Key Insights

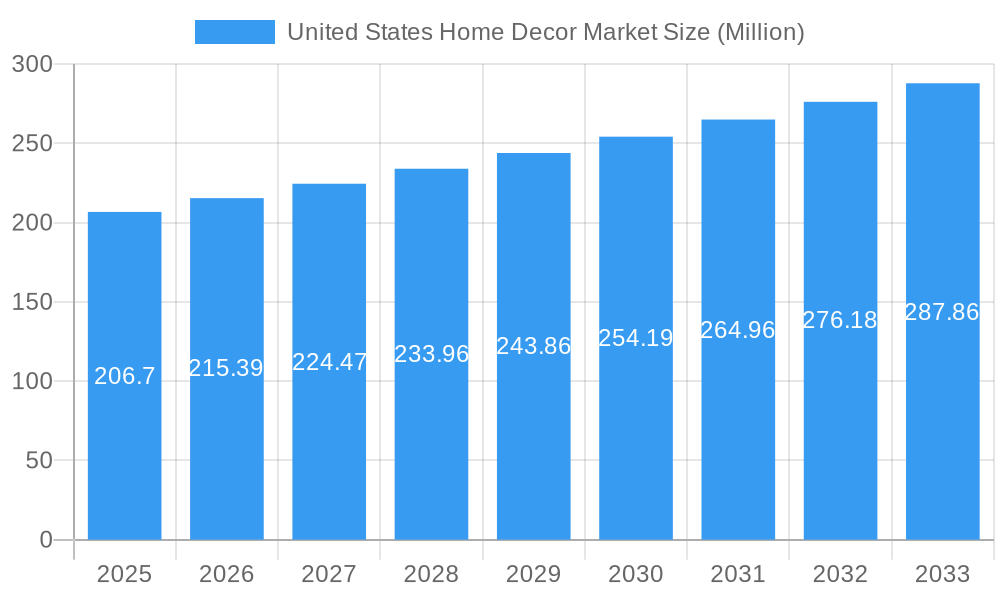

The United States home decor market, valued at $206.70 million in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 4.11% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes and increased homeownership rates contribute to higher consumer spending on home improvement and aesthetic upgrades. The increasing popularity of home staging and interior design trends, fueled by social media and online platforms, encourages homeowners to invest in enhancing their living spaces. Furthermore, the expanding e-commerce sector provides convenient access to a wider array of products, boosting market expansion. The market is segmented by distribution channel (supermarkets/hypermarkets, specialty stores, online, other) and product type (home furniture, home textiles, flooring, wall decor, lighting, accessories, other). Online sales are expected to witness significant growth, driven by consumer preference for online shopping and the broader availability of diverse product options. The shift towards sustainable and eco-friendly home decor products is also a notable trend, with consumers increasingly prioritizing environmentally responsible choices.

United States Home Decor Market Market Size (In Million)

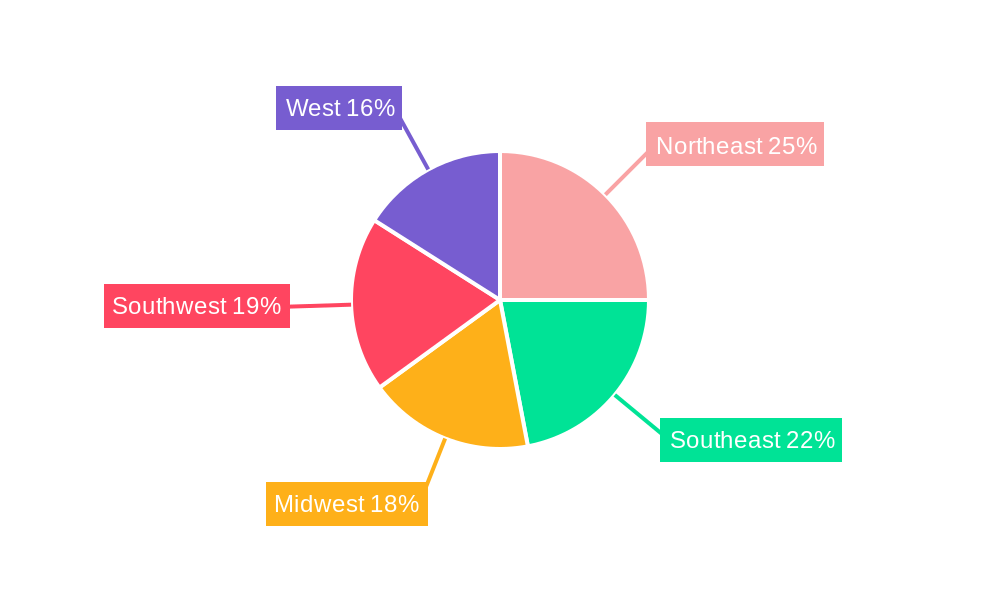

Competition in the US home decor market is intense, with major players like IKEA USA, Shaw Industries Group, and Ashley Furniture vying for market share. However, smaller, specialized businesses focusing on unique designs and sustainable practices are also gaining traction. While economic downturns could potentially restrain market growth, the long-term outlook remains positive, driven by evolving consumer preferences and continuous innovation within the home decor industry. The geographic distribution across the United States (Northeast, Southeast, Midwest, Southwest, West) shows variations based on regional economic conditions and population density. Regions with higher disposable incomes and greater homeownership rates generally exhibit stronger market performance. The forecast period (2025-2033) anticipates continued expansion, influenced by ongoing trends and the sustained appeal of home improvement and personalization.

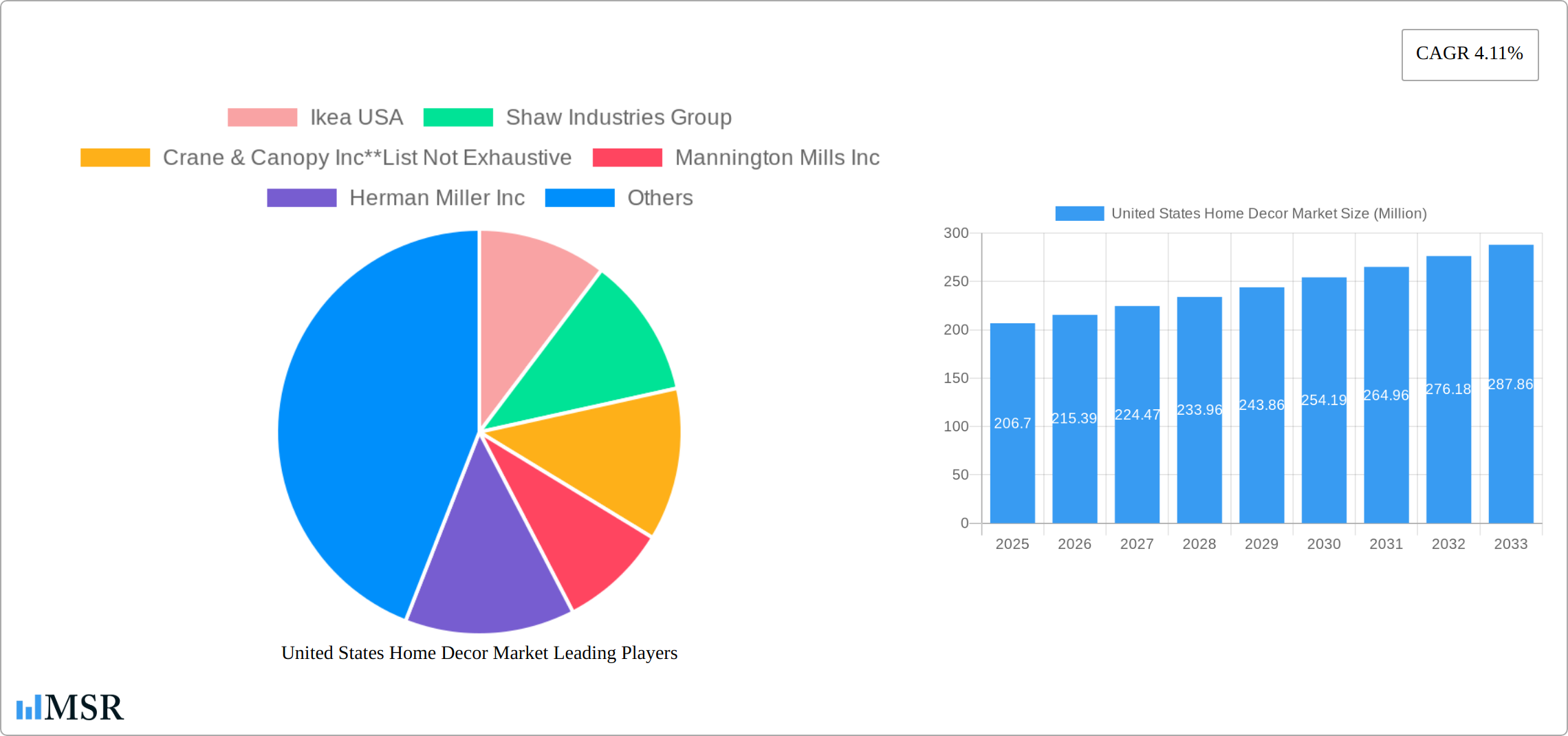

United States Home Decor Market Company Market Share

United States Home Decor Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the United States home decor market, covering the period from 2019 to 2033. It delves into market dynamics, key segments, leading players, and future growth opportunities, offering actionable insights for industry stakeholders. The report leverages data from the historical period (2019-2024), base year (2025), and estimated year (2025), projecting the market's trajectory until 2033. Expect detailed analysis of market size, CAGR, and key trends impacting this multi-billion dollar industry.

United States Home Decor Market Concentration & Dynamics

The US home decor market, valued at approximately $XX Billion in 2025, exhibits a moderately concentrated landscape. Key players like Ikea USA, Shaw Industries Group, and Crane & Canopy Inc hold significant market share, but a multitude of smaller players and regional businesses also contribute to the overall market size. The market's competitive intensity is driven by factors such as product differentiation, pricing strategies, and brand reputation.

- Market Share: Top 5 players account for approximately xx% of the total market share in 2025.

- M&A Activity: The period 2019-2024 witnessed xx M&A deals, signaling consolidation and strategic expansion within the sector. Recent activity, such as Overstock.com's acquisition of Bed Bath & Beyond assets, highlights the dynamic nature of the market.

- Innovation Ecosystem: The market is characterized by continuous innovation in materials, designs, and manufacturing processes, spurred by evolving consumer preferences and technological advancements. This includes the rise of sustainable and eco-friendly products.

- Regulatory Framework: Existing regulations concerning product safety and environmental standards impact the market, influencing manufacturing processes and product design.

- Substitute Products: The market faces competition from substitute products, particularly in areas like flooring and furniture, where alternative materials and styles constantly emerge.

- End-User Trends: Shifting consumer preferences towards personalized home spaces, minimalism, and sustainable living are shaping product demand and market segmentation.

United States Home Decor Market Industry Insights & Trends

The US home decor market is projected to experience robust growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by several factors: rising disposable incomes, increasing urbanization leading to smaller living spaces needing efficient décor solutions, and a growing preference for home improvement and personalization among millennials and Gen Z. Technological advancements, such as the increased use of e-commerce platforms and 3D design tools, are also reshaping market dynamics. The increasing adoption of smart home technologies and the growth of the online retail sector further contribute to market expansion. Consumer behavior is shifting towards omnichannel shopping, seeking convenience and personalized experiences. The market size is estimated to reach $XX Billion by 2033.

Key Markets & Segments Leading United States Home Decor Market

The online distribution channel is expected to dominate the market throughout the forecast period, driven by the increasing penetration of internet and e-commerce across the US. The Home Furniture segment is anticipated to hold the largest market share, followed by flooring and home textiles.

By Distribution Channel:

- Online: Rapid growth fueled by convenience, broader product selection, and targeted advertising.

- Specialty Stores: Maintaining a strong presence, though facing increasing competition from online retailers.

- Supermarkets/Hypermarkets: Offer a limited selection of home decor items, primarily targeting price-sensitive consumers.

- Other Distribution Channels: Includes direct-to-consumer sales, pop-up shops, and wholesale distribution.

By Product:

- Home Furniture: Dominant segment driven by consistently high demand for furniture across various styles and price points.

- Home Textiles: Significant market share, influenced by trends in interior design and changing aesthetics.

- Flooring: Growing segment due to renovation activities and demand for durable and stylish flooring options.

- Wall Decor: Experiencing steady growth, driven by personalized home décor trends.

- Lighting and Lamps: Significant segment, with evolving styles and technological advancements in lighting solutions.

- Accessories: A diverse range of products contributing significantly to the market's overall value.

- Other Home Decor Products: Includes a broad range of items like rugs, mirrors, and decorative accents.

Regional Dominance: While data is limited on precise regional breakdown, the coastal regions (East and West Coasts) and major metropolitan areas are expected to exhibit higher demand due to higher population density and higher disposable income levels.

United States Home Decor Market Product Developments

Significant advancements in material science, manufacturing processes, and design aesthetics are reshaping the US home décor market. Smart home integration is becoming increasingly popular, with lighting and other products offering connectivity and remote control capabilities. Sustainable materials and eco-friendly manufacturing processes are gaining traction, aligning with environmentally conscious consumer trends. Customization and personalization options are also rising in importance, allowing consumers to tailor products to their individual preferences.

Challenges in the United States Home Decor Market Market

The US home decor market faces several challenges, including supply chain disruptions impacting material availability and production costs, intense competition, and fluctuating raw material prices, leading to potential price increases. Regulatory changes concerning product safety and environmental standards can also add to operational complexities. Economic downturns can significantly impact consumer spending on discretionary items like home décor, leading to reduced market demand.

Forces Driving United States Home Decor Market Growth

Despite these challenges, several powerful forces propel growth in the U.S. home decor market. A key driver is the rising disposable income, particularly among millennials and Gen Z, who prioritize creating personalized and aesthetically pleasing homes reflecting their unique styles. This translates into increased spending on home improvement and décor projects. The exponential growth of e-commerce platforms broadens market reach, providing access to a wider customer base and fostering convenient online shopping experiences. Furthermore, technological advancements are transforming the industry. Smart home integration, the rising popularity of sustainable and eco-friendly materials (such as reclaimed wood and recycled fabrics), and the increasing availability of customizable design options cater to evolving consumer preferences and demand for unique, personalized spaces. This trend towards personalization fuels demand for niche products and bespoke design services.

Long-Term Growth Catalysts in the United States Home Decor Market

Long-term growth will be fueled by strategic partnerships, fostering collaborations between designers, manufacturers, and retailers. Expansion into new markets and product segments will diversify revenue streams and create opportunities for growth. Continued innovation in materials, design, and technology will drive the development of unique and appealing products.

Emerging Opportunities in United States Home Decor Market

Emerging opportunities include the increasing demand for sustainable and eco-friendly products, personalized home décor solutions, and smart home technology integration. Expansion into rural markets and underserved communities offers untapped potential. The growth of the rental market presents opportunities to target renters with temporary or easily replaceable decor solutions.

Leading Players in the United States Home Decor Market Sector

- Ikea USA

- Shaw Industries Group

- Crane & Canopy Inc

- Mannington Mills Inc

- Herman Miller Inc

- Generation Lighting

- Ashley Furniture

- Mohawk Flooring

- Kimball International

- American Textile Systems

- Acuity Brands Lighting

Key Milestones in United States Home Decor Market Industry

- April 2023: IKEA announces a USD 2.2 Billion investment for omnichannel expansion in the US.

- June 2023: Overstock.com acquires select intellectual property assets from Bed Bath & Beyond.

- August 2023: Overstock.com and Bed Bath & Beyond launch BedBathandBeyond.com.

Strategic Outlook for United States Home Decor Market Market

The US home decor market shows strong potential for long-term growth. Strategic investments in e-commerce, innovative product development, and sustainable practices will be crucial for success. Companies that adapt to evolving consumer preferences and effectively leverage technological advancements will secure a competitive advantage and capture significant market share in the coming years.

United States Home Decor Market Segmentation

-

1. Product

- 1.1. Home Furniture

- 1.2. Home Textiles

- 1.3. Flooring

- 1.4. Wall Decor

- 1.5. Lighting and Lamps

- 1.6. Acessoriess

- 1.7. Other Home Decor Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

United States Home Decor Market Segmentation By Geography

- 1. United States

United States Home Decor Market Regional Market Share

Geographic Coverage of United States Home Decor Market

United States Home Decor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Demand for Home Decor Products is Surging as People are Inclined to Show their Creativity Through DIY Activities.

- 3.3. Market Restrains

- 3.3.1. The Price Fluctuations of Raw Materials can be a Challenge for the Home Decor Industry.; Lack of Skilled Labour who Design Home Decor Furniture

- 3.4. Market Trends

- 3.4.1. The Market is Being Fueled by the Growth of E-Commerce Distribution

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Home Decor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Home Furniture

- 5.1.2. Home Textiles

- 5.1.3. Flooring

- 5.1.4. Wall Decor

- 5.1.5. Lighting and Lamps

- 5.1.6. Acessoriess

- 5.1.7. Other Home Decor Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ikea USA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shaw Industries Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Crane & Canopy Inc**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mannington Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Herman Miller Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Generation Lighting

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ashley Furniture

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mohawak Flooring

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kimball International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 American Textile Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Acuity Brands Lighting

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Ikea USA

List of Figures

- Figure 1: United States Home Decor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Home Decor Market Share (%) by Company 2025

List of Tables

- Table 1: United States Home Decor Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Home Decor Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: United States Home Decor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Home Decor Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: United States Home Decor Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Home Decor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Home Decor Market?

The projected CAGR is approximately 4.11%.

2. Which companies are prominent players in the United States Home Decor Market?

Key companies in the market include Ikea USA, Shaw Industries Group, Crane & Canopy Inc**List Not Exhaustive, Mannington Mills Inc, Herman Miller Inc, Generation Lighting, Ashley Furniture, Mohawak Flooring, Kimball International, American Textile Systems, Acuity Brands Lighting.

3. What are the main segments of the United States Home Decor Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 206.70 Million as of 2022.

5. What are some drivers contributing to market growth?

The Demand for Home Decor Products is Surging as People are Inclined to Show their Creativity Through DIY Activities..

6. What are the notable trends driving market growth?

The Market is Being Fueled by the Growth of E-Commerce Distribution.

7. Are there any restraints impacting market growth?

The Price Fluctuations of Raw Materials can be a Challenge for the Home Decor Industry.; Lack of Skilled Labour who Design Home Decor Furniture.

8. Can you provide examples of recent developments in the market?

August 2023: Overstock.com Inc., in collaboration with Bed Bath & Beyond, unveiled BedBathandBeyond.com in the United States. This strategic move consolidates the strengths of both companies, creating a unified online retail platform operating exclusively as Bed Bath & Beyond.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Home Decor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Home Decor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Home Decor Market?

To stay informed about further developments, trends, and reports in the United States Home Decor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence