Key Insights

The UK bariatric surgery market is projected for substantial growth, propelled by rising obesity rates and increasing recognition of the long-term health advantages of surgical interventions. With a market size of £9.46 billion in the 2025 base year, the sector is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 13.15% by 2033. Key growth drivers include advancements in surgical techniques, the proliferation of minimally invasive procedures, and significant investment in healthcare infrastructure. The escalating prevalence of obesity-related comorbidities, such as type 2 diabetes, hypertension, and cardiovascular diseases, is intensifying demand for effective weight management solutions, establishing bariatric surgery as a vital public health strategy. The widening array of treatment options, including implantable and assisting devices, addresses a diverse patient population with varied needs.

UK Bariatric Surgery Industry Market Size (In Billion)

Market expansion is further bolstered by evolving patient perceptions, viewing bariatric surgery as a transformative treatment rather than a final option. The integration of advanced assisting devices, including sophisticated suturing and stapling instruments, improves procedural safety and efficacy, resulting in better patient outcomes and expedited recovery. Concurrently, innovative implantable devices, such as advanced gastric balloons and electrical stimulation devices, provide less invasive alternatives, broadening the appeal of bariatric interventions. Potential challenges, including high upfront costs, limited insurance coverage for specific procedures, and the requirement for significant post-operative lifestyle adjustments, may temper growth. Nevertheless, continuous technological innovation and concerted efforts by healthcare providers to enhance accessibility and affordability are expected to overcome these obstacles, ensuring sustained market expansion and contributing to improved public health across the UK.

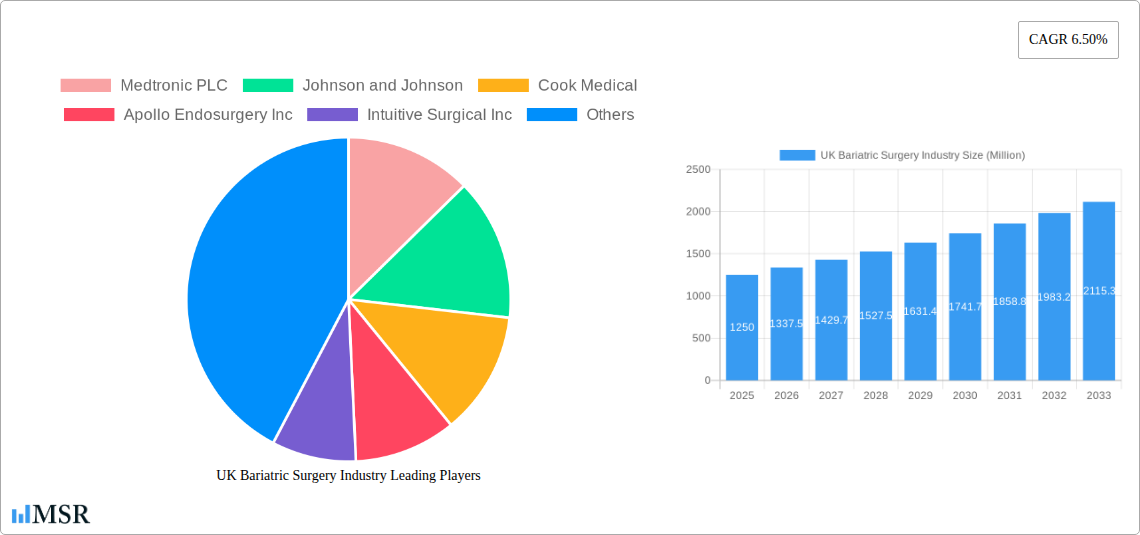

UK Bariatric Surgery Industry Company Market Share

Unlocking the Future of Obesity Management: UK Bariatric Surgery Industry Report 2025-2033

This comprehensive report offers an in-depth analysis of the UK Bariatric Surgery Industry, a rapidly evolving sector focused on providing life-changing solutions for obesity. Delve into market dynamics, technological advancements, and strategic opportunities that are shaping the future of weight management in the UK. With a detailed examination spanning from 2019 to 2033, including a base year of 2025 and an extensive forecast period from 2025 to 2033, this report is essential for industry leaders, investors, medical professionals, and policymakers.

UK Bariatric Surgery Industry Market Concentration & Dynamics

The UK Bariatric Surgery Industry exhibits a dynamic market concentration, with a few key players dominating the landscape. The innovation ecosystem is fueled by continuous research and development in minimally invasive techniques and advanced device technology. Regulatory frameworks, primarily governed by the MHRA and NICE, are crucial in ensuring patient safety and technology adoption. Substitute products, such as non-surgical weight loss programs and pharmacological interventions, present a competitive challenge, albeit one that often complements surgical solutions for severe obesity. End-user trends are increasingly leaning towards less invasive procedures with quicker recovery times. Merger and acquisition (M&A) activities, while not yet at an extreme peak, are anticipated to rise as companies seek to expand their product portfolios and market reach. Key metrics indicate a market share concentration of approximately 65% held by the top five companies in the device segment. The number of M&A deals in the past five years is estimated at xx, signaling a consolidating but competitive environment.

UK Bariatric Surgery Industry Industry Insights & Trends

The UK Bariatric Surgery Industry is experiencing robust growth, driven by an increasing prevalence of obesity and rising awareness of bariatric surgery as a viable treatment option. The market size is projected to reach GBP 5.7 Billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.5% forecast from 2025 to 2033. Technological disruptions are at the forefront, with advancements in robotic-assisted surgery and the development of novel implantable devices revolutionizing patient outcomes and procedural efficiency. Evolving consumer behaviors are characterized by a growing demand for personalized treatment plans, a preference for minimally invasive approaches, and a greater emphasis on post-operative support and long-term lifestyle changes. The increasing adoption of advanced surgical stapling devices, gastric balloons, and robotic surgery systems are significant market growth drivers. Furthermore, the influence of digital health platforms in patient monitoring and engagement is on the rise, creating new avenues for service delivery and market expansion. The focus on evidence-based medicine and improved patient selection criteria is also contributing to higher success rates and enhanced patient satisfaction, further bolstering market confidence and growth.

Key Markets & Segments Leading UK Bariatric Surgery Industry

The Assisting Devices segment is currently the dominant force within the UK Bariatric Surgery Industry, driven by the widespread adoption of advanced surgical techniques.

- Assisting Devices: This segment is a primary revenue generator, with substantial demand for:

- Stapling Devices: Essential for creating surgical anastomoses during procedures like gastric bypass and sleeve gastrectomy, these devices are experiencing continuous innovation for enhanced precision and safety.

- Suturing Devices: Crucial for wound closure and tissue approximation, modern suturing devices offer improved ease of use and reduced complication rates.

- Closure Devices: Utilized for sealing incisions and internal openings, these devices contribute to faster healing and reduced surgical trauma.

- Trocars: Fundamental for minimally invasive access, advancements in trocar design focus on minimizing port site complications and improving surgeon maneuverability.

- Other Assisting Devices: This category encompasses a range of essential surgical tools and instruments supporting various bariatric procedures.

The dominance of Assisting Devices is underpinned by their integral role in the most frequently performed bariatric procedures. Economic growth in the UK healthcare sector and consistent investment in surgical infrastructure further fuel this segment's expansion. The increasing number of accredited bariatric surgery centers across the nation also contributes to sustained demand for these critical instruments.

The Implantable Devices segment, while currently holding a smaller market share, is poised for significant growth.

- Implantable Devices: This segment is characterized by innovative solutions for long-term weight management:

- Gastric Balloons: Non-surgical, reversible devices that aid in weight loss by promoting satiety, these have seen increasing popularity as an initial intervention.

- Gastric Emptying Devices: These devices offer a controlled release of stomach contents, aiding in portion control and calorie reduction.

- Gastric Bands: Though less common in recent years due to advancements in other techniques, gastric bands still represent a historical and sometimes relevant option.

- Electrical Stimulation Devices: Emerging technologies in this area aim to influence appetite and metabolism through targeted electrical impulses.

The growth in this segment is driven by a demand for reversible and less invasive options, appealing to a broader patient demographic.

UK Bariatric Surgery Industry Product Developments

Recent product developments in the UK Bariatric Surgery Industry are significantly enhancing procedural outcomes and patient experience. Innovations in robotic-assisted surgery, such as Medtronic's Hugo RAS system receiving CE Mark approval for general surgery including bariatric procedures, are increasing precision and minimizing invasiveness. Advancements in stapling technology offer greater control and efficacy during gastric reconstructions. Furthermore, the development of novel gastric balloons with improved comfort and duration of use is expanding non-surgical intervention options. The introduction of more advanced closure devices also contributes to faster patient recovery times. These technological leaps are not only improving surgical techniques but also broadening the accessibility and appeal of bariatric interventions.

Challenges in the UK Bariatric Surgery Industry Market

The UK Bariatric Surgery Industry faces several challenges. High upfront costs associated with advanced surgical equipment and robotic systems can be a significant barrier for some healthcare providers. Stringent regulatory approval processes, while essential for safety, can slow down the market entry of innovative devices. Public perception and the ongoing need for comprehensive patient education regarding surgical risks and benefits remain crucial considerations. Additionally, competition from less invasive weight management alternatives and the potential for post-operative complications can impact market growth. The estimated impact of regulatory hurdles on new product launches is approximately xx%.

Forces Driving UK Bariatric Surgery Industry Growth

Several key forces are propelling the growth of the UK Bariatric Surgery Industry. The escalating prevalence of obesity and associated comorbidities is a primary driver, increasing the demand for effective treatment solutions. Technological advancements, particularly in minimally invasive surgery and robotic systems, are enhancing safety, reducing recovery times, and improving patient outcomes. Growing awareness and acceptance of bariatric surgery as a life-improving intervention, supported by positive patient testimonials and clinical evidence, are also significant growth catalysts. Government initiatives and healthcare policies aimed at tackling the obesity epidemic further contribute to the positive market trajectory.

Challenges in the UK Bariatric Surgery Industry Market

Long-term growth catalysts in the UK Bariatric Surgery Industry lie in continued innovation and strategic market expansion. The development of more advanced implantable devices, such as those for electrical stimulation and gastric emptying, holds considerable potential. Partnerships between device manufacturers, research institutions, and healthcare providers will foster collaborative research and accelerate the adoption of novel technologies. Expanding access to bariatric surgery through improved funding models and increased surgical capacity will unlock new patient populations. The integration of digital health solutions for remote patient monitoring and support will also be a critical factor in long-term success.

Emerging Opportunities in UK Bariatric Surgery Industry

Emerging opportunities in the UK Bariatric Surgery Industry are abundant. The increasing focus on personalized medicine and tailored treatment approaches presents a significant avenue for growth. The development of innovative, less invasive procedures, such as the minimally invasive left gastric artery embolization (LGAE) being investigated by researchers, offers promising alternatives. The growing demand for revisional bariatric surgery and the potential for technological integration in remote patient monitoring and rehabilitation also represent lucrative markets. Furthermore, the expansion of services targeting specific patient demographics, such as adolescent obesity, is an untapped opportunity.

Leading Players in the UK Bariatric Surgery Industry Sector

- Medtronic PLC

- Johnson and Johnson

- Cook Medical

- Apollo Endosurgery Inc

- Intuitive Surgical Inc

- Teleflex (Standard Bariatrics Inc )

- Conmed Corporation

- Reshape Lifesciences Inc

- B Braun SE

- Olympus Corporation

Key Milestones in UK Bariatric Surgery Industry Industry

- December 2022: Medtronic received CE Mark approval for the Hugo robotic-assisted surgery (RAS) system for general surgery procedures in Europe, including bariatric surgery.

- October 2022: Researchers at University College London Hospitals and Imperial College Healthcare NHS Trust were awarded GBP 1.2 million (USD 1.45 million) by the NIHR Efficacy and Mechanism Evaluation program to investigate left gastric artery embolization (LGAE) as a minimally invasive procedure.

Strategic Outlook for UK Bariatric Surgery Industry Market

The strategic outlook for the UK Bariatric Surgery Industry is highly positive, characterized by sustained growth and innovation. The market is expected to witness further consolidation through strategic acquisitions and partnerships, enhancing competitive advantages. A key growth accelerator will be the increased integration of artificial intelligence and data analytics to personalize treatment plans and improve patient outcomes. Continued investment in research and development for novel implantable devices and minimally invasive techniques will drive market expansion. Furthermore, collaborations with governmental bodies and healthcare providers to address the rising obesity epidemic will be crucial for long-term success and market penetration.

UK Bariatric Surgery Industry Segmentation

-

1. Device

-

1.1. Assisting Devices

- 1.1.1. Suturing Device

- 1.1.2. Closure Device

- 1.1.3. Stapling Device

- 1.1.4. Trocars

- 1.1.5. Other Assisting Devices

-

1.2. Implantable Devices

- 1.2.1. Gastric Bands

- 1.2.2. Electrical Stimulation Devices

- 1.2.3. Gastric Balloons

- 1.2.4. Gastric Emptying

- 1.3. Other Devices

-

1.1. Assisting Devices

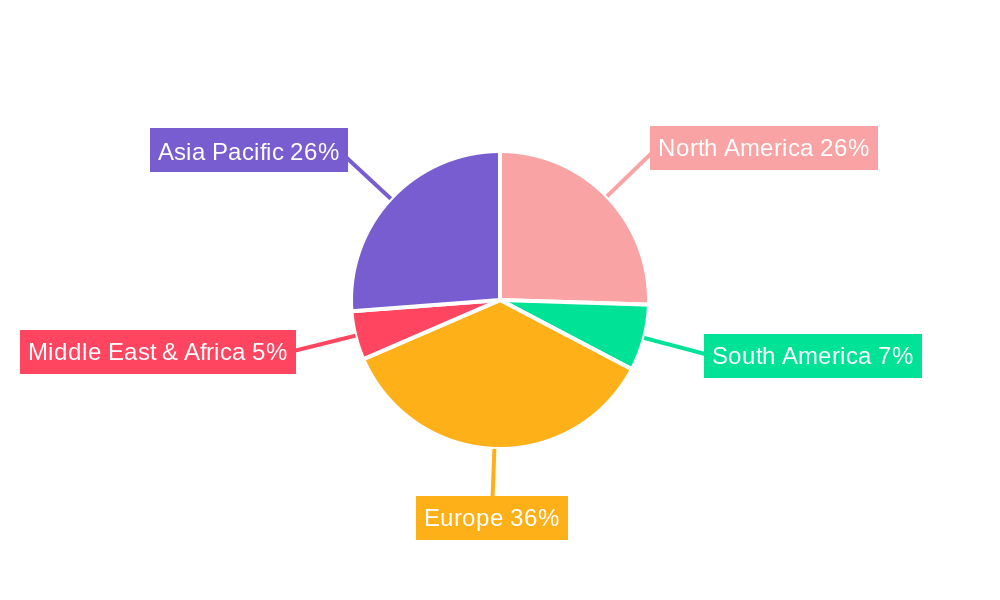

UK Bariatric Surgery Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Bariatric Surgery Industry Regional Market Share

Geographic Coverage of UK Bariatric Surgery Industry

UK Bariatric Surgery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Diabetes and Heart Diseases; Increase in Obesity Among People; Rising Government Initiatives

- 3.3. Market Restrains

- 3.3.1. High Cost of Surgery

- 3.4. Market Trends

- 3.4.1. Closure Device Segment Expected to Witness a Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Assisting Devices

- 5.1.1.1. Suturing Device

- 5.1.1.2. Closure Device

- 5.1.1.3. Stapling Device

- 5.1.1.4. Trocars

- 5.1.1.5. Other Assisting Devices

- 5.1.2. Implantable Devices

- 5.1.2.1. Gastric Bands

- 5.1.2.2. Electrical Stimulation Devices

- 5.1.2.3. Gastric Balloons

- 5.1.2.4. Gastric Emptying

- 5.1.3. Other Devices

- 5.1.1. Assisting Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. North America UK Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Assisting Devices

- 6.1.1.1. Suturing Device

- 6.1.1.2. Closure Device

- 6.1.1.3. Stapling Device

- 6.1.1.4. Trocars

- 6.1.1.5. Other Assisting Devices

- 6.1.2. Implantable Devices

- 6.1.2.1. Gastric Bands

- 6.1.2.2. Electrical Stimulation Devices

- 6.1.2.3. Gastric Balloons

- 6.1.2.4. Gastric Emptying

- 6.1.3. Other Devices

- 6.1.1. Assisting Devices

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. South America UK Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Assisting Devices

- 7.1.1.1. Suturing Device

- 7.1.1.2. Closure Device

- 7.1.1.3. Stapling Device

- 7.1.1.4. Trocars

- 7.1.1.5. Other Assisting Devices

- 7.1.2. Implantable Devices

- 7.1.2.1. Gastric Bands

- 7.1.2.2. Electrical Stimulation Devices

- 7.1.2.3. Gastric Balloons

- 7.1.2.4. Gastric Emptying

- 7.1.3. Other Devices

- 7.1.1. Assisting Devices

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Europe UK Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Assisting Devices

- 8.1.1.1. Suturing Device

- 8.1.1.2. Closure Device

- 8.1.1.3. Stapling Device

- 8.1.1.4. Trocars

- 8.1.1.5. Other Assisting Devices

- 8.1.2. Implantable Devices

- 8.1.2.1. Gastric Bands

- 8.1.2.2. Electrical Stimulation Devices

- 8.1.2.3. Gastric Balloons

- 8.1.2.4. Gastric Emptying

- 8.1.3. Other Devices

- 8.1.1. Assisting Devices

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Middle East & Africa UK Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device

- 9.1.1. Assisting Devices

- 9.1.1.1. Suturing Device

- 9.1.1.2. Closure Device

- 9.1.1.3. Stapling Device

- 9.1.1.4. Trocars

- 9.1.1.5. Other Assisting Devices

- 9.1.2. Implantable Devices

- 9.1.2.1. Gastric Bands

- 9.1.2.2. Electrical Stimulation Devices

- 9.1.2.3. Gastric Balloons

- 9.1.2.4. Gastric Emptying

- 9.1.3. Other Devices

- 9.1.1. Assisting Devices

- 9.1. Market Analysis, Insights and Forecast - by Device

- 10. Asia Pacific UK Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device

- 10.1.1. Assisting Devices

- 10.1.1.1. Suturing Device

- 10.1.1.2. Closure Device

- 10.1.1.3. Stapling Device

- 10.1.1.4. Trocars

- 10.1.1.5. Other Assisting Devices

- 10.1.2. Implantable Devices

- 10.1.2.1. Gastric Bands

- 10.1.2.2. Electrical Stimulation Devices

- 10.1.2.3. Gastric Balloons

- 10.1.2.4. Gastric Emptying

- 10.1.3. Other Devices

- 10.1.1. Assisting Devices

- 10.1. Market Analysis, Insights and Forecast - by Device

- 11. England UK Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 12. Wales UK Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 13. Scotland UK Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 14. Northern UK Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 15. Ireland UK Bariatric Surgery Industry Analysis, Insights and Forecast, 2020-2032

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 Medtronic PLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Johnson and Johnson

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Cook Medical

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Apollo Endosurgery Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Intuitive Surgical Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Teleflex (Standard Bariatrics Inc )

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Conmed Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Reshape Lifesciences Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 B Braun SE

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Olympus Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Medtronic PLC

List of Figures

- Figure 1: Global UK Bariatric Surgery Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global UK Bariatric Surgery Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: United kingdom Region UK Bariatric Surgery Industry Revenue (billion), by Country 2025 & 2033

- Figure 4: United kingdom Region UK Bariatric Surgery Industry Volume (K Unit), by Country 2025 & 2033

- Figure 5: United kingdom Region UK Bariatric Surgery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: United kingdom Region UK Bariatric Surgery Industry Volume Share (%), by Country 2025 & 2033

- Figure 7: North America UK Bariatric Surgery Industry Revenue (billion), by Device 2025 & 2033

- Figure 8: North America UK Bariatric Surgery Industry Volume (K Unit), by Device 2025 & 2033

- Figure 9: North America UK Bariatric Surgery Industry Revenue Share (%), by Device 2025 & 2033

- Figure 10: North America UK Bariatric Surgery Industry Volume Share (%), by Device 2025 & 2033

- Figure 11: North America UK Bariatric Surgery Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America UK Bariatric Surgery Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America UK Bariatric Surgery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America UK Bariatric Surgery Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: South America UK Bariatric Surgery Industry Revenue (billion), by Device 2025 & 2033

- Figure 16: South America UK Bariatric Surgery Industry Volume (K Unit), by Device 2025 & 2033

- Figure 17: South America UK Bariatric Surgery Industry Revenue Share (%), by Device 2025 & 2033

- Figure 18: South America UK Bariatric Surgery Industry Volume Share (%), by Device 2025 & 2033

- Figure 19: South America UK Bariatric Surgery Industry Revenue (billion), by Country 2025 & 2033

- Figure 20: South America UK Bariatric Surgery Industry Volume (K Unit), by Country 2025 & 2033

- Figure 21: South America UK Bariatric Surgery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: South America UK Bariatric Surgery Industry Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe UK Bariatric Surgery Industry Revenue (billion), by Device 2025 & 2033

- Figure 24: Europe UK Bariatric Surgery Industry Volume (K Unit), by Device 2025 & 2033

- Figure 25: Europe UK Bariatric Surgery Industry Revenue Share (%), by Device 2025 & 2033

- Figure 26: Europe UK Bariatric Surgery Industry Volume Share (%), by Device 2025 & 2033

- Figure 27: Europe UK Bariatric Surgery Industry Revenue (billion), by Country 2025 & 2033

- Figure 28: Europe UK Bariatric Surgery Industry Volume (K Unit), by Country 2025 & 2033

- Figure 29: Europe UK Bariatric Surgery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 30: Europe UK Bariatric Surgery Industry Volume Share (%), by Country 2025 & 2033

- Figure 31: Middle East & Africa UK Bariatric Surgery Industry Revenue (billion), by Device 2025 & 2033

- Figure 32: Middle East & Africa UK Bariatric Surgery Industry Volume (K Unit), by Device 2025 & 2033

- Figure 33: Middle East & Africa UK Bariatric Surgery Industry Revenue Share (%), by Device 2025 & 2033

- Figure 34: Middle East & Africa UK Bariatric Surgery Industry Volume Share (%), by Device 2025 & 2033

- Figure 35: Middle East & Africa UK Bariatric Surgery Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Middle East & Africa UK Bariatric Surgery Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Middle East & Africa UK Bariatric Surgery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa UK Bariatric Surgery Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Asia Pacific UK Bariatric Surgery Industry Revenue (billion), by Device 2025 & 2033

- Figure 40: Asia Pacific UK Bariatric Surgery Industry Volume (K Unit), by Device 2025 & 2033

- Figure 41: Asia Pacific UK Bariatric Surgery Industry Revenue Share (%), by Device 2025 & 2033

- Figure 42: Asia Pacific UK Bariatric Surgery Industry Volume Share (%), by Device 2025 & 2033

- Figure 43: Asia Pacific UK Bariatric Surgery Industry Revenue (billion), by Country 2025 & 2033

- Figure 44: Asia Pacific UK Bariatric Surgery Industry Volume (K Unit), by Country 2025 & 2033

- Figure 45: Asia Pacific UK Bariatric Surgery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 46: Asia Pacific UK Bariatric Surgery Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 3: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 4: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 5: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: England UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: England UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Wales UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Wales UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Scotland UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Scotland UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Northern UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Northern UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Ireland UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Ireland UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 20: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 21: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: United States UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: United States UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Canada UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Canada UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Mexico UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Mexico UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 30: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 31: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Brazil UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Brazil UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Argentina UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Argentina UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Rest of South America UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of South America UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 40: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 41: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: United Kingdom UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Germany UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Germany UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: France UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: France UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Italy UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Italy UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Spain UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Spain UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Russia UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Russia UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Benelux UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Benelux UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Nordics UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Nordics UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Rest of Europe UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Rest of Europe UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 62: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 63: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 64: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 65: Turkey UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Turkey UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Israel UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: Israel UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: GCC UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: GCC UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: North Africa UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: North Africa UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Africa UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East & Africa UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East & Africa UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Device 2020 & 2033

- Table 78: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 79: Global UK Bariatric Surgery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 80: Global UK Bariatric Surgery Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 81: China UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: China UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: India UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: India UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: Japan UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: Japan UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: South Korea UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: South Korea UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: ASEAN UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: ASEAN UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 91: Oceania UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Oceania UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: Rest of Asia Pacific UK Bariatric Surgery Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 94: Rest of Asia Pacific UK Bariatric Surgery Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Bariatric Surgery Industry?

The projected CAGR is approximately 13.15%.

2. Which companies are prominent players in the UK Bariatric Surgery Industry?

Key companies in the market include Medtronic PLC, Johnson and Johnson, Cook Medical, Apollo Endosurgery Inc, Intuitive Surgical Inc, Teleflex (Standard Bariatrics Inc ), Conmed Corporation, Reshape Lifesciences Inc, B Braun SE, Olympus Corporation.

3. What are the main segments of the UK Bariatric Surgery Industry?

The market segments include Device.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Diabetes and Heart Diseases; Increase in Obesity Among People; Rising Government Initiatives.

6. What are the notable trends driving market growth?

Closure Device Segment Expected to Witness a Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Surgery.

8. Can you provide examples of recent developments in the market?

Dec 2022: Medtronic received CE Mark approval for the Hugo robotic-assisted surgery (RAS) system to be used in general surgery procedures in Europe. The CE Mark for general surgery spans several specialties, including hernia, colorectal, and bariatric surgery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Bariatric Surgery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Bariatric Surgery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Bariatric Surgery Industry?

To stay informed about further developments, trends, and reports in the UK Bariatric Surgery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence