Key Insights

The Middle East and Africa (MEA) prepaid card market is experiencing substantial growth, propelled by increasing digital payment adoption, financial inclusion efforts, and a thriving e-commerce landscape. A Compound Annual Growth Rate (CAGR) of 11.3% from 2025 to 2033 underscores a strong upward trend. This expansion is driven by several key factors. Firstly, the region's youthful demographic and high smartphone penetration are fostering a large base of digitally-savvy consumers. Secondly, MEA governments are actively championing financial inclusion, positioning prepaid cards as an accessible and efficient payment method for unbanked and underbanked populations. Furthermore, the surge in e-commerce necessitates secure and convenient online payment solutions, directly benefiting the prepaid card sector. The market is segmented by offering type (general purpose, gift cards, government cards, incentive/payroll cards, and others), card type (closed-loop and open-loop), and end-user (retail, corporate, and government). Leading players such as Amazon, Visa, American Express, and prominent regional banks are actively shaping this dynamic market through innovation and expanded product portfolios.

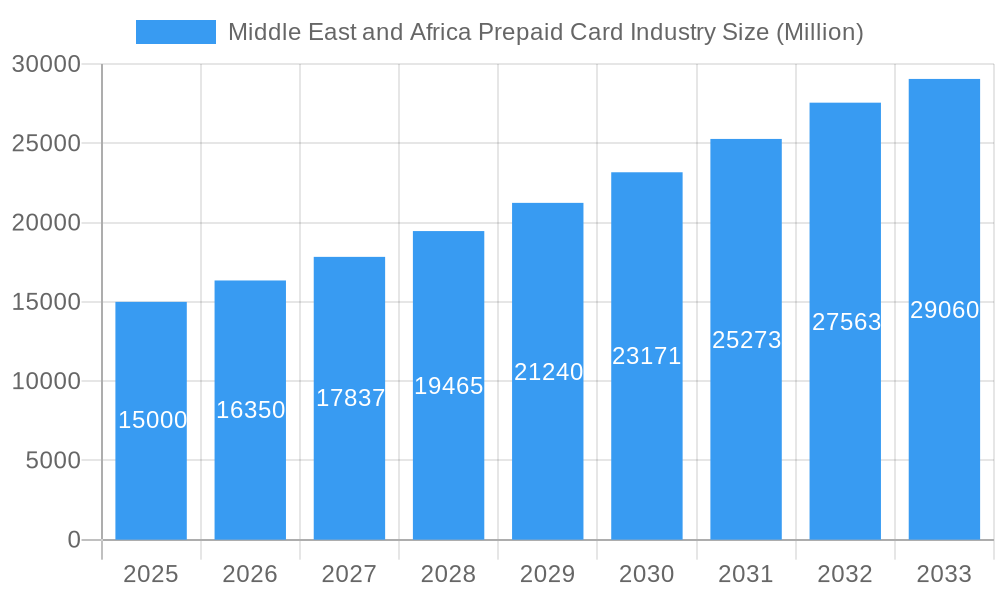

Middle East and Africa Prepaid Card Industry Market Size (In Billion)

The MEA prepaid card market, valued at approximately $44 billion in 2025, is projected for significant expansion through 2033. Growth is anticipated to be concentrated in nations with high mobile penetration and young demographics, including the UAE and South Africa. Despite infrastructure limitations in certain areas and potential digital transaction security concerns, the market outlook remains highly optimistic. Continued growth will be fueled by technological advancements and supportive regulatory frameworks, with innovations in mobile payment technology and expanded government-backed digital financial inclusion programs playing a pivotal role.

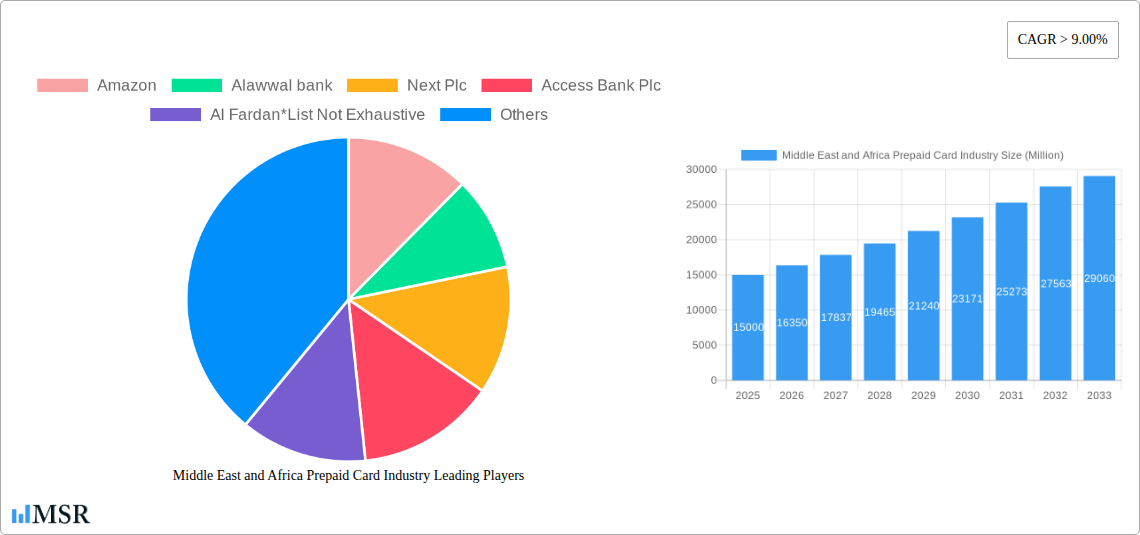

Middle East and Africa Prepaid Card Industry Company Market Share

Middle East & Africa Prepaid Card Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa prepaid card industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report forecasts market trends until 2033, leveraging historical data from 2019-2024. The report covers key market segments, including general purpose, gift cards, government cards, incentive/payroll cards, and others, across closed-loop and open-loop card types, and analyzes the industry across retail, corporate, and government end-user sectors. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Middle East and Africa Prepaid Card Industry Market Concentration & Dynamics

This section analyzes the competitive landscape of the MEA prepaid card market, encompassing market concentration, innovation, regulatory frameworks, substitute products, end-user trends, and mergers & acquisitions (M&A) activity. The market demonstrates a moderately concentrated structure, with key players holding significant market share. For instance, Visa and Mastercard together control approximately xx% of the market, while regional banks such as First Abu Dhabi Bank and Equity Bank hold substantial shares within their respective territories.

- Market Share: Visa and Mastercard: xx%; Regional Banks (e.g., First Abu Dhabi Bank, Equity Bank): xx%; Other Players: xx%.

- M&A Activity: Over the historical period (2019-2024), approximately xx M&A deals were recorded, primarily focused on expanding geographical reach and acquiring fintech companies with innovative payment technologies. This reflects the dynamic nature of the sector and its growing attractiveness to investors. The predicted deal count for the forecast period (2025-2033) is expected to be xx, driven by growing market size and potential for disruption.

- Innovation Ecosystem: A vibrant fintech ecosystem is emerging, fostering the development of innovative prepaid card solutions, particularly in mobile money and digital payment platforms.

- Regulatory Frameworks: Regulatory frameworks vary across the MEA region, impacting market entry and operation. The evolving regulatory landscape is likely to influence future market dynamics.

- Substitute Products: Mobile money transfer services and other digital payment methods present strong competition to prepaid cards.

- End-User Trends: The increasing adoption of digital payments and mobile banking is driving demand for prepaid cards, especially among younger demographics.

Middle East and Africa Prepaid Card Industry Industry Insights & Trends

The MEA prepaid card industry is experiencing robust growth, fueled by several key factors. The expanding mobile phone penetration, rising internet usage, and the increasing financial inclusion initiatives across the region are significantly contributing to market expansion. The growth is further accelerated by the increasing preference for cashless transactions, particularly among younger consumers. The rise of e-commerce and the increasing adoption of online shopping further drives the demand for convenient payment methods like prepaid cards. Technological innovations, such as contactless payments and biometric authentication, are also streamlining the user experience and enhancing the overall adoption rate. Government initiatives aimed at improving financial infrastructure and expanding access to financial services contribute significantly to market expansion, resulting in a projected market value of xx Million in 2033.

Key Markets & Segments Leading Middle East and Africa Prepaid Card Industry

The MEA prepaid card market shows diverse growth patterns across different regions, countries, and segments. While specific market share breakdowns are not readily available for all segments, the following observations highlight key trends:

- Dominant Regions: North Africa and Sub-Saharan Africa exhibit robust growth potential, driven by factors such as growing mobile penetration, and increasing adoption of digital payments.

- Dominant Countries: Egypt, Nigeria, Kenya, and South Africa represent some of the most prominent markets. These countries have a favorable regulatory environment, a large consumer base, and advanced mobile payment infrastructure.

- Dominant Segments:

- Offering: The general-purpose prepaid card segment dominates the market, owing to its widespread usability and applicability. Growth in the gift card and incentive/payroll segments is also notable.

- Card Type: Open-loop cards hold a larger market share compared to closed-loop cards due to wider acceptance and greater flexibility.

- End-User: Retail users constitute the largest segment, reflecting the widespread adoption of prepaid cards for everyday transactions.

Drivers:

- Economic Growth: Steady economic growth in many MEA countries fuels the increase in disposable income, enabling higher spending on goods and services, thus boosting the demand for prepaid cards.

- Infrastructure Development: Improvements in mobile network infrastructure and digital payment systems drive the adoption of prepaid cards.

Middle East and Africa Prepaid Card Industry Product Developments

The MEA prepaid card industry witnesses constant innovation. Recent advancements include the integration of mobile wallets, the introduction of contactless payment technologies, and the rise of virtual prepaid cards. These developments enhance the convenience and security of prepaid card usage, appealing to a wider user base. Companies are increasingly leveraging big data and analytics to personalize offerings and provide targeted services, strengthening customer loyalty. The competitive landscape is marked by strategic partnerships between banks, fintech companies, and mobile network operators, resulting in the development of innovative and integrated payment solutions.

Challenges in the Middle East and Africa Prepaid Card Industry Market

Several challenges hinder the growth of the MEA prepaid card market. These include the relatively low financial literacy levels in some regions, which restrict the widespread adoption of digital payments. Furthermore, concerns about data security and fraud remain barriers to wider acceptance. Infrastructure gaps in certain regions, particularly unreliable internet connectivity in remote areas, hinder the seamless use of prepaid cards. Lastly, competition from other digital payment methods, including mobile money platforms, creates an increasingly competitive environment. These factors collectively contribute to approximately xx% of market potential remaining untapped.

Forces Driving Middle East and Africa Prepaid Card Industry Growth

Several factors drive growth within the MEA prepaid card industry. Government initiatives promoting financial inclusion are actively expanding access to financial services, increasing the addressable market. Technological advancements, particularly in mobile payment technologies and mobile money platforms, enhance convenience and user experience, making prepaid cards increasingly attractive to a broader population. Moreover, the growth of e-commerce continues to fuel demand for digital payment options, such as prepaid cards. This combination of factors is projected to boost market growth by xx% within the next five years.

Challenges in the Middle East and Africa Prepaid Card Industry Market

Long-term growth catalysts include strategic partnerships between banks and fintech companies to leverage technological advancements and expand reach. Innovations in biometric authentication and fraud detection will further enhance consumer trust and security. Moreover, the continued expansion of mobile network infrastructure, particularly in underserved regions, will play a crucial role in boosting market penetration and extending the reach of prepaid cards. Governmental support for financial inclusion and digital economy initiatives will act as a significant growth catalyst.

Emerging Opportunities in Middle East and Africa Prepaid Card Industry

Emerging opportunities in the MEA prepaid card industry include leveraging the growth of the gig economy by creating specialized prepaid cards for freelancers and independent contractors. Expanding into underserved rural markets through strategic partnerships with local agents will significantly enhance market reach. Developing tailored prepaid card solutions catering to specific customer segments, such as students and tourists, holds significant potential for growth. Innovation in card functionalities, such as integration with loyalty programs and budgeting tools, will enhance user engagement.

Leading Players in the Middle East and Africa Prepaid Card Industry Sector

- Amazon

- Alawwal bank

- Next Plc

- Access Bank Plc

- Al Fardan

- Capitec Bank

- Wal-mart Stores Inc

- Equity Bank

- First Abu Dhabi Bank

- Visa

- American Express

Key Milestones in Middle East and Africa Prepaid Card Industry Industry

- September 2022: Launch of Telda prepaid cards in Egypt, a partnership between Banque du Caire and a fintech company, powered by Mastercard. This partnership significantly enhances the availability of digital payment solutions in Egypt.

- April 2022: OPay Egypt receives approval from the Central Bank of Egypt to issue prepaid cards through its app. This expands the accessibility of digital financial services to a wider population in Egypt.

Strategic Outlook for Middle East and Africa Prepaid Card Industry Market

The future of the MEA prepaid card market is bright, with significant growth potential driven by increasing financial inclusion, expanding digital infrastructure, and ongoing technological innovations. Strategic partnerships and collaborations between banks, fintech companies, and telecommunication providers are critical for market expansion. Focus on enhancing security features, improving user experience, and addressing the needs of underserved populations will be crucial to unlocking the full potential of this dynamic market. The market is poised for substantial growth, driven by these factors, resulting in a significant increase in market value and transaction volume in the coming years.

Middle East and Africa Prepaid Card Industry Segmentation

-

1. Offering

- 1.1. General Purpose

- 1.2. Gift Card

- 1.3. Government Card

- 1.4. Incentive/ Payroll

- 1.5. Others

-

2. Card Type

- 2.1. Closed- Loop Card

- 2.2. Open- Loop Card

-

3. End- User

- 3.1. Retail

- 3.2. Corporate

- 3.3. Government

-

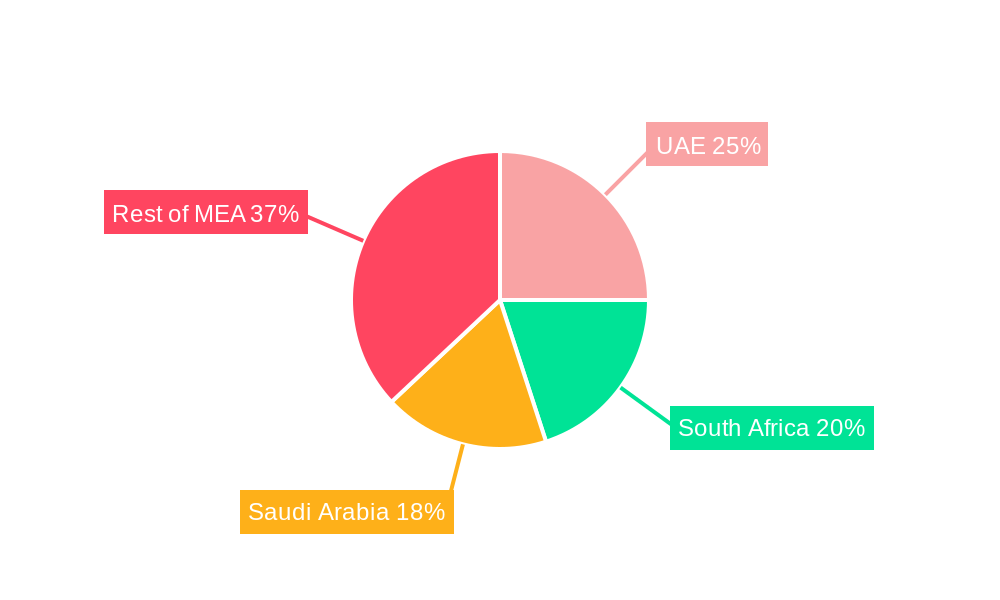

4. Geography

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. South Africa

- 4.4. Rest of the Middle East and Africa

Middle East and Africa Prepaid Card Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of the Middle East and Africa

Middle East and Africa Prepaid Card Industry Regional Market Share

Geographic Coverage of Middle East and Africa Prepaid Card Industry

Middle East and Africa Prepaid Card Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Digital and Mobile Banking is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. General Purpose

- 5.1.2. Gift Card

- 5.1.3. Government Card

- 5.1.4. Incentive/ Payroll

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Card Type

- 5.2.1. Closed- Loop Card

- 5.2.2. Open- Loop Card

- 5.3. Market Analysis, Insights and Forecast - by End- User

- 5.3.1. Retail

- 5.3.2. Corporate

- 5.3.3. Government

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of the Middle East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.5.2. United Arab Emirates

- 5.5.3. South Africa

- 5.5.4. Rest of the Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Saudi Arabia Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. General Purpose

- 6.1.2. Gift Card

- 6.1.3. Government Card

- 6.1.4. Incentive/ Payroll

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Card Type

- 6.2.1. Closed- Loop Card

- 6.2.2. Open- Loop Card

- 6.3. Market Analysis, Insights and Forecast - by End- User

- 6.3.1. Retail

- 6.3.2. Corporate

- 6.3.3. Government

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Saudi Arabia

- 6.4.2. United Arab Emirates

- 6.4.3. South Africa

- 6.4.4. Rest of the Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. United Arab Emirates Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. General Purpose

- 7.1.2. Gift Card

- 7.1.3. Government Card

- 7.1.4. Incentive/ Payroll

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Card Type

- 7.2.1. Closed- Loop Card

- 7.2.2. Open- Loop Card

- 7.3. Market Analysis, Insights and Forecast - by End- User

- 7.3.1. Retail

- 7.3.2. Corporate

- 7.3.3. Government

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Saudi Arabia

- 7.4.2. United Arab Emirates

- 7.4.3. South Africa

- 7.4.4. Rest of the Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. South Africa Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. General Purpose

- 8.1.2. Gift Card

- 8.1.3. Government Card

- 8.1.4. Incentive/ Payroll

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Card Type

- 8.2.1. Closed- Loop Card

- 8.2.2. Open- Loop Card

- 8.3. Market Analysis, Insights and Forecast - by End- User

- 8.3.1. Retail

- 8.3.2. Corporate

- 8.3.3. Government

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Saudi Arabia

- 8.4.2. United Arab Emirates

- 8.4.3. South Africa

- 8.4.4. Rest of the Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Rest of the Middle East and Africa Middle East and Africa Prepaid Card Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. General Purpose

- 9.1.2. Gift Card

- 9.1.3. Government Card

- 9.1.4. Incentive/ Payroll

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Card Type

- 9.2.1. Closed- Loop Card

- 9.2.2. Open- Loop Card

- 9.3. Market Analysis, Insights and Forecast - by End- User

- 9.3.1. Retail

- 9.3.2. Corporate

- 9.3.3. Government

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Saudi Arabia

- 9.4.2. United Arab Emirates

- 9.4.3. South Africa

- 9.4.4. Rest of the Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Amazon

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alawwal bank

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Next Plc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Access Bank Plc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Al Fardan*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Capitec Bank

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Wal-mart Stores Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Equity Bank

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 First Abu Dhabi Bank

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Visa

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 American Express

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Amazon

List of Figures

- Figure 1: Middle East and Africa Prepaid Card Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Prepaid Card Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 2: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 3: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 4: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 7: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 8: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 9: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 12: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 13: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 14: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 17: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 18: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 19: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 22: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 23: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by End- User 2020 & 2033

- Table 24: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Middle East and Africa Prepaid Card Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Prepaid Card Industry?

The projected CAGR is approximately 11.3%.

2. Which companies are prominent players in the Middle East and Africa Prepaid Card Industry?

Key companies in the market include Amazon, Alawwal bank, Next Plc, Access Bank Plc, Al Fardan*List Not Exhaustive, Capitec Bank, Wal-mart Stores Inc, Equity Bank, First Abu Dhabi Bank, Visa, American Express.

3. What are the main segments of the Middle East and Africa Prepaid Card Industry?

The market segments include Offering, Card Type, End- User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 44 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Digital and Mobile Banking is Driving the Market.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

In September 2022, One of Egypt's leading banks and a fintech company jointly created Telda prepaid cards, which were powered by Mastercard's debut. The ground-breaking payment solution is the result of a fruitful partnership between Telda, a rapidly expanding Egyptian fintech start-up, and Banque du Caire, one of the nation's top financial institutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Prepaid Card Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Prepaid Card Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Prepaid Card Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Prepaid Card Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence