Key Insights

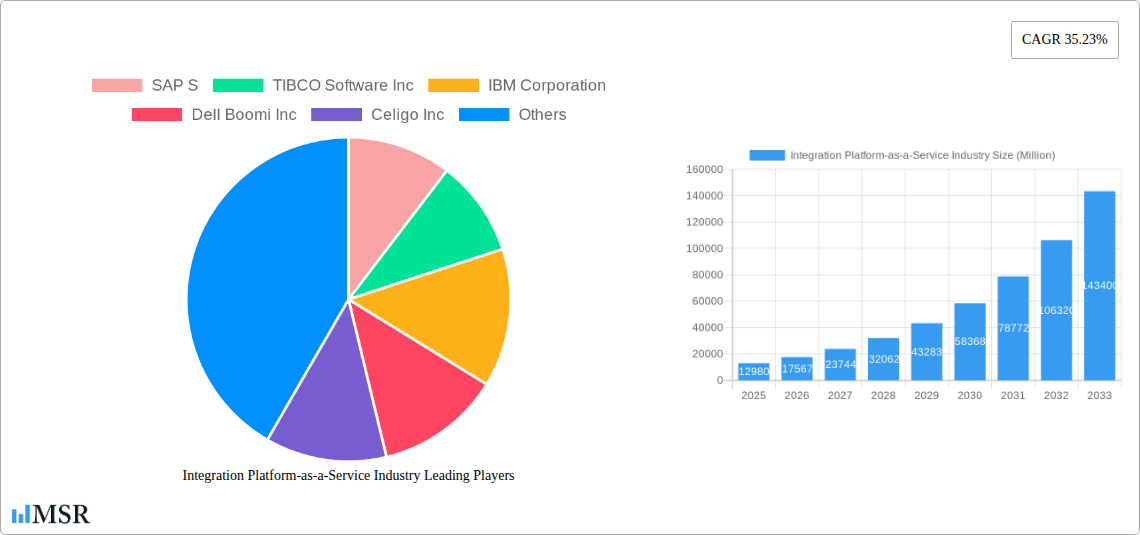

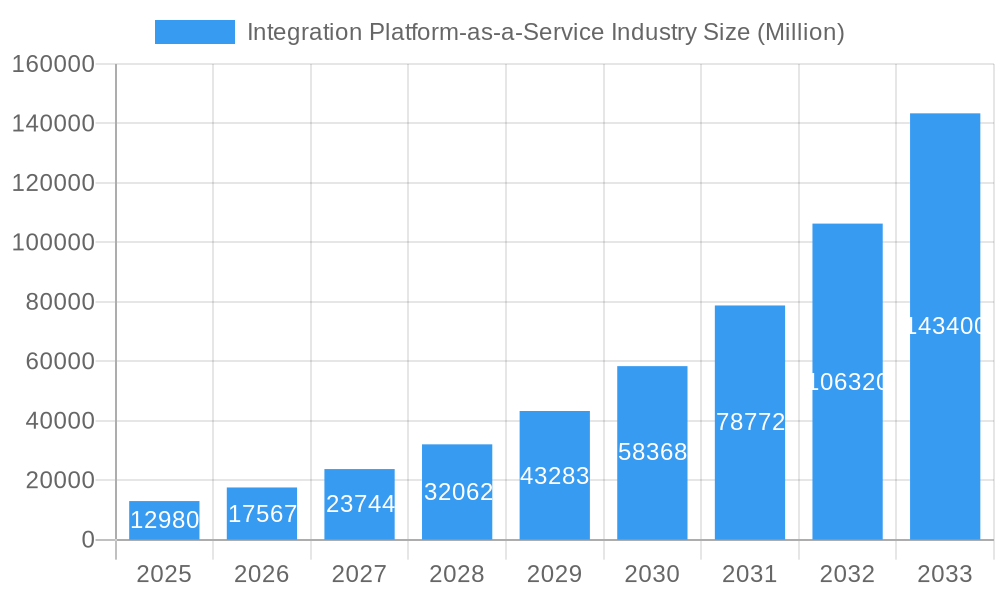

The Integration Platform-as-a-Service (iPaaS) market is experiencing robust growth, projected to reach \$12.98 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 35.23%. This expansion is fueled by several key factors. The increasing adoption of cloud-based solutions across various industries, particularly BFSI (Banking, Financial Services, and Insurance), Retail & E-commerce, and Healthcare & Life Sciences, is a major driver. Businesses are seeking to streamline their operations, improve data integration efficiency, and enhance agility, all of which iPaaS solutions effectively address. Furthermore, the rise of hybrid cloud environments and the need for secure and scalable integration solutions are contributing significantly to market growth. The competitive landscape is vibrant, with major players like SAP, TIBCO, IBM, Dell Boomi, and MuleSoft vying for market share through continuous innovation and strategic acquisitions. The market is segmented by deployment model (public, private, hybrid cloud) and end-user vertical, reflecting the diverse applications of iPaaS across various sectors.

Integration Platform-as-a-Service Industry Market Size (In Billion)

Looking ahead, the iPaaS market is poised for continued expansion throughout the forecast period (2025-2033). Technological advancements, such as the integration of artificial intelligence (AI) and machine learning (ML) capabilities within iPaaS platforms, will further enhance efficiency and automate complex integration processes. The increasing demand for real-time data integration and improved data governance will also drive adoption. While challenges such as security concerns and the complexity of integrating legacy systems remain, the overall market outlook is positive, with substantial opportunities for growth and innovation. The geographical distribution of the market is expected to see continued growth across North America, Europe, and the Asia-Pacific region, with emerging markets also showing promising potential.

Integration Platform-as-a-Service Industry Company Market Share

Integration Platform-as-a-Service (iPaaS) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Integration Platform-as-a-Service (iPaaS) market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a robust understanding of market dynamics, key players, and future trends. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Integration Platform-as-a-Service Industry Market Concentration & Dynamics

The iPaaS market exhibits a moderately concentrated landscape, with several major players holding significant market share. Key players such as SAP, IBM, Oracle, and MuleSoft compete intensely, driving innovation and shaping market dynamics. However, numerous smaller, specialized iPaaS providers also contribute significantly, creating a diverse ecosystem. Market share analysis reveals that SAP holds approximately xx% of the market, followed by IBM with xx%, Oracle with xx%, and MuleSoft with xx%. The remaining share is distributed among other players like TIBCO, Dell Boomi, Celigo, Jitterbit, Informatica, and Snaplogic.

M&A activity in the iPaaS sector has been robust, with over xx deals recorded between 2019 and 2024. These acquisitions primarily aimed at expanding product portfolios, strengthening technological capabilities, and securing access to new markets. Regulatory frameworks, while generally supportive of cloud adoption, vary across regions, impacting market penetration and compliance requirements. The increasing demand for seamless data integration across diverse systems fuels market growth, while competing technologies like traditional Enterprise Service Buses (ESBs) present ongoing challenges. End-user trends indicate a strong preference for cloud-based iPaaS solutions due to their scalability, flexibility, and cost-effectiveness.

Integration Platform-as-a-Service Industry Industry Insights & Trends

The iPaaS market is experiencing significant growth driven by the increasing adoption of cloud computing, the proliferation of data, and the need for real-time data integration. The global shift towards digital transformation across various industries fuels the demand for robust iPaaS solutions. Technological disruptions, such as advancements in artificial intelligence (AI) and machine learning (ML), are further enhancing the capabilities of iPaaS platforms, enabling smarter automation and improved data integration processes. Evolving consumer behaviors, characterized by a greater preference for personalized experiences and seamless digital interactions, are creating a compelling need for integrated systems and enhanced data management.

The market size is estimated at xx Million in 2025, with a projected value of xx Million by 2033. This represents a significant growth trajectory, propelled by factors like the rising adoption of cloud-native applications, the increasing complexity of IT infrastructure, and the need for better data governance. The market's CAGR during this period is expected to be approximately xx%. Furthermore, the expanding ecosystem of cloud-based applications necessitates robust integration capabilities, further bolstering iPaaS market growth.

Key Markets & Segments Leading Integration Platform-as-a-Service Industry

The Public Cloud segment currently dominates the iPaaS market, accounting for approximately xx% of the overall revenue in 2025, driven by its scalability, cost-effectiveness, and ease of deployment. However, the Hybrid Cloud segment is rapidly gaining traction, with an estimated xx% market share, as organizations seek to combine the benefits of both public and private cloud environments. The Private Cloud segment holds a smaller market share of xx%, primarily driven by organizations with stringent security and compliance requirements.

By End-user Vertical:

- BFSI (Banking, Financial Services, and Insurance): This sector experiences strong growth due to the high volume of data processed and the need for secure and efficient data integration across various financial systems. Drivers include increasing regulatory compliance demands and the need for enhanced customer experiences.

- Retail & E-commerce: The rapid expansion of e-commerce and the increasing complexity of supply chains fuel iPaaS adoption in this segment. Growth is driven by the need for real-time inventory management, efficient order fulfillment, and personalized customer experiences.

- Healthcare and Life Science: Data integration is crucial in healthcare for managing patient records, facilitating research, and ensuring seamless data exchange between healthcare providers. Regulatory compliance and the growing adoption of telehealth contribute to market growth.

- Manufacturing: Smart factories and Industry 4.0 initiatives rely heavily on seamless data integration across various systems. iPaaS solutions help optimize production processes, enhance supply chain visibility, and improve operational efficiency.

- IT & Telecom: The need for seamless integration of various IT systems and services, along with the increasing adoption of cloud-based services in this sector drives significant iPaaS demand.

- Media & Entertainment: Efficient content management, distribution, and personalized customer experiences necessitate data integration, fueling growth in this segment.

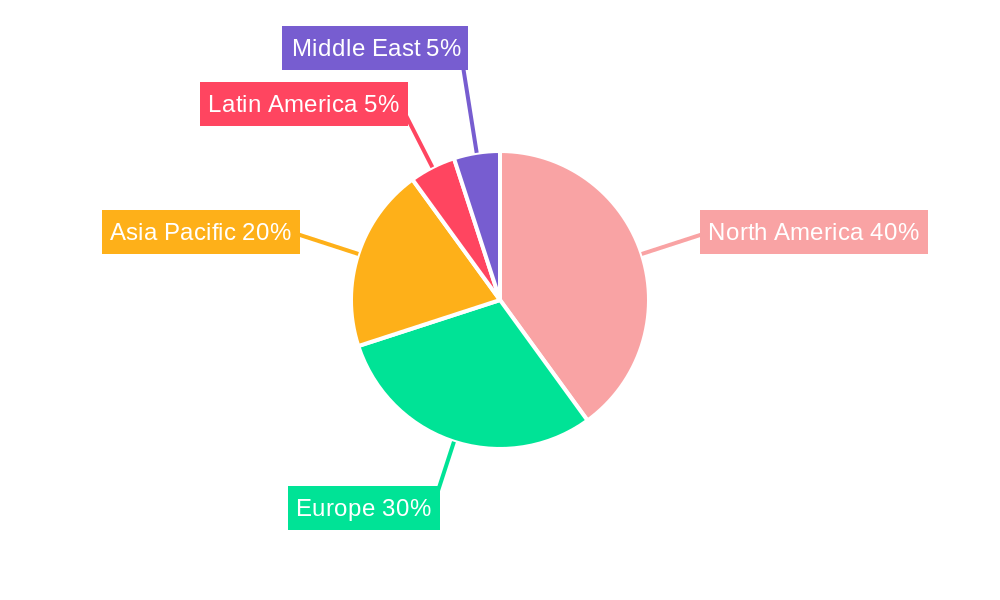

North America currently leads the iPaaS market, followed by Europe, and then Asia-Pacific, with the fastest growth anticipated in Asia-Pacific due to the rapid adoption of cloud computing and digital transformation initiatives across various industries.

Integration Platform-as-a-Service Industry Product Developments

Recent product innovations in the iPaaS space include advancements in AI-powered automation, enhanced security features, and improved integration capabilities with various cloud and on-premise applications. These innovations enhance efficiency, improve data management, and provide organizations with better control over their integration processes. The competitive landscape is marked by a focus on user-friendly interfaces, robust support, and integrations with leading cloud platforms like AWS, Azure, and GCP, granting competitive advantages to the frontrunners.

Challenges in the Integration Platform-as-a-Service Industry Market

Several challenges hinder iPaaS market growth. Data security and privacy concerns remain significant, influencing investment decisions and requiring robust security measures. The complexity of integration projects and the need for skilled professionals also present obstacles. Furthermore, integrating legacy systems with modern cloud applications can be complex and costly, posing a hurdle to wider adoption. Finally, competitive pressures from both established players and emerging startups necessitate continuous innovation and adaptability. These factors cumulatively reduce the market penetration rate by approximately xx%.

Forces Driving Integration Platform-as-a-Service Industry Growth

The iPaaS market's growth is fueled by several key factors. The increasing adoption of cloud-based applications, the demand for real-time data integration, and the growing need for streamlined business processes are major drivers. Technological advancements, such as AI and ML, improve the capabilities of iPaaS platforms, enhancing efficiency and automation. Favorable government regulations and policies promoting digital transformation further accelerate market expansion. The rising volume and velocity of data generated across various industries necessitate the use of efficient iPaaS solutions.

Long-Term Growth Catalysts in the Integration Platform-as-a-Service Industry Market

Long-term growth in the iPaaS market will be driven by continuous innovation in areas such as AI-driven automation, serverless architecture integration, and enhanced security capabilities. Strategic partnerships between iPaaS providers and other technology companies will expand market reach and create new opportunities. The expansion into emerging markets and the increasing demand for data integration in industries like healthcare and manufacturing will also contribute to long-term growth.

Emerging Opportunities in Integration Platform-as-a-Service Industry

Emerging opportunities include the growing adoption of iPaaS in niche industries, the development of specialized iPaaS solutions for specific industry needs, and the integration of emerging technologies such as blockchain and IoT. The market is also seeing a rise in low-code/no-code iPaaS platforms, allowing businesses to build and manage integrations with minimal coding expertise. This trend expands the addressable market and facilitates faster integration implementation.

Leading Players in the Integration Platform-as-a-Service Industry Sector

Key Milestones in Integration Platform-as-a-Service Industry Industry

- December 2022: Internet Initiative Japan Inc. launched its IIJ Cloud Data Platform Service, a data integration service leveraging cloud technology to facilitate data utilization without affecting existing systems. This signifies the growing adoption of iPaaS in the Asia-Pacific region.

- October 2022: Virtuoso Partners expanded its capabilities into iPaaS by partnering with Workato. This collaboration highlights the increasing importance of partnerships and strategic alliances in the iPaaS market to broaden reach and service offerings.

Strategic Outlook for Integration Platform-as-a-Service Industry Market

The iPaaS market exhibits considerable future potential, driven by the continuous growth of cloud computing, the increasing demand for data integration, and the emergence of new technologies. Strategic opportunities exist in expanding into niche markets, developing innovative solutions, and fostering strategic partnerships. The focus on enhancing security, improving user experience, and addressing the needs of diverse industries will shape the future of the iPaaS market. The market is poised for substantial growth, presenting significant opportunities for both established players and new entrants.

Integration Platform-as-a-Service Industry Segmentation

-

1. Deployment Model

- 1.1. Public Cloud

- 1.2. Private Cloud

- 1.3. Hybrid Cloud

-

2. End-user Vertical

- 2.1. BFSI

- 2.2. Retail & E-commerce

- 2.3. Healthcare and Life Science

- 2.4. Manufacturing

- 2.5. IT & Telecom

- 2.6. Media & Entertainment

Integration Platform-as-a-Service Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Integration Platform-as-a-Service Industry Regional Market Share

Geographic Coverage of Integration Platform-as-a-Service Industry

Integration Platform-as-a-Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 35.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Convergence of IoT and AI Technologies; Increasing Demand From Organizations to Streamline Business Processes

- 3.3. Market Restrains

- 3.3.1. Increased Competition in the Market

- 3.4. Market Trends

- 3.4.1. Retail & E-commerce to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Integration Platform-as-a-Service Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Model

- 5.1.1. Public Cloud

- 5.1.2. Private Cloud

- 5.1.3. Hybrid Cloud

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. BFSI

- 5.2.2. Retail & E-commerce

- 5.2.3. Healthcare and Life Science

- 5.2.4. Manufacturing

- 5.2.5. IT & Telecom

- 5.2.6. Media & Entertainment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Model

- 6. North America Integration Platform-as-a-Service Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Model

- 6.1.1. Public Cloud

- 6.1.2. Private Cloud

- 6.1.3. Hybrid Cloud

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. BFSI

- 6.2.2. Retail & E-commerce

- 6.2.3. Healthcare and Life Science

- 6.2.4. Manufacturing

- 6.2.5. IT & Telecom

- 6.2.6. Media & Entertainment

- 6.1. Market Analysis, Insights and Forecast - by Deployment Model

- 7. Europe Integration Platform-as-a-Service Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Model

- 7.1.1. Public Cloud

- 7.1.2. Private Cloud

- 7.1.3. Hybrid Cloud

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. BFSI

- 7.2.2. Retail & E-commerce

- 7.2.3. Healthcare and Life Science

- 7.2.4. Manufacturing

- 7.2.5. IT & Telecom

- 7.2.6. Media & Entertainment

- 7.1. Market Analysis, Insights and Forecast - by Deployment Model

- 8. Asia Integration Platform-as-a-Service Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Model

- 8.1.1. Public Cloud

- 8.1.2. Private Cloud

- 8.1.3. Hybrid Cloud

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. BFSI

- 8.2.2. Retail & E-commerce

- 8.2.3. Healthcare and Life Science

- 8.2.4. Manufacturing

- 8.2.5. IT & Telecom

- 8.2.6. Media & Entertainment

- 8.1. Market Analysis, Insights and Forecast - by Deployment Model

- 9. Latin America Integration Platform-as-a-Service Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Model

- 9.1.1. Public Cloud

- 9.1.2. Private Cloud

- 9.1.3. Hybrid Cloud

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. BFSI

- 9.2.2. Retail & E-commerce

- 9.2.3. Healthcare and Life Science

- 9.2.4. Manufacturing

- 9.2.5. IT & Telecom

- 9.2.6. Media & Entertainment

- 9.1. Market Analysis, Insights and Forecast - by Deployment Model

- 10. Middle East and Africa Integration Platform-as-a-Service Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Model

- 10.1.1. Public Cloud

- 10.1.2. Private Cloud

- 10.1.3. Hybrid Cloud

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. BFSI

- 10.2.2. Retail & E-commerce

- 10.2.3. Healthcare and Life Science

- 10.2.4. Manufacturing

- 10.2.5. IT & Telecom

- 10.2.6. Media & Entertainment

- 10.1. Market Analysis, Insights and Forecast - by Deployment Model

- 11. North America Integration Platform-as-a-Service Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Integration Platform-as-a-Service Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Integration Platform-as-a-Service Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Integration Platform-as-a-Service Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Integration Platform-as-a-Service Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 SAP S

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 TIBCO Software Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 IBM Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Dell Boomi Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Celigo Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Jitterbit Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Oracle Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Mulesoft Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Informatica Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Snaplogic Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 SAP S

List of Figures

- Figure 1: Global Integration Platform-as-a-Service Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Integration Platform-as-a-Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Integration Platform-as-a-Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Integration Platform-as-a-Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Integration Platform-as-a-Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Integration Platform-as-a-Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Integration Platform-as-a-Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Latin America Integration Platform-as-a-Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Latin America Integration Platform-as-a-Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Middle East Integration Platform-as-a-Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: Middle East Integration Platform-as-a-Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Integration Platform-as-a-Service Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 13: North America Integration Platform-as-a-Service Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 14: North America Integration Platform-as-a-Service Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 15: North America Integration Platform-as-a-Service Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: North America Integration Platform-as-a-Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Integration Platform-as-a-Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Integration Platform-as-a-Service Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 19: Europe Integration Platform-as-a-Service Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 20: Europe Integration Platform-as-a-Service Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 21: Europe Integration Platform-as-a-Service Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 22: Europe Integration Platform-as-a-Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 23: Europe Integration Platform-as-a-Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 24: Asia Integration Platform-as-a-Service Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 25: Asia Integration Platform-as-a-Service Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 26: Asia Integration Platform-as-a-Service Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 27: Asia Integration Platform-as-a-Service Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 28: Asia Integration Platform-as-a-Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 29: Asia Integration Platform-as-a-Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 30: Latin America Integration Platform-as-a-Service Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 31: Latin America Integration Platform-as-a-Service Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 32: Latin America Integration Platform-as-a-Service Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 33: Latin America Integration Platform-as-a-Service Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 34: Latin America Integration Platform-as-a-Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 35: Latin America Integration Platform-as-a-Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 36: Middle East and Africa Integration Platform-as-a-Service Industry Revenue (Million), by Deployment Model 2025 & 2033

- Figure 37: Middle East and Africa Integration Platform-as-a-Service Industry Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 38: Middle East and Africa Integration Platform-as-a-Service Industry Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Middle East and Africa Integration Platform-as-a-Service Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East and Africa Integration Platform-as-a-Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Integration Platform-as-a-Service Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 3: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 6: Integration Platform-as-a-Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Integration Platform-as-a-Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Integration Platform-as-a-Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Integration Platform-as-a-Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Integration Platform-as-a-Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 16: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 17: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 19: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 22: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 23: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 25: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 26: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Deployment Model 2020 & 2033

- Table 28: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global Integration Platform-as-a-Service Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Integration Platform-as-a-Service Industry?

The projected CAGR is approximately 35.23%.

2. Which companies are prominent players in the Integration Platform-as-a-Service Industry?

Key companies in the market include SAP S, TIBCO Software Inc, IBM Corporation, Dell Boomi Inc, Celigo Inc, Jitterbit Inc, Oracle Corporation, Mulesoft Inc, Informatica Corporation, Snaplogic Inc.

3. What are the main segments of the Integration Platform-as-a-Service Industry?

The market segments include Deployment Model, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Convergence of IoT and AI Technologies; Increasing Demand From Organizations to Streamline Business Processes.

6. What are the notable trends driving market growth?

Retail & E-commerce to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increased Competition in the Market.

8. Can you provide examples of recent developments in the market?

December 2022 - Internet Initiative Japan Inc., one of the providers of leading Internet access and comprehensive network solutions providers in Japan, declared that it would start delivering the IIJ Cloud Data Platform Service, a data integration service that facilitates data utilization using the cloud. By aggregating data flowing between on-premise procedures and cloud services on this service platform, required data can be extracted without influencing existing systems, and data can be well integrated with cloud services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Integration Platform-as-a-Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Integration Platform-as-a-Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Integration Platform-as-a-Service Industry?

To stay informed about further developments, trends, and reports in the Integration Platform-as-a-Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence