Key Insights

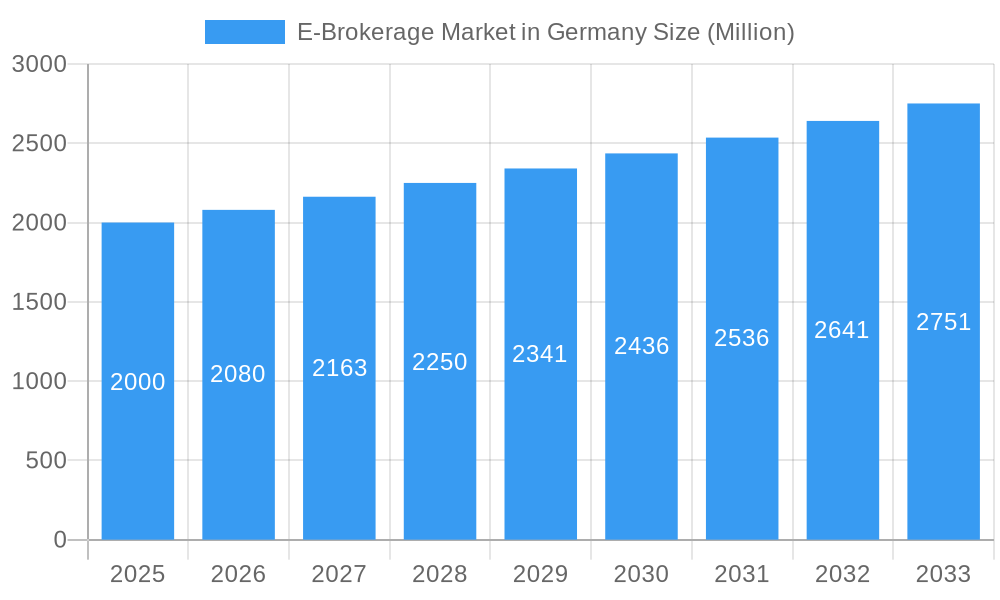

The German e-brokerage market is poised for significant growth, projected at a Compound Annual Growth Rate (CAGR) of 6.4% from 2025 to 2033. This expansion is driven by increasing digitalization, a surge in younger investors adopting online platforms, and a growing retail investor appetite for diversified investment strategies. Technological advancements, including intuitive mobile trading applications and advanced analytical tools, have democratized market access, fostering broader participation. However, evolving regulatory frameworks and inherent financial market volatility present ongoing challenges. Intense competition from established firms and emerging disruptors necessitates continuous innovation and competitive pricing. The market can be segmented by service type, investor profile, and regional focus within Germany. With a projected market size of 1 billion Euros in 2025, the German e-brokerage sector demonstrates strong growth potential for the forecast period.

E-Brokerage Market in Germany Market Size (In Billion)

To achieve sustained success, e-brokerage firms must prioritize adapting to dynamic customer needs and market shifts. Key strategies include delivering exceptional customer service, offering personalized investment guidance, implementing robust security protocols, and maintaining competitive fee structures. Expanding product portfolios beyond traditional stock trading to include robo-advisory and fractional share options will be crucial for capturing a wider audience. The competitive environment may witness strategic consolidations to achieve economies of scale and enhance market standing. While regulatory compliance is essential for investor protection, it also requires vigilant navigation by market participants. The long-term outlook for the German e-brokerage market remains optimistic, supported by ongoing technological innovation, expanding investor engagement, and the agility of industry players.

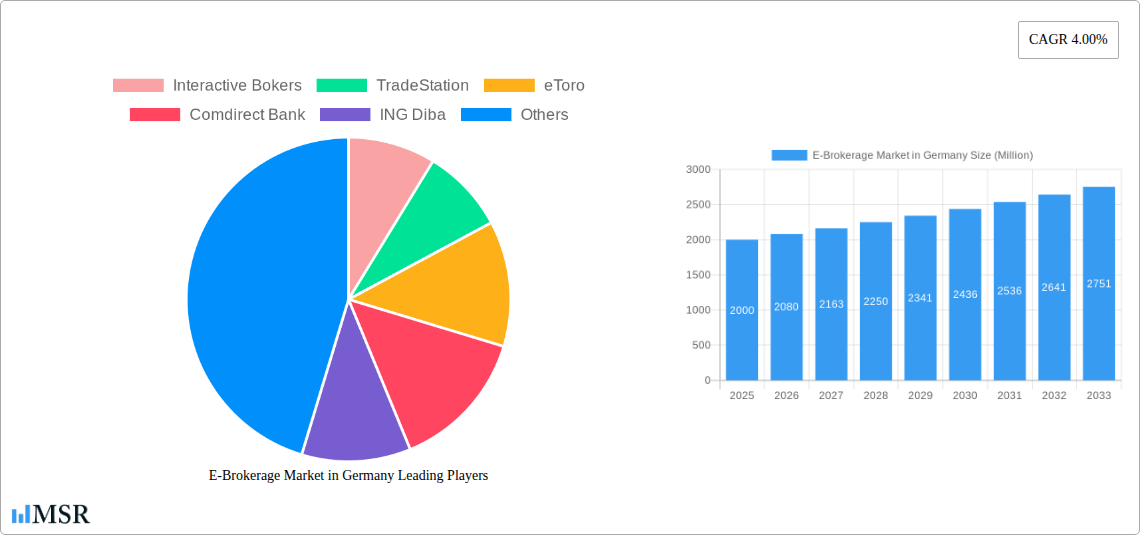

E-Brokerage Market in Germany Company Market Share

E-Brokerage Market in Germany: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the German e-brokerage market, covering market dynamics, industry trends, key players, and future growth prospects from 2019 to 2033. The study utilizes data from the historical period (2019-2024), the base year (2025), and forecasts the market's trajectory until 2033. Gain actionable insights into this dynamic sector, identifying lucrative opportunities and navigating potential challenges. This report is crucial for investors, industry stakeholders, and anyone seeking a deep understanding of the German e-brokerage landscape.

Keywords: German e-brokerage market, online brokerage, German online trading, retail investors, Comdirect Bank, ING Diba, Flatex, Trade Republic, TradeStation, Interactive Brokers, eToro, Lynx, Onvista, Consors Bank, Geno Broker, market size, CAGR, M&A, Fintech, regulatory framework, industry trends, market share, competitive landscape, growth opportunities, Germany investment market.

E-Brokerage Market in Germany Market Concentration & Dynamics

The German e-brokerage market exhibits a moderately concentrated landscape, with several major players commanding significant market share. While precise market share figures for each company require further proprietary data analysis, we can infer that players like Comdirect Bank, ING Diba, and Flatex hold substantial positions. However, the rise of innovative fintech companies like Trade Republic presents a dynamic competitive environment.

Market Concentration Metrics (Estimated 2025):

- Top 5 players hold approximately xx% of the market.

- Market concentration ratio (CR5): xx%

- Herfindahl-Hirschman Index (HHI): xx

Market Dynamics:

- Innovation Ecosystems: The German market witnesses continuous innovation, fueled by fintech startups and established players alike. This is evident in the introduction of new trading platforms, mobile applications, and investment products.

- Regulatory Frameworks: BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht), Germany's financial regulatory authority, plays a significant role in shaping the market's landscape. Stringent regulations impact market entry, operations, and product offerings.

- Substitute Products: Traditional brokerage services and investment products represent substitutes, although the convenience and cost-effectiveness of e-brokerage platforms are strong drivers of market growth.

- End-User Trends: Increasing digitalization, a growing millennial investor base, and the rise of mobile trading are key trends shaping consumer behavior. Demand for commission-free trading and sophisticated investment tools is also on the rise.

- M&A Activities: The past five years have witnessed xx M&A deals in the German e-brokerage market, indicating ongoing consolidation and market restructuring. These deals often involve smaller players being acquired by larger entities to enhance market share and product offerings.

E-Brokerage Market in Germany Industry Insights & Trends

The German e-brokerage market has experienced significant growth during the period 2019-2024, driven by several factors. The market size reached an estimated €xx Million in 2024. This growth is projected to continue, with a Compound Annual Growth Rate (CAGR) of xx% expected between 2025 and 2033, leading to an estimated market size of €xx Million by 2033.

Market Growth Drivers:

- Increasing smartphone penetration and mobile trading adoption.

- Rising retail investor participation fueled by economic growth and low interest rates (prior to recent rate increases).

- The emergence of innovative fintech companies disrupting traditional brokerage models.

- Government initiatives promoting financial literacy and investment among the population.

- Favorable regulatory environment, albeit with ongoing adjustments.

Technological Disruptions & Evolving Consumer Behaviors:

The increasing adoption of artificial intelligence (AI), machine learning (ML), and robo-advisory services is reshaping the landscape. Consumers are demanding personalized investment solutions, user-friendly interfaces, and seamless mobile trading experiences.

Key Markets & Segments Leading E-Brokerage Market in Germany

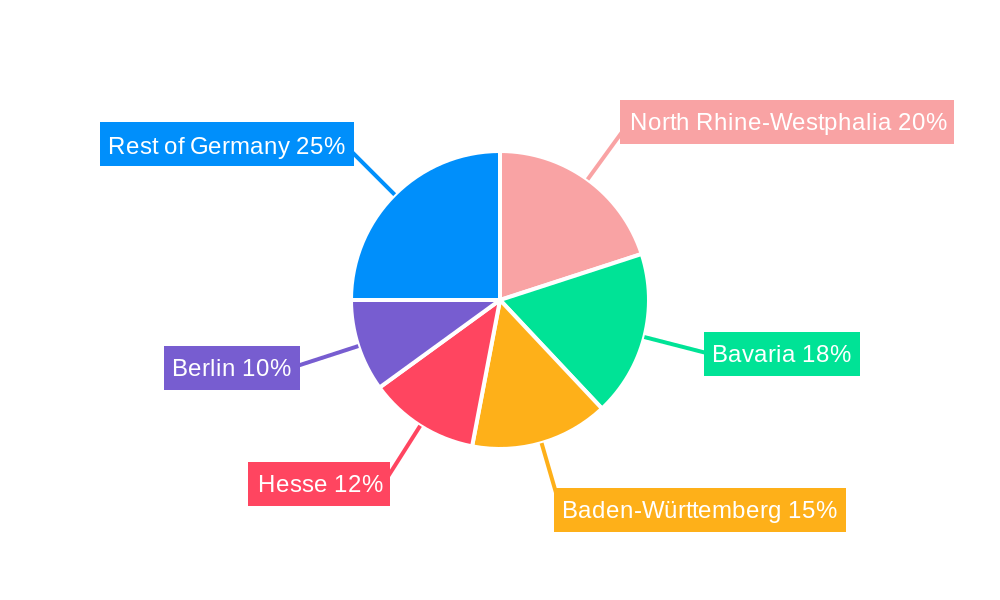

The German e-brokerage market is primarily driven by retail investors across various demographics. Urban areas with higher digital literacy and disposable income show higher adoption rates.

Dominant Segments and Drivers:

- Retail Investors: This segment constitutes the majority of the market, driven by the increasing accessibility of online trading platforms and a rising interest in self-directed investments.

- Age Demographics: The millennial and Gen Z populations are increasingly adopting e-brokerage platforms, driving substantial growth.

Regional Dominance:

While nationwide accessibility is key, urban centers in Germany demonstrate higher market penetration due to factors such as higher internet penetration, digital literacy, and higher income levels.

E-Brokerage Market in Germany Product Developments

The German e-brokerage market showcases significant product innovations. Platforms now offer advanced charting tools, fractional share trading, robo-advisory services, and crypto-trading capabilities. Integration with banking services and seamless account management features are also becoming crucial differentiators. These innovations cater to evolving investor needs and enhance overall trading experience.

Challenges in the E-Brokerage Market in Germany Market

The German e-brokerage market faces several challenges. These include the increasing regulatory scrutiny imposed by BaFin, which can lead to higher compliance costs and hinder market entry for smaller players. Furthermore, intense competition, especially from established banks and rapidly growing fintech companies, leads to margin compression and necessitates continuous innovation. Cybersecurity threats and the need for robust data protection measures are also significant challenges.

Forces Driving E-Brokerage Market in Germany Growth

Several factors contribute to the long-term growth of the German e-brokerage market. Technological advancements, particularly in AI and mobile trading, will continue to enhance user experience and attract new investors. Economic growth, coupled with improved financial literacy, should boost investor participation. Government initiatives promoting digitalization and financial inclusion further contribute to a favorable growth environment. Additionally, strategic partnerships between established financial institutions and innovative fintech companies will play a vital role in expanding market reach and offering diverse products.

Challenges in the E-Brokerage Market in Germany Market

Despite the opportunities, market saturation, especially in the larger cities, poses a challenge to new entrants. Attracting and retaining customers amidst increased competition requires continuous innovation and superior customer service. Also, maintaining regulatory compliance while adapting to evolving regulations represents a considerable undertaking for all participants.

Emerging Opportunities in E-Brokerage Market in Germany

The growing popularity of sustainable and ethical investments presents an important opportunity. E-brokerage platforms offering ESG (Environmental, Social, and Governance) screened investment options and educational resources are well positioned for growth. Expansion into niche market segments, such as providing services for specific demographic groups (e.g., younger investors or specific professional sectors), also offers significant potential. Finally, integrating blockchain technology and decentralized finance (DeFi) offerings could unlock new avenues for growth.

Leading Players in the E-Brokerage Market in Germany Sector

- Interactive Brokers

- TradeStation

- eToro

- Comdirect Bank

- ING Diba

- Flatex

- Trade Republic

- Lynx

- Onvista

- Consors Bank

- Geno Broker

- List Not Exhaustive

Key Milestones in E-Brokerage Market in Germany Industry

- July 2022: Flatex became the Exclusive Online Brokerage Partner of the Police Union ('Gewerkschaft der Polizei, GdP') of North Rhine-Westphalia, significantly expanding its customer base.

- January 2022: Comdirect Bank partnered with ETC Group, offering crypto ETP-based savings plans, enhancing its product portfolio and attracting crypto-savvy investors.

Strategic Outlook for E-Brokerage Market in Germany Market

The German e-brokerage market exhibits significant potential for growth, driven by technological advancements, evolving consumer preferences, and strategic partnerships. Companies focusing on providing personalized investment solutions, robust cybersecurity measures, and seamless user experiences will thrive. Expansion into new market segments and strategic acquisitions will also be key to maintaining a competitive edge in the coming years. The market is expected to continue its strong growth trajectory, with opportunities for both established players and innovative startups.

E-Brokerage Market in Germany Segmentation

-

1. Investor Type

- 1.1. Retail

- 1.2. Institutional

-

2. Broker Ownership Type

- 2.1. Local

- 2.2. Foreign

E-Brokerage Market in Germany Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-Brokerage Market in Germany Regional Market Share

Geographic Coverage of E-Brokerage Market in Germany

E-Brokerage Market in Germany REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment Culture is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Investment Culture is Driving the Market

- 3.4. Market Trends

- 3.4.1. Increase in Internet and Mobile Penetration in Germany is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investor Type

- 5.1.1. Retail

- 5.1.2. Institutional

- 5.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 5.2.1. Local

- 5.2.2. Foreign

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Investor Type

- 6. North America E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investor Type

- 6.1.1. Retail

- 6.1.2. Institutional

- 6.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 6.2.1. Local

- 6.2.2. Foreign

- 6.1. Market Analysis, Insights and Forecast - by Investor Type

- 7. South America E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investor Type

- 7.1.1. Retail

- 7.1.2. Institutional

- 7.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 7.2.1. Local

- 7.2.2. Foreign

- 7.1. Market Analysis, Insights and Forecast - by Investor Type

- 8. Europe E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investor Type

- 8.1.1. Retail

- 8.1.2. Institutional

- 8.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 8.2.1. Local

- 8.2.2. Foreign

- 8.1. Market Analysis, Insights and Forecast - by Investor Type

- 9. Middle East & Africa E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investor Type

- 9.1.1. Retail

- 9.1.2. Institutional

- 9.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 9.2.1. Local

- 9.2.2. Foreign

- 9.1. Market Analysis, Insights and Forecast - by Investor Type

- 10. Asia Pacific E-Brokerage Market in Germany Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investor Type

- 10.1.1. Retail

- 10.1.2. Institutional

- 10.2. Market Analysis, Insights and Forecast - by Broker Ownership Type

- 10.2.1. Local

- 10.2.2. Foreign

- 10.1. Market Analysis, Insights and Forecast - by Investor Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Interactive Bokers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TradeStation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 eToro

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Comdirect Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ING Diba

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Flatex

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trade Republic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lynx

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Onvista

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Consors Bank

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Geno Broker**List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Interactive Bokers

List of Figures

- Figure 1: Global E-Brokerage Market in Germany Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 3: North America E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 4: North America E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 5: North America E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 6: North America E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 7: North America E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 9: South America E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 10: South America E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 11: South America E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 12: South America E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 13: South America E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 15: Europe E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 16: Europe E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 17: Europe E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 18: Europe E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 21: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 22: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 23: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 24: Middle East & Africa E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Investor Type 2025 & 2033

- Figure 27: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Investor Type 2025 & 2033

- Figure 28: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Broker Ownership Type 2025 & 2033

- Figure 29: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Broker Ownership Type 2025 & 2033

- Figure 30: Asia Pacific E-Brokerage Market in Germany Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific E-Brokerage Market in Germany Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 2: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 3: Global E-Brokerage Market in Germany Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 5: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 6: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 11: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 12: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 17: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 18: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 29: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 30: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global E-Brokerage Market in Germany Revenue billion Forecast, by Investor Type 2020 & 2033

- Table 38: Global E-Brokerage Market in Germany Revenue billion Forecast, by Broker Ownership Type 2020 & 2033

- Table 39: Global E-Brokerage Market in Germany Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific E-Brokerage Market in Germany Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-Brokerage Market in Germany?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the E-Brokerage Market in Germany?

Key companies in the market include Interactive Bokers, TradeStation, eToro, Comdirect Bank, ING Diba, Flatex, Trade Republic, Lynx, Onvista, Consors Bank, Geno Broker**List Not Exhaustive.

3. What are the main segments of the E-Brokerage Market in Germany?

The market segments include Investor Type, Broker Ownership Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1 billion as of 2022.

5. What are some drivers contributing to market growth?

Investment Culture is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Internet and Mobile Penetration in Germany is Driving the Market.

7. Are there any restraints impacting market growth?

Investment Culture is Driving the Market.

8. Can you provide examples of recent developments in the market?

July 2022: Flatex, Europe's leading online broker for retail investors, became the Exclusive Online Brokerage Partner of the Police Union ('Gewerkschaft der Polizei, GdP') of North Rhine-Westphalia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-Brokerage Market in Germany," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-Brokerage Market in Germany report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-Brokerage Market in Germany?

To stay informed about further developments, trends, and reports in the E-Brokerage Market in Germany, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence