Key Insights

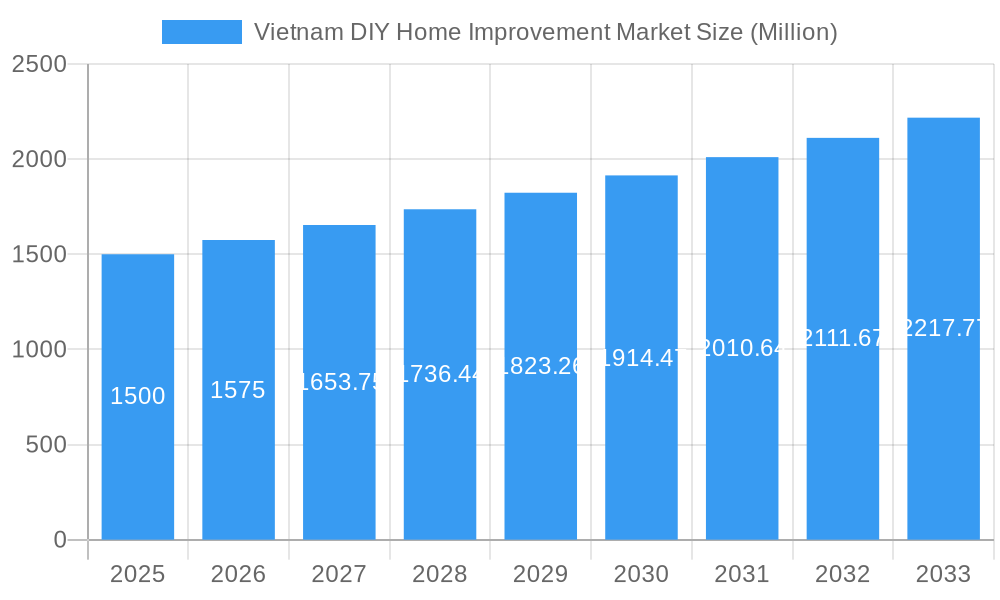

The Vietnam DIY Home Improvement market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes among Vietnam's burgeoning middle class are empowering homeowners to invest in home renovation and improvement projects. A preference for aesthetically pleasing and functional living spaces is driving demand for high-quality building materials, décor items, and specialized tools. Furthermore, the growth of e-commerce platforms offers increased accessibility to a wider range of products and services, further stimulating market growth. The market is segmented by product type, encompassing lumber and landscape management, décor and indoor gardening, kitchen renovations, painting and wallpapering, tools and hardware, building materials, lighting, plumbing and equipment, flooring, repair and replacement services, and electrical work. Distribution channels include DIY home improvement stores, specialty stores, online retailers, and other physical stores. Leading players such as Ambassador Signage & Lighting, Rockwool, Andersen Corporation, Kohler, and 3M Vietnam are actively shaping the market landscape through product innovation and strategic expansion. While potential restraints such as fluctuations in raw material prices and economic uncertainties exist, the overall positive outlook for Vietnam's economy and construction sector suggests a bright future for the DIY home improvement market.

Vietnam DIY Home Improvement Market Market Size (In Billion)

The market's segmentation by distribution channel highlights the significant role of online platforms in expanding market reach. The convenience and wider selection offered by e-commerce are attracting a growing number of DIY enthusiasts. The increasing popularity of home renovation television shows and online design resources further stimulates demand by inspiring homeowners to undertake DIY projects. This trend is particularly pronounced among younger demographics, who are more tech-savvy and readily embrace online shopping and digital design tools. The ongoing urbanization in Vietnam also plays a crucial role, as newly constructed homes and apartments drive demand for furnishings, fixtures, and home improvement solutions. The continued expansion of the construction industry acts as a synergistic force, creating further opportunities for growth within the DIY home improvement sector. Successfully navigating the market requires understanding evolving consumer preferences, leveraging online channels effectively, and offering competitive pricing and high-quality products.

Vietnam DIY Home Improvement Market Company Market Share

Vietnam DIY Home Improvement Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Vietnam DIY home improvement market, projecting robust growth and significant opportunities for stakeholders. The study period covers 2019-2033, with 2025 as the base and estimated year. We analyze market dynamics, key segments, leading players (including Ambassador Signage & Lighting, Rockwool, Andersen Corporation, Kohler, Luca Interior Design Company Limited, DuPont Building Innovations, Truong Thanh, 3M Vietnam Co Ltd, Innoci Viet Nam Co Ltd, and Caesar), and emerging trends shaping this dynamic sector. Expect detailed insights into market size (valued at xx Million USD in 2025), CAGR, and future projections, empowering informed decision-making.

Vietnam DIY Home Improvement Market Concentration & Dynamics

The Vietnam DIY home improvement market exhibits a moderately concentrated landscape, with several established players and a growing number of smaller, specialized businesses. Market share is currently dominated by a few large players, however, fragmentation is expected to increase slightly with the entry of new players and increased online presence. The innovation ecosystem is developing, with local and international companies investing in new product lines and technological advancements. Regulatory frameworks are generally supportive of market growth, although some challenges remain regarding building permits and compliance. Substitute products exist in certain segments, notably in building materials, posing moderate competitive pressure. End-user trends are increasingly focused on sustainability, affordability, and aesthetics, driving demand for eco-friendly and stylish home improvement solutions. M&A activity has been relatively low in recent years (xx deals in the past 5 years), but increased consolidation is anticipated as the market matures.

Vietnam DIY Home Improvement Market Industry Insights & Trends

The Vietnam DIY home improvement market is experiencing significant growth, fueled by a combination of factors. Rising disposable incomes, urbanization, and a growing middle class are driving increased demand for home improvement products and services. The market size is estimated at xx Million USD in 2025, with a projected CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of e-commerce and the adoption of smart home technologies, are transforming the industry, leading to greater convenience and efficiency. Consumer behavior is shifting towards online channels, personalized experiences, and a preference for high-quality, durable products. Furthermore, government initiatives promoting infrastructure development and affordable housing are further boosting the market.

Key Markets & Segments Leading Vietnam DIY Home Improvement Market

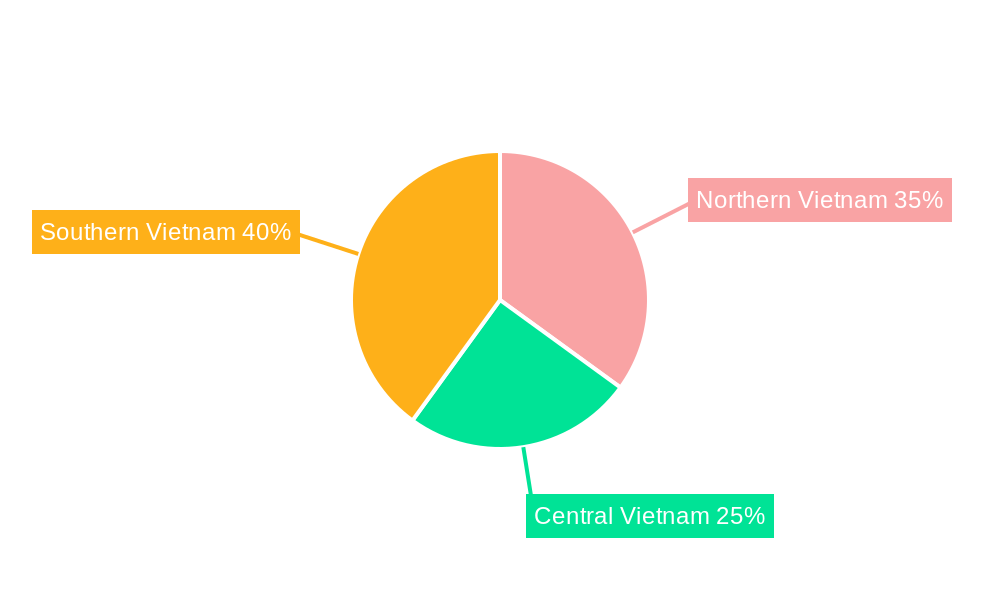

The key markets driving growth include major urban centers such as Ho Chi Minh City and Hanoi.

By Type:

- Building Materials: This segment holds the largest market share, driven by ongoing construction activities and infrastructure development.

- Kitchen & Bathroom Renovations: A growing focus on home aesthetics is fueling this sector's growth.

- Tools & Hardware: Steady growth due to the increasing number of DIY enthusiasts and renovation projects.

By Distribution Channel:

- DIY Home Improvement Stores: These stores are the primary distribution channel, though online channels are rapidly gaining traction.

- Online Channels: The increasing penetration of the internet and e-commerce platforms is rapidly expanding this segment.

Drivers:

- Rapid urbanization and economic growth.

- Increasing disposable incomes of the middle class.

- Government infrastructure projects.

- Growing DIY culture and homeownership rates.

Vietnam DIY Home Improvement Market Product Developments

Product innovations are focused on enhancing functionality, durability, and aesthetics, emphasizing eco-friendly materials and smart home integration. New applications are emerging in areas such as smart lighting, water-efficient plumbing, and energy-efficient building materials. These innovations provide competitive advantages, attracting environmentally conscious customers and tech-savvy homeowners.

Challenges in the Vietnam DIY Home Improvement Market Market

The Vietnam DIY home improvement market faces several challenges. Supply chain disruptions, particularly exacerbated by global events, impact material availability and pricing. Competition is intensifying, both domestically and internationally, putting pressure on profit margins. Regulatory hurdles and bureaucratic processes can delay project completion and increase costs. Furthermore, fluctuating exchange rates and raw material prices also present significant risks.

Forces Driving Vietnam DIY Home Improvement Market Growth

Key drivers include rapid economic growth, increasing disposable incomes, and the rising popularity of DIY home improvement. Government initiatives promoting affordable housing and infrastructure development also stimulate growth. Technological advancements in smart home technology and the growing e-commerce sector are shaping consumer behavior and creating new opportunities.

Long-Term Growth Catalysts in Vietnam DIY Home Improvement Market

Long-term growth hinges on continuous innovation in materials and technologies, strategic partnerships between international and local businesses, and market expansion into secondary cities and rural areas. Government policies that further incentivize homeownership and infrastructure projects will remain crucial.

Emerging Opportunities in Vietnam DIY Home Improvement Market

Opportunities exist in the growing demand for sustainable building materials, smart home integration, and customized home improvement solutions. Expansion into niche markets, such as eco-friendly landscaping and bespoke furniture, also presents significant potential. The increasing usage of online platforms creates a chance for businesses to enhance their marketing and reach a broader audience.

Leading Players in the Vietnam DIY Home Improvement Market Sector

- Ambassador Signage & Lighting

- Rockwool

- Andersen Corporation

- Kohler

- Luca Interior Design Company Limited

- DuPont Building Innovations

- Truong Thanh

- 3M Vietnam Co Ltd

- Innoci Viet Nam Co Ltd

- Caesar

Key Milestones in Vietnam DIY Home Improvement Market Industry

- September 2022: Kohnan Japan Long Bien opens its 10th store in Hanoi, expanding its retail presence and introducing new product lines.

- November 2021: Andersen Corporation publishes its first Environmental Product Declaration (EPD), highlighting its commitment to sustainability and potentially influencing consumer choices.

Strategic Outlook for Vietnam DIY Home Improvement Market Market

The Vietnam DIY home improvement market presents a compelling investment opportunity, with strong growth potential driven by a combination of economic, demographic, and technological factors. Strategic partnerships, focus on innovation, and expansion into new markets are key to capitalizing on the significant opportunities presented by this rapidly expanding sector. Companies that adapt to evolving consumer preferences and embrace technological advancements are poised for success.

Vietnam DIY Home Improvement Market Segmentation

-

1. Type

- 1.1. Lumber and Landscape Management

- 1.2. Décor and Indoor Garden

- 1.3. Kitchen

- 1.4. Painting and Wallpaper

- 1.5. Tools and Hardware

- 1.6. Building Materials

- 1.7. Lighting

- 1.8. Plumbing and Equipment

- 1.9. Flooring, Repair, and Replacement

- 1.10. Electrical Work

-

2. Distribution Channel

- 2.1. DIY Home Improvement Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Physical Stores

Vietnam DIY Home Improvement Market Segmentation By Geography

- 1. Vietnam

Vietnam DIY Home Improvement Market Regional Market Share

Geographic Coverage of Vietnam DIY Home Improvement Market

Vietnam DIY Home Improvement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Residential and bedroom spaces driving the market; Rising Personal Consumer Consumption expenditure

- 3.3. Market Restrains

- 3.3.1. Rising demand for Mattress Bases are limited to the young generation age.; Negative impact of Supply chain disruption and Inflation on the market post covid

- 3.4. Market Trends

- 3.4.1. Increasing Focus on Online Retailing of DIY Products is Driving the Market in Vietnam

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam DIY Home Improvement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lumber and Landscape Management

- 5.1.2. Décor and Indoor Garden

- 5.1.3. Kitchen

- 5.1.4. Painting and Wallpaper

- 5.1.5. Tools and Hardware

- 5.1.6. Building Materials

- 5.1.7. Lighting

- 5.1.8. Plumbing and Equipment

- 5.1.9. Flooring, Repair, and Replacement

- 5.1.10. Electrical Work

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. DIY Home Improvement Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Physical Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ambassador Signage & Lighting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rockwool

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Andersen Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kohler

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Luca Interior Design Company Limited**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DuPont Building Innovations

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Truong Thanh

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 3M Vietnam Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Innoci Viet Nam Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Caeser

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ambassador Signage & Lighting

List of Figures

- Figure 1: Vietnam DIY Home Improvement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam DIY Home Improvement Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Vietnam DIY Home Improvement Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam DIY Home Improvement Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Vietnam DIY Home Improvement Market?

Key companies in the market include Ambassador Signage & Lighting, Rockwool, Andersen Corporation, Kohler, Luca Interior Design Company Limited**List Not Exhaustive, DuPont Building Innovations, Truong Thanh, 3M Vietnam Co Ltd, Innoci Viet Nam Co Ltd, Caeser.

3. What are the main segments of the Vietnam DIY Home Improvement Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Residential and bedroom spaces driving the market; Rising Personal Consumer Consumption expenditure.

6. What are the notable trends driving market growth?

Increasing Focus on Online Retailing of DIY Products is Driving the Market in Vietnam.

7. Are there any restraints impacting market growth?

Rising demand for Mattress Bases are limited to the young generation age.; Negative impact of Supply chain disruption and Inflation on the market post covid.

8. Can you provide examples of recent developments in the market?

In September 2022, the Japan-based DIY retailer Kohnan Japan Long Bien opened its 10th store in the Aeon Mall in Hanoi City, Vietnam. The store provides products such as outdoor goods, miscellaneous indoor goods, and tableware. Kohnan also has its own brands - Southernport and Lifelex. It is planning to manufacture unique products in collaboration with local Vietnamese companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam DIY Home Improvement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam DIY Home Improvement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam DIY Home Improvement Market?

To stay informed about further developments, trends, and reports in the Vietnam DIY Home Improvement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence