Key Insights

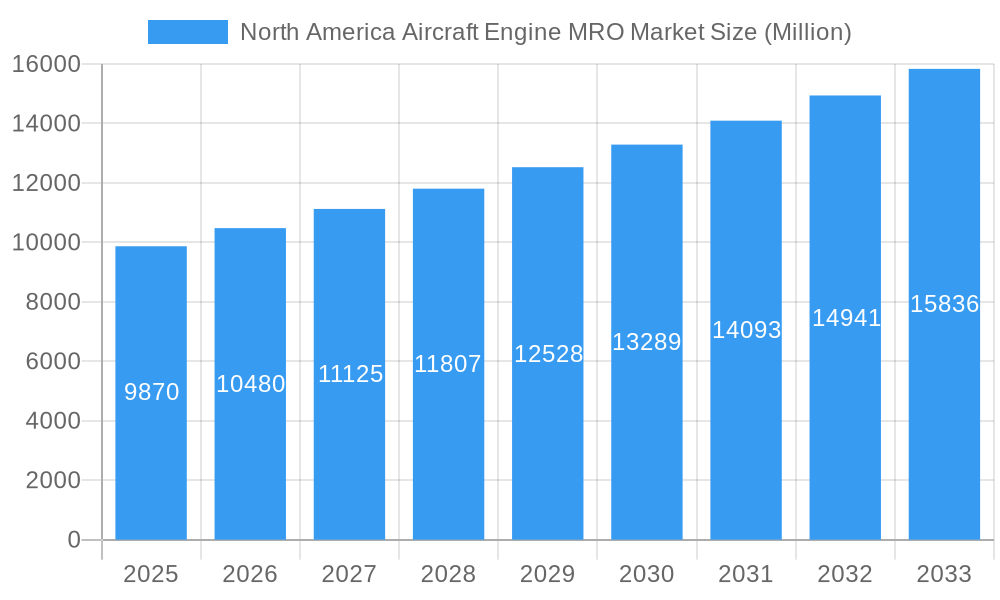

The North American Aircraft Engine Maintenance, Repair, and Overhaul (MRO) market, valued at $9.87 billion in 2025, is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.09% from 2025 to 2033. This expansion is driven by several key factors. The aging global aircraft fleet necessitates increased MRO services, particularly for older turbine engines prevalent in commercial and military aviation. Furthermore, the rising demand for air travel, especially in North America, fuels the need for efficient and reliable engine maintenance to ensure operational safety and minimize downtime. Technological advancements in engine diagnostics and predictive maintenance are also contributing to market growth, enabling more proactive and cost-effective MRO strategies. The market is segmented by engine type (turbine and piston) and application (commercial, military, and general aviation), with the commercial aviation segment dominating due to the large number of commercial aircraft operating within North America. Major players such as AAR Corp, Honeywell, Lockheed Martin, and Rolls-Royce are key contributors, leveraging their expertise and extensive service networks to cater to the growing demand. Competitive pressures are driving innovation in MRO techniques and service offerings, emphasizing efficiency and cost-reduction for airlines. While economic downturns could potentially constrain growth, the long-term outlook for the North American Aircraft Engine MRO market remains positive, driven by the continuous need for reliable and efficient aircraft operations.

North America Aircraft Engine MRO Market Market Size (In Billion)

The significant presence of major aerospace manufacturers and airlines in North America provides a strong foundation for this market. The region benefits from well-established infrastructure and skilled workforce supporting MRO activities. Government regulations emphasizing safety and airworthiness standards further underpin the market's growth. However, challenges remain, including fluctuating fuel prices, potential supply chain disruptions, and the increasing complexity of modern aircraft engines which can impact maintenance costs. Despite these factors, strategic partnerships, technological advancements, and a focus on efficient maintenance practices are expected to mitigate these challenges and contribute to the sustained growth trajectory of the North American Aircraft Engine MRO market through 2033. The market's future hinges on the continued expansion of air travel, the efficient management of aging aircraft fleets, and the ongoing technological innovations within the aviation industry.

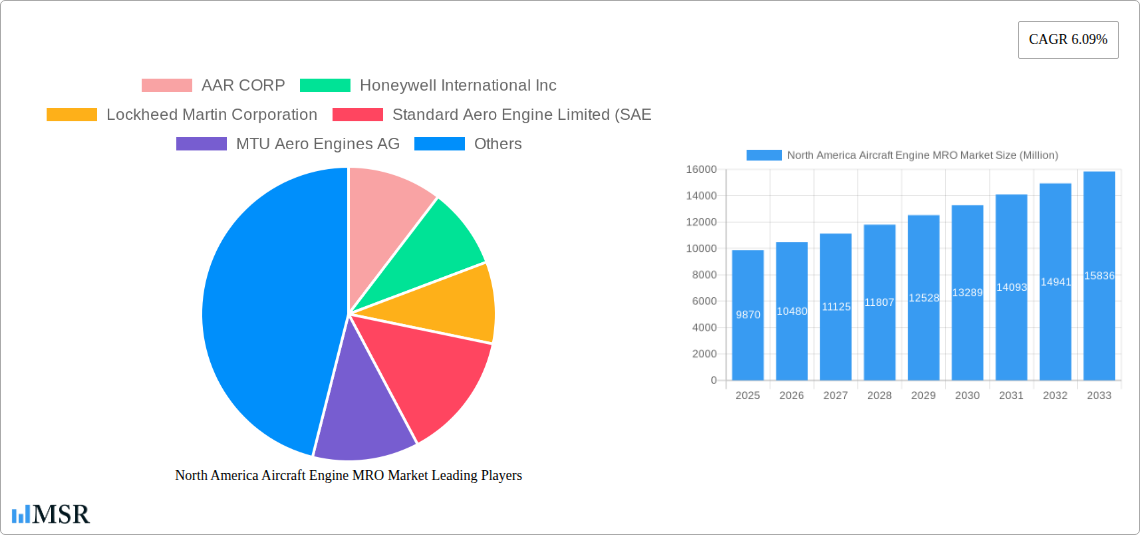

North America Aircraft Engine MRO Market Company Market Share

North America Aircraft Engine MRO Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Aircraft Engine MRO (Maintenance, Repair, and Overhaul) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The report meticulously examines market dynamics, key segments, leading players, and future growth potential, providing actionable intelligence to navigate the complexities of this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Aircraft Engine MRO Market Concentration & Dynamics

The North America Aircraft Engine MRO market exhibits a moderately concentrated landscape, with a few major players holding significant market share. AAR CORP, Honeywell International Inc, and GE Aviation, among others, dominate the market, leveraging their extensive experience, technological capabilities, and global reach. However, the market also accommodates several smaller, specialized MRO providers catering to niche segments.

The market's dynamics are shaped by several factors:

- Innovation Ecosystems: Continuous technological advancements in engine design and materials are driving the need for specialized MRO services and innovative solutions. The rise of digital technologies, such as predictive maintenance and AI-driven diagnostics, is significantly influencing market growth.

- Regulatory Frameworks: Stringent safety regulations and compliance requirements imposed by agencies like the FAA heavily impact the operational aspects and investment decisions within the MRO sector.

- Substitute Products: While limited, the availability of alternative maintenance and repair techniques influences pricing and service offerings.

- End-User Trends: The increasing demand for efficient and cost-effective MRO services, particularly from commercial aviation, fuels market expansion. Airlines are increasingly focusing on optimizing operational efficiency and reducing downtime.

- M&A Activities: The market has witnessed several mergers and acquisitions in recent years, reflecting a consolidation trend among leading players aiming to expand their service portfolios and geographic presence. The number of M&A deals averaged approximately xx per year during the historical period (2019-2024), indicating significant consolidation activity. Market share for the top 5 players is estimated at xx%.

North America Aircraft Engine MRO Market Industry Insights & Trends

The North America Aircraft Engine MRO market is experiencing robust growth, driven by a multitude of factors. The expanding commercial aviation fleet, particularly in North America, is a primary driver, increasing demand for regular maintenance and repair services. The rising age of existing aircraft further fuels this trend, as older engines require more frequent and extensive MRO interventions. Technological advancements, such as the adoption of advanced materials and engine designs, contribute to increased complexity, requiring specialized expertise and sophisticated maintenance technologies. However, fluctuations in fuel prices and overall economic conditions can impact the frequency of MRO activities, presenting a degree of uncertainty. The market size in 2025 is estimated at xx Million, and the projected growth trajectory signals significant potential for expansion in the coming years. The continuous evolution of air travel patterns and shifting passenger preferences also play a role in shaping market demand.

Key Markets & Segments Leading North America Aircraft Engine MRO Market

The commercial aviation segment dominates the North America Aircraft Engine MRO market, contributing to approximately xx% of the total market revenue in 2025. The large and aging commercial aircraft fleet in the region significantly drives the demand for MRO services. Within engine types, turbine engines account for the largest share due to their prevalence in modern commercial and military aircraft.

Drivers for Commercial Aviation Segment Dominance:

- High Fleet Size and Age: The large number of commercial aircraft in operation, coupled with their increasing age, creates a substantial need for regular MRO activities.

- Stringent Regulatory Requirements: Strict safety regulations necessitate frequent inspections and maintenance, bolstering demand for MRO services.

- Economic Growth: Economic growth in North America directly influences air travel demand, subsequently increasing the need for MRO services.

Dominance Analysis:

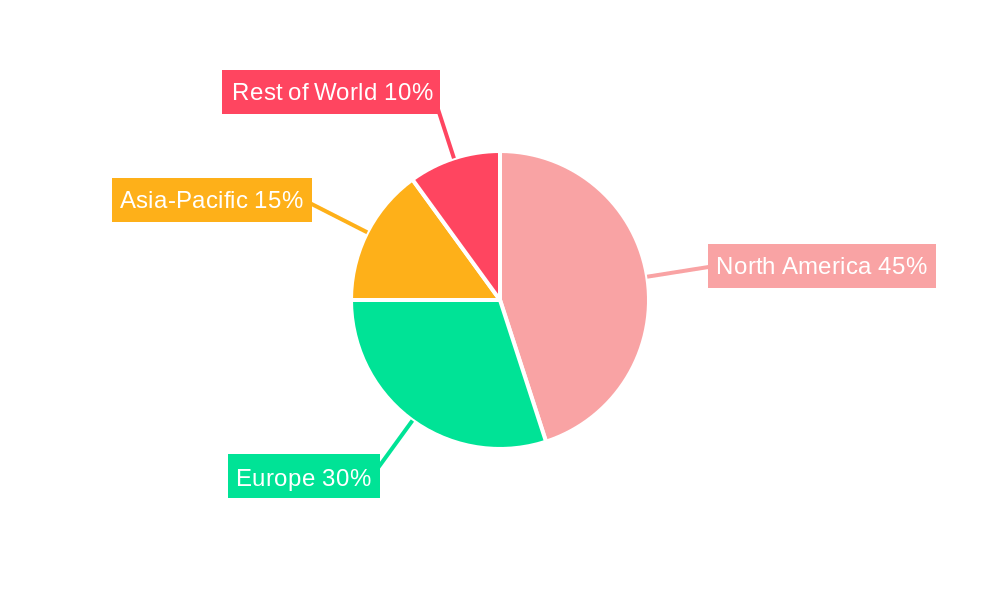

The United States holds the largest market share within North America, driven by its vast commercial aviation network and a significant military aircraft fleet. Canada and Mexico show promising growth prospects, although at a slower rate than the U.S. due to their smaller aviation sectors. The market share breakdown is approximately xx% for the United States, xx% for Canada, and xx% for Mexico in 2025.

North America Aircraft Engine MRO Market Product Developments

Recent advancements in engine diagnostics, using AI and predictive analytics, are transforming MRO operations. The incorporation of advanced materials and repair techniques allows for improved engine durability and extended lifespans. These advancements enhance operational efficiency, reduce downtime, and optimize maintenance costs. The development of specialized tools and equipment is further improving the quality and speed of MRO services. This focus on innovation is vital in maintaining a competitive edge in this technologically driven market.

Challenges in the North America Aircraft Engine MRO Market

The North America Aircraft Engine MRO market faces several challenges, including:

- Supply Chain Disruptions: Global supply chain vulnerabilities can lead to delays in procuring necessary parts and materials, impacting service delivery timelines and increasing costs. This can lead to a xx% increase in operational expenses during peak disruption periods.

- Regulatory Hurdles: Compliance with stringent safety regulations and obtaining necessary certifications can be time-consuming and costly, adding complexity to MRO operations.

- Intense Competition: The market is characterized by intense competition among established players and emerging entrants, leading to pricing pressures and the need for continuous innovation to maintain a competitive advantage.

Forces Driving North America Aircraft Engine MRO Market Growth

Several factors are driving the growth of the North America Aircraft Engine MRO market. Technological advancements, including predictive maintenance and the adoption of advanced materials, are enhancing operational efficiency. Economic growth is directly correlated with increased air travel, leading to higher demand for MRO services. Favorable government policies and investments in aviation infrastructure further support market expansion.

Long-Term Growth Catalysts in the North America Aircraft Engine MRO Market

Long-term growth will be fueled by continued technological innovation, strategic partnerships between MRO providers and OEMs, and expansion into new markets and service offerings. The increasing focus on sustainability and eco-friendly aviation technologies will also present significant opportunities for growth.

Emerging Opportunities in North America Aircraft Engine MRO Market

Emerging opportunities include the expansion of services into new aircraft platforms, the development of specialized MRO capabilities for next-generation engines, and the growth of digital solutions for predictive maintenance and remote diagnostics. These advancements will lead to optimized maintenance schedules, reduced downtime, and enhanced operational efficiency. The integration of blockchain technology for improved supply chain transparency and security is another area poised for growth.

Leading Players in the North America Aircraft Engine MRO Market Sector

- AAR CORP

- Honeywell International Inc

- Lockheed Martin Corporation

- Standard Aero Engine Limited (SAE)

- MTU Aero Engines AG

- Safran SA

- RTX Corporation

- Delta Air Lines Inc

- Rolls-Royce plc

- GKN plc

- IAG Aero Group

- General Electric Company

Key Milestones in North America Aircraft Engine MRO Market Industry

- 2020: Increased adoption of digital technologies in MRO operations due to the pandemic.

- 2021: Several strategic partnerships formed between MRO providers and aircraft manufacturers.

- 2022: Significant investments in advanced MRO facilities and equipment.

- 2023: Launch of several new MRO service offerings focused on sustainability.

- 2024: Consolidation in the market through mergers and acquisitions.

Strategic Outlook for North America Aircraft Engine MRO Market

The North America Aircraft Engine MRO market is poised for continued growth, driven by technological advancements, increasing fleet size, and stringent regulatory requirements. Strategic partnerships, investments in advanced technologies, and a focus on sustainable practices will be crucial for success in this competitive market. The long-term outlook remains positive, with significant opportunities for growth and innovation in the years to come.

North America Aircraft Engine MRO Market Segmentation

-

1. Engine Type

-

1.1. Turbine Engine

- 1.1.1. Turborprop Engine

- 1.1.2. Turbofan Engine

- 1.1.3. Turboshaft

- 1.2. Piston Engine

-

1.1. Turbine Engine

-

2. Application

- 2.1. Commercial Aviation

- 2.2. Military Aviation

- 2.3. General Aviation

-

3. Geography

- 3.1. United States

- 3.2. Canada

North America Aircraft Engine MRO Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Aircraft Engine MRO Market Regional Market Share

Geographic Coverage of North America Aircraft Engine MRO Market

North America Aircraft Engine MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Aviation Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Aircraft Engine MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 5.1.1. Turbine Engine

- 5.1.1.1. Turborprop Engine

- 5.1.1.2. Turbofan Engine

- 5.1.1.3. Turboshaft

- 5.1.2. Piston Engine

- 5.1.1. Turbine Engine

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Aviation

- 5.2.2. Military Aviation

- 5.2.3. General Aviation

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 6. United States North America Aircraft Engine MRO Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 6.1.1. Turbine Engine

- 6.1.1.1. Turborprop Engine

- 6.1.1.2. Turbofan Engine

- 6.1.1.3. Turboshaft

- 6.1.2. Piston Engine

- 6.1.1. Turbine Engine

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial Aviation

- 6.2.2. Military Aviation

- 6.2.3. General Aviation

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 7. Canada North America Aircraft Engine MRO Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 7.1.1. Turbine Engine

- 7.1.1.1. Turborprop Engine

- 7.1.1.2. Turbofan Engine

- 7.1.1.3. Turboshaft

- 7.1.2. Piston Engine

- 7.1.1. Turbine Engine

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial Aviation

- 7.2.2. Military Aviation

- 7.2.3. General Aviation

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 AAR CORP

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Honeywell International Inc

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Lockheed Martin Corporation

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Standard Aero Engine Limited (SAE

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 MTU Aero Engines AG

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Safran SA

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 RTX Corporation

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Delta Air Lines Inc

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Rolls-Royce plc

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 GKN plc

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 IAG Aero Group

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 General Electric Company

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.1 AAR CORP

List of Figures

- Figure 1: North America Aircraft Engine MRO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Aircraft Engine MRO Market Share (%) by Company 2025

List of Tables

- Table 1: North America Aircraft Engine MRO Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 2: North America Aircraft Engine MRO Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Aircraft Engine MRO Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Aircraft Engine MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Aircraft Engine MRO Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 6: North America Aircraft Engine MRO Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: North America Aircraft Engine MRO Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Aircraft Engine MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Aircraft Engine MRO Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 10: North America Aircraft Engine MRO Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: North America Aircraft Engine MRO Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Aircraft Engine MRO Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Aircraft Engine MRO Market?

The projected CAGR is approximately 6.09%.

2. Which companies are prominent players in the North America Aircraft Engine MRO Market?

Key companies in the market include AAR CORP, Honeywell International Inc, Lockheed Martin Corporation, Standard Aero Engine Limited (SAE, MTU Aero Engines AG, Safran SA, RTX Corporation, Delta Air Lines Inc, Rolls-Royce plc, GKN plc, IAG Aero Group, General Electric Company.

3. What are the main segments of the North America Aircraft Engine MRO Market?

The market segments include Engine Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.87 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Aviation Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Aircraft Engine MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Aircraft Engine MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Aircraft Engine MRO Market?

To stay informed about further developments, trends, and reports in the North America Aircraft Engine MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence