Key Insights

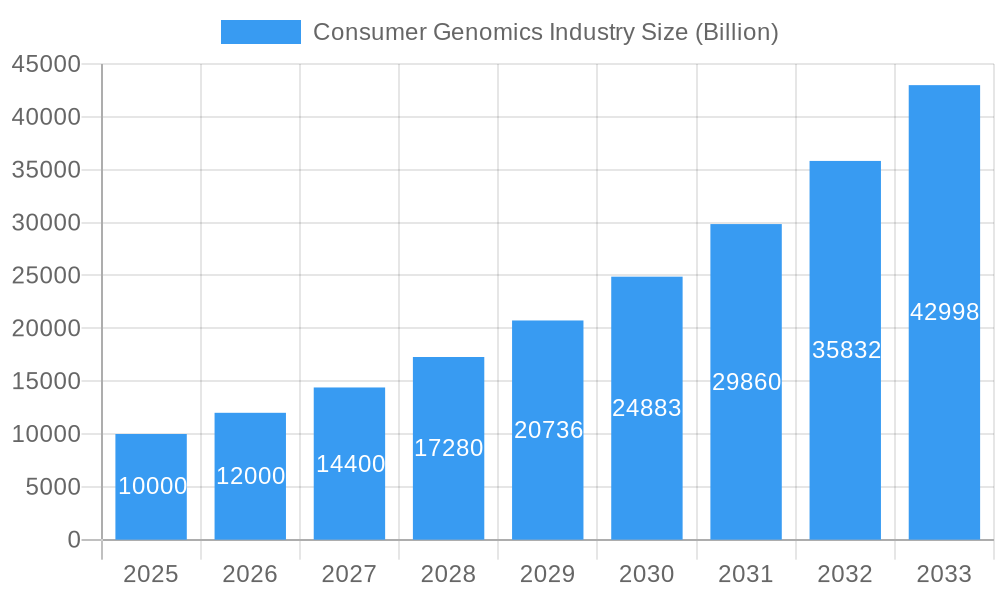

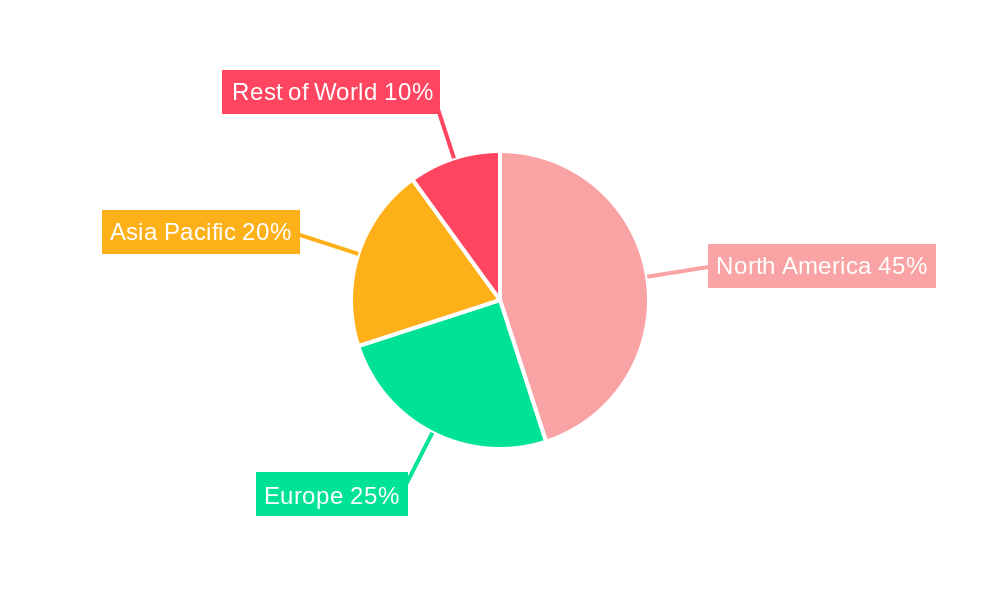

The consumer genomics market is experiencing explosive growth, driven by decreasing sequencing costs, increasing consumer awareness of personalized health, and the rising popularity of direct-to-consumer (DTC) genetic testing kits. The market, currently valued at approximately $XX billion in 2025 (assuming a logical extrapolation based on the provided CAGR of 20% and a base year of 2025), is projected to reach significantly higher values by 2033. This expansion is fueled by several key factors. The application of genomics in personalized medicine, allowing for tailored treatment plans based on individual genetic profiles, is a major driver. Moreover, the growing interest in ancestry tracing and the increasing use of genetic testing in areas like wellness, nutrition, and sports performance contribute substantially to market growth. The North American market currently holds a significant share, owing to high adoption rates and advanced healthcare infrastructure, but the Asia-Pacific region is anticipated to witness the fastest growth due to rising disposable incomes and increasing health consciousness.

Consumer Genomics Industry Market Size (In Billion)

Several challenges remain. Concerns about data privacy and security surrounding genetic information are prominent. Furthermore, the need for clear regulatory frameworks and consumer education regarding the interpretation of genetic test results poses hurdles to wider adoption. Despite these challenges, the continuous advancements in sequencing technologies, coupled with the development of user-friendly testing kits and analytical tools, are expected to overcome these limitations, fostering further market expansion. Companies like 23andMe, Ancestry, and MyHeritage are prominent players, leveraging technological innovation and marketing strategies to capture significant market shares. Competition is likely to intensify as new entrants emerge, potentially leading to further cost reductions and increased innovation within the sector. The long-term outlook for the consumer genomics market is exceptionally positive, anticipating substantial growth driven by technological advancements and increasing consumer demand for personalized healthcare solutions.

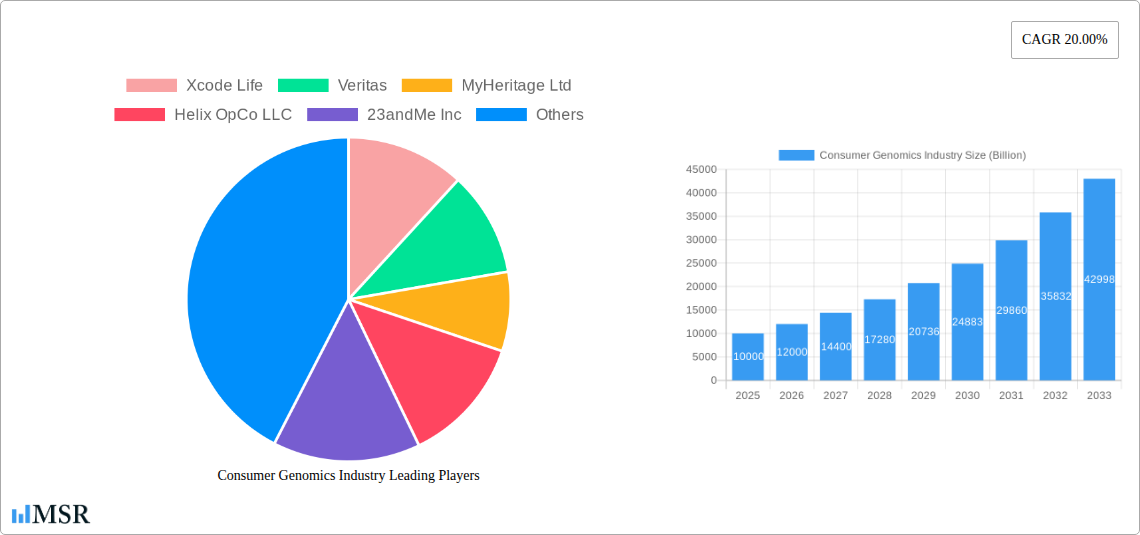

Consumer Genomics Industry Company Market Share

Consumer Genomics Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global consumer genomics market, projecting a market size exceeding $XX Billion by 2033. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is invaluable for investors, industry stakeholders, and businesses seeking to understand the market dynamics, growth drivers, and future opportunities within the rapidly evolving consumer genomics landscape.

Consumer Genomics Industry Market Concentration & Dynamics

The consumer genomics market exhibits a moderately concentrated landscape, with key players like 23andMe Inc., Illumina Inc., and MyHeritage Ltd. holding significant market share. However, the presence of numerous smaller companies and startups indicates a dynamic competitive environment. The market is characterized by ongoing innovation, particularly in areas like next-generation sequencing (NGS) and bioinformatics. Regulatory frameworks, varying across different geographies, significantly influence market growth and access. Substitute products, such as traditional diagnostic methods, pose a competitive challenge. Evolving consumer preferences towards personalized healthcare drive market expansion. Mergers and acquisitions (M&A) activities, exemplified by Genetic Technologies Limited's acquisition of AffinityDNA in May 2022, are reshaping market dynamics.

- Market Concentration: Moderately concentrated, with a few dominant players and many smaller competitors.

- Innovation Ecosystem: Highly dynamic, with significant advancements in NGS and bioinformatics.

- Regulatory Frameworks: Vary across geographies, impacting market access and growth.

- Substitute Products: Traditional diagnostic methods pose some competitive pressure.

- End-User Trends: Increasing demand for personalized healthcare and wellness solutions.

- M&A Activity: Growing number of mergers and acquisitions, reflecting market consolidation. Estimated XX M&A deals occurred between 2019-2024. Major players' market share is estimated to be: 23andMe Inc (XX%), Illumina Inc (XX%), MyHeritage Ltd (XX%).

Consumer Genomics Industry Industry Insights & Trends

The consumer genomics market is experiencing robust growth, fueled by several key factors. The market size reached approximately $XX Billion in 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Technological advancements, such as reduced sequencing costs and improved data analysis techniques, are major drivers. Evolving consumer behaviors, reflecting an increased interest in personalized healthcare, preventative medicine, and ancestry tracing, significantly contribute to market expansion. Growing consumer awareness of genetic predispositions to diseases further fuels demand for genetic testing services. The market is witnessing a shift towards direct-to-consumer (DTC) testing, driven by convenience and affordability.

Key Markets & Segments Leading Consumer Genomics Industry

North America currently dominates the consumer genomics market, driven by high healthcare expenditure, advanced technological infrastructure, and early adoption of personalized medicine. However, Asia Pacific is expected to witness significant growth in the coming years due to rising disposable incomes, expanding healthcare infrastructure, and increasing awareness of genetic testing.

Dominant Segments by Application:

- Ancestry: High consumer interest in lineage and heritage fuels significant market share.

- Personalized Medicine & Pharmacogenetic Testing: Growing adoption of personalized therapies drives market growth.

- Diagnostics: Increasing demand for early disease detection and prevention contributes to a significant segment.

- Lifestyle, Wellness & Nutrition: Growing focus on proactive health management boosts this segment.

Drivers of Growth:

- North America: High healthcare spending, advanced technology infrastructure, and early adoption of personalized medicine.

- Asia Pacific: Rising disposable incomes, expanding healthcare infrastructure, and increasing awareness of genetic testing.

- Europe: Growing regulatory support and investment in healthcare research and development.

Consumer Genomics Industry Product Developments

Recent product innovations include the development of more affordable and accessible testing kits, advancements in data analysis and interpretation software, and the integration of genomics data with other health information platforms. These innovations enhance the accessibility, accuracy, and usability of consumer genomic services, fostering competition and driving market growth.

Challenges in the Consumer Genomics Industry Market

Key challenges include stringent regulatory frameworks across different jurisdictions, potential supply chain disruptions impacting test kit availability, and intense competition among established players and emerging startups. Data privacy and security concerns also present significant hurdles, potentially affecting market expansion. The estimated impact of regulatory hurdles on market growth is a reduction of XX% annually.

Forces Driving Consumer Genomics Industry Growth

Key growth drivers include technological advancements, particularly in NGS and bioinformatics, leading to reduced testing costs and improved data accuracy. Increased consumer awareness of the benefits of personalized medicine and rising disposable incomes globally fuel market expansion. Favorable government policies and initiatives supporting the development and adoption of genomic technologies also contribute significantly.

Long-Term Growth Catalysts in the Consumer Genomics Industry

Long-term growth hinges on continued innovation in sequencing technologies, the development of novel applications, and strategic partnerships between genomics companies and healthcare providers. Expansion into new markets, particularly in developing economies, represents a significant growth opportunity. The integration of consumer genomics data with electronic health records (EHRs) will further enhance its clinical utility and market potential.

Emerging Opportunities in Consumer Genomics Industry

Emerging trends include the integration of consumer genomics with wearable technology and the development of AI-driven diagnostic tools. Growing interest in applications beyond ancestry and health, such as personalized nutrition and fitness plans, presents new market opportunities. Expansion into niche markets, such as veterinary genomics, also holds significant potential.

Leading Players in the Consumer Genomics Industry Sector

- Xcode Life

- Veritas Genetics

- MyHeritage Ltd

- Helix OpCo LLC

- 23andMe Inc

- Pathway Genomics

- Illumina Inc

- Positive Biosciences Ltd

- Futura Genetics

- Toolbox Genomics

- List Not Exhaustive

Key Milestones in Consumer Genomics Industry Industry

- October 2022: GC LabTech partnered with 1health.io to deliver FDA-registered plasma tests directly to consumers, expanding DTC testing options.

- May 2022: Genetic Technologies Limited acquired AffinityDNA's DTC eCommerce business, increasing market reach.

Strategic Outlook for Consumer Genomics Industry Market

The consumer genomics market holds significant long-term growth potential, driven by continuous technological advancements, increasing consumer awareness, and the expansion of applications beyond healthcare. Strategic partnerships and collaborations will be crucial for companies to capitalize on emerging opportunities and navigate the challenges associated with regulation, data privacy, and competition. The market is poised for further consolidation through M&A activities, with a focus on developing innovative products and expanding global reach.

Consumer Genomics Industry Segmentation

-

1. Application

- 1.1. Genetic Relatedness

- 1.2. Diagnostics

- 1.3. Lifestyle, Wellness, & Nutrition

- 1.4. Ancestry

- 1.5. Personalized Medicine & Pharmacogenetic Testing

- 1.6. Sports Nutrition & Health

- 1.7. Other Application Types

Consumer Genomics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Consumer Genomics Industry Regional Market Share

Geographic Coverage of Consumer Genomics Industry

Consumer Genomics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Interest of Consumers & Physicians in DTC kits; Advancements in Technology; Increasing Applications of Consumer Genomics and Favorable Government Policies; Growing Trend of Personalized Genomics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Challenges; Misleading Results Create Challenges in Adoption of Home-based Genetic Tests

- 3.4. Market Trends

- 3.4.1. Genetic Relatedness Expected to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Genetic Relatedness

- 5.1.2. Diagnostics

- 5.1.3. Lifestyle, Wellness, & Nutrition

- 5.1.4. Ancestry

- 5.1.5. Personalized Medicine & Pharmacogenetic Testing

- 5.1.6. Sports Nutrition & Health

- 5.1.7. Other Application Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Genetic Relatedness

- 6.1.2. Diagnostics

- 6.1.3. Lifestyle, Wellness, & Nutrition

- 6.1.4. Ancestry

- 6.1.5. Personalized Medicine & Pharmacogenetic Testing

- 6.1.6. Sports Nutrition & Health

- 6.1.7. Other Application Types

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Genetic Relatedness

- 7.1.2. Diagnostics

- 7.1.3. Lifestyle, Wellness, & Nutrition

- 7.1.4. Ancestry

- 7.1.5. Personalized Medicine & Pharmacogenetic Testing

- 7.1.6. Sports Nutrition & Health

- 7.1.7. Other Application Types

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Genetic Relatedness

- 8.1.2. Diagnostics

- 8.1.3. Lifestyle, Wellness, & Nutrition

- 8.1.4. Ancestry

- 8.1.5. Personalized Medicine & Pharmacogenetic Testing

- 8.1.6. Sports Nutrition & Health

- 8.1.7. Other Application Types

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Genetic Relatedness

- 9.1.2. Diagnostics

- 9.1.3. Lifestyle, Wellness, & Nutrition

- 9.1.4. Ancestry

- 9.1.5. Personalized Medicine & Pharmacogenetic Testing

- 9.1.6. Sports Nutrition & Health

- 9.1.7. Other Application Types

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. South America Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Genetic Relatedness

- 10.1.2. Diagnostics

- 10.1.3. Lifestyle, Wellness, & Nutrition

- 10.1.4. Ancestry

- 10.1.5. Personalized Medicine & Pharmacogenetic Testing

- 10.1.6. Sports Nutrition & Health

- 10.1.7. Other Application Types

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Xcode Life

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Veritas

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MyHeritage Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Helix OpCo LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 23andMe Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pathway Genomics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Illumina Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Positive Biosciences Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Futura Genetics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Toolbox Genomics*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Xcode Life

List of Figures

- Figure 1: Global Consumer Genomics Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Consumer Genomics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Consumer Genomics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Consumer Genomics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Consumer Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Consumer Genomics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 7: Europe Consumer Genomics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Consumer Genomics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Consumer Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Consumer Genomics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Asia Pacific Consumer Genomics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Consumer Genomics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Consumer Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa Consumer Genomics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: Middle East and Africa Consumer Genomics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Middle East and Africa Consumer Genomics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East and Africa Consumer Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Consumer Genomics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 19: South America Consumer Genomics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: South America Consumer Genomics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: South America Consumer Genomics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Consumer Genomics Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Consumer Genomics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Global Consumer Genomics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Germany Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: France Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Italy Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Spain Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Consumer Genomics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: China Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Japan Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Australia Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 25: Global Consumer Genomics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: GCC Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: South Africa Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Middle East and Africa Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Consumer Genomics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Brazil Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Argentina Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Genomics Industry?

The projected CAGR is approximately 30.4%.

2. Which companies are prominent players in the Consumer Genomics Industry?

Key companies in the market include Xcode Life, Veritas, MyHeritage Ltd, Helix OpCo LLC, 23andMe Inc, Pathway Genomics, Illumina Inc, Positive Biosciences Ltd, Futura Genetics, Toolbox Genomics*List Not Exhaustive.

3. What are the main segments of the Consumer Genomics Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Interest of Consumers & Physicians in DTC kits; Advancements in Technology; Increasing Applications of Consumer Genomics and Favorable Government Policies; Growing Trend of Personalized Genomics.

6. What are the notable trends driving market growth?

Genetic Relatedness Expected to Witness High Growth.

7. Are there any restraints impacting market growth?

Stringent Regulatory Challenges; Misleading Results Create Challenges in Adoption of Home-based Genetic Tests.

8. Can you provide examples of recent developments in the market?

October 2022: GC LabTech FDA-registered specialty laboratory with life-saving plasma tests selected 1health.io to deliver its innovative new lab tests direct-to-consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Consumer Genomics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Consumer Genomics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Consumer Genomics Industry?

To stay informed about further developments, trends, and reports in the Consumer Genomics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence