Key Insights

The China supply chain finance market is projected for substantial growth, fueled by the nation's burgeoning e-commerce sector, intricate global supply chain integration, and government-backed financial inclusion programs for SMEs. The market is anticipated to reach a size of $9.3 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 9.2% through 2033. Key growth catalysts include the persistent need for optimized working capital management by businesses, particularly SMEs, which frequently encounter hurdles in securing conventional financing. The proliferation of fintech platforms offering streamlined, technology-centric supply chain finance solutions is accelerating this expansion. Emerging trends such as blockchain integration for enhanced supply chain transparency and security, alongside the increasing application of AI for credit risk evaluation, are actively transforming the market dynamics. Nevertheless, regulatory complexities and inherent credit risk concerns associated with financing smaller enterprises present ongoing challenges. The competitive arena features established financial institutions like Bank of China and Ping An Bank, alongside innovative fintech companies and specialized logistics providers such as Flexport, all competing through tailored product offerings for China's varied supply chain industries.

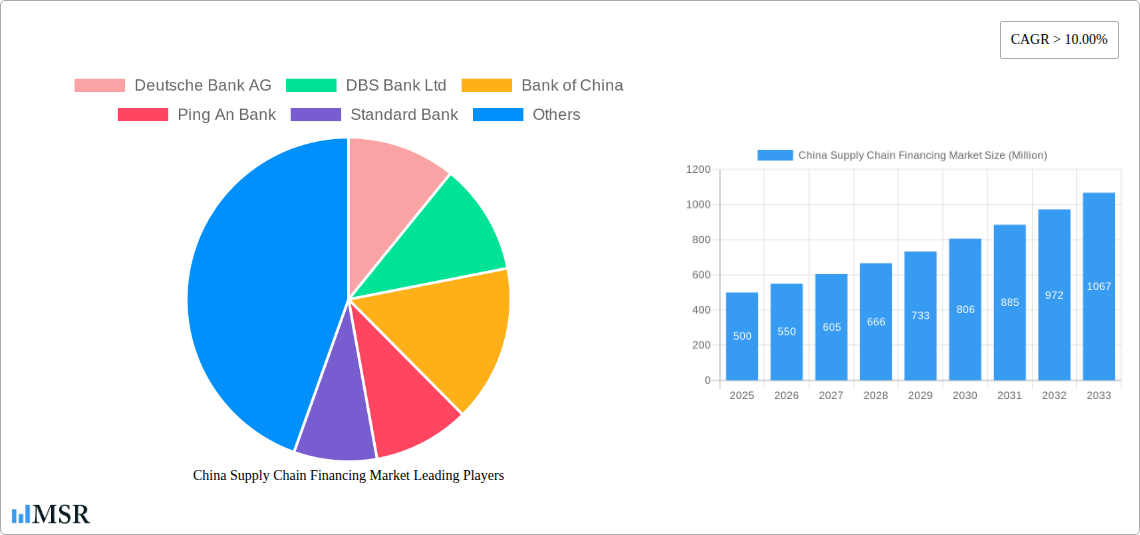

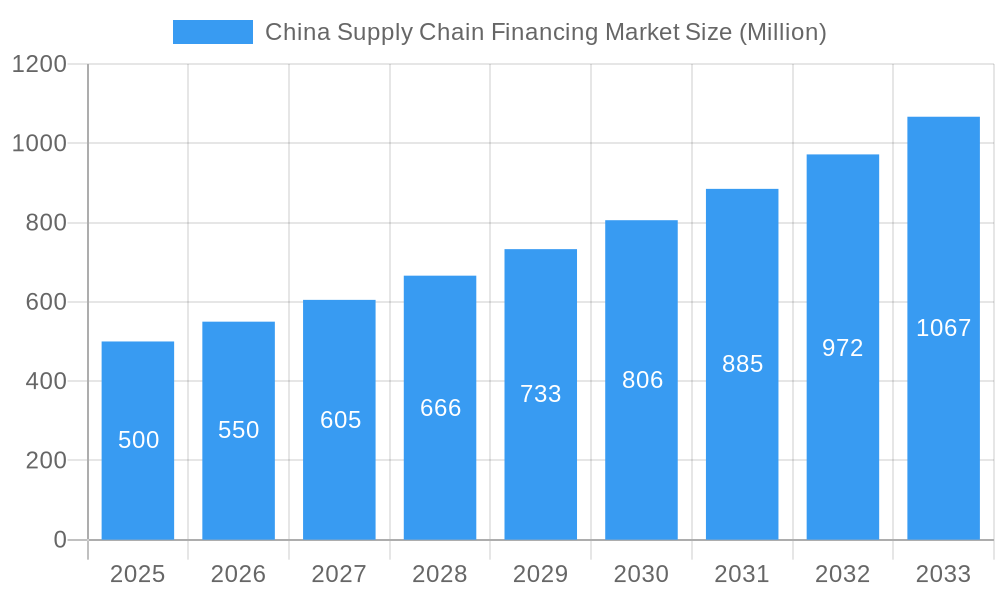

China Supply Chain Financing Market Market Size (In Billion)

Future expansion is expected to be driven by sustained e-commerce growth, advancing digital infrastructure, and government backing for supply chain modernization. Effective credit risk management and regulatory oversight will be paramount for sustained development, while robust market fundamentals indicate a promising outlook. A commitment to technological innovation, coupled with expanded financial inclusion initiatives, positions the China supply chain finance market for significant future expansion. Strategic alliances between financial entities and technology innovators will be instrumental in defining the market's path and realizing additional growth potential.

China Supply Chain Financing Market Company Market Share

China Supply Chain Financing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China Supply Chain Financing Market, offering crucial insights for investors, businesses, and stakeholders seeking to understand this dynamic sector. The study covers the period 2019-2033, with 2025 as the base and estimated year. We project significant growth driven by technological advancements, evolving regulatory frameworks, and burgeoning e-commerce. This report meticulously examines market concentration, key trends, leading players, and emerging opportunities, providing actionable intelligence for strategic decision-making. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

China Supply Chain Financing Market Market Concentration & Dynamics

The China Supply Chain Financing market exhibits a moderately concentrated landscape, with key players such as Bank of China, Industrial and Commercial Bank of China, and HSBC Bank holding significant market share. However, the market is witnessing increased competition from both domestic and international players, including DBS Bank Ltd, Ping An Bank, Standard Bank, and Citibank. The market is characterized by a complex interplay of factors including:

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating moderate concentration. This is likely to shift slightly in the coming years due to increased competition and M&A activity.

- Innovation Ecosystems: Fintech advancements are driving innovation, with digital platforms and blockchain technology transforming supply chain finance processes. The ecosystem includes technology providers, financial institutions, and logistics companies.

- Regulatory Frameworks: Stringent regulations from the China Banking and Insurance Regulatory Commission (CBIRC) and other bodies influence market dynamics. Recent regulatory changes have impacted market access and operational procedures.

- Substitute Products: Traditional financing options and alternative lending platforms pose competitive pressures on supply chain finance providers.

- End-User Trends: The increasing adoption of e-commerce and global supply chains is driving demand for efficient and reliable supply chain financing solutions. SMEs are a particularly important end-user segment.

- M&A Activities: The market has witnessed notable M&A activities. For instance, Zhongyuan Bank's acquisition of several smaller banks in May 2022 demonstrates consolidation trends. The number of M&A deals is projected to be xx in 2025.

China Supply Chain Financing Market Industry Insights & Trends

The China Supply Chain Financing market is experiencing robust growth, fueled by several key factors. The market size reached xx Million in 2024 and is expected to reach xx Million in 2025, indicating a significant expansion. Several factors are driving this expansion, including:

- Rapid Growth of E-commerce: The explosive growth of e-commerce in China has increased the demand for efficient and reliable supply chain financing solutions to support the complex logistics involved.

- Government Initiatives: Government policies aimed at supporting SMEs and improving supply chain efficiency are providing a favorable environment for market growth.

- Technological Advancements: The adoption of fintech solutions, including blockchain and AI, is streamlining processes, reducing costs, and improving transparency across supply chains.

- Increasing Global Trade: China’s expanding role in global trade necessitates sophisticated supply chain financing mechanisms to manage international transactions and mitigate risks.

- Shifting Consumer Behavior: The rise of omnichannel retail and increased demand for faster delivery are impacting supply chains, creating new opportunities for specialized financing solutions.

Key Markets & Segments Leading China Supply Chain Financing Market

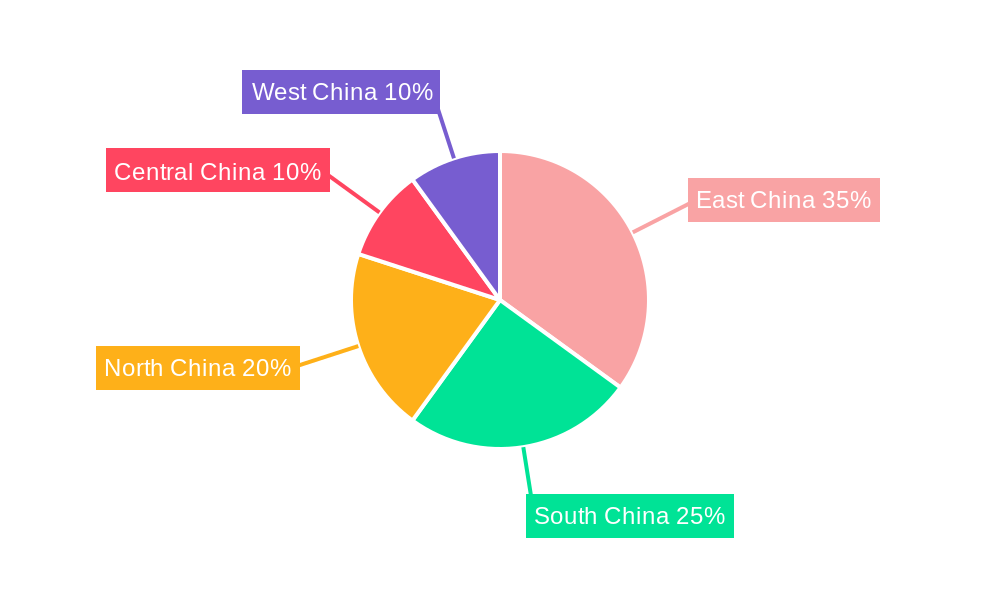

While data on precise regional dominance is unavailable, the coastal regions of China, particularly the Yangtze River Delta and the Pearl River Delta, are likely to be the dominant markets. This dominance is driven by:

- High Concentration of Manufacturing and Export Activities: These regions house a large concentration of manufacturing and exporting companies, creating high demand for supply chain financing services.

- Developed Infrastructure: Excellent infrastructure, including ports, logistics networks, and financial hubs, supports the efficient functioning of supply chains.

- Access to Capital and Financial Services: These areas have better access to capital and sophisticated financial services, creating a more developed and competitive supply chain finance market.

The SME segment represents a significant portion of the market. Drivers include:

- High Growth Potential: SMEs form a large and dynamic part of the Chinese economy, contributing significantly to economic growth and requiring substantial financing for their operations.

- Limited Access to Traditional Financing: Many SMEs struggle to obtain traditional financing, making supply chain finance solutions an attractive alternative.

China Supply Chain Financing Market Product Developments

Recent product developments focus on integrated, technology-driven solutions that offer greater transparency, efficiency, and risk mitigation. This includes the rise of digital platforms offering streamlined financing processes, automated invoice processing, and real-time monitoring of transactions. The incorporation of blockchain technology enhances security and transparency, while AI-powered analytics enables better risk assessment and credit scoring. These innovations are enhancing the competitive edge of leading providers.

Challenges in the China Supply Chain Financing Market Market

The market faces several challenges, including:

- Regulatory Uncertainty: Evolving regulations can create uncertainty and hinder market growth.

- Supply Chain Disruptions: Geopolitical factors and global supply chain disruptions pose risks to financing arrangements.

- Credit Risk: Assessing and managing credit risk effectively is crucial, particularly in the SME segment.

- Competition: Intense competition from both established and emerging players requires continuous innovation and adaptation. The impact of competition is estimated to reduce average profit margins by xx% in 2025.

Forces Driving China Supply Chain Financing Market Growth

Several key factors are driving growth:

- Technological Advancements: Fintech innovations are transforming the industry, improving efficiency and access to finance.

- Economic Growth: Continued economic growth in China fuels demand for supply chain financing services.

- Government Support: Government policies supporting SMEs and supply chain development create a positive environment.

Long-Term Growth Catalysts in the China Supply Chain Financing Market

Long-term growth will be driven by increased adoption of innovative financing solutions, strategic partnerships between fintech companies and traditional financial institutions, and expansion into new markets and industries. The development of specialized financing products for specific sectors will also play a key role.

Emerging Opportunities in China Supply Chain Financing Market

Opportunities lie in leveraging AI and big data analytics for improved risk management and personalized financing solutions. Green finance initiatives and sustainability-linked supply chain finance will attract increasing attention. Expansion into underserved regions and industries also presents significant potential.

Leading Players in the China Supply Chain Financing Market Sector

Key Milestones in China Supply Chain Financing Market Industry

- October 2023: DBS launched its first hybrid financing solution for SMEs focusing on sustainability. This demonstrates a shift towards environmentally conscious financing options.

- May 2022: Zhongyuan Bank's acquisition of several smaller banks signifies consolidation within the market and strengthens its market position.

- December 2022: Citi's decision to wind down its consumer banking business in China alters the competitive landscape, potentially opening opportunities for other players.

Strategic Outlook for China Supply Chain Financing Market Market

The China Supply Chain Financing market holds immense potential for growth driven by continued technological advancements, economic expansion, and supportive government policies. Strategic opportunities exist for players who can effectively leverage innovation, build strong partnerships, and adapt to evolving market dynamics. The market's future hinges on its ability to embrace technological advancements, cater to the specific needs of SMEs, and navigate the complexities of the regulatory landscape.

China Supply Chain Financing Market Segmentation

-

1. Offering

- 1.1. Export and Import Bills

- 1.2. Letter of Credit

- 1.3. Performance Bonds

- 1.4. Shipping, Guarantees

- 1.5. Other Offerings

-

2. Provider

- 2.1. Banks

- 2.2. Trade Finance House

- 2.3. Other Providers

-

3. Application

- 3.1. Domestic

- 3.2. International

-

4. End-User

- 4.1. Large Enterprises

- 4.2. Small and Medium-sized Enterprises

China Supply Chain Financing Market Segmentation By Geography

- 1. China

China Supply Chain Financing Market Regional Market Share

Geographic Coverage of China Supply Chain Financing Market

China Supply Chain Financing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Incorporation of New Novel Technologies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Supply Chain Financing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Export and Import Bills

- 5.1.2. Letter of Credit

- 5.1.3. Performance Bonds

- 5.1.4. Shipping, Guarantees

- 5.1.5. Other Offerings

- 5.2. Market Analysis, Insights and Forecast - by Provider

- 5.2.1. Banks

- 5.2.2. Trade Finance House

- 5.2.3. Other Providers

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Large Enterprises

- 5.4.2. Small and Medium-sized Enterprises

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deutsche Bank AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DBS Bank Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bank of China

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ping An Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Standard Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flexport

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Industrial and Commercial Bank of China

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HSBC Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Citibank*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Deutsche Bank AG

List of Figures

- Figure 1: China Supply Chain Financing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Supply Chain Financing Market Share (%) by Company 2025

List of Tables

- Table 1: China Supply Chain Financing Market Revenue billion Forecast, by Offering 2020 & 2033

- Table 2: China Supply Chain Financing Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 3: China Supply Chain Financing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: China Supply Chain Financing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: China Supply Chain Financing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: China Supply Chain Financing Market Revenue billion Forecast, by Offering 2020 & 2033

- Table 7: China Supply Chain Financing Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 8: China Supply Chain Financing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: China Supply Chain Financing Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: China Supply Chain Financing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Supply Chain Financing Market?

The projected CAGR is approximately 9.2%.

2. Which companies are prominent players in the China Supply Chain Financing Market?

Key companies in the market include Deutsche Bank AG, DBS Bank Ltd, Bank of China, Ping An Bank, Standard Bank, Flexport, Industrial and Commercial Bank of China, HSBC Bank, Citibank*List Not Exhaustive.

3. What are the main segments of the China Supply Chain Financing Market?

The market segments include Offering, Provider, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.3 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Incorporation of New Novel Technologies.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2023: DBS launched its first hybrid financing solution to help small and medium enterprises (SMEs) access a wider pool of capital to finance their sustainability journeys.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Supply Chain Financing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Supply Chain Financing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Supply Chain Financing Market?

To stay informed about further developments, trends, and reports in the China Supply Chain Financing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence