Key Insights

The global recreation services market, valued at $1.32 billion in 2025, is projected to experience robust growth, driven by several key factors. Rising disposable incomes, particularly in developing economies, are fueling increased spending on leisure activities. Technological advancements, such as virtual reality and augmented reality experiences, are enhancing the appeal and accessibility of various recreation options. Furthermore, a growing emphasis on health and wellness is boosting participation in sports and fitness activities. The market is segmented by type into amusements, arts, and sports, each exhibiting unique growth trajectories. Amusements, encompassing theme parks and casinos, are expected to maintain a significant market share due to their enduring popularity and consistent innovation. The arts segment, encompassing museums and cultural events, is experiencing growth fueled by increasing appreciation for cultural heritage and artistic experiences. The sports segment benefits from rising participation in both professional and amateur sports, driven by health awareness and the desire for community engagement. Geographic variations exist, with North America and Europe currently holding the largest market shares due to established infrastructure and high per capita spending on recreation. However, Asia-Pacific is poised for significant expansion, fueled by rapid economic growth and a burgeoning middle class. While the market faces challenges such as economic downturns and seasonality impacting certain segments, the overall outlook remains positive due to the intrinsic human desire for leisure and entertainment. The continued development of innovative offerings and strategic investments in infrastructure will play a critical role in shaping future market growth.

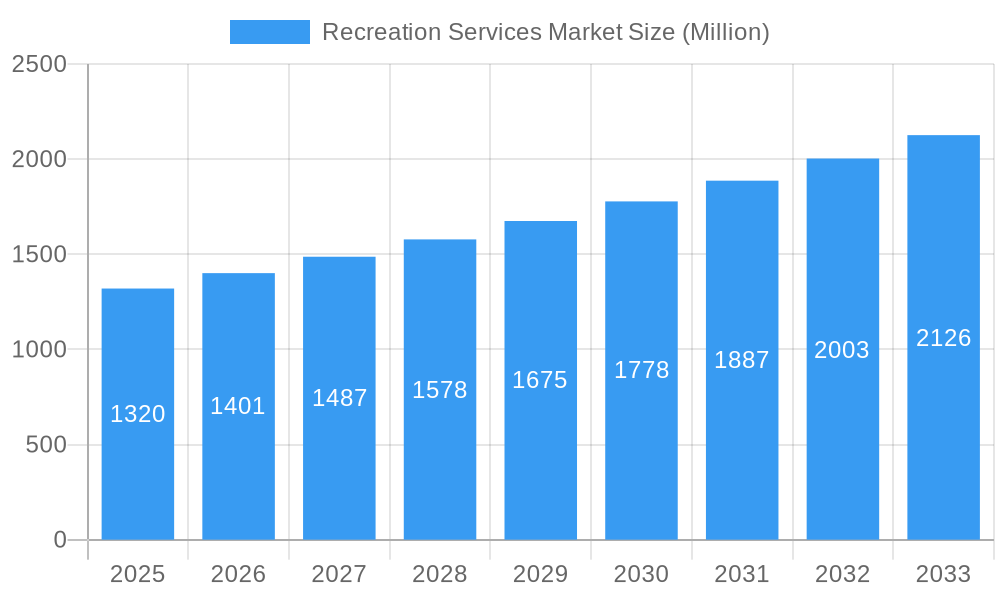

Recreation Services Market Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational corporations and smaller, specialized businesses. Major players like The Walt Disney Company and MGM Resorts are leveraging their brands and extensive resources to dominate specific segments. Meanwhile, smaller companies are focusing on niche markets and innovative offerings to gain a competitive edge. Strategic alliances, mergers, and acquisitions are expected to further consolidate the market in the coming years. The increasing importance of sustainability and responsible tourism is also influencing market dynamics, with businesses increasingly adopting environmentally friendly practices and promoting ethical operations. Government regulations regarding safety and accessibility also play a significant role, shaping the operational landscape for businesses across the recreation services sector. Overall, the market's future trajectory hinges on the interplay between economic conditions, technological advancements, changing consumer preferences, and evolving regulatory frameworks.

Recreation Services Market Company Market Share

Recreation Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Recreation Services Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth opportunities. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Recreation Services Market Market Concentration & Dynamics

The Recreation Services Market is characterized by a moderately concentrated landscape, with a few large players dominating specific segments. Market share analysis reveals that The Walt Disney Company and Merlin Entertainment Group hold significant positions, while regional players exert influence within their respective territories. Innovation ecosystems vary across segments, with the Amusement segment showcasing the highest level of technological advancement. Regulatory frameworks, particularly concerning safety and environmental standards, impact market operations significantly. Substitute products, such as home entertainment options and virtual reality experiences, pose a moderate threat, while mergers and acquisitions (M&A) activity remains consistent, with an estimated xx M&A deals in the historical period.

- Market Share: The Walt Disney Company (xx%), Merlin Entertainment Group (xx%), Others (xx%).

- M&A Activity: xx deals (2019-2024), driven primarily by expansion into new markets and technological integration.

- Innovation: High in the Amusement segment, moderate in Sports and Arts.

- Regulatory Impact: Significant influence on safety and environmental compliance.

Recreation Services Market Industry Insights & Trends

The global Recreation Services Market is experiencing robust growth, driven by several key factors. Rising disposable incomes, particularly in emerging economies, are fueling demand for leisure activities. Technological advancements, such as immersive virtual reality experiences and gamified fitness apps, are transforming the sector. Evolving consumer preferences, emphasizing personalized experiences and sustainable tourism, are shaping market offerings. The market size was valued at xx Million in 2025 and is projected to reach xx Million by 2033, indicating strong growth potential.

Key Markets & Segments Leading Recreation Services Market

The Amusement segment currently dominates the Recreation Services Market, accounting for xx% of the total market revenue in 2025. North America and Europe represent the leading regional markets, primarily due to high disposable incomes, well-established tourism infrastructure, and a preference for diverse recreational activities.

Drivers for Amusement Segment Dominance:

- High disposable incomes: Fueling demand for entertainment and leisure.

- Technological advancements: Virtual reality, augmented reality, and interactive experiences are enhancing the appeal of amusement parks and attractions.

- Strong tourism infrastructure: Supporting large-scale amusement parks and attractions.

Drivers for other Segments:

- Sports: Growing interest in fitness and wellness, increasing participation in sports events.

- Arts: Rising appreciation for cultural experiences, museum attendance and performing arts.

Recreation Services Market Product Developments

Recent product innovations focus on enhancing customer experience through technology integration. Interactive exhibits, personalized entertainment, and data-driven operational efficiencies are key areas of development. These advancements are creating competitive advantages for companies that effectively leverage technology to offer unique and engaging experiences.

Challenges in the Recreation Services Market Market

The Recreation Services Market faces several challenges, including stringent regulatory compliance requirements, supply chain disruptions impacting materials and labor costs, and intense competition from both established players and new entrants. These factors contribute to increased operational costs and can impact profitability. For example, increased regulations related to safety and environmental sustainability add approximately xx Million annually to operational expenses.

Forces Driving Recreation Services Market Growth

Key growth drivers include increasing disposable incomes globally, advancements in technology leading to enhanced user experiences, and favorable government policies promoting tourism and recreation. The growing popularity of health and wellness activities also contributes to growth within the sports segment.

Long-Term Growth Catalysts in the Recreation Services Market

Long-term growth will be fueled by the development of innovative recreation technologies, strategic partnerships that expand market reach, and market expansions into new geographic areas. The focus on sustainability and eco-tourism will also create new opportunities.

Emerging Opportunities in Recreation Services Market

Emerging trends and opportunities include the integration of virtual and augmented reality technologies, the rise of personalized experiences, and the increasing demand for sustainable and eco-friendly recreation options. Expansion into underserved markets and the development of unique experiences will also present significant opportunities.

Leading Players in the Recreation Services Market Sector

- Bourne Leisure Holdings Limited

- Castle Leisure Club

- Las Vegas Sands

- Universal Studios

- Smithsonian Institution

- SeaWorld Entertainment Inc

- New York State Lottery

- The Walt Disney Company

- Go Ape

- MGM Resorts

- National Park Service

- Live Nation Entertainment Inc

- Virgin Oceani

- INOX Leisure Limited

- Merlin Entertainment Group

- Olympiad Leisure Centers

Key Milestones in Recreation Services Market Industry

- September 2023: Merlin Entertainments and Tencent partner to enhance the LEGOLAND Resort experience in China using innovative technologies and data analytics. This signifies the growing importance of technology and data in the amusement sector.

- March 2024: The Hercules City Council adopts the Parks and Recreation Facilities Master Plan, highlighting the ongoing investment in public recreation infrastructure and its impact on local economies.

Strategic Outlook for Recreation Services Market Market

The Recreation Services Market is poised for continued growth, driven by technological advancements, changing consumer preferences, and expanding global tourism. Strategic partnerships, sustainable practices, and the development of unique and personalized experiences will be crucial for success in this dynamic market. The focus on providing value-added experiences and incorporating technological innovations will continue to shape the market landscape.

Recreation Services Market Segmentation

-

1. Type

- 1.1. Amusements

- 1.2. Arts

- 1.3. Sports

Recreation Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Recreation Services Market Regional Market Share

Geographic Coverage of Recreation Services Market

Recreation Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Individual Preference Toward Well-being; Growing Disposable Income Among Middle Class Population; Increase in Health and Fitness Problems

- 3.3. Market Restrains

- 3.3.1. High Investment Cost for Opening Fitness and Recreational Sports Centers

- 3.4. Market Trends

- 3.4.1. Sports Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Amusements

- 5.1.2. Arts

- 5.1.3. Sports

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Amusements

- 6.1.2. Arts

- 6.1.3. Sports

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Amusements

- 7.1.2. Arts

- 7.1.3. Sports

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Amusements

- 8.1.2. Arts

- 8.1.3. Sports

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Amusements

- 9.1.2. Arts

- 9.1.3. Sports

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Amusements

- 10.1.2. Arts

- 10.1.3. Sports

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Amusements

- 11.1.2. Arts

- 11.1.3. Sports

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Recreation Services Market Analysis, Insights and Forecast, 2020-2032

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2025

- 18.2. Company Profiles

- 18.2.1 Bourne Leisure Holdings Limited

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Castle Leisure Club

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Las Vegas Sands

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Universal Studios

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Smithsonian Institution

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 SeaWorld Entertainment Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 New York State Lottery

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 The Walt Disney Company

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Go Ape

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 MGM Resorts

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 National Park Service

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Live Nation Entertainment Inc

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Virgin Oceani

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 INOX Leisure Limited

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 Merlin Entertainment Group

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.16 Olympiad Leisure Centers

- 18.2.16.1. Overview

- 18.2.16.2. Products

- 18.2.16.3. SWOT Analysis

- 18.2.16.4. Recent Developments

- 18.2.16.5. Financials (Based on Availability)

- 18.2.1 Bourne Leisure Holdings Limited

List of Figures

- Figure 1: Global Recreation Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Recreation Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Recreation Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Recreation Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Australia and New Zealand Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Australia and New Zealand Recreation Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Latin America Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 11: Latin America Recreation Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Middle East and Africa Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Middle East and Africa Recreation Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Recreation Services Market Revenue (Million), by Type 2025 & 2033

- Figure 15: North America Recreation Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: North America Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Recreation Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Recreation Services Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe Recreation Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Recreation Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Recreation Services Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Asia Recreation Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Recreation Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Recreation Services Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Australia and New Zealand Recreation Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Australia and New Zealand Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 29: Australia and New Zealand Recreation Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 30: Latin America Recreation Services Market Revenue (Million), by Type 2025 & 2033

- Figure 31: Latin America Recreation Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 32: Latin America Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Recreation Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Recreation Services Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Recreation Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Recreation Services Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Recreation Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Recreation Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Recreation Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Recreation Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Recreation Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Recreation Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Recreation Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Recreation Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Recreation Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Recreation Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Recreation Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Recreation Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Recreation Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Recreation Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Recreation Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Recreation Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Recreation Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Recreation Services Market?

The projected CAGR is approximately 5.87%.

2. Which companies are prominent players in the Recreation Services Market?

Key companies in the market include Bourne Leisure Holdings Limited, Castle Leisure Club, Las Vegas Sands, Universal Studios, Smithsonian Institution, SeaWorld Entertainment Inc, New York State Lottery, The Walt Disney Company, Go Ape, MGM Resorts, National Park Service, Live Nation Entertainment Inc, Virgin Oceani, INOX Leisure Limited, Merlin Entertainment Group, Olympiad Leisure Centers.

3. What are the main segments of the Recreation Services Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Shift in Individual Preference Toward Well-being; Growing Disposable Income Among Middle Class Population; Increase in Health and Fitness Problems.

6. What are the notable trends driving market growth?

Sports Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Investment Cost for Opening Fitness and Recreational Sports Centers.

8. Can you provide examples of recent developments in the market?

March 2024 - The Hercules City Council approved a resolution adopting the Parks and Recreation Facilities Master Plan, which has been in development. The adopted plan represents the culmination of years of effort and collaboration between the city council, city staff, a steering committee, community leaders, stakeholders, and residents. It will serve as an invaluable blueprint for years to come as the company charts the future of its city parks system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Recreation Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Recreation Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Recreation Services Market?

To stay informed about further developments, trends, and reports in the Recreation Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence