Key Insights

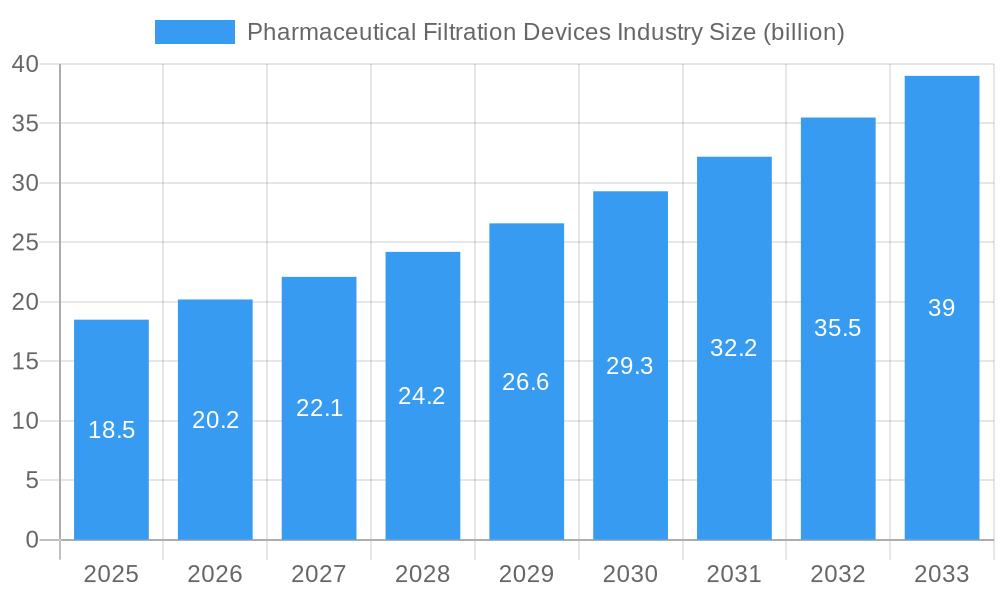

The Pharmaceutical Filtration Devices market is poised for significant expansion, projected to reach a substantial market size of approximately $XX billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.10% anticipated through 2033. This impressive growth is propelled by an escalating demand for high-purity therapeutics, stringent regulatory mandates for pharmaceutical product quality, and the increasing adoption of advanced filtration technologies in biopharmaceutical manufacturing. Key market drivers include the expanding pipeline of biologics, a growing emphasis on sterile processing to prevent contamination, and the continuous innovation in membrane materials and filtration techniques that enhance efficiency and yield. The market is witnessing a substantial rise in the application of filtration devices in final product processing, crucial for ensuring the safety and efficacy of drugs, alongside its integral role in raw material filtration and cell separation within the biotechnology sector. Water and air purification within pharmaceutical facilities are also significant application areas, underscoring the comprehensive role of filtration in maintaining aseptic environments and producing high-quality pharmaceuticals.

Pharmaceutical Filtration Devices Industry Market Size (In Million)

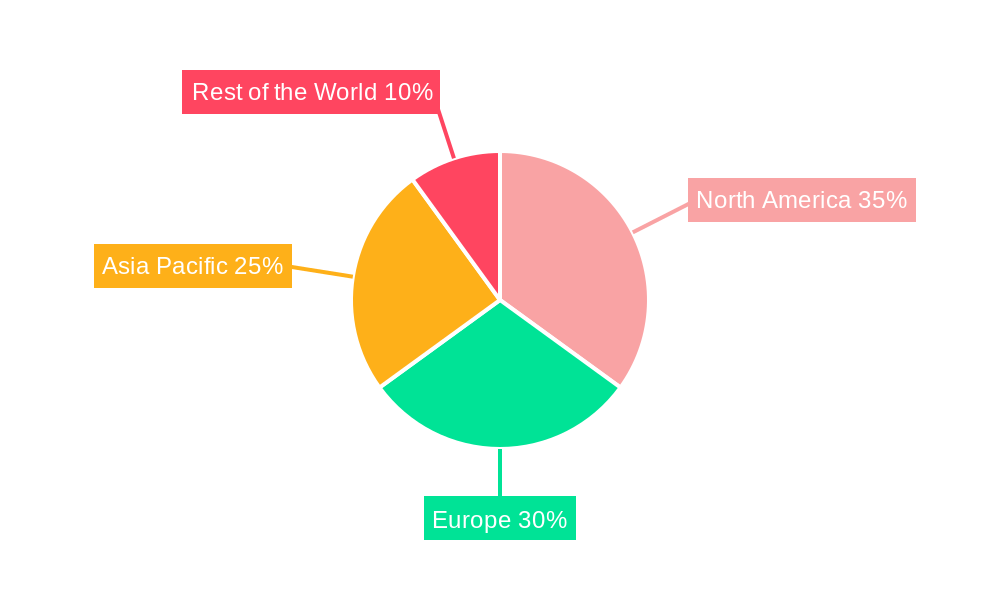

The market landscape for pharmaceutical filtration devices is characterized by a dynamic interplay of technological advancements and evolving industry needs. Polyethersulfone (PES) and Polyvinylidene Difluoride (PVDF) membranes are leading material segments due to their excellent chemical resistance and performance characteristics. Microfiltration and ultrafiltration are the dominant techniques, widely employed for particle removal and concentration. However, the growing complexity of biomolecules and the increasing need for precise separation are driving the adoption of nanofiltration. Geographically, North America and Europe currently hold significant market shares, driven by established pharmaceutical industries and advanced research and development activities. The Asia Pacific region, however, presents the most substantial growth opportunities, fueled by the burgeoning pharmaceutical manufacturing sector in countries like China and India, alongside increasing investments in biopharmaceutical production. Key restraints include the high initial cost of advanced filtration systems and the complexity of validating new filtration technologies within existing manufacturing processes. Nonetheless, the overall outlook remains highly positive, with continuous innovation and expanding applications ensuring sustained market growth.

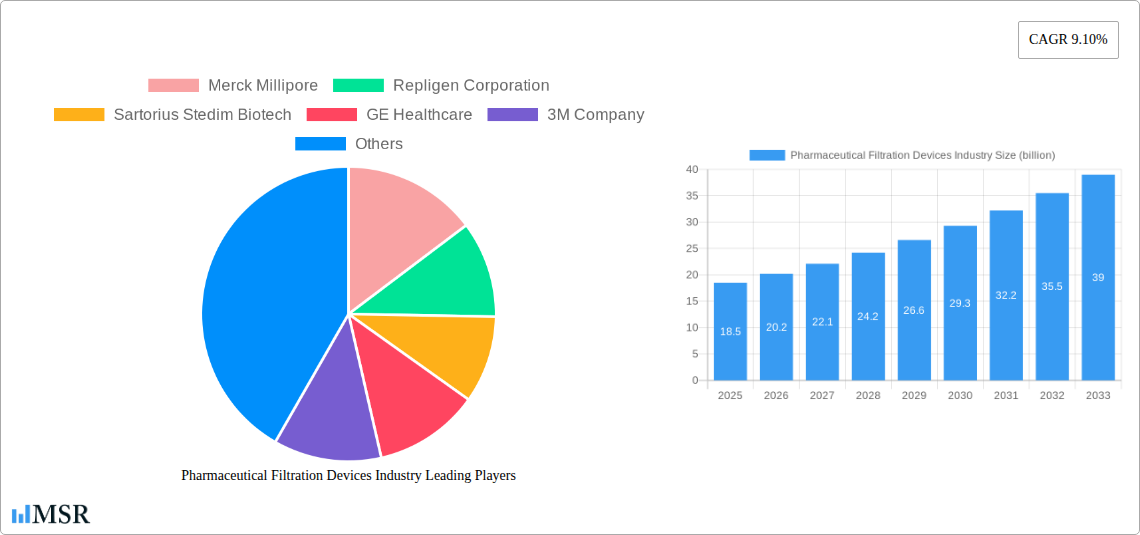

Pharmaceutical Filtration Devices Industry Company Market Share

This in-depth report provides an exhaustive analysis of the pharmaceutical filtration devices market, a critical component of drug manufacturing and healthcare. Covering the historical period of 2019-2024 and projecting growth through 2033, with a base and estimated year of 2025, this study offers unparalleled insights for stakeholders. The global pharmaceutical filtration devices market size is projected to reach $30 billion by 2025, with a robust CAGR of 8.5% during the forecast period, driven by increasing demand for biologics, stringent quality control, and advancements in drug development.

Pharmaceutical Filtration Devices Industry Market Concentration & Dynamics

The pharmaceutical filtration devices industry exhibits a moderately consolidated market structure, with key players like Merck Millipore, Sartorius Stedim Biotech, Danaher Corporation, and Thermo Fisher Scientific holding significant market shares. Innovation ecosystems are vibrant, fueled by substantial R&D investments aimed at developing advanced filtration membranes and systems. Regulatory frameworks, primarily from the FDA and EMA, play a crucial role, mandating high standards for product purity and safety, thereby influencing product development and market entry. Substitute products, such as advanced centrifugation techniques, offer some competition but often lack the specificity and efficacy of filtration for critical biopharmaceutical applications. End-user trends show a growing preference for single-use filtration technologies due to their reduced risk of cross-contamination, enhanced flexibility, and lower validation costs. Mergers and acquisitions (M&A) activity remains a strategic imperative for market leaders to expand their product portfolios and geographical reach. In the historical period (2019-2024), an estimated 35 M&A deals valued at over $15 billion have reshaped the competitive landscape. Leading companies command an average market share exceeding 15% each, highlighting the concentrated nature of the sector.

Pharmaceutical Filtration Devices Industry Industry Insights & Trends

The pharmaceutical filtration devices industry is experiencing remarkable growth, driven by several pivotal factors. The escalating demand for biologics and advanced therapies, including monoclonal antibodies, vaccines, and cell and gene therapies, necessitates highly efficient and reliable filtration solutions for purification and sterilization. This trend is a major market driver, as these complex molecules require precise separation to ensure safety and efficacy. Technological disruptions are continuously reshaping the market, with a significant focus on developing novel membrane materials with enhanced selectivity, improved flux rates, and greater chemical compatibility. Innovations in nanofiltration and ultrafiltration are particularly noteworthy, enabling the removal of smaller impurities and the concentration of valuable biomolecules. Furthermore, the increasing adoption of single-use filtration systems is transforming manufacturing processes. These systems offer significant advantages, including reduced contamination risks, faster changeovers, and lower capital investment compared to traditional reusable systems, making them highly attractive for pharmaceutical manufacturers seeking greater operational efficiency and flexibility.

The global pandemic accelerated the adoption of advanced filtration technologies for vaccine manufacturing and the production of critical therapeutics, further bolstering market growth. Stringent regulatory requirements worldwide, mandating the highest purity standards for pharmaceutical products, also act as a strong growth catalyst. Manufacturers must adhere to strict guidelines to prevent contamination and ensure product safety, thereby driving demand for high-performance filtration devices. Evolving consumer behaviors, including a growing preference for personalized medicine and targeted therapies, also influence the market. These specialized treatments often involve complex biological materials that require sophisticated filtration techniques for isolation and purification. The rise of continuous manufacturing processes in the pharmaceutical sector is another key trend. Filtration plays a crucial role in maintaining the integrity and efficiency of these integrated production lines, leading to increased demand for inline and at-line filtration solutions.

The market is also witnessing a surge in research and development activities focused on developing sustainable and cost-effective filtration solutions. This includes the exploration of biodegradable materials and reusable membrane technologies to reduce the environmental footprint of pharmaceutical manufacturing. The increasing outsourcing of pharmaceutical manufacturing to contract development and manufacturing organizations (CDMOs) is also contributing to market expansion, as these organizations require a diverse range of filtration equipment to serve their clients. The market size for pharmaceutical filtration devices was estimated at $28 billion in 2024 and is projected to reach $30 billion by 2025, with a compound annual growth rate (CAGR) of 8.5% anticipated from 2025 to 2033. This sustained growth trajectory underscores the indispensable role of filtration technologies in modern pharmaceutical production.

Key Markets & Segments Leading Pharmaceutical Filtration Devices Industry

The pharmaceutical filtration devices industry is characterized by dynamic regional and segmental performance. North America currently dominates the market, driven by a strong presence of leading pharmaceutical and biotechnology companies, substantial investments in R&D, and a robust regulatory environment that encourages innovation and adherence to high-quality standards. The United States, in particular, is a significant contributor due to its advanced healthcare infrastructure and its leading role in drug discovery and development. Asia Pacific is emerging as the fastest-growing region, fueled by increasing pharmaceutical manufacturing capabilities, growing healthcare expenditure, and a rising prevalence of chronic diseases, necessitating greater production of medicines.

Within the material segment, Polyethersulfone (PES) membranes hold a leading position due to their excellent chemical compatibility, high flow rates, and low protein binding properties, making them ideal for a wide range of biopharmaceutical applications, including sterile filtration of buffers, media, and drug solutions. Polyvinylidene Difluoride (PVDF) is also a key material, widely used in sterilization and clarification processes, particularly for its robustness and compatibility with aggressive chemicals. Nylon membrane filters are crucial for applications requiring low extractables and high strength.

By technique, Microfiltration remains the most widely adopted technique, essential for removing bacteria, yeast, and other particulate matter to achieve sterile products. Ultrafiltration is gaining significant traction for its role in concentrating biomolecules and removing viruses and endotoxins. Nanofiltration is increasingly being utilized for the specific removal of small molecules, salts, and endotoxins, contributing to higher purity levels in complex drug formulations.

In terms of application, Final Product Processing is the largest segment, encompassing sterile filtration, purification, and clarification of finished drug products to ensure their safety and efficacy. Raw Material Filtration is also a critical application, used to remove contaminants from incoming materials and ensure the quality of starting ingredients. Cell Separation is a rapidly growing application area, especially with the rise of cell-based therapies, where precise separation of cell populations is paramount. Water Purification and Air Purification are essential upstream processes that underpin the entire pharmaceutical manufacturing chain, requiring highly efficient filtration systems to maintain sterile environments.

Drivers for Material Dominance (PES & PVDF):

- Biocompatibility and Low Protein Binding: Essential for preserving the integrity of sensitive biomolecules.

- Broad Chemical Compatibility: Allows for use with a variety of solvents and cleaning agents.

- High Flow Rates and Throughput: Contributes to efficient and cost-effective manufacturing.

- Proven Regulatory Compliance: Established track record in meeting stringent pharmaceutical standards.

Drivers for Technique Dominance (Microfiltration & Ultrafiltration):

- Versatility: Applicable to a wide array of purification and sterilization tasks.

- Cost-Effectiveness: Generally more economical than more advanced techniques for routine applications.

- Scalability: Easily adapted for laboratory, pilot, and large-scale manufacturing.

- Essential for Sterility Assurance: Microfiltration is critical for removing microbial contaminants.

Drivers for Application Dominance (Final Product Processing & Raw Material Filtration):

- Regulatory Mandates: Strict requirements for the purity and safety of final drug products.

- Product Quality and Yield: Efficient filtration directly impacts the quality and quantity of the final pharmaceutical product.

- Process Efficiency: Streamlined raw material filtration reduces downstream processing challenges.

- Preventing Contamination: Crucial for maintaining product integrity throughout the manufacturing lifecycle.

Pharmaceutical Filtration Devices Industry Product Developments

Product innovation in the pharmaceutical filtration devices industry is relentless, focusing on enhancing efficiency, safety, and sustainability. Recent developments include the introduction of advanced single-use filter capsules with integrated pre-filters and optimized membrane configurations for improved throughput and reduced hold-up volumes. Companies are also investing in novel membrane chemistries for enhanced selectivity, enabling precise removal of specific impurities like endotoxins and viruses with minimal product loss. The integration of smart technologies, such as sensors for real-time monitoring of filtration performance and integrity testing, is another significant trend, providing greater process control and reducing the risk of batch failures. Furthermore, there's a growing emphasis on developing filters with reduced extractables and leachables, critical for sensitive biologics and parenteral drugs, ensuring the ultimate purity and safety of pharmaceutical products.

Challenges in the Pharmaceutical Filtration Devices Industry Market

Despite robust growth, the pharmaceutical filtration devices industry faces several significant challenges. Regulatory hurdles remain a primary concern, with evolving guidelines and stringent validation requirements demanding substantial investment and time for product approval. Supply chain disruptions, as witnessed in recent years, can impact the availability of raw materials and critical components, leading to production delays and increased costs. Intense competitive pressures from established players and emerging low-cost manufacturers necessitate continuous innovation and price optimization. The high cost of advanced filtration technologies, especially for novel applications like cell and gene therapy, can also be a barrier to widespread adoption for smaller biopharmaceutical companies. Furthermore, the environmental impact of disposable filtration products is a growing concern, driving the need for more sustainable solutions.

Forces Driving Pharmaceutical Filtration Devices Industry Growth

Several powerful forces are propelling the pharmaceutical filtration devices industry forward. The exponential growth in the biologics and biosimilars market necessitates highly sophisticated filtration for protein purification and sterile processing. Increasing global healthcare expenditure and the rising prevalence of chronic diseases are driving demand for a wider range of pharmaceutical products, all requiring filtration. Stringent regulatory mandates for product purity and safety, enforced by bodies like the FDA and EMA, are driving the adoption of advanced and reliable filtration solutions. Technological advancements in membrane science, leading to improved selectivity, higher flux rates, and enhanced chemical compatibility, are continuously expanding the application scope of filtration devices. The shift towards continuous manufacturing processes in the pharmaceutical sector also demands integrated and efficient filtration systems, further boosting market growth.

Challenges in the Pharmaceutical Filtration Devices Industry Market

(This section addresses long-term growth catalysts. Given the similarity to the previous "Challenges" section, it's rephrased to focus on enduring catalysts.)

Long-term growth catalysts for the pharmaceutical filtration devices industry are deeply intertwined with ongoing advancements and evolving market needs. Continued innovation in novel membrane materials with superior performance characteristics, such as enhanced selectivity for complex biomolecules and greater resistance to fouling, will remain a key driver. The burgeoning fields of cell and gene therapy present immense opportunities, requiring specialized filtration solutions for cell harvesting, purification, and media preparation. Strategic partnerships and collaborations between filtration device manufacturers and pharmaceutical companies will accelerate the development and adoption of customized filtration technologies tailored to specific therapeutic needs. Furthermore, the expansion of emerging markets, driven by increasing healthcare access and growing pharmaceutical manufacturing capabilities, offers substantial untapped potential for market growth. Investments in sustainable filtration technologies, including reusable membranes and biodegradable materials, will also become increasingly important as environmental concerns grow.

Emerging Opportunities in Pharmaceutical Filtration Devices Industry

The pharmaceutical filtration devices industry is ripe with emerging opportunities. The rapid advancement of cell and gene therapies is creating a significant demand for novel filtration solutions capable of handling sensitive cell populations and complex genetic material. The rise of personalized medicine necessitates smaller-scale, highly adaptable filtration systems for custom drug formulations. The increasing adoption of process analytical technology (PAT) in pharmaceutical manufacturing presents opportunities for integrated filtration systems with real-time monitoring capabilities, enhancing process control and ensuring product quality. Furthermore, the growing focus on vaccine production, especially in response to global health threats, will continue to drive demand for sterile filtration technologies. Expansion into emerging economies with improving healthcare infrastructure and growing pharmaceutical production capacity also offers substantial growth potential.

Leading Players in the Pharmaceutical Filtration Devices Industry Sector

- Merck Millipore

- Repligen Corporation

- Sartorius Stedim Biotech

- GE Healthcare

- 3M Company

- GEA Group

- Danaher Corporation

- Graver Technologies

- Thermo Fisher Scientific

- Parker Hannifin Corporation

Key Milestones in Pharmaceutical Filtration Devices Industry Industry

- 2019: Launch of advanced single-use tangential flow filtration (TFF) systems by Sartorius Stedim Biotech, enhancing efficiency in downstream processing.

- 2020: Merck Millipore's introduction of novel membrane technologies with improved viral clearance capabilities, crucial for vaccine manufacturing.

- 2021: GE Healthcare's expansion of its filtration portfolio to support the growing cell and gene therapy market.

- 2022: Danaher Corporation's strategic acquisition of Cytiva, significantly bolstering its bioprocess solutions, including filtration.

- 2023: Thermo Fisher Scientific's continued innovation in sterile filtration solutions for biologics, addressing increasing demand for high-purity therapeutics.

- 2024: Significant advancements in sustainable filtration materials and reusable membrane technologies by several key players, responding to environmental concerns.

Strategic Outlook for Pharmaceutical Filtration Devices Industry Market

The strategic outlook for the pharmaceutical filtration devices industry is exceptionally positive, driven by sustained demand for high-purity pharmaceuticals and ongoing technological advancements. Key growth accelerators include the expanding pipeline of biologic drugs, the rise of personalized medicine, and the increasing adoption of single-use filtration technologies for their inherent benefits in flexibility and contamination control. Strategic opportunities lie in further developing specialized filtration solutions for the burgeoning cell and gene therapy market, investing in sustainable and reusable filtration technologies to address environmental concerns, and expanding market presence in rapidly growing regions like Asia Pacific. Companies that focus on innovation, strategic collaborations, and addressing the evolving regulatory landscape will be well-positioned to capitalize on the significant growth potential within this vital industry.

Pharmaceutical Filtration Devices Industry Segmentation

-

1. Material

- 1.1. Polyethersulfone (PES)

- 1.2. Mixed Ce

- 1.3. Polyvinylidene Difluoride (PVDF)

- 1.4. Nylon Membrane Filters

- 1.5. Others

-

2. Technique

- 2.1. Microfiltration

- 2.2. Ultrafiltration

- 2.3. Nanofiltration

- 2.4. Others

-

3. Application

- 3.1. Final Product Processing

- 3.2. Raw Material Filtration

- 3.3. Cell Separation

- 3.4. Water Purification

- 3.5. Air Purification

Pharmaceutical Filtration Devices Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Pharmaceutical Filtration Devices Industry Regional Market Share

Geographic Coverage of Pharmaceutical Filtration Devices Industry

Pharmaceutical Filtration Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Single-Use Technologies; Advancements in Nanofiltration Technology

- 3.3. Market Restrains

- 3.3.1. High Capital Required for Operations; Membrane Fouling

- 3.4. Market Trends

- 3.4.1. Microfiltration is Expected to Register a High CAGR Through the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Filtration Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polyethersulfone (PES)

- 5.1.2. Mixed Ce

- 5.1.3. Polyvinylidene Difluoride (PVDF)

- 5.1.4. Nylon Membrane Filters

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Technique

- 5.2.1. Microfiltration

- 5.2.2. Ultrafiltration

- 5.2.3. Nanofiltration

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Final Product Processing

- 5.3.2. Raw Material Filtration

- 5.3.3. Cell Separation

- 5.3.4. Water Purification

- 5.3.5. Air Purification

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Pharmaceutical Filtration Devices Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Polyethersulfone (PES)

- 6.1.2. Mixed Ce

- 6.1.3. Polyvinylidene Difluoride (PVDF)

- 6.1.4. Nylon Membrane Filters

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Technique

- 6.2.1. Microfiltration

- 6.2.2. Ultrafiltration

- 6.2.3. Nanofiltration

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Final Product Processing

- 6.3.2. Raw Material Filtration

- 6.3.3. Cell Separation

- 6.3.4. Water Purification

- 6.3.5. Air Purification

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Pharmaceutical Filtration Devices Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Polyethersulfone (PES)

- 7.1.2. Mixed Ce

- 7.1.3. Polyvinylidene Difluoride (PVDF)

- 7.1.4. Nylon Membrane Filters

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Technique

- 7.2.1. Microfiltration

- 7.2.2. Ultrafiltration

- 7.2.3. Nanofiltration

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Final Product Processing

- 7.3.2. Raw Material Filtration

- 7.3.3. Cell Separation

- 7.3.4. Water Purification

- 7.3.5. Air Purification

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Pharmaceutical Filtration Devices Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Polyethersulfone (PES)

- 8.1.2. Mixed Ce

- 8.1.3. Polyvinylidene Difluoride (PVDF)

- 8.1.4. Nylon Membrane Filters

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Technique

- 8.2.1. Microfiltration

- 8.2.2. Ultrafiltration

- 8.2.3. Nanofiltration

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Final Product Processing

- 8.3.2. Raw Material Filtration

- 8.3.3. Cell Separation

- 8.3.4. Water Purification

- 8.3.5. Air Purification

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Rest of the World Pharmaceutical Filtration Devices Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Polyethersulfone (PES)

- 9.1.2. Mixed Ce

- 9.1.3. Polyvinylidene Difluoride (PVDF)

- 9.1.4. Nylon Membrane Filters

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Technique

- 9.2.1. Microfiltration

- 9.2.2. Ultrafiltration

- 9.2.3. Nanofiltration

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Final Product Processing

- 9.3.2. Raw Material Filtration

- 9.3.3. Cell Separation

- 9.3.4. Water Purification

- 9.3.5. Air Purification

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. North Americ Pharmaceutical Filtration Devices Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 11. South America Pharmaceutical Filtration Devices Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Brazil

- 11.1.2 Mexico

- 11.1.3 Rest of South America

- 12. Europe Pharmaceutical Filtration Devices Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Pharmaceutical Filtration Devices Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Taiwan

- 13.1.6 Australia

- 13.1.7 Rest of Asia-Pacific

- 14. MEA Pharmaceutical Filtration Devices Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Middle East

- 14.1.2 Africa

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 Merck Millipore

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Repligen Corporation

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Sartorius Stedim Biotech

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 GE Healthcare

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 3M Company

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 GEA Group

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Danaher Corporation

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Graver Technologies

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Thermo Fisher Scientific

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Parker Hannifin Corporation

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Merck Millipore

List of Figures

- Figure 1: Global Pharmaceutical Filtration Devices Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Pharmaceutical Filtration Devices Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North Americ Pharmaceutical Filtration Devices Industry Revenue (billion), by Country 2025 & 2033

- Figure 4: North Americ Pharmaceutical Filtration Devices Industry Volume (K Units), by Country 2025 & 2033

- Figure 5: North Americ Pharmaceutical Filtration Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: North Americ Pharmaceutical Filtration Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 7: South America Pharmaceutical Filtration Devices Industry Revenue (billion), by Country 2025 & 2033

- Figure 8: South America Pharmaceutical Filtration Devices Industry Volume (K Units), by Country 2025 & 2033

- Figure 9: South America Pharmaceutical Filtration Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Pharmaceutical Filtration Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Pharmaceutical Filtration Devices Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: Europe Pharmaceutical Filtration Devices Industry Volume (K Units), by Country 2025 & 2033

- Figure 13: Europe Pharmaceutical Filtration Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Pharmaceutical Filtration Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Asia Pacific Pharmaceutical Filtration Devices Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: Asia Pacific Pharmaceutical Filtration Devices Industry Volume (K Units), by Country 2025 & 2033

- Figure 17: Asia Pacific Pharmaceutical Filtration Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Pharmaceutical Filtration Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: MEA Pharmaceutical Filtration Devices Industry Revenue (billion), by Country 2025 & 2033

- Figure 20: MEA Pharmaceutical Filtration Devices Industry Volume (K Units), by Country 2025 & 2033

- Figure 21: MEA Pharmaceutical Filtration Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: MEA Pharmaceutical Filtration Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 23: North America Pharmaceutical Filtration Devices Industry Revenue (billion), by Material 2025 & 2033

- Figure 24: North America Pharmaceutical Filtration Devices Industry Volume (K Units), by Material 2025 & 2033

- Figure 25: North America Pharmaceutical Filtration Devices Industry Revenue Share (%), by Material 2025 & 2033

- Figure 26: North America Pharmaceutical Filtration Devices Industry Volume Share (%), by Material 2025 & 2033

- Figure 27: North America Pharmaceutical Filtration Devices Industry Revenue (billion), by Technique 2025 & 2033

- Figure 28: North America Pharmaceutical Filtration Devices Industry Volume (K Units), by Technique 2025 & 2033

- Figure 29: North America Pharmaceutical Filtration Devices Industry Revenue Share (%), by Technique 2025 & 2033

- Figure 30: North America Pharmaceutical Filtration Devices Industry Volume Share (%), by Technique 2025 & 2033

- Figure 31: North America Pharmaceutical Filtration Devices Industry Revenue (billion), by Application 2025 & 2033

- Figure 32: North America Pharmaceutical Filtration Devices Industry Volume (K Units), by Application 2025 & 2033

- Figure 33: North America Pharmaceutical Filtration Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: North America Pharmaceutical Filtration Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: North America Pharmaceutical Filtration Devices Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: North America Pharmaceutical Filtration Devices Industry Volume (K Units), by Country 2025 & 2033

- Figure 37: North America Pharmaceutical Filtration Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: North America Pharmaceutical Filtration Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Europe Pharmaceutical Filtration Devices Industry Revenue (billion), by Material 2025 & 2033

- Figure 40: Europe Pharmaceutical Filtration Devices Industry Volume (K Units), by Material 2025 & 2033

- Figure 41: Europe Pharmaceutical Filtration Devices Industry Revenue Share (%), by Material 2025 & 2033

- Figure 42: Europe Pharmaceutical Filtration Devices Industry Volume Share (%), by Material 2025 & 2033

- Figure 43: Europe Pharmaceutical Filtration Devices Industry Revenue (billion), by Technique 2025 & 2033

- Figure 44: Europe Pharmaceutical Filtration Devices Industry Volume (K Units), by Technique 2025 & 2033

- Figure 45: Europe Pharmaceutical Filtration Devices Industry Revenue Share (%), by Technique 2025 & 2033

- Figure 46: Europe Pharmaceutical Filtration Devices Industry Volume Share (%), by Technique 2025 & 2033

- Figure 47: Europe Pharmaceutical Filtration Devices Industry Revenue (billion), by Application 2025 & 2033

- Figure 48: Europe Pharmaceutical Filtration Devices Industry Volume (K Units), by Application 2025 & 2033

- Figure 49: Europe Pharmaceutical Filtration Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 50: Europe Pharmaceutical Filtration Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 51: Europe Pharmaceutical Filtration Devices Industry Revenue (billion), by Country 2025 & 2033

- Figure 52: Europe Pharmaceutical Filtration Devices Industry Volume (K Units), by Country 2025 & 2033

- Figure 53: Europe Pharmaceutical Filtration Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 54: Europe Pharmaceutical Filtration Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 55: Asia Pacific Pharmaceutical Filtration Devices Industry Revenue (billion), by Material 2025 & 2033

- Figure 56: Asia Pacific Pharmaceutical Filtration Devices Industry Volume (K Units), by Material 2025 & 2033

- Figure 57: Asia Pacific Pharmaceutical Filtration Devices Industry Revenue Share (%), by Material 2025 & 2033

- Figure 58: Asia Pacific Pharmaceutical Filtration Devices Industry Volume Share (%), by Material 2025 & 2033

- Figure 59: Asia Pacific Pharmaceutical Filtration Devices Industry Revenue (billion), by Technique 2025 & 2033

- Figure 60: Asia Pacific Pharmaceutical Filtration Devices Industry Volume (K Units), by Technique 2025 & 2033

- Figure 61: Asia Pacific Pharmaceutical Filtration Devices Industry Revenue Share (%), by Technique 2025 & 2033

- Figure 62: Asia Pacific Pharmaceutical Filtration Devices Industry Volume Share (%), by Technique 2025 & 2033

- Figure 63: Asia Pacific Pharmaceutical Filtration Devices Industry Revenue (billion), by Application 2025 & 2033

- Figure 64: Asia Pacific Pharmaceutical Filtration Devices Industry Volume (K Units), by Application 2025 & 2033

- Figure 65: Asia Pacific Pharmaceutical Filtration Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 66: Asia Pacific Pharmaceutical Filtration Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 67: Asia Pacific Pharmaceutical Filtration Devices Industry Revenue (billion), by Country 2025 & 2033

- Figure 68: Asia Pacific Pharmaceutical Filtration Devices Industry Volume (K Units), by Country 2025 & 2033

- Figure 69: Asia Pacific Pharmaceutical Filtration Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 70: Asia Pacific Pharmaceutical Filtration Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 71: Rest of the World Pharmaceutical Filtration Devices Industry Revenue (billion), by Material 2025 & 2033

- Figure 72: Rest of the World Pharmaceutical Filtration Devices Industry Volume (K Units), by Material 2025 & 2033

- Figure 73: Rest of the World Pharmaceutical Filtration Devices Industry Revenue Share (%), by Material 2025 & 2033

- Figure 74: Rest of the World Pharmaceutical Filtration Devices Industry Volume Share (%), by Material 2025 & 2033

- Figure 75: Rest of the World Pharmaceutical Filtration Devices Industry Revenue (billion), by Technique 2025 & 2033

- Figure 76: Rest of the World Pharmaceutical Filtration Devices Industry Volume (K Units), by Technique 2025 & 2033

- Figure 77: Rest of the World Pharmaceutical Filtration Devices Industry Revenue Share (%), by Technique 2025 & 2033

- Figure 78: Rest of the World Pharmaceutical Filtration Devices Industry Volume Share (%), by Technique 2025 & 2033

- Figure 79: Rest of the World Pharmaceutical Filtration Devices Industry Revenue (billion), by Application 2025 & 2033

- Figure 80: Rest of the World Pharmaceutical Filtration Devices Industry Volume (K Units), by Application 2025 & 2033

- Figure 81: Rest of the World Pharmaceutical Filtration Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 82: Rest of the World Pharmaceutical Filtration Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 83: Rest of the World Pharmaceutical Filtration Devices Industry Revenue (billion), by Country 2025 & 2033

- Figure 84: Rest of the World Pharmaceutical Filtration Devices Industry Volume (K Units), by Country 2025 & 2033

- Figure 85: Rest of the World Pharmaceutical Filtration Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 86: Rest of the World Pharmaceutical Filtration Devices Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 3: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 4: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Material 2020 & 2033

- Table 5: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Technique 2020 & 2033

- Table 6: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Technique 2020 & 2033

- Table 7: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 9: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 11: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 21: Brazil Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Brazil Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: Mexico Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Mexico Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 25: Rest of South America Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 29: Germany Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Germany Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: United Kingdom Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: United Kingdom Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: France Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: France Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Italy Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Italy Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Spain Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Spain Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 43: China Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Japan Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: India Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: South Korea Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: South Korea Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Taiwan Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Taiwan Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Australia Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Australia Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia-Pacific Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia-Pacific Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 58: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 59: Middle East Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Middle East Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 61: Africa Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Africa Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 64: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Material 2020 & 2033

- Table 65: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Technique 2020 & 2033

- Table 66: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Technique 2020 & 2033

- Table 67: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 68: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 69: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 71: United States Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: United States Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: Canada Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Canada Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Mexico Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Mexico Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 78: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Material 2020 & 2033

- Table 79: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Technique 2020 & 2033

- Table 80: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Technique 2020 & 2033

- Table 81: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 82: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 83: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 84: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 85: Germany Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: Germany Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: United Kingdom Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: United Kingdom Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: France Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: France Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 91: Italy Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Italy Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 93: Spain Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 94: Spain Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 95: Rest of Europe Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 96: Rest of Europe Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 97: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 98: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Material 2020 & 2033

- Table 99: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Technique 2020 & 2033

- Table 100: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Technique 2020 & 2033

- Table 101: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 102: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 103: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 104: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 105: China Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 106: China Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 107: Japan Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 108: Japan Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 109: India Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 110: India Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 111: Australia Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 112: Australia Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 113: South Korea Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 114: South Korea Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 115: Rest of Asia Pacific Pharmaceutical Filtration Devices Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 116: Rest of Asia Pacific Pharmaceutical Filtration Devices Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 117: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 118: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Material 2020 & 2033

- Table 119: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Technique 2020 & 2033

- Table 120: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Technique 2020 & 2033

- Table 121: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 122: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 123: Global Pharmaceutical Filtration Devices Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 124: Global Pharmaceutical Filtration Devices Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Filtration Devices Industry?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the Pharmaceutical Filtration Devices Industry?

Key companies in the market include Merck Millipore, Repligen Corporation, Sartorius Stedim Biotech, GE Healthcare, 3M Company, GEA Group, Danaher Corporation, Graver Technologies, Thermo Fisher Scientific, Parker Hannifin Corporation.

3. What are the main segments of the Pharmaceutical Filtration Devices Industry?

The market segments include Material, Technique, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Single-Use Technologies; Advancements in Nanofiltration Technology.

6. What are the notable trends driving market growth?

Microfiltration is Expected to Register a High CAGR Through the Forecast Period.

7. Are there any restraints impacting market growth?

High Capital Required for Operations; Membrane Fouling.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Filtration Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Filtration Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Filtration Devices Industry?

To stay informed about further developments, trends, and reports in the Pharmaceutical Filtration Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence