold, and Flu Products

- 11.1.2. Analgesics

- 11.1.3. Dermatology Products

- 11.1.4. Gastrointestinal Products

- 11.1.5. Vitamins, Mineral, and Supplements (VMS)

- 11.1.6. Weight-loss/Dietary Products

- 11.1.7. Ophthalmic Products

- 11.1.8. Sleeping Aids

- 11.1.9. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Hospital Pharmacies

- 11.2.2. Retail Pharmacies

- 11.2.3. Online Pharmacies

- 11.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Germany OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 13. France OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 14. Italy OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 15. United Kingdom OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 16. Netherlands OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 17. Sweden OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 18. Rest of Europe OTC Market Europe Analysis, Insights and Forecast, 2020-2032

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2025

- 19.2. Company Profiles

- 19.2.1 Sanofi SA

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Vitaris (Mylan NV)

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Boehringer Ingelheim International GmbH

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Merck & Co Inc

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Bayer AG

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Novartis AG

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Abbott Laboratories

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Cardinal Health Inc

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Bristol Myers Squibb Company

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Perrigo Company PLC*List Not Exhaustive

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Johnson & Johnson

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 GlaxoSmithKline PLC

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.13 Pfizer Inc

- 19.2.13.1. Overview

- 19.2.13.2. Products

- 19.2.13.3. SWOT Analysis

- 19.2.13.4. Recent Developments

- 19.2.13.5. Financials (Based on Availability)

- 19.2.1 Sanofi SA

List of Figures

- Figure 1: OTC Market Europe Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: OTC Market Europe Share (%) by Company 2025

List of Tables

- Table 1: OTC Market Europe Revenue billion Forecast, by Region 2020 & 2033

- Table 2: OTC Market Europe Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: OTC Market Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: OTC Market Europe Revenue billion Forecast, by Region 2020 & 2033

- Table 5: OTC Market Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 6: Germany OTC Market Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France OTC Market Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy OTC Market Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: United Kingdom OTC Market Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands OTC Market Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Sweden OTC Market Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe OTC Market Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: OTC Market Europe Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: OTC Market Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: OTC Market Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 16: OTC Market Europe Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: OTC Market Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: OTC Market Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 19: OTC Market Europe Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: OTC Market Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: OTC Market Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 22: OTC Market Europe Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: OTC Market Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: OTC Market Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 25: OTC Market Europe Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: OTC Market Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 27: OTC Market Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 28: OTC Market Europe Revenue billion Forecast, by Product Type 2020 & 2033

- Table 29: OTC Market Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: OTC Market Europe Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the OTC Market Europe?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the OTC Market Europe?

Key companies in the market include Sanofi SA, Vitaris (Mylan NV), Boehringer Ingelheim International GmbH, Merck & Co Inc, Bayer AG, Novartis AG, Abbott Laboratories, Cardinal Health Inc, Bristol Myers Squibb Company, Perrigo Company PLC*List Not Exhaustive, Johnson & Johnson, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the OTC Market Europe?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Self-medication Practices; Increasing New Product Launches.

6. What are the notable trends driving market growth?

Cough. Cold. and Flu Products Expected to Register High Growth.

7. Are there any restraints impacting market growth?

High Probability of OTC Drug Abuse; Lack of Awareness.

8. Can you provide examples of recent developments in the market?

In March 2022, Cymbiotika launched an e-commerce store in the United Kingdom for its range of natural supplements aimed at boosting consumer vitality and longevity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "OTC Market Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the OTC Market Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the OTC Market Europe?

To stay informed about further developments, trends, and reports in the OTC Market Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence