Key Insights

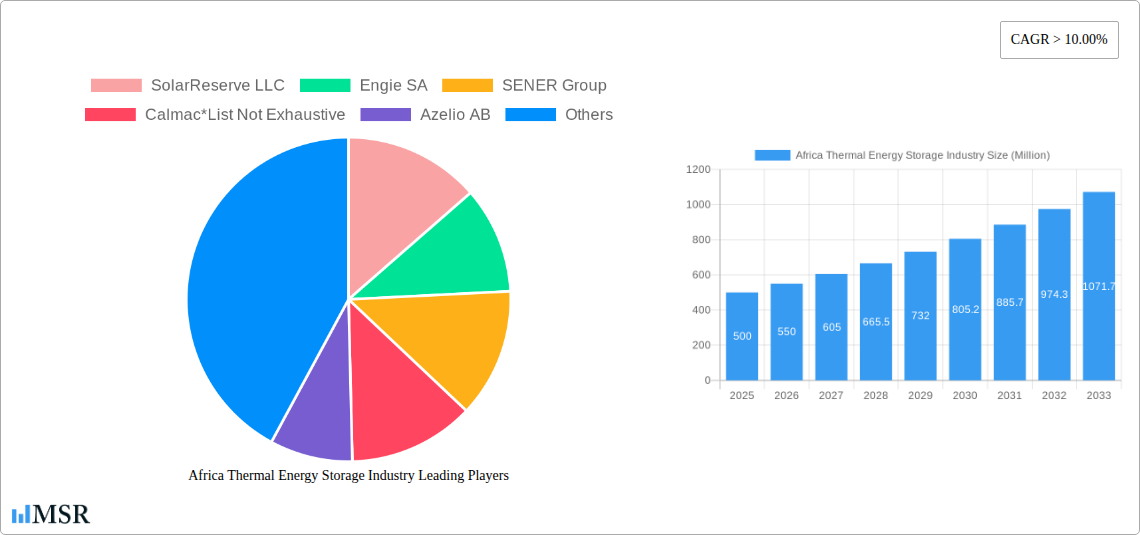

The African thermal energy storage (TES) market is experiencing robust growth, driven by increasing demand for reliable and sustainable energy solutions across the continent. A CAGR exceeding 10% from 2025 to 2033 indicates a significant expansion, fueled by factors such as the intermittent nature of renewable energy sources (solar and wind) and the need for baseload power generation. The market is segmented by application (power generation, heating and cooling) and storage type (molten salt, heat, ice, other). Power generation currently dominates, but heating and cooling applications are expected to see substantial growth, particularly in urban areas and industrial sectors. Molten salt storage is currently the leading technology due to its high energy density and relatively low cost, but other technologies like heat and ice storage are gaining traction due to their suitability for specific applications and ongoing technological advancements. Key players, including SolarReserve LLC, Engie SA, and SENER Group, are actively investing in projects across the continent, focusing on countries like South Africa, Kenya, and others with high solar irradiation and energy demands. However, challenges remain, including high initial investment costs for TES systems, the lack of supportive regulatory frameworks in some regions, and the need for skilled workforce development.

Africa Thermal Energy Storage Industry Market Size (In Million)

The expansion of the African TES market is projected to be particularly significant in countries with substantial renewable energy potential and limited grid infrastructure. The ongoing diversification of energy sources and the increased focus on energy security are key drivers. Growth will also be influenced by technological advancements, reducing the cost of deployment and enhancing the efficiency of different storage technologies. While the market is expected to grow rapidly, future success will depend on overcoming challenges like financing project development, addressing grid integration issues, and building the capacity to support the expanding TES industry. The forecast period of 2025-2033 represents a window of substantial opportunity for businesses and investors involved in energy storage solutions within the African context. Specific growth trajectories within the sub-segments will depend on the pace of renewable energy adoption and the availability of financing for TES deployment projects.

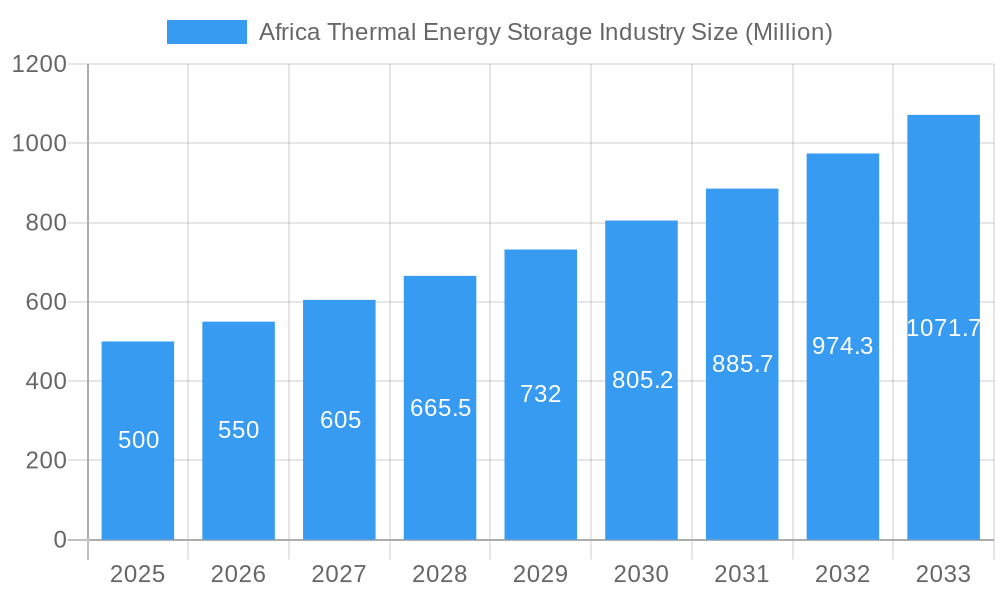

Africa Thermal Energy Storage Industry Company Market Share

Africa Thermal Energy Storage Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the burgeoning Africa Thermal Energy Storage industry, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Expect in-depth analysis across key segments, including molten salt, heat, and ice storage, and applications such as power generation and heating/cooling. The market's dynamic landscape, driven by significant investments and technological advancements, is meticulously examined, revealing promising opportunities and potential challenges. Discover the leading players shaping this exciting sector and gain a competitive edge with our data-driven analysis. The market size in 2025 is estimated at USD xx Million, showcasing impressive growth with a CAGR of xx% during the forecast period.

Africa Thermal Energy Storage Industry Market Concentration & Dynamics

The African thermal energy storage market is characterized by a moderate level of concentration, with several key players holding significant market share, though the exact figures are challenging to pinpoint due to the fragmented nature of some sub-sectors. Major players include SolarReserve LLC, Engie SA, SENER Group, Calmac, Azelio AB, Eskom Holdings SOC Ltd, Abengoa SA, ACWA Power International, and BrightSource Energy Inc. However, the market also features numerous smaller, regional players. Innovation within the sector is driven by the need for reliable and cost-effective energy solutions, particularly in regions with limited grid infrastructure.

Market Share: While precise figures are not readily available for each company, it is observed that a few large multinational corporations command a substantial share, with the remaining market share being spread across smaller regional players and startups.

M&A Activity: The past few years have seen a notable increase in mergers and acquisitions (M&A) activity, indicating consolidation within the market. Examples include ENGIE's acquisition of Abengoa's stake in Xina Solar One, reflecting the strategic importance of thermal energy storage assets. The total number of M&A deals over the study period is estimated to be xx.

Regulatory Frameworks: Government policies promoting renewable energy sources and energy independence are critical in shaping the market. Regulatory support and incentives directly influence the investment landscape. Inconsistencies across different African nations regarding regulations and licensing present a challenge.

Substitute Products: While thermal energy storage is emerging as a strong solution, its success depends on factors such as cost competitiveness compared to other storage technologies like pumped hydro or batteries. Market dominance depends on the overall cost of electricity generation and storage.

End-User Trends: A significant driver of market growth is the increasing demand for reliable and affordable energy in Africa. Power generation remains the primary application; however, heating and cooling segments offer significant growth potential as urbanization and industrialization increase.

Africa Thermal Energy Storage Industry Industry Insights & Trends

The African thermal energy storage market is experiencing robust growth fueled by several key factors. The increasing demand for renewable energy sources, coupled with the intermittent nature of solar and wind power, necessitates efficient energy storage solutions. The rising costs of fossil fuels and the need for energy security are also contributing to the sector’s expansion. Technological advancements, particularly in molten salt and other storage technologies, are continuously improving the efficiency and reducing the costs of thermal energy storage systems.

Technological disruptions, such as the introduction of advanced materials and improved thermal management systems, are further enhancing the efficiency and cost-effectiveness of thermal energy storage. Consumer behavior is shifting towards sustainable energy solutions, driving the demand for thermal energy storage in both residential and commercial applications. The market size in 2024 was estimated at USD xx Million, and it is projected to reach USD xx Million by 2033.

Key Markets & Segments Leading Africa Thermal Energy Storage Industry

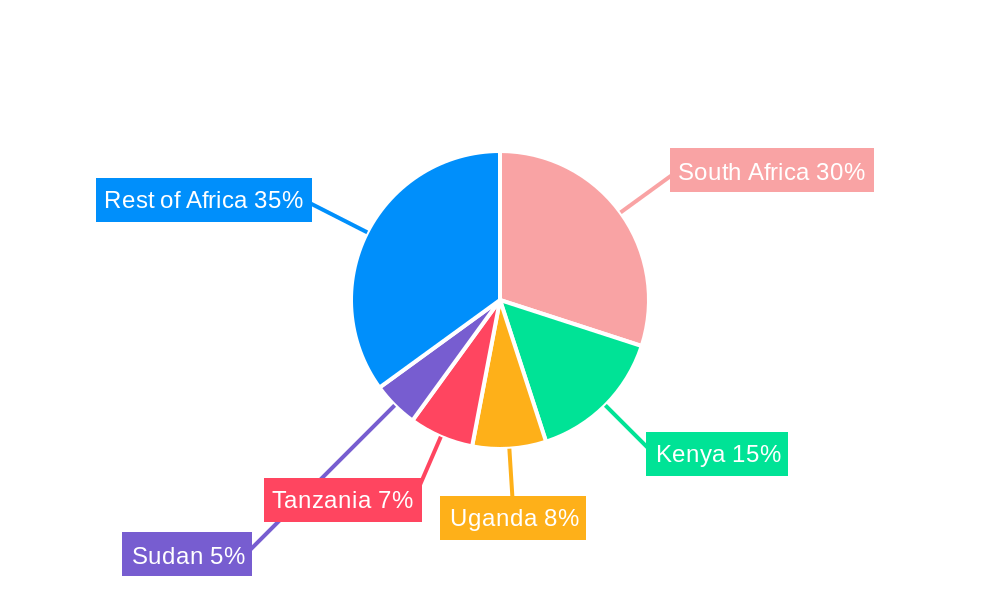

Dominant Region/Country: South Africa, with its established renewable energy sector and large-scale solar power projects, currently holds a leading position in the African thermal energy storage market. However, other nations are rapidly developing their capacity.

Dominant Application Segment: Power generation remains the dominant application segment, driven by the increasing capacity of renewable energy sources requiring reliable storage. Heating and cooling applications are showing significant growth, particularly in urban areas.

Dominant Storage Type: Molten salt technology currently dominates the market due to its high energy density and relatively long-term storage capabilities. However, other storage types, such as heat and ice storage, are gaining traction in niche applications.

Drivers by Segment:

Power Generation: Government incentives, increasing renewable energy deployment, grid instability, and the need for baseload power.

Heating and Cooling: Urbanization, industrial expansion, demand for energy-efficient buildings, and falling prices of thermal storage systems.

Molten Salt: High energy storage density and ability to sustain high temperatures for extended periods.

Heat: Cost-effectiveness, simplicity of design and implementation, particularly for industrial process heat applications.

Ice: Suitable for applications requiring cold energy storage and improved grid management capabilities.

The market’s dominance is not static. Several factors, including government policies, infrastructure development, and technological advancements, are expected to shift the competitive landscape in the coming years. The availability of funding, particularly from international organizations and private investors, also plays a major role in the regional distribution of the market.

Africa Thermal Energy Storage Industry Product Developments

Recent years have witnessed significant advancements in thermal energy storage technologies. Innovations focus on improving the efficiency, durability, and cost-effectiveness of existing systems, as well as exploring new storage materials and designs. These advancements are creating new market opportunities and improving the competitiveness of thermal energy storage compared to alternative solutions. Improved thermal insulation, advanced control systems, and the integration of AI in optimizing energy storage and retrieval are some notable trends. This translates to a greater range of applications and more competitive pricing, broadening the market appeal.

Challenges in the Africa Thermal Energy Storage Industry Market

Several challenges hinder the growth of the African thermal energy storage market. These include:

High upfront capital costs: The initial investment required for large-scale thermal energy storage projects can be substantial, deterring potential investors. This is particularly true for smaller projects and is exacerbated by financing limitations.

Technological limitations: Some storage technologies are still relatively immature, and their long-term reliability and performance need to be further improved. This leads to technology risks for investors.

Regulatory uncertainties: The inconsistent regulatory frameworks across different African countries create uncertainty for investors and hinder the development of the industry.

Supply chain disruptions: The availability of crucial components and materials for thermal energy storage systems can be challenging, potentially leading to delays in project completion.

Limited skilled workforce: A shortage of skilled labor capable of designing, installing, and maintaining thermal energy storage systems presents a significant hurdle.

Addressing these challenges requires a concerted effort from governments, industry players, and research institutions.

Forces Driving Africa Thermal Energy Storage Industry Growth

Several factors are driving the growth of the African thermal energy storage market:

Government support: Many African governments are implementing policies promoting renewable energy sources and energy efficiency, which directly benefits the thermal energy storage sector.

Increasing renewable energy capacity: The significant growth of renewable energy projects in Africa creates a strong demand for reliable energy storage solutions to manage the intermittency of solar and wind power.

Falling costs of thermal energy storage systems: Technological advancements are making thermal energy storage systems more affordable and accessible, driving market expansion.

Improving grid infrastructure: Investments in upgrading power grids across Africa are creating more opportunities for integration of thermal energy storage.

Long-Term Growth Catalysts in the Africa Thermal Energy Storage Industry

Long-term growth in the African thermal energy storage market hinges on continuing technological innovation, strategic partnerships between industry players and governments, and expansion into new markets. The development of next-generation storage materials and systems with improved efficiency and cost-effectiveness will be crucial. Furthermore, collaborative efforts involving international organizations and private investors in developing infrastructure and financing mechanisms will unlock the market's full potential. Finally, exploring new applications of thermal energy storage, such as in district heating and industrial processes, will open up additional growth avenues.

Emerging Opportunities in Africa Thermal Energy Storage Industry

Emerging opportunities exist in exploring niche applications for thermal energy storage, focusing on cost-effective solutions for residential use, and leveraging innovative financing models such as Power Purchase Agreements (PPAs). Expanding into less-developed regions of Africa will unlock significant growth potential as access to electricity grows. Further innovation in storage technologies, including advancements in materials and thermal management, will lead to improved efficiency and reduced costs. The creation of sustainable supply chains for raw materials and skilled workforce development through training programs are also critical factors that can unlock significant business prospects.

Leading Players in the Africa Thermal Energy Storage Industry Sector

- SolarReserve LLC

- Engie SA

- SENER Group

- Calmac

- Azelio AB

- Eskom Holdings SOC Ltd

- Abengoa SA

- ACWA Power International

- BrightSource Energy Inc

Key Milestones in Africa Thermal Energy Storage Industry Industry

December 2021: Namibia Power Corporation Ltd (NamPower) announced a tender for a 50MW-130MW CSP project with energy storage, anticipated to cost USD 600 Million - USD 1 Billion. This highlights the growing interest in large-scale thermal energy storage projects.

November 2021: ENGIE completed the acquisition of Abengoa's stake in Xina Solar One, demonstrating consolidation within the sector and the strategic value of existing CSP plants.

Strategic Outlook for Africa Thermal Energy Storage Market

The African thermal energy storage market holds significant long-term growth potential. The continued expansion of renewable energy, coupled with technological advancements and supportive government policies, will drive market expansion. Strategic partnerships between international companies and local players will be crucial for unlocking the sector's full potential. Furthermore, the development of innovative financing mechanisms and addressing challenges related to infrastructure and skilled workforce will be key for realizing this potential. The market is expected to witness strong growth and sustained innovation in the coming decade.

Africa Thermal Energy Storage Industry Segmentation

-

1. Application

- 1.1. Power Generation

- 1.2. Heating and Cooling

-

2. Storage Type

- 2.1. Molten Salt

- 2.2. Heat

- 2.3. Ice

- 2.4. Other Storage Types

-

3. Geography

- 3.1. South Africa

- 3.2. Morocco

- 3.3. Rest of Africa

Africa Thermal Energy Storage Industry Segmentation By Geography

- 1. South Africa

- 2. Morocco

- 3. Rest of Africa

Africa Thermal Energy Storage Industry Regional Market Share

Geographic Coverage of Africa Thermal Energy Storage Industry

Africa Thermal Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Secure

- 3.2.2 Sustainable

- 3.2.3 and Clean Energy

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Production of Biofuels

- 3.4. Market Trends

- 3.4.1. Power Generation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation

- 5.1.2. Heating and Cooling

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Molten Salt

- 5.2.2. Heat

- 5.2.3. Ice

- 5.2.4. Other Storage Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Morocco

- 5.3.3. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Morocco

- 5.4.3. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. South Africa Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Power Generation

- 6.1.2. Heating and Cooling

- 6.2. Market Analysis, Insights and Forecast - by Storage Type

- 6.2.1. Molten Salt

- 6.2.2. Heat

- 6.2.3. Ice

- 6.2.4. Other Storage Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Morocco

- 6.3.3. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Morocco Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Power Generation

- 7.1.2. Heating and Cooling

- 7.2. Market Analysis, Insights and Forecast - by Storage Type

- 7.2.1. Molten Salt

- 7.2.2. Heat

- 7.2.3. Ice

- 7.2.4. Other Storage Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Morocco

- 7.3.3. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Rest of Africa Africa Thermal Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Power Generation

- 8.1.2. Heating and Cooling

- 8.2. Market Analysis, Insights and Forecast - by Storage Type

- 8.2.1. Molten Salt

- 8.2.2. Heat

- 8.2.3. Ice

- 8.2.4. Other Storage Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Morocco

- 8.3.3. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 SolarReserve LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Engie SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 SENER Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Calmac*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Azelio AB

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Eskom Holdings SOC Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Abengoa SA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 ACWA Power International

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 BrightSource Energy Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 SolarReserve LLC

List of Figures

- Figure 1: Africa Thermal Energy Storage Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Africa Thermal Energy Storage Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 3: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 7: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 11: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Storage Type 2020 & 2033

- Table 15: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Africa Thermal Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Thermal Energy Storage Industry?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the Africa Thermal Energy Storage Industry?

Key companies in the market include SolarReserve LLC, Engie SA, SENER Group, Calmac*List Not Exhaustive, Azelio AB, Eskom Holdings SOC Ltd, Abengoa SA, ACWA Power International, BrightSource Energy Inc.

3. What are the main segments of the Africa Thermal Energy Storage Industry?

The market segments include Application, Storage Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Secure. Sustainable. and Clean Energy.

6. What are the notable trends driving market growth?

Power Generation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Cost of Production of Biofuels.

8. Can you provide examples of recent developments in the market?

In December 2021, Namibia Power Corporation Ltd (NamPower), the national electric power utility of the country, announced a tender for a project combining concentrated solar power (CSP) with energy storage of 50MW-130MW. It is anticipated that the proposed project will cost between USD 600 million and USD 1 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Thermal Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Thermal Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Thermal Energy Storage Industry?

To stay informed about further developments, trends, and reports in the Africa Thermal Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence