Key Insights

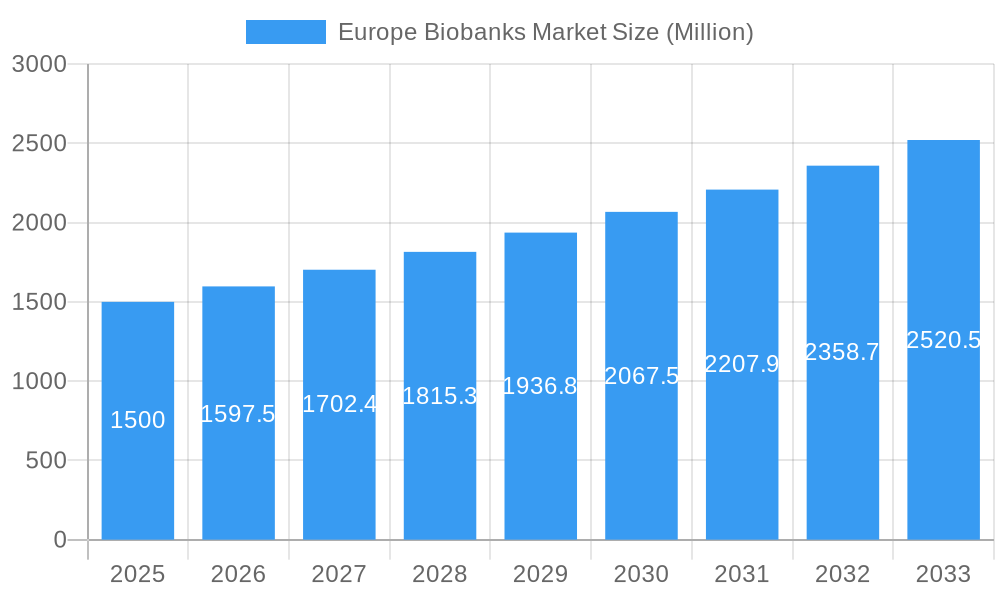

The European biobanks market is poised for substantial expansion, with an estimated market size of 34083.8 million in the base year 2025. Projections indicate a robust compound annual growth rate (CAGR) of 8.3% from 2025 to 2033. This growth is underpinned by several critical drivers. The increasing incidence of chronic diseases across Europe necessitates enhanced biological sample storage and analysis to accelerate the development of novel therapies. Concurrently, the burgeoning field of regenerative medicine, encompassing cell-based therapies and personalized medicine, is generating significant demand for premium biobanking services. Additionally, stringent regulatory frameworks for data privacy and sample management are spurring investment in advanced biobanking technologies and sophisticated operational systems. The market is segmented by application (regenerative medicine, drug discovery, disease research), equipment (cryogenic storage systems, automation systems), media (optimized and non-optimized), and services (human tissue, stem cell, cord, and DNA/RNA biobanking). Key national markets include Germany, France, the UK, and Italy, distinguished by their advanced healthcare infrastructure and vibrant research ecosystems. The competitive landscape features both established multinational corporations and specialized biobanking service providers. Future market dynamics will likely be shaped by advancements in automation and artificial intelligence within biobanking processes, alongside ongoing progress in personalized medicine.

Europe Biobanks Market Market Size (In Billion)

The sustained growth trajectory of the European biobanks market is expected to be fueled by increased R&D investments, particularly within the pharmaceutical and biotechnology sectors. Stringent regulations and ethical considerations concerning data privacy and sample management continue to influence the market, prompting the adoption of advanced security and quality control measures. The increasing adoption of cloud-based data management systems is optimizing biobank operations, facilitating greater data sharing and collaboration among European researchers. The market also experiences ongoing consolidation, with larger entities acquiring specialized biobanking firms, thereby enhancing economies of scale and service portfolios. However, significant initial investment requirements for establishing and maintaining state-of-the-art biobanks may pose challenges for smaller entities. Notwithstanding these challenges, the long-term outlook remains highly positive, driven by the aforementioned factors and the substantial societal benefits derived from advancements in biomedical research facilitated by high-quality biobanking services.

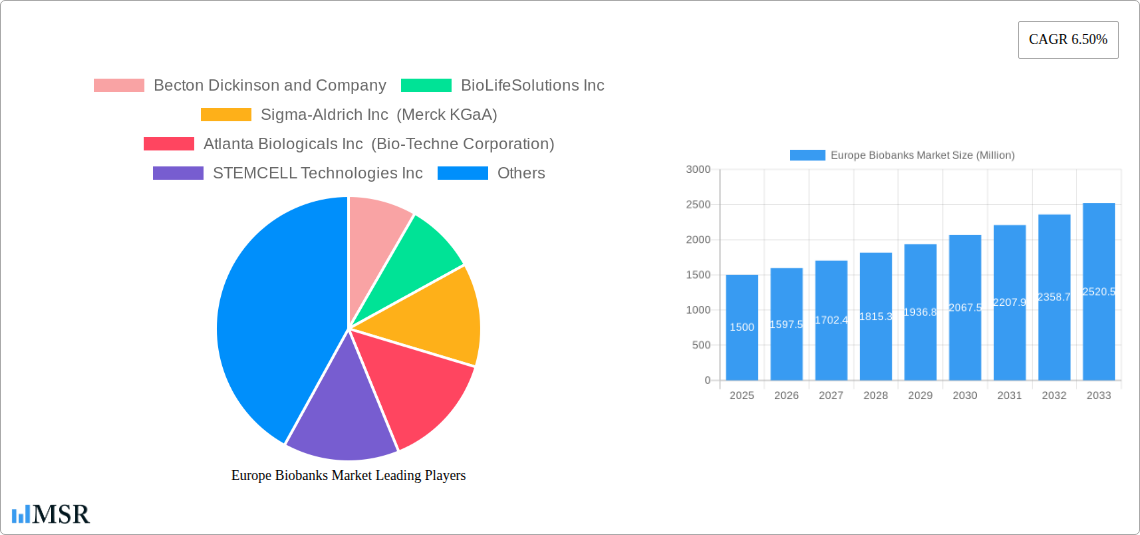

Europe Biobanks Market Company Market Share

Europe Biobanks Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Biobanks Market, offering valuable insights for stakeholders across the industry. From market size and CAGR projections to detailed segment analysis and competitive landscape assessment, this report is your essential guide to navigating this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Key players analyzed include Becton Dickinson and Company, BioLifeSolutions Inc, Sigma-Aldrich Inc (Merck KGaA), Atlanta Biologicals Inc (Bio-Techne Corporation), STEMCELL Technologies Inc, Thermo Fisher Scientific Inc, Chart Industries Inc, VWR International LLC, Hamilton Company, and Qiagen NV. The market is segmented by application (Regenerative Medicine, Drug Discovery, Disease Research), equipment (Cryogenic Storage Systems), media (Optimized Media, Non-optimized Media), and services (Human Tissue Biobanking, Stem Cell Biobanking, Cord Banking, DNA/RNA Biobanking, Other Services). The report projects a market value of xx Million by 2033.

Europe Biobanks Market Market Concentration & Dynamics

The Europe biobanks market exhibits a moderately concentrated landscape, with several key players holding significant market share. The market share of the top five players is estimated at xx%. However, a growing number of smaller specialized biobanks are also emerging, particularly focused on niche applications like cord blood banking. The innovative ecosystem is vibrant, fueled by continuous advancements in cryogenic storage technologies, automation, and bioinformatics. Regulatory frameworks, like those set by the European Medicines Agency (EMA) and national authorities, significantly impact market operations, particularly concerning data privacy and ethical considerations for human tissue and stem cell banking. Substitute products are limited, although alternative sample storage methods exist, but their efficacy and cost-effectiveness are often inferior. End-user trends indicate a rising demand for high-throughput biobanking services, driven by increasing research activities in areas like personalized medicine and drug development. M&A activity in the market has been moderate, with xx M&A deals recorded between 2019 and 2024. This is expected to increase as larger companies seek to expand their market share and gain access to innovative technologies.

- Market Concentration: Top 5 players hold xx% market share.

- Innovation: Advancements in cryogenic storage and bioinformatics.

- Regulatory Framework: Significant influence from EMA and national agencies.

- Substitute Products: Limited, with existing alternatives less efficient.

- End-User Trends: Growing demand for high-throughput services.

- M&A Activity: xx deals recorded between 2019 and 2024.

Europe Biobanks Market Industry Insights & Trends

The Europe biobanks market is experiencing robust growth, driven primarily by the increasing prevalence of chronic diseases, rising investments in biomedical research, and the growing adoption of personalized medicine. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Technological disruptions, such as the development of advanced cryogenic storage systems and automated sample management solutions, are enhancing efficiency and reducing operational costs. Evolving consumer behavior, including increased awareness of biobanking benefits and greater demand for personalized healthcare, is fueling market expansion. The rising adoption of cloud-based data management systems and advancements in genomics and proteomics are also key drivers of market growth. However, challenges remain, including stringent regulatory requirements, concerns about data security and privacy, and the need for skilled professionals.

Key Markets & Segments Leading Europe Biobanks Market

Germany and the UK are currently the dominant markets within Europe, driven by robust research infrastructure, substantial government funding for biomedical research, and a large pool of skilled professionals.

- Application: Drug discovery holds the largest segment of the market followed by Disease Research and Regenerative Medicine. The drivers for this are strong pharmaceutical industries, research investments and increasing prevalence of chronic diseases.

- Equipment: Cryogenic storage systems are the leading segment due to their crucial role in sample preservation.

- Media: Optimized media holds a larger share because of the need for high-quality sample storage and processing.

- Services: Human tissue biobanking is a major segment, driven by the growing demand for samples in research and clinical applications.

Other factors contributing to market leadership include access to a large patient population, well-established healthcare systems, and strong government support for research and development.

Europe Biobanks Market Product Developments

Recent product innovations focus on improving the efficiency and efficacy of biobanking processes. Advanced cryogenic storage systems with improved temperature control and monitoring capabilities are gaining prominence. Automation technologies are being integrated into sample handling and processing workflows to increase throughput and reduce human error. The development of new optimized media formulations is enhancing sample preservation and reducing degradation. These advancements offer competitive advantages by enhancing the quality, reliability, and cost-effectiveness of biobanking services.

Challenges in the Europe Biobanks Market Market

The Europe biobanks market faces challenges including stringent regulatory compliance requirements, increasing operational costs, and securing sufficient funding. Supply chain disruptions, especially concerning specialized reagents and equipment, can impact service delivery. Maintaining data security and patient privacy is paramount. Intense competition among existing players and the entry of new players add to the complexity. These factors can lead to decreased profitability and limit market expansion, impacting overall growth. The estimated impact of these challenges on market growth is approximately xx% by 2033.

Forces Driving Europe Biobanks Market Growth

Several factors propel the Europe biobanks market's growth. Technological advancements in sample preservation, automation, and data management enhance efficiency and lower costs. Rising government funding for research and development projects fuels demand for biobanking services. The growing adoption of personalized medicine increases the need for large-scale biobanking initiatives. Furthermore, increasing awareness of biobanking's role in accelerating scientific discoveries and advancing healthcare also contributes positively.

Long-Term Growth Catalysts in Europe Biobanks Market

Long-term growth is fueled by continuous innovation in cryogenic technologies and automation. Strategic partnerships between research institutions, pharmaceutical companies, and biobanks accelerate progress. Expansion into emerging markets in Eastern Europe presents significant growth opportunities. The increased focus on data analytics and AI applications in biobanking further enhances market potential.

Emerging Opportunities in Europe Biobanks Market

Emerging opportunities lie in the growing demand for biobanking solutions in areas such as personalized oncology, infectious disease research, and regenerative medicine. The expansion of cloud-based data management systems allows for improved data sharing and collaborative research. The increasing adoption of digitalization and automation increases efficiency and reduces costs. The untapped potential in smaller European countries presents significant opportunities for market expansion.

Leading Players in the Europe Biobanks Market Sector

Key Milestones in Europe Biobanks Market Industry

- 2020: Launch of a new automated sample management system by Thermo Fisher Scientific.

- 2021: Acquisition of a smaller biobank by Becton Dickinson and Company.

- 2022: Introduction of a novel cryogenic storage technology by Chart Industries.

- 2023: Implementation of new data privacy regulations across several European countries.

- 2024: Several partnerships formed between major biobanks and pharmaceutical companies.

Strategic Outlook for Europe Biobanks Market Market

The Europe biobanks market exhibits significant long-term growth potential, driven by continuous technological advancements, increasing research funding, and expanding applications in healthcare. Strategic opportunities exist for companies to expand their service offerings, invest in automation and digitalization, and forge strategic partnerships to capture market share. Focusing on data analytics and personalized medicine will be crucial for long-term success. The market's future hinges on addressing regulatory challenges, ensuring data security and ethical considerations, and maintaining a skilled workforce.

Europe Biobanks Market Segmentation

-

1. Equipment

-

1.1. Cryogenic Storage Systems

- 1.1.1. Refrigerators

- 1.1.2. Ice Machines

- 1.1.3. Freezers

- 1.2. Alarm Monitoring Systems

- 1.3. Other Equipment

-

1.1. Cryogenic Storage Systems

-

2. Media

- 2.1. Optimized Media

- 2.2. Non-optimized Media

-

3. Services

- 3.1. Human Tissue Biobanking

- 3.2. Stem Cell Biobanking

- 3.3. Cord Banking

- 3.4. DNA/RNA Biobanking

- 3.5. Other Services

-

4. Application

- 4.1. Regenerative Medicine

- 4.2. Drug Discovery

- 4.3. Disease Research

Europe Biobanks Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

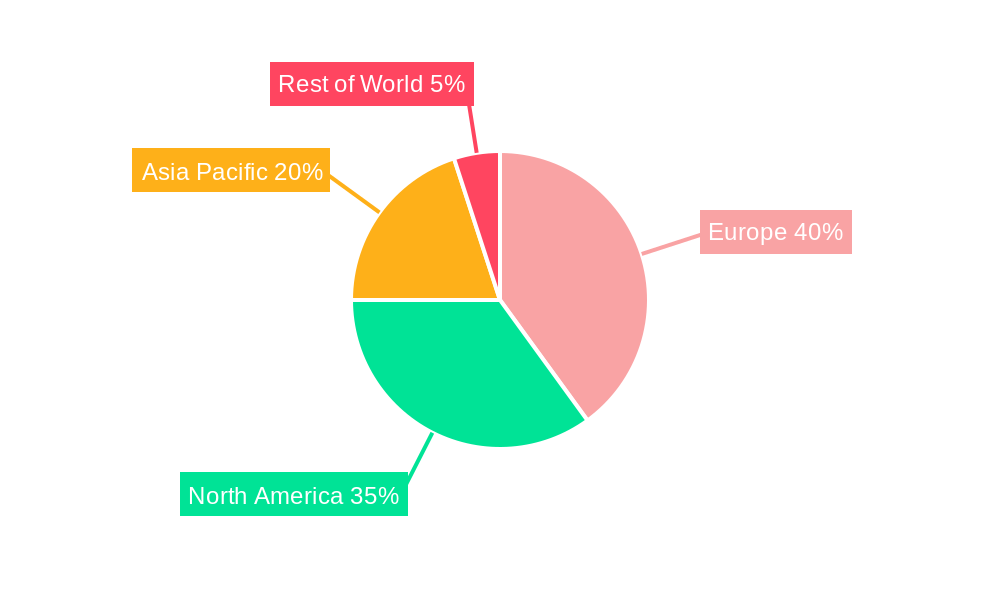

Europe Biobanks Market Regional Market Share

Geographic Coverage of Europe Biobanks Market

Europe Biobanks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Advancements in Stem Cell and Regenerative Medicine Research; Rising Burden of Chronic Diseases; R&D Funding and Investments by Government and Non-Governmental Organizations

- 3.3. Market Restrains

- 3.3.1. ; Regulatory Issues; Cost Constraints

- 3.4. Market Trends

- 3.4.1. Alarm Monitoring Systems Segment is Expected to Show Better Growth in the Forecast Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biobanks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Cryogenic Storage Systems

- 5.1.1.1. Refrigerators

- 5.1.1.2. Ice Machines

- 5.1.1.3. Freezers

- 5.1.2. Alarm Monitoring Systems

- 5.1.3. Other Equipment

- 5.1.1. Cryogenic Storage Systems

- 5.2. Market Analysis, Insights and Forecast - by Media

- 5.2.1. Optimized Media

- 5.2.2. Non-optimized Media

- 5.3. Market Analysis, Insights and Forecast - by Services

- 5.3.1. Human Tissue Biobanking

- 5.3.2. Stem Cell Biobanking

- 5.3.3. Cord Banking

- 5.3.4. DNA/RNA Biobanking

- 5.3.5. Other Services

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Regenerative Medicine

- 5.4.2. Drug Discovery

- 5.4.3. Disease Research

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BioLifeSolutions Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sigma-Aldrich Inc (Merck KGaA)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Atlanta Biologicals Inc (Bio-Techne Corporation)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STEMCELL Technologies Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thermo Fisher Scientific Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chart Industries Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 VWR International LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hamilton Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Qiagen NV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Europe Biobanks Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Biobanks Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Biobanks Market Revenue million Forecast, by Equipment 2020 & 2033

- Table 2: Europe Biobanks Market Volume K Unit Forecast, by Equipment 2020 & 2033

- Table 3: Europe Biobanks Market Revenue million Forecast, by Media 2020 & 2033

- Table 4: Europe Biobanks Market Volume K Unit Forecast, by Media 2020 & 2033

- Table 5: Europe Biobanks Market Revenue million Forecast, by Services 2020 & 2033

- Table 6: Europe Biobanks Market Volume K Unit Forecast, by Services 2020 & 2033

- Table 7: Europe Biobanks Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Europe Biobanks Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Europe Biobanks Market Revenue million Forecast, by Region 2020 & 2033

- Table 10: Europe Biobanks Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Europe Biobanks Market Revenue million Forecast, by Equipment 2020 & 2033

- Table 12: Europe Biobanks Market Volume K Unit Forecast, by Equipment 2020 & 2033

- Table 13: Europe Biobanks Market Revenue million Forecast, by Media 2020 & 2033

- Table 14: Europe Biobanks Market Volume K Unit Forecast, by Media 2020 & 2033

- Table 15: Europe Biobanks Market Revenue million Forecast, by Services 2020 & 2033

- Table 16: Europe Biobanks Market Volume K Unit Forecast, by Services 2020 & 2033

- Table 17: Europe Biobanks Market Revenue million Forecast, by Application 2020 & 2033

- Table 18: Europe Biobanks Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 19: Europe Biobanks Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: Europe Biobanks Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: United Kingdom Europe Biobanks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Europe Biobanks Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Germany Europe Biobanks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Europe Biobanks Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: France Europe Biobanks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: France Europe Biobanks Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Italy Europe Biobanks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Italy Europe Biobanks Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Spain Europe Biobanks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Spain Europe Biobanks Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Netherlands Europe Biobanks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Netherlands Europe Biobanks Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Belgium Europe Biobanks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Belgium Europe Biobanks Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Sweden Europe Biobanks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Sweden Europe Biobanks Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Norway Europe Biobanks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Norway Europe Biobanks Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Poland Europe Biobanks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Poland Europe Biobanks Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Denmark Europe Biobanks Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Denmark Europe Biobanks Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biobanks Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Europe Biobanks Market?

Key companies in the market include Becton Dickinson and Company, BioLifeSolutions Inc, Sigma-Aldrich Inc (Merck KGaA), Atlanta Biologicals Inc (Bio-Techne Corporation), STEMCELL Technologies Inc, Thermo Fisher Scientific Inc, Chart Industries Inc, VWR International LLC, Hamilton Company, Qiagen NV.

3. What are the main segments of the Europe Biobanks Market?

The market segments include Equipment, Media, Services, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 34083.8 million as of 2022.

5. What are some drivers contributing to market growth?

; Advancements in Stem Cell and Regenerative Medicine Research; Rising Burden of Chronic Diseases; R&D Funding and Investments by Government and Non-Governmental Organizations.

6. What are the notable trends driving market growth?

Alarm Monitoring Systems Segment is Expected to Show Better Growth in the Forecast Years.

7. Are there any restraints impacting market growth?

; Regulatory Issues; Cost Constraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biobanks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biobanks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biobanks Market?

To stay informed about further developments, trends, and reports in the Europe Biobanks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence