Key Insights

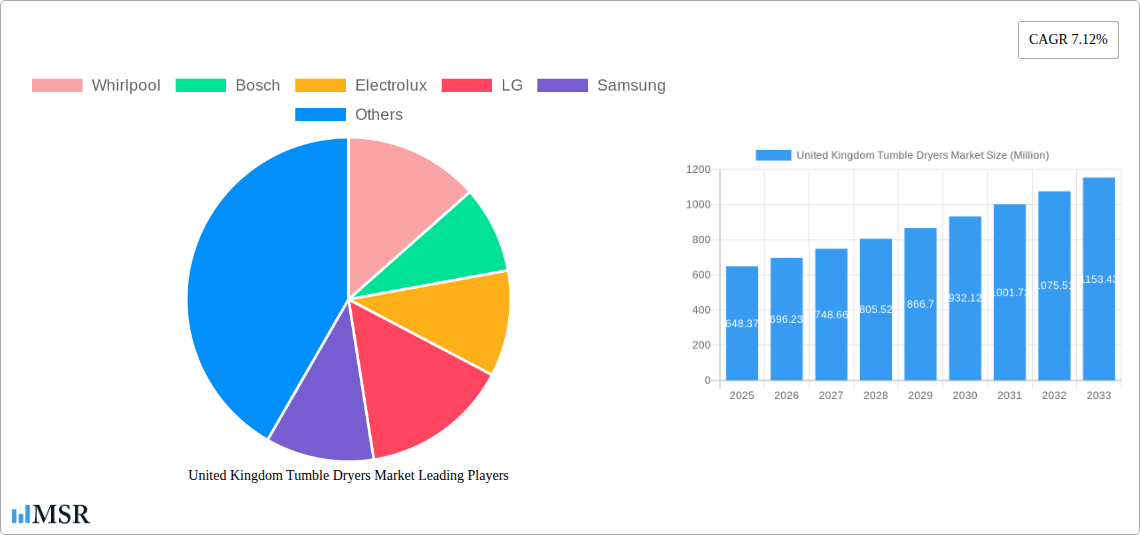

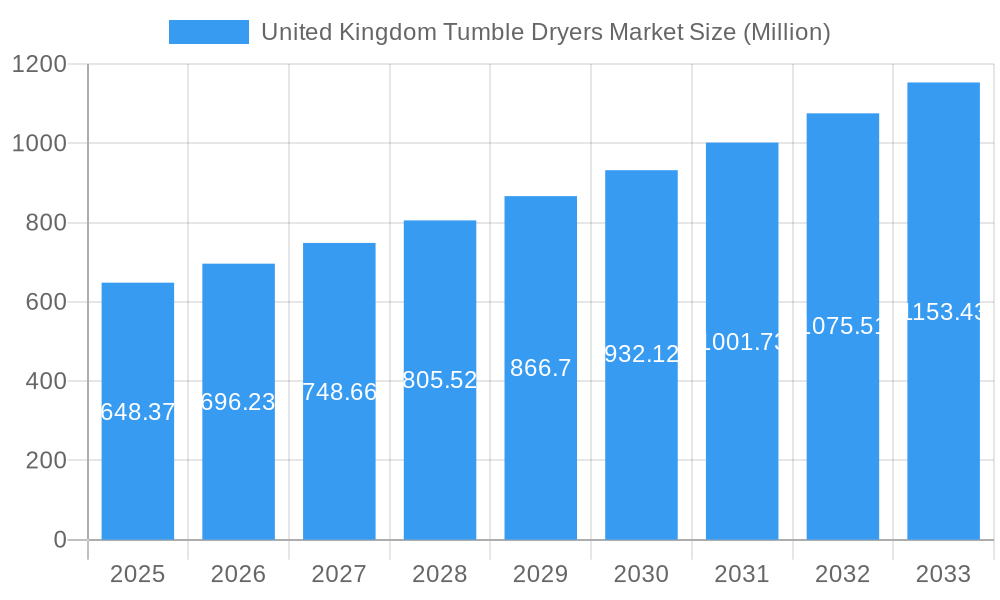

The United Kingdom tumble dryer market, valued at approximately £648.37 million in 2025, is projected to experience robust growth, driven by several key factors. Rising disposable incomes and increasing urbanization are leading to higher demand for convenient home appliances, boosting tumble dryer sales. The shift towards smaller households and busy lifestyles further fuels this demand, as tumble dryers offer time-saving benefits compared to traditional air drying methods. Technological advancements, such as heat pump technology offering energy efficiency, and smart features enhancing user convenience, are also contributing to market expansion. However, concerns regarding energy consumption and environmental impact represent a significant restraint, prompting manufacturers to focus on developing more sustainable models. Competition among established brands like Whirlpool, Bosch, Electrolux, LG, Samsung, Miele, Haier, Hitachi, Kenmore, and Beko (among others) is intensifying, leading to price competition and innovation. The market segmentation likely includes variations based on capacity, energy efficiency class, features (e.g., smart connectivity, sensor drying), and price points, with higher-end models commanding premium prices. The UK market's growth is anticipated to continue at a Compound Annual Growth Rate (CAGR) of 7.12% from 2025 to 2033, indicating a substantial increase in market value over the forecast period.

United Kingdom Tumble Dryers Market Market Size (In Million)

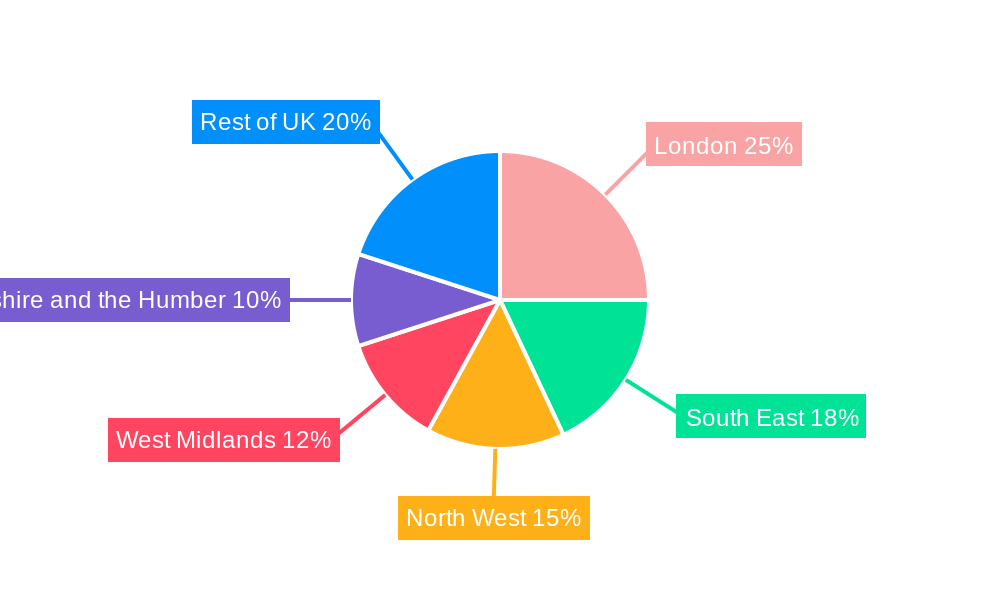

The regional distribution of sales within the UK likely reflects population density and economic activity, with higher sales volumes concentrated in urban areas and affluent regions. While precise regional data is unavailable, it's reasonable to assume that London and the South East will account for a significant portion of the market share. Future growth will depend on several factors including consumer confidence, economic stability, government policies related to energy efficiency, and the continuous innovation within the appliance sector. The market is poised for steady expansion, but manufacturers must actively address sustainability concerns and adapt to evolving consumer preferences to maintain their market position. Marketing efforts focusing on energy-efficient and eco-friendly models, along with highlighting time-saving benefits, will prove crucial for success in this competitive market.

United Kingdom Tumble Dryers Market Company Market Share

United Kingdom Tumble Dryers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom tumble dryers market, covering market dynamics, industry trends, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The forecast period extends from 2025 to 2033, while the historical period covers 2019-2024. The market value is expressed in Millions throughout.

United Kingdom Tumble Dryers Market Market Concentration & Dynamics

The UK tumble dryer market exhibits a moderately concentrated landscape, with key players like Whirlpool, Bosch, Electrolux, LG, Samsung, Miele, Haier, Hitachi, Kenmore, and Beko holding significant market share. However, the market also accommodates several smaller niche players, contributing to a diverse competitive environment. Market share distribution among the top players is estimated to be xx% in 2025, with Whirlpool and Bosch leading the pack. The market's dynamics are significantly influenced by several factors.

- Innovation Ecosystem: Continuous advancements in energy efficiency, drying technology (e.g., heat pump dryers), and smart home integration drive innovation.

- Regulatory Frameworks: Stringent energy efficiency regulations (e.g., EU Ecodesign Directive) influence product development and consumer choices, pushing manufacturers towards more sustainable solutions.

- Substitute Products: While tumble dryers remain dominant, the rise of clothes airers and laundry services presents a degree of substitution, particularly amongst environmentally conscious consumers.

- End-User Trends: Growing preference for convenience, time-saving appliances, and improved fabric care fuels market growth. The increasing number of dual-income households further drives the demand for efficient laundry solutions.

- M&A Activities: The UK tumble dryer market has witnessed xx M&A deals in the past five years, primarily focused on expanding market reach and acquiring innovative technologies. The recent acquisition of Wairarapa Machinery Services Ltd by The Brandt Group (August 2023) is an example of this activity, though not directly within the UK tumble dryer market, it highlights the consolidation trend in the wider home appliance industry.

United Kingdom Tumble Dryers Market Industry Insights & Trends

The UK tumble dryer market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), driven by several key factors. The market size in 2025 is estimated at £xx Million. Several trends are shaping the market:

Technological disruptions, such as the increased adoption of heat pump technology for improved energy efficiency and the integration of smart features for remote control and monitoring, are key drivers. Consumer behaviour is also evolving with increasing demand for larger capacity dryers to accommodate larger households and preference for models with enhanced features. The rising disposable incomes and changing lifestyles within the UK contribute to the expanding market. However, economic downturns could potentially impact consumer spending on non-essential appliances such as tumble dryers, leading to fluctuations in market growth.

Key Markets & Segments Leading United Kingdom Tumble Dryers Market

The UK represents a significant market for tumble dryers, with its robust economy and well-established infrastructure supporting high demand. Regional variations in market size exist, with urban areas experiencing higher consumption rates due to higher population density and apartment living.

- Drivers of Dominance:

- High disposable income levels.

- Modern housing infrastructure.

- Increasing adoption of convenient appliances.

The dominant segments are heat pump dryers due to energy efficiency and large capacity models meeting the needs of growing families.

Within the UK market, the South East region currently holds the largest market share due to its higher population density and average income levels. London, in particular, contributes significantly to overall sales due to high demand from apartment dwellers and a large population.

United Kingdom Tumble Dryers Market Product Developments

Recent product innovations focus on energy efficiency improvements, such as heat pump technology, and smart features, including Wi-Fi connectivity and app integration. The introduction of compact models caters to consumers with space constraints, while larger-capacity dryers address the needs of larger households. These developments offer competitive advantages by enhancing user experience and appealing to specific consumer needs. Bosch's launch of new compact washers and dryers in June 2024 exemplifies this trend.

Challenges in the United Kingdom Tumble Dryers Market Market

The UK tumble dryer market faces challenges like increased raw material costs impacting production prices, supply chain disruptions causing delays, and intense competition among established and emerging players. These factors lead to pricing pressures, potentially reducing profit margins. Furthermore, fluctuations in consumer confidence, driven by the overall economic climate, can significantly influence demand.

Forces Driving United Kingdom Tumble Dryers Market Growth

Key growth drivers include increasing disposable incomes, rising urbanization leading to smaller living spaces but higher demand for convenience, and a growing preference for energy-efficient appliances, spurred by environmental consciousness and government regulations. Technological advancements, such as heat pump technology and smart features, further enhance demand.

Challenges in the United Kingdom Tumble Dryers Market Market

Long-term growth will depend on manufacturers' ability to innovate continuously, offering energy-efficient and technologically advanced products. Strategic partnerships with retailers and service providers will help reach consumers effectively. Expanding into niche segments such as commercial laundry solutions will provide further growth avenues.

Emerging Opportunities in United Kingdom Tumble Dryers Market

Emerging opportunities lie in the growing demand for energy-efficient heat pump dryers and smart connected appliances. There’s also potential in developing specialized dryers for niche applications, such as those designed for delicate fabrics or specific materials. Furthermore, expansion into the rental and subscription-based models for appliances could be lucrative.

Key Milestones in United Kingdom Tumble Dryers Market Industry

- July 2023: Electrolux Group launched its CIH partner program, aiming for growth through collaborations.

- August 2023: The Brandt Group acquired Wairarapa Machinery Services Ltd., expanding its dealership network.

- June 2024: Bosch unveiled two new lines of compact washers and dryers, targeting space-constrained consumers. These launches signal a focus on innovation and market segmentation.

Strategic Outlook for United Kingdom Tumble Dryers Market Market

The UK tumble dryer market presents significant growth opportunities, driven by continuous technological advancements, evolving consumer preferences, and supportive government policies. Companies focusing on energy efficiency, smart features, and diverse product portfolios are best positioned to capitalize on this potential. Strategic partnerships, robust supply chain management, and effective marketing strategies will play a crucial role in market success.

United Kingdom Tumble Dryers Market Segmentation

-

1. Product

- 1.1. Heat Pump Tumble Dryer

- 1.2. Condenser Tumble Dryer

- 1.3. Vented Tumble Dryer

-

1.4. By Application

- 1.4.1. Residential

- 1.4.2. Commercial

-

1.5. By Distribution Channel

- 1.5.1. Multi-Brand Stores

- 1.5.2. Specialty Stores

- 1.5.3. Online

- 1.5.4. Others

United Kingdom Tumble Dryers Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Tumble Dryers Market Regional Market Share

Geographic Coverage of United Kingdom Tumble Dryers Market

United Kingdom Tumble Dryers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tumble Dryers in Residential Segment

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Tumble Dryers in Residential Segment

- 3.4. Market Trends

- 3.4.1. Demand for Tumble Dryers is being Driven by the UK's Exceptionally Cold Weather.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Tumble Dryers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Heat Pump Tumble Dryer

- 5.1.2. Condenser Tumble Dryer

- 5.1.3. Vented Tumble Dryer

- 5.1.4. By Application

- 5.1.4.1. Residential

- 5.1.4.2. Commercial

- 5.1.5. By Distribution Channel

- 5.1.5.1. Multi-Brand Stores

- 5.1.5.2. Specialty Stores

- 5.1.5.3. Online

- 5.1.5.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Electrolux

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Miele

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Haier

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hitachi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kenmore

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Beko**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool

List of Figures

- Figure 1: United Kingdom Tumble Dryers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Tumble Dryers Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Tumble Dryers Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United Kingdom Tumble Dryers Market Volume Million Forecast, by Product 2020 & 2033

- Table 3: United Kingdom Tumble Dryers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Tumble Dryers Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Tumble Dryers Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: United Kingdom Tumble Dryers Market Volume Million Forecast, by Product 2020 & 2033

- Table 7: United Kingdom Tumble Dryers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: United Kingdom Tumble Dryers Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Tumble Dryers Market?

The projected CAGR is approximately 7.12%.

2. Which companies are prominent players in the United Kingdom Tumble Dryers Market?

Key companies in the market include Whirlpool, Bosch, Electrolux, LG, Samsung, Miele, Haier, Hitachi, Kenmore, Beko**List Not Exhaustive.

3. What are the main segments of the United Kingdom Tumble Dryers Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 648.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tumble Dryers in Residential Segment.

6. What are the notable trends driving market growth?

Demand for Tumble Dryers is being Driven by the UK's Exceptionally Cold Weather..

7. Are there any restraints impacting market growth?

Increasing Demand for Tumble Dryers in Residential Segment.

8. Can you provide examples of recent developments in the market?

In June 2024, Bosch, a leader in home appliances, unveiled two new lines of compact washers and dryers. These models cater to consumers who desire full-size performance in limited living spaces. Positioned alongside Bosch's established 500 and 800 Series, these machines boast advanced features uncommon in Bosch's compact range.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Tumble Dryers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Tumble Dryers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Tumble Dryers Market?

To stay informed about further developments, trends, and reports in the United Kingdom Tumble Dryers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence