Key Insights

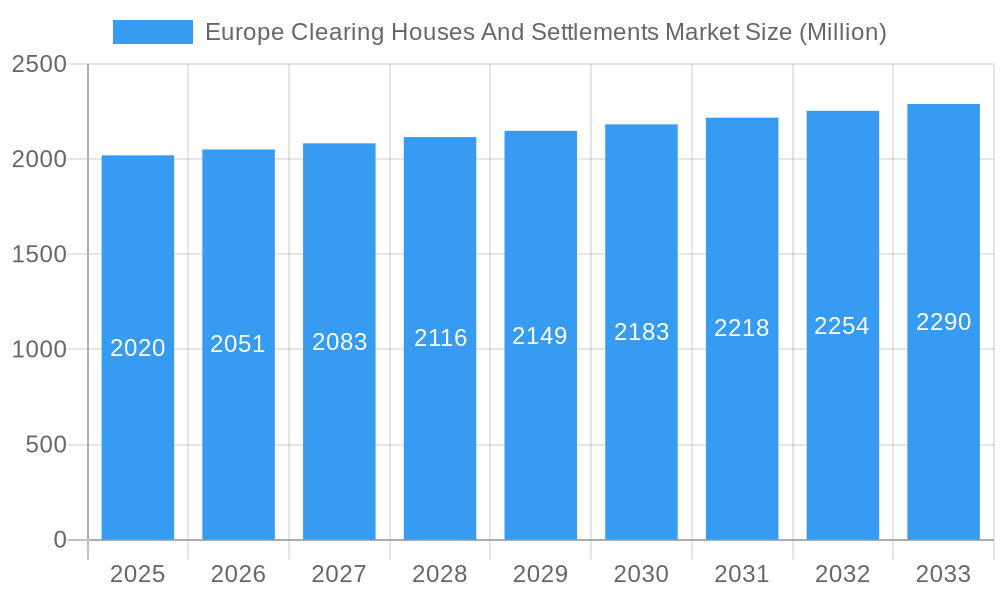

The European Clearing Houses and Settlements market, valued at €2.02 billion in 2025, is projected to experience steady growth, driven primarily by increasing regulatory scrutiny demanding greater transparency and risk mitigation in financial transactions. This necessitates robust clearing and settlement infrastructure, fueling demand for the services offered by established players like Euroclear, Clearstream Banking, and LCH Clearnet, as well as newer entrants leveraging technology advancements. The market's growth, while moderate at a CAGR of 1.59%, reflects a maturing yet crucial sector within the European financial ecosystem. The expansion is anticipated to be influenced by factors such as the rising adoption of digital assets and blockchain technology, potentially streamlining processes and reducing costs, although this adoption remains in its early stages. Competition will likely intensify as established players consolidate their market position and innovative fintech firms introduce novel solutions.

Europe Clearing Houses And Settlements Market Market Size (In Billion)

Growth within specific segments, while not explicitly detailed, can be inferred. Given the evolving regulatory landscape and the increasing complexity of financial instruments, segments focusing on specialized clearing services (e.g., derivatives, securities lending) are likely to experience higher growth rates than more traditional segments. Geographical distribution of market share will likely favor established financial centers like London, Frankfurt, and Luxembourg, although the impact of Brexit and shifting regulatory landscapes may influence regional growth trajectories. The forecast period of 2025-2033 offers ample opportunity for market players to adapt to technological changes and navigate regulatory challenges, positioning themselves for success in a dynamic and increasingly competitive environment.

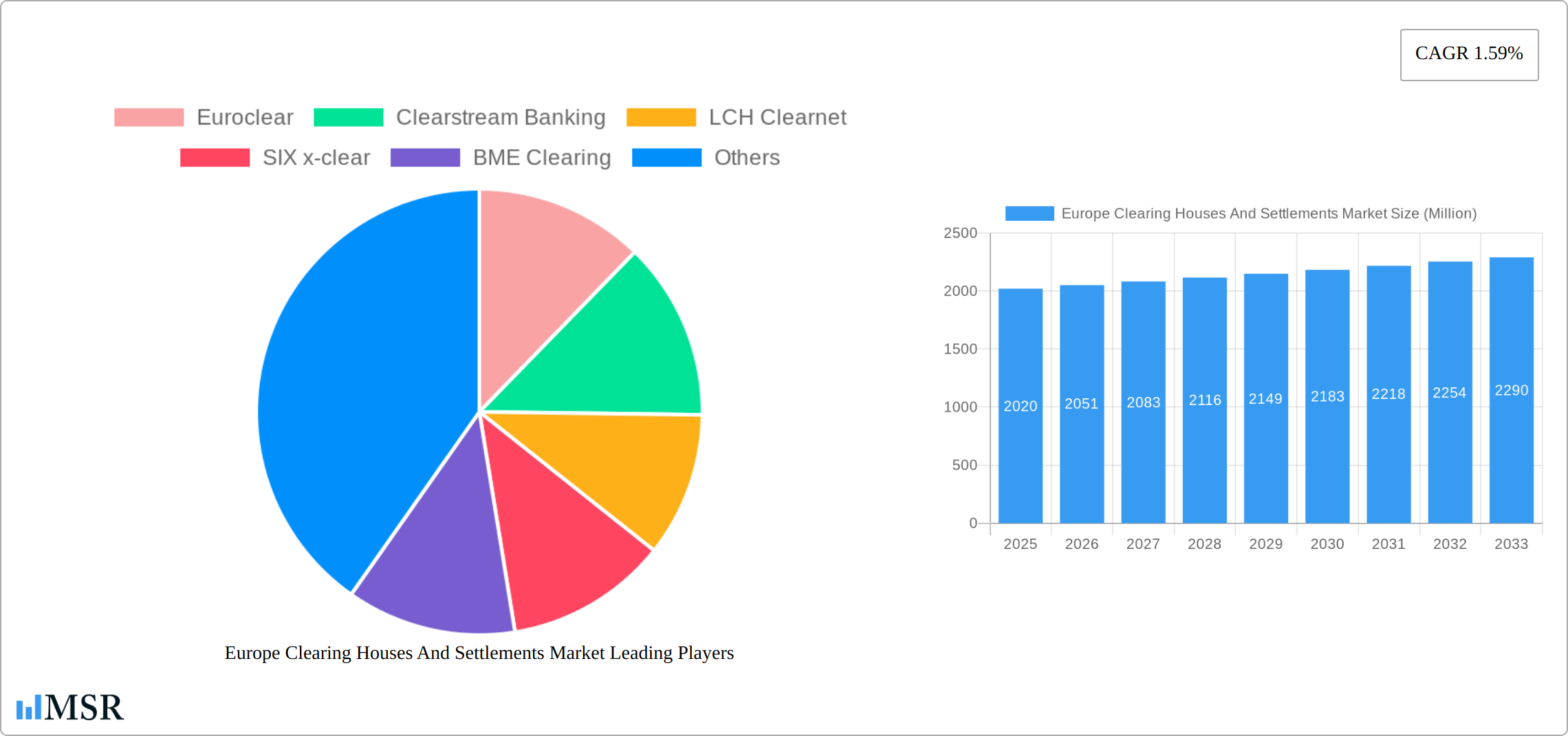

Europe Clearing Houses And Settlements Market Company Market Share

Europe Clearing Houses and Settlements Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Clearing Houses and Settlements Market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, and emerging trends. The report is built upon extensive research, offering actionable intelligence to navigate the complexities of this rapidly evolving market. The market size in 2025 is estimated at xx Million. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at xx%.

Europe Clearing Houses And Settlements Market Market Concentration & Dynamics

The European clearing houses and settlements market exhibits moderate concentration, with several major players holding significant market share. Euroclear and Clearstream Banking dominate the landscape, followed by LCH Clearnet and SIX x-clear. Smaller players like BME Clearing, NSD, Monte Titoli, and Nasdaq CSD cater to niche segments or specific geographies. The market share of the top three players combined is estimated at 65% in 2025. The market is witnessing significant innovation driven by technological advancements, primarily blockchain and distributed ledger technology (DLT). Regulatory frameworks, such as those implemented by the European Securities and Markets Authority (ESMA), significantly influence market practices. The landscape is also shaped by ongoing M&A activities, with xx mergers and acquisitions recorded in the historical period (2019-2024). Future M&A activity is anticipated to consolidate the market further. Substitute products, such as peer-to-peer settlement systems, pose a growing challenge. End-user trends favor streamlined, cost-effective, and technologically advanced solutions.

- Market Share (2025): Euroclear (xx%), Clearstream Banking (xx%), LCH Clearnet (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Key Regulatory Frameworks: ESMA regulations, PSD2, MiFID II

Europe Clearing Houses And Settlements Market Industry Insights & Trends

The European clearing houses and settlements market is experiencing robust growth, driven by several key factors. Increasing trading volumes, particularly in equities and derivatives, fuel demand for efficient and reliable clearing and settlement services. The burgeoning digital asset market presents significant new opportunities, requiring innovative solutions for clearing and settling cryptocurrencies and other tokenized assets. Furthermore, the widespread adoption of Distributed Ledger Technology (DLT) is revolutionizing the industry, offering improved transparency, reduced settlement times, and enhanced security. The projected market size for 2025 is estimated at [Insert Updated Market Size] Million, reflecting this dynamic growth. This expansion is further fueled by evolving consumer expectations, which prioritize faster, more transparent, and secure settlement processes. Regulatory changes, including those focused on increased transparency and risk mitigation, are also significantly shaping market dynamics, driving adoption of advanced technologies and improved operational efficiency. The increasing adoption of securities financing transactions (SFTs) is creating substantial demand for CCP clearing services, adding another layer to market growth. Globalization and the expansion of financial markets are leading to a significant rise in cross-border transactions, further boosting market demand.

Key Markets & Segments Leading Europe Clearing Houses And Settlements Market

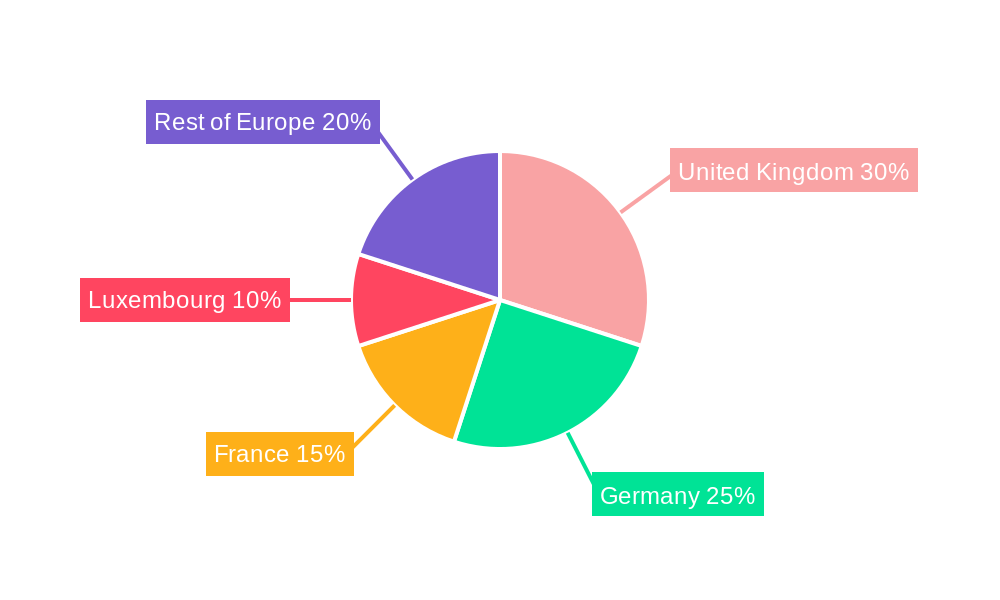

Western Europe remains the dominant region in the European clearing houses and settlements market, commanding [Insert Updated Percentage]% of the market share in 2025. Within this region, the United Kingdom and Germany maintain their positions as leading countries, driven by robust financial infrastructures, high trading volumes, and a concentration of major market players.

- Drivers of Dominance in Western Europe:

- Well-established and sophisticated financial infrastructure

- High trading volumes across various asset classes

- Stringent regulatory frameworks promoting investor confidence and market stability

- Presence of major market players such as Euroclear and Clearstream, offering a wide range of clearing and settlement services

- Significant concentration of financial institutions and expertise.

- Detailed Dominance Analysis: The UK and Germany benefit from a dense network of financial institutions, sophisticated trading ecosystems, and strong regulatory environments that attract substantial international investment and trading activity. This concentration of activity leads to high market concentration and high transaction volumes in these two countries, solidifying their leading positions.

Europe Clearing Houses And Settlements Market Product Developments

The competitive landscape is rapidly evolving due to significant product innovations. The adoption of DLT platforms for securities issuance and settlement, spearheaded by industry leaders such as Euroclear, is transforming the industry by enhancing efficiency, transparency, and cost-effectiveness. Improvements in CCP (Central Counterparty) infrastructure, focusing on advanced risk management techniques and automation, are strengthening market resilience and reducing operational risk. The development of new clearing services specifically designed for SFTs, as exemplified by Cboe Clear Europe's initiative, is expanding market offerings and catering to the increasing demand for these services. These technological advancements are not only enhancing market efficiency and reducing operational costs but also significantly improving security and transparency for all market stakeholders.

Challenges in the Europe Clearing Houses And Settlements Market Market

The market faces challenges such as stringent regulatory compliance requirements, which can increase operational costs. Cybersecurity risks and data protection concerns represent a significant obstacle. Intense competition among established players and the emergence of new entrants also pose challenges. These factors limit market growth and profitability. The high initial investment required for DLT implementation could hinder adoption among smaller players.

Forces Driving Europe Clearing Houses And Settlements Market Growth

Technological advancements, particularly DLT, are a major growth driver, improving efficiency and security. The increasing volume of cross-border transactions fuels market expansion. Favorable regulatory frameworks promoting transparency and risk mitigation also contribute to growth. The growing adoption of digital assets and securities financing transactions creates significant market opportunities.

Challenges in the Europe Clearing Houses And Settlements Market Market

Long-term growth hinges on the successful adoption and integration of DLT, strategic partnerships fostering innovation, and expanding into new markets. Continuous technological upgrades are crucial to maintain a competitive edge, and fostering collaboration across the industry will promote wider adoption of innovative solutions.

Emerging Opportunities in Europe Clearing Houses And Settlements Market

The growing demand for streamlined, cost-effective, and secure settlement solutions presents significant opportunities for market participants. Expansion into new markets, particularly those embracing digital assets and decentralized finance (DeFi), offers lucrative growth potential. Innovation in risk management and cybersecurity, particularly in addressing the unique challenges of digital assets, will be crucial for continued growth. Opportunities also exist in developing specialized, tailored solutions for specific asset classes, such as green bonds or other sustainable investments, and expanding into new geographical regions within Europe and beyond.

Leading Players in the Europe Clearing Houses And Settlements Market Sector

- Euroclear

- Clearstream Banking

- LCH Clearnet

- SIX x-clear

- BME Clearing

- National Settlements Depository (NSD)

- Monte Titoli

- Nasdaq CSD

- Bitbond

- Fnality

- Clearmatics

- List Not Exhaustive

Key Milestones in Europe Clearing Houses And Settlements Market Industry

- [Updated Month, Year]: [More detailed and specific description of Cboe Clear Europe's SFT clearing service launch, including any outcomes or impact].

- [Updated Month, Year]: [More detailed and specific description of Euroclear's DLT platform announcement, including any updates on its development and release].

- [Add other relevant milestones] Add other significant developments, such as regulatory changes, partnerships, or mergers and acquisitions that have shaped the market.

Strategic Outlook for Europe Clearing Houses And Settlements Market Market

The future of the European clearing houses and settlements market is bright, driven by technological innovation and the increasing demand for efficient and secure settlement solutions. Strategic partnerships and expansion into new markets, along with continuous investments in cybersecurity and risk management, will shape the industry's future growth. The continued adoption of DLT and AI will transform market dynamics, creating significant opportunities for growth and innovation.

Europe Clearing Houses And Settlements Market Segmentation

-

1. Type

- 1.1. Outward House Clearing

- 1.2. Inward House Clearing

-

2. Type of System

- 2.1. TARGET2

- 2.2. SEPA

- 2.3. EBICS

- 2.4. Other Systems

Europe Clearing Houses And Settlements Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Clearing Houses And Settlements Market Regional Market Share

Geographic Coverage of Europe Clearing Houses And Settlements Market

Europe Clearing Houses And Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory Requirements; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Regulatory Requirements; Technological Advancements

- 3.4. Market Trends

- 3.4.1. SEPA Schemes are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Clearing Houses And Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Outward House Clearing

- 5.1.2. Inward House Clearing

- 5.2. Market Analysis, Insights and Forecast - by Type of System

- 5.2.1. TARGET2

- 5.2.2. SEPA

- 5.2.3. EBICS

- 5.2.4. Other Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Euroclear

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clearstream Banking

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LCH Clearnet

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SIX x-clear

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BME Clearing

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Settlements Depository (NSD)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Monte Titoli

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nasdaq CSD

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bitbond

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fnality

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Clearmatics**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Euroclear

List of Figures

- Figure 1: Europe Clearing Houses And Settlements Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Clearing Houses And Settlements Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type 2020 & 2033

- Table 3: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type of System 2020 & 2033

- Table 4: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type of System 2020 & 2033

- Table 5: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Region 2020 & 2033

- Table 7: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type 2020 & 2033

- Table 9: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Type of System 2020 & 2033

- Table 10: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Type of System 2020 & 2033

- Table 11: Europe Clearing Houses And Settlements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Clearing Houses And Settlements Market Volume Quadrillion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Clearing Houses And Settlements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Clearing Houses And Settlements Market Volume (Quadrillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Clearing Houses And Settlements Market?

The projected CAGR is approximately 1.59%.

2. Which companies are prominent players in the Europe Clearing Houses And Settlements Market?

Key companies in the market include Euroclear, Clearstream Banking, LCH Clearnet, SIX x-clear, BME Clearing, National Settlements Depository (NSD), Monte Titoli, Nasdaq CSD, Bitbond, Fnality, Clearmatics**List Not Exhaustive.

3. What are the main segments of the Europe Clearing Houses And Settlements Market?

The market segments include Type, Type of System.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory Requirements; Technological Advancements.

6. What are the notable trends driving market growth?

SEPA Schemes are Driving the Market.

7. Are there any restraints impacting market growth?

Regulatory Requirements; Technological Advancements.

8. Can you provide examples of recent developments in the market?

On June 2023, Cboe Clear Europe's plan to launch a central counterparty (CCP) clearing service for securities financing transactions (SFTs). Cboe Clear Europe is a wholly-owned subsidiary of derivatives and securities exchange network Cboe Clear Markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Quadrillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Clearing Houses And Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Clearing Houses And Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Clearing Houses And Settlements Market?

To stay informed about further developments, trends, and reports in the Europe Clearing Houses And Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence