Key Insights

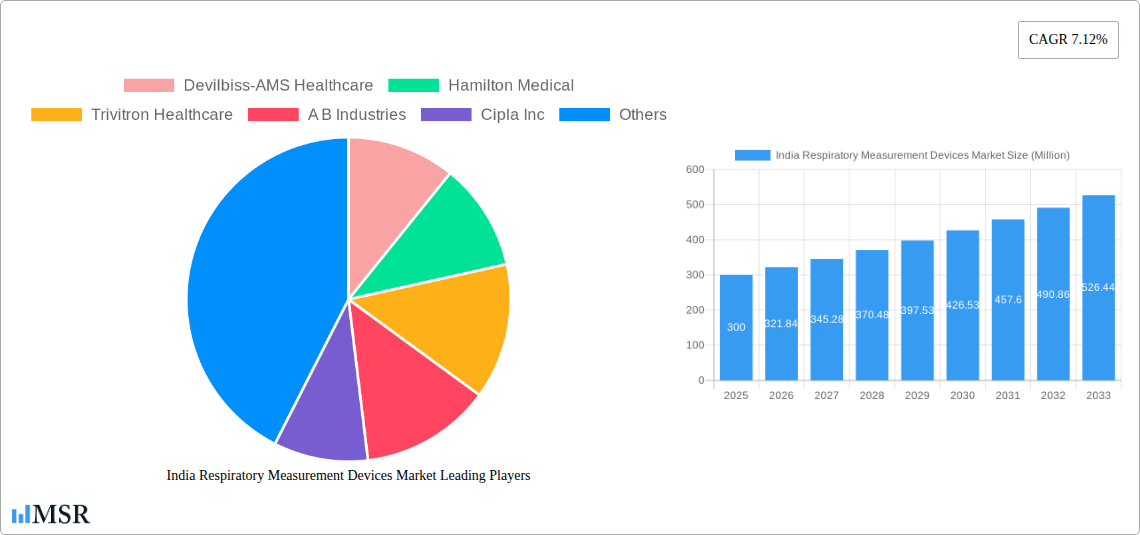

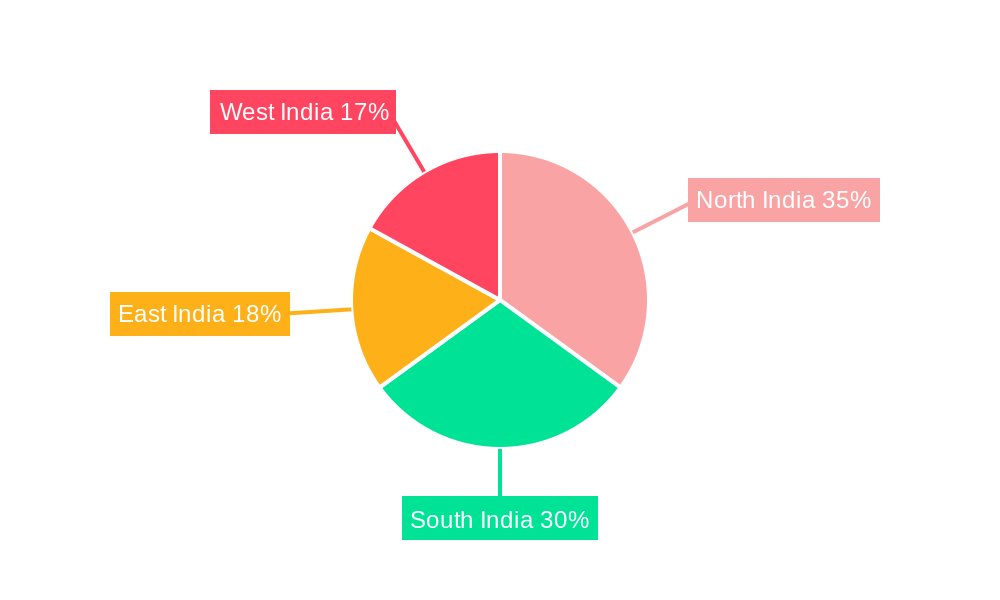

The India respiratory measurement devices market, valued at ₹300 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.12% from 2025 to 2033. This expansion is driven by several key factors. The rising prevalence of chronic respiratory diseases like asthma, COPD, and sleep apnea, coupled with an aging population, significantly fuels demand for accurate and reliable diagnostic tools. Increased healthcare infrastructure development and rising healthcare expenditure in India further contribute to market growth. Technological advancements, such as the introduction of portable and user-friendly devices, are also improving accessibility and adoption rates. The market is segmented by product type (pulse oximeters, capnographs, spirometers, polysomnographs, peak flow meters, gas analyzers, and others), indication (sleep apnea, COPD, asthma, infectious diseases, and others), and end-user (home care, hospitals, ambulatory surgical centers, specialty clinics, and others). The home care segment is experiencing particularly strong growth due to the increasing preference for convenient, at-home monitoring. While challenges remain, such as the need for greater awareness and affordability concerns in certain regions, the overall market outlook is optimistic, projecting substantial expansion in the coming years. The presence of established players like GE Healthcare, Medtronic, and ResMed, alongside domestic manufacturers like Trivitron Healthcare, indicates a competitive yet dynamic market landscape. Regional variations exist, with North and South India potentially leading in market share due to higher healthcare infrastructure and awareness levels.

India Respiratory Measurement Devices Market Market Size (In Million)

Growth in the coming years will be fueled by government initiatives promoting healthcare accessibility, increasing adoption of telehealth, and the continued focus on early diagnosis and disease management. The market will witness a shift towards technologically advanced devices, potentially including integration with digital health platforms for remote patient monitoring and data analysis. Competition is expected to intensify as both multinational and domestic players strive to cater to the growing demand. This will likely lead to product innovation, improved affordability, and an overall enhanced quality of care for respiratory patients across India.

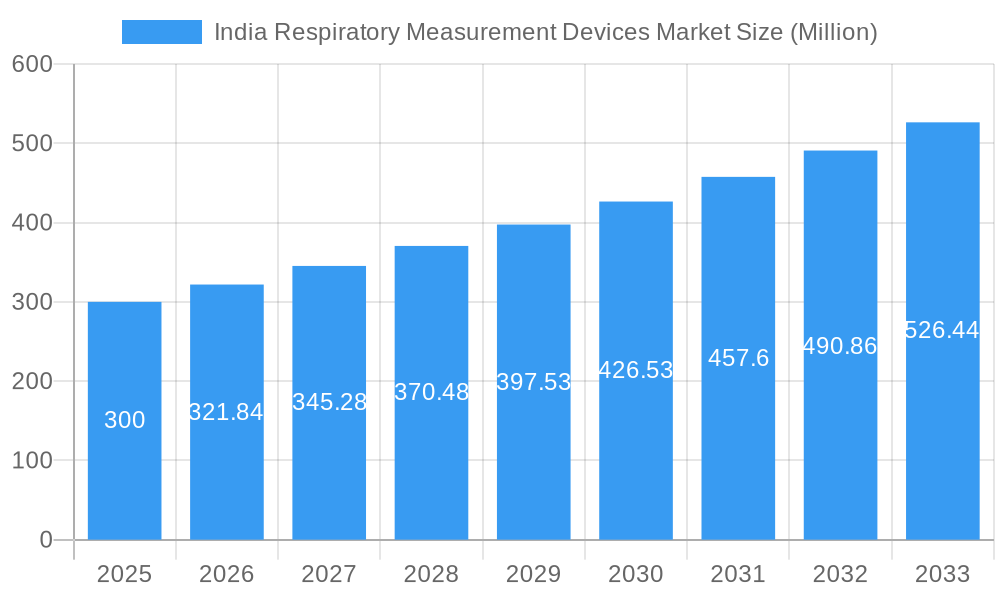

India Respiratory Measurement Devices Market Company Market Share

India Respiratory Measurement Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Respiratory Measurement Devices Market, offering actionable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report analyzes market dynamics, key segments, leading players, and future opportunities. The market is segmented by product type (Pulse Oximeters, Capnographs, Spirometers, Polysomnographs (PSG), Peak Flow Meters, Gas Analyzers, Others), indication (Sleep Apnea, COPD, Asthma, Infectious Disease, Others), and end-user (Home Care, Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Others). Key players include Devilbiss-AMS Healthcare, Hamilton Medical, Trivitron Healthcare, A B Industries, Cipla Inc, GE Healthcare, Medtronic PLC, AgVa Healthcare, Koninklijke Philips NV, Air Liquide Medical Systems India, ResMed Inc, and Fisher & Paykel Healthcare Ltd. The report projects a market size of xx Million by 2025 and a CAGR of xx% during the forecast period.

India Respiratory Measurement Devices Market Market Concentration & Dynamics

The India respiratory measurement devices market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller players and emerging startups fosters a dynamic competitive environment. Innovation in the sector is driven by technological advancements such as improved sensor technology, miniaturization, wireless connectivity, and data analytics integration within devices. The regulatory framework, primarily governed by the Central Drugs Standard Control Organisation (CDSCO), influences market access and product approvals. Substitute products, such as traditional diagnostic methods, present a degree of competitive pressure, though the accuracy and convenience offered by advanced devices often outweigh these alternatives. End-user trends reveal a shift towards home-based care, driven by rising healthcare costs and an aging population. Mergers and acquisitions (M&A) activities in the sector have been relatively moderate in recent years, with an estimated xx M&A deals in the historical period (2019-2024). Leading players are increasingly focusing on strategic partnerships and collaborations to expand their market reach and product portfolios.

- Market Share: Top 5 players account for approximately xx% of the market share in 2025.

- M&A Activity: xx M&A deals were recorded between 2019 and 2024.

- Regulatory Landscape: CDSCO regulations influence market entry and product approvals.

- Innovation Ecosystem: Technological advancements drive innovation within the sector.

India Respiratory Measurement Devices Market Industry Insights & Trends

The India respiratory measurement devices market is experiencing robust growth, fueled by a confluence of factors. The increasing prevalence of respiratory diseases such as asthma, COPD, and sleep apnea, alongside the rising geriatric population, is driving demand for these devices. Technological advancements, including the development of compact, user-friendly, and wirelessly connected devices, are enhancing market penetration. Furthermore, rising healthcare expenditure and increasing awareness about respiratory health are contributing to market expansion. The market witnessed significant growth during the historical period (2019-2024), with a CAGR of xx%, and is projected to maintain a healthy growth trajectory during the forecast period (2025-2033), reaching an estimated market value of xx Million by 2033. Changing consumer preferences, including a growing preference for non-invasive and home-based diagnostic solutions, are further shaping market dynamics. The rising adoption of telemedicine and remote patient monitoring is also expected to fuel market growth in the coming years.

Key Markets & Segments Leading India Respiratory Measurement Devices Market

The hospitals segment dominates the end-user landscape, owing to the higher concentration of patients requiring advanced respiratory diagnostic and monitoring capabilities within these settings. However, the home care segment is witnessing remarkable growth driven by the rising affordability and convenience of at-home respiratory monitoring devices. Among product types, Pulse Oximeters hold the largest market share due to their widespread use in both healthcare facilities and home care settings for monitoring oxygen saturation levels. The prevalence of COPD and asthma significantly contributes to the high demand for Spirometers and Peak Flow Meters.

- Dominant Segment: Hospitals constitute the largest end-user segment.

- Fastest Growing Segment: Home care segment is exhibiting the fastest growth rate.

- Leading Product Type: Pulse oximeters hold the largest market share.

- Growth Drivers:

- Increasing prevalence of respiratory diseases

- Rising geriatric population

- Technological advancements

- Rising healthcare expenditure

- Growing awareness about respiratory health

India Respiratory Measurement Devices Market Product Developments

Recent years have witnessed significant innovation in respiratory measurement devices, with a focus on improving accuracy, portability, and ease of use. Advancements in sensor technology, miniaturization, and wireless connectivity have resulted in smaller, more user-friendly devices. The incorporation of data analytics capabilities enables remote patient monitoring and facilitates better disease management. Manufacturers are also developing integrated solutions that combine multiple diagnostic capabilities into a single device, enhancing convenience for healthcare professionals and patients. The integration of AI and machine learning is further expected to advance the diagnostic capabilities and provide more insightful information for early disease detection and personalized treatment plans.

Challenges in the India Respiratory Measurement Devices Market Market

The India respiratory measurement devices market faces several challenges. High costs associated with advanced devices can limit accessibility, especially in underserved areas. Supply chain disruptions and the dependency on imported components can affect market stability. Stringent regulatory requirements and lengthy approval processes can delay product launches and market entry. Intense competition among established and emerging players further complicates the market landscape. The lack of awareness regarding the benefits of respiratory testing, particularly in rural communities, remains a considerable hurdle to overcome. These factors collectively contribute to market barriers and affect the overall growth potential.

Forces Driving India Respiratory Measurement Devices Market Growth

Technological advancements, primarily in sensor technology, miniaturization, and wireless connectivity, are major drivers of market growth. The rising prevalence of chronic respiratory diseases, including asthma, COPD, and sleep apnea, fuels demand for diagnostic and monitoring devices. Increasing healthcare expenditure and government initiatives to improve healthcare infrastructure create a favorable environment for market expansion. Growing awareness about respiratory health among the general population and increasing adoption of self-care practices contribute to a greater demand for home-based monitoring devices. Favorable government policies encouraging the development and adoption of medical devices further stimulate market growth.

Challenges in the India Respiratory Measurement Devices Market Market

Long-term growth catalysts for the India respiratory measurement devices market include the continuous development of innovative products, strategic partnerships and collaborations between manufacturers and healthcare providers, and market expansion into underserved regions. Government initiatives to improve healthcare access and affordability, coupled with rising investments in healthcare infrastructure, will contribute to sustained market growth. Increased awareness and adoption of remote patient monitoring and telehealth technologies are expected to positively influence market expansion in the long term.

Emerging Opportunities in India Respiratory Measurement Devices Market

Emerging opportunities lie in the expanding home care segment and the growing adoption of telehealth technologies. The development of more user-friendly and affordable devices tailored to the specific needs of the Indian population presents considerable potential. The integration of AI and machine learning for improved diagnostics and personalized treatment plans offers substantial prospects for innovation and market expansion. Expanding into rural and underserved areas through targeted public health initiatives offers significant untapped market potential.

Leading Players in the India Respiratory Measurement Devices Market Sector

- Devilbiss-AMS Healthcare

- Hamilton Medical

- Trivitron Healthcare

- A B Industries

- Cipla Inc

- GE Healthcare

- Medtronic PLC

- AgVa Healthcare

- Koninklijke Philips NV

- Air Liquide Medical Systems India

- ResMed Inc

- Fisher & Paykel Healthcare Ltd

Key Milestones in India Respiratory Measurement Devices Market Industry

- October 2022: AirPhysio partnered with Apollo Hospitals Group and Medsmart to launch respiratory devices in India.

- November 2022: Xplore Health Technologies launched Airofit PRO, a respiratory muscle training (RMT) device, in collaboration with Airofit, Denmark.

Strategic Outlook for India Respiratory Measurement Devices Market Market

The India respiratory measurement devices market holds significant growth potential driven by favorable demographics, increasing disease prevalence, and technological advancements. Strategic opportunities exist for companies to focus on product innovation, expansion into underserved markets, and the development of integrated telehealth solutions. Partnerships with healthcare providers and government initiatives to improve healthcare access will be crucial for market penetration and success. Focusing on affordability and user-friendliness will be key factors in expanding market access and achieving sustainable growth.

India Respiratory Measurement Devices Market Segmentation

-

1. Type

-

1.1. Diagnostic and Monitoring Devices

- 1.1.1. Spirometers

- 1.1.2. Sleep Test Devices

- 1.1.3. Peak Flow Meters

- 1.1.4. Pulse Oximeters

- 1.1.5. Capnographs

- 1.1.6. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic Devices

- 1.2.1. CPAP Devices

- 1.2.2. BiPAP Devices

- 1.2.3. Humidifiers

- 1.2.4. Nebulizers

- 1.2.5. Oxygen Concentrators

- 1.2.6. Ventilators

- 1.2.7. Inhalers

- 1.2.8. Other Therapeutic Devices

-

1.3. Disposables

- 1.3.1. Masks

- 1.3.2. Breathing Circuits

- 1.3.3. Other Disposables

-

1.1. Diagnostic and Monitoring Devices

India Respiratory Measurement Devices Market Segmentation By Geography

- 1. India

India Respiratory Measurement Devices Market Regional Market Share

Geographic Coverage of India Respiratory Measurement Devices Market

India Respiratory Measurement Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Prevalence of Respiratory Disorders

- 3.2.2 such as COPD

- 3.2.3 TB

- 3.2.4 Asthma

- 3.2.5 and Sleep Apnea; Technological Advancements and Increasing Applications in Home care Settings

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Spirometers is Anticipated to Have Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Respiratory Measurement Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.1.1. Spirometers

- 5.1.1.2. Sleep Test Devices

- 5.1.1.3. Peak Flow Meters

- 5.1.1.4. Pulse Oximeters

- 5.1.1.5. Capnographs

- 5.1.1.6. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic Devices

- 5.1.2.1. CPAP Devices

- 5.1.2.2. BiPAP Devices

- 5.1.2.3. Humidifiers

- 5.1.2.4. Nebulizers

- 5.1.2.5. Oxygen Concentrators

- 5.1.2.6. Ventilators

- 5.1.2.7. Inhalers

- 5.1.2.8. Other Therapeutic Devices

- 5.1.3. Disposables

- 5.1.3.1. Masks

- 5.1.3.2. Breathing Circuits

- 5.1.3.3. Other Disposables

- 5.1.1. Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Devilbiss-AMS Healthcare

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hamilton Medical

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trivitron Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 A B Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cipla Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GE Healthcare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AgVa Healthcare

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koninklijke Philips NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Air Liquide Medical Systems India

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ResMed Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Fisher & Paykel Healthcare Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Devilbiss-AMS Healthcare

List of Figures

- Figure 1: India Respiratory Measurement Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Respiratory Measurement Devices Market Share (%) by Company 2025

List of Tables

- Table 1: India Respiratory Measurement Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Respiratory Measurement Devices Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: India Respiratory Measurement Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Respiratory Measurement Devices Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: India Respiratory Measurement Devices Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: India Respiratory Measurement Devices Market Volume K Units Forecast, by Type 2020 & 2033

- Table 7: India Respiratory Measurement Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: India Respiratory Measurement Devices Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Respiratory Measurement Devices Market?

The projected CAGR is approximately 7.12%.

2. Which companies are prominent players in the India Respiratory Measurement Devices Market?

Key companies in the market include Devilbiss-AMS Healthcare, Hamilton Medical, Trivitron Healthcare, A B Industries, Cipla Inc, GE Healthcare, Medtronic PLC, AgVa Healthcare, Koninklijke Philips NV, Air Liquide Medical Systems India, ResMed Inc, Fisher & Paykel Healthcare Ltd.

3. What are the main segments of the India Respiratory Measurement Devices Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 300 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Respiratory Disorders. such as COPD. TB. Asthma. and Sleep Apnea; Technological Advancements and Increasing Applications in Home care Settings.

6. What are the notable trends driving market growth?

Spirometers is Anticipated to Have Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices.

8. Can you provide examples of recent developments in the market?

November 2022 : Xplore Health Technologies launched a first-of-its-kind respiratory muscle training (RMT) device called Airofit PRO in collaboration with Airofit, Denmark.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Respiratory Measurement Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Respiratory Measurement Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Respiratory Measurement Devices Market?

To stay informed about further developments, trends, and reports in the India Respiratory Measurement Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence