Key Insights

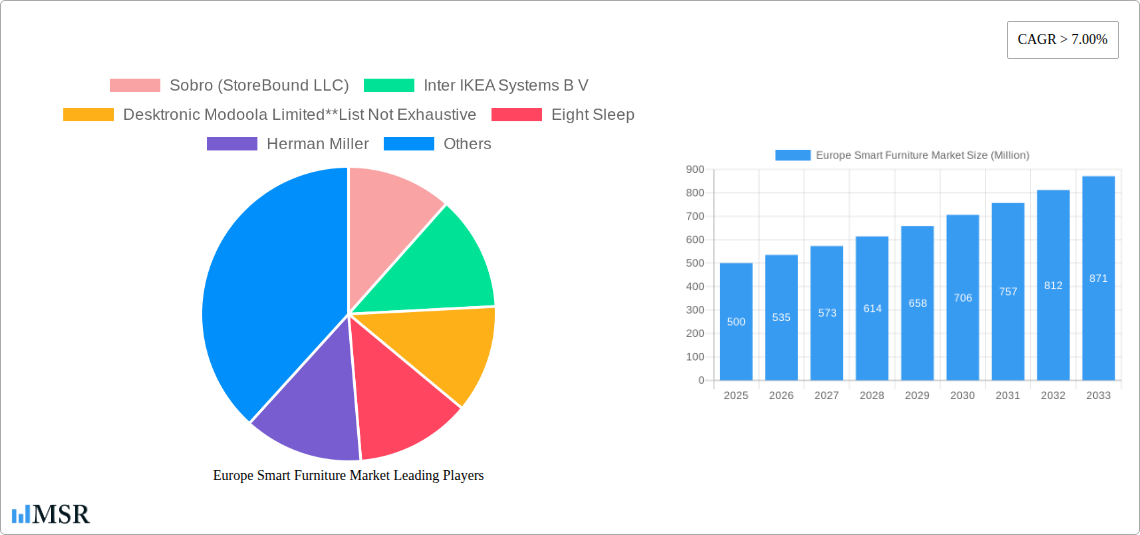

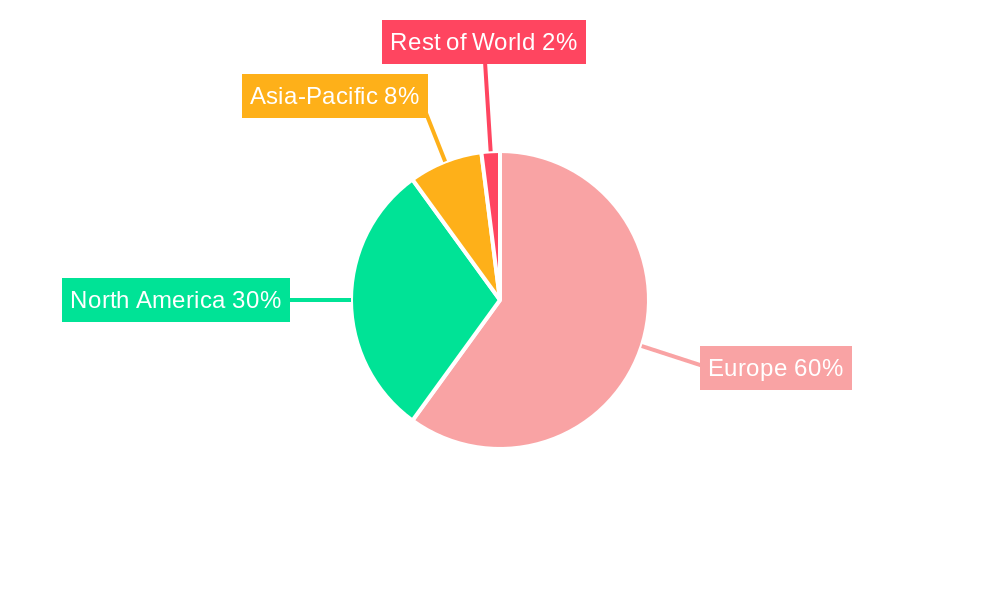

The European smart furniture market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 7% from 2025 to 2033. This expansion is driven by several key factors. Increasing urbanization and the demand for space-saving, multifunctional furniture are significant contributors. Consumers are increasingly seeking technologically integrated solutions for their homes and offices, leading to a surge in demand for smart desks, tables, and chairs that offer features like adjustable heights, integrated power outlets, and wireless charging capabilities. Furthermore, the rising adoption of smart home technology and the desire for enhanced comfort and convenience are fueling market growth. The commercial sector, including offices and co-working spaces, is also a key driver, as businesses seek to improve employee productivity and create modern, technologically advanced work environments. While the initial investment cost might be a restraint for some consumers, the long-term benefits in terms of ergonomics, efficiency, and lifestyle enhancements are expected to offset this concern, particularly in the higher income brackets. The market is segmented by product type (smart desks, tables, chairs, and others), end-user (residential and commercial), and distribution channel (home centers, specialty stores, and online retailers). Germany, France, the UK, and Italy represent the largest national markets within Europe, driven by higher disposable incomes and early adoption of smart home technologies.

Europe Smart Furniture Market Market Size (In Million)

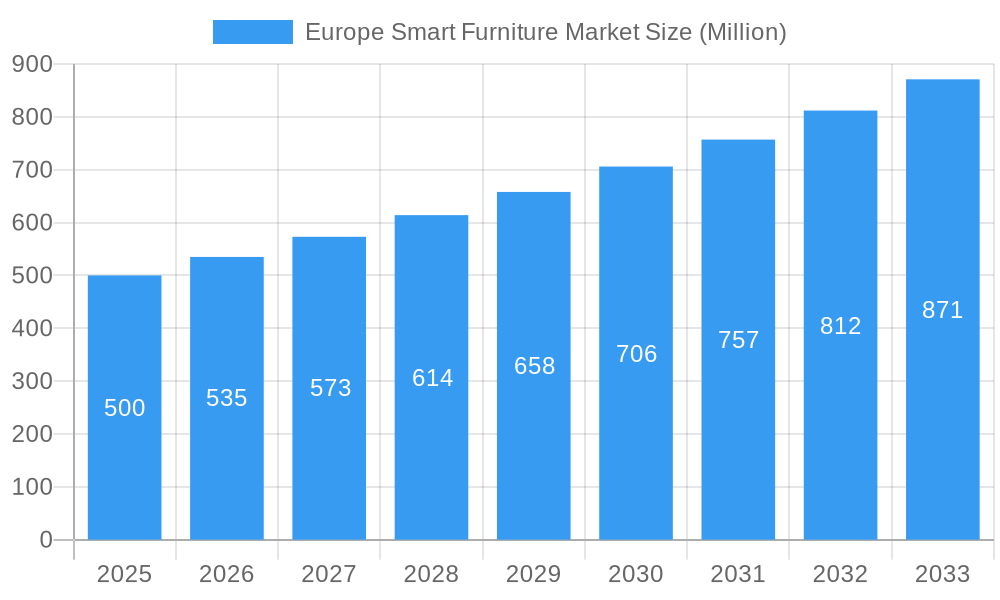

The market's competitive landscape includes both established furniture brands like Herman Miller and Steelcase, alongside newer entrants specializing in smart furniture technology such as Sobro and Eight Sleep. These companies are constantly innovating, introducing new features and designs to cater to evolving consumer preferences. The online distribution channel is witnessing significant growth, offering consumers greater convenience and access to a wider range of products. The future of the European smart furniture market looks promising, with continued technological advancements and increasing consumer awareness expected to drive further market expansion over the forecast period. The market will likely see the emergence of more integrated and sophisticated smart furniture solutions, potentially incorporating features like AI-powered personalization and enhanced connectivity with other smart home devices. This evolution is expected to attract a broader range of consumers and fuel even faster growth.

Europe Smart Furniture Market Company Market Share

Europe Smart Furniture Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning Europe Smart Furniture Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The market is segmented by product (Smart Desks, Smart Tables, Smart Chairs, Others), end-user (Residential, Commercial), and distribution channel (Home Centers, Specialty Stores, Online, Other Distribution Channels). Expected to reach xx Million by 2033, this report unveils the opportunities and challenges shaping this dynamic sector.

Europe Smart Furniture Market Concentration & Dynamics

The Europe smart furniture market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the presence of numerous smaller, innovative companies indicates a dynamic and competitive environment. Market share data for 2024 shows Inter IKEA Systems B.V. holding approximately 15% market share, followed by Herman Miller at 10%, and Steelcase at 8%. The remaining market share is distributed amongst numerous players. The innovation ecosystem is robust, driven by technological advancements in areas like IoT integration, AI-powered features, and ergonomic designs.

Regulatory frameworks, while generally supportive of innovation, vary across European countries and impact product compliance and safety standards. Substitute products, such as traditional furniture, pose a competitive challenge, though smart furniture's enhanced functionality and convenience offer a key differentiator. End-user trends demonstrate a growing preference for smart, connected home environments and technologically advanced workspaces. The market has also witnessed notable M&A activity, with a notable example being the merger of P3G Group and Alsapan in June 2021, forming Alpagroup. This signifies increasing consolidation and strategic expansion within the sector. The number of M&A deals in the smart furniture sector increased by 25% from 2022 to 2023, reflecting industry consolidation and strategic acquisitions.

Europe Smart Furniture Market Industry Insights & Trends

The Europe smart furniture market is experiencing robust growth, driven by several key factors. The market size was valued at approximately 1500 Million in 2024, exhibiting a compound annual growth rate (CAGR) of 12% during the historical period (2019-2024). This growth is fueled by rising consumer disposable incomes, increasing urbanization, and a growing preference for technologically advanced home and office environments. Technological disruptions, such as the integration of smart home ecosystems and the development of innovative materials, are significantly impacting the market. Evolving consumer behaviors reveal a preference for personalized and customizable furniture, driving demand for smart furniture solutions that cater to individual needs and preferences. The integration of smart technology is not only enhancing convenience but also promoting health and wellness through features like adjustable desks and posture monitoring. This aligns with the broader market trends of sustainability and health consciousness. The market is projected to reach xx Million by 2033.

Key Markets & Segments Leading Europe Smart Furniture Market

Germany, the UK, and France represent the leading markets within Europe for smart furniture. This dominance is driven by:

- High disposable incomes: Affordability of smart furniture.

- Technological advancements: Strong tech sector fostering innovation.

- Well-developed e-commerce infrastructure: Enabling convenient purchasing.

By Product: Smart desks currently dominate the market share, accounting for 40%, reflecting increased demand from both residential and commercial sectors, due to their adaptability to work-from-home trends and ergonomic benefits. Smart chairs are also gaining traction, with a market share of 25% driven by health-conscious consumers.

By End-User: The commercial segment demonstrates faster growth, driven by corporate investments in improving workplace productivity and employee well-being. Residential adoption, while growing steadily, remains slightly behind, due to factors like cost and perceived necessity.

By Distribution Channel: Online sales are witnessing significant growth, exceeding that of traditional channels. This signifies evolving consumer behavior and the increasing role of e-commerce in the furniture market.

Europe Smart Furniture Market Product Developments

Recent years have witnessed significant product innovations, including the introduction of wireless and adaptable workspaces (as seen with Bachmann's September 2021 announcement). Smart furniture incorporates features like integrated power outlets, USB charging ports, adjustable heights, and even built-in lighting. These advancements not only enhance functionality but also create competitive advantages for manufacturers, enabling them to cater to a broader range of consumer needs and preferences. The integration of AI-powered features, like posture detection and personalized settings, further distinguishes smart furniture from traditional counterparts.

Challenges in the Europe Smart Furniture Market Market

The Europe smart furniture market faces several challenges, including:

- High initial investment costs: This presents a barrier to entry for many consumers, particularly in the residential sector.

- Supply chain disruptions: These can impact production and delivery timelines.

- Intense competition: The market includes established furniture manufacturers as well as emerging tech companies.

Forces Driving Europe Smart Furniture Market Growth

Several factors are driving market growth:

- Technological advancements: Continuous innovation leads to enhanced functionality and user experience.

- Rising disposable incomes: Increased purchasing power fuels demand.

- Growing awareness of health and well-being: Smart furniture’s ergonomic features are increasingly appealing.

Long-Term Growth Catalysts in the Europe Smart Furniture Market

Long-term growth will be spurred by strategic partnerships between furniture manufacturers and technology companies, leading to more sophisticated and integrated products. Expansion into new markets across Europe, particularly in Eastern European countries with rising incomes and young populations, will fuel continued market growth. Innovation in sustainable materials and environmentally conscious production processes will also contribute to long-term market expansion.

Emerging Opportunities in Europe Smart Furniture Market

Emerging opportunities exist in the development of smart furniture tailored to specific niches, such as smart furniture for senior citizens or those with disabilities. The integration of smart furniture with other smart home systems offers significant growth potential. Furthermore, exploring new business models, such as furniture-as-a-service, could broaden market access and appeal.

Leading Players in the Europe Smart Furniture Market Sector

- Sobro (StoreBound LLC)

- Inter IKEA Systems B.V.

- Desktronic Modoola Limited

- Eight Sleep

- Herman Miller

- Steelcase

- Hi-Interiors

- Nitz Engineering Srl

- Srl Fonesalesman Ltd

- Sleep Number Corporation

Key Milestones in Europe Smart Furniture Market Industry

- September 2021: Bachmann announces its innovative wireless workstation, signifying advancements in workplace flexibility.

- June 2021: P3G Group and Alsapan merge, creating Alpagroup and consolidating the European furniture market.

Strategic Outlook for Europe Smart Furniture Market Market

The Europe smart furniture market holds significant future potential. Strategic opportunities lie in focusing on product differentiation, expanding into new market segments, and forging strategic partnerships to drive innovation and market penetration. Companies that successfully integrate sustainability, affordability, and advanced technology will be best positioned for long-term growth and market leadership.

Europe Smart Furniture Market Segmentation

-

1. Product

- 1.1. Smart Desks

- 1.2. Smart Tables

- 1.3. Smart Chairs

- 1.4. Others

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Europe Smart Furniture Market Segmentation By Geography

- 1. Germany

- 2. UK

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of Europe

Europe Smart Furniture Market Regional Market Share

Geographic Coverage of Europe Smart Furniture Market

Europe Smart Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market

- 3.3. Market Restrains

- 3.3.1. Economic Fluctuations; High Competition in the Furniture Market

- 3.4. Market Trends

- 3.4.1. Home Automation Aiding the Smart Furniture Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Smart Desks

- 5.1.2. Smart Tables

- 5.1.3. Smart Chairs

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. UK

- 5.4.3. France

- 5.4.4. Spain

- 5.4.5. Italy

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Smart Desks

- 6.1.2. Smart Tables

- 6.1.3. Smart Chairs

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. UK Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Smart Desks

- 7.1.2. Smart Tables

- 7.1.3. Smart Chairs

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. France Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Smart Desks

- 8.1.2. Smart Tables

- 8.1.3. Smart Chairs

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Spain Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Smart Desks

- 9.1.2. Smart Tables

- 9.1.3. Smart Chairs

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Italy Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Smart Desks

- 10.1.2. Smart Tables

- 10.1.3. Smart Chairs

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Europe Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Smart Desks

- 11.1.2. Smart Tables

- 11.1.3. Smart Chairs

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Residential

- 11.2.2. Commercial

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Home Centers

- 11.3.2. Specialty Stores

- 11.3.3. Online

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Germany Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 13. France Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 14. Italy Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 15. United Kingdom Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 16. Netherlands Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 17. Sweden Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 18. Rest of Europe Europe Smart Furniture Market Analysis, Insights and Forecast, 2020-2032

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2025

- 19.2. Company Profiles

- 19.2.1 Sobro (StoreBound LLC)

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Inter IKEA Systems B V

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Desktronic Modoola Limited**List Not Exhaustive

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Eight Sleep

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Herman Miller

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Steel Case

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Hi-Interiors

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Nitz Engineering Srl

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Srl Fonesalesman Ltd

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Sleep Number Corporation

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Sobro (StoreBound LLC)

List of Figures

- Figure 1: Europe Smart Furniture Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Smart Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Smart Furniture Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 3: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Smart Furniture Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Germany Europe Smart Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: France Europe Smart Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Italy Europe Smart Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Smart Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Netherlands Europe Smart Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Smart Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Smart Furniture Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 15: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 16: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 17: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 19: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 20: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 21: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 23: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 24: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 25: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 27: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 28: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 29: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 31: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 32: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 33: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Europe Smart Furniture Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 35: Europe Smart Furniture Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 36: Europe Smart Furniture Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 37: Europe Smart Furniture Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Smart Furniture Market?

The projected CAGR is approximately 15.5%.

2. Which companies are prominent players in the Europe Smart Furniture Market?

Key companies in the market include Sobro (StoreBound LLC), Inter IKEA Systems B V, Desktronic Modoola Limited**List Not Exhaustive, Eight Sleep, Herman Miller, Steel Case, Hi-Interiors, Nitz Engineering Srl, Srl Fonesalesman Ltd, Sleep Number Corporation.

3. What are the main segments of the Europe Smart Furniture Market?

The market segments include Product , End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market.

6. What are the notable trends driving market growth?

Home Automation Aiding the Smart Furniture Market Growth.

7. Are there any restraints impacting market growth?

Economic Fluctuations; High Competition in the Furniture Market.

8. Can you provide examples of recent developments in the market?

On 15th September 2021, Bachmann announced their innovation in the form of wireless workstation, which can be flexibly positioned wherever it is needed. With this innovation, Bachmann aims to revolutionize the future of the world of work.The statement was made at the SICAM event in Pordenone, Italy, which was the annual gathering of the world's leading manufacturers of furniture accessories, semi-finished goods, and components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Smart Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Smart Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Smart Furniture Market?

To stay informed about further developments, trends, and reports in the Europe Smart Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence