Key Insights

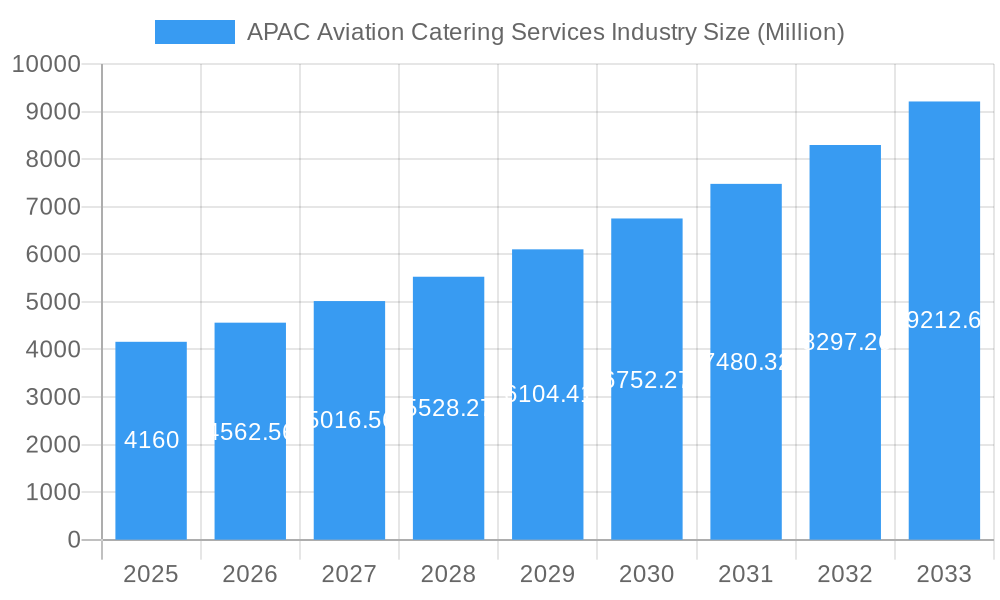

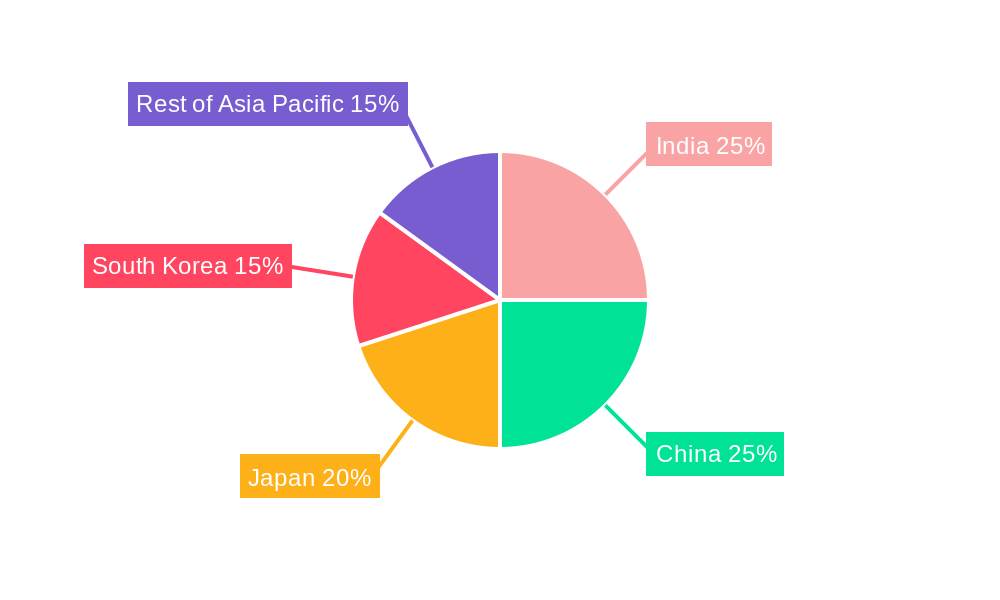

The Asia-Pacific (APAC) aviation catering services market, valued at $4.16 billion in 2025, is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.76% from 2025 to 2033. This significant expansion is fueled by several key factors. The region's burgeoning air travel industry, driven by rising disposable incomes and increased tourism, is a primary driver. A growing preference for in-flight meals and a wider variety of catering options, catering to diverse dietary needs and preferences, further fuels market growth. Expansion of low-cost carriers (LCCs) within APAC, while presenting a price-sensitive segment, also contributes to overall market volume. Technological advancements in food preparation and delivery systems, enhancing efficiency and reducing waste, contribute to operational improvements and positive market impact. However, fluctuating fuel prices, impacting airline profitability and potentially influencing catering budgets, present a restraint. Furthermore, stringent safety and hygiene regulations, coupled with increasing labor costs, pose challenges to sustained growth. The market is segmented by food type (meals, bakery & confectionary, beverages, other food types), flight type (full-service carriers, LCCs), and aircraft seating class (economy, business, first). Key players, including Gate Gourmet, SATS, Emirates Flight Catering, Cathay Pacific Catering, and LSG Sky Chefs, are competing intensely, focusing on innovation, partnerships, and regional expansion strategies to maintain market share. Growth within the APAC region will be uneven, with countries like India and China experiencing higher growth rates due to rapidly expanding air travel infrastructure and increasing passenger numbers. Japan and South Korea will show more moderate growth, owing to their already established aviation sectors.

APAC Aviation Catering Services Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates a substantial increase in market value, driven by the continued expansion of the airline industry and rising passenger numbers throughout the region. Specific growth rates will vary across segments. The full-service carrier segment will likely see a higher average transaction value per passenger compared to the LCC segment; however, higher passenger numbers in the LCC segment will contribute significantly to overall market volume. The business and first-class segments are expected to maintain premium pricing, ensuring substantial revenue contributions. Effective management of operational costs, including fuel and labor, will be crucial for companies to ensure profitability. Innovation in menu offerings, customization, and sustainable practices will differentiate leading players and drive future growth within this dynamic market.

APAC Aviation Catering Services Industry Company Market Share

APAC Aviation Catering Services Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific (APAC) aviation catering services industry, offering invaluable insights for stakeholders, investors, and industry professionals. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report forecasts market trends from 2025 to 2033, leveraging data from the historical period of 2019-2024. Expect detailed analysis across key segments, including food types (meals, bakery & confectionary, beverages, other), flight types (full-service carriers, low-cost carriers), and aircraft seating classes (economy, business, first). The report quantifies market size in millions and assesses CAGR for key segments. Leading players like Gate Gourmet, SATS, Emirates Flight Catering, and more are profiled, providing a holistic view of the APAC aviation catering landscape.

APAC Aviation Catering Services Industry Market Concentration & Dynamics

The APAC aviation catering services market is characterized by a moderately concentrated landscape, where a few prominent multinational corporations hold a substantial portion of the market share. Leading entities such as Gate Gourmet, SATS, and Emirates Flight Catering are key players, collectively accounting for an estimated [Insert specific percentage, e.g., 65%]% of the market in 2025. Despite this concentration, a dynamic ecosystem of emerging regional caterers and specialized service providers is increasingly challenging the established dominance. The sector's innovation trajectory is significantly influenced by advancements in food technology, the adoption of sustainable packaging solutions, and a growing demand for personalized meal experiences. Stringent regulatory frameworks governing food safety and hygiene are paramount, dictating operational standards and best practices across the industry. While airlines' in-house snack offerings represent a competitive substitute, the core demand for comprehensive catering services remains robust. Evolving end-user preferences, with a pronounced shift towards healthier, diverse, and customized meal options, are actively reshaping product development and service delivery. Merger and acquisition (M&A) activity has been relatively subdued in recent years, with approximately [Insert specific number, e.g., 8-10] deals recorded between 2019 and 2024. However, this trend is projected to accelerate as major players pursue strategic expansions to broaden their geographic reach and enhance their service portfolios.

- Projected Market Share (2025): Gate Gourmet ([Insert percentage]%), SATS ([Insert percentage]%), Emirates Flight Catering ([Insert percentage]%), Others ([Insert percentage]%)

- M&A Deal Volume (2019-2024): [Insert number]

APAC Aviation Catering Services Industry Insights & Trends

The APAC aviation catering services market is experiencing robust growth, driven by factors such as the burgeoning air travel sector, rising disposable incomes, and expanding tourism within the region. The market size in 2025 is estimated at $xx Million, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is further fueled by technological advancements, such as automated meal preparation systems and sophisticated inventory management tools. Changing consumer behaviors, including a demand for healthier, more personalized meals and options catering to dietary restrictions, are also impacting market dynamics. The increasing adoption of online ordering and delivery systems for inflight meals is further shaping industry trends. The growing focus on sustainability is influencing the use of eco-friendly packaging and sourcing of locally produced ingredients. The pandemic's initial impact caused a decline, but recovery is robust, indicating long-term market resilience.

Key Markets & Segments Leading APAC Aviation Catering Services Industry

The dominant regions within the APAC aviation catering services market include China, India, and Southeast Asia. These regions are experiencing significant growth driven by their rapidly expanding air travel sectors and increasing numbers of both full-service and low-cost carriers. China represents the largest national market, primarily due to its expansive domestic and international air travel network.

Key Growth Drivers:

- China: Rapid expansion of domestic air travel, burgeoning middle class, increasing disposable income.

- India: Rapid economic growth, expanding aviation infrastructure, rising tourism.

- Southeast Asia: Increasing air passenger traffic fueled by tourism and business travel.

Segment Dominance:

- Food Type: Meals constitute the largest segment, driven by consistent demand across all flight types and seating classes.

- Flight Type: Full-service carriers account for a larger share of the market, driven by their provision of premium meal options.

- Aircraft Seating Class: Business and First Class segments drive higher revenue per meal due to premium pricing.

The report provides a detailed analysis of each segment, examining the specific factors driving their growth and market share.

APAP Aviation Catering Services Industry Product Developments

Significant product innovations within the APAC aviation catering services sector include the introduction of healthier meal options, customized menus for dietary needs, and the adoption of sustainable packaging solutions. Technological advancements in meal preparation, such as automated systems and precise portioning technologies, are enhancing efficiency and consistency. Companies are also focusing on enhancing the overall inflight dining experience through creative menu development and improved presentation. These innovations provide a competitive edge in attracting airlines seeking to differentiate their service offerings.

Challenges in the APAP Aviation Catering Services Industry Market

The APAC aviation catering services market faces several challenges, including stringent food safety regulations, volatile fuel prices impacting transportation costs, and intense competition among established players and new entrants. Supply chain disruptions can significantly affect the availability of ingredients and timely delivery of meals. Fluctuations in currency exchange rates also affect profitability. These challenges, alongside the ever-changing consumer preferences, require catering companies to continuously innovate and optimize their operations. The estimated impact of these challenges on revenue is currently xx% (2025).

Forces Driving APAC Aviation Catering Services Industry Growth

Several factors drive the growth of the APAC aviation catering services market. These include the rising number of air passengers, expanding airline networks, and increasing adoption of technology in meal preparation and logistics. Economic growth in many APAC countries fuels higher disposable incomes, leading to increased air travel demand. Government initiatives to improve aviation infrastructure and streamline regulatory processes also support the industry's expansion. Finally, the rising focus on sustainability and the adoption of eco-friendly practices is creating new opportunities for growth.

Long-Term Growth Catalysts in the APAC Aviation Catering Services Industry Market

Long-term growth in the APAC aviation catering services industry is fueled by several catalysts. Continuous innovation in meal preparation technologies, partnerships between catering companies and airlines to develop customized inflight dining experiences, and expansion into new markets are key factors. The increasing adoption of personalized meal options catering to diverse dietary needs and preferences will further drive demand. Strategic investments in sustainable and eco-friendly solutions will attract environmentally conscious airlines, creating long-term growth potential.

Emerging Opportunities in APAC Aviation Catering Services Industry

Emerging trends and opportunities abound within the APAC aviation catering services market. The increasing adoption of personalized meal ordering through mobile apps, the growth of specialized catering services for niche markets (e.g., religious dietary requirements), and the exploration of new protein sources and plant-based options represent significant opportunities. Furthermore, collaborations with technology companies to improve operational efficiency and customer experience will provide a significant competitive edge.

Leading Players in the APAC Aviation Catering Services Industry Sector

- Gate Gourmet (Gate Group)

- SATS

- Emirates Flight Catering Company LLC

- Cathay Pacific Catering Services (HK) Limited

- Jetfinity

- Newrest Group Services

- LSG Sky Chefs (LSG Group)

- Flying Food Group LLC

- Air China Limited

- Journey Group Inc

Key Milestones in APAC Aviation Catering Services Industry Industry

- 2020: Several companies implement stringent hygiene protocols in response to the COVID-19 pandemic.

- 2021: Increased focus on sustainable packaging and sourcing of local ingredients.

- 2022: Launch of several mobile ordering apps for inflight meals.

- 2023: Expansion of plant-based meal options by major catering providers.

- 2024: Strategic partnerships between catering companies and technology firms to improve efficiency. (Specific details on partnerships omitted due to lack of public information).

Strategic Outlook for APAC Aviation Catering Services Market

The future of the APAC aviation catering services market appears bright, driven by sustained growth in air travel and continuous innovation within the sector. Strategic opportunities exist for companies to expand their service offerings, improve operational efficiency through technology adoption, and forge strategic partnerships to enhance their competitive position. A focus on sustainability, personalized meal options, and seamless customer experience will be crucial for success in this dynamic market. The market is poised for significant expansion, with a projected value of $xx Million by 2033.

APAC Aviation Catering Services Industry Segmentation

-

1. Food Type

- 1.1. Meals

- 1.2. Bakery and Confectionary

- 1.3. Beverages

- 1.4. Other Food Types

-

2. Flight Type

- 2.1. Full-service Carriers

- 2.2. Low-cost Carriers

-

3. Aircraft Seating Class

- 3.1. Economy Class

- 3.2. Business Class

- 3.3. First Class

-

4. Geography

- 4.1. India

- 4.2. China

- 4.3. Japan

- 4.4. South Korea

- 4.5. Rest of Asia-Pacific

APAC Aviation Catering Services Industry Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

APAC Aviation Catering Services Industry Regional Market Share

Geographic Coverage of APAC Aviation Catering Services Industry

APAC Aviation Catering Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Meals Segment is Projected to Occupy the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 5.1.1. Meals

- 5.1.2. Bakery and Confectionary

- 5.1.3. Beverages

- 5.1.4. Other Food Types

- 5.2. Market Analysis, Insights and Forecast - by Flight Type

- 5.2.1. Full-service Carriers

- 5.2.2. Low-cost Carriers

- 5.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 5.3.1. Economy Class

- 5.3.2. Business Class

- 5.3.3. First Class

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.5.2. China

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 6. India APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 6.1.1. Meals

- 6.1.2. Bakery and Confectionary

- 6.1.3. Beverages

- 6.1.4. Other Food Types

- 6.2. Market Analysis, Insights and Forecast - by Flight Type

- 6.2.1. Full-service Carriers

- 6.2.2. Low-cost Carriers

- 6.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 6.3.1. Economy Class

- 6.3.2. Business Class

- 6.3.3. First Class

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. India

- 6.4.2. China

- 6.4.3. Japan

- 6.4.4. South Korea

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 7. China APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 7.1.1. Meals

- 7.1.2. Bakery and Confectionary

- 7.1.3. Beverages

- 7.1.4. Other Food Types

- 7.2. Market Analysis, Insights and Forecast - by Flight Type

- 7.2.1. Full-service Carriers

- 7.2.2. Low-cost Carriers

- 7.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 7.3.1. Economy Class

- 7.3.2. Business Class

- 7.3.3. First Class

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. India

- 7.4.2. China

- 7.4.3. Japan

- 7.4.4. South Korea

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 8. Japan APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Food Type

- 8.1.1. Meals

- 8.1.2. Bakery and Confectionary

- 8.1.3. Beverages

- 8.1.4. Other Food Types

- 8.2. Market Analysis, Insights and Forecast - by Flight Type

- 8.2.1. Full-service Carriers

- 8.2.2. Low-cost Carriers

- 8.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 8.3.1. Economy Class

- 8.3.2. Business Class

- 8.3.3. First Class

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. India

- 8.4.2. China

- 8.4.3. Japan

- 8.4.4. South Korea

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Food Type

- 9. South Korea APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Food Type

- 9.1.1. Meals

- 9.1.2. Bakery and Confectionary

- 9.1.3. Beverages

- 9.1.4. Other Food Types

- 9.2. Market Analysis, Insights and Forecast - by Flight Type

- 9.2.1. Full-service Carriers

- 9.2.2. Low-cost Carriers

- 9.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 9.3.1. Economy Class

- 9.3.2. Business Class

- 9.3.3. First Class

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. India

- 9.4.2. China

- 9.4.3. Japan

- 9.4.4. South Korea

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Food Type

- 10. Rest of Asia Pacific APAC Aviation Catering Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Food Type

- 10.1.1. Meals

- 10.1.2. Bakery and Confectionary

- 10.1.3. Beverages

- 10.1.4. Other Food Types

- 10.2. Market Analysis, Insights and Forecast - by Flight Type

- 10.2.1. Full-service Carriers

- 10.2.2. Low-cost Carriers

- 10.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 10.3.1. Economy Class

- 10.3.2. Business Class

- 10.3.3. First Class

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. India

- 10.4.2. China

- 10.4.3. Japan

- 10.4.4. South Korea

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Food Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Gate Gourmet (Gate Group)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SATS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Emirates Flight Catering Company LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cathay Pacific Catering Services (HK) Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jetfinity

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Newrest Group Services

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LSG Sky Chefs (LSG Group)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Flying Food Group LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Air China Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Journey Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Gate Gourmet (Gate Group)

List of Figures

- Figure 1: Global APAC Aviation Catering Services Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: India APAC Aviation Catering Services Industry Revenue (Million), by Food Type 2025 & 2033

- Figure 3: India APAC Aviation Catering Services Industry Revenue Share (%), by Food Type 2025 & 2033

- Figure 4: India APAC Aviation Catering Services Industry Revenue (Million), by Flight Type 2025 & 2033

- Figure 5: India APAC Aviation Catering Services Industry Revenue Share (%), by Flight Type 2025 & 2033

- Figure 6: India APAC Aviation Catering Services Industry Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 7: India APAC Aviation Catering Services Industry Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 8: India APAC Aviation Catering Services Industry Revenue (Million), by Geography 2025 & 2033

- Figure 9: India APAC Aviation Catering Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: India APAC Aviation Catering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: India APAC Aviation Catering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: China APAC Aviation Catering Services Industry Revenue (Million), by Food Type 2025 & 2033

- Figure 13: China APAC Aviation Catering Services Industry Revenue Share (%), by Food Type 2025 & 2033

- Figure 14: China APAC Aviation Catering Services Industry Revenue (Million), by Flight Type 2025 & 2033

- Figure 15: China APAC Aviation Catering Services Industry Revenue Share (%), by Flight Type 2025 & 2033

- Figure 16: China APAC Aviation Catering Services Industry Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 17: China APAC Aviation Catering Services Industry Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 18: China APAC Aviation Catering Services Industry Revenue (Million), by Geography 2025 & 2033

- Figure 19: China APAC Aviation Catering Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: China APAC Aviation Catering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: China APAC Aviation Catering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Japan APAC Aviation Catering Services Industry Revenue (Million), by Food Type 2025 & 2033

- Figure 23: Japan APAC Aviation Catering Services Industry Revenue Share (%), by Food Type 2025 & 2033

- Figure 24: Japan APAC Aviation Catering Services Industry Revenue (Million), by Flight Type 2025 & 2033

- Figure 25: Japan APAC Aviation Catering Services Industry Revenue Share (%), by Flight Type 2025 & 2033

- Figure 26: Japan APAC Aviation Catering Services Industry Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 27: Japan APAC Aviation Catering Services Industry Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 28: Japan APAC Aviation Catering Services Industry Revenue (Million), by Geography 2025 & 2033

- Figure 29: Japan APAC Aviation Catering Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Japan APAC Aviation Catering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Japan APAC Aviation Catering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: South Korea APAC Aviation Catering Services Industry Revenue (Million), by Food Type 2025 & 2033

- Figure 33: South Korea APAC Aviation Catering Services Industry Revenue Share (%), by Food Type 2025 & 2033

- Figure 34: South Korea APAC Aviation Catering Services Industry Revenue (Million), by Flight Type 2025 & 2033

- Figure 35: South Korea APAC Aviation Catering Services Industry Revenue Share (%), by Flight Type 2025 & 2033

- Figure 36: South Korea APAC Aviation Catering Services Industry Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 37: South Korea APAC Aviation Catering Services Industry Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 38: South Korea APAC Aviation Catering Services Industry Revenue (Million), by Geography 2025 & 2033

- Figure 39: South Korea APAC Aviation Catering Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: South Korea APAC Aviation Catering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South Korea APAC Aviation Catering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue (Million), by Food Type 2025 & 2033

- Figure 43: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue Share (%), by Food Type 2025 & 2033

- Figure 44: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue (Million), by Flight Type 2025 & 2033

- Figure 45: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue Share (%), by Flight Type 2025 & 2033

- Figure 46: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 47: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 48: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue (Million), by Geography 2025 & 2033

- Figure 49: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Rest of Asia Pacific APAC Aviation Catering Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 2: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 3: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 4: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 7: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 8: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 9: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 12: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 13: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 14: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 17: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 18: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 19: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 22: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 23: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 24: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 27: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 28: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 29: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global APAC Aviation Catering Services Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Aviation Catering Services Industry?

The projected CAGR is approximately 9.76%.

2. Which companies are prominent players in the APAC Aviation Catering Services Industry?

Key companies in the market include Gate Gourmet (Gate Group), SATS, Emirates Flight Catering Company LLC, Cathay Pacific Catering Services (HK) Limited, Jetfinity, Newrest Group Services, LSG Sky Chefs (LSG Group), Flying Food Group LLC, Air China Limited, Journey Group Inc.

3. What are the main segments of the APAC Aviation Catering Services Industry?

The market segments include Food Type, Flight Type, Aircraft Seating Class, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.16 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Meals Segment is Projected to Occupy the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Aviation Catering Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Aviation Catering Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Aviation Catering Services Industry?

To stay informed about further developments, trends, and reports in the APAC Aviation Catering Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence