Key Insights

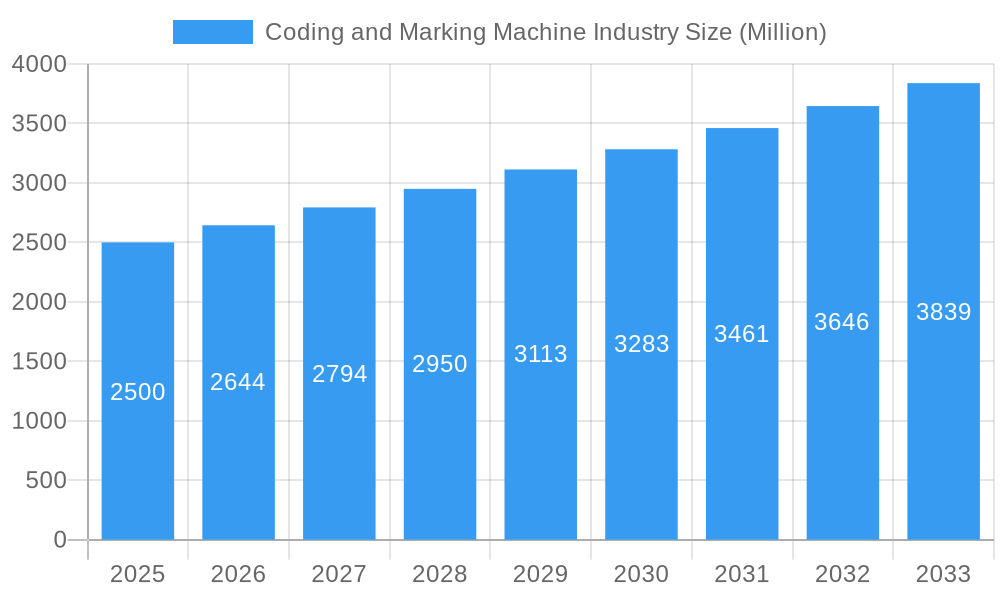

The global coding and marking machine market is experiencing robust growth, driven by increasing demand across diverse end-user industries. A 5.64% Compound Annual Growth Rate (CAGR) from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. The pharmaceutical, food and beverage, and cosmetics sectors are key drivers, fueled by stringent regulatory requirements for product traceability and enhanced brand protection. Technological advancements, particularly in high-speed inkjet printing and laser marking technologies, are further boosting market expansion. The shift towards automation and Industry 4.0 initiatives across manufacturing facilities is accelerating the adoption of advanced coding and marking solutions. While the market faces challenges such as high initial investment costs for sophisticated equipment, these are largely offset by long-term benefits like improved efficiency and reduced production errors. The market is segmented by end-user industry (Pharmaceutical, Construction, Food and Beverage, Cosmetics, Others), solution type (Equipment, Fluids and Ribbons, Spares), and equipment type (Thermal Inkjet (TIJ) Printer, Continuous Inkjet (CIJ) Printer, Laser Printer, Others). Major players like Keyence, Domino, and Danaher are vying for market share through innovation and strategic acquisitions. The Asia-Pacific region is expected to show strong growth due to rapid industrialization and expanding manufacturing bases.

Coding and Marking Machine Industry Market Size (In Billion)

The competitive landscape is characterized by both established players and emerging technology providers. Companies are focusing on developing sustainable and efficient solutions, aligning with growing environmental concerns. Furthermore, the integration of smart technologies, such as connectivity and data analytics, is transforming the coding and marking industry, enabling predictive maintenance and optimized production processes. The market's future trajectory indicates continued growth, propelled by increasing demand for precise and reliable product identification across a wide array of industries globally. The market size in 2025 is estimated (based on the provided CAGR and assuming a reasonable starting point in 2019) to be around $X Billion. Further projections are provided in the chart data section, demonstrating the continued growth trend predicted for this market.

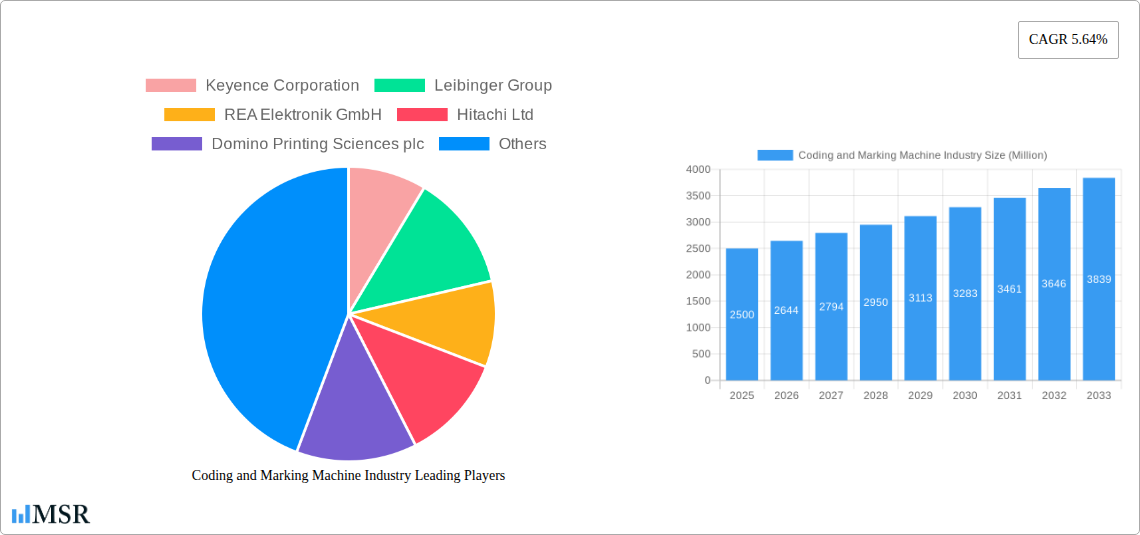

Coding and Marking Machine Industry Company Market Share

Coding and Marking Machine Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Coding and Marking Machine industry, offering valuable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamic landscape, encompassing market size, growth drivers, technological advancements, and competitive analysis. The global market value is projected at xx Million in 2025, exhibiting a CAGR of xx% during the forecast period.

Coding and Marking Machine Industry Market Concentration & Dynamics

The Coding and Marking Machine industry exhibits a moderately concentrated market structure, with key players holding significant market share. Leading companies like Keyence Corporation, Leibinger Group, REA Elektronik GmbH, Hitachi Ltd, Domino Printing Sciences plc, Koenig & Bauer Coding GmbH, Danaher Corporation, Dover Corporation, Control Print Ltd, and Matthews International Corporation compete fiercely, driving innovation and consolidation. Market share data for 2024 indicates that the top five players collectively hold approximately xx% of the market, while the remaining share is distributed among numerous smaller players and niche providers.

The industry’s dynamics are shaped by several factors:

- Innovation Ecosystems: Continuous advancements in inkjet, laser, and thermal transfer technologies fuel product diversification and improved performance.

- Regulatory Frameworks: Stringent regulations regarding product traceability and labeling across various industries (e.g., pharmaceuticals, food & beverage) significantly impact market growth.

- Substitute Products: While limited, alternative marking methods like manual labeling present competition, though their scalability and efficiency are significantly lower.

- End-User Trends: Growing demand for high-speed, high-resolution coding solutions across diverse end-user sectors, driven by increasing traceability requirements, is a key market driver.

- M&A Activities: The industry has witnessed several mergers and acquisitions in recent years, indicating consolidation trends and strategic expansion efforts. The number of M&A deals averaged xx per year during the historical period (2019-2024).

Coding and Marking Machine Industry Industry Insights & Trends

The global Coding and Marking Machine market is experiencing robust growth, driven by several key factors. The increasing demand for efficient and reliable product identification and traceability across various industries is a primary catalyst. The rising adoption of automation technologies across manufacturing and packaging processes further fuels market expansion. Technological advancements, such as the development of high-resolution inkjet printers and laser coders with enhanced functionalities, are also significantly contributing to market growth.

Furthermore, the evolving consumer behavior, which demands greater transparency and detailed product information, is driving the need for sophisticated coding and marking solutions. The market is experiencing a shift towards digitalization, with smart coding solutions offering data integration, remote monitoring, and improved operational efficiency. This trend, coupled with rising regulatory compliance requirements, is stimulating demand for advanced coding and marking technologies. The market size in 2024 was estimated at xx Million, exhibiting substantial growth compared to previous years.

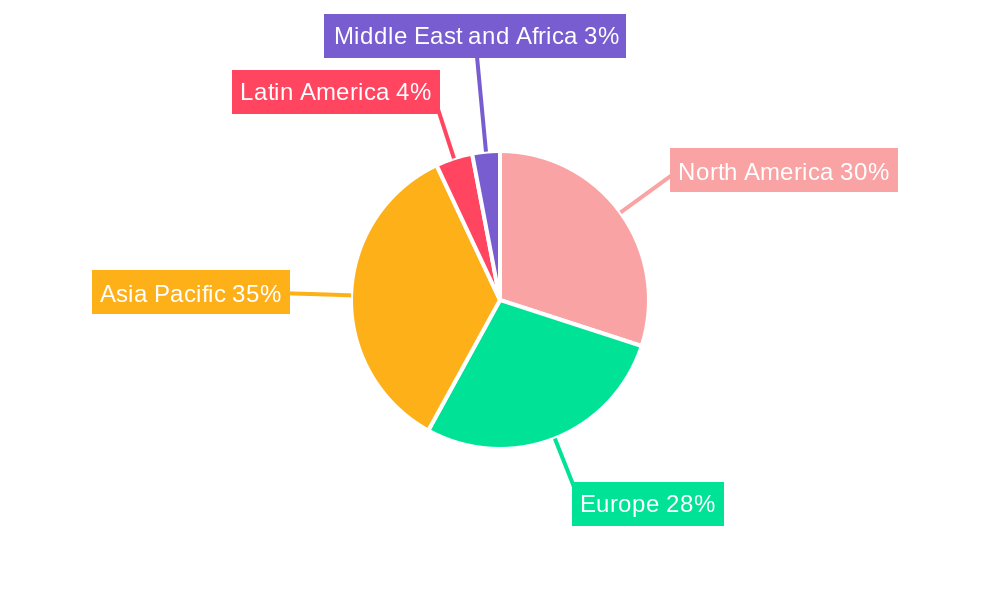

Key Markets & Segments Leading Coding and Marking Machine Industry

The Food and Beverage industry represents the largest segment within the Coding and Marking Machine market, driven by strict regulations and the need for accurate product traceability for safety and quality control. The Pharmaceutical and Cosmetics sectors follow closely, emphasizing the need for tamper-evident coding and serialization. Geographically, North America and Europe currently hold significant market share due to the presence of established manufacturing industries and high adoption rates of advanced technologies. However, developing economies in Asia-Pacific are showing rapid growth, driven by expanding industrialization and increasing investments in manufacturing infrastructure.

Key Market Drivers:

By End-user Industry:

- Pharmaceutical: Stringent regulatory compliance, serialization mandates.

- Food and Beverage: Safety and quality control, traceability regulations.

- Cosmetics: Brand protection, anti-counterfeiting measures.

- Construction: Product identification, traceability of materials.

By Solution:

- Equipment: High demand for advanced printers and coding systems.

- Fluids and Ribbons: Consumables for various coding technologies.

- Spares: Maintenance and repair of existing equipment.

By Equipment:

- Continuous Inkjet (CIJ) Printer: High versatility and adaptability.

- Thermal Inkjet (TIJ) Printer: Cost-effective solution for various applications.

- Laser Printer: High-resolution coding for demanding applications.

Dominance Analysis: The Food and Beverage sector’s dominance is attributed to its substantial volume of packaged goods requiring clear and accurate coding. North America leads in terms of market value, due to the strong presence of established players and high technological adoption rates.

Coding and Marking Machine Industry Product Developments

Recent years have witnessed significant advancements in Coding and Marking Machine technology, emphasizing higher resolution, faster printing speeds, and improved integration with existing manufacturing systems. The launch of new generation continuous inkjet printers (like Markem-Imaje’s 9750) and laser coders (like Linx SL3) exemplifies this trend. These products offer enhanced features, including improved traceability capabilities, more robust coding on diverse packaging materials, and customizable user interfaces. Such innovations provide manufacturers with competitive advantages by improving efficiency and reducing production costs.

Challenges in the Coding and Marking Machine Industry Market

The industry faces challenges including stringent regulatory compliance requirements, which increase operational complexity and costs. Supply chain disruptions and fluctuations in raw material prices (inks, ribbons) significantly impact production and profitability. Furthermore, intense competition from established and emerging players necessitates continuous innovation and cost optimization to maintain market share. These factors collectively pose challenges to sustained growth and profitability in the industry.

Forces Driving Coding and Marking Machine Industry Growth

Several factors are propelling the growth of the Coding and Marking Machine industry. Technological advancements, particularly in inkjet and laser printing technologies, offer improved precision, speed, and versatility. The increasing demand for product traceability and anti-counterfeiting measures across various industries is driving the adoption of advanced coding solutions. Furthermore, supportive government regulations and incentives promoting automation in manufacturing contribute to sustained market expansion.

Long-Term Growth Catalysts in the Coding and Marking Machine Industry

Long-term growth will be fueled by strategic partnerships between coding machine manufacturers and software providers, leading to integrated solutions for enhanced data management and traceability. Expanding into emerging markets with growing industrialization, such as parts of Asia and Africa, presents significant opportunities. Continuous research and development in new coding technologies, including advancements in digital printing and sustainable inks, will further drive industry expansion and create new applications.

Emerging Opportunities in Coding and Marking Machine Industry

The integration of smart technologies, like IoT and AI, into coding machines presents significant growth opportunities. This allows for predictive maintenance, real-time data analysis, and optimized production workflows. Sustainable and eco-friendly inks and ribbons represent another burgeoning segment, appealing to environmentally conscious consumers and manufacturers. Furthermore, developing customized solutions for niche industries and exploring new applications in emerging markets will unlock new revenue streams.

Leading Players in the Coding and Marking Machine Industry Sector

- Keyence Corporation

- Leibinger Group

- REA Elektronik GmbH

- Hitachi Ltd

- Domino Printing Sciences plc

- Koenig & Bauer Coding GmbH

- Danaher Corporation

- Dover Corporation

- Control Print Ltd

- Matthews International Corporation

Key Milestones in Coding and Marking Machine Industry Industry

- September 2021: Linx Printing Technologies launched the Linx SL3 laser coder, offering enhanced user control and diverse application possibilities.

- May 2022: Markem-Imaje (Dover Corporation) launched the 9750 continuous inkjet printer, featuring robust traceability coding for various packaging types.

Strategic Outlook for Coding and Marking Machine Industry Market

The Coding and Marking Machine industry is poised for continued growth, driven by technological advancements, increasing regulatory demands, and the expansion of key end-user sectors. Strategic investments in research and development, expansion into emerging markets, and strategic partnerships will be crucial for companies to capitalize on the market's potential. The focus on sustainable and smart technologies will further shape the industry's future trajectory.

Coding and Marking Machine Industry Segmentation

-

1. Solution

- 1.1. Equipment

- 1.2. Fluids and Ribbons

- 1.3. Spares

-

2. Equipment

- 2.1. Thermal Inkjet (TIJ) Printer

- 2.2. Continuous Inkjet (CIJ) Printer

- 2.3. Laser Printer

- 2.4. Others

-

3. End-user Industry

- 3.1. Pharmaceutical

- 3.2. Construction

- 3.3. Food and Beverage

- 3.4. Cosmetics

- 3.5. Others

Coding and Marking Machine Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Coding and Marking Machine Industry Regional Market Share

Geographic Coverage of Coding and Marking Machine Industry

Coding and Marking Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of the production and packaging industry and increasing adoption of creative packaging techniques; Increasing demand for product traceability solutions across supply chain of various industries

- 3.3. Market Restrains

- 3.3.1. High upfront and operational cost for deploying coding and making equipment

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is Analyzed To Hold Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Equipment

- 5.1.2. Fluids and Ribbons

- 5.1.3. Spares

- 5.2. Market Analysis, Insights and Forecast - by Equipment

- 5.2.1. Thermal Inkjet (TIJ) Printer

- 5.2.2. Continuous Inkjet (CIJ) Printer

- 5.2.3. Laser Printer

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Pharmaceutical

- 5.3.2. Construction

- 5.3.3. Food and Beverage

- 5.3.4. Cosmetics

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Equipment

- 6.1.2. Fluids and Ribbons

- 6.1.3. Spares

- 6.2. Market Analysis, Insights and Forecast - by Equipment

- 6.2.1. Thermal Inkjet (TIJ) Printer

- 6.2.2. Continuous Inkjet (CIJ) Printer

- 6.2.3. Laser Printer

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Pharmaceutical

- 6.3.2. Construction

- 6.3.3. Food and Beverage

- 6.3.4. Cosmetics

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Equipment

- 7.1.2. Fluids and Ribbons

- 7.1.3. Spares

- 7.2. Market Analysis, Insights and Forecast - by Equipment

- 7.2.1. Thermal Inkjet (TIJ) Printer

- 7.2.2. Continuous Inkjet (CIJ) Printer

- 7.2.3. Laser Printer

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Pharmaceutical

- 7.3.2. Construction

- 7.3.3. Food and Beverage

- 7.3.4. Cosmetics

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Equipment

- 8.1.2. Fluids and Ribbons

- 8.1.3. Spares

- 8.2. Market Analysis, Insights and Forecast - by Equipment

- 8.2.1. Thermal Inkjet (TIJ) Printer

- 8.2.2. Continuous Inkjet (CIJ) Printer

- 8.2.3. Laser Printer

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Pharmaceutical

- 8.3.2. Construction

- 8.3.3. Food and Beverage

- 8.3.4. Cosmetics

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Equipment

- 9.1.2. Fluids and Ribbons

- 9.1.3. Spares

- 9.2. Market Analysis, Insights and Forecast - by Equipment

- 9.2.1. Thermal Inkjet (TIJ) Printer

- 9.2.2. Continuous Inkjet (CIJ) Printer

- 9.2.3. Laser Printer

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Pharmaceutical

- 9.3.2. Construction

- 9.3.3. Food and Beverage

- 9.3.4. Cosmetics

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East and Africa Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Equipment

- 10.1.2. Fluids and Ribbons

- 10.1.3. Spares

- 10.2. Market Analysis, Insights and Forecast - by Equipment

- 10.2.1. Thermal Inkjet (TIJ) Printer

- 10.2.2. Continuous Inkjet (CIJ) Printer

- 10.2.3. Laser Printer

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Pharmaceutical

- 10.3.2. Construction

- 10.3.3. Food and Beverage

- 10.3.4. Cosmetics

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Keyence Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leibinger Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 REA Elektronik GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hitachi Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Domino Printing Sciences plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Koenig & Bauer Coding GmbH*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danaher Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dover Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Control Print Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Matthews International Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Keyence Corporation

List of Figures

- Figure 1: Global Coding and Marking Machine Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 3: North America Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 4: North America Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 5: North America Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 6: North America Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 11: Europe Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 12: Europe Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 13: Europe Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 14: Europe Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 19: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 20: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 21: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 22: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 27: Latin America Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 28: Latin America Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 29: Latin America Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 30: Latin America Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 35: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 36: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 37: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 38: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 2: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 3: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Coding and Marking Machine Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 6: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 7: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 10: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 11: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 14: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 15: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 18: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 19: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 22: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 23: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coding and Marking Machine Industry?

The projected CAGR is approximately 5.64%.

2. Which companies are prominent players in the Coding and Marking Machine Industry?

Key companies in the market include Keyence Corporation, Leibinger Group, REA Elektronik GmbH, Hitachi Ltd, Domino Printing Sciences plc, Koenig & Bauer Coding GmbH*List Not Exhaustive, Danaher Corporation, Dover Corporation, Control Print Ltd, Matthews International Corporation.

3. What are the main segments of the Coding and Marking Machine Industry?

The market segments include Solution, Equipment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of the production and packaging industry and increasing adoption of creative packaging techniques; Increasing demand for product traceability solutions across supply chain of various industries.

6. What are the notable trends driving market growth?

Food and Beverage Industry is Analyzed To Hold Highest Share.

7. Are there any restraints impacting market growth?

High upfront and operational cost for deploying coding and making equipment.

8. Can you provide examples of recent developments in the market?

May 2022- Markem-Imaje, a subsidiary of Dover and a global provider of end-to-end supply chain solutions and industrial marking and coding systems, has announced the launch of the 9750 continuous inkjet printer. The 9750 is the first of a new generation of printers that can print robust traceability coding on a wide range of packaging, including up to five-line text messages, logos, and high-resolution 1D and 2D codes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coding and Marking Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coding and Marking Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coding and Marking Machine Industry?

To stay informed about further developments, trends, and reports in the Coding and Marking Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence