Key Insights

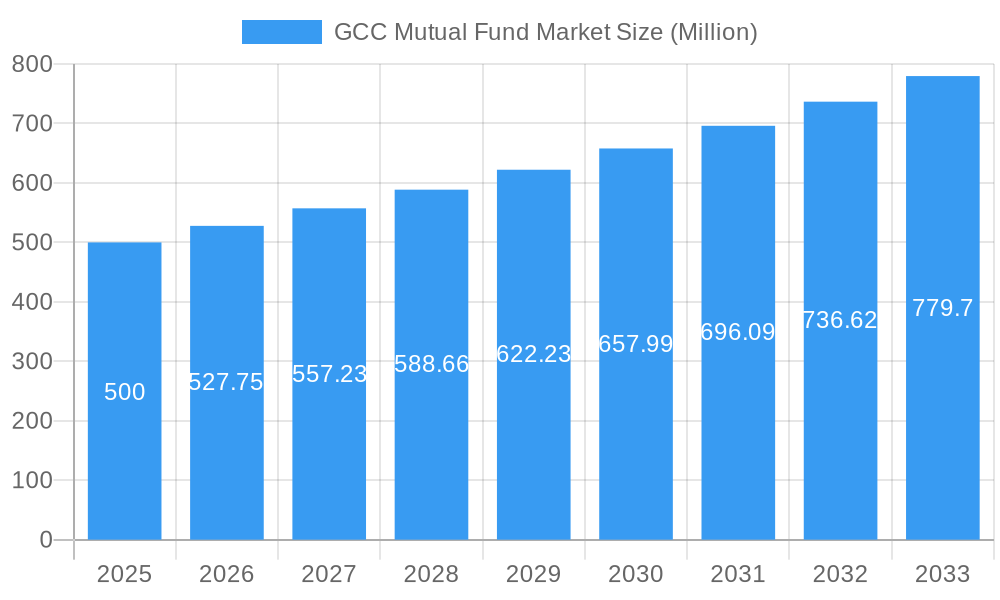

The GCC mutual fund market demonstrates significant growth potential, propelled by rising disposable incomes, an expanding middle class seeking diversified investment opportunities, and favorable government policies encouraging financial diversification. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 6.5%. Key contributors to the market, estimated at $4.5 billion in 2025, include prominent entities such as Riyad Capital, NCB Capital, and Samba Capital. The market's segmentation likely encompasses equity, debt, and balanced funds to cater to varied investor risk profiles. Enhanced financial literacy initiatives and the introduction of novel investment products are further stimulating market expansion. Potential challenges may arise from regional geopolitical uncertainties, oil price volatility affecting investor sentiment, and evolving regulatory frameworks. The forecast period (2025-2033) presents substantial opportunities for market growth, amplified by ongoing economic diversification and increasing foreign investment within the GCC region.

GCC Mutual Fund Market Market Size (In Billion)

Technological advancements will continue to drive growth by improving investment accessibility and transparency. The widespread adoption of online trading platforms and robo-advisors is anticipated to broaden investor participation. Moreover, heightened awareness of long-term investment strategies, combined with government efforts to promote financial inclusion, will be crucial in shaping future market expansion. Despite existing challenges, the GCC mutual fund market's outlook remains exceptionally strong, projecting considerable growth over the next decade and positioning it as a compelling investment destination for both local and international participants.

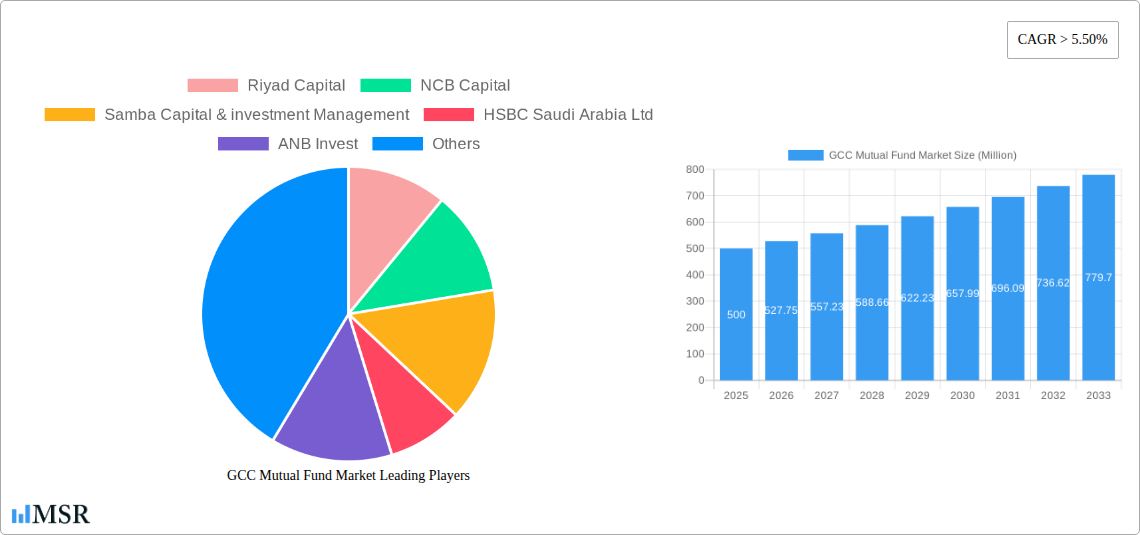

GCC Mutual Fund Market Company Market Share

GCC Mutual Fund Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the GCC Mutual Fund Market, covering market dynamics, industry trends, key players, and future growth prospects from 2019 to 2033. The study period encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering valuable insights for investors, industry stakeholders, and strategic decision-makers. With a focus on key market segments and leading players like Riyad Capital, NCB Capital, Samba Capital & Investment Management, and others, this report unveils the opportunities and challenges shaping this dynamic market. The report's detailed analysis includes projected market size and CAGR, highlighting significant events such as the USD 133.3 Million Riyad Real Estate Development fund launch. This report is essential for understanding the current landscape and navigating the future of the GCC Mutual Fund Market.

GCC Mutual Fund Market Market Concentration & Dynamics

The GCC mutual fund market exhibits a moderately concentrated landscape, with a few dominant players controlling a significant market share. Riyad Capital, NCB Capital, and Samba Capital & Investment Management, along with international players like HSBC Saudi Arabia Ltd and BNP Paribas Asset Management, are key contributors to this concentration. The market is characterized by a dynamic innovation ecosystem, driven by technological advancements in portfolio management and investment platforms. Regulatory frameworks, while evolving, play a crucial role in shaping market conduct and investor protection. Substitute products, including alternative investments, compete for investor capital. End-user trends reveal a growing preference for diversified portfolios and actively managed funds. The recent M&A activity in the industry, including the landmark merger between NCB and Samba Financial Group (January 2022), signifies consolidation and the pursuit of economies of scale.

- Market Share Concentration: Top 5 players hold approximately xx% of the market share (2024).

- M&A Deal Count: xx deals in the last 5 years.

- Regulatory Changes: Increasing focus on transparency and investor protection.

- Innovation: Adoption of Fintech and AI-driven investment strategies.

GCC Mutual Fund Market Industry Insights & Trends

The GCC mutual fund market demonstrates robust growth, driven by several factors. Increasing disposable incomes and financial literacy among the population are key drivers, fostering greater participation in investment vehicles. Government initiatives promoting financial inclusion and diversification of the economy play a crucial role. Technological disruptions, notably the adoption of digital platforms and robo-advisors, are changing the way investors access and manage their portfolios. The market size is estimated to be USD xx Million in 2025 and is projected to reach USD xx Million by 2033, exhibiting a CAGR of xx%. Evolving consumer behaviors indicate a growing demand for ESG (Environmental, Social, and Governance) compliant funds and personalized investment solutions. The rising adoption of mobile-based investment platforms is also shaping the consumer experience. The market’s growth is fueled by increased investor confidence and a favourable regulatory environment.

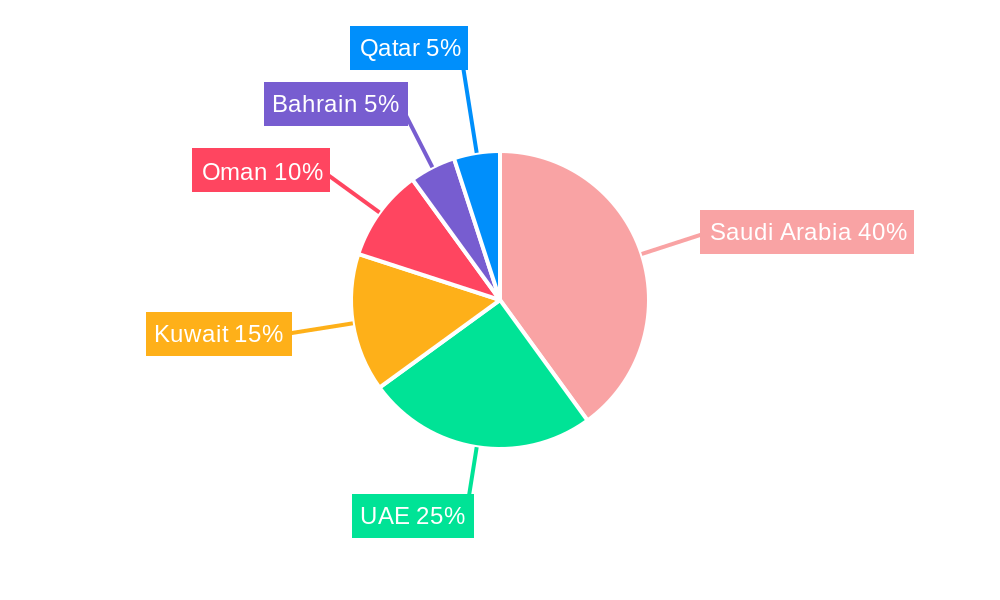

Key Markets & Segments Leading GCC Mutual Fund Market

The Saudi Arabian market dominates the GCC mutual fund sector, contributing approximately xx% of the total market value. This dominance is attributed to a combination of factors.

- Economic Growth: Strong economic growth and rising disposable incomes in Saudi Arabia.

- Government Initiatives: Government policies supporting the development of the financial sector.

- Infrastructure Development: Robust infrastructure and investment in the capital markets.

- Regulatory Environment: A relatively stable and supportive regulatory environment.

Other GCC countries like the UAE and Kuwait also present significant market opportunities, though their overall contribution to the regional market is smaller. The equity segment generally leads in terms of assets under management (AUM), although other segments like fixed income and real estate funds are also witnessing growth.

GCC Mutual Fund Market Product Developments

Recent product innovations include the introduction of Sharia-compliant funds tailored to the religious preferences of a significant portion of the population. There's also a growing trend towards the launch of thematic funds focused on specific sectors (e.g., technology, renewable energy) and sustainable investing. The integration of Fintech and AI is enhancing the efficiency and personalization of investment solutions. These advancements are aimed at providing investors with more diversified and tailored investment strategies.

Challenges in the GCC Mutual Fund Market Market

The GCC mutual fund market faces several challenges. Regulatory hurdles, such as stringent licensing requirements and compliance protocols, can pose barriers to entry for new players. The relatively underdeveloped institutional investor base limits the overall market capacity. Competitive pressures among established players and the rising popularity of alternative investment options also pose challenges. These factors collectively impact market growth and require strategic adaptation from industry participants.

Forces Driving GCC Mutual Fund Market Growth

Several factors are driving the growth of the GCC mutual fund market. Technological advancements such as digital platforms and AI-driven portfolio management tools are attracting younger investors. Favorable economic growth across the GCC nations is a major driver, creating higher disposable incomes and prompting investments in diverse asset classes. Government initiatives promoting financial inclusion and market development also fuel growth. The increasing awareness of long-term investment benefits among the population encourages investment in mutual funds.

Long-Term Growth Catalysts in the GCC Mutual Fund Market

The long-term growth of the GCC mutual fund market is fueled by several factors. Continuous product innovation, including the development of specialized thematic and Sharia-compliant funds, aligns with evolving investor preferences. Strategic partnerships between local and international players introduce global investment expertise and expand market reach. Expansion into new market segments, such as sustainable and impact investing, offers significant growth potential.

Emerging Opportunities in GCC Mutual Fund Market

Emerging opportunities include the growing demand for ESG-focused investments, aligned with global sustainability trends. The rising popularity of Fintech and AI-driven solutions offers enhanced personalization and efficiency in investment management. Expansion into under-penetrated segments, like smaller regional markets, holds significant untapped potential. The increasing adoption of digital distribution channels offers broader market access and cost efficiencies.

Leading Players in the GCC Mutual Fund Sector

- Riyad Capital

- NCB Capital

- Samba Capital & Investment Management

- HSBC Saudi Arabia Ltd

- ANB Invest

- Saudi Hollandi Capital

- Al Rajhi Capital

- Jadwa Investment

- Caaam Saudi Fransi

- BNP Paribas Asset Management (List Not Exhaustive)

Key Milestones in GCC Mutual Fund Market Industry

- May 2023: Riyad Capital launches the Riyad Real Estate Development fund - Durrat Hitteen (USD 133.3 Million), marking significant investment in real estate development.

- January 2022: Merger of NCB and Samba Financial Group, creating the region's largest banking entity and impacting the mutual fund landscape through increased market share and resources.

Strategic Outlook for GCC Mutual Fund Market Market

The future of the GCC mutual fund market looks promising. Continued economic growth, coupled with increasing financial literacy and favorable regulatory changes, will underpin substantial market expansion. Strategic partnerships, product diversification, and the adoption of technological advancements will remain crucial for capturing growth opportunities. The sector is well-positioned for sustained growth, driven by both domestic and international investment.

GCC Mutual Fund Market Segmentation

-

1. Fund Type

- 1.1. Equity

- 1.2. Money market

- 1.3. Real Estate

- 1.4. Other Fund Types (Bond, Commodities, Mixed)

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. Qatar

- 2.3. Abu Dhabi

- 2.4. Kuwait

- 2.5. Dubai

GCC Mutual Fund Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Qatar

- 3. Abu Dhabi

- 4. Kuwait

- 5. Dubai

GCC Mutual Fund Market Regional Market Share

Geographic Coverage of GCC Mutual Fund Market

GCC Mutual Fund Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth; Rising Wealth and Income Levels

- 3.3. Market Restrains

- 3.3.1. Economic Growth; Rising Wealth and Income Levels

- 3.4. Market Trends

- 3.4.1. Emerging Leadership of Saudi Arabia in GCC Capital Markets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 5.1.1. Equity

- 5.1.2. Money market

- 5.1.3. Real Estate

- 5.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. Qatar

- 5.2.3. Abu Dhabi

- 5.2.4. Kuwait

- 5.2.5. Dubai

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Qatar

- 5.3.3. Abu Dhabi

- 5.3.4. Kuwait

- 5.3.5. Dubai

- 5.1. Market Analysis, Insights and Forecast - by Fund Type

- 6. Saudi Arabia GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 6.1.1. Equity

- 6.1.2. Money market

- 6.1.3. Real Estate

- 6.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. Qatar

- 6.2.3. Abu Dhabi

- 6.2.4. Kuwait

- 6.2.5. Dubai

- 6.1. Market Analysis, Insights and Forecast - by Fund Type

- 7. Qatar GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 7.1.1. Equity

- 7.1.2. Money market

- 7.1.3. Real Estate

- 7.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. Qatar

- 7.2.3. Abu Dhabi

- 7.2.4. Kuwait

- 7.2.5. Dubai

- 7.1. Market Analysis, Insights and Forecast - by Fund Type

- 8. Abu Dhabi GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 8.1.1. Equity

- 8.1.2. Money market

- 8.1.3. Real Estate

- 8.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. Qatar

- 8.2.3. Abu Dhabi

- 8.2.4. Kuwait

- 8.2.5. Dubai

- 8.1. Market Analysis, Insights and Forecast - by Fund Type

- 9. Kuwait GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 9.1.1. Equity

- 9.1.2. Money market

- 9.1.3. Real Estate

- 9.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. Qatar

- 9.2.3. Abu Dhabi

- 9.2.4. Kuwait

- 9.2.5. Dubai

- 9.1. Market Analysis, Insights and Forecast - by Fund Type

- 10. Dubai GCC Mutual Fund Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 10.1.1. Equity

- 10.1.2. Money market

- 10.1.3. Real Estate

- 10.1.4. Other Fund Types (Bond, Commodities, Mixed)

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. Qatar

- 10.2.3. Abu Dhabi

- 10.2.4. Kuwait

- 10.2.5. Dubai

- 10.1. Market Analysis, Insights and Forecast - by Fund Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Riyad Capital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NCB Capital

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samba Capital & investment Management

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HSBC Saudi Arabia Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ANB Invest

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Saudi Hollandi Capital

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Al Rajhi Capital

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jadwa Investment

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Caaam Saudi Fransi

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BNP Paribas Asset Management**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Riyad Capital

List of Figures

- Figure 1: Global GCC Mutual Fund Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 3: Saudi Arabia GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 4: Saudi Arabia GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: Saudi Arabia GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: Saudi Arabia GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Saudi Arabia GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Qatar GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 9: Qatar GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 10: Qatar GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: Qatar GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Qatar GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Qatar GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Abu Dhabi GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 15: Abu Dhabi GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 16: Abu Dhabi GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Abu Dhabi GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Abu Dhabi GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Abu Dhabi GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Kuwait GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 21: Kuwait GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 22: Kuwait GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Kuwait GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Kuwait GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Kuwait GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Dubai GCC Mutual Fund Market Revenue (billion), by Fund Type 2025 & 2033

- Figure 27: Dubai GCC Mutual Fund Market Revenue Share (%), by Fund Type 2025 & 2033

- Figure 28: Dubai GCC Mutual Fund Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Dubai GCC Mutual Fund Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Dubai GCC Mutual Fund Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Dubai GCC Mutual Fund Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 2: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global GCC Mutual Fund Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 5: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 8: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 11: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 14: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global GCC Mutual Fund Market Revenue billion Forecast, by Fund Type 2020 & 2033

- Table 17: Global GCC Mutual Fund Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global GCC Mutual Fund Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Mutual Fund Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the GCC Mutual Fund Market?

Key companies in the market include Riyad Capital, NCB Capital, Samba Capital & investment Management, HSBC Saudi Arabia Ltd, ANB Invest, Saudi Hollandi Capital, Al Rajhi Capital, Jadwa Investment, Caaam Saudi Fransi, BNP Paribas Asset Management**List Not Exhaustive.

3. What are the main segments of the GCC Mutual Fund Market?

The market segments include Fund Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth; Rising Wealth and Income Levels.

6. What are the notable trends driving market growth?

Emerging Leadership of Saudi Arabia in GCC Capital Markets.

7. Are there any restraints impacting market growth?

Economic Growth; Rising Wealth and Income Levels.

8. Can you provide examples of recent developments in the market?

May 2023: Saudi-based Riyad Capital has launched the Riyad Real Estate Development fund - Durrat Hitteen, in partnership with property developer Al Ramz Real Estate Company. The fund, with a value exceeding SAR0.5 billion (USD 133.3 million), aims to develop a mixed-use project in the Hitteen district in Riyadh with a total area of 27,119 square meters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Mutual Fund Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Mutual Fund Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Mutual Fund Market?

To stay informed about further developments, trends, and reports in the GCC Mutual Fund Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence