Key Insights

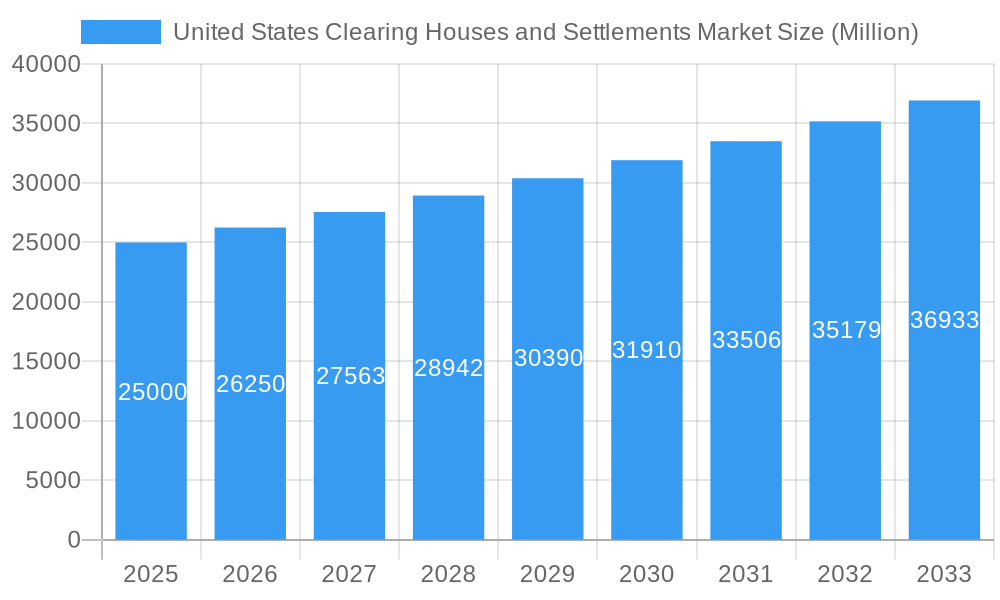

The United States clearing houses and settlements market is exhibiting strong growth, driven by escalating trading volumes, the proliferation of electronic trading, and a rising demand for efficient, secure post-trade solutions. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5% from 2024 to 2033. This expansion is propelled by the increasing adoption of algorithmic and high-frequency trading, requiring faster and more dependable clearing and settlement mechanisms. Furthermore, regulatory mandates aimed at bolstering market stability and mitigating systemic risk are accelerating the adoption of advanced clearing and settlement technologies. The increasing complexity of financial instruments and the globalization of financial markets also contribute to market expansion. Leading U.S. market participants, including exchanges like the New York Stock Exchange (NYSE), NASDAQ, and CBOE, are continually investing in technological enhancements and strategic alliances to maintain competitive advantage. Market segmentation encompasses various services such as equities clearing, derivatives clearing, and fixed income clearing, each with distinct growth trajectories. The 2024 market size is estimated at $6.75 billion, with substantial growth anticipated through 2033. Geographic segmentation is dominated by the Northeast region due to the high concentration of financial institutions.

United States Clearing Houses and Settlements Market Market Size (In Billion)

The outlook for the U.S. clearing houses and settlements market is positive, despite persistent challenges. Potential growth inhibitors include the dynamic evolution of regulatory frameworks, evolving cybersecurity threats, and the continuous need for substantial infrastructure investment to manage increasing transaction volumes. However, innovative technologies such as Distributed Ledger Technology (DLT) and Artificial Intelligence (AI) are creating opportunities for enhanced efficiency, transparency, and reduced operational costs, expected to be key growth drivers. Strategic mergers, acquisitions, and the development of integrated post-trade platforms are poised to reshape the competitive landscape. The growing emphasis on data analytics and sophisticated risk management will also influence technological advancements and foster opportunities for specialized service providers.

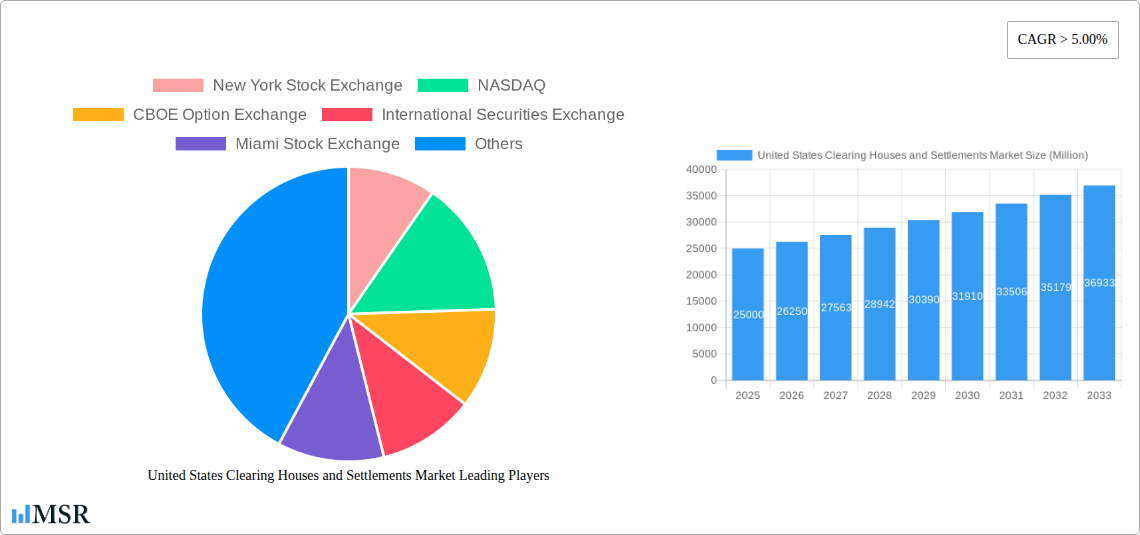

United States Clearing Houses and Settlements Market Company Market Share

United States Clearing Houses and Settlements Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Clearing Houses and Settlements Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report meticulously examines market dynamics, trends, and future growth potential. The report utilizes a robust methodology to analyze market size (in Millions), CAGR, and key performance indicators, providing a clear picture of the current landscape and future trajectory. Key market segments are examined, alongside detailed profiles of leading players, including the New York Stock Exchange, NASDAQ, CBOE Option Exchange, International Securities Exchange, Miami Stock Exchange, National Stock Exchange, and Philadelphia Stock Exchange (list not exhaustive).

United States Clearing Houses and Settlements Market Market Concentration & Dynamics

The U.S. clearing houses and settlements market exhibits a moderately concentrated structure, dominated by a few major players. Market share data for 2024 indicates that the top three players account for approximately xx% of the market, with the remaining share distributed amongst numerous smaller firms. This concentration is largely due to significant capital requirements, stringent regulatory oversight, and the economies of scale inherent in the business. The market is characterized by a complex interplay of factors influencing its dynamics:

- Innovation Ecosystems: Ongoing technological advancements, particularly in areas like blockchain and distributed ledger technology (DLT), are reshaping clearing and settlement processes, driving efficiency and reducing risk. However, adoption rates vary among different market participants.

- Regulatory Frameworks: The regulatory landscape plays a pivotal role, with bodies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) continuously evolving regulations to enhance market stability and protect investors. Recent regulatory changes, as discussed later, significantly impact market dynamics.

- Substitute Products: The emergence of alternative trading systems and decentralized finance (DeFi) platforms presents potential substitutes, albeit with varying degrees of maturity and adoption.

- End-User Trends: Growing institutional and retail investor participation necessitates robust clearing and settlement infrastructure, driving market growth. The increasing volume of electronic trading also significantly impacts market activity.

- M&A Activities: The market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with an estimated xx M&A deals closed between 2019 and 2024. These activities are largely driven by efforts to expand market share and enhance operational efficiency. Consolidation is expected to continue in the coming years.

United States Clearing Houses and Settlements Market Industry Insights & Trends

The U.S. clearing houses and settlements market experienced a robust growth trajectory during the historical period (2019-2024), with a CAGR of xx%. The market size in 2024 reached approximately xx Million. This growth was primarily driven by factors such as:

- Increased Trading Volumes: The rising popularity of equity and derivatives trading fuels demand for efficient clearing and settlement services.

- Regulatory Compliance: Stringent regulatory requirements necessitate the utilization of clearing houses for risk mitigation, thus boosting the market.

- Technological Advancements: The adoption of advanced technologies, including AI and machine learning, leads to improved operational efficiency and reduced costs.

- Expanding Market Reach: The increasing participation of global investors in the U.S. market expands the demand for efficient clearing and settlement services.

The forecast period (2025-2033) anticipates continued growth, projected at a CAGR of xx%, driven by a surge in electronic trading and the integration of newer technologies. The market size is estimated to reach xx Million by 2033. However, factors such as heightened competition and evolving regulatory landscapes could potentially impact the overall growth rate.

Key Markets & Segments Leading United States Clearing Houses and Settlements Market

The U.S. clearing houses and settlements market is largely concentrated within the major financial hubs, with New York City playing a dominant role. This dominance is attributable to various factors:

- High Concentration of Financial Institutions: New York's status as a global financial center attracts a large number of financial institutions, directly impacting the demand for clearing and settlement services.

- Robust Infrastructure: The city possesses advanced technological infrastructure capable of supporting the complex operations of clearing houses.

- Regulatory Environment: The presence of regulatory bodies within New York further reinforces its position as a central hub for the market.

Other key regional markets include Chicago, Boston, and other major financial centers. While New York City holds a dominant market share, other regions contribute significantly to overall market growth. Drivers of regional growth include:

- Economic Growth: Regional economic expansion stimulates financial activity, leading to increased demand for clearing and settlement services.

- Infrastructure Development: Investments in technological infrastructure enhance the capacity of regional markets to handle increased trading volumes.

- Regulatory Support: Favorable regulatory frameworks can attract financial institutions and boost market development.

United States Clearing Houses and Settlements Market Product Developments

Recent product developments within the U.S. clearing houses and settlements market have focused on enhancing efficiency and reducing operational risk. This includes the implementation of advanced technologies like blockchain for faster and more secure settlement processes, improvements in risk management systems to mitigate counterparty risk, and the development of innovative solutions for handling complex derivative products. These advancements are creating competitive advantages for market participants by increasing speed and reducing costs, while simultaneously enhancing regulatory compliance.

Challenges in the United States Clearing Houses and Settlements Market Market

The U.S. clearing houses and settlements market faces several challenges, including:

- Regulatory Scrutiny: Constant regulatory changes necessitate substantial investments in compliance, increasing operational costs.

- Cybersecurity Threats: The increasing reliance on technology exposes the market to potential cybersecurity threats, requiring robust security measures.

- Competition: Intense competition among established and emerging players puts pressure on pricing and profitability. The combined effect of these factors creates significant hurdles for market players.

Forces Driving United States Clearing Houses and Settlements Market Growth

Several factors propel the growth of the U.S. clearing houses and settlements market:

- Technological Advancements: Innovation in areas like AI, machine learning, and DLT are enhancing operational efficiency and reducing costs.

- Increased Trading Activity: The rise in electronic trading significantly increases the demand for clearing and settlement services.

- Regulatory Compliance: Stringent regulations driving the use of clearing houses for risk mitigation bolster market expansion.

Challenges in the United States Clearing Houses and Settlements Market Market

Long-term growth catalysts include strategic partnerships to leverage technological advancements, expansion into new markets, and continuous innovation in risk management systems. Strategic initiatives focused on addressing cybersecurity risks and navigating the evolving regulatory landscape will be crucial for sustained long-term growth.

Emerging Opportunities in United States Clearing Houses and Settlements Market

Emerging opportunities lie in leveraging blockchain technology for faster and more secure settlements, expanding into new markets, and providing customized solutions to meet the specific needs of diverse client segments. The adoption of advanced analytics for risk management presents another significant opportunity for growth and differentiation.

Leading Players in the United States Clearing Houses and Settlements Market Sector

- New York Stock Exchange

- NASDAQ

- CBOE Option Exchange

- International Securities Exchange

- Miami Stock Exchange

- National Stock Exchange

- Philadelphia Stock Exchange

Key Milestones in United States Clearing Houses and Settlements Market Industry

- December 2023: Miami International Holdings, Inc. launched MIAX Sapphire, a new physical trading floor and electronic exchange in Miami's Wynwood district, expanding options trading capacity.

- December 2023: New regulations enacted by Wall Street's top regulators mandate increased clearing house usage for U.S. Treasury market trades, reducing systemic risk within the $26 trillion market.

Strategic Outlook for United States Clearing Houses and Settlements Market Market

The U.S. clearing houses and settlements market presents significant future potential, driven by technological advancements, increased trading activity, and evolving regulatory landscapes. Strategic opportunities exist in developing innovative solutions, expanding into new markets, and forging strategic partnerships to enhance operational efficiency and risk management capabilities. Companies that effectively adapt to these trends and proactively manage regulatory challenges will be best positioned for success in this dynamic market.

United States Clearing Houses and Settlements Market Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Instruments

- 2.1. Debt

- 2.2. Equity

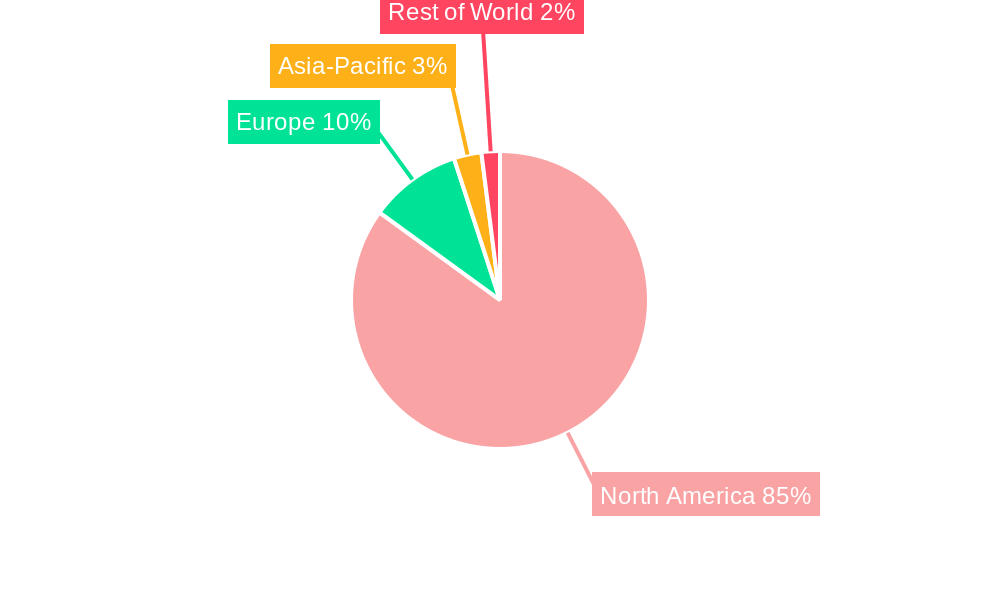

United States Clearing Houses and Settlements Market Segmentation By Geography

- 1. United States

United States Clearing Houses and Settlements Market Regional Market Share

Geographic Coverage of United States Clearing Houses and Settlements Market

United States Clearing Houses and Settlements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digital Assets and Digitalization is Expected to Boost the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Clearing Houses and Settlements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Instruments

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 New York Stock Exchange

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NASDAQ

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CBOE Option Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Securities Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miami Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Philadelphia Stock Exchange*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 New York Stock Exchange

List of Figures

- Figure 1: United States Clearing Houses and Settlements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Clearing Houses and Settlements Market Share (%) by Company 2025

List of Tables

- Table 1: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 2: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 3: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Type of Market 2020 & 2033

- Table 5: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Financial Instruments 2020 & 2033

- Table 6: United States Clearing Houses and Settlements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Clearing Houses and Settlements Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the United States Clearing Houses and Settlements Market?

Key companies in the market include New York Stock Exchange, NASDAQ, CBOE Option Exchange, International Securities Exchange, Miami Stock Exchange, National Stock Exchange, Philadelphia Stock Exchange*List Not Exhaustive.

3. What are the main segments of the United States Clearing Houses and Settlements Market?

The market segments include Type of Market, Financial Instruments.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.75 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digital Assets and Digitalization is Expected to Boost the Growth of the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In December 2023, Miami International Holdings, Inc. has introduced new MIAX Sapphire, physical trading floor located in Miami's Wynwood district. The new MIAX Sapphire exchange, which will run both an electronic exchange and a physical trading floor, will be MIAX's fourth national securities exchange for U.S. multi-listed options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Clearing Houses and Settlements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Clearing Houses and Settlements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Clearing Houses and Settlements Market?

To stay informed about further developments, trends, and reports in the United States Clearing Houses and Settlements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence