Key Insights

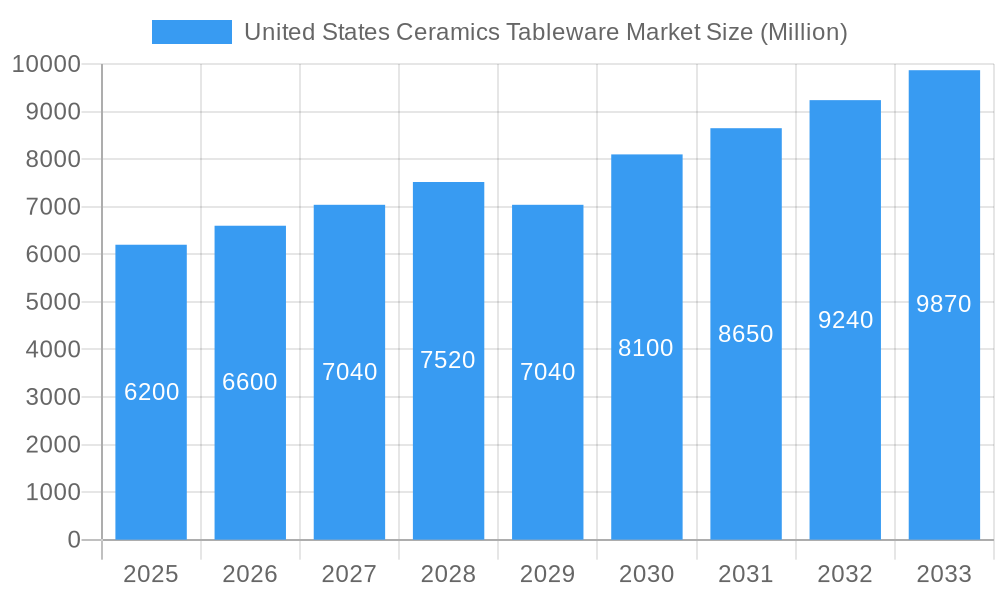

The United States ceramics tableware market, valued at $6.20 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 6.69% from 2025 to 2033. This expansion is fueled by several key factors. The increasing popularity of home cooking and dining, coupled with a rising disposable income among consumers, is driving demand for high-quality, aesthetically pleasing tableware. Furthermore, the shift towards healthier lifestyles and a renewed focus on mindful eating experiences are contributing to the preference for durable and elegant ceramic tableware over disposable alternatives. The market is segmented by type (porcelain and bone china, stoneware, and others), end-user (household and commercial), and distribution channel (supermarkets/hypermarkets, specialty stores, wholesalers, online, and others). Growth within the online distribution channel is particularly notable, reflecting evolving consumer purchasing habits and the convenience offered by e-commerce platforms. While the market faces potential restraints such as fluctuations in raw material prices and increased competition from other materials, the overall positive trajectory suggests significant opportunities for established players and new entrants alike.

United States Ceramics Tableware Market Market Size (In Billion)

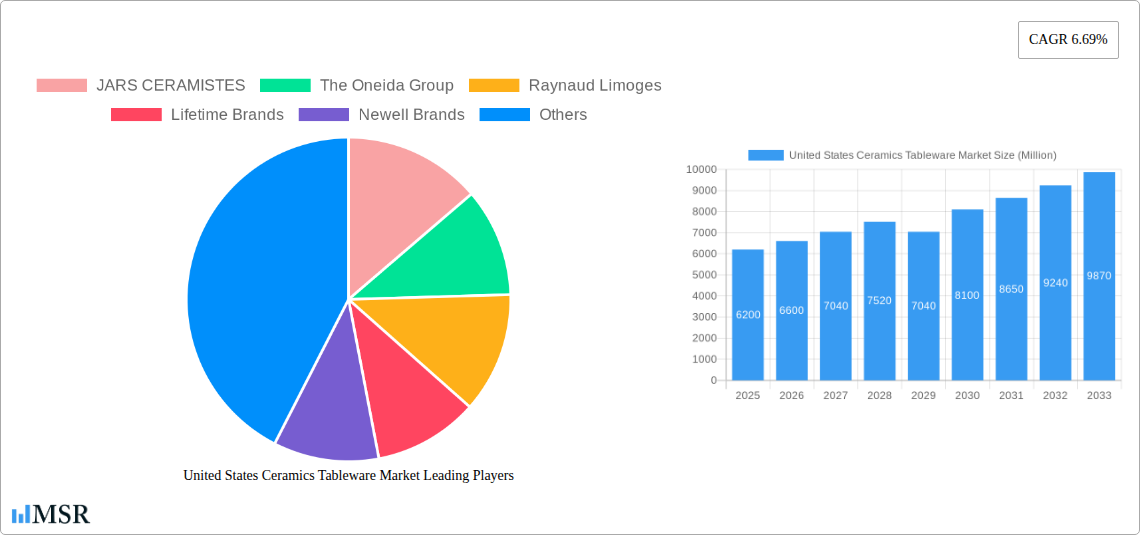

The dominance of key players like JARS CERAMISTES, The Oneida Group, and Raynaud Limoges underscores the competitive landscape. However, the market also offers potential for smaller, specialized brands focusing on unique designs, sustainable materials, or niche consumer segments. The continued growth in the commercial sector, driven by the hospitality industry’s focus on enhancing dining experiences, presents further opportunities. Future growth will depend on factors such as innovation in design and material technology, effective marketing strategies targeting specific consumer demographics, and successful navigation of supply chain challenges. The continued expansion of the online retail sector will remain a crucial area for market development and growth within the forecast period.

United States Ceramics Tableware Market Company Market Share

United States Ceramics Tableware Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States ceramics tableware market, encompassing market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market. The report delves into crucial aspects, offering actionable insights for strategic decision-making.

United States Ceramics Tableware Market Market Concentration & Dynamics

The US ceramics tableware market exhibits a moderately concentrated landscape, with several major players commanding significant market share. The market share of the top five players is estimated at xx%. However, the presence of numerous smaller, specialized companies fosters competition and innovation. The regulatory framework, primarily focused on safety and labeling, influences market dynamics. Substitute products, such as melamine and plastic tableware, pose a competitive threat, particularly in the price-sensitive segment. Evolving consumer preferences towards sustainable and aesthetically pleasing tableware are shaping market trends. Mergers and acquisitions (M&A) activity has been moderate, with xx deals recorded between 2019 and 2024. For example, Lifetime Brands’ acquisition of S'well Bottle in March 2022 signifies a strategic move to expand product portfolios.

- Market Concentration: Top 5 players hold xx% market share.

- M&A Activity: xx deals recorded between 2019 and 2024.

- Substitute Products: Melamine and plastic tableware pose competition.

- Consumer Trends: Growing demand for sustainable and aesthetically appealing products.

- Regulatory Framework: Focus on safety and labeling standards.

United States Ceramics Tableware Market Industry Insights & Trends

The United States ceramics tableware market is experiencing steady growth, driven by several factors. The market size in 2025 is estimated at $xx Million, with a CAGR of xx% projected from 2025 to 2033. Rising disposable incomes and a growing preference for home-cooked meals are boosting demand. Technological advancements in ceramic manufacturing, including the use of advanced materials and automated processes, are enhancing product quality and efficiency. Consumer behaviors are shifting towards premiumization, with a greater emphasis on design, durability, and unique aesthetics. These trends are shaping the landscape of the US ceramics tableware market, driving the demand for high-quality, innovative products.

Key Markets & Segments Leading United States Ceramics Tableware Market

The household segment dominates the end-user market, accounting for approximately xx% of total sales. Porcelain and Bone China remain the preferred type, driven by their elegance and perceived value. Supermarkets and hypermarkets are the leading distribution channels due to their extensive reach and accessibility.

- Dominant Segment: Household end-user segment (xx% market share).

- Leading Type: Porcelain and Bone China (xx% market share).

- Primary Distribution Channel: Supermarkets and Hypermarkets.

Drivers by Segment:

- Household: Rising disposable incomes, increased focus on home dining.

- Commercial: Growth in the hospitality and food service sectors.

- Porcelain & Bone China: Preference for premium quality, aesthetics.

- Stoneware: Cost-effectiveness and durability.

- Supermarkets/Hypermarkets: Wide reach, convenience for consumers.

United States Ceramics Tableware Market Product Developments

Recent innovations in the US ceramics tableware market include the development of lightweight yet durable materials, enhanced glazes for improved stain resistance, and unique designs catering to evolving consumer preferences. Technological advancements in 3D printing are also enabling greater design flexibility and customization. These developments provide competitive advantages and expand market applications.

Challenges in the United States Ceramics Tableware Market Market

The US ceramics tableware market faces challenges like increased raw material costs, global supply chain disruptions impacting production and delivery timelines, and intense competition from both domestic and international players. These factors contribute to fluctuating prices and affect profitability. Regulatory compliance and stringent safety standards also pose challenges.

Forces Driving United States Ceramics Tableware Market Growth

Key growth drivers include the increasing disposable incomes of American households, a renewed focus on home cooking and dining, and the demand for high-quality tableware. Furthermore, technological advancements in manufacturing and design contribute to product innovation, attracting consumers.

Long-Term Growth Catalysts in the United States Ceramics Tableware Market

Long-term growth hinges on continuous product innovation, strategic partnerships within the supply chain to mitigate disruptions, and expansion into new market segments. Exploring opportunities in the sustainable and eco-friendly tableware niche will also drive growth.

Emerging Opportunities in United States Ceramics Tableware Market

Emerging opportunities lie in the increasing demand for personalized and customizable tableware, eco-friendly and sustainable materials, and innovative designs tailored to modern lifestyles. Exploring online retail channels and expanding into niche markets can unlock significant growth potential.

Leading Players in the United States Ceramics Tableware Market Sector

- JARS CERAMISTES

- The Oneida Group

- Raynaud Limoges

- Lifetime Brands

- Newell Brands

- Homer Laughlin China

- International Tableware

- Meyer Corporation

- CuisinArt

- Mikasa

Key Milestones in United States Ceramics Tableware Market Industry

- October 2022: Jars Ceramics launches a new showroom showcasing new stoneware collections (Wabi, Dashi, Canine). This signifies a focus on design innovation and market expansion.

- March 2022: Lifetime Brands acquires S'well Bottle, expanding its product portfolio and market reach.

Strategic Outlook for United States Ceramics Tableware Market Market

The future of the US ceramics tableware market is promising, with ongoing growth driven by consumer demand for high-quality, aesthetically pleasing, and sustainable products. Strategic investments in research and development, supply chain optimization, and effective marketing strategies will be crucial for companies to thrive in this competitive market.

United States Ceramics Tableware Market Segmentation

-

1. Type

- 1.1. Porcelain and Bone China

- 1.2. Stoneware (Ceramic)

- 1.3. Other Types

-

2. End User

- 2.1. Household

-

2.2. Commercial

- 2.2.1. Accomodation and Hospitality Segment

- 2.2.2. Food Service Segment

- 2.2.3. Other End Users

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. Wholesalers

- 3.4. Online

- 3.5. Other Distribution Channels

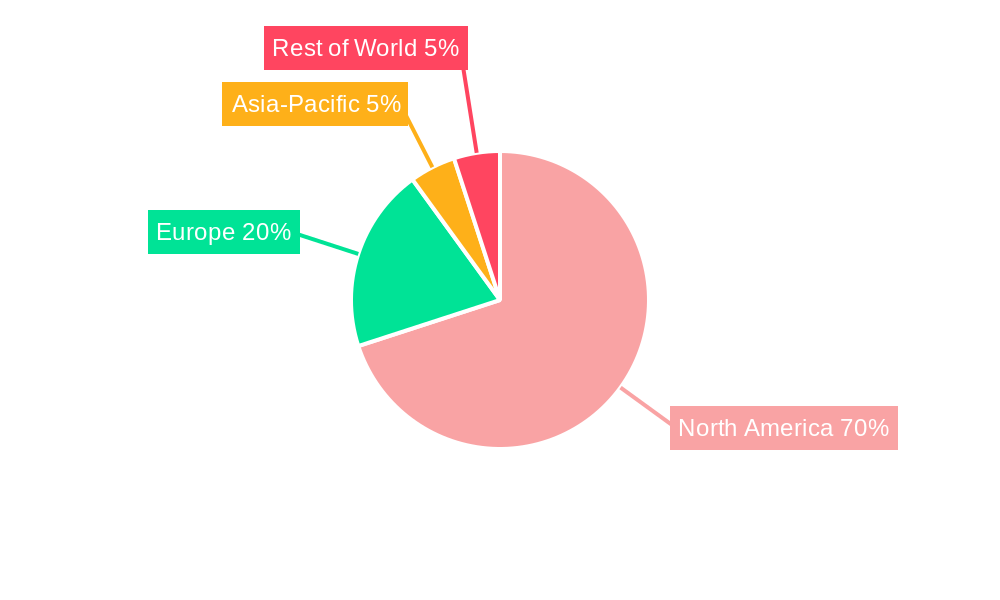

United States Ceramics Tableware Market Segmentation By Geography

- 1. United States

United States Ceramics Tableware Market Regional Market Share

Geographic Coverage of United States Ceramics Tableware Market

United States Ceramics Tableware Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Restaurants and Food Chains globally; Rise in the share of people opting for vegan and vegetarian foods

- 3.3. Market Restrains

- 3.3.1. Rise in price of electric appliances globally; Rising inflation decreasing the purchasing power

- 3.4. Market Trends

- 3.4.1. Increase in Product Development Activities Create Lucrative Prospects in Ceramic Tableware Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Ceramics Tableware Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Porcelain and Bone China

- 5.1.2. Stoneware (Ceramic)

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Household

- 5.2.2. Commercial

- 5.2.2.1. Accomodation and Hospitality Segment

- 5.2.2.2. Food Service Segment

- 5.2.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Wholesalers

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JARS CERAMISTES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Oneida Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raynaud Limoges

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lifetime Brands

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Newell Brands

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Homer Laughlin China

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 International Tableware

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Meyer Coroporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CuisinArt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mikasa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JARS CERAMISTES

List of Figures

- Figure 1: United States Ceramics Tableware Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Ceramics Tableware Market Share (%) by Company 2025

List of Tables

- Table 1: United States Ceramics Tableware Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Ceramics Tableware Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: United States Ceramics Tableware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: United States Ceramics Tableware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: United States Ceramics Tableware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Ceramics Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Ceramics Tableware Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Ceramics Tableware Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United States Ceramics Tableware Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: United States Ceramics Tableware Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: United States Ceramics Tableware Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: United States Ceramics Tableware Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: United States Ceramics Tableware Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: United States Ceramics Tableware Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: United States Ceramics Tableware Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Ceramics Tableware Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Ceramics Tableware Market?

The projected CAGR is approximately 6.69%.

2. Which companies are prominent players in the United States Ceramics Tableware Market?

Key companies in the market include JARS CERAMISTES, The Oneida Group, Raynaud Limoges, Lifetime Brands, Newell Brands, Homer Laughlin China, International Tableware, Meyer Coroporation, CuisinArt, Mikasa.

3. What are the main segments of the United States Ceramics Tableware Market?

The market segments include Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Restaurants and Food Chains globally; Rise in the share of people opting for vegan and vegetarian foods.

6. What are the notable trends driving market growth?

Increase in Product Development Activities Create Lucrative Prospects in Ceramic Tableware Market.

7. Are there any restraints impacting market growth?

Rise in price of electric appliances globally; Rising inflation decreasing the purchasing power.

8. Can you provide examples of recent developments in the market?

In October 2022, Jars Ceramics launches a new showroom at 41 Madison during the New York Tabletop Show. The company will showcase new stoneware pieces with rich glazes and colors including deep and moody blues, greens, and blacks in the Wabi and Dashi collections and vintage, charming pastels in the Canine collection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Ceramics Tableware Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Ceramics Tableware Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Ceramics Tableware Market?

To stay informed about further developments, trends, and reports in the United States Ceramics Tableware Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence