Key Insights

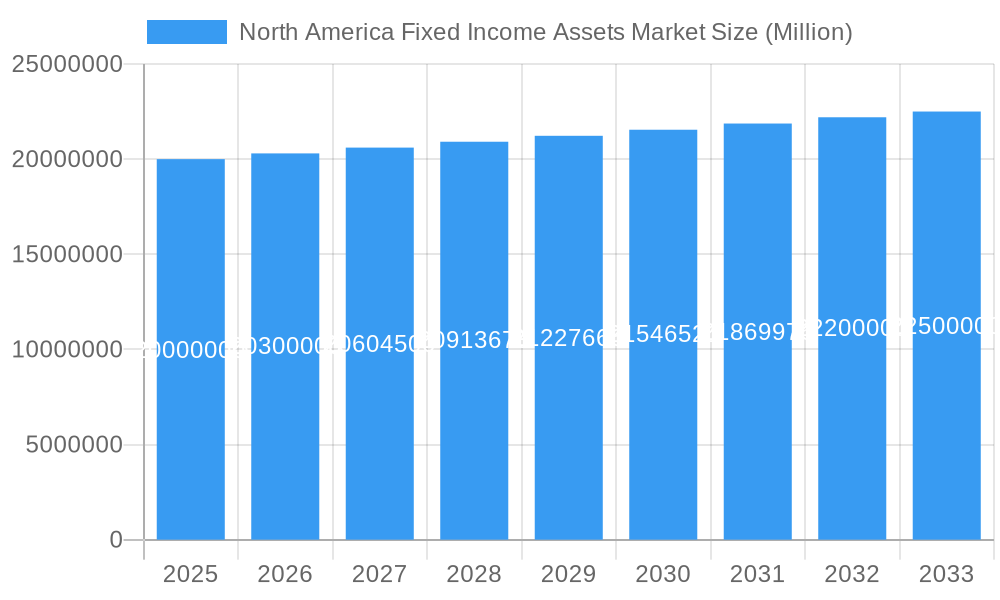

The North American fixed income assets market, while exhibiting a moderate Compound Annual Growth Rate (CAGR) of 1.50% between 2019 and 2033, reveals a complex interplay of driving forces, trends, and constraints. The market's substantial size (let's assume a 2025 market size of $20 trillion, a reasonable estimate given the scale of the US economy and its dominance in global fixed income markets) is fueled by several key factors. Firstly, a persistent low-interest-rate environment historically encouraged investors to seek higher yields in fixed income products, driving considerable investment into the market. Secondly, the increasing complexity of global markets and geopolitical uncertainty often lead investors to favor the perceived safety and stability of fixed-income assets as a portfolio diversifier. Furthermore, the continued growth of institutional investors, such as pension funds and insurance companies, significantly bolsters demand for fixed-income securities. However, rising inflation and potential interest rate hikes pose a significant constraint. Increased inflation erodes the purchasing power of fixed-income returns, potentially dampening investor enthusiasm. Furthermore, shifts in investor sentiment and regulatory changes in the financial landscape continuously impact market performance. Segmentation within the market encompasses diverse asset classes, including government bonds, corporate bonds, mortgage-backed securities, and municipal bonds, each exhibiting unique growth trajectories and investor preferences. Major players like The Vanguard Group, Pimco Funds, and Fidelity Distributors Corp are key contributors to this market's dynamism, continuously shaping product innovation and market strategy.

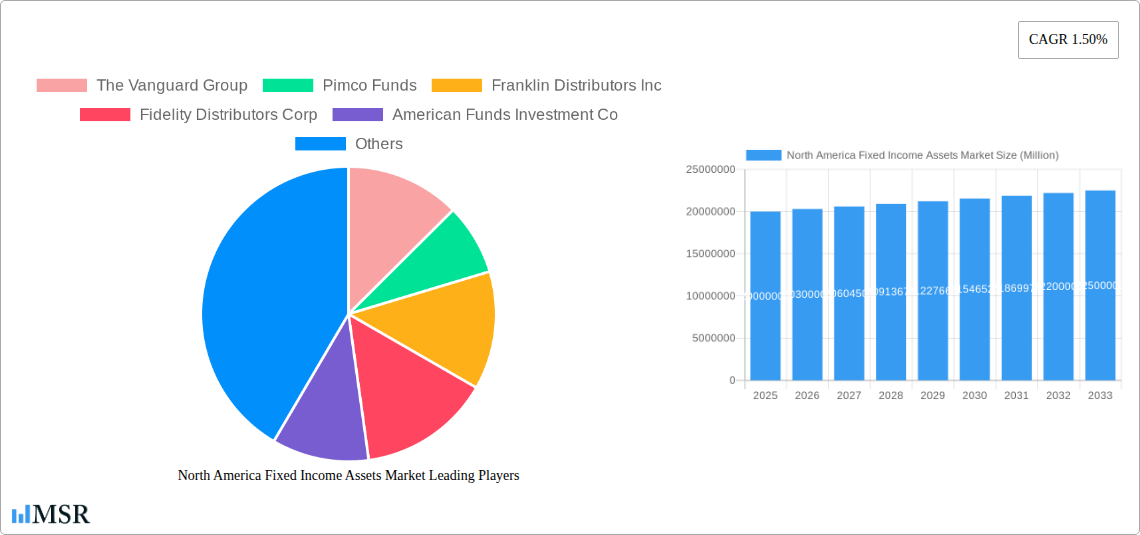

North America Fixed Income Assets Market Market Size (In Million)

The forecast period from 2025 to 2033 suggests a continued, albeit moderate, expansion of the North American fixed income assets market. While the 1.5% CAGR suggests relatively stable growth, the market is far from stagnant. We can anticipate ongoing competition amongst asset managers, with innovation in areas such as ESG investing (Environmental, Social, and Governance) and the rise of technology-driven investment solutions likely to reshape the landscape. The regulatory environment will continue to be a crucial factor, influencing investment strategies and product development. Regional variations within North America will also play a significant role, with potentially stronger growth in regions with more robust economic activity and higher investor confidence. The market's future hinges on the interplay of macroeconomic conditions, investor sentiment, and the adaptability of major market participants to evolving market dynamics.

North America Fixed Income Assets Market Company Market Share

Unlock Growth Opportunities in the North America Fixed Income Assets Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Fixed Income Assets Market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. With a meticulous study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence to navigate the complexities of this dynamic market. The report leverages rigorous data analysis to paint a vivid picture of market dynamics, growth drivers, and emerging opportunities, empowering you to make informed decisions and gain a competitive edge.

North America Fixed Income Assets Market Market Concentration & Dynamics

This section analyzes the competitive landscape of the North America Fixed Income Assets Market, focusing on market concentration, innovation, regulatory frameworks, substitute products, end-user trends, and M&A activities. The market is characterized by a moderately concentrated structure, with key players such as The Vanguard Group, Pimco Funds, and Fidelity Distributors Corp holding significant market share. However, the presence of numerous smaller players contributes to a dynamic and competitive environment.

- Market Share (Estimated 2025): The Vanguard Group (xx%), Pimco Funds (xx%), Fidelity Distributors Corp (xx%), Others (xx%). These figures reflect the estimated distribution of market share among the leading players. Exact figures are subject to ongoing market evolution.

- M&A Activity (2019-2024): The historical period witnessed xx M&A deals, indicating a moderate level of consolidation within the market. These transactions primarily involved smaller players seeking strategic partnerships or acquisitions to expand their product offerings and market reach.

- Regulatory Framework: The market is subject to stringent regulations aimed at ensuring investor protection and market stability. These regulations significantly influence the strategies and operational practices of market participants.

- Innovation Ecosystem: The market is witnessing increasing innovation in areas such as algorithmic trading, risk management technologies and data analytics. These technological advancements are enhancing efficiency and driving market growth.

- Substitute Products: While traditional fixed-income products remain dominant, alternative investment options, such as private equity and real estate, are posing growing competition.

North America Fixed Income Assets Market Industry Insights & Trends

This section delves into the key drivers shaping the growth trajectory of the North America Fixed Income Assets Market. The market size in 2025 is estimated at $xx Million, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several factors, including increasing investor demand for fixed-income assets, favorable regulatory environments, and the increasing use of technology in portfolio management. However, factors such as interest rate volatility and macroeconomic uncertainty can impact this trajectory. The evolving consumer behavior is moving towards more digitally native platforms and customized solutions which are forcing incumbents to innovate and adapt.

Key Markets & Segments Leading North America Fixed Income Assets Market

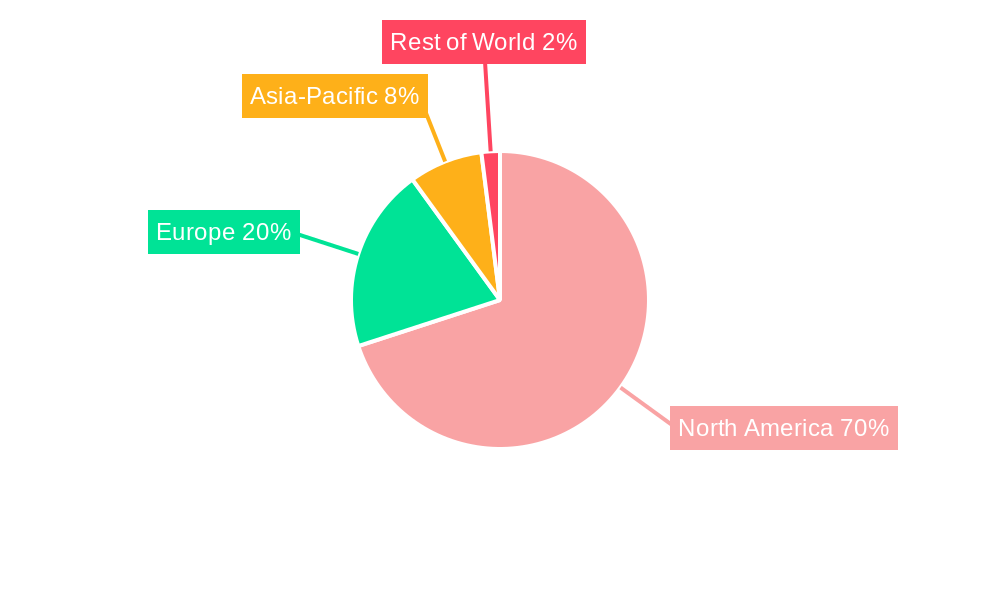

This section highlights the key geographical segments and product categories within the North America Fixed Income Assets Market. While detailed regional breakdowns are provided in the full report, the United States currently represents the dominant market, fueled by robust economic growth, a mature financial infrastructure, and a large pool of institutional and individual investors.

- Key Market Drivers (United States):

- Strong economic growth.

- Well-established financial markets.

- High investor participation.

- Technological advancements in trading and portfolio management.

- Dominance Analysis: The US market's dominance stems from its mature financial sector, high investor sophistication, and consistent economic performance. This creates a fertile ground for the growth of the fixed-income asset market. However, emerging markets such as Canada are also showing significant growth potential.

North America Fixed Income Assets Market Product Developments

Recent years have witnessed significant innovation in fixed-income products, with a focus on creating more sophisticated and tailored solutions to meet the diverse needs of investors. These innovations encompass the development of exchange-traded funds (ETFs), actively managed funds and structured products providing customized solutions for distinct investment objectives. The incorporation of technology has also resulted in the development of sophisticated risk management models and high frequency trading systems, thereby improving efficiency and expanding market access.

Challenges in the North America Fixed Income Assets Market Market

The North America Fixed Income Assets Market faces several challenges. These include increasing regulatory scrutiny, which adds compliance costs for market participants; rising interest rate volatility impacting valuations; and intense competition from other investment options. These hurdles collectively represent significant challenges that need strategic planning to navigate effectively. The quantifiable impact of these factors manifests in reduced profit margins and increased operational complexity for market players.

Forces Driving North America Fixed Income Assets Market Growth

Growth in the North America Fixed Income Assets Market is fueled by several key drivers: the increasing demand for stable investment options amid global economic uncertainty; technological advancements enabling more efficient trading and risk management; and the growing penetration of digital platforms that enhance accessibility and convenience for investors. These converging factors will continue to stimulate market expansion.

Long-Term Growth Catalysts in the North America Fixed Income Assets Market

Long-term growth will be driven by continuous product innovation, strategic partnerships between asset managers and technology providers, and expansion into new markets such as sustainable and ESG focused investments. This synergistic approach positions the market for sustained and substantial growth in the years ahead.

Emerging Opportunities in North America Fixed Income Assets Market

Emerging trends and opportunities include the growing demand for ESG (environmental, social, and governance) investing in fixed income assets; the increasing adoption of fintech solutions within the industry; and the potential for growth in emerging markets. These trends offer significant potential for growth and innovation within the sector.

Leading Players in the North America Fixed Income Assets Market Sector

- The Vanguard Group

- Pimco Funds

- Franklin Distributors Inc

- Fidelity Distributors Corp

- American Funds Investment Co

- Putnam Investments LLC

- Oppenheimer Funds Inc

- Scudder Investments

- Evergreen Investments

- Dreyfus Corp

- Federated Investors Inc

- T Rowe Price Group

Key Milestones in North America Fixed Income Assets Market Industry

- 2020: Increased adoption of digital investment platforms.

- 2021: Growing interest in ESG investing in fixed income assets.

- 2022: Several notable M&A activities among smaller firms, accelerating market consolidation.

- 2023: Launch of several innovative fixed-income ETFs targeting specific investment strategies.

- 2024: Regulatory changes aimed at enhancing investor protection and market transparency.

Strategic Outlook for North America Fixed Income Assets Market Market

The future of the North America Fixed Income Assets Market looks bright, driven by a combination of technological advancements, evolving investor preferences, and macroeconomic factors. Strategic opportunities exist for players who can leverage technology to enhance efficiency, develop innovative products, and effectively manage risk in a dynamic market environment. The focus on sustainable investing and the expanding adoption of digital investment platforms will continue to shape the market landscape, offering compelling opportunities for growth and innovation.

North America Fixed Income Assets Market Segmentation

-

1. Source of Funds

- 1.1. Pension Funds and Insurance Companies

- 1.2. Retail Investors

- 1.3. Institutional Investors

- 1.4. Government/Sovereign Wealth Fund

- 1.5. Others

-

2. Fixed Income Type

- 2.1. Core Fixed Income

- 2.2. Alternative Credit

-

3. Type of Asset Management Firms

- 3.1. Large financial institutions/Bulge bracket banks

- 3.2. Mutual Funds ETFs

- 3.3. Private Equity and Venture Capital

- 3.4. Fixed Income Funds

- 3.5. Managed Pension Funds

- 3.6. Others

North America Fixed Income Assets Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fixed Income Assets Market Regional Market Share

Geographic Coverage of North America Fixed Income Assets Market

North America Fixed Income Assets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Prominence of HNWIs in Fixed Income Investments in North America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fixed Income Assets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Funds

- 5.1.1. Pension Funds and Insurance Companies

- 5.1.2. Retail Investors

- 5.1.3. Institutional Investors

- 5.1.4. Government/Sovereign Wealth Fund

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Fixed Income Type

- 5.2.1. Core Fixed Income

- 5.2.2. Alternative Credit

- 5.3. Market Analysis, Insights and Forecast - by Type of Asset Management Firms

- 5.3.1. Large financial institutions/Bulge bracket banks

- 5.3.2. Mutual Funds ETFs

- 5.3.3. Private Equity and Venture Capital

- 5.3.4. Fixed Income Funds

- 5.3.5. Managed Pension Funds

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Source of Funds

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Vanguard Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pimco Funds

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Franklin Distributors Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fidelity Distributors Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Funds Investment Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Putnam Investments LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oppenheimer Funds Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Scudder Investments

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evergreen Investments

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dreyfus Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Federated Investors Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 T Rowe Price Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 The Vanguard Group

List of Figures

- Figure 1: North America Fixed Income Assets Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Fixed Income Assets Market Share (%) by Company 2025

List of Tables

- Table 1: North America Fixed Income Assets Market Revenue Million Forecast, by Source of Funds 2020 & 2033

- Table 2: North America Fixed Income Assets Market Revenue Million Forecast, by Fixed Income Type 2020 & 2033

- Table 3: North America Fixed Income Assets Market Revenue Million Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 4: North America Fixed Income Assets Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Fixed Income Assets Market Revenue Million Forecast, by Source of Funds 2020 & 2033

- Table 6: North America Fixed Income Assets Market Revenue Million Forecast, by Fixed Income Type 2020 & 2033

- Table 7: North America Fixed Income Assets Market Revenue Million Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 8: North America Fixed Income Assets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fixed Income Assets Market?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the North America Fixed Income Assets Market?

Key companies in the market include The Vanguard Group, Pimco Funds, Franklin Distributors Inc, Fidelity Distributors Corp, American Funds Investment Co, Putnam Investments LLC, Oppenheimer Funds Inc, Scudder Investments, Evergreen Investments, Dreyfus Corp, Federated Investors Inc, T Rowe Price Group.

3. What are the main segments of the North America Fixed Income Assets Market?

The market segments include Source of Funds, Fixed Income Type, Type of Asset Management Firms.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Prominence of HNWIs in Fixed Income Investments in North America.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fixed Income Assets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fixed Income Assets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fixed Income Assets Market?

To stay informed about further developments, trends, and reports in the North America Fixed Income Assets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence