Key Insights

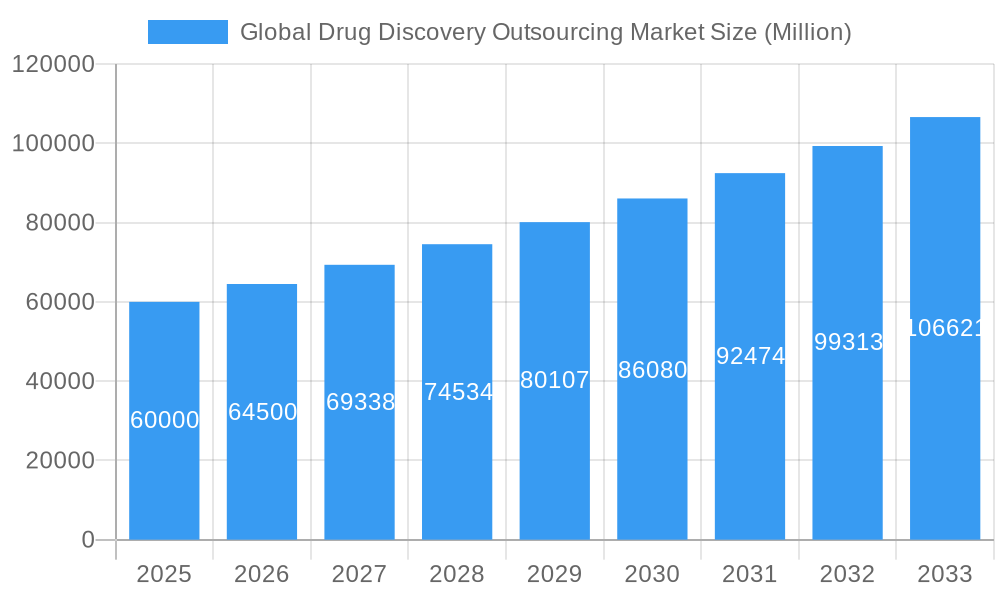

The global drug discovery outsourcing market is poised for substantial growth, projected to reach a market size of approximately $XX billion by 2033, with a Compound Annual Growth Rate (CAGR) of 7.50%. This robust expansion is fueled by increasing R&D investments from pharmaceutical and biotechnology companies seeking cost-efficiency, specialized expertise, and accelerated timelines. The market's value is denominated in millions of USD, reflecting the significant financial transactions within this sector. Key drivers include the rising prevalence of chronic diseases, the escalating complexity of drug development, and the growing need for innovative therapies, particularly in oncology and infectious diseases. Contract Research Organizations (CROs) are instrumental in providing a wide spectrum of services, from early-stage research and lead optimization to preclinical and clinical development, thereby enabling companies to focus on their core competencies and navigate the intricate regulatory landscape. The segment of small molecules continues to dominate, though large molecules (biopharmaceuticals) are rapidly gaining traction due to advancements in biotechnology.

Global Drug Discovery Outsourcing Market Market Size (In Billion)

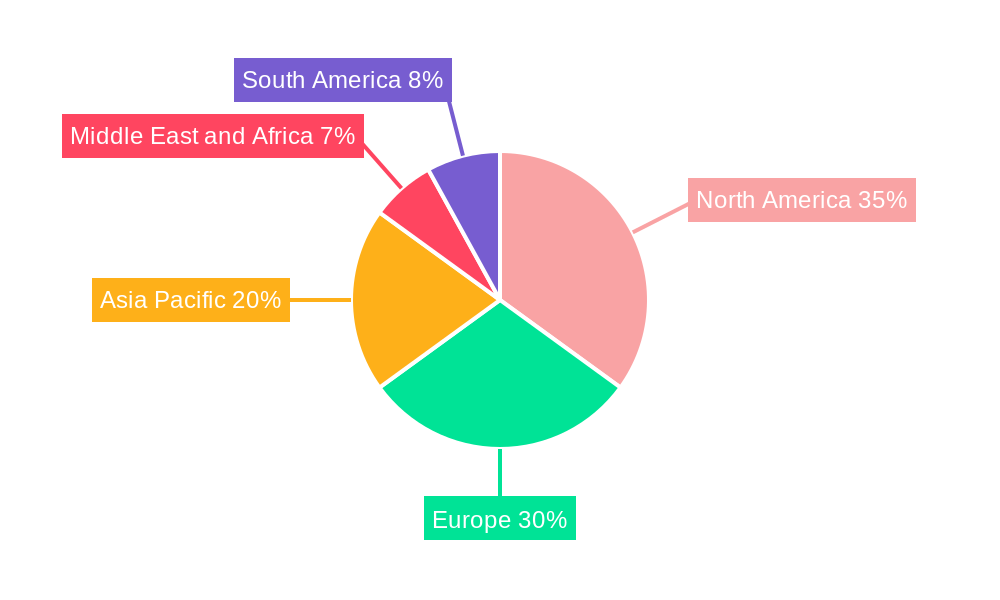

The market's trajectory is further shaped by several influential trends. A significant one is the increasing adoption of artificial intelligence (AI) and machine learning (ML) in drug discovery, which enhances target identification, drug design, and predictive modeling, thus streamlining the R&D process. Furthermore, the growing emphasis on personalized medicine and rare disease treatments is creating new avenues for outsourcing specialized research. However, the market is not without its restraints. Challenges such as stringent regulatory hurdles, intellectual property concerns, and the potential for data security breaches necessitate careful consideration and robust mitigation strategies by both clients and CROs. Despite these challenges, the competitive landscape is characterized by the presence of established global players and emerging specialized providers, all vying to offer innovative solutions and build strategic partnerships. North America and Europe currently lead in market share, owing to well-established pharmaceutical industries and significant R&D expenditure. However, the Asia Pacific region, particularly China and India, is emerging as a formidable growth engine due to its cost advantages, expanding talent pool, and supportive government initiatives.

Global Drug Discovery Outsourcing Market Company Market Share

Global Drug Discovery Outsourcing Market Report: Unlocking Innovation and Growth in Pharmaceutical R&D

This comprehensive report provides an in-depth analysis of the Global Drug Discovery Outsourcing Market, a rapidly evolving sector crucial for pharmaceutical and biotechnology companies seeking to accelerate their research and development pipelines. Covering the study period from 2019 to 2033, with a base year of 2025, this report offers detailed insights into market dynamics, key segments, competitive landscape, and future opportunities. Leveraging high-ranking keywords such as "drug discovery outsourcing," "pharmaceutical R&D," "biotechnology services," "CRO market," "drug development outsourcing," and "biologics outsourcing," this report is designed to attract and inform industry stakeholders, including pharmaceutical executives, R&D managers, investors, and market analysts.

Global Drug Discovery Outsourcing Market Market Concentration & Dynamics

The Global Drug Discovery Outsourcing Market exhibits a dynamic concentration, characterized by the presence of both large, established Contract Research Organizations (CROs) and specialized niche players. Market leadership is contested, with key players vying for market share through strategic partnerships and acquisitions. Innovation ecosystems are flourishing, driven by advancements in artificial intelligence (AI), machine learning, and novel therapeutic modalities. Regulatory frameworks, while evolving to accommodate new technologies, continue to play a significant role in shaping market entry and operational standards. The emergence of substitute products and technologies, such as advancements in in-vitro diagnostics and personalized medicine, influences demand for traditional drug discovery outsourcing services. End-user trends are shifting towards a greater reliance on external expertise for specialized services, particularly in areas like complex biologics and rare disease research. Merger and acquisition (M&A) activities are prevalent, indicating a trend towards consolidation and expanded service offerings. For instance, the historical period (2019-2024) witnessed numerous M&A deals aimed at enhancing capabilities and geographical reach. This section will delve into the competitive landscape, market share analysis of leading companies, and an overview of recent M&A transactions, providing a clear picture of the market's competitive intensity.

Global Drug Discovery Outsourcing Market Industry Insights & Trends

The Global Drug Discovery Outsourcing Market is projected to witness substantial growth, driven by an increasing demand for cost-effective and efficient drug development solutions. The market size, estimated to be in the range of tens of billions of dollars, is expected to expand at a robust Compound Annual Growth Rate (CAGR) throughout the forecast period (2025–2033). Key market growth drivers include the escalating costs associated with in-house drug discovery, the growing pipeline of biopharmaceuticals, and the increasing prevalence of chronic and infectious diseases globally, necessitating accelerated drug development. Technological disruptions, such as the integration of AI and machine learning in drug target identification and lead optimization, are revolutionizing the outsourcing landscape. Companies are increasingly leveraging these advanced tools offered by CROs to improve success rates and reduce time-to-market. Evolving consumer behaviors, particularly the demand for personalized medicine and targeted therapies, are also fueling the need for specialized outsourcing services. Furthermore, the growing focus of pharmaceutical companies on core competencies and the need to access specialized expertise are significant contributors to the market's upward trajectory. This section will provide a detailed analysis of these drivers, supported by market size projections and CAGR estimates, offering a granular view of the industry's potential.

Key Markets & Segments Leading Global Drug Discovery Outsourcing Market

The Global Drug Discovery Outsourcing Market is characterized by the dominance of specific regions and segments, offering lucrative opportunities for service providers. North America and Europe currently lead the market, driven by established pharmaceutical hubs, robust R&D investments, and a strong presence of leading biopharmaceutical companies. However, the Asia-Pacific region is emerging as a significant growth driver, fueled by cost-effectiveness, a growing pool of skilled talent, and favorable government initiatives supporting the life sciences sector.

Within the Type segment, Biology Service is anticipated to hold a dominant share due to the increasing complexity of biological assays, target validation, and preclinical studies. Medical Chemistry Service also remains a critical component, supporting the design and synthesis of novel drug candidates.

In terms of Drug Type, Large Molecules (Biopharmaceuticals) are experiencing rapid growth, driven by advancements in biologics, monoclonal antibodies, and gene and cell therapies. The outsourcing of biopharmaceutical development requires specialized expertise and infrastructure, which CROs are increasingly providing. Small Molecule drug discovery, while mature, continues to be a significant market.

The Therapeutic Area segment showcasing the most significant traction is Oncology, followed closely by Infectious Disease and Cardiovascular diseases. The escalating burden of cancer, coupled with the persistent threat of emerging infectious diseases and the growing prevalence of cardiovascular ailments, fuels substantial R&D efforts and, consequently, outsourcing demand. Other therapeutic areas like Gastrointestinal diseases and Others (including neurological disorders, metabolic diseases, and rare diseases) also contribute to market growth.

- North America Dominance: Driven by high R&D expenditure, advanced technological infrastructure, and a dense concentration of major pharmaceutical and biotechnology firms.

- Asia-Pacific Growth Engine: Fueled by cost advantages, a burgeoning skilled workforce, and increasing government support for the life sciences industry.

- Biology Service Leadership: Essential for target identification, validation, and early-stage efficacy studies.

- Biopharmaceuticals Ascendancy: Reflecting the growing prominence of biologics, antibodies, and advanced therapies in the drug pipeline.

- Oncology & Infectious Disease Demand: Driven by unmet medical needs and substantial global health challenges.

Global Drug Discovery Outsourcing Market Product Developments

Product developments in the Global Drug Discovery Outsourcing Market are primarily centered on enhancing efficiency, accuracy, and speed in the drug discovery process. Companies are investing in advanced technologies such as AI-powered drug discovery platforms, high-throughput screening (HTS) systems, and sophisticated bioanalytical tools. The application of these technologies allows for faster identification of potential drug candidates, more precise prediction of drug efficacy and toxicity, and streamlined lead optimization. Market relevance is high, as these innovations directly address the industry's need to reduce R&D costs and accelerate the delivery of novel therapies to patients. Competitive edges are gained by CROs that can offer integrated solutions, encompassing early-stage research through to preclinical development, leveraging cutting-edge technologies.

Challenges in the Global Drug Discovery Outsourcing Market Market

Despite its robust growth, the Global Drug Discovery Outsourcing Market faces several challenges. Regulatory hurdles, including evolving compliance requirements and the lengthy approval processes for new drugs, can impact project timelines and costs. Supply chain disruptions, particularly for specialized reagents and raw materials, can also pose significant operational challenges. Intense competitive pressures among CROs can lead to price wars and impact profit margins. Furthermore, intellectual property (IP) protection concerns and the need for robust data security protocols remain critical considerations for clients outsourcing their sensitive research.

Forces Driving Global Drug Discovery Outsourcing Market Growth

Several powerful forces are propelling the Global Drug Discovery Outsourcing Market forward. The relentless pursuit of innovation by pharmaceutical companies, coupled with the increasing complexity and cost of in-house R&D, makes outsourcing an attractive proposition. Technological advancements, particularly in areas like AI, machine learning, and omics technologies, are enhancing the capabilities of CROs, enabling them to offer more sophisticated services. Favorable regulatory environments in certain regions and government incentives for pharmaceutical R&D further support market expansion. The growing pipeline of biopharmaceuticals and the rising prevalence of chronic diseases globally are also significant market accelerators.

Challenges in the Global Drug Discovery Outsourcing Market Market

While opportunities abound, the Global Drug Discovery Outsourcing Market is not without its long-term growth catalysts that require careful navigation. The increasing demand for specialized expertise in areas such as cell and gene therapies, as well as rare disease research, presents a continuous need for CROs to invest in talent development and advanced capabilities. Strategic partnerships and collaborations between pharmaceutical companies and CROs are becoming more sophisticated, moving beyond transactional relationships to integrated R&D efforts. Market expansions into emerging economies offer significant growth potential, provided CROs can navigate local regulatory landscapes and establish robust operational frameworks.

Emerging Opportunities in Global Drug Discovery Outsourcing Market

Emerging opportunities in the Global Drug Discovery Outsourcing Market are largely driven by novel technological integrations and shifting therapeutic focus. The expanding application of AI and machine learning in predictive toxicology and patient stratification for clinical trials presents a significant area for growth. The burgeoning field of personalized medicine and the increasing focus on rare diseases are creating demand for highly specialized outsourcing services. Furthermore, the growing interest in novel drug modalities, such as mRNA therapeutics and antibody-drug conjugates (ADCs), opens up new avenues for CROs with specialized expertise. Expansion into underdeveloped markets with growing pharmaceutical sectors also presents untapped potential.

Leading Players in the Global Drug Discovery Outsourcing Market Sector

- Thermo Fisher Scientific (PPD Inc)

- Eurofins Scientific

- Laboratory Corporation of America Holdings

- Charles River Laboratories International Inc

- GenScript Biotech Corporation

- Oncodesign

- WuXi AppTec

- Evotec SE

- Dalton Pharma Services

- Curia Inc

- Jubilant Life Sciences Limited

Key Milestones in Global Drug Discovery Outsourcing Market Industry

- November 2022: Sanofi and Insilico Medicine, a clinical-stage biotechnology company, inked a USD 1200 million Drug Development Deal. The agreement will see Sanofi utilize Insilico's AI platform, Pharma.AI, to advance drug development in up to six new targets, highlighting the growing impact of AI in drug discovery.

- October 2022: Amphista Therapeutics, a biotechnology company focusing on drug discovery projects that use targeted protein degradation (TPD), collaborated with Domainex, a medicines research service partner. This collaboration aims to provide integrated drug discovery services for Amphista's research programs, benefiting from Domainex's expertise in protein production, assay biology, and medicinal chemistry.

Strategic Outlook for Global Drug Discovery Outsourcing Market Market

The strategic outlook for the Global Drug Discovery Outsourcing Market is one of sustained expansion and innovation. Growth accelerators will include deeper integration of AI and machine learning across the entire drug discovery continuum, leading to more efficient and predictive R&D processes. The increasing demand for specialized services in biologics, cell and gene therapies, and rare diseases will drive further segmentation and specialization within the CRO market. Strategic partnerships and collaborations will become more crucial, fostering co-development models and risk-sharing agreements. CROs that can demonstrate a strong commitment to quality, compliance, and technological advancement will be best positioned to capitalize on future market potential and secure long-term growth opportunities.

Global Drug Discovery Outsourcing Market Segmentation

-

1. Type

- 1.1. Medical Chemistry Service

- 1.2. Biology Service

-

2. Drug Type

- 2.1. Small Molecule

- 2.2. Large Molecules (Biopharmaceuticals)

-

3. Therapeutic Area

- 3.1. Oncology

- 3.2. Infectious Disease

- 3.3. Respiratory Disease

- 3.4. Cardiovascular

- 3.5. Gastrointestinal

- 3.6. Others

Global Drug Discovery Outsourcing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Drug Discovery Outsourcing Market Regional Market Share

Geographic Coverage of Global Drug Discovery Outsourcing Market

Global Drug Discovery Outsourcing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing R&D In Biopharmaceutical Industry; Increasing demand for outsourcing Services in Drug Development

- 3.3. Market Restrains

- 3.3.1. High Cost of Drug Development and Stringent Regulations for Drug Manufacturing

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Hold a Significant Market Share Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Medical Chemistry Service

- 5.1.2. Biology Service

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Small Molecule

- 5.2.2. Large Molecules (Biopharmaceuticals)

- 5.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 5.3.1. Oncology

- 5.3.2. Infectious Disease

- 5.3.3. Respiratory Disease

- 5.3.4. Cardiovascular

- 5.3.5. Gastrointestinal

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Medical Chemistry Service

- 6.1.2. Biology Service

- 6.2. Market Analysis, Insights and Forecast - by Drug Type

- 6.2.1. Small Molecule

- 6.2.2. Large Molecules (Biopharmaceuticals)

- 6.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 6.3.1. Oncology

- 6.3.2. Infectious Disease

- 6.3.3. Respiratory Disease

- 6.3.4. Cardiovascular

- 6.3.5. Gastrointestinal

- 6.3.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Medical Chemistry Service

- 7.1.2. Biology Service

- 7.2. Market Analysis, Insights and Forecast - by Drug Type

- 7.2.1. Small Molecule

- 7.2.2. Large Molecules (Biopharmaceuticals)

- 7.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 7.3.1. Oncology

- 7.3.2. Infectious Disease

- 7.3.3. Respiratory Disease

- 7.3.4. Cardiovascular

- 7.3.5. Gastrointestinal

- 7.3.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Medical Chemistry Service

- 8.1.2. Biology Service

- 8.2. Market Analysis, Insights and Forecast - by Drug Type

- 8.2.1. Small Molecule

- 8.2.2. Large Molecules (Biopharmaceuticals)

- 8.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 8.3.1. Oncology

- 8.3.2. Infectious Disease

- 8.3.3. Respiratory Disease

- 8.3.4. Cardiovascular

- 8.3.5. Gastrointestinal

- 8.3.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Medical Chemistry Service

- 9.1.2. Biology Service

- 9.2. Market Analysis, Insights and Forecast - by Drug Type

- 9.2.1. Small Molecule

- 9.2.2. Large Molecules (Biopharmaceuticals)

- 9.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 9.3.1. Oncology

- 9.3.2. Infectious Disease

- 9.3.3. Respiratory Disease

- 9.3.4. Cardiovascular

- 9.3.5. Gastrointestinal

- 9.3.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Medical Chemistry Service

- 10.1.2. Biology Service

- 10.2. Market Analysis, Insights and Forecast - by Drug Type

- 10.2.1. Small Molecule

- 10.2.2. Large Molecules (Biopharmaceuticals)

- 10.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 10.3.1. Oncology

- 10.3.2. Infectious Disease

- 10.3.3. Respiratory Disease

- 10.3.4. Cardiovascular

- 10.3.5. Gastrointestinal

- 10.3.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thermo Fisher Scientific (PPD Inc )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eurofins Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Laboratory Corporation of America Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Charles River Laboratories International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GenScript Biotech Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Oncodesign

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 WuXi AppTec

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evotec SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dalton Pharma Services

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Curia Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jubilant Life Sciences Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Thermo Fisher Scientific (PPD Inc )

List of Figures

- Figure 1: Global Global Drug Discovery Outsourcing Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Drug Discovery Outsourcing Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Global Drug Discovery Outsourcing Market Revenue (undefined), by Drug Type 2025 & 2033

- Figure 5: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 6: North America Global Drug Discovery Outsourcing Market Revenue (undefined), by Therapeutic Area 2025 & 2033

- Figure 7: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 8: North America Global Drug Discovery Outsourcing Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Drug Discovery Outsourcing Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Global Drug Discovery Outsourcing Market Revenue (undefined), by Drug Type 2025 & 2033

- Figure 13: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 14: Europe Global Drug Discovery Outsourcing Market Revenue (undefined), by Therapeutic Area 2025 & 2033

- Figure 15: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 16: Europe Global Drug Discovery Outsourcing Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (undefined), by Drug Type 2025 & 2033

- Figure 21: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 22: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (undefined), by Therapeutic Area 2025 & 2033

- Figure 23: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 24: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (undefined), by Drug Type 2025 & 2033

- Figure 29: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 30: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (undefined), by Therapeutic Area 2025 & 2033

- Figure 31: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 32: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Drug Discovery Outsourcing Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Global Drug Discovery Outsourcing Market Revenue (undefined), by Drug Type 2025 & 2033

- Figure 37: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 38: South America Global Drug Discovery Outsourcing Market Revenue (undefined), by Therapeutic Area 2025 & 2033

- Figure 39: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 40: South America Global Drug Discovery Outsourcing Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 3: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 4: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 7: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 8: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 14: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 15: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 23: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 24: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 25: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 34: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 35: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 40: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Drug Type 2020 & 2033

- Table 41: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Therapeutic Area 2020 & 2033

- Table 42: Global Drug Discovery Outsourcing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Global Drug Discovery Outsourcing Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Drug Discovery Outsourcing Market?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Global Drug Discovery Outsourcing Market?

Key companies in the market include Thermo Fisher Scientific (PPD Inc ), Eurofins Scientific, Laboratory Corporation of America Holdings, Charles River Laboratories International Inc, GenScript Biotech Corporation, Oncodesign, WuXi AppTec, Evotec SE, Dalton Pharma Services, Curia Inc, Jubilant Life Sciences Limited.

3. What are the main segments of the Global Drug Discovery Outsourcing Market?

The market segments include Type, Drug Type, Therapeutic Area.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing R&D In Biopharmaceutical Industry; Increasing demand for outsourcing Services in Drug Development.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Hold a Significant Market Share Over The Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Drug Development and Stringent Regulations for Drug Manufacturing.

8. Can you provide examples of recent developments in the market?

November 2022: Sanofi and Insilico Medicine, a clinical-stage biotechnology company, inked USD 1200 million Drug Development Deal. The agreement will see Sanofi use Insilico's AI platform, Pharma.AI, to advance drug development in up to six new targets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Drug Discovery Outsourcing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Drug Discovery Outsourcing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Drug Discovery Outsourcing Market?

To stay informed about further developments, trends, and reports in the Global Drug Discovery Outsourcing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence