Key Insights

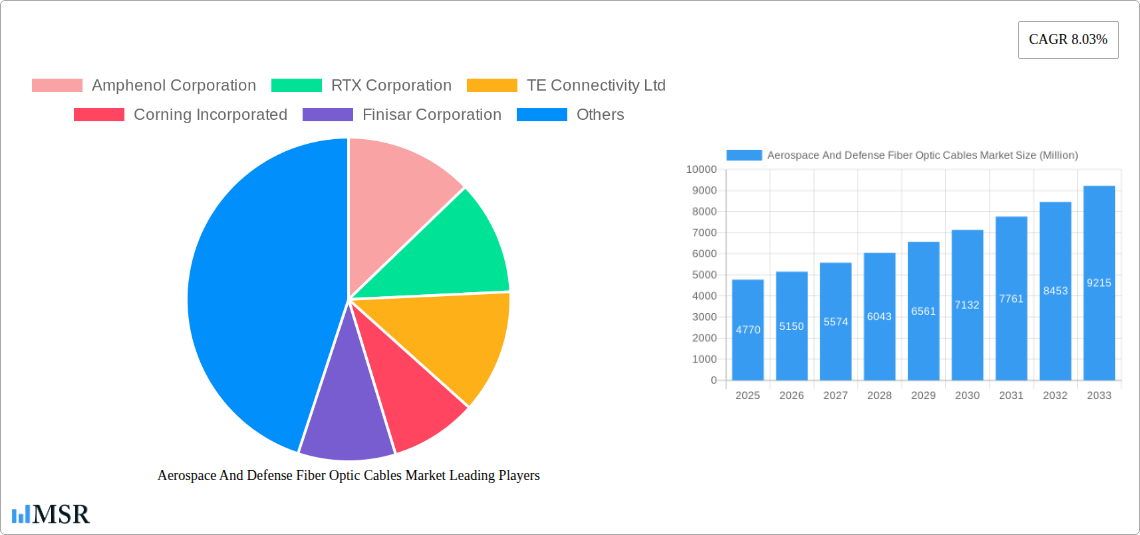

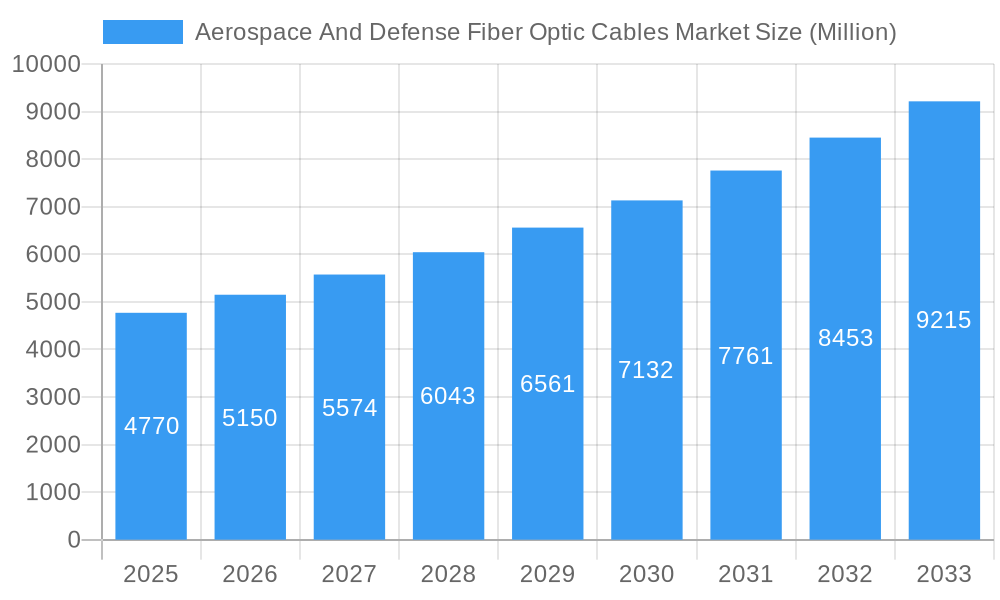

The Aerospace and Defense Fiber Optic Cables market is experiencing robust growth, projected to reach $4.77 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.03% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for high-bandwidth, lightweight, and reliable communication systems within aircraft, spacecraft, and defense platforms is a primary driver. Advances in fiber optic technology, offering improved signal integrity and data transmission speeds compared to traditional copper cabling, are fueling adoption. Furthermore, the growing integration of advanced sensor technologies and autonomous systems in aerospace and defense applications necessitates high-speed data transmission capabilities, further boosting market demand. Stringent regulatory requirements for enhanced safety and reliability in these critical sectors also contribute to the market's growth. Key players such as Amphenol Corporation, RTX Corporation, TE Connectivity Ltd, and Corning Incorporated are at the forefront of innovation, developing advanced fiber optic cable solutions tailored to the specific needs of aerospace and defense applications. Competition is fierce, pushing companies to innovate in areas like miniaturization, improved durability, and radiation hardening to withstand the harsh environments encountered in these sectors.

Aerospace And Defense Fiber Optic Cables Market Market Size (In Billion)

Market restraints include the high initial investment costs associated with implementing fiber optic cable systems and the complexity of installation in existing aircraft and defense systems. However, the long-term benefits of enhanced performance and reduced maintenance costs are overcoming these initial hurdles. Future growth will likely be shaped by technological advancements in areas like space-qualified fiber optics, improved connector designs for harsh environments, and the increasing adoption of software-defined networking (SDN) within aerospace and defense communication systems. The market segmentation is likely diverse, encompassing different cable types (e.g., single-mode, multi-mode), applications (e.g., avionics, satellite communication), and regions. Continued investment in research and development, coupled with strong government spending on defense modernization programs, will significantly impact the market's trajectory in the coming years.

Aerospace And Defense Fiber Optic Cables Market Company Market Share

Dive Deep into the Aerospace and Defense Fiber Optic Cables Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Aerospace and Defense Fiber Optic Cables Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report leverages rigorous data analysis and industry expertise to forecast market trends and opportunities from 2025 to 2033. Key players like Amphenol Corporation, RTX Corporation, TE Connectivity Ltd, Corning Incorporated, Finisar Corporation, Prysmian Group, Optical Cable Corporation, Radiall, Timbercon, and L Gore & Associates Inc. are profiled, revealing their market positioning and strategic initiatives. The market's value is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Aerospace And Defense Fiber Optic Cables Market Market Concentration & Dynamics

The Aerospace and Defense Fiber Optic Cables Market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Amphenol Corporation and TE Connectivity Ltd., for example, command a combined xx% market share (estimated), reflecting their strong brand recognition and extensive product portfolios. However, the market also displays a vibrant innovation ecosystem, with smaller players focusing on niche applications and specialized technologies. Stringent regulatory frameworks governing aerospace and defense components influence market dynamics, demanding rigorous quality control and safety standards. Substitute products, such as copper cables, face challenges in competing due to fiber optics' superior bandwidth and data transmission capabilities. End-user trends toward increased data processing and connectivity drive market growth. The past five years (2019-2024) witnessed xx M&A deals in the sector, indicating consolidation and strategic expansion.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (estimated).

- Innovation Ecosystem: Active, with focus on advanced materials, miniaturization, and improved reliability.

- Regulatory Framework: Stringent, emphasizing quality, safety, and security.

- Substitute Products: Copper cables pose limited competition due to fiber optics' advantages.

- End-User Trends: Increasing demand for high-bandwidth, high-speed data transmission.

- M&A Activity: xx deals during 2019-2024, signifying market consolidation.

Aerospace And Defense Fiber Optic Cables Market Industry Insights & Trends

The Aerospace and Defense Fiber Optic Cables Market experienced significant growth during the historical period (2019-2024), reaching a market size of xx Million in 2024. This growth is primarily driven by several factors. The increasing adoption of advanced communication and sensing technologies in aerospace and defense systems necessitates high-bandwidth and reliable data transmission, fueling demand for fiber optic cables. Technological advancements, including the development of smaller, lighter, and more durable fiber optic cables, further contribute to market expansion. Government investments in defense modernization and the rising adoption of unmanned aerial vehicles (UAVs) and other autonomous systems further propel market growth. Consumer behavior, particularly in the defense sector, leans towards greater reliance on data-driven decision-making, emphasizing the need for robust communication infrastructure. The market is expected to continue its robust growth trajectory during the forecast period (2025-2033), driven by ongoing technological innovations and increasing demand across various defense applications. The market is projected to reach xx Million by 2033, demonstrating a CAGR of xx%.

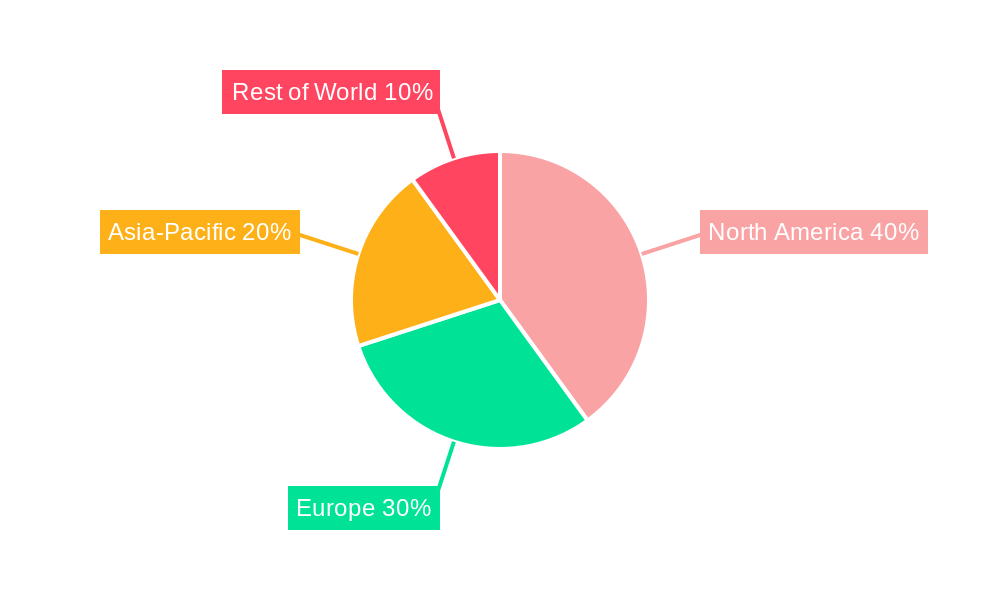

Key Markets & Segments Leading Aerospace And Defense Fiber Optic Cables Market

The North American region currently dominates the Aerospace and Defense Fiber Optic Cables Market, accounting for xx% of the global market share in 2024. This dominance is driven by several factors:

- Strong Defense Budgets: Significant government investment in defense modernization and technological upgrades.

- Technological Advancement: Presence of major aerospace and defense companies fostering innovation.

- Robust Infrastructure: Well-established supply chains and manufacturing capabilities.

While North America leads, the Asia-Pacific region exhibits the fastest growth rate due to rising defense spending in countries like China and India. The European market maintains a stable position, driven by defense modernization efforts within the region. The key segments driving growth are military aircraft and UAVs, as these applications heavily rely on high-performance communication systems.

Aerospace And Defense Fiber Optic Cables Market Product Developments

Recent product innovations in the Aerospace and Defense Fiber Optic Cables market have focused on enhancing durability, miniaturization, and performance in extreme environments. Manufacturers are developing cables with improved resistance to radiation, temperature fluctuations, and vibration, crucial for demanding aerospace and defense applications. Advances in connector technology have led to smaller, lighter, and more reliable connections, enabling greater system integration. These developments provide competitive advantages, offering improved performance, reduced weight, and increased reliability for end-users.

Challenges in the Aerospace And Defense Fiber Optic Cables Market Market

The Aerospace and Defense Fiber Optic Cables market faces challenges such as stringent regulatory compliance requirements, increasing raw material costs, and the complexity of supply chain management for specialized components. These factors contribute to higher manufacturing costs and can potentially limit market growth. Intense competition from established and emerging players also exerts pressure on profit margins. Furthermore, disruptions in the global supply chain can significantly impact production and delivery timelines. These challenges necessitate robust risk management strategies and innovation to maintain competitiveness.

Forces Driving Aerospace And Defense Fiber Optic Cables Market Growth

Several key factors drive the growth of the Aerospace and Defense Fiber Optic Cables Market. Firstly, the escalating demand for high-bandwidth communication systems in military and aerospace applications is a major impetus. Secondly, advancements in fiber optic technology, resulting in lighter, more durable, and radiation-resistant cables, fuel market expansion. Thirdly, increasing government investments in defense modernization across various countries worldwide bolster market growth. These factors, combined with the growing adoption of UAVs and autonomous systems, paint a positive picture for future market expansion.

Long-Term Growth Catalysts in the Aerospace and Defense Fiber Optic Cables Market

Long-term growth in the Aerospace and Defense Fiber Optic Cables market hinges on continuous innovation in material science, leading to more robust and lightweight cables capable of withstanding extreme conditions. Strategic partnerships between cable manufacturers and defense contractors will be crucial for integrating advanced fiber optic solutions into next-generation systems. Expansion into emerging markets with growing defense budgets, such as certain regions in Asia and the Middle East, will also provide significant growth opportunities.

Emerging Opportunities in Aerospace And Defense Fiber Optic Cables Market

Emerging opportunities lie in the development of specialized fiber optic cables for advanced applications, such as high-speed data transmission in hypersonic vehicles and improved sensor integration in unmanned systems. The integration of fiber optics into next-generation satellite communication systems offers substantial growth potential. Furthermore, the market presents opportunities in developing robust and secure communication systems for military applications, emphasizing cybersecurity and data protection.

Leading Players in the Aerospace And Defense Fiber Optic Cables Market Sector

- Amphenol Corporation

- RTX Corporation

- TE Connectivity Ltd

- Corning Incorporated

- Finisar Corporation

- Prysmian Group

- Optical Cable Corporation

- Radiall

- Timbercon

- L Gore & Associates Inc

Key Milestones in Aerospace And Defense Fiber Optic Cables Market Industry

- November 2023: Prysmian Group completed a major subsea interconnector project between Italy and Greece, highlighting its expertise in complex cable infrastructure projects with potential military and aerospace implications.

- January 2024: Amphenol Corporation launched a new line of high-performance fiber optic connectors for demanding military and aerospace environments, showcasing its commitment to innovation.

Strategic Outlook for Aerospace And Defense Fiber Optic Cables Market Market

The Aerospace and Defense Fiber Optic Cables Market presents a compelling investment opportunity, driven by long-term growth catalysts such as technological advancements, escalating defense budgets, and the expanding adoption of advanced systems. Strategic partnerships, focused innovation, and expansion into new markets will be essential for companies seeking to capitalize on the market's significant potential. The market's future growth trajectory remains positive, promising lucrative returns for companies with a keen focus on technological leadership and strategic market positioning.

Aerospace And Defense Fiber Optic Cables Market Segmentation

-

1. Application

- 1.1. Communication Systems

- 1.2. Avionics

- 1.3. Weapon Systems

- 1.4. Surveillance and Reconnaissance

- 1.5. Electronic Warfare

-

2. Type

- 2.1. Single-mode

- 2.2. Multi-mode

Aerospace And Defense Fiber Optic Cables Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Aerospace And Defense Fiber Optic Cables Market Regional Market Share

Geographic Coverage of Aerospace And Defense Fiber Optic Cables Market

Aerospace And Defense Fiber Optic Cables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Multi-mode Segment is Expected to Record the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication Systems

- 5.1.2. Avionics

- 5.1.3. Weapon Systems

- 5.1.4. Surveillance and Reconnaissance

- 5.1.5. Electronic Warfare

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single-mode

- 5.2.2. Multi-mode

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communication Systems

- 6.1.2. Avionics

- 6.1.3. Weapon Systems

- 6.1.4. Surveillance and Reconnaissance

- 6.1.5. Electronic Warfare

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single-mode

- 6.2.2. Multi-mode

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communication Systems

- 7.1.2. Avionics

- 7.1.3. Weapon Systems

- 7.1.4. Surveillance and Reconnaissance

- 7.1.5. Electronic Warfare

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single-mode

- 7.2.2. Multi-mode

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communication Systems

- 8.1.2. Avionics

- 8.1.3. Weapon Systems

- 8.1.4. Surveillance and Reconnaissance

- 8.1.5. Electronic Warfare

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single-mode

- 8.2.2. Multi-mode

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communication Systems

- 9.1.2. Avionics

- 9.1.3. Weapon Systems

- 9.1.4. Surveillance and Reconnaissance

- 9.1.5. Electronic Warfare

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single-mode

- 9.2.2. Multi-mode

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communication Systems

- 10.1.2. Avionics

- 10.1.3. Weapon Systems

- 10.1.4. Surveillance and Reconnaissance

- 10.1.5. Electronic Warfare

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single-mode

- 10.2.2. Multi-mode

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Amphenol Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RTX Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TE Connectivity Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Corning Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Finisar Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Prysmian Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Optical Cable Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Radiall

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Timbercon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 L Gore & Associates Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Amphenol Corporation

List of Figures

- Figure 1: Global Aerospace And Defense Fiber Optic Cables Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Aerospace And Defense Fiber Optic Cables Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Application 2025 & 2033

- Figure 4: North America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Application 2025 & 2033

- Figure 5: North America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Type 2025 & 2033

- Figure 8: North America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Type 2025 & 2033

- Figure 9: North America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Application 2025 & 2033

- Figure 16: Europe Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Application 2025 & 2033

- Figure 17: Europe Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Application 2025 & 2033

- Figure 19: Europe Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Europe Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Application 2025 & 2033

- Figure 29: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Type 2025 & 2033

- Figure 32: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Type 2025 & 2033

- Figure 33: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Type 2025 & 2033

- Figure 35: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Application 2025 & 2033

- Figure 40: Latin America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Application 2025 & 2033

- Figure 41: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Latin America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Type 2025 & 2033

- Figure 44: Latin America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Type 2025 & 2033

- Figure 45: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Latin America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Type 2025 & 2033

- Figure 47: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Application 2025 & 2033

- Figure 52: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Application 2025 & 2033

- Figure 53: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Application 2025 & 2033

- Figure 55: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Type 2025 & 2033

- Figure 56: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Type 2025 & 2033

- Figure 57: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Type 2025 & 2033

- Figure 58: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Type 2025 & 2033

- Figure 59: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 9: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: US Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: US Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 19: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: France Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Germany Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Russia Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 35: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 37: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: China Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: India Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: India Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Japan Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Japan Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: South Korea Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: South Korea Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 51: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 53: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Brazil Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Brazil Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Latin America Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Latin America Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 60: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 61: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 62: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 63: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Country 2020 & 2033

- Table 65: Saudi Arabia Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Saudi Arabia Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: United Arab Emirates Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: United Arab Emirates Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Rest of Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace And Defense Fiber Optic Cables Market?

The projected CAGR is approximately 8.03%.

2. Which companies are prominent players in the Aerospace And Defense Fiber Optic Cables Market?

Key companies in the market include Amphenol Corporation, RTX Corporation, TE Connectivity Ltd, Corning Incorporated, Finisar Corporation, Prysmian Group, Optical Cable Corporation, Radiall, Timbercon, L Gore & Associates Inc.

3. What are the main segments of the Aerospace And Defense Fiber Optic Cables Market?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.77 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Multi-mode Segment is Expected to Record the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2024: Amphenol Corporation unveiled a new line of high-performance fiber optic connectors tailored for demanding military and aerospace settings, underscoring their commitment to innovation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerospace And Defense Fiber Optic Cables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerospace And Defense Fiber Optic Cables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerospace And Defense Fiber Optic Cables Market?

To stay informed about further developments, trends, and reports in the Aerospace And Defense Fiber Optic Cables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence