Key Insights

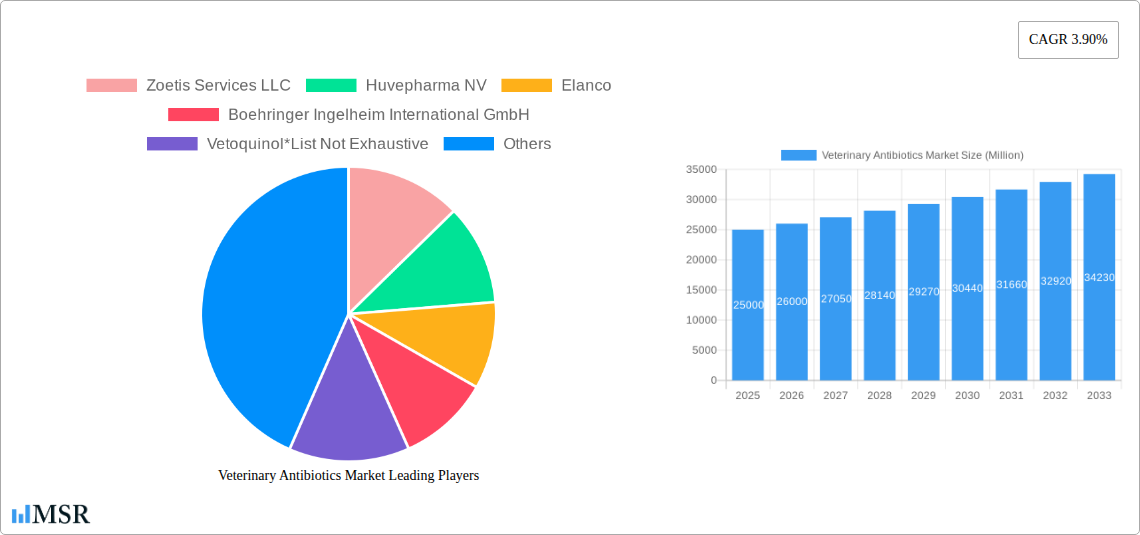

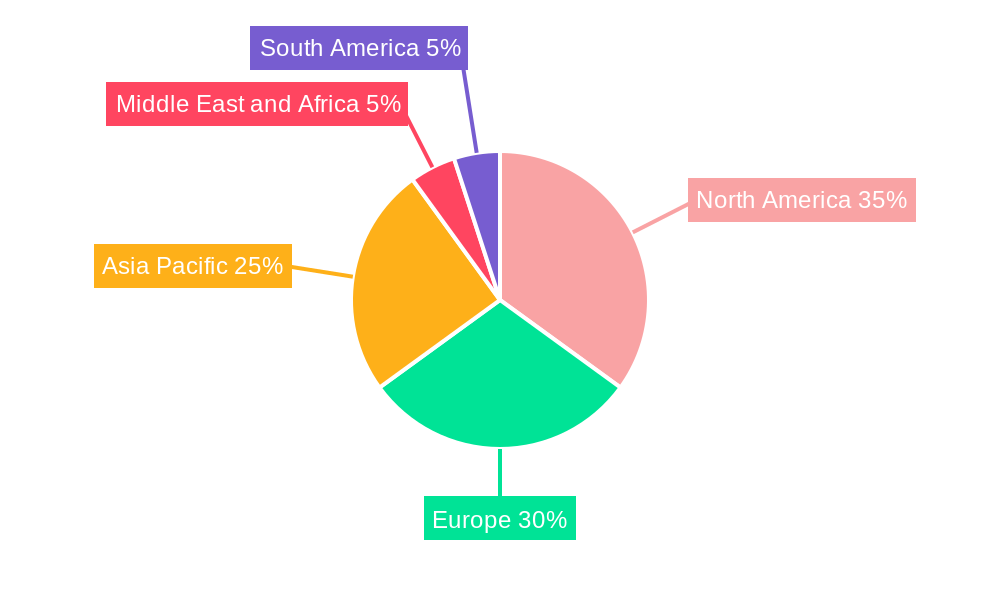

The global veterinary antibiotics market, currently valued at approximately $XX million (estimated based on market size and CAGR data), is projected to experience steady growth, driven by factors such as the increasing prevalence of animal diseases, rising demand for animal protein, and advancements in veterinary healthcare. The market's Compound Annual Growth Rate (CAGR) of 3.90% from 2019 to 2024 suggests a consistent upward trajectory, and this growth is expected to continue through 2033, albeit potentially with some fluctuation influenced by global economic conditions and regulatory changes impacting antibiotic use. Significant market segmentation exists, with poultry, pigs, and cattle representing the largest consumer segments by animal type, reflecting the scale of these industries and their susceptibility to various bacterial infections. The most commonly used drug classes include tetracyclines, penicillin, and sulfonamides, though the market is also witnessing growth in the adoption of newer, more targeted antibiotics to mitigate the rising concerns around antibiotic resistance. Oral powders and injections dominate the dosage form segment, dictated largely by ease of administration and effectiveness in different animal species. Key players like Zoetis, Elanco, and Boehringer Ingelheim are continuously innovating and expanding their product portfolios to cater to this growing demand. Geographic distribution reveals strong market presence across North America and Europe, largely driven by advanced veterinary practices and higher per-capita animal healthcare expenditure. The Asia-Pacific region, fueled by rapid economic growth and expanding livestock populations, shows significant potential for future growth. However, increasing regulatory scrutiny concerning antibiotic resistance, coupled with the development of alternative disease management strategies, presents a potential restraint on market expansion.

Veterinary Antibiotics Market Market Size (In Billion)

The market’s future trajectory will heavily depend on the effectiveness of strategies to combat antibiotic resistance, the development and adoption of novel antibiotic therapies, and global economic stability. Emerging markets will play a crucial role in shaping future growth. Competition among major players is intense, and success will hinge on innovation, strategic partnerships, and robust distribution networks. The sustained focus on animal health and welfare coupled with continuous advancements in veterinary medicine will likely maintain the positive growth trend within the veterinary antibiotics market for the forecast period. The market is expected to see strategic mergers and acquisitions as companies seek to strengthen their market positions and broaden their product portfolios. Understanding regional variations in disease prevalence, regulatory landscapes, and veterinary practices is crucial for effective market penetration and long-term success.

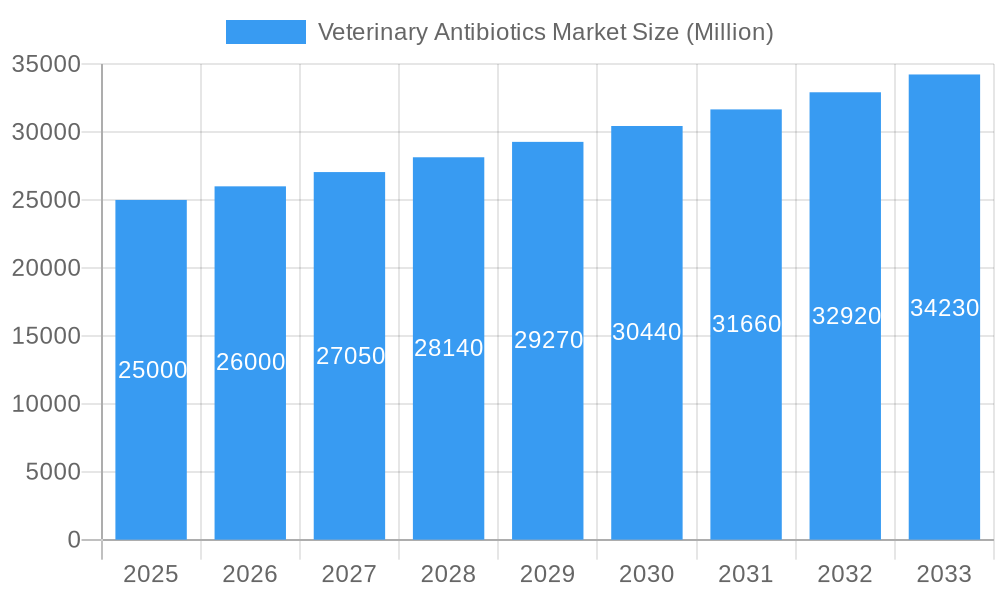

Veterinary Antibiotics Market Company Market Share

Veterinary Antibiotics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Veterinary Antibiotics Market, offering invaluable insights for stakeholders, investors, and industry professionals. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. The market is segmented by animal type (Poultry, Pigs, Cattle, Sheep & Goats, Companion Animals, Other Animal Types), drug class (Tetracyclines, Penicillin, Sulfonamides, Macrolides, Other Drug Classes), and dosage form (Oral Powder, Oral Solutions, Injections, Other Dosage Forms). Key players analyzed include Zoetis Services LLC, Huvepharma NV, Elanco, Boehringer Ingelheim International GmbH, Vetoquinol, Merck & Co Inc, Ceva, Dechra Pharmaceuticals PLC, Phibro Animal Health Corporation, and Virbac. The report projects a market value of xx Million by 2033, representing a CAGR of xx%.

Veterinary Antibiotics Market Concentration & Dynamics

The Veterinary Antibiotics Market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Zoetis and Elanco are currently leading the market, while other companies like Boehringer Ingelheim and Merck & Co. Inc. also have substantial presence. Market share dynamics are influenced by factors like R&D investments, product portfolio diversity, and strategic partnerships.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated to be xx, indicating a moderately concentrated market.

- Innovation Ecosystems: Significant investment in R&D drives the development of novel antibiotics with improved efficacy and reduced side effects. The emergence of antibiotic resistance is a major driver for innovation.

- Regulatory Frameworks: Stringent regulations regarding antibiotic usage and residue limits impact market dynamics. Variations in regulations across different geographies create challenges for market players.

- Substitute Products: The availability of alternative treatments, including vaccines and other therapeutics, influences market growth.

- End-User Trends: The increasing demand for safe and effective antibiotics in animal healthcare fuels market growth. The rising prevalence of animal diseases also drives the need for effective antibiotics.

- M&A Activities: The market has witnessed a moderate number of mergers and acquisitions (M&A) deals in recent years (xx deals in the past five years), indicating a trend of consolidation.

Veterinary Antibiotics Market Industry Insights & Trends

The Veterinary Antibiotics Market is experiencing substantial growth driven by several factors. The increasing global demand for animal protein, coupled with rising animal disease prevalence, is a significant market driver. Technological advancements in antibiotic development, including the creation of novel drug delivery systems, are contributing to market expansion. Consumer awareness regarding animal health and welfare is also pushing the demand for safe and effective antibiotic treatments. The market size was valued at xx Million in 2024, and it's projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Key Markets & Segments Leading Veterinary Antibiotics Market

The global Veterinary Antibiotics Market is geographically diverse, with significant contributions from North America, Europe, and Asia-Pacific regions. By animal type, the companion animal segment currently holds a leading position, driven by rising pet ownership and increased veterinary care expenditure. The poultry segment also shows strong growth potential due to the high density of poultry farms and the consequent susceptibility to disease outbreaks.

Leading Segments & Drivers:

- By Animal Type:

- Companion Animals: High pet ownership rates, increased veterinary visits, and rising disposable incomes.

- Poultry: High poultry density, disease outbreaks, and significant economic impact of poultry health.

- By Drug Class:

- Tetracyclines: Wide-spectrum activity and cost-effectiveness.

- Penicillin: High efficacy for specific bacterial infections.

- By Dosage Form:

- Injections: Faster onset of action and suitability for treating severe infections.

- Oral Solutions: Easier administration and improved compliance.

Veterinary Antibiotics Market Product Developments

Recent product innovations focus on developing novel antibiotics with improved efficacy, reduced side effects, and resistance to existing antibiotic-resistant strains. The introduction of extended-release formulations and targeted drug delivery systems enhances therapeutic effectiveness and patient compliance. Companies are investing in developing companion animal-specific antibiotics to cater to this growing segment.

Challenges in the Veterinary Antibiotics Market Market

The Veterinary Antibiotics Market faces several challenges, including stringent regulatory approvals, increasing concerns about antibiotic resistance, and fluctuations in raw material prices affecting the supply chain. Competition among established players and the emergence of generic products also poses challenges to market growth. The global regulatory landscape for veterinary antibiotics is constantly changing, causing compliance costs and delays in product launches.

Forces Driving Veterinary Antibiotics Market Growth

Several factors drive the market's growth, including rising animal diseases, increased awareness about animal health, technological advancements (new drug delivery systems and formulations), and growing disposable incomes enabling greater spending on animal healthcare. The expanding livestock industry and intensification of animal farming also contribute to growth.

Long-Term Growth Catalysts in the Veterinary Antibiotics Market

Long-term growth will be fueled by the development of novel antibiotics, strategic partnerships between pharmaceutical companies and veterinary practices, and the expansion into emerging markets with growing animal populations and rising demand for better animal healthcare. Investment in R&D of novel drugs with alternative modes of action to combat antibiotic resistance will be crucial for sustainable growth.

Emerging Opportunities in Veterinary Antibiotics Market

Emerging opportunities lie in developing innovative drug delivery systems, personalized medicine for animals, and expansion into untapped markets in developing economies. Focusing on antibiotics with less environmental impact and improved safety profiles will be critical. Utilizing advanced diagnostic tools to detect infections faster and more accurately is another avenue for growth.

Leading Players in the Veterinary Antibiotics Market Sector

- Zoetis Services LLC

- Huvepharma NV

- Elanco

- Boehringer Ingelheim International GmbH

- Vetoquinol

- Merck & Co Inc

- Ceva

- Dechra Pharmaceuticals PLC

- Phibro Animal Health Corporation

- Virbac

Key Milestones in Veterinary Antibiotics Market Industry

- July 2022: Krka launched Cladaxxa, expanding treatment options for common infections in dogs and cats. This broadened the therapeutic options available to veterinarians and improved treatment outcomes for pets.

- July 2021: Virbac launched Tulissin 25 and Tulissin 100, injectable solutions for cattle and swine, strengthening their portfolio in the livestock sector. These introductions helped Virbac expand its market share within the livestock antibiotic sector.

Strategic Outlook for Veterinary Antibiotics Market Market

The Veterinary Antibiotics Market presents significant opportunities for growth over the next decade. Strategic partnerships, focused R&D investments to address antibiotic resistance, expansion into new geographical markets, and a strong focus on sustainable practices will be key determinants of success. The market is expected to experience sustained growth driven by the factors mentioned above, providing a strong outlook for players willing to adapt and innovate.

Veterinary Antibiotics Market Segmentation

-

1. Animal Type

- 1.1. Poultry

- 1.2. Pigs

- 1.3. Cattle

- 1.4. Sheep & Goats

- 1.5. Companion Animals

- 1.6. Other Animal Types

-

2. Drug Class

- 2.1. Tetracyclines

- 2.2. Penicillin

- 2.3. Sulfonamides

- 2.4. Macrolides

- 2.5. Other Drug Classes

-

3. Dosage Form

- 3.1. Oral Powder

- 3.2. Oral Solutions

- 3.3. Injections

- 3.4. Other Dosage Forms

Veterinary Antibiotics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Veterinary Antibiotics Market Regional Market Share

Geographic Coverage of Veterinary Antibiotics Market

Veterinary Antibiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Pet & Livestock Ownership; Increasing Incidence of Livestock Diseases; Rising Focus On Animal-Only Antibiotics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations and Increasing Antibiotic Resistance Among Food-Producing Animals; Scarcity of Veterinarians and Skilled Farm Workers

- 3.4. Market Trends

- 3.4.1. Penicillin Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Poultry

- 5.1.2. Pigs

- 5.1.3. Cattle

- 5.1.4. Sheep & Goats

- 5.1.5. Companion Animals

- 5.1.6. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Drug Class

- 5.2.1. Tetracyclines

- 5.2.2. Penicillin

- 5.2.3. Sulfonamides

- 5.2.4. Macrolides

- 5.2.5. Other Drug Classes

- 5.3. Market Analysis, Insights and Forecast - by Dosage Form

- 5.3.1. Oral Powder

- 5.3.2. Oral Solutions

- 5.3.3. Injections

- 5.3.4. Other Dosage Forms

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. North America Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Poultry

- 6.1.2. Pigs

- 6.1.3. Cattle

- 6.1.4. Sheep & Goats

- 6.1.5. Companion Animals

- 6.1.6. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Drug Class

- 6.2.1. Tetracyclines

- 6.2.2. Penicillin

- 6.2.3. Sulfonamides

- 6.2.4. Macrolides

- 6.2.5. Other Drug Classes

- 6.3. Market Analysis, Insights and Forecast - by Dosage Form

- 6.3.1. Oral Powder

- 6.3.2. Oral Solutions

- 6.3.3. Injections

- 6.3.4. Other Dosage Forms

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. Europe Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Poultry

- 7.1.2. Pigs

- 7.1.3. Cattle

- 7.1.4. Sheep & Goats

- 7.1.5. Companion Animals

- 7.1.6. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Drug Class

- 7.2.1. Tetracyclines

- 7.2.2. Penicillin

- 7.2.3. Sulfonamides

- 7.2.4. Macrolides

- 7.2.5. Other Drug Classes

- 7.3. Market Analysis, Insights and Forecast - by Dosage Form

- 7.3.1. Oral Powder

- 7.3.2. Oral Solutions

- 7.3.3. Injections

- 7.3.4. Other Dosage Forms

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Asia Pacific Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Poultry

- 8.1.2. Pigs

- 8.1.3. Cattle

- 8.1.4. Sheep & Goats

- 8.1.5. Companion Animals

- 8.1.6. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Drug Class

- 8.2.1. Tetracyclines

- 8.2.2. Penicillin

- 8.2.3. Sulfonamides

- 8.2.4. Macrolides

- 8.2.5. Other Drug Classes

- 8.3. Market Analysis, Insights and Forecast - by Dosage Form

- 8.3.1. Oral Powder

- 8.3.2. Oral Solutions

- 8.3.3. Injections

- 8.3.4. Other Dosage Forms

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Middle East and Africa Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Poultry

- 9.1.2. Pigs

- 9.1.3. Cattle

- 9.1.4. Sheep & Goats

- 9.1.5. Companion Animals

- 9.1.6. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Drug Class

- 9.2.1. Tetracyclines

- 9.2.2. Penicillin

- 9.2.3. Sulfonamides

- 9.2.4. Macrolides

- 9.2.5. Other Drug Classes

- 9.3. Market Analysis, Insights and Forecast - by Dosage Form

- 9.3.1. Oral Powder

- 9.3.2. Oral Solutions

- 9.3.3. Injections

- 9.3.4. Other Dosage Forms

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. South America Veterinary Antibiotics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Poultry

- 10.1.2. Pigs

- 10.1.3. Cattle

- 10.1.4. Sheep & Goats

- 10.1.5. Companion Animals

- 10.1.6. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Drug Class

- 10.2.1. Tetracyclines

- 10.2.2. Penicillin

- 10.2.3. Sulfonamides

- 10.2.4. Macrolides

- 10.2.5. Other Drug Classes

- 10.3. Market Analysis, Insights and Forecast - by Dosage Form

- 10.3.1. Oral Powder

- 10.3.2. Oral Solutions

- 10.3.3. Injections

- 10.3.4. Other Dosage Forms

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zoetis Services LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huvepharma NV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Elanco

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Boehringer Ingelheim International GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vetoquinol*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Merck & Co Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ceva

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dechra Pharmaceuticals PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Phibro Animal Health Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Virbac

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Zoetis Services LLC

List of Figures

- Figure 1: Global Veterinary Antibiotics Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Veterinary Antibiotics Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 3: North America Veterinary Antibiotics Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: North America Veterinary Antibiotics Market Revenue (undefined), by Drug Class 2025 & 2033

- Figure 5: North America Veterinary Antibiotics Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 6: North America Veterinary Antibiotics Market Revenue (undefined), by Dosage Form 2025 & 2033

- Figure 7: North America Veterinary Antibiotics Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 8: North America Veterinary Antibiotics Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Veterinary Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Veterinary Antibiotics Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 11: Europe Veterinary Antibiotics Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: Europe Veterinary Antibiotics Market Revenue (undefined), by Drug Class 2025 & 2033

- Figure 13: Europe Veterinary Antibiotics Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 14: Europe Veterinary Antibiotics Market Revenue (undefined), by Dosage Form 2025 & 2033

- Figure 15: Europe Veterinary Antibiotics Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 16: Europe Veterinary Antibiotics Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Veterinary Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Veterinary Antibiotics Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 19: Asia Pacific Veterinary Antibiotics Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 20: Asia Pacific Veterinary Antibiotics Market Revenue (undefined), by Drug Class 2025 & 2033

- Figure 21: Asia Pacific Veterinary Antibiotics Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 22: Asia Pacific Veterinary Antibiotics Market Revenue (undefined), by Dosage Form 2025 & 2033

- Figure 23: Asia Pacific Veterinary Antibiotics Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 24: Asia Pacific Veterinary Antibiotics Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Veterinary Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Veterinary Antibiotics Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 27: Middle East and Africa Veterinary Antibiotics Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Middle East and Africa Veterinary Antibiotics Market Revenue (undefined), by Drug Class 2025 & 2033

- Figure 29: Middle East and Africa Veterinary Antibiotics Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 30: Middle East and Africa Veterinary Antibiotics Market Revenue (undefined), by Dosage Form 2025 & 2033

- Figure 31: Middle East and Africa Veterinary Antibiotics Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 32: Middle East and Africa Veterinary Antibiotics Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Veterinary Antibiotics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Veterinary Antibiotics Market Revenue (undefined), by Animal Type 2025 & 2033

- Figure 35: South America Veterinary Antibiotics Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 36: South America Veterinary Antibiotics Market Revenue (undefined), by Drug Class 2025 & 2033

- Figure 37: South America Veterinary Antibiotics Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 38: South America Veterinary Antibiotics Market Revenue (undefined), by Dosage Form 2025 & 2033

- Figure 39: South America Veterinary Antibiotics Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 40: South America Veterinary Antibiotics Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Veterinary Antibiotics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 2: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 3: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 4: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 6: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 7: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 8: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 13: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 14: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 15: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 23: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 24: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 25: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 33: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 34: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 35: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 40: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 41: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Dosage Form 2020 & 2033

- Table 42: Global Veterinary Antibiotics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Veterinary Antibiotics Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Antibiotics Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Veterinary Antibiotics Market?

Key companies in the market include Zoetis Services LLC, Huvepharma NV, Elanco, Boehringer Ingelheim International GmbH, Vetoquinol*List Not Exhaustive, Merck & Co Inc, Ceva, Dechra Pharmaceuticals PLC, Phibro Animal Health Corporation, Virbac.

3. What are the main segments of the Veterinary Antibiotics Market?

The market segments include Animal Type, Drug Class, Dosage Form.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Pet & Livestock Ownership; Increasing Incidence of Livestock Diseases; Rising Focus On Animal-Only Antibiotics.

6. What are the notable trends driving market growth?

Penicillin Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulations and Increasing Antibiotic Resistance Among Food-Producing Animals; Scarcity of Veterinarians and Skilled Farm Workers.

8. Can you provide examples of recent developments in the market?

In July 2022, Krka launched Cladaxxa which helps to treat respiratory, digestive, urinary, skin, and dental infections in dogs and cats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Antibiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Antibiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Antibiotics Market?

To stay informed about further developments, trends, and reports in the Veterinary Antibiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence