Key Insights

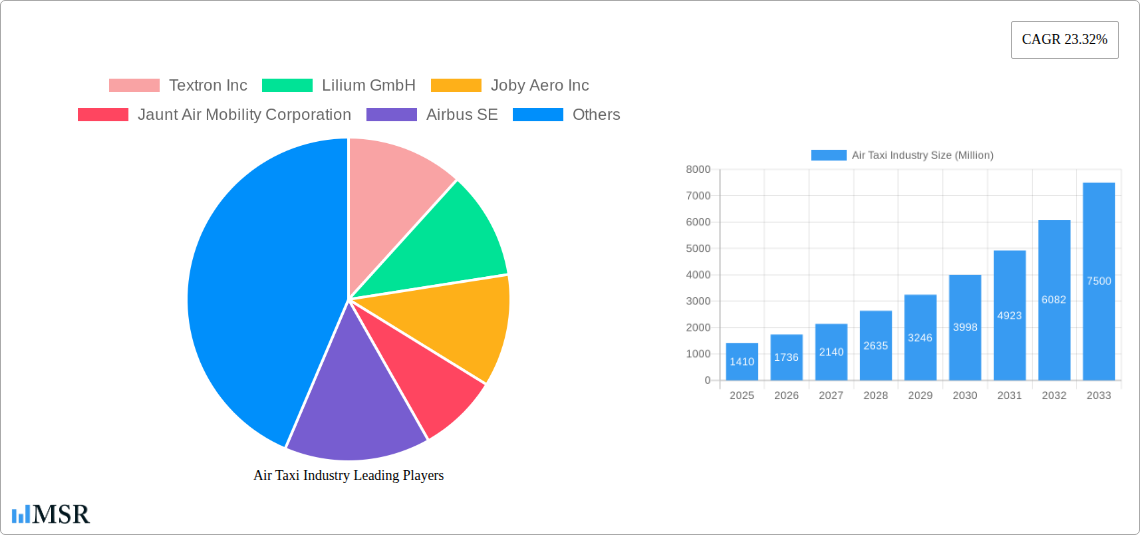

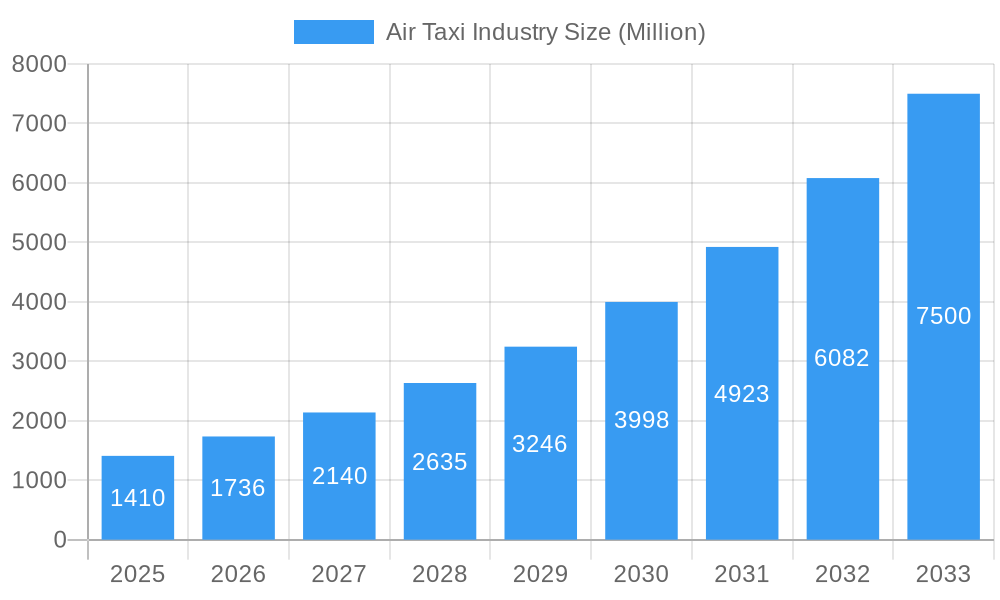

The air taxi industry is poised for explosive growth, projected to reach a market size of $1.41 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 23.32% from 2025 to 2033. This surge is driven by several key factors. Increasing urbanization and traffic congestion in major metropolitan areas are creating a compelling demand for faster, more efficient urban transportation solutions. Technological advancements in electric vertical takeoff and landing (eVTOL) aircraft, coupled with ongoing improvements in battery technology and autonomous flight systems, are making air taxis increasingly feasible and safe. Furthermore, supportive government regulations and significant investments from both established aerospace giants and innovative startups are fueling market expansion. The market is segmented by mode of operation, with piloted and autonomous options representing distinct yet interconnected growth avenues. Autonomous operations, while still in the early stages of development, hold the potential for significant cost reductions and increased scalability in the long term.

Air Taxi Industry Market Size (In Billion)

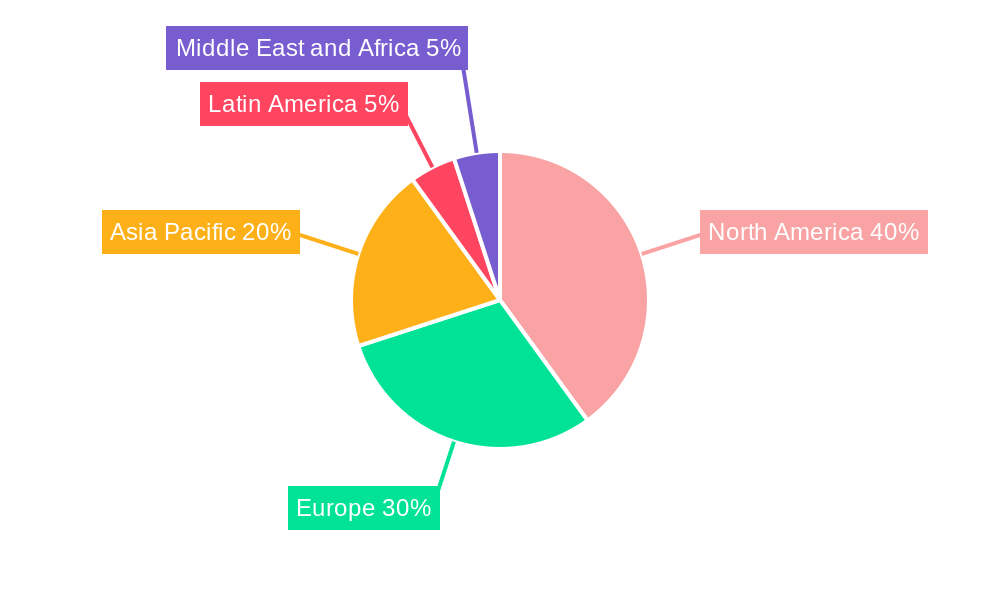

The geographical distribution of the market reveals strong regional variations. North America, with its advanced technological infrastructure and early adoption of innovative transportation solutions, is expected to lead the market initially. Europe and Asia Pacific will follow closely, driven by significant government initiatives focused on sustainable transportation and urban development. While current regulatory hurdles and high initial investment costs pose challenges, the overall market outlook remains highly positive, indicating a substantial expansion in the coming years, particularly as autonomous technology matures and operational costs decrease. The substantial involvement of major players like Textron, Lilium, Joby Aero, and Airbus, amongst others, signifies the industry's significant potential and validates the robust investment climate. The coming decade will be crucial in shaping the air taxi landscape, with continuous innovation and regulatory developments expected to define its trajectory.

Air Taxi Industry Company Market Share

Air Taxi Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning air taxi industry, projecting a market valued at $XX Million by 2033. We delve into market dynamics, technological advancements, key players, and future growth potential, offering invaluable insights for industry stakeholders, investors, and policymakers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Air Taxi Industry Market Concentration & Dynamics

The air taxi market is characterized by intense competition and rapid innovation, with a relatively concentrated landscape dominated by a few key players, including Textron Inc, Lilium GmbH, Joby Aero Inc, and Airbus SE. However, numerous startups and established aerospace companies are aggressively vying for market share.

- Market Concentration: The market share for the top 5 players in 2025 is estimated at XX%. This figure is expected to fluctuate slightly by 2033, reflecting ongoing M&A activity and the entrance of new players.

- Innovation Ecosystems: Significant investments are flowing into R&D, fostering innovation in areas such as electric propulsion, autonomous flight technology, and advanced air traffic management systems. Collaboration between aerospace companies, technology firms, and research institutions is accelerating technological advancements.

- Regulatory Frameworks: The regulatory landscape remains a critical factor, with varying rules and certifications across different jurisdictions impacting market entry and operations. The streamlining of regulations is crucial for accelerated industry growth.

- Substitute Products: Traditional helicopter services and private jets represent existing substitutes, albeit at significantly higher costs. The affordability and accessibility of air taxis pose a considerable threat to these incumbents.

- End-User Trends: Increasing demand for faster and more efficient urban transportation, coupled with growing awareness of environmental concerns, fuels the adoption of electric air taxis.

- M&A Activities: The air taxi market has seen a surge in mergers and acquisitions, with approximately XX M&A deals recorded during the historical period (2019-2024). This trend is expected to continue as companies seek to consolidate market share and gain access to crucial technologies.

Air Taxi Industry Industry Insights & Trends

The global air taxi market experienced significant growth during the historical period (2019-2024), expanding at a CAGR of XX%. This robust growth is projected to continue throughout the forecast period (2025-2033), reaching a market value of $XX Million by 2033, with a projected CAGR of XX%. This expansion is driven by several factors:

- Technological Disruptions: Advancements in battery technology, electric propulsion systems, and autonomous flight capabilities are revolutionizing the industry, making air taxi services more viable and cost-effective.

- Market Growth Drivers: Increasing urbanization, traffic congestion in major cities, and the rising demand for faster and more efficient point-to-point transportation are primary growth drivers. Government initiatives promoting sustainable urban mobility further contribute to market growth.

- Evolving Consumer Behaviors: Consumers are increasingly seeking convenient, efficient, and environmentally friendly transportation alternatives. The air taxi market caters to this evolving demand, attracting environmentally conscious and time-sensitive individuals.

Key Markets & Segments Leading Air Taxi Industry

The North American region is expected to dominate the air taxi market throughout the forecast period, driven by significant investments, robust technological advancements, and supportive regulatory frameworks. Within this region, major metropolitan areas with high population density and extensive infrastructure are poised for accelerated growth.

- Dominant Region: North America

- Drivers for North American Dominance:

- Strong presence of major air taxi companies.

- Significant government funding for infrastructure development.

- High consumer acceptance of emerging technologies.

- Favorable regulatory environment (relatively advanced compared to other regions).

- Mode of Operation: While piloted air taxis will initially dominate the market, autonomous operations are expected to gain traction towards the end of the forecast period, driven by advancements in AI and sensor technologies.

Air Taxi Industry Product Developments

Recent product developments focus on improving safety, efficiency, and passenger comfort. Manufacturers are continuously refining electric propulsion systems, enhancing autonomous flight capabilities, and designing aircraft with improved aerodynamic profiles. These innovations provide a competitive edge in terms of operational costs, range, and passenger experience. Integration of advanced sensor technologies and real-time data analytics are also key features driving product differentiation.

Challenges in the Air Taxi Industry Market

Significant challenges hinder market expansion, including regulatory hurdles that delay certification processes and vary greatly by location, affecting the speed of market entry. Supply chain complexities and potential shortages of critical components, such as batteries and advanced sensors, impact production timelines and costs. Furthermore, intense competition among established players and new entrants puts significant pressure on pricing and profitability. These factors could collectively reduce market growth by approximately XX% by 2033.

Forces Driving Air Taxi Industry Growth

Technological advancements in battery technology, electric propulsion, and autonomous flight systems are major growth drivers. Government support and initiatives promoting sustainable urban mobility provide regulatory incentives. Finally, increasing urbanization and congestion in major cities create a strong demand for faster and more efficient transportation solutions, accelerating market adoption.

Long-Term Growth Catalysts

Long-term growth hinges on continued technological innovation, strategic partnerships between manufacturers and infrastructure providers, and the expansion of air taxi services to new markets globally. The development of robust air traffic management systems for urban environments will be crucial for widespread adoption.

Emerging Opportunities in Air Taxi Industry

Opportunities exist in developing and deploying air taxi services in emerging markets with developing infrastructure. The integration of air taxi services into broader mobility ecosystems and the adoption of innovative business models like air taxi sharing services will also create significant growth opportunities. Advancements in urban air mobility infrastructure, such as vertiports, represent a critical opportunity for market expansion.

Leading Players in the Air Taxi Industry Sector

- Textron Inc

- Lilium GmbH

- Joby Aero Inc

- Jaunt Air Mobility Corporation

- Airbus SE

- Hyundai Motor Company

- Volocopter GmbH

- Wisk Aero LL

- Guangzhou EHang Intelligent Technology Co Ltd

- The Boeing Company

Key Milestones in Air Taxi Industry Industry

- 2020: Joby Aero secured significant funding for its electric vertical takeoff and landing (eVTOL) aircraft development.

- 2021: Lilium GmbH unveiled its five-seater eVTOL aircraft prototype.

- 2022: Airbus SE announced collaborations with several partners to advance urban air mobility solutions.

- 2023: Several companies commenced initial test flights of their eVTOL aircraft.

- 2024: First commercial operations of limited air taxi services commenced in selected regions (exact dates and locations vary widely depending on regulatory approvals).

Strategic Outlook for Air Taxi Industry Market

The air taxi industry holds immense long-term growth potential. Strategic investments in technological advancements, infrastructure development, and effective regulatory frameworks are crucial for realizing this potential. The integration of air taxi services into broader urban transportation networks, and the development of sustainable business models, will be essential for long-term success and market leadership.

Air Taxi Industry Segmentation

-

1. Mode of Operation

- 1.1. Piloted

- 1.2. Autonomous

Air Taxi Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Egypt

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Air Taxi Industry Regional Market Share

Geographic Coverage of Air Taxi Industry

Air Taxi Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Piloted Segment to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.1.1. Piloted

- 5.1.2. Autonomous

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 6. North America Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 6.1.1. Piloted

- 6.1.2. Autonomous

- 6.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 7. Europe Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 7.1.1. Piloted

- 7.1.2. Autonomous

- 7.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 8. Asia Pacific Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 8.1.1. Piloted

- 8.1.2. Autonomous

- 8.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 9. Latin America Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 9.1.1. Piloted

- 9.1.2. Autonomous

- 9.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 10. Middle East and Africa Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 10.1.1. Piloted

- 10.1.2. Autonomous

- 10.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lilium GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Joby Aero Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jaunt Air Mobility Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hyundai Motor Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Volocopter GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wisk Aero LL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Guangzhou EHang Intelligent Technology Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Boeing Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Air Taxi Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 3: North America Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 4: North America Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 7: Europe Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 8: Europe Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 11: Asia Pacific Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 12: Asia Pacific Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 15: Latin America Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 16: Latin America Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 19: Middle East and Africa Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 20: Middle East and Africa Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 2: Global Air Taxi Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 4: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 8: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Russia Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 15: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: China Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Australia Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 23: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Mexico Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Latin America Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 28: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Egypt Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Israel Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East and Africa Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Taxi Industry?

The projected CAGR is approximately 23.32%.

2. Which companies are prominent players in the Air Taxi Industry?

Key companies in the market include Textron Inc, Lilium GmbH, Joby Aero Inc, Jaunt Air Mobility Corporation, Airbus SE, Hyundai Motor Company, Volocopter GmbH, Wisk Aero LL, Guangzhou EHang Intelligent Technology Co Ltd, The Boeing Company.

3. What are the main segments of the Air Taxi Industry?

The market segments include Mode of Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.41 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Piloted Segment to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air Taxi Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air Taxi Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air Taxi Industry?

To stay informed about further developments, trends, and reports in the Air Taxi Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence