Key Insights

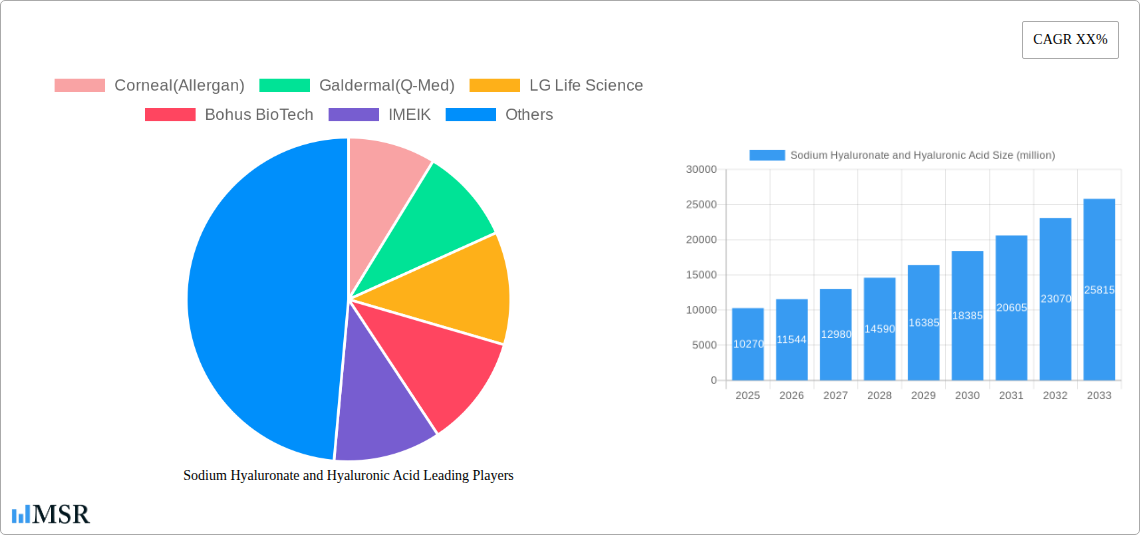

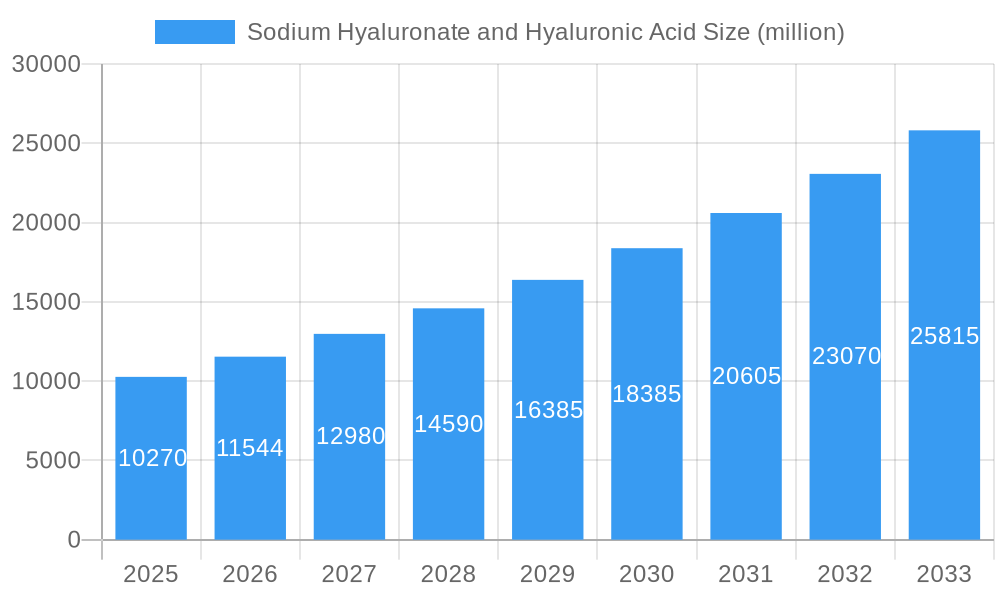

The global market for Sodium Hyaluronate and Hyaluronic Acid is poised for significant expansion, estimated to reach $10.27 billion in 2025. This growth is fueled by an impressive projected Compound Annual Growth Rate (CAGR) of 12.34% from 2025 to 2033. The versatility of these compounds, primarily derived from Hyaluronic Acid and its salt form, Sodium Hyaluronate, is driving their adoption across various high-value applications. The beauty industry stands as a major consumer, leveraging the humectant properties for skincare products, anti-aging treatments, and dermal fillers that enhance facial aesthetics and promote skin hydration. Beyond cosmetics, therapeutic applications are gaining substantial traction. Medical treatments, including ophthalmic surgeries, osteoarthritis management, and wound healing, are increasingly incorporating these biomaterials due to their biocompatibility and tissue-regenerating capabilities. Key players such as Corneal (Allergan), Galdermal (Q-Med), LG Life Science, Bohus BioTech, IMEIK, and Bloomage Freda are actively investing in research and development, expanding production capacities, and forging strategic partnerships to capture a larger share of this dynamic market.

Sodium Hyaluronate and Hyaluronic Acid Market Size (In Billion)

The market's robust growth trajectory is underpinned by several key drivers and emerging trends. Increasing consumer awareness regarding the benefits of hyaluronic acid in anti-aging and aesthetic procedures, coupled with a rising disposable income globally, is a primary growth catalyst. Advancements in biotechnology and manufacturing processes are leading to more cost-effective production of high-purity hyaluronic acid and sodium hyaluronate, making them accessible for a wider range of applications. The growing preference for minimally invasive cosmetic procedures further bolsters demand for dermal fillers. Geographically, Asia Pacific, particularly China and South Korea, is emerging as a significant market due to a burgeoning beauty industry and increasing healthcare expenditure. While the market exhibits strong upward momentum, certain restraints, such as stringent regulatory approvals for medical-grade products and the potential for price volatility of raw materials, need to be navigated by market participants. Nevertheless, the overarching trend points towards sustained demand and innovation within the Sodium Hyaluronate and Hyaluronic Acid market.

Sodium Hyaluronate and Hyaluronic Acid Company Market Share

Here is an SEO-optimized and engaging report description for Sodium Hyaluronate and Hyaluronic Acid, incorporating your specified requirements:

Sodium Hyaluronate and Hyaluronic Acid Market Concentration & Dynamics

This comprehensive report delves into the intricate market concentration and dynamic forces shaping the global Sodium Hyaluronate and Hyaluronic Acid industry. We dissect the innovation ecosystems, highlighting key research and development hubs and their impact on market evolution. Regulatory frameworks, a crucial determinant of market access and product approval, are analyzed in detail, providing clarity on current and upcoming compliance requirements. The report also assesses the threat of substitute products, evaluating their potential to disrupt market share and influence pricing strategies. End-user trends, particularly within the booming Beauty Industry and burgeoning Therapy applications, are meticulously examined to understand evolving demand patterns. Furthermore, M&A activities are tracked, revealing strategic consolidations and their influence on market concentration. With a projected market size expected to reach billions, understanding these dynamics is paramount for strategic decision-making. Key players like Corneal (Allergan), Galdermal (Q-Med), LG Life Science, Bohus BioTech, IMEIK, and Bloomage Freda are analyzed within this context. The report includes quantifiable metrics such as estimated market share percentages for leading companies and the number of significant M&A deals observed throughout the historical and forecast periods, offering actionable intelligence on the competitive landscape and future market trajectories.

Sodium Hyaluronate and Hyaluronic Acid Industry Insights & Trends

The global Sodium Hyaluronate and Hyaluronic Acid market is poised for substantial growth, projected to reach billions by 2033. Our in-depth analysis, covering the study period from 2019 to 2033 with a base year of 2025, reveals a Compound Annual Growth Rate (CAGR) of xx%, driven by a confluence of powerful market growth drivers. Technological disruptions are at the forefront, with advancements in fermentation processes and cross-linking techniques enhancing product efficacy and expanding application horizons. Evolving consumer behaviors, characterized by an increasing demand for anti-aging solutions, advanced skincare, and minimally invasive aesthetic treatments, are fueling the expansion of the Beauty Industry segment, which alone is projected to contribute billions to the market. The therapeutic applications, ranging from osteoarthritis treatment to ophthalmic surgeries, are also witnessing significant uptake, bolstered by an aging global population and advancements in medical procedures. Market size in 2025 is estimated at billions, with projections indicating a robust expansion throughout the forecast period. We explore the impact of scientific breakthroughs, such as novel delivery systems for hyaluronic acid and the development of biocompatible sodium hyaluronate derivatives, on market penetration. Consumer awareness regarding the benefits of hyaluronic acid for skin hydration and joint health is a critical driver, leading to increased product adoption across diverse demographics. The report also examines the influence of lifestyle trends, such as the growing interest in preventative healthcare and aesthetic maintenance, which further stimulate demand for these versatile compounds. Furthermore, the development of advanced formulations and the increasing application of hyaluronic acid in wound healing and regenerative medicine are opening up new avenues for market expansion. Our analysis provides a granular view of these trends, offering insights into the evolving landscape and future opportunities within the multi-billion dollar Sodium Hyaluronate and Hyaluronic Acid industry.

Key Markets & Segments Leading Sodium Hyaluronate and Hyaluronic Acid

This section meticulously identifies and analyzes the dominant markets and segments propelling the global Sodium Hyaluronate and Hyaluronic Acid industry forward, with a focus on the period from 2019 to 2033.

Dominant Regions and Countries:

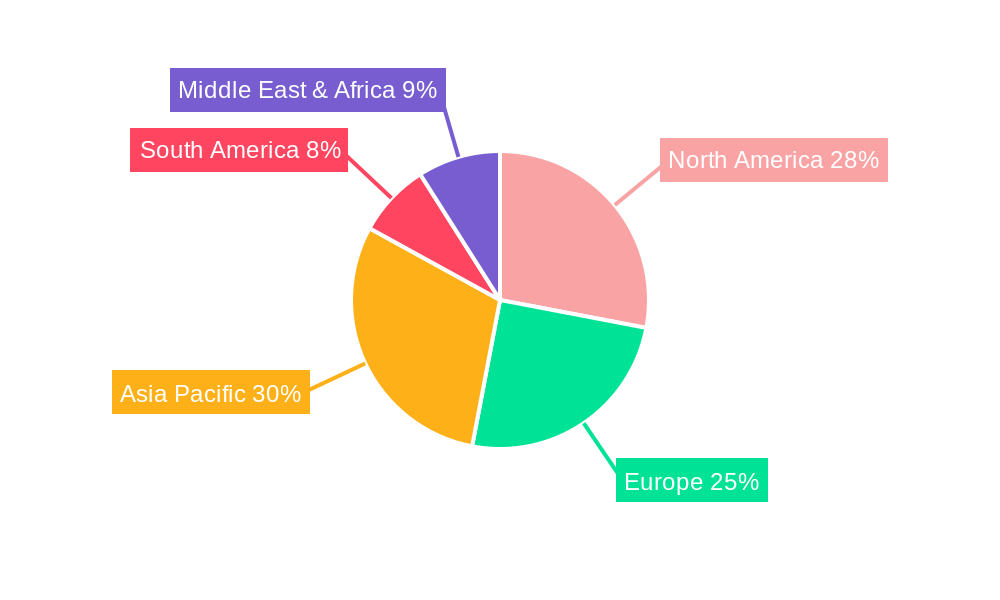

The North American region, particularly the United States, consistently demonstrates market leadership due to its high disposable income, advanced healthcare infrastructure, and strong consumer preference for aesthetic and dermatological treatments. Economic growth in this region directly translates to increased investment in beauty products and medical therapies utilizing hyaluronic acid.

- Drivers of Dominance in North America:

- High Disposable Income: Enables greater consumer spending on premium beauty and anti-aging products.

- Advanced Healthcare Infrastructure: Supports widespread adoption of hyaluronic acid-based therapies.

- Strong Regulatory Support (for approved applications): Facilitates market entry and product development.

- Technological Innovation Hubs: Drives development of novel applications and formulations.

Asia Pacific, with its rapidly growing economies and a burgeoning middle class, is emerging as a significant growth engine. Countries like China and South Korea are witnessing an exponential rise in demand for cosmetic procedures and skincare, driven by increasing awareness and affordability.

- Drivers of Dominance in Asia Pacific:

- Rapid Economic Growth: Fuels consumer spending power.

- Increasing Disposable Incomes: Makes advanced beauty and therapeutic products accessible.

- Growing Beauty Consciousness: High demand for effective skincare and aesthetic treatments.

- Government Initiatives: Supporting the growth of the biotechnology and pharmaceutical sectors.

Dominant Application Segments:

The Beauty Industry stands as the primary growth driver, contributing billions to the market. This segment encompasses a wide array of products, including dermal fillers, moisturizers, serums, and anti-aging creams, all leveraging the humectant and volumizing properties of hyaluronic acid and its salt.

- Drivers of Beauty Industry Dominance:

- Growing Anti-Aging Market: High demand for solutions to reduce wrinkles and improve skin elasticity.

- Increasing Popularity of Minimally Invasive Procedures: Dermal fillers remain a top choice for aesthetic enhancement.

- Consumer Demand for Natural and Effective Ingredients: Hyaluronic acid is perceived as a safe and highly effective ingredient.

- Influence of Social Media and Celebrity Endorsements: Drives consumer interest and product adoption.

The Therapy segment, while currently smaller, is demonstrating robust growth. This includes applications in ophthalmology (e.g., for dry eye treatment and intraocular lens insertion), orthopedics (for osteoarthritis treatment and joint lubrication), and wound healing.

- Drivers of Therapy Segment Growth:

- Aging Global Population: Increases prevalence of age-related conditions like osteoarthritis and dry eye.

- Advancements in Medical Procedures: Expansion of applications in surgery and regenerative medicine.

- Focus on Minimally Invasive Therapies: Hyaluronic acid offers less invasive treatment options.

- Growing Awareness of Therapeutic Benefits: Increased understanding of hyaluronic acid's role in tissue repair and lubrication.

Dominant Product Types:

Both Hyaluronic Acid and Sodium Hyaluronate are critical to market growth. Sodium Hyaluronate, the salt form, is often preferred for its enhanced stability and compatibility in various formulations, making it a key player in both beauty and therapeutic applications.

- Drivers of Dominance for Sodium Hyaluronate:

- Superior Stability and Compatibility: Ideal for use in diverse product formulations.

- Enhanced Penetration: Facilitates effective delivery into skin layers.

- Wide Range of Molecular Weights: Allows for tailored applications with specific benefits.

Hyaluronic Acid, in its pure form, is also integral, particularly in high-end skincare and specific therapeutic contexts where its unique properties are most beneficial. The ability to synthesize hyaluronic acid with precise molecular weights and purity levels is crucial for its continued dominance.

- Drivers of Dominance for Hyaluronic Acid:

- Fundamental Humectant Properties: Essential for skin hydration and moisture retention.

- Biocompatibility and Biodegradability: Ensures safety and natural integration within the body.

- Versatility in Formulations: Adaptable for various product types and delivery methods.

Sodium Hyaluronate and Hyaluronic Acid Product Developments

Recent product developments in the Sodium Hyaluronate and Hyaluronic Acid sector are characterized by a strong emphasis on enhanced efficacy and expanded applications. Innovations in cross-linking technologies are yielding hyaluronic acid formulations with superior longevity and resistance to degradation, particularly for dermal fillers, leading to longer-lasting aesthetic results. Furthermore, advancements in controlled release mechanisms are enabling more targeted delivery of therapeutic hyaluronic acid, optimizing treatment outcomes for conditions like osteoarthritis and chronic wounds. The development of novel molecular weight fractions of hyaluronic acid and sodium hyaluronate is also a key trend, allowing for precise customization of product properties to suit specific skincare needs or therapeutic objectives. These technological advancements are not only enhancing the performance of existing products but also paving the way for entirely new applications, solidifying the competitive edge of leading manufacturers in the multi-billion dollar global market.

Challenges in the Sodium Hyaluronate and Hyaluronic Acid Market

Despite significant growth, the Sodium Hyaluronate and Hyaluronic Acid market faces several challenges that could impact its trajectory. Regulatory hurdles in different regions can slow down product approvals, especially for novel therapeutic applications, adding significant time and cost to market entry. Supply chain disruptions, exacerbated by global events, can lead to price volatility for raw materials and finished products, potentially affecting market accessibility. Intense competition among numerous players, including established giants and emerging biotech firms, puts pressure on profit margins. The need for continuous innovation to maintain a competitive edge also requires substantial R&D investment, which can be a barrier for smaller companies. Furthermore, the availability of cost-effective alternatives in certain non-critical applications, while not a direct substitute for high-grade medical or cosmetic hyaluronic acid, can influence market segmentation. These challenges, if not addressed strategically, could moderate the otherwise robust growth projections for this multi-billion dollar industry.

Forces Driving Sodium Hyaluronate and Hyaluronic Acid Growth

The growth of the Sodium Hyaluronate and Hyaluronic Acid market is propelled by a powerful combination of forces. Technological advancements in biotechnology, particularly in the optimization of fermentation and purification processes, have made hyaluronic acid and its derivatives more accessible and cost-effective, contributing billions to market expansion. The increasing global demand for aesthetic and dermatological treatments, driven by a growing emphasis on anti-aging and skin health, is a significant economic driver. Regulatory bodies in various countries are also recognizing and approving new therapeutic applications, opening up vast market opportunities. Furthermore, the aging global population is a key demographic driver, increasing the incidence of conditions like osteoarthritis and dry eye, which are effectively managed with hyaluronic acid-based therapies. These multifaceted drivers collectively ensure a promising future for this multi-billion dollar industry.

Challenges in the Sodium Hyaluronate and Hyaluronic Acid Market

Long-term growth catalysts for the Sodium Hyaluronate and Hyaluronic Acid market are deeply rooted in continuous innovation and strategic market expansion. The development of advanced delivery systems, such as microneedles and liposomal encapsulation, promises to enhance the efficacy and patient compliance of both cosmetic and therapeutic hyaluronic acid applications. Partnerships between research institutions and industry players are crucial for unlocking new scientific discoveries and translating them into commercially viable products. Furthermore, the exploration and penetration of emerging markets, particularly in developing economies with growing disposable incomes and increasing healthcare awareness, represent significant growth opportunities. The focus on sustainable and eco-friendly production methods for hyaluronic acid is also gaining traction, aligning with global environmental consciousness and potentially creating new market niches. These long-term catalysts are expected to sustain the multi-billion dollar trajectory of the industry.

Emerging Opportunities in Sodium Hyaluronate and Hyaluronic Acid

Emerging opportunities in the Sodium Hyaluronate and Hyaluronic Acid sector are diverse and promising, offering significant potential for market expansion in the coming years. The growing interest in regenerative medicine presents a substantial avenue, with hyaluronic acid showing promise in tissue engineering and wound healing applications, potentially creating a multi-billion dollar sub-segment. Advances in personalized medicine are also opening doors for tailored hyaluronic acid formulations based on individual genetic profiles or specific medical needs. The increasing demand for bio-based and sustainable ingredients in the cosmetics and personal care industry positions hyaluronic acid favorably as a natural and highly effective component. Furthermore, the exploration of novel therapeutic applications, such as its potential role in treating certain inflammatory conditions or in drug delivery systems beyond ophthalmology and orthopedics, represents untapped market potential. As research continues to uncover the multifaceted benefits of this versatile biopolymer, new applications and market segments will undoubtedly emerge.

Leading Players in the Sodium Hyaluronate and Hyaluronic Acid Sector

- Corneal

- Galdermal

- LG Life Science

- Bohus BioTech

- IMEIK

- Bloomage Freda

Key Milestones in Sodium Hyaluronate and Hyaluronic Acid Industry

- 2019: Significant investment in R&D for novel hyaluronic acid derivatives for regenerative medicine.

- 2020: Increased demand for hyaluronic acid-based moisturizers and serums due to heightened focus on skincare during lockdowns.

- 2021: Expansion of therapeutic applications for hyaluronic acid in joint pain management and post-operative recovery.

- 2022: Development of advanced cross-linking techniques for longer-lasting dermal fillers.

- 2023: Growing interest in sustainable and bio-fermentation production methods for sodium hyaluronate.

- 2024: Introduction of new hyaluronic acid formulations with enhanced skin penetration capabilities.

Strategic Outlook for Sodium Hyaluronate and Hyaluronic Acid Market

The strategic outlook for the Sodium Hyaluronate and Hyaluronic Acid market is exceptionally robust, driven by ongoing innovation and expanding applications. The continued growth in the beauty industry, fueled by the persistent demand for anti-aging and skin rejuvenation solutions, will remain a primary accelerator. Simultaneously, the therapeutic segment is poised for substantial expansion as new medical applications in orthopedics, ophthalmology, and wound healing gain traction and regulatory approvals. Strategic investments in research and development to create novel formulations with targeted functionalities and enhanced biocompatibility will be crucial for maintaining market leadership. Furthermore, collaborations and partnerships between key players and research institutions will foster innovation and accelerate the commercialization of next-generation hyaluronic acid products. The increasing consumer preference for naturally derived and scientifically validated ingredients further solidifies the long-term potential of this multi-billion dollar market.

Sodium Hyaluronate and Hyaluronic Acid Segmentation

-

1. Application

- 1.1. Beauty Industry

- 1.2. Therapy

-

2. Types

- 2.1. Hyaluronic Acid

- 2.2. Sodium Hyaluronate

Sodium Hyaluronate and Hyaluronic Acid Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sodium Hyaluronate and Hyaluronic Acid Regional Market Share

Geographic Coverage of Sodium Hyaluronate and Hyaluronic Acid

Sodium Hyaluronate and Hyaluronic Acid REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sodium Hyaluronate and Hyaluronic Acid Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Beauty Industry

- 5.1.2. Therapy

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Hyaluronic Acid

- 5.2.2. Sodium Hyaluronate

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sodium Hyaluronate and Hyaluronic Acid Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Beauty Industry

- 6.1.2. Therapy

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Hyaluronic Acid

- 6.2.2. Sodium Hyaluronate

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Sodium Hyaluronate and Hyaluronic Acid Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Beauty Industry

- 7.1.2. Therapy

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Hyaluronic Acid

- 7.2.2. Sodium Hyaluronate

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Sodium Hyaluronate and Hyaluronic Acid Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Beauty Industry

- 8.1.2. Therapy

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Hyaluronic Acid

- 8.2.2. Sodium Hyaluronate

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Sodium Hyaluronate and Hyaluronic Acid Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Beauty Industry

- 9.1.2. Therapy

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Hyaluronic Acid

- 9.2.2. Sodium Hyaluronate

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Sodium Hyaluronate and Hyaluronic Acid Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Beauty Industry

- 10.1.2. Therapy

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Hyaluronic Acid

- 10.2.2. Sodium Hyaluronate

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Corneal(Allergan)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Galdermal(Q-Med)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LG Life Science

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bohus BioTech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IMEIK

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bloomage Freda

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Corneal(Allergan)

List of Figures

- Figure 1: Global Sodium Hyaluronate and Hyaluronic Acid Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Sodium Hyaluronate and Hyaluronic Acid Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Types 2020 & 2033

- Table 7: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Types 2020 & 2033

- Table 13: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Types 2020 & 2033

- Table 19: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Types 2020 & 2033

- Table 31: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Types 2020 & 2033

- Table 40: Global Sodium Hyaluronate and Hyaluronic Acid Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Sodium Hyaluronate and Hyaluronic Acid Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sodium Hyaluronate and Hyaluronic Acid?

The projected CAGR is approximately 12.34%.

2. Which companies are prominent players in the Sodium Hyaluronate and Hyaluronic Acid?

Key companies in the market include Corneal(Allergan), Galdermal(Q-Med), LG Life Science, Bohus BioTech, IMEIK, Bloomage Freda.

3. What are the main segments of the Sodium Hyaluronate and Hyaluronic Acid?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sodium Hyaluronate and Hyaluronic Acid," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sodium Hyaluronate and Hyaluronic Acid report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sodium Hyaluronate and Hyaluronic Acid?

To stay informed about further developments, trends, and reports in the Sodium Hyaluronate and Hyaluronic Acid, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence