Key Insights

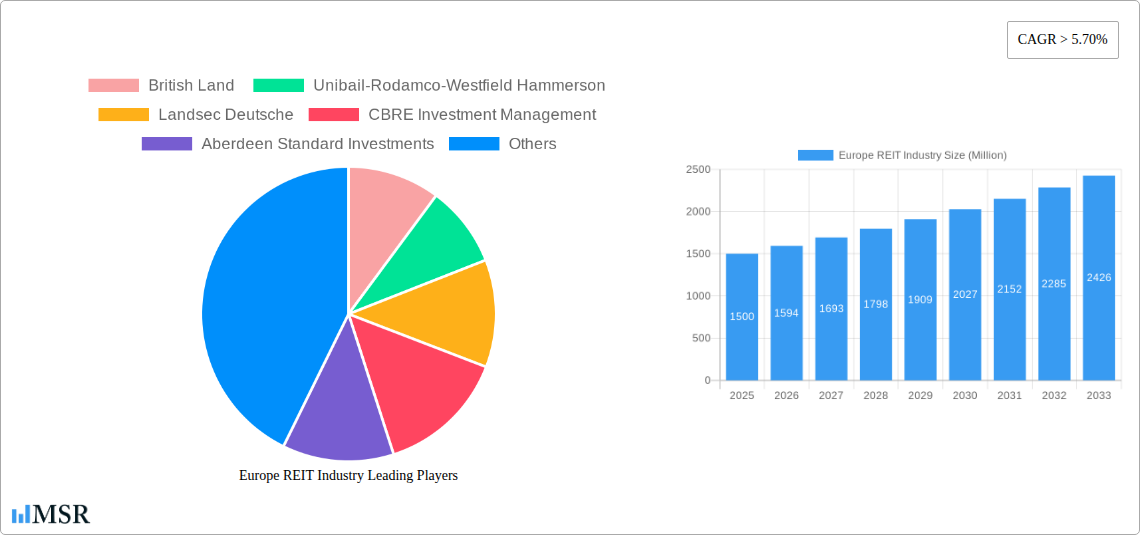

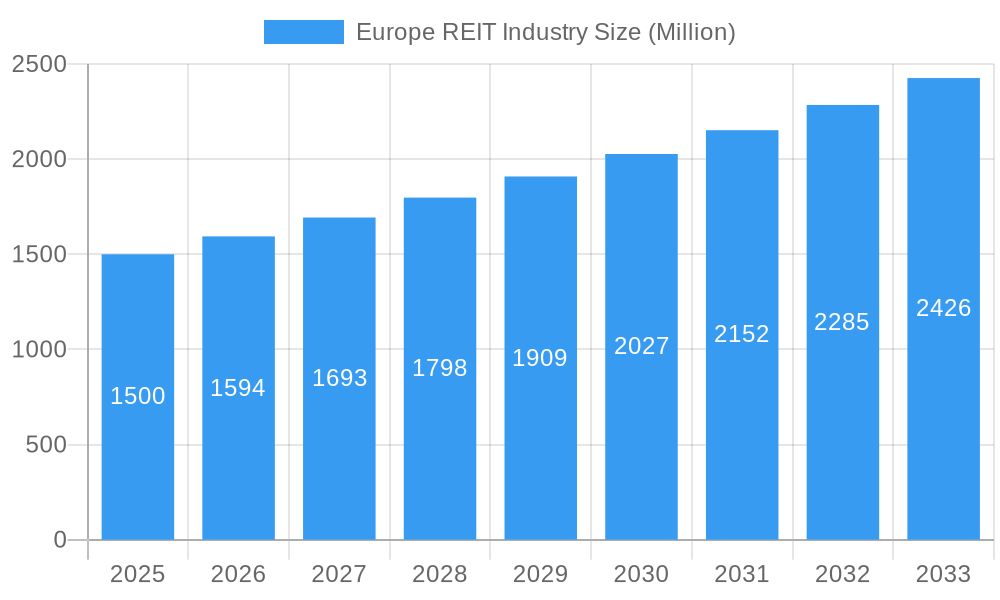

The European REIT (Real Estate Investment Trust) industry is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5.70% from 2025 to 2033. This expansion is fueled by several key factors. Increasing urbanization across major European cities like London, Paris, and Amsterdam is driving demand for commercial and residential properties, boosting the value of REIT holdings. Furthermore, favorable government policies encouraging real estate investment and infrastructure development are contributing to this positive trajectory. The sector is witnessing a shift towards diversification, with a rise in popularity of diversified REITs alongside traditional sectors like retail and office. This diversification strategy mitigates risk associated with individual property sectors and provides investors with more resilient investment options. The growth is not uniform across all segments; while retail REITs face ongoing challenges from e-commerce, industrial REITs are experiencing significant growth fueled by the rise of e-commerce logistics and supply chain demands. Residential REITs are also benefiting from strong rental markets in major European cities. Competition among major players like British Land, Unibail-Rodamco-Westfield, and Hammerson is intense, driving innovation and efficiency within the industry.

Europe REIT Industry Market Size (In Billion)

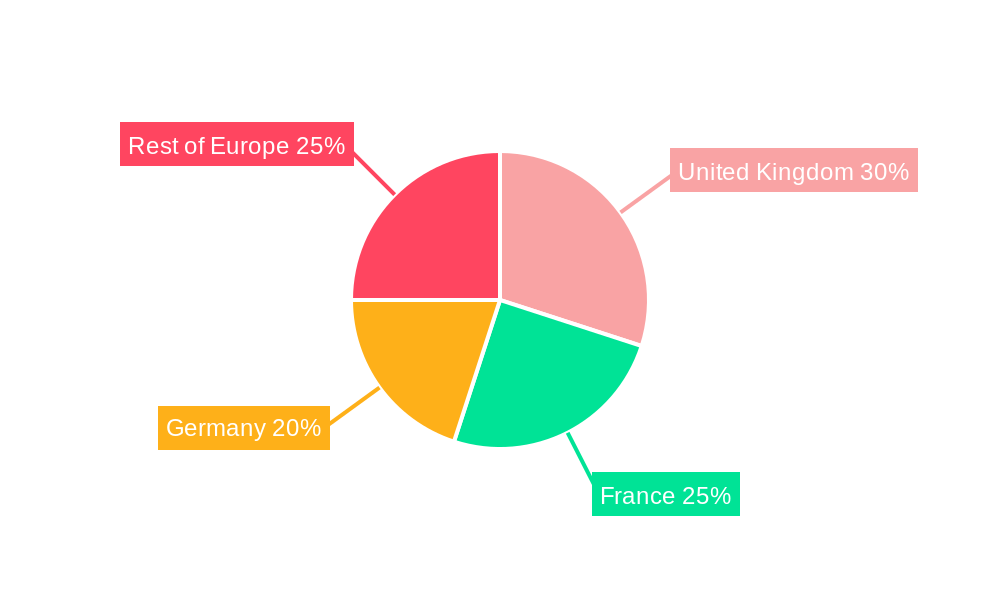

The UK, France, and Germany represent the largest markets within Europe, accounting for a significant portion of the overall market size. However, other countries like the Netherlands, Belgium, and Spain are showing promising growth potential, driven by increasing foreign investment and strong economic performance. Challenges facing the industry include fluctuating interest rates, geopolitical uncertainty, and potential regulatory changes. Nevertheless, the long-term outlook remains positive, driven by sustained demand for commercial and residential real estate and the ongoing appeal of REITs as a relatively stable and diversified investment vehicle. The continuous evolution of the industry, including the incorporation of sustainable practices and technological advancements in property management, will further shape the future landscape of European REITs.

Europe REIT Industry Company Market Share

Europe REIT Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European Real Estate Investment Trust (REIT) industry, covering market dynamics, key players, investment trends, and future growth projections from 2019 to 2033. The report is crucial for investors, industry professionals, and stakeholders seeking actionable insights into this dynamic sector. We provide detailed segment analysis by sector of exposure and geography, incorporating recent significant M&A activity. Our study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033.

Europe REIT Industry Market Concentration & Dynamics

The European REIT market exhibits moderate concentration, with a few dominant players holding significant market share. However, the landscape is characterized by ongoing consolidation through mergers and acquisitions (M&A). Innovation is driven by technological advancements in property management, data analytics, and sustainable building practices. Regulatory frameworks, varying across European nations, significantly impact investment decisions and market access. Substitute products, such as private equity real estate investments, compete for capital. End-user trends, particularly towards flexible workspaces and sustainable living, influence sector-specific demand.

- Market Share: The top 5 REITs in Europe hold approximately xx% of the total market share (2024 data).

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, averaging xx deals annually. This pace is expected to accelerate slightly in the forecast period. (Note: Precise figures require further data analysis).

Europe REIT Industry Industry Insights & Trends

The European REIT market is projected to experience substantial growth, driven by factors such as increasing urbanization, rising demand for commercial and residential spaces, and favorable government policies. Technological disruptions, including PropTech innovations, are streamlining operations and enhancing efficiency. Evolving consumer behaviors, like the preference for sustainable and technologically advanced buildings, influence investment strategies. The market size is estimated at €xx Million in 2025, with a Compound Annual Growth Rate (CAGR) of xx% projected for 2025-2033. The shift towards remote work post-pandemic has influenced the demand across various sectors, generating both opportunities and challenges for the industry.

Key Markets & Segments Leading Europe REIT Industry

The United Kingdom remains the dominant market for European REITs, followed by France and Germany, driven by strong economic growth, robust infrastructure, and favorable investment climates. Within the sector of exposure, diversified REITs and residential REITs are currently leading the market, largely driven by growing demand for residential properties across major European cities and a desire to balance risk exposure in the investment portfolios.

By Country:

- United Kingdom: Strong institutional investment, established regulatory framework, and significant market depth.

- France: Growing demand in major cities, government initiatives supporting real estate investment.

- Germany: Stable economy, growing demand for residential and industrial properties.

- Rest of Europe: Emerging markets with potential for growth, subject to varying economic conditions.

By Sector of Exposure:

- Residential REITs: High demand driven by urbanization and population growth.

- Diversified REITs: Offer risk diversification and attractive investment opportunities.

- Industrial REITs: Driven by increasing e-commerce activity and logistics.

Europe REIT Industry Product Developments

Recent innovations focus on leveraging data analytics for better portfolio management, incorporating sustainable building practices, and creating flexible workspaces. These advancements enhance property values, attract tenants, and improve operational efficiencies, creating a competitive advantage. Technological integration into property management systems (PMS) is rapidly improving efficiency and transparency.

Challenges in the Europe REIT Industry Market

The industry faces challenges including varying regulatory environments across different European countries, supply chain disruptions impacting construction projects, and intense competition from other investment vehicles. Interest rate fluctuations and macroeconomic uncertainties also impact investment decisions. These factors can lead to project delays and increased costs, negatively impacting profitability.

Forces Driving Europe REIT Industry Growth

Key drivers include increasing urbanization leading to greater demand for real estate, the rising popularity of e-commerce boosting the industrial REIT sector, government incentives promoting sustainable building practices, and technological innovations enabling better property management. These factors create opportunities for both established and new market entrants.

Long-Term Growth Catalysts in the Europe REIT Industry

Long-term growth is projected to be driven by technological innovations in building design, materials, and management systems, partnerships between REITs and technology companies, and further expansion into emerging markets within Europe. The increasing focus on sustainable investments will also contribute to sustained long-term growth.

Emerging Opportunities in Europe REIT Industry

Emerging opportunities include the rise of PropTech, creating new avenues for efficiency and investment, increased focus on sustainable and green buildings, and the expansion of REIT activity into secondary and tertiary European cities. Growth in specific sectors like data centers and logistics properties presents further growth opportunities.

Leading Players in the Europe REIT Industry Sector

- British Land

- Unibail-Rodamco-Westfield

- Hammerson

- Landsec

- CBRE Investment Management

- Aberdeen Standard Investments

- Wohnen SE

- Vonovia SE

Key Milestones in Europe REIT Industry Industry

- March 2023: Landsec secures 100% ownership of St David’s shopping centre, Cardiff, strengthening its market position in retail.

- October 2022: Cromwell European REIT acquires assets in Denmark for EUR 15.8 Million, expanding its portfolio in the Nordic region.

- September 2022: Inbest and GPF create a new REIT to invest €600 Million in prime properties, signifying increased investor confidence.

Strategic Outlook for Europe REIT Industry Market

The European REIT market holds significant long-term potential, driven by consistent demand for real estate across various sectors. Strategic opportunities lie in adopting PropTech innovations, investing in sustainable developments, and exploring expansion into emerging European markets. The successful players will be those that can adapt to evolving market conditions, integrate technology effectively, and focus on sustainable practices.

Europe REIT Industry Segmentation

-

1. Sector of Exposure

- 1.1. Retail REITs

- 1.2. Industrial REITs

- 1.3. Office REITs

- 1.4. Residential REITs

- 1.5. Diversified REITs

- 1.6. Other Sector Specific REITs

Europe REIT Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe REIT Industry Regional Market Share

Geographic Coverage of Europe REIT Industry

Europe REIT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fund Inflows is Driving the ETF Market

- 3.3. Market Restrains

- 3.3.1. Underlying Fluctuations and Risks are Restraining the Market

- 3.4. Market Trends

- 3.4.1. United Kingdom as the Leader of REIT market in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe REIT Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector of Exposure

- 5.1.1. Retail REITs

- 5.1.2. Industrial REITs

- 5.1.3. Office REITs

- 5.1.4. Residential REITs

- 5.1.5. Diversified REITs

- 5.1.6. Other Sector Specific REITs

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Sector of Exposure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 British Land

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Unibail-Rodamco-Westfield Hammerson

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Landsec Deutsche

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CBRE Investment Management

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aberdeen Standard Investments

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wohnen SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vonovia SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 British Land

List of Figures

- Figure 1: Europe REIT Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe REIT Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe REIT Industry Revenue undefined Forecast, by Sector of Exposure 2020 & 2033

- Table 2: Europe REIT Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Europe REIT Industry Revenue undefined Forecast, by Sector of Exposure 2020 & 2033

- Table 4: Europe REIT Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: France Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe REIT Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe REIT Industry?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Europe REIT Industry?

Key companies in the market include British Land , Unibail-Rodamco-Westfield Hammerson , Landsec Deutsche, CBRE Investment Management , Aberdeen Standard Investments, Wohnen SE , Vonovia SE .

3. What are the main segments of the Europe REIT Industry?

The market segments include Sector of Exposure.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Fund Inflows is Driving the ETF Market.

6. What are the notable trends driving market growth?

United Kingdom as the Leader of REIT market in Europe.

7. Are there any restraints impacting market growth?

Underlying Fluctuations and Risks are Restraining the Market.

8. Can you provide examples of recent developments in the market?

March 2023: Landsec has secured 100% ownership of St David’s shopping centre, Cardiff, following its purchase of the debt secured against the 50% share of the asset previously owned by intu plc. Comprising separate transactions with two debt holders

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe REIT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe REIT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe REIT Industry?

To stay informed about further developments, trends, and reports in the Europe REIT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence