Key Insights

Sweden's payments market is set for substantial growth, projected to reach 2.01 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 38.47% from its 2025 base year. This expansion is driven by the rapid adoption of e-commerce and digital transactions across key sectors including retail, entertainment, healthcare, and hospitality. The increasing consumer preference for convenient and contactless payment solutions, such as Point of Sale (POS) systems and mobile wallets, is a significant catalyst. Technological advancements in payment innovation and enhanced security measures further propel market development. While regulatory compliance and cybersecurity threats present challenges, they are mitigated by the growing consumer demand for seamless and secure payment experiences. The retail and e-commerce sectors are the primary contributors, with POS systems dominating transaction methods.

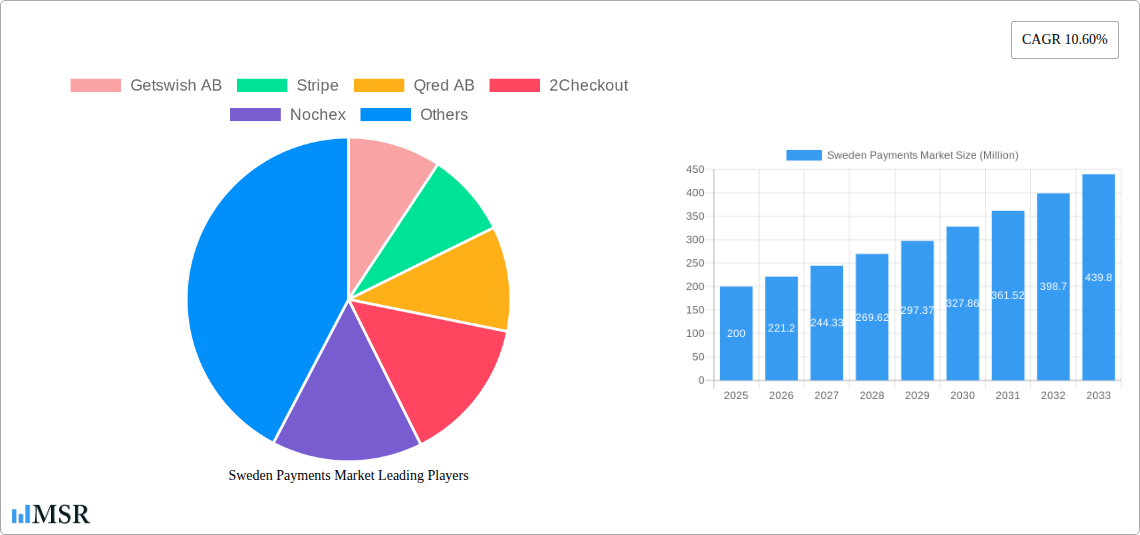

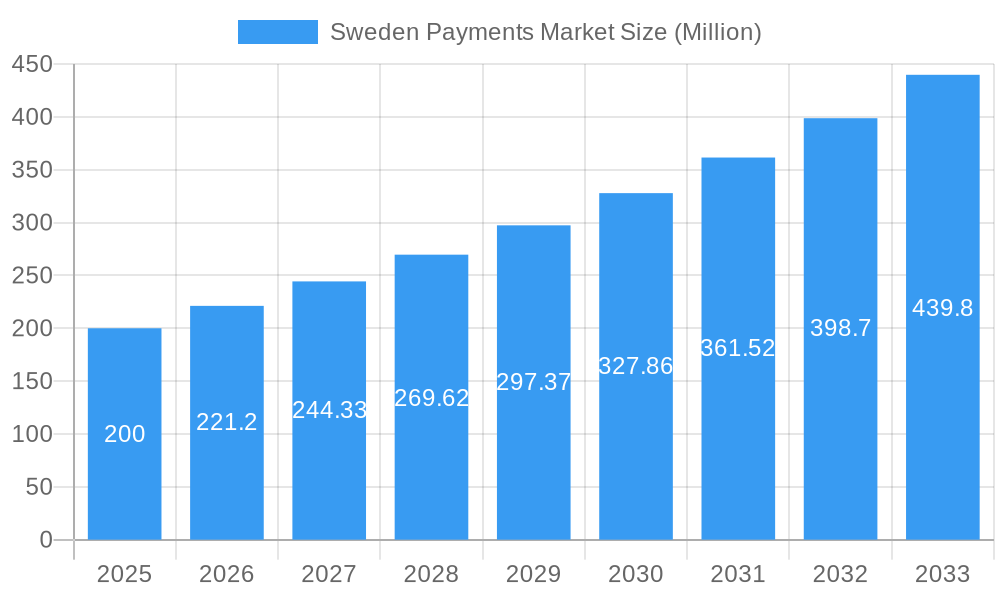

Sweden Payments Market Market Size (In Billion)

The competitive arena features a blend of global leaders like Stripe, Braintree, and WorldPay, alongside influential Swedish entities such as Getswish AB and Klarna Bank AB. This dynamic competition fosters innovation and operational efficiency. The market's future is characterized by continued expansion, fueled by the ongoing digitization of the Swedish economy and a consistent demand for advanced and secure payment solutions. The forecast period (2025-2033) anticipates significant evolution, with segment-specific growth influenced by adoption rates and technological integration. Maintaining clear regulatory frameworks and robust security protocols will be crucial for sustainable market growth.

Sweden Payments Market Company Market Share

Sweden Payments Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Sweden Payments Market, covering its historical performance (2019-2024), current state (2025), and future projections (2025-2033). It delves into market dynamics, key segments, leading players, and emerging opportunities, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report utilizes robust data and analysis to present a clear picture of the evolving landscape of the Swedish payments ecosystem.

Sweden Payments Market Concentration & Dynamics

The Sweden Payments Market exhibits a dynamic interplay of established players and emerging fintechs. Market concentration is moderate, with key players like Klarna Bank AB holding significant market share, but also displaying a competitive landscape with numerous smaller players vying for market share. The market is characterized by a robust innovation ecosystem, fueled by advancements in mobile payments and digital technologies. Sweden's progressive regulatory framework encourages innovation while ensuring consumer protection. Substitute products, such as cash and checks, are gradually declining in usage due to the rising popularity of digital payments. End-user trends showcase a strong preference for contactless and mobile payment solutions. M&A activity in the sector has been relatively consistent, with xx deals recorded in the last five years, contributing to market consolidation and the emergence of larger players.

- Market Share (2025 Estimate): Klarna Bank AB (xx%), Swish (xx%), Other major players (xx%), Smaller players (xx%)

- M&A Deal Count (2019-2024): xx

- Key Regulatory Developments: (Include details on specific regulations affecting the market)

Sweden Payments Market Industry Insights & Trends

The Sweden Payments Market is experiencing robust growth, driven by factors such as increasing smartphone penetration, rising e-commerce adoption, and a burgeoning digital economy. The market size reached xx Million in 2025, exhibiting a CAGR of xx% during the historical period (2019-2024). Technological disruptions, such as the rise of mobile wallets and contactless payments, are significantly shaping consumer behavior. Consumers are increasingly adopting digital payment solutions for their convenience, speed, and security. This trend is further accelerated by initiatives such as the expansion of Swish, which boasts over 8 Million users and 300,000 connected businesses. This shift towards digital payments is also contributing to the decline in traditional payment methods. The increasing demand for seamless and secure online transactions is driving innovation in payment security and fraud prevention technologies. The market is expected to maintain a strong growth trajectory in the forecast period (2025-2033), driven by factors such as the increasing adoption of mobile wallets and contactless payments.

- Market Size (2025): xx Million

- CAGR (2019-2024): xx%

- Projected Market Size (2033): xx Million

Key Markets & Segments Leading Sweden Payments Market

The Swedish payments market is characterized by strong growth across various segments. The retail sector dominates due to high consumer spending and the widespread adoption of digital payments. The online sales segment is also exhibiting remarkable growth, reflecting the surging popularity of e-commerce in Sweden.

By End-user Industry:

- Retail: High consumer spending and robust e-commerce adoption drive market growth.

- Entertainment: Significant growth driven by digital ticketing and online streaming services.

- Healthcare: Growing adoption of digital payment solutions for medical services and insurance.

- Hospitality: Increasing adoption of contactless payments and mobile wallets.

- Other End-user Industries: Steady growth across diverse sectors like transportation and utilities.

By Mode of Payment:

- Point of Sale (POS): Contactless payments are gaining significant traction, leading to the growth of this segment.

- Online Sale: This segment exhibits exponential growth due to increased e-commerce activity.

Dominance Analysis: The Retail and Online Sales segments currently hold the largest market share, driven by strong consumer spending and the rapid expansion of e-commerce. However, other segments like Entertainment and Hospitality are showing promising growth potential.

Sweden Payments Market Product Developments

Significant technological advancements are shaping the Swedish payments landscape. The emergence of innovative payment solutions like Swish has revolutionized the way Swedes make payments, fostering faster, more convenient transactions. Open banking initiatives are further driving innovation by enabling seamless data sharing and integration between different payment platforms. The introduction of Tap to Pay solutions enhances the efficiency and convenience of contactless payments. These developments are not only enhancing the user experience but also driving competition and market growth.

Challenges in the Sweden Payments Market Market

The Swedish payments market faces several challenges, including maintaining robust security against cyber threats and fraud, and ensuring the continued adaptation of digital payment solutions by all demographics. Regulatory compliance, especially concerning data privacy and consumer protection, continues to be a significant hurdle. Maintaining robust infrastructure to support the growing volume of digital transactions is also critical. These challenges require continuous investment in infrastructure and security measures.

Forces Driving Sweden Payments Market Growth

The growth of the Swedish payments market is propelled by several factors, including the increasing adoption of mobile wallets and contactless payments, robust digital infrastructure and high internet penetration, and supportive government regulations promoting financial technology innovation. The expansion of Swish, with its widespread adoption by businesses and consumers, significantly contributes to market growth. The rising popularity of e-commerce and online shopping further fuels the demand for convenient and secure digital payment solutions.

Long-Term Growth Catalysts in the Sweden Payments Market

Long-term growth will be driven by the expansion of innovative payment technologies, strategic partnerships between established players and fintech startups, and the exploration of new market segments such as the integration of payments into Internet of Things (IoT) devices. Continued investment in security and fraud prevention technologies will further enhance consumer trust and drive adoption.

Emerging Opportunities in Sweden Payments Market

Emerging opportunities include the integration of payments with other financial services, offering bundled financial solutions to consumers. The expansion of open banking APIs offers significant potential for developing innovative payment solutions and partnerships. The increasing adoption of biometrics and other advanced authentication technologies presents further opportunities to enhance security and convenience.

Leading Players in the Sweden Payments Market Sector

- Getswish AB

- Stripe

- Qred AB

- 2Checkout

- Nochex

- Braintree

- QuickPay

- Klarna Bank AB

- WorldPay

- Wirecard *List Not Exhaustive

Key Milestones in Sweden Payments Market Industry

- February 2022: Adyen joins Swish, expanding its reach to enterprise customers.

- May 2022: PayPal's Zettle Go enables contactless payments on Android devices in the UK, Sweden, and Netherlands.

Strategic Outlook for Sweden Payments Market Market

The Sweden Payments Market presents significant growth potential, fueled by continued technological advancements, expanding e-commerce, and increasing consumer adoption of digital payment solutions. Strategic partnerships and investments in security infrastructure will be critical for capturing this potential. The market is poised for further consolidation, with larger players likely acquiring smaller fintechs to enhance their offerings and expand their market share.

Sweden Payments Market Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Others

-

1.2. Online Sale

- 1.2.1. Others (

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Sweden Payments Market Segmentation By Geography

- 1. Sweden

Sweden Payments Market Regional Market Share

Geographic Coverage of Sweden Payments Market

Sweden Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 38.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High Proliferation of E-commerce

- 3.2.2 including the rise of m-commerce and cross-border e-commerce supported by the increase in purchasing power; Enablement Programs by Key Retailers and Government encouraging digitization and contactless payments in the market; Government Trials of Sweden's first digital national bank currency e-krona

- 3.3. Market Restrains

- 3.3.1. Security Concerns Related to Cyber Attacks and Data Breaches; Lack of Robust and Reliable Infrastructure in Remote Regions

- 3.4. Market Trends

- 3.4.1. Retail is expected to grow significantly in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Payments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Others

- 5.1.2. Online Sale

- 5.1.2.1. Others (

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Getswish AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stripe

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Qred AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2Checkout

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nochex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Braintree

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 QuickPay

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Klarna Bank AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 WorldPay

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wirecard*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Getswish AB

List of Figures

- Figure 1: Sweden Payments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Sweden Payments Market Share (%) by Company 2025

List of Tables

- Table 1: Sweden Payments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Sweden Payments Market Revenue billion Forecast, by Mode of Payment 2020 & 2033

- Table 3: Sweden Payments Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Sweden Payments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Sweden Payments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 6: Sweden Payments Market Revenue billion Forecast, by Mode of Payment 2020 & 2033

- Table 7: Sweden Payments Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Sweden Payments Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Payments Market?

The projected CAGR is approximately 38.47%.

2. Which companies are prominent players in the Sweden Payments Market?

Key companies in the market include Getswish AB, Stripe, Qred AB, 2Checkout, Nochex, Braintree, QuickPay, Klarna Bank AB, WorldPay, Wirecard*List Not Exhaustive.

3. What are the main segments of the Sweden Payments Market?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.01 billion as of 2022.

5. What are some drivers contributing to market growth?

High Proliferation of E-commerce. including the rise of m-commerce and cross-border e-commerce supported by the increase in purchasing power; Enablement Programs by Key Retailers and Government encouraging digitization and contactless payments in the market; Government Trials of Sweden's first digital national bank currency e-krona.

6. What are the notable trends driving market growth?

Retail is expected to grow significantly in the country.

7. Are there any restraints impacting market growth?

Security Concerns Related to Cyber Attacks and Data Breaches; Lack of Robust and Reliable Infrastructure in Remote Regions.

8. Can you provide examples of recent developments in the market?

February 2022 - Adyen is the next bank to join Swish, providing enterprise customers with easy, fast, and secure Swish payments. About 8 million Swedes and more than 300,000 companies are connected to Swish. Currently, 12 banks offer Swish to their customers, and each bank is responsible for the provision, terms, and conditions of the Swish service it provides and for all fees.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Payments Market?

To stay informed about further developments, trends, and reports in the Sweden Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence