Key Insights

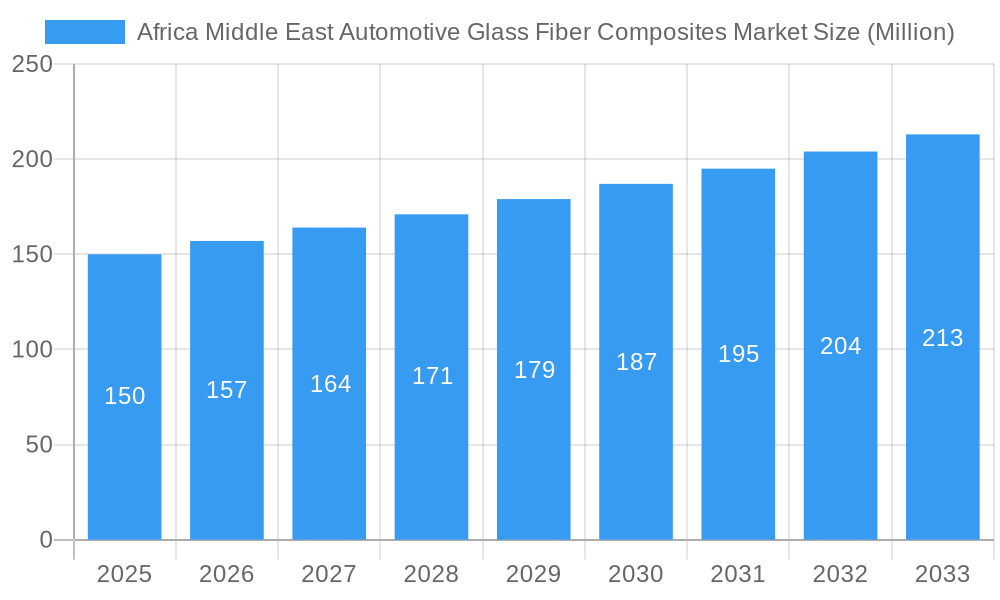

The Africa and Middle East Automotive Glass Fiber Composites market, projected to reach $1120.4 million by 2024 and grow at a CAGR of 5.4% from 2024 to 2033, is experiencing significant expansion. This growth is propelled by a rapidly developing regional automotive sector, driven by rising disposable incomes and an expanding middle class. Demand for fuel-efficient and high-performance vehicles is increasing, accelerating the adoption of lightweight glass fiber composites. Supportive government policies promoting sustainable transportation and the integration of advanced automotive technologies further contribute to market buoyancy. Key production methods include hand layup and resin transfer molding, with structural assembly and powertrain components being dominant application areas. Major market participants are investing in innovative composite materials and manufacturing processes, fostering intense competition and technological progress.

Africa Middle East Automotive Glass Fiber Composites Market Market Size (In Billion)

Despite the positive trajectory, the market encounters challenges such as substantial initial investment costs for composite manufacturing, which can be a deterrent for smaller enterprises. Volatile raw material prices, particularly for resins and fibers, present a risk to profit margins. Additionally, a shortage of skilled labor and limited advanced manufacturing infrastructure in certain regions may impede rapid expansion. Nevertheless, the long-term outlook remains robust, bolstered by sustained automotive industry development and advancements in composite materials. The increasing emphasis on sustainability and the preference for lighter vehicles underpin this optimistic forecast. Regions with robust economic development and burgeoning automotive production within Africa and the Middle East are anticipated to lead market growth throughout the forecast period.

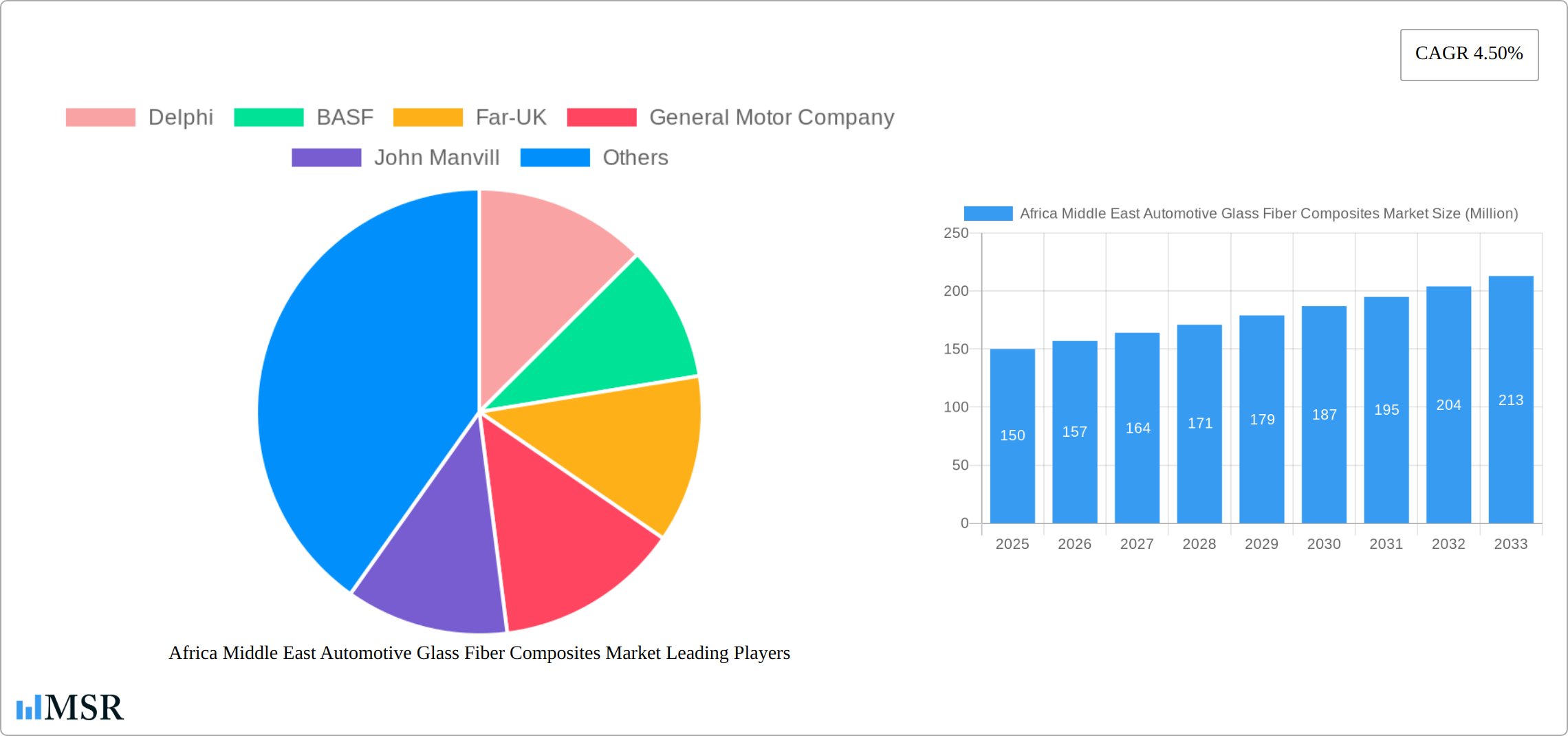

Africa Middle East Automotive Glass Fiber Composites Market Company Market Share

Africa Middle East Automotive Glass Fiber Composites Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa Middle East Automotive Glass Fiber Composites Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by production type (Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding, Compression Molding) and application type (Structural Assembly, Power Train Component, Interior, Exterior, Others). Key players analyzed include Delphi, BASF, Far-UK, General Motor Company, John Manvill, Cytec Industries, Gurit, 3B-Fiberglass, Base Group, and BMW. Expect detailed market sizing and CAGR projections, along with a thorough evaluation of market dynamics and growth drivers.

Africa Middle East Automotive Glass Fiber Composites Market Market Concentration & Dynamics

The Africa Middle East Automotive Glass Fiber Composites market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share of the top five players is estimated at xx% in 2025. Innovation ecosystems are developing, driven by government initiatives promoting lightweighting in the automotive sector and increasing adoption of advanced composites. Regulatory frameworks concerning material safety and environmental impact are becoming more stringent. Substitute materials, such as high-strength steel and aluminum, present a competitive challenge, although the unique properties of glass fiber composites, including high strength-to-weight ratio and design flexibility, continue to drive demand. End-user trends toward fuel efficiency and improved vehicle performance further bolster market growth. M&A activity has been moderate in recent years, with xx deals recorded between 2019 and 2024, primarily focused on expanding geographical reach and technological capabilities.

- Market Concentration: Top 5 players hold xx% market share (2025).

- Innovation: Focus on lightweighting and advanced composites.

- Regulatory Landscape: Increasingly stringent safety and environmental regulations.

- Substitute Products: High-strength steel and aluminum pose competition.

- End-User Trends: Demand driven by fuel efficiency and performance improvements.

- M&A Activity: xx deals between 2019 and 2024.

Africa Middle East Automotive Glass Fiber Composites Market Industry Insights & Trends

The Africa Middle East Automotive Glass Fiber Composites market is experiencing robust growth, driven by the burgeoning automotive industry in the region and increasing demand for lightweight vehicles. The market size is projected to reach xx Million by 2025, growing at a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, including advancements in resin systems and manufacturing processes, are enhancing the performance and cost-effectiveness of glass fiber composites. Evolving consumer preferences towards safer, fuel-efficient, and technologically advanced vehicles are fueling market expansion. Government initiatives promoting sustainable transportation and investments in automotive manufacturing further contribute to market growth. However, challenges such as fluctuating raw material prices and the availability of skilled labor need to be addressed for sustained growth.

Key Markets & Segments Leading Africa Middle East Automotive Glass Fiber Composites Market

The report identifies xx as the dominant region in the Africa Middle East Automotive Glass Fiber Composites market, driven by robust automotive production and infrastructure development. Within this region, xx is the leading country. The analysis of segments reveals that the Hand Layup process holds the largest market share within the Production Type segment due to its cost-effectiveness for smaller production runs. In terms of Application Type, the Structural Assembly segment dominates due to the increasing demand for lightweight and high-strength components.

Dominant Region: xx

Leading Country: xx

Production Type:

- Hand Layup: Largest market share due to cost-effectiveness.

- Resin Transfer Molding: Growing adoption due to higher production rates.

- Vacuum Infusion Processing: Niche applications in high-performance vehicles.

- Injection Molding: Used for high-volume production of smaller components.

- Compression Molding: Suitable for large, complex components.

Application Type:

- Structural Assembly: Dominates due to high demand for lightweight components.

- Power Train Component: Growing demand from advancements in engine technology.

- Interior: Use in dashboards, door panels, etc.

- Exterior: Used in body panels, bumpers, etc.

- Others: Minor applications in various parts of the vehicle.

Market Drivers:

- Economic growth and increasing automotive production.

- Investments in infrastructure development.

- Government support for sustainable transportation.

Africa Middle East Automotive Glass Fiber Composites Market Product Developments

Recent product innovations are aggressively focused on developing next-generation glass fiber composite materials that offer a superior balance of reduced weight, enhanced structural integrity, and improved cost-effectiveness. This involves extensive research into advanced resin chemistries, novel fiber weaving and lay-up architectures, and optimized manufacturing methodologies such as advanced molding techniques. The paramount objective is to significantly elevate the durability and performance characteristics of composite components, paving the way for their widespread integration into critical automotive applications, especially within structural frameworks. These groundbreaking innovations empower manufacturers with a distinct competitive edge by directly contributing to improved fuel efficiency, substantial vehicle weight reduction, and an overall enhancement in dynamic vehicle performance and safety.

Challenges in the Africa Middle East Automotive Glass Fiber Composites Market Market

Sustained long-term growth within the Africa Middle East Automotive Glass Fiber Composites market is intrinsically linked to ongoing advancements in material science and the continuous refinement of manufacturing techniques. The cultivation of strategic alliances and collaborative partnerships between leading automotive manufacturers and specialized composite material suppliers will be absolutely instrumental in accelerating the adoption rate of these advanced materials. Moreover, proactive market expansion into burgeoning segments, most notably the rapidly growing electric vehicle (EV) and hybrid vehicle sectors, is poised to play a vital role in ensuring the market's continued and robust growth.

Forces Driving Africa Middle East Automotive Glass Fiber Composites Market Growth

Several factors propel the market's growth. The expanding automotive industry in the region is a primary driver, along with increasing demand for fuel-efficient and lightweight vehicles. Government initiatives promoting sustainable transportation and investment in automotive manufacturing are creating favorable conditions for growth. Technological advancements in composite materials and manufacturing processes further improve the performance and cost-effectiveness of glass fiber composites, enhancing market appeal.

Challenges in the Africa Middle East Automotive Glass Fiber Composites Market Market

Sustained long-term growth within the Africa Middle East Automotive Glass Fiber Composites market is intrinsically linked to ongoing advancements in material science and the continuous refinement of manufacturing techniques. The cultivation of strategic alliances and collaborative partnerships between leading automotive manufacturers and specialized composite material suppliers will be absolutely instrumental in accelerating the adoption rate of these advanced materials. Moreover, proactive market expansion into burgeoning segments, most notably the rapidly growing electric vehicle (EV) and hybrid vehicle sectors, is poised to play a vital role in ensuring the market's continued and robust growth.

Emerging Opportunities in Africa Middle East Automotive Glass Fiber Composites Market

Emerging opportunities lie in the growing adoption of electric vehicles and the development of advanced composite materials with improved properties. The increasing demand for lightweighting in commercial vehicles presents a significant growth avenue. Exploring new applications for glass fiber composites in automotive interiors and exteriors can unlock further market potential. The region's focus on infrastructure development offers additional opportunities for growth.

Leading Players in the Africa Middle East Automotive Glass Fiber Composites Market Sector

- Delphi Technologies

- BASF SE

- Far-UK Limited

- General Motors Company

- Johns Manville

- Solvay (formerly Cytec Industries)

- Gurit AG

- 3B-Fibreglass

- Base Group

- BMW Group

Key Milestones in Africa Middle East Automotive Glass Fiber Composites Market Industry

- 2021: Introduction of a new lightweight composite material by xx company.

- 2022: Government initiative launched to promote the adoption of lightweight vehicles.

- 2023: Major automotive manufacturer announces significant investment in a new composite manufacturing facility.

- 2024: Partnership formed between a composite material supplier and an automotive OEM to develop a new generation of composite parts.

Strategic Outlook for Africa Middle East Automotive Glass Fiber Composites Market Market

The Africa Middle East Automotive Glass Fiber Composites market is characterized by a promising outlook, fueled by a confluence of factors including the escalating global demand for lightweight and fuel-efficient vehicles, continuous technological advancements in composite materials and manufacturing, and the implementation of supportive government policies aimed at promoting innovation and sustainable practices. Key strategic avenues for growth include the pioneering development of novel composite materials with enhanced properties, targeted expansion into emerging automotive applications, and the establishment of robust strategic partnerships. A steadfast commitment to embracing sustainable manufacturing practices and proactively addressing and mitigating supply chain vulnerabilities will be indispensable for achieving enduring success and capitalizing on the opportunities presented within this dynamic and evolving market landscape.

Africa Middle East Automotive Glass Fiber Composites Market Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vacuum Infusion Processing

- 1.4. Injection Molding

- 1.5. Compression Molding

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Power Train Component

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others

Africa Middle East Automotive Glass Fiber Composites Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. United Arab Emirates

- 4. Saudi Arabia

- 5. Rest of Region

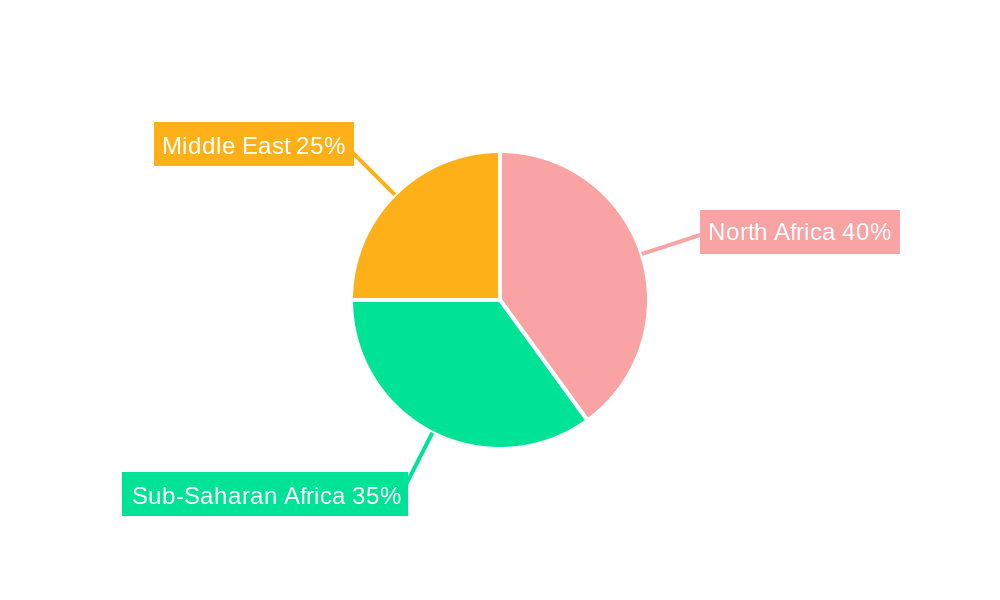

Africa Middle East Automotive Glass Fiber Composites Market Regional Market Share

Geographic Coverage of Africa Middle East Automotive Glass Fiber Composites Market

Africa Middle East Automotive Glass Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Glass Fiber Composites in Automobiles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Middle East Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vacuum Infusion Processing

- 5.1.4. Injection Molding

- 5.1.5. Compression Molding

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Power Train Component

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. United Arab Emirates

- 5.3.4. Saudi Arabia

- 5.3.5. Rest of Region

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. South Africa Africa Middle East Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 6.1.1. Hand Layup

- 6.1.2. Resin Transfer Molding

- 6.1.3. Vacuum Infusion Processing

- 6.1.4. Injection Molding

- 6.1.5. Compression Molding

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Structural Assembly

- 6.2.2. Power Train Component

- 6.2.3. Interior

- 6.2.4. Exterior

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 7. Egypt Africa Middle East Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 7.1.1. Hand Layup

- 7.1.2. Resin Transfer Molding

- 7.1.3. Vacuum Infusion Processing

- 7.1.4. Injection Molding

- 7.1.5. Compression Molding

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Structural Assembly

- 7.2.2. Power Train Component

- 7.2.3. Interior

- 7.2.4. Exterior

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 8. United Arab Emirates Africa Middle East Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 8.1.1. Hand Layup

- 8.1.2. Resin Transfer Molding

- 8.1.3. Vacuum Infusion Processing

- 8.1.4. Injection Molding

- 8.1.5. Compression Molding

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Structural Assembly

- 8.2.2. Power Train Component

- 8.2.3. Interior

- 8.2.4. Exterior

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 9. Saudi Arabia Africa Middle East Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 9.1.1. Hand Layup

- 9.1.2. Resin Transfer Molding

- 9.1.3. Vacuum Infusion Processing

- 9.1.4. Injection Molding

- 9.1.5. Compression Molding

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Structural Assembly

- 9.2.2. Power Train Component

- 9.2.3. Interior

- 9.2.4. Exterior

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 10. Rest of Region Africa Middle East Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 10.1.1. Hand Layup

- 10.1.2. Resin Transfer Molding

- 10.1.3. Vacuum Infusion Processing

- 10.1.4. Injection Molding

- 10.1.5. Compression Molding

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Structural Assembly

- 10.2.2. Power Train Component

- 10.2.3. Interior

- 10.2.4. Exterior

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Delphi

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BASF

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Far-UK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Motor Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 John Manvill

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cytec Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gurit

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 3B-Fiberglass

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Base Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BMW

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Delphi

List of Figures

- Figure 1: Africa Middle East Automotive Glass Fiber Composites Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Africa Middle East Automotive Glass Fiber Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 2: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 5: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 6: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 8: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 9: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 11: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 12: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 14: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 15: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Production Type 2020 & 2033

- Table 17: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 18: Africa Middle East Automotive Glass Fiber Composites Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Middle East Automotive Glass Fiber Composites Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Africa Middle East Automotive Glass Fiber Composites Market?

Key companies in the market include Delphi, BASF, Far-UK, General Motor Company, John Manvill, Cytec Industries, Gurit, 3B-Fiberglass, Base Group, BMW.

3. What are the main segments of the Africa Middle East Automotive Glass Fiber Composites Market?

The market segments include Production Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1120.4 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Increasing Adoption of Glass Fiber Composites in Automobiles.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Middle East Automotive Glass Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Middle East Automotive Glass Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Middle East Automotive Glass Fiber Composites Market?

To stay informed about further developments, trends, and reports in the Africa Middle East Automotive Glass Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence