Key Insights

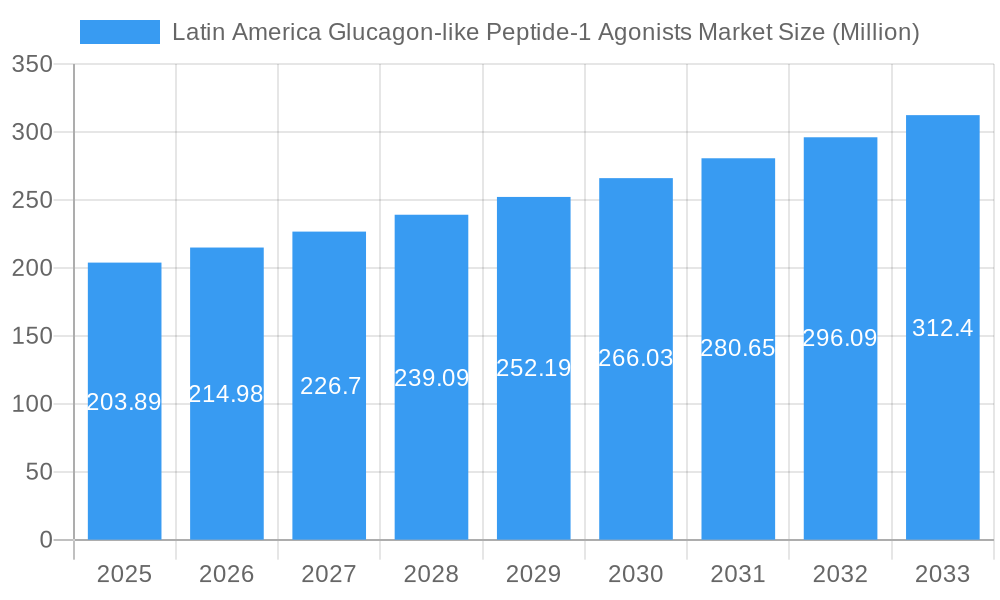

The Latin America Glucagon-like Peptide-1 (GLP-1) Agonists Market is poised for substantial expansion, projected to reach approximately USD 203.89 million by 2025. This growth is propelled by a robust Compound Annual Growth Rate (CAGR) of 5.50% over the forecast period of 2025-2033. The market is primarily driven by the increasing prevalence of type 2 diabetes and obesity across Latin America, coupled with a growing awareness and adoption of advanced therapeutic options like GLP-1 agonists. Factors such as rising healthcare expenditure, an aging population, and the introduction of innovative drug formulations are further fueling market momentum. Key drug segments including Semaglutide, Liraglutide, Dulaglutide, Exenatide, and Lixisenatide are expected to witness significant demand as healthcare providers and patients increasingly recognize their efficacy in managing glycemic control and promoting weight loss.

Latin America Glucagon-like Peptide-1 Agonists Market Market Size (In Million)

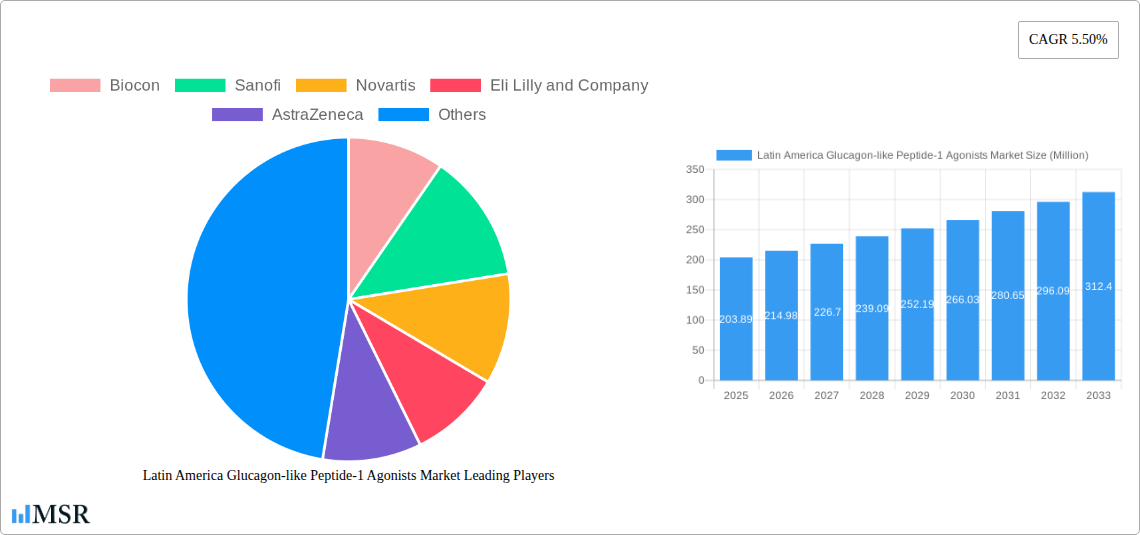

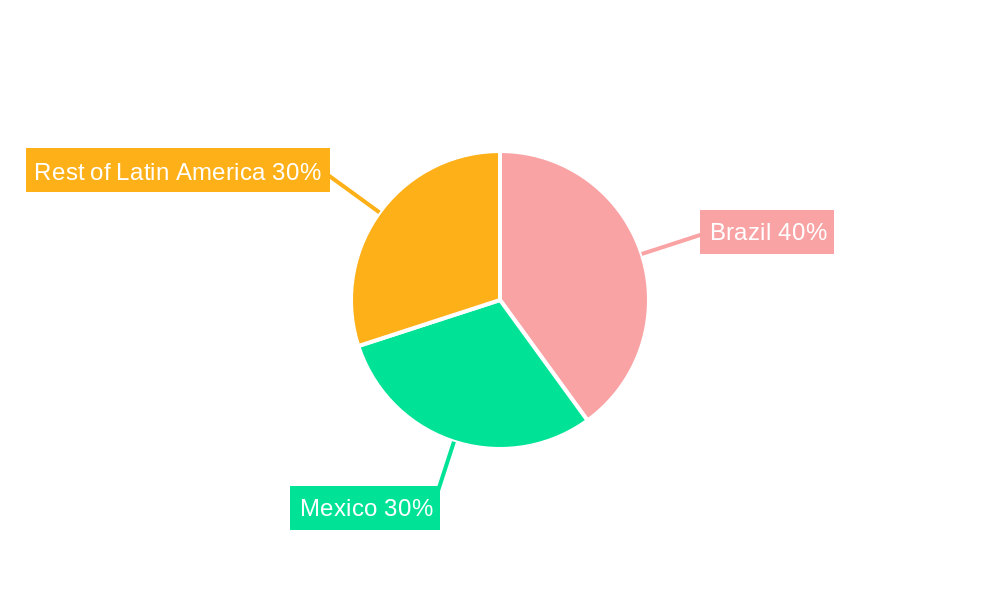

Geographically, Brazil, Mexico, and the Rest of Latin America are the key regions contributing to the market's growth. Brazil, with its large population and significant burden of metabolic diseases, is anticipated to be a leading market. Mexico also presents considerable opportunities due to its increasing healthcare infrastructure and rising disposable incomes. The competitive landscape is characterized by the presence of major pharmaceutical players such as Novo Nordisk, Eli Lilly and Company, AstraZeneca, Sanofi, Novartis, and Biocon, who are actively investing in research and development and expanding their market presence. The market is expected to benefit from ongoing clinical trials and the potential for new product launches, further stimulating innovation and competition. However, factors such as high treatment costs and limited reimbursement policies in certain sub-regions could pose challenges to the market's full potential.

Latin America Glucagon-like Peptide-1 Agonists Market Company Market Share

Latin America Glucagon-like Peptide-1 Agonists Market: Comprehensive Growth Forecast & Industry Dynamics (2019–2033)

This in-depth report provides a definitive analysis of the Latin America Glucagon-like Peptide-1 (GLP-1) agonists market, exploring key trends, market size, competitive landscape, and future projections from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study offers crucial insights for pharmaceutical companies, healthcare providers, investors, and policymakers navigating this rapidly evolving segment. Discover the strategic imperatives and growth catalysts shaping the Latin American GLP-1 market, driven by increasing prevalence of type 2 diabetes and obesity, coupled with advancements in therapeutic innovation.

Latin America Glucagon-like Peptide-1 Agonists Market Market Concentration & Dynamics

The Latin America GLP-1 agonists market exhibits a moderate to high concentration, primarily dominated by key global pharmaceutical giants. Innovation ecosystems are robust, with significant investment in research and development for novel GLP-1 receptor agonists and dual/triple agonists addressing metabolic disorders. Regulatory frameworks across Latin America are gradually aligning with global standards, facilitating market access for innovative therapies, though variations persist. Substitute products, including older antidiabetic classes and bariatric surgery, present competition, but the superior efficacy and broader applications of GLP-1 agonists in weight management are increasingly recognized. End-user trends highlight a growing demand for convenient, effective, and comprehensive treatment options for type 2 diabetes and obesity, with a particular focus on patient outcomes and quality of life. Mergers and acquisitions (M&A) activities are anticipated to remain a significant avenue for strategic consolidation and market expansion, with potential for localized partnerships to enhance distribution and market penetration. Historical M&A deal counts are estimated at xx, with a projected increase in the forecast period. Market share is heavily influenced by the success of blockbuster drugs, with Novo Nordisk and Eli Lilly and Company holding substantial positions.

Latin America Glucagon-like Peptide-1 Agonists Market Industry Insights & Trends

The Latin America GLP-1 agonists market is poised for substantial growth, driven by a confluence of compelling factors. The escalating prevalence of type 2 diabetes and obesity across the region presents a vast and underserved patient population, creating a significant demand for effective therapeutic solutions. For instance, Brazil and Mexico, two of the largest economies in Latin America, are witnessing alarming rises in metabolic diseases. Technological disruptions, particularly in the development of novel GLP-1 receptor agonists and dual/triple agonists, are revolutionizing treatment paradigms. These advancements offer improved efficacy, enhanced safety profiles, and more convenient dosing regimens, such as once-weekly injections, which are highly valued by patients. Evolving consumer behaviors also play a crucial role, with an increasing emphasis on proactive health management, preventative care, and a desire for treatments that not only manage chronic conditions but also improve overall well-being, including weight loss.

The market size for Latin America GLP-1 agonists is projected to reach approximately $3,500 million in 2025, with an estimated Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period of 2025–2033. This robust growth is fueled by the expanding indications for GLP-1 agonists, moving beyond glycemic control to encompass significant cardiovascular benefits and substantial weight management capabilities. The U.S. FDA's approval of Zepbound (tirzepatide) for chronic weight management in November 2023, and Eli Lilly and Company's Mounjaro (tirzepatide) in May 2022 for type 2 diabetes, are pivotal developments that are expected to influence market dynamics in Latin America as these therapies become more accessible. Furthermore, the promising results from clinical trials, such as Novo Nordisk's Phase 2 trial with CagriSema in August 2022, indicate a pipeline of innovative combination therapies that could further broaden the therapeutic landscape and drive market expansion. The increasing healthcare expenditure in key Latin American countries, coupled with a growing awareness of the long-term economic burden of untreated metabolic diseases, further underpins the optimistic growth trajectory for the GLP-1 agonists market in Latin America.

Key Markets & Segments Leading Latin America Glucagon-like Peptide-1 Agonists Market

The Latin America GLP-1 agonists market is characterized by distinct regional and drug segment dominance. Brazil stands out as the leading market, driven by its large population, high prevalence of type 2 diabetes and obesity, and a growing healthcare infrastructure capable of supporting advanced therapies. The country’s increasing healthcare expenditure and government initiatives aimed at managing chronic diseases further bolster its market leadership. Mexico follows as another significant market, exhibiting similar growth drivers, including a substantial patient pool and a progressively expanding pharmaceutical market. The Rest of Latin America, encompassing countries like Argentina, Colombia, and Chile, collectively represents a growing segment with untapped potential, fueled by improving economic conditions and increasing access to advanced medical treatments.

Within the Drugs segment, Semaglutide has emerged as a dominant force, owing to its proven efficacy in glycemic control and significant weight loss potential. Its broad approval for type 2 diabetes and its growing role in weight management are key drivers of its market share. Liraglutide and Dulaglutide also hold substantial market presence, offering established treatment options for type 2 diabetes. Exenatide and Lixisenatide, while having established roles, are facing increasing competition from newer, more advanced GLP-1 agonists. The increasing recognition of GLP-1 agonists for their cardiovascular benefits and weight management applications is a critical factor driving the growth of drugs like Semaglutide and the anticipated impact of tirzepatide-based therapies as they gain regulatory approvals and market penetration across the region.

Dominant Geography Drivers:

- Brazil: Large population base, high incidence of type 2 diabetes and obesity, robust healthcare infrastructure, increasing healthcare expenditure, and government focus on chronic disease management.

- Mexico: Significant patient population, growing obesity rates, expanding pharmaceutical market, and increasing adoption of advanced therapies.

- Rest of Latin America: Emerging economies with improving healthcare access, rising disposable incomes, and a growing awareness of metabolic health.

Dominant Drug Segment Drivers:

- Semaglutide: Superior efficacy in glycemic control and weight management, broad therapeutic indications, and strong clinical trial data.

- Liraglutide & Dulaglutide: Established efficacy and safety profiles, wide availability, and existing market share in type 2 diabetes management.

- Tirzepatide (as it gains traction): Dual agonist mechanism offering enhanced efficacy for both glycemic control and weight loss, creating significant market potential.

The interplay between these geographical markets and drug segments creates a dynamic landscape. The ongoing development and introduction of new GLP-1 agonists and related therapies, coupled with the increasing understanding of their benefits beyond diabetes, are expected to further reshape the market's trajectory, with a sustained demand for innovative and effective treatment options.

Latin America Glucagon-like Peptide-1 Agonists Market Product Developments

Product developments in the Latin America GLP-1 agonists market are characterized by a strong focus on enhancing therapeutic efficacy, improving patient convenience, and expanding indications. The approval of tirzepatide-based therapies in major markets is a significant advancement, offering a novel dual agonist mechanism for both type 2 diabetes and chronic weight management. Innovations like once-weekly formulations continue to be a key competitive edge, addressing patient adherence and simplifying treatment regimens. The exploration of combination therapies, such as the investigational CagriSema, signifies a move towards more potent and comprehensive metabolic disease management. These developments are crucial for capturing market share and addressing the unmet needs of a growing patient population struggling with chronic conditions like type 2 diabetes and obesity.

Challenges in the Latin America Glucagon-like Peptide-1 Agonists Market Market

The Latin America GLP-1 agonists market faces several critical challenges that can impede its growth trajectory. High drug costs remain a significant barrier, limiting access for a substantial portion of the population, particularly in lower-income segments and countries with less robust public healthcare coverage. Regulatory hurdles and varying approval timelines across different Latin American countries can also cause delays in market entry and adoption. Supply chain complexities and the need for robust cold chain logistics for injectable medications present logistical challenges. Furthermore, intense competition from established generic antidiabetic drugs and the emergence of biosimil products in the future will exert pricing pressures. The economic volatility in some Latin American nations can also impact healthcare spending and pharmaceutical market growth.

Forces Driving Latin America Glucagon-like Peptide-1 Agonists Market Growth

Several key forces are propelling the growth of the Latin America GLP-1 agonists market. The escalating epidemic of type 2 diabetes and obesity across the region is a primary demand driver, creating a substantial and growing patient pool requiring effective treatments. Technological advancements in drug discovery and development have led to the introduction of more efficacious and patient-friendly GLP-1 agonists, including once-weekly formulations and dual/triple agonists, offering superior outcomes. Increasing healthcare expenditure and a growing emphasis on managing chronic diseases at both governmental and individual levels contribute to market expansion. Furthermore, the expanding evidence base showcasing the cardiovascular benefits and significant weight loss potential of GLP-1 agonists is broadening their therapeutic applications beyond glycemic control, attracting a wider patient and prescriber base.

Challenges in the Latin America Glucagon-like Peptide-1 Agonists Market Market

Long-term growth catalysts for the Latin America GLP-1 agonists market are deeply intertwined with continued innovation and strategic market penetration. The ongoing development of next-generation GLP-1 receptor agonists, including those with enhanced efficacy, novel delivery mechanisms, and improved side-effect profiles, will be crucial for sustained growth. Partnerships between global pharmaceutical companies and local distributors or manufacturers could facilitate market access and address logistical challenges specific to the region. Expanding the approved indications for GLP-1 agonists to encompass a wider range of metabolic and cardiovascular conditions will further unlock market potential. Moreover, a growing focus on patient education and support programs can enhance adherence and improve long-term patient outcomes, solidifying the market's value proposition.

Emerging Opportunities in Latin America Glucagon-like Peptide-1 Agonists Market

Emerging opportunities within the Latin America GLP-1 agonists market are ripe for exploitation. The increasing recognition of GLP-1 agonists for their weight management benefits presents a significant untapped market, especially in countries with high obesity rates. Exploring combinations with other therapeutic agents for synergistic effects in treating complex metabolic disorders is another promising avenue. The development of more affordable formulations or alternative delivery methods could enhance accessibility for a broader patient demographic. Furthermore, as regulatory pathways in some Latin American countries become more streamlined, there is an opportunity for early market entry and establishing strong brand presence. Leveraging digital health platforms for patient monitoring and support can also create new avenues for engagement and brand loyalty.

Leading Players in the Latin America Glucagon-like Peptide-1 Agonists Market Sector

- Novo Nordisk

- Eli Lilly and Company

- Sanofi

- AstraZeneca

- Biocon

- Novartis

Key Milestones in Latin America Glucagon-like Peptide-1 Agonists Market Industry

- November 2023: The U.S. Food and Drug Administration approved Zepbound (tirzepatide) GLP-1 injection for chronic weight management in adults with obesity (body mass index of 30 kilograms per square meter (kg/ m2) or greater) or overweight (body mass index of 27 kg/m2 or greater) with at least one weight-related condition (such as high blood pressure, type 2 diabetes or high cholesterol) for use, in addition to a reduced calorie diet and increased physical activity. This approval significantly expands the application of GLP-1 agonists and is expected to influence market demand and product development strategies across Latin America.

- August 2022: Novo Nordisk announced results from a phase 2 clinical trial with CagriSema, a once-weekly subcutaneous combination of semaglutide and a novel amylin analogue, cagrilintide. The trial investigated the efficacy and safety of a fixed dose combination of CagriSema (2.4 mg semaglutide and 2.4 mg cagrilintide) compared to the individual components, semaglutide 2.4 mg and cagrilintide 2.4 mg, all administered once weekly, in 92 people with type 2 diabetes and overweight. The positive outcomes suggest a promising pipeline for potent combination therapies.

- May, 2022: Eli Lilly and Company's Mounjaro (tirzepatide) injection was approved as an adjunct to diet and exercise to enhance glycemic control in adult patients with type 2 diabetes. Mounjaro, a single molecule, is a once-weekly glucose-dependent insulinotropic polypeptide (GIP) and glucagon-like peptide-1 receptor agonist. This dual-action mechanism offers enhanced efficacy and represents a significant innovation in the treatment landscape.

Strategic Outlook for Latin America Glucagon-like Peptide-1 Agonists Market Market

The strategic outlook for the Latin America Glucagon-like Peptide-1 agonists market is exceptionally promising, driven by the escalating burden of type 2 diabetes and obesity. Growth accelerators will be rooted in the continued launch and market penetration of highly effective GLP-1 agonists and novel dual agonists, particularly those approved for weight management. Companies will focus on strategic pricing models and partnerships to enhance market access and affordability in diverse Latin American economies. Furthermore, investing in robust market development initiatives, including patient education and healthcare professional training, will be crucial to foster wider adoption and drive sustained demand. The potential for localized manufacturing or co-development partnerships could also offer competitive advantages and better serve regional needs.

Latin America Glucagon-like Peptide-1 Agonists Market Segmentation

-

1. Drugs

- 1.1. Exenatide

- 1.2. Liraglutide

- 1.3. Lixisenatide

- 1.4. Dulaglutide

- 1.5. Semaglutide

-

2. Geography

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Rest of Latin America

Latin America Glucagon-like Peptide-1 Agonists Market Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Rest of Latin America

Latin America Glucagon-like Peptide-1 Agonists Market Regional Market Share

Geographic Coverage of Latin America Glucagon-like Peptide-1 Agonists Market

Latin America Glucagon-like Peptide-1 Agonists Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising R&D Focus on the Development of Biotechnology-engineered Anti-cancer Drugs; Rapid Growth in the Usage of Pre-filled Syringes for Biologics; Increased Outsourcing Activities Across Value Chain Expected to Boost Supply of Injectable Products

- 3.3. Market Restrains

- 3.3.1. High Expenses Associated with Inventory Management; Availability of Alternate Drug Delivery Methods

- 3.4. Market Trends

- 3.4.1. The Dulaglutide Segment holds the highest market share in the Latin America Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Glucagon-like Peptide-1 Agonists Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 5.1.1. Exenatide

- 5.1.2. Liraglutide

- 5.1.3. Lixisenatide

- 5.1.4. Dulaglutide

- 5.1.5. Semaglutide

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 6. Brazil Latin America Glucagon-like Peptide-1 Agonists Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 6.1.1. Exenatide

- 6.1.2. Liraglutide

- 6.1.3. Lixisenatide

- 6.1.4. Dulaglutide

- 6.1.5. Semaglutide

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Mexico

- 6.2.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 7. Mexico Latin America Glucagon-like Peptide-1 Agonists Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 7.1.1. Exenatide

- 7.1.2. Liraglutide

- 7.1.3. Lixisenatide

- 7.1.4. Dulaglutide

- 7.1.5. Semaglutide

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Mexico

- 7.2.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 8. Rest of Latin America Latin America Glucagon-like Peptide-1 Agonists Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 8.1.1. Exenatide

- 8.1.2. Liraglutide

- 8.1.3. Lixisenatide

- 8.1.4. Dulaglutide

- 8.1.5. Semaglutide

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Mexico

- 8.2.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Biocon

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Sanofi

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Novartis

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Eli Lilly and Company

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 AstraZeneca

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Novo Nordisk

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 Biocon

List of Figures

- Figure 1: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Glucagon-like Peptide-1 Agonists Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 2: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 3: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 8: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 9: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 14: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 15: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Drugs 2020 & 2033

- Table 20: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Drugs 2020 & 2033

- Table 21: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Latin America Glucagon-like Peptide-1 Agonists Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Latin America Glucagon-like Peptide-1 Agonists Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Glucagon-like Peptide-1 Agonists Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Latin America Glucagon-like Peptide-1 Agonists Market?

Key companies in the market include Biocon, Sanofi, Novartis, Eli Lilly and Company, AstraZeneca, Novo Nordisk.

3. What are the main segments of the Latin America Glucagon-like Peptide-1 Agonists Market?

The market segments include Drugs, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 203.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising R&D Focus on the Development of Biotechnology-engineered Anti-cancer Drugs; Rapid Growth in the Usage of Pre-filled Syringes for Biologics; Increased Outsourcing Activities Across Value Chain Expected to Boost Supply of Injectable Products.

6. What are the notable trends driving market growth?

The Dulaglutide Segment holds the highest market share in the Latin America Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year.

7. Are there any restraints impacting market growth?

High Expenses Associated with Inventory Management; Availability of Alternate Drug Delivery Methods.

8. Can you provide examples of recent developments in the market?

November 2023: The U.S. Food and Drug Administration approved Zepbound (tirzepatide) GLP-1 injection for chronic weight management in adults with obesity (body mass index of 30 kilograms per square meter (kg/ m2) or greater) or overweight (body mass index of 27 kg/m2 or greater) with at least one weight-related condition (such as high blood pressure, type 2 diabetes or high cholesterol) for use, in addition to a reduced calorie diet and increased physical activity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Glucagon-like Peptide-1 Agonists Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Glucagon-like Peptide-1 Agonists Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Glucagon-like Peptide-1 Agonists Market?

To stay informed about further developments, trends, and reports in the Latin America Glucagon-like Peptide-1 Agonists Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence