Key Insights

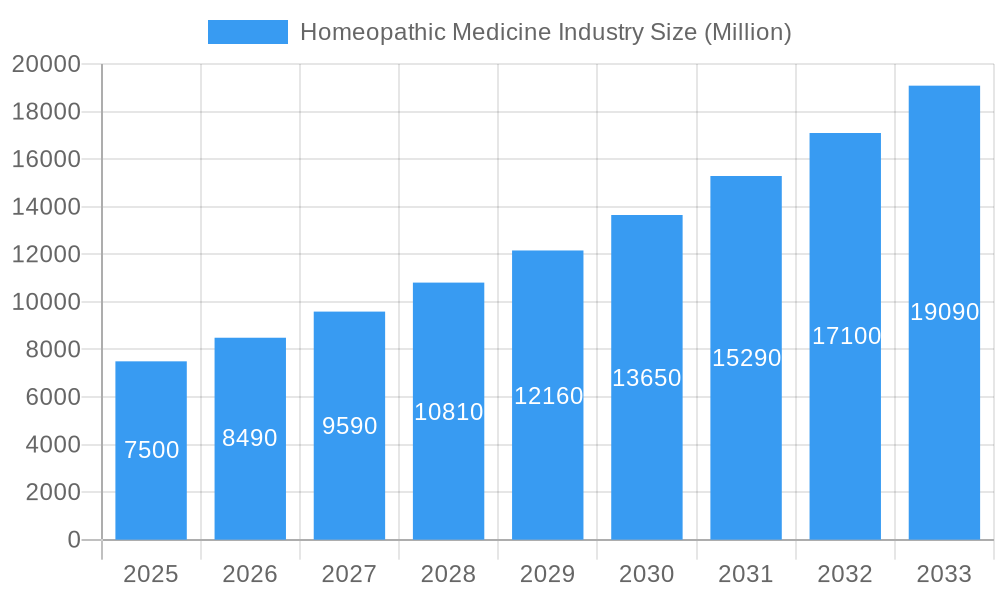

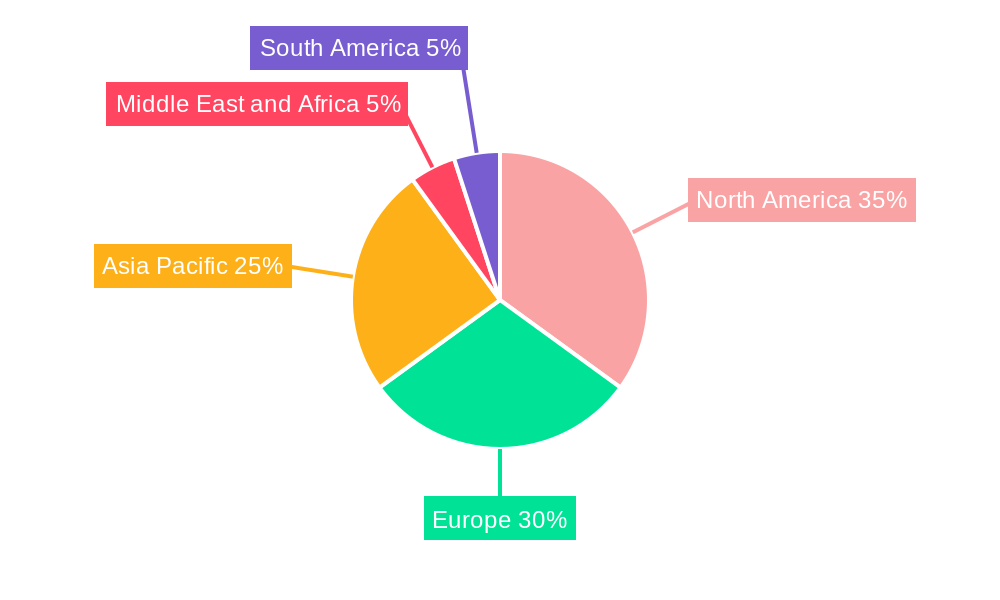

The global Homeopathic Medicine market is projected for significant expansion, estimated to reach $8.97 billion with a Compound Annual Growth Rate (CAGR) of 13.12% from the base year of 2025 through 2033. This growth is driven by increasing consumer preference for natural and holistic healthcare, rising awareness of homeopathic treatments for chronic conditions, and substantial R&D investments. The market benefits from the growing prevalence of lifestyle-related ailments, prompting consumers to seek alternatives to conventional pharmaceuticals. North America and Europe currently lead market share due to established acceptance, while the Asia Pacific region is anticipated to experience the fastest growth, fueled by a rising middle class, increased disposable income, and a traditional embrace of natural remedies.

Homeopathic Medicine Industry Market Size (In Billion)

The market encompasses diverse product types, with Tinctures and Dilutions expected to hold a leading share due to their ease of use and broad therapeutic applications. Key application segments such as Analgesics, Antipyretics, and Respiratory Disorders are experiencing high demand, aligning with global health trends. Primary market drivers include the growing demand for personalized medicine, the perceived minimal side effects of homeopathic remedies, and supportive regulatory environments in select regions. Potential restraints include ongoing debates regarding scientific consensus on efficacy and varied regulatory frameworks. Leading companies like Boiron, Dr. Willmar Schwabe, and Biologische Heilmittel Heel GmbH are driving innovation and portfolio expansion. Continued exploration of Plants, Animals, and Minerals as sources for homeopathic preparations will shape future product development.

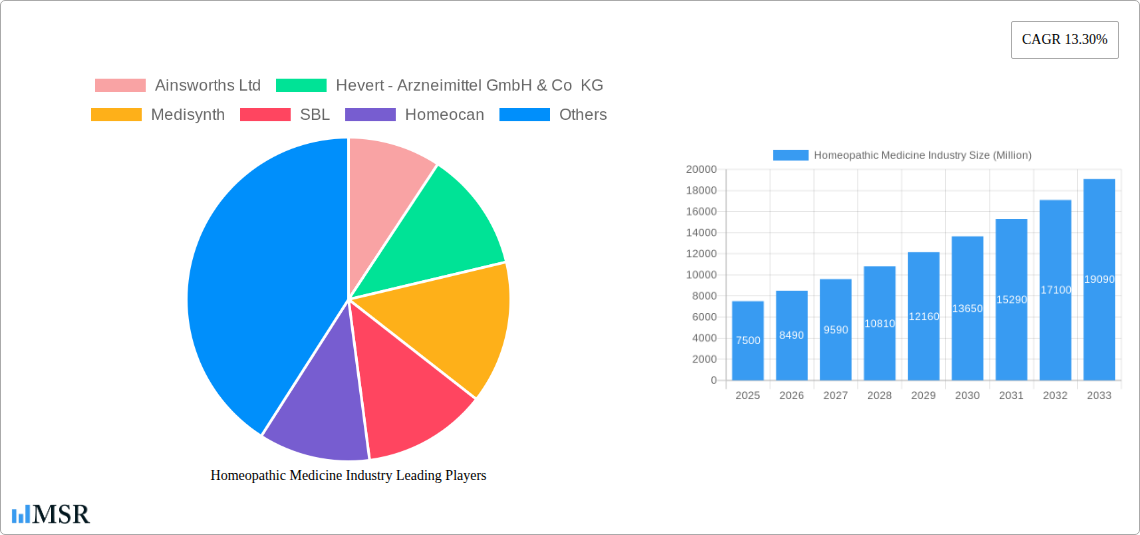

Homeopathic Medicine Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global homeopathic medicine market, projecting substantial growth driven by increasing consumer preference for natural and holistic healthcare. Covering the historical period of 2019–2024, the base year of 2025, and a forecast period of 2025–2033, this study provides critical insights for stakeholders in the homeopathic pharmaceutical sector. With an estimated market size projected to reach $8.97 billion by 2025 and a robust CAGR of 13.12% anticipated, this report is an essential resource for understanding market dynamics and identifying growth opportunities within the natural remedies and alternative medicine industries.

Homeopathic Medicine Industry Market Concentration & Dynamics

The homeopathic medicine industry exhibits a moderate market concentration, with a blend of large multinational corporations and a significant number of smaller, specialized manufacturers. The innovation ecosystem is characterized by continuous research into new homeopathic remedies derived from a diverse range of sources, including plants, animals, and minerals. Regulatory frameworks, while evolving, present a complex landscape for market entry and product approval across different regions, influencing market accessibility and consumer trust in FDA-regulated homeopathic remedies. The availability of substitute products, such as conventional pharmaceuticals and other complementary and alternative medicine (CAM) therapies, poses a competitive challenge, necessitating a focus on product efficacy and perceived benefits. End-user trends indicate a growing demand for personalized and preventative healthcare, aligning well with the principles of homeopathy. Merger and acquisition (M&A) activities, while not as aggressive as in some other pharmaceutical sectors, play a role in market consolidation and strategic expansion. The market share distribution reflects the dominance of established players alongside the agility of emerging companies focusing on niche segments within the homeopathic product market. Key M&A deal counts are being closely monitored to understand strategic shifts and competitive advantages.

Homeopathic Medicine Industry Industry Insights & Trends

The homeopathic medicine industry is poised for substantial expansion, driven by a confluence of powerful market growth drivers. A primary catalyst is the escalating global demand for natural and organic healthcare products, fueled by growing consumer awareness of the potential side effects of conventional drugs and a rising interest in holistic wellness. This trend is particularly pronounced in regions with a strong cultural inclination towards traditional medicine. Technological disruptions, though subtle compared to conventional pharmaceuticals, are emerging in areas such as advanced manufacturing techniques for homeopathic dilutions and innovative delivery systems for homeopathic tablets and tinctures. The development of sophisticated analytical methods for quality control and efficacy assessment is also contributing to market credibility. Evolving consumer behaviors are central to the market's growth; individuals are increasingly seeking preventative healthcare strategies and personalized treatment plans, where homeopathy, with its individualized approach, finds a receptive audience. The global homeopathic medicine market size is projected to witness a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period, reaching an estimated $XXX million by 2033. Factors such as increasing disposable incomes in developing economies, supportive government initiatives promoting traditional medicine in certain countries, and a growing number of qualified homeopathic practitioners are further bolstering market penetration. The perception of homeopathy as a safe and gentle therapeutic option, especially for chronic conditions and pediatric care, continues to attract a significant user base, contributing to sustained market momentum. The market is also observing a rise in homeopathic e-commerce, making products more accessible to a wider demographic.

Key Markets & Segments Leading Homeopathic Medicine Industry

The global homeopathic medicine market demonstrates significant regional and segmental dominance, with North America and Europe currently leading in terms of market share, driven by established healthcare infrastructures and a mature consumer base with a predisposition towards alternative therapies. However, the Asia-Pacific region, particularly India, is emerging as a powerhouse, propelled by its rich heritage of traditional medicine, a large and growing population, and increasing government support for the homeopathic medicine sector.

- Dominant Product Type: Within the product type segmentation, dilutions represent a substantial portion of the market, owing to their wide applicability and perceived efficacy in treating a broad spectrum of ailments. Tablets are also gaining considerable traction due to their ease of administration and convenience.

- Drivers for Dilutions: Wide therapeutic range, personalized dosage, perceived gentle action.

- Drivers for Tablets: Convenience, portability, ease of use for self-medication.

- Dominant Application: The analgesic and antipyretic application segment is a significant market driver, reflecting the demand for natural pain relief and fever management solutions. The respiratory segment also exhibits robust growth, driven by the prevalence of conditions like coughs, colds, and allergies.

- Drivers for Analgesic & Antipyretic: Growing preference for non-opioid pain relief, perceived safety profile.

- Drivers for Respiratory: High incidence of respiratory ailments, desire for symptom relief without side effects.

- Dominant Source: Plants constitute the most dominant source for homeopathic medicines, owing to their diverse therapeutic properties and established use in traditional healing practices.

- Drivers for Plant-Based Homeopathy: Extensive availability of medicinal plants, established research on phytochemical properties, consumer trust in botanical remedies.

The expansion of healthcare access, increasing awareness campaigns promoting homeopathic treatments, and favorable reimbursement policies in some key markets further solidify the dominance of these segments and regions. The growing middle class in emerging economies, coupled with a rising health consciousness, is expected to drive future growth in these dominant areas.

Homeopathic Medicine Industry Product Developments

Product development in the homeopathic medicine industry is characterized by a focus on enhancing existing formulations and exploring novel applications. Innovations are centered around improving the bioavailability and efficacy of homeopathic remedies, alongside the development of user-friendly delivery systems such as advanced homeopathic tablets and improved tincture formulations. Research also delves into harnessing the therapeutic potential of a wider array of plant, animal, and mineral sources to address emerging health concerns. The emphasis remains on providing safe, effective, and natural alternatives, aligning with consumer demand for holistic healthcare solutions. This continuous evolution ensures the homeopathic product market remains dynamic and responsive to market needs.

Challenges in the Homeopathic Medicine Industry Market

The homeopathic medicine industry faces several significant challenges that impact its growth and market penetration. A primary restraint is the ongoing scientific debate and skepticism regarding the efficacy of homeopathic principles, leading to stringent regulatory hurdles and limitations in marketing claims in many regions. Supply chain complexities for sourcing high-quality raw materials for plant, animal, and mineral-based remedies can also pose difficulties. Intense competition from established conventional pharmaceutical markets and other CAM therapies further pressures market share. The lack of widespread insurance coverage for homeopathic treatments in many countries limits accessibility for a significant portion of the population.

Forces Driving Homeopathic Medicine Industry Growth

Several key forces are propelling the growth of the homeopathic medicine industry. The increasing global consumer inclination towards natural and organic healthcare solutions is a primary driver, as individuals seek alternatives to synthetic drugs. Growing health consciousness and a desire for preventative healthcare align perfectly with the holistic approach of homeopathy. Supportive government policies in certain countries, promoting traditional medicine, are creating a more favorable market environment. Furthermore, advancements in homeopathic medicine research and quality control are gradually building greater acceptance and trust in these therapies. The convenience of accessing homeopathic products through various channels, including online platforms, is also expanding market reach.

Challenges in the Homeopathic Medicine Industry Market

The homeopathic medicine industry faces enduring challenges that require strategic navigation for sustained growth. The persistent lack of definitive scientific consensus on the mechanisms of action and the efficacy of homeopathic remedies creates significant regulatory obstacles and consumer skepticism. Navigating diverse and often stringent regulatory frameworks across different countries adds complexity and cost to product development and market entry. Intense competition from established conventional medicine and other alternative therapies necessitates continuous innovation and robust marketing strategies. The challenge of consumer education and perception management remains crucial to overcome ingrained doubts and highlight the therapeutic benefits of natural and homeopathic treatments.

Emerging Opportunities in Homeopathic Medicine Industry

Emerging opportunities within the homeopathic medicine industry are ripe for exploitation by forward-thinking companies. The growing trend of personalized medicine presents a significant avenue, as homeopathy's individualized treatment approach resonates strongly with this movement. Expansion into emerging economies with a rising middle class and increasing disposable incomes offers substantial untapped market potential. The development of new homeopathic applications for chronic diseases and lifestyle-related conditions, backed by more rigorous clinical studies, can enhance credibility and market acceptance. Furthermore, collaborations between homeopathic manufacturers and conventional healthcare providers can foster greater integration and wider adoption of these therapies. The rise of digital platforms for e-commerce of homeopathic products also presents a significant opportunity for wider reach and accessibility.

Leading Players in the Homeopathic Medicine Industry Sector

- Ainsworths Ltd

- Hevert - Arzneimittel GmbH & Co KG

- Medisynth

- SBL

- Homeocan

- Dr Reckeweg & Co

- A Nelson & Co Ltd

- Powell Laboratories Pvt Ltd

- Biologische Heilmittel Heel GmbH

- Boiron

- Dr Willmar Schwabe GmbH & Co KG

- Hahnemann Laboratories

Key Milestones in Homeopathic Medicine Industry Industry

- August 2022: The Academy of Homeopathy Education partnered with the American Institute of Homeopathy (AIH) to launch an Acute Care Homeopathy course for medical professionals in a hybrid model. This initiative aims to enhance medical professionals' practice by expanding their treatment tools with acute care homeopathy, teaching safe and effective pain management and antibiotic overuse mitigation with FDA-regulated homeopathic remedies.

- April 2022: Kaps3 Lifesciences Pvt Ltd., headquartered in Gujarat, India, launched its 'Kaps3 Homeopathy Division' to support the growing demand for homeopathy products in the country, signaling a strategic expansion in a key growth market for homeopathic medicines.

Strategic Outlook for Homeopathic Medicine Industry Market

The strategic outlook for the homeopathic medicine industry is one of measured but consistent growth, driven by escalating consumer demand for natural healthcare and a growing acceptance of holistic treatment modalities. Key growth accelerators include continued investment in research and development to validate efficacy and address scientific skepticism, alongside the expansion of product portfolios to cater to a wider range of health concerns. Strategic partnerships with healthcare providers and regulatory bodies will be crucial for enhancing credibility and market integration. Focus on e-commerce and digital marketing will expand reach, especially in developing markets. Furthermore, highlighting the safety and gentle nature of homeopathic remedies, particularly for sensitive populations, will remain a cornerstone of market penetration and long-term success in the global alternative medicine market.

Homeopathic Medicine Industry Segmentation

-

1. Product Type

- 1.1. Tincture

- 1.2. Dilutions

- 1.3. Tablets

- 1.4. Others

-

2. Application

- 2.1. Analgesic and Antipyretic

- 2.2. Respiratory

- 2.3. Neurology

- 2.4. Others

-

3. Source

- 3.1. Plants

- 3.2. Animals

- 3.3. Minerals

Homeopathic Medicine Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Homeopathic Medicine Industry Regional Market Share

Geographic Coverage of Homeopathic Medicine Industry

Homeopathic Medicine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1199999999999% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness Regarding the Homeopathy Medicine; Rising Prevalence of Lifestyle-Associated Diseases

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness about Homeopathic Products

- 3.4. Market Trends

- 3.4.1. Dilutions Segment is Expected to Hold a Significant Market Share Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tincture

- 5.1.2. Dilutions

- 5.1.3. Tablets

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Analgesic and Antipyretic

- 5.2.2. Respiratory

- 5.2.3. Neurology

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Source

- 5.3.1. Plants

- 5.3.2. Animals

- 5.3.3. Minerals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Tincture

- 6.1.2. Dilutions

- 6.1.3. Tablets

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Analgesic and Antipyretic

- 6.2.2. Respiratory

- 6.2.3. Neurology

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Source

- 6.3.1. Plants

- 6.3.2. Animals

- 6.3.3. Minerals

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Tincture

- 7.1.2. Dilutions

- 7.1.3. Tablets

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Analgesic and Antipyretic

- 7.2.2. Respiratory

- 7.2.3. Neurology

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Source

- 7.3.1. Plants

- 7.3.2. Animals

- 7.3.3. Minerals

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Tincture

- 8.1.2. Dilutions

- 8.1.3. Tablets

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Analgesic and Antipyretic

- 8.2.2. Respiratory

- 8.2.3. Neurology

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Source

- 8.3.1. Plants

- 8.3.2. Animals

- 8.3.3. Minerals

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Tincture

- 9.1.2. Dilutions

- 9.1.3. Tablets

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Analgesic and Antipyretic

- 9.2.2. Respiratory

- 9.2.3. Neurology

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Source

- 9.3.1. Plants

- 9.3.2. Animals

- 9.3.3. Minerals

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Homeopathic Medicine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Tincture

- 10.1.2. Dilutions

- 10.1.3. Tablets

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Analgesic and Antipyretic

- 10.2.2. Respiratory

- 10.2.3. Neurology

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Source

- 10.3.1. Plants

- 10.3.2. Animals

- 10.3.3. Minerals

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ainsworths Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hevert - Arzneimittel GmbH & Co KG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medisynth

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SBL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Homeocan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dr Reckeweg & Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 A Nelson & Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Powell Laboratories Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Biologische Heilmittel Heel GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Boiron

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dr Willmar Schwabe GmbH & Co KG*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hahnemann Laboratories

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Ainsworths Ltd

List of Figures

- Figure 1: Global Homeopathic Medicine Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 7: North America Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 8: North America Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Europe Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 15: Europe Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 16: Europe Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 23: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 24: Asia Pacific Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 31: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 32: Middle East and Africa Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Homeopathic Medicine Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 35: South America Homeopathic Medicine Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: South America Homeopathic Medicine Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: South America Homeopathic Medicine Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Homeopathic Medicine Industry Revenue (billion), by Source 2025 & 2033

- Figure 39: South America Homeopathic Medicine Industry Revenue Share (%), by Source 2025 & 2033

- Figure 40: South America Homeopathic Medicine Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Homeopathic Medicine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 4: Global Homeopathic Medicine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 8: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 15: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 25: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 35: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Homeopathic Medicine Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 40: Global Homeopathic Medicine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Homeopathic Medicine Industry Revenue billion Forecast, by Source 2020 & 2033

- Table 42: Global Homeopathic Medicine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Homeopathic Medicine Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Homeopathic Medicine Industry?

The projected CAGR is approximately 13.1199999999999%.

2. Which companies are prominent players in the Homeopathic Medicine Industry?

Key companies in the market include Ainsworths Ltd, Hevert - Arzneimittel GmbH & Co KG, Medisynth, SBL, Homeocan, Dr Reckeweg & Co, A Nelson & Co Ltd, Powell Laboratories Pvt Ltd, Biologische Heilmittel Heel GmbH, Boiron, Dr Willmar Schwabe GmbH & Co KG*List Not Exhaustive, Hahnemann Laboratories.

3. What are the main segments of the Homeopathic Medicine Industry?

The market segments include Product Type, Application, Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.97 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness Regarding the Homeopathy Medicine; Rising Prevalence of Lifestyle-Associated Diseases.

6. What are the notable trends driving market growth?

Dilutions Segment is Expected to Hold a Significant Market Share Over The Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Awareness about Homeopathic Products.

8. Can you provide examples of recent developments in the market?

August 2022: the Academy of Homeopathy Education partnered with the American Institute of Homeopathy (AIH) to launch Acute Care Homeopathy course for medical professionals in a hybrid model. The customized educational program enhances medical professionals' practice and expands the treatment tools available with acute care homeopathy. In the course, participants will learn safe and effective ways to manage pain and mitigate antibiotic overuse with FDA-regulated and approved Homeopathic remedies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Homeopathic Medicine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Homeopathic Medicine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Homeopathic Medicine Industry?

To stay informed about further developments, trends, and reports in the Homeopathic Medicine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence