Key Insights

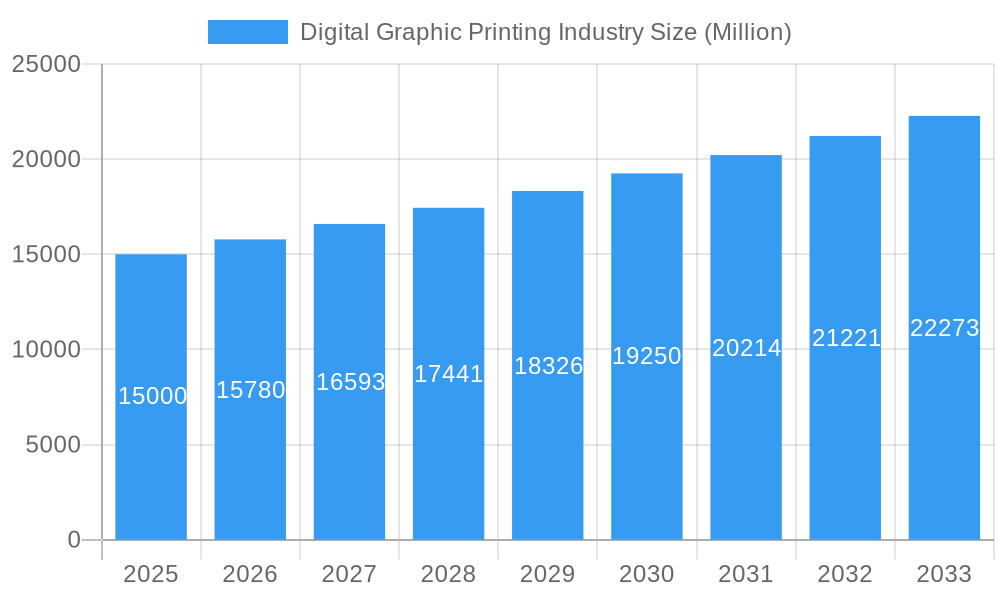

The digital graphic printing market is poised for significant expansion, driven by escalating demand for premium, customized printed materials across a broad spectrum of industries. With a current market size of $14.9 billion, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 1.7% from the base year 2025 to 2033. Key growth catalysts include the widespread adoption of inkjet and electrophotography printing technologies, valued for their operational efficiency, rapid output, and cost-effectiveness. The increasing emphasis on personalized marketing campaigns and packaging solutions, coupled with the imperative for secure documentation in finance and government sectors, further propels market advancement. Sub-segments such as advertising prints and transactional printing are demonstrating robust growth, underscoring the evolving business requirements for enhanced customer engagement and streamlined operational processes. Despite potential challenges posed by volatile raw material costs and intense market competition, the industry's trajectory remains optimistic, with emergent opportunities stemming from advancements in print quality, sustainable practices, and the convergence of digital printing with other innovative technologies.

Digital Graphic Printing Industry Market Size (In Billion)

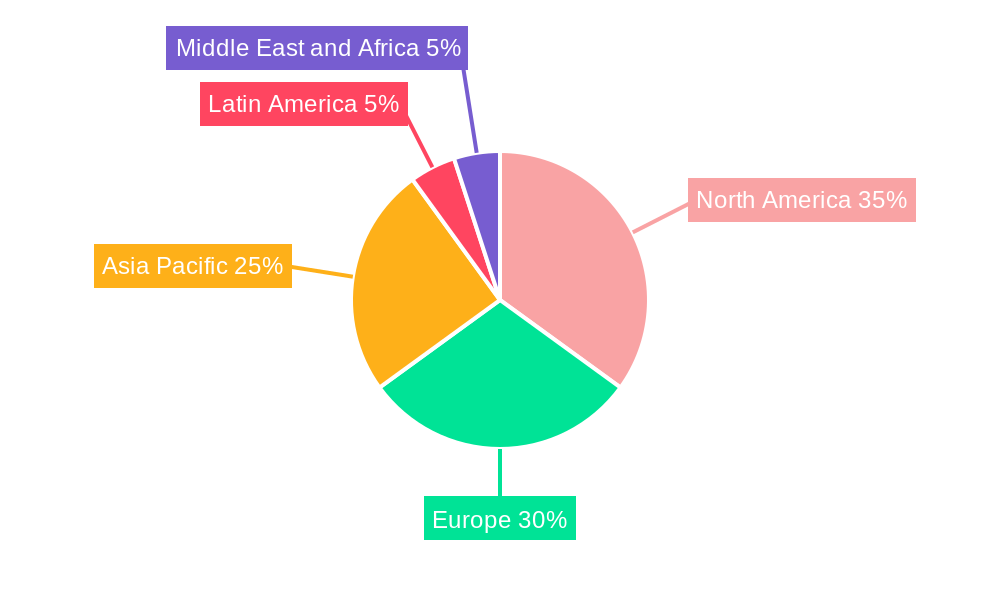

Segmentation within the digital graphic printing industry reveals the varied applications of this technology. Inkjet printing holds a dominant position in specific market niches, owing to its adaptability to diverse substrates and its suitability for high-volume, on-demand production. Electrophotography, recognized for its speed and accuracy, maintains a strong presence in applications requiring crisp imagery and consistent quality. Regional market dynamics show North America and Europe as leading contributors to market share. However, the Asia-Pacific region exhibits substantial growth potential, attributed to rapid economic development and accelerating digital technology adoption. Leading industry contributors, including Landa Corporation, Xerox Holdings Corporation, and Giesecke+Devrient Currency Technology GmbH, alongside numerous regional entities, are actively shaping the competitive environment through persistent innovation and strategic market penetration. The forecast period from 2025 to 2033 offers considerable avenues for market participants to leverage these growth trends and drive further innovation in response to the dynamic demands of the digital graphic printing industry.

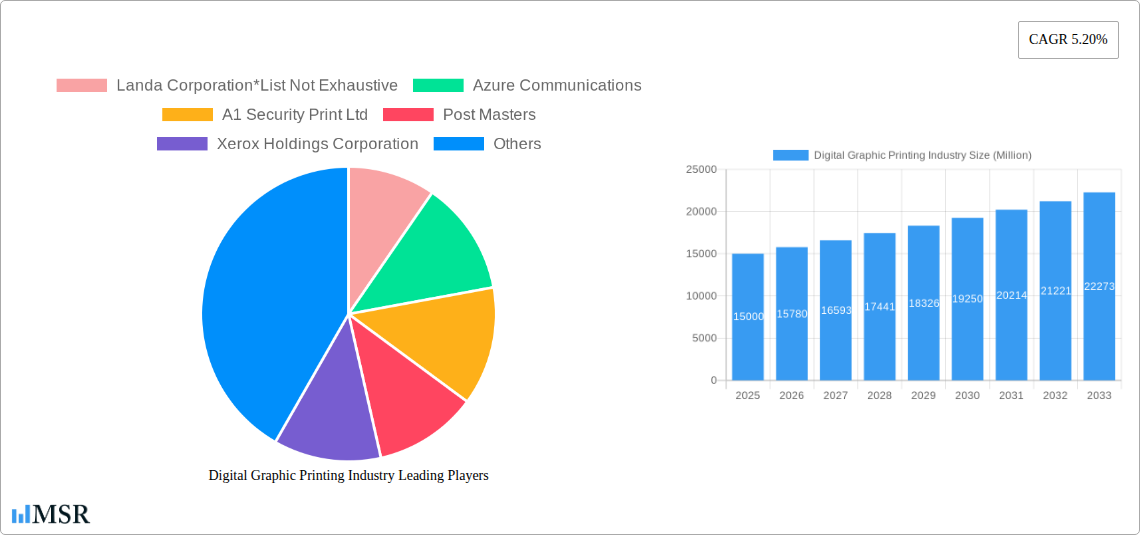

Digital Graphic Printing Industry Company Market Share

Digital Graphic Printing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global digital graphic printing industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report leverages extensive market research to project a market size exceeding $XX Million by 2033, exhibiting a CAGR of XX% during the forecast period. Key segments analyzed include inkjet and electrophotography printing processes, and applications spanning advertising print, transactional printing, security printing, and general commercial print. Leading players like Landa Corporation, Xerox Holdings Corporation, and Giesecke+Devrient Currency Technology GmbH are profiled, providing a comprehensive understanding of the competitive landscape.

Digital Graphic Printing Industry Market Concentration & Dynamics

The digital graphic printing market exhibits a moderately concentrated structure, with a few major players holding significant market share. The industry is characterized by ongoing innovation, driven by advancements in inkjet and electrophotography technologies. Regulatory frameworks, particularly concerning data privacy and environmental regulations, significantly impact market dynamics. Substitute products, such as digital signage and online advertising, pose a competitive threat. End-user trends, such as the increasing demand for personalized and on-demand printing, are shaping market growth. Mergers and acquisitions (M&A) activity has been moderate, with an estimated XX M&A deals concluded during the historical period (2019-2024). Market share distribution shows a top 5 concentration of approximately XX%, with the remaining market share fragmented among numerous smaller players.

- Market Share: Top 5 players – XX%

- M&A Activity (2019-2024): XX deals

- Key Regulatory Factors: Data privacy regulations, environmental compliance standards.

- Substitute Products: Digital signage, online advertising.

Digital Graphic Printing Industry Industry Insights & Trends

The digital graphic printing industry is experiencing robust growth, fueled by several key factors. The increasing demand for personalized marketing materials and on-demand printing services is a primary driver. Technological advancements, particularly in inkjet technology and automation, are enhancing efficiency and reducing costs. Evolving consumer preferences towards customized products and faster turnaround times are also boosting market expansion. The market size in 2025 is estimated at $XX Million, projected to reach $XX Million by 2033, representing a significant expansion. This growth is largely attributed to the rising adoption of digital printing in various applications, including advertising, packaging, and security printing. The shift towards digital platforms and e-commerce is also creating new opportunities for the industry.

Key Markets & Segments Leading Digital Graphic Printing Industry

The North American region currently holds the largest market share in the digital graphic printing industry, driven by robust economic growth and a well-established printing infrastructure. Within applications, transactional printing demonstrates the highest growth potential, propelled by the expansion of the financial services sector and the growing demand for personalized financial documents. Inkjet printing dominates the printing process segment, owing to its versatility and high-quality output.

- Dominant Region: North America

- Fastest-Growing Application: Transactional Printing

- Leading Printing Process: Inkjet

- Drivers for North American Dominance: Strong economic growth, advanced infrastructure, high technology adoption rates.

- Drivers for Transactional Printing Growth: Expansion of the financial services sector, increasing demand for personalized statements and documents.

- Drivers for Inkjet Printing Dominance: Versatility, high print quality, cost-effectiveness for high-volume printing.

Digital Graphic Printing Industry Product Developments

Recent years have witnessed significant advancements in digital graphic printing technology. High-speed inkjet printers with enhanced color accuracy and resolution are transforming the market. The integration of artificial intelligence and machine learning is improving print quality control and optimizing workflow efficiency. These developments are leading to improved cost-effectiveness, faster turnaround times, and enhanced personalization capabilities, bolstering the industry's competitiveness.

Challenges in the Digital Graphic Printing Industry Market

The digital graphic printing industry faces several key challenges. Fluctuating raw material prices, particularly for inks and toners, impact profitability. Intense competition from established players and new entrants requires continuous innovation and cost optimization. Stringent environmental regulations necessitate the adoption of sustainable printing practices, adding to operational costs. Supply chain disruptions can lead to production delays and increased expenses. Furthermore, fluctuating economic conditions can dampen demand. These factors combined can decrease the profitability of businesses.

Forces Driving Digital Graphic Printing Industry Growth

The digital graphic printing industry's growth is driven by several key factors. Technological advancements, such as the development of high-speed, high-resolution printers and sustainable inks, are enhancing efficiency and reducing environmental impact. The increasing demand for personalized and customized printing solutions is also fueling market growth. Favorable economic conditions and governmental initiatives promoting digitalization are further boosting the industry’s expansion.

Long-Term Growth Catalysts in the Digital Graphic Printing Industry

Long-term growth in the digital graphic printing industry will be catalyzed by continuous innovation in printing technologies, strategic partnerships between printing companies and software providers to offer integrated solutions, and market expansions into emerging economies with growing demand for high-quality printing services.

Emerging Opportunities in Digital Graphic Printing Industry

Emerging opportunities exist in the growing demand for 3D printing, specialized printing solutions for niche markets (e.g., personalized medicine packaging), and the integration of digital printing with other technologies such as augmented reality and the metaverse. Furthermore, expansion into new geographic regions with developing economies presents substantial growth potential.

Leading Players in the Digital Graphic Printing Industry Sector

- Landa Corporation

- Azure Communications

- A1 Security Print Ltd

- Post Masters

- Xerox Holdings Corporation

- Giesecke+Devrient Currency Technology GmbH

- Madras Security Printers Pvt Ltd

- Swiss Post Solutions

Key Milestones in Digital Graphic Printing Industry Industry

- 2020: Introduction of eco-friendly inks by several major players.

- 2021: Significant investment in R&D for high-speed inkjet printers.

- 2022: Merger of two mid-sized printing companies.

- 2023: Launch of a new generation of high-resolution inkjet printers.

- 2024: Increased adoption of AI in print quality control.

Strategic Outlook for Digital Graphic Printing Industry Market

The future of the digital graphic printing industry is bright, characterized by continued technological advancements, strategic partnerships, and market expansion. The increasing demand for personalized and on-demand printing services, coupled with the development of sustainable printing solutions, will drive market growth. Companies that embrace innovation, prioritize sustainability, and strategically adapt to evolving consumer preferences are poised to succeed in this dynamic market.

Digital Graphic Printing Industry Segmentation

-

1. Printing Process

- 1.1. Inkjet

- 1.2. Electrophotography

-

2. Application

- 2.1. Advertising Print

- 2.2. Transactional Printing

- 2.3. Security Printing

- 2.4. General Commercial Print

Digital Graphic Printing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Poland

- 2.7. Netherlands

- 2.8. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Digital Graphic Printing Industry Regional Market Share

Geographic Coverage of Digital Graphic Printing Industry

Digital Graphic Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Glass containers for food and beverages are 100% recyclable and hence can be recycled endlessly without loss in quality or purity - something few food and beverage packaging options can claim. Manufacturers benefit from recycling in several ways

- 3.3. Market Restrains

- 3.3.1 However

- 3.3.2 container glass is manufactured by a process called annealing in which different air polluting compounds such as nitrogen oxides

- 3.3.3 sulfur dioxides

- 3.3.4 and other harmful particulates are released. Exposure to these harmful compounds at high concentrations can cause severe respiratory diseases such as asthma

- 3.3.5 chronic bronchitis

- 3.3.6 mucus secretion

- 3.3.7 and lung cancer.

- 3.4. Market Trends

- 3.4.1. Inkjet Printing Process is Expected to Hold a Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Printing Process

- 5.1.1. Inkjet

- 5.1.2. Electrophotography

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Advertising Print

- 5.2.2. Transactional Printing

- 5.2.3. Security Printing

- 5.2.4. General Commercial Print

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Printing Process

- 6. North America Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Printing Process

- 6.1.1. Inkjet

- 6.1.2. Electrophotography

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Advertising Print

- 6.2.2. Transactional Printing

- 6.2.3. Security Printing

- 6.2.4. General Commercial Print

- 6.1. Market Analysis, Insights and Forecast - by Printing Process

- 7. Europe Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Printing Process

- 7.1.1. Inkjet

- 7.1.2. Electrophotography

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Advertising Print

- 7.2.2. Transactional Printing

- 7.2.3. Security Printing

- 7.2.4. General Commercial Print

- 7.1. Market Analysis, Insights and Forecast - by Printing Process

- 8. Asia Pacific Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Printing Process

- 8.1.1. Inkjet

- 8.1.2. Electrophotography

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Advertising Print

- 8.2.2. Transactional Printing

- 8.2.3. Security Printing

- 8.2.4. General Commercial Print

- 8.1. Market Analysis, Insights and Forecast - by Printing Process

- 9. Latin America Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Printing Process

- 9.1.1. Inkjet

- 9.1.2. Electrophotography

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Advertising Print

- 9.2.2. Transactional Printing

- 9.2.3. Security Printing

- 9.2.4. General Commercial Print

- 9.1. Market Analysis, Insights and Forecast - by Printing Process

- 10. Middle East and Africa Digital Graphic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Printing Process

- 10.1.1. Inkjet

- 10.1.2. Electrophotography

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Advertising Print

- 10.2.2. Transactional Printing

- 10.2.3. Security Printing

- 10.2.4. General Commercial Print

- 10.1. Market Analysis, Insights and Forecast - by Printing Process

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Landa Corporation*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Azure Communications

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 A1 Security Print Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Post Masters

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Xerox Holdings Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Giesecke+Devrient Currency Technology GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Madras Security Printers Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Swiss Post Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Landa Corporation*List Not Exhaustive

List of Figures

- Figure 1: Global Digital Graphic Printing Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Digital Graphic Printing Industry Revenue (billion), by Printing Process 2025 & 2033

- Figure 3: North America Digital Graphic Printing Industry Revenue Share (%), by Printing Process 2025 & 2033

- Figure 4: North America Digital Graphic Printing Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Digital Graphic Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Digital Graphic Printing Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Digital Graphic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Digital Graphic Printing Industry Revenue (billion), by Printing Process 2025 & 2033

- Figure 9: Europe Digital Graphic Printing Industry Revenue Share (%), by Printing Process 2025 & 2033

- Figure 10: Europe Digital Graphic Printing Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Digital Graphic Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Digital Graphic Printing Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Digital Graphic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Digital Graphic Printing Industry Revenue (billion), by Printing Process 2025 & 2033

- Figure 15: Asia Pacific Digital Graphic Printing Industry Revenue Share (%), by Printing Process 2025 & 2033

- Figure 16: Asia Pacific Digital Graphic Printing Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Digital Graphic Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Digital Graphic Printing Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Digital Graphic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Digital Graphic Printing Industry Revenue (billion), by Printing Process 2025 & 2033

- Figure 21: Latin America Digital Graphic Printing Industry Revenue Share (%), by Printing Process 2025 & 2033

- Figure 22: Latin America Digital Graphic Printing Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America Digital Graphic Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Digital Graphic Printing Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Digital Graphic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Digital Graphic Printing Industry Revenue (billion), by Printing Process 2025 & 2033

- Figure 27: Middle East and Africa Digital Graphic Printing Industry Revenue Share (%), by Printing Process 2025 & 2033

- Figure 28: Middle East and Africa Digital Graphic Printing Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Digital Graphic Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Digital Graphic Printing Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Digital Graphic Printing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 2: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Digital Graphic Printing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 5: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Digital Graphic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 10: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Digital Graphic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United kingdom Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Poland Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 21: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Digital Graphic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Digital Graphic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 28: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Digital Graphic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Digital Graphic Printing Industry Revenue billion Forecast, by Printing Process 2020 & 2033

- Table 31: Global Digital Graphic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Global Digital Graphic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Graphic Printing Industry?

The projected CAGR is approximately 1.7%.

2. Which companies are prominent players in the Digital Graphic Printing Industry?

Key companies in the market include Landa Corporation*List Not Exhaustive, Azure Communications, A1 Security Print Ltd, Post Masters, Xerox Holdings Corporation, Giesecke+Devrient Currency Technology GmbH, Madras Security Printers Pvt Ltd, Swiss Post Solutions.

3. What are the main segments of the Digital Graphic Printing Industry?

The market segments include Printing Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Glass containers for food and beverages are 100% recyclable and hence can be recycled endlessly without loss in quality or purity - something few food and beverage packaging options can claim. Manufacturers benefit from recycling in several ways: Recycled glass reduces emissions and consumption of raw materials. extends the life of plant equipment. such as furnaces. and saves energy.; The growth in population in the country in the recent years has led to a rise in the building & construction sector where soda-lime-silica-based glass is used in windowpanes. owing to their hardness and ease of workability..

6. What are the notable trends driving market growth?

Inkjet Printing Process is Expected to Hold a Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

However. container glass is manufactured by a process called annealing in which different air polluting compounds such as nitrogen oxides. sulfur dioxides. and other harmful particulates are released. Exposure to these harmful compounds at high concentrations can cause severe respiratory diseases such as asthma. chronic bronchitis. mucus secretion. and lung cancer..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Graphic Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Graphic Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Graphic Printing Industry?

To stay informed about further developments, trends, and reports in the Digital Graphic Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence