Key Insights

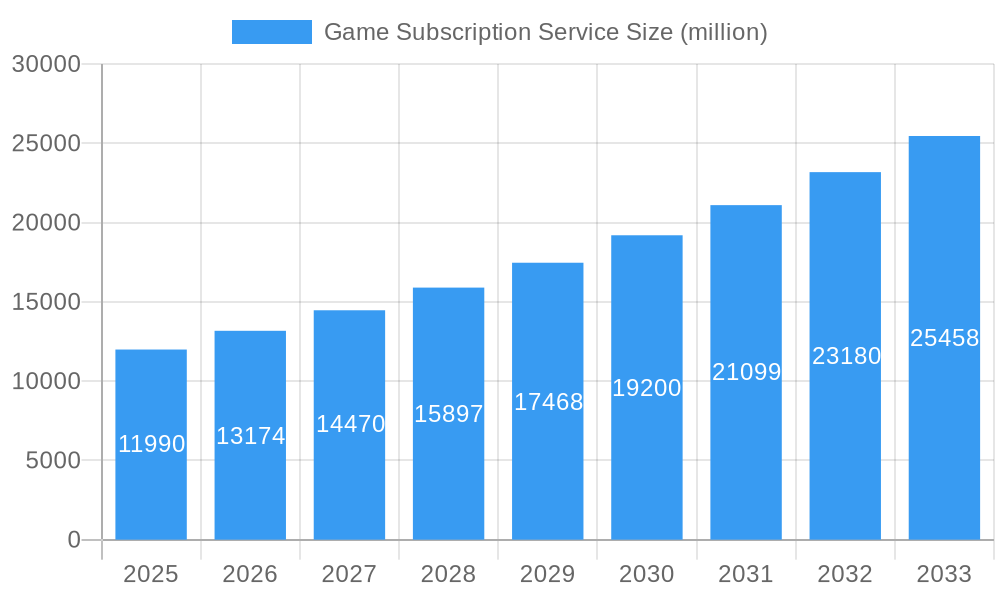

The global Game Subscription Service market is poised for significant expansion, projected to reach an estimated USD 11.99 billion in 2025. This robust growth is fueled by an impressive compound annual growth rate (CAGR) of 9.84% from 2019 to 2033, indicating sustained and substantial momentum. The market's trajectory is primarily propelled by increasing digital adoption across all age groups, from children to adults, and the diversification of gaming platforms. The proliferation of affordable and accessible PC games, alongside the ever-growing dominance of mobile gaming and the enduring appeal of console gaming, creates a fertile ground for subscription models. Furthermore, the continuous innovation by leading companies such as Xbox, PlayStation, Nintendo, and emerging players like Apple Arcade and Netflix is introducing compelling content libraries and exclusive titles, thereby attracting and retaining subscribers. The convenience of a single subscription providing access to a vast catalog of games, coupled with the cost-effectiveness compared to individual game purchases, is a powerful draw for consumers worldwide.

Game Subscription Service Market Size (In Billion)

Looking ahead, the market is expected to witness further acceleration driven by evolving consumer preferences and technological advancements. Factors such as cloud gaming services like GeForce Now and Amazon Luna are democratizing access to high-fidelity gaming experiences, removing hardware barriers and expanding the potential subscriber base. The integration of subscription services with broader entertainment ecosystems, exemplified by Netflix and Apple Arcade, signifies a strategic shift towards bundled offerings that enhance value proposition. While the market enjoys strong tailwinds, potential challenges may arise from increasing competition, the need for continuous content refreshes to combat subscriber churn, and the evolving regulatory landscape surrounding digital content. However, the overarching trend of gamers seeking more value and flexibility in their gaming consumption strongly supports the continued dominance of game subscription services in the coming years.

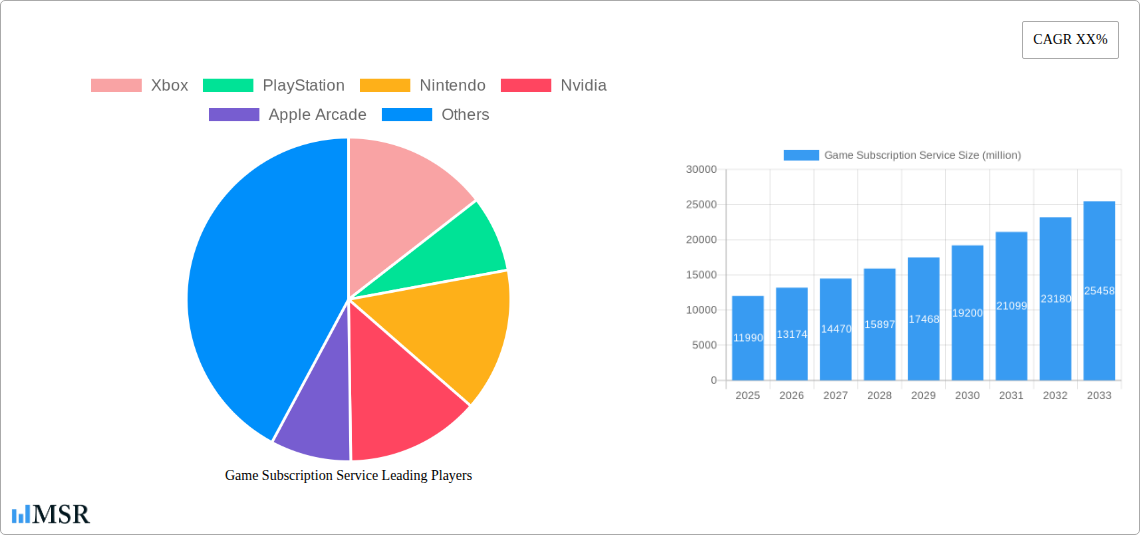

Game Subscription Service Company Market Share

Game Subscription Service Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the global Game Subscription Service market, a sector projected to reach a valuation exceeding one billion dollars by 2025. Spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this research delves into market dynamics, key trends, leading players, and future opportunities. Leveraging high-ranking keywords such as "game subscription services," "cloud gaming," "PC games," "mobile games," and "console games," this report is optimized for search visibility and designed to attract industry stakeholders, investors, and decision-makers.

Game Subscription Service Market Concentration & Dynamics

The global game subscription service market exhibits a dynamic and evolving concentration, characterized by significant innovation ecosystems driven by major players like Xbox, PlayStation, Nintendo, Nvidia (through GeForce Now), Apple Arcade, Ubisoft+, Humble Choice, EA Games, Unleashd, Utomik, Amazon Luna, UnboxBoardom, Covenant, and Netflix. Regulatory frameworks are becoming increasingly important, particularly concerning data privacy and content accessibility. Substitute products, including individual game purchases and free-to-play models, continue to exert influence. End-user trends are shifting towards value-driven and all-inclusive entertainment experiences. Mergers and acquisitions (M&A) activities are a key indicator of market consolidation, with an estimated 10 billion dollars in M&A deal counts anticipated throughout the forecast period. The market share distribution is currently dominated by a few key players, but the landscape is ripe for disruption and niche market expansion.

Game Subscription Service Industry Insights & Trends

The game subscription service industry is experiencing robust growth, propelled by a confluence of factors. The market size is projected to exceed 100 billion dollars by 2025, with a projected Compound Annual Growth Rate (CAGR) of 15% during the forecast period of 2025–2033. Technological disruptions, most notably the advancements in cloud gaming and streaming technology, are democratizing access to high-fidelity gaming experiences across a wider range of devices, from PCs and consoles to mobile phones and smart TVs. Evolving consumer behaviors, driven by the desire for convenience, affordability, and a diverse content library, are fueling the adoption of subscription models. The shift from ownership to access is a fundamental paradigm change, with consumers increasingly opting for monthly or annual subscriptions that offer a vast catalog of games for a predictable cost. This trend is further amplified by the increasing penetration of high-speed internet and the proliferation of gaming-capable devices. The pandemic significantly accelerated these trends, with more individuals turning to gaming for entertainment and social connection, solidifying the subscription model's appeal. The integration of AI and machine learning in game development and personalized content delivery is also poised to enhance user engagement and retention, further driving industry growth.

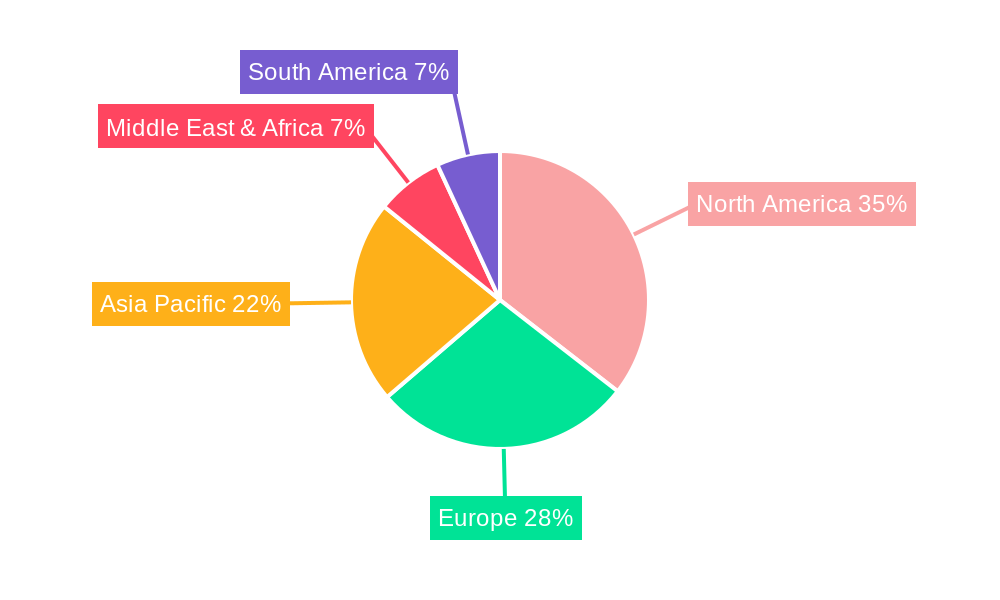

Key Markets & Segments Leading Game Subscription Service

The dominance in the game subscription service market is multifaceted, with significant contributions from various regions and segments.

Dominant Regions:

- North America: This region consistently leads in terms of revenue and user adoption, driven by a mature gaming culture, high disposable incomes, and widespread access to high-speed internet.

- Europe: Strong growth is observed across Western and Eastern Europe, fueled by increasing internet penetration, a growing middle class, and a rising demand for affordable entertainment options.

- Asia-Pacific: While still developing in some areas, this region represents a significant future growth engine, particularly in markets like China and South Korea, with a massive mobile gaming user base and rapidly advancing digital infrastructure.

Dominant Segments:

Application:

- Adult: This segment constitutes the largest consumer base, driven by access to a wider variety of genres and more complex gaming experiences. The demand for high-definition PC games and console titles is particularly strong within this demographic.

- Child: While smaller, this segment is experiencing rapid growth, with a rising demand for age-appropriate, curated content on mobile and console platforms. Parental controls and educational gaming subscriptions are key drivers.

Types:

- PC Games: This remains a cornerstone of the subscription market, offering a vast library of titles and a platform for cutting-edge graphics and gameplay. Services like GeForce Now and Utomik are instrumental in this segment.

- Mobile Game: The accessibility and widespread ownership of smartphones make mobile games a massive and rapidly expanding segment. Services offering casual, hyper-casual, and even AAA mobile titles are gaining traction. Apple Arcade is a prime example of a dedicated mobile game subscription.

- Console Game: With the continued popularity of Xbox, PlayStation, and Nintendo consoles, subscription services offering access to extensive game libraries for these platforms are highly sought after. Services like Xbox Game Pass and PlayStation Plus are key players here.

Drivers of Dominance:

- Economic Growth & Disposable Income: Regions with higher economic development and disposable income tend to have higher subscription rates.

- Infrastructure Development: Widespread availability of high-speed internet is crucial for seamless cloud gaming and large game downloads.

- Gaming Culture & Adoption Rates: Societies with a deeply ingrained gaming culture naturally exhibit higher adoption of subscription services.

- Device Penetration: The prevalence of PCs, smartphones, and gaming consoles directly impacts the reach of different subscription types.

- Content Availability & Exclusives: The diversity and quality of games offered, especially exclusive titles, are significant drivers of segment dominance.

Game Subscription Service Product Developments

Product innovation in game subscription services is primarily focused on enhancing user experience and expanding content accessibility. Key developments include the advancement of cloud streaming technologies by companies like Nvidia and Amazon Luna, enabling near-instantaneous gameplay on a wide array of devices. Furthermore, the integration of AI for personalized game recommendations and curated content libraries is becoming standard. Companies are also focusing on cross-platform play and progression, allowing users to seamlessly switch between devices. Exclusive content and early access to new titles by publishers like EA Games and Ubisoft+ are crucial competitive differentiators, driving subscriber acquisition and retention. The development of family-friendly bundles and child-focused subscription tiers by services like Apple Arcade is also a significant trend, catering to a broader demographic.

Challenges in the Game Subscription Service Market

The game subscription service market faces several significant challenges. Regulatory hurdles, particularly concerning data privacy and antitrust concerns related to market consolidation, can impede growth and innovation. Supply chain issues for hardware, impacting console availability, indirectly affect console game subscription adoption. Fierce competitive pressures from established players and new entrants, coupled with the need for continuous content acquisition and development, demand substantial investment. Piracy and account sharing also present ongoing threats to revenue streams, with an estimated loss of 5 billion dollars annually due to these factors. The high cost of licensing AAA titles for subscription services also poses a significant financial burden for providers.

Forces Driving Game Subscription Service Growth

Several forces are propelling the growth of game subscription services. Technological advancements in cloud computing and high-speed internet infrastructure are making streaming-based gaming more viable and accessible. The evolving consumer preference for subscription-based models, driven by convenience and value, is a primary economic driver. Government initiatives promoting digital entertainment and digital infrastructure development also contribute positively. Furthermore, the increasing diversification of game genres and the appeal to a wider demographic, including casual gamers and families, are expanding the market's reach. The cost-effectiveness of subscription services compared to purchasing individual titles for avid gamers is a strong incentive for adoption.

Challenges in the Game Subscription Service Market

Long-term growth catalysts for the game subscription service market lie in continuous innovation and strategic market expansion. The development of more immersive gaming experiences through virtual and augmented reality (VR/AR) integration with subscription models, spearheaded by companies like Meta, presents a significant opportunity. Strategic partnerships with hardware manufacturers, content creators, and internet service providers will be crucial for broader distribution and enhanced user experience. Exploring untapped markets in emerging economies with developing digital infrastructures and catering to niche gaming communities with specialized subscription offerings will unlock new revenue streams. The successful integration of social features and community building within subscription platforms can foster long-term user loyalty.

Emerging Opportunities in Game Subscription Service

Emerging opportunities in the game subscription service market are abundant. The expansion of cloud gaming to underserved markets with limited hardware capabilities, facilitated by advancements in lower-bandwidth streaming, is a significant trend. The integration of subscription services with other entertainment platforms, such as streaming video services like Netflix, could create compelling bundled offerings. The growth of esports and competitive gaming also presents opportunities for specialized subscription tiers offering exclusive access to tournaments, player content, and in-game items. The increasing adoption of blockchain technology and NFTs within gaming could lead to new models for in-game asset ownership and trading within subscription frameworks, creating unique value propositions for subscribers. The rise of user-generated content platforms integrated with subscriptions also offers avenues for community engagement and content diversity.

Leading Players in the Game Subscription Service Sector

- Xbox

- PlayStation

- Nintendo

- Nvidia

- Apple Arcade

- Ubisoft+

- Humble Choice

- EA Games

- Unleashd

- Utomik

- Amazon Luna

- UnboxBoardom

- Covenant

- Netflix

Key Milestones in Game Subscription Service Industry

- 2019: Launch of Apple Arcade, signaling a major entry into the mobile game subscription space.

- 2019: Humble Choice rebranded from Humble Monthly, shifting focus to a more curated subscription model.

- 2020: Xbox Game Pass for PC gains significant traction, expanding its reach beyond console gamers.

- 2020: Amazon Luna launches, entering the cloud gaming arena with a unique channel-based subscription model.

- 2021: Ubisoft+ expands its availability to PC and cloud platforms, offering a comprehensive library of Ubisoft titles.

- 2022: Nvidia GeForce Now sees continued growth, enhancing its cloud gaming capabilities with RTX support.

- 2022: Netflix Games begins its rollout, leveraging its vast subscriber base to enter the gaming market.

- 2023: Utomik announces significant expansion of its game library and European market presence.

- 2024: EA Games continues to integrate its portfolio into subscription services, strengthening its offerings.

- 2025 (Projected): Anticipated significant growth in market share for console game subscription services.

- 2026 (Projected): Increased adoption of mobile game subscriptions driven by emerging markets.

- 2027 (Projected): Emergence of new subscription models incorporating VR/AR gaming.

- 2030 (Projected): Cloud gaming subscriptions surpass traditional download models in several key markets.

- 2033 (Projected): Continued consolidation and diversification within the global game subscription service landscape.

Strategic Outlook for Game Subscription Service Market

The strategic outlook for the game subscription service market is overwhelmingly positive, driven by a sustained demand for accessible and value-driven entertainment. Future growth will be accelerated by continued investment in cloud infrastructure, the development of exclusive content, and strategic partnerships that expand reach and enhance user experience. The diversification of subscription offerings to cater to niche audiences and emerging markets will be crucial for long-term success. Companies that can effectively leverage technological innovation, adapt to evolving consumer preferences, and navigate the regulatory landscape are poised to capture significant market share in this rapidly expanding sector, projected to grow beyond 100 billion dollars in the coming years.

Game Subscription Service Segmentation

-

1. Application

- 1.1. Child

- 1.2. Adult

-

2. Types

- 2.1. PC Games

- 2.2. Mobile Game

- 2.3. Console Game

Game Subscription Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Game Subscription Service Regional Market Share

Geographic Coverage of Game Subscription Service

Game Subscription Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Game Subscription Service Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Child

- 5.1.2. Adult

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. PC Games

- 5.2.2. Mobile Game

- 5.2.3. Console Game

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Game Subscription Service Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Child

- 6.1.2. Adult

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. PC Games

- 6.2.2. Mobile Game

- 6.2.3. Console Game

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Game Subscription Service Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Child

- 7.1.2. Adult

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. PC Games

- 7.2.2. Mobile Game

- 7.2.3. Console Game

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Game Subscription Service Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Child

- 8.1.2. Adult

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. PC Games

- 8.2.2. Mobile Game

- 8.2.3. Console Game

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Game Subscription Service Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Child

- 9.1.2. Adult

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. PC Games

- 9.2.2. Mobile Game

- 9.2.3. Console Game

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Game Subscription Service Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Child

- 10.1.2. Adult

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. PC Games

- 10.2.2. Mobile Game

- 10.2.3. Console Game

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Xbox

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PlayStation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nintendo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nvidia

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Apple Arcade

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ubisoft+

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Humble Choice

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 EA Games

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Unleashd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Utomik

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amazon Luna

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 UnboxBoardom

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Covenant

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Netflix

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 GeForce Now

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Meta

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Xbox

List of Figures

- Figure 1: Global Game Subscription Service Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Game Subscription Service Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Game Subscription Service Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Game Subscription Service Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Game Subscription Service Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Game Subscription Service Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Game Subscription Service Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Game Subscription Service Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Game Subscription Service Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Game Subscription Service Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Game Subscription Service Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Game Subscription Service Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Game Subscription Service Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Game Subscription Service Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Game Subscription Service Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Game Subscription Service Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Game Subscription Service Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Game Subscription Service Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Game Subscription Service Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Game Subscription Service Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Game Subscription Service Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Game Subscription Service Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Game Subscription Service Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Game Subscription Service Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Game Subscription Service Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Game Subscription Service Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Game Subscription Service Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Game Subscription Service Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Game Subscription Service Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Game Subscription Service Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Game Subscription Service Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Game Subscription Service Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Game Subscription Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Game Subscription Service Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global Game Subscription Service Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Game Subscription Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Game Subscription Service Revenue undefined Forecast, by Types 2020 & 2033

- Table 7: Global Game Subscription Service Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Game Subscription Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Game Subscription Service Revenue undefined Forecast, by Types 2020 & 2033

- Table 13: Global Game Subscription Service Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Game Subscription Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Game Subscription Service Revenue undefined Forecast, by Types 2020 & 2033

- Table 19: Global Game Subscription Service Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Game Subscription Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Game Subscription Service Revenue undefined Forecast, by Types 2020 & 2033

- Table 31: Global Game Subscription Service Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Game Subscription Service Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Game Subscription Service Revenue undefined Forecast, by Types 2020 & 2033

- Table 40: Global Game Subscription Service Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Game Subscription Service Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Game Subscription Service?

The projected CAGR is approximately 9.84%.

2. Which companies are prominent players in the Game Subscription Service?

Key companies in the market include Xbox, PlayStation, Nintendo, Nvidia, Apple Arcade, Ubisoft+, Humble Choice, EA Games, Unleashd, Utomik, Amazon Luna, UnboxBoardom, Covenant, Netflix, GeForce Now, Meta.

3. What are the main segments of the Game Subscription Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Game Subscription Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Game Subscription Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Game Subscription Service?

To stay informed about further developments, trends, and reports in the Game Subscription Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence