Key Insights

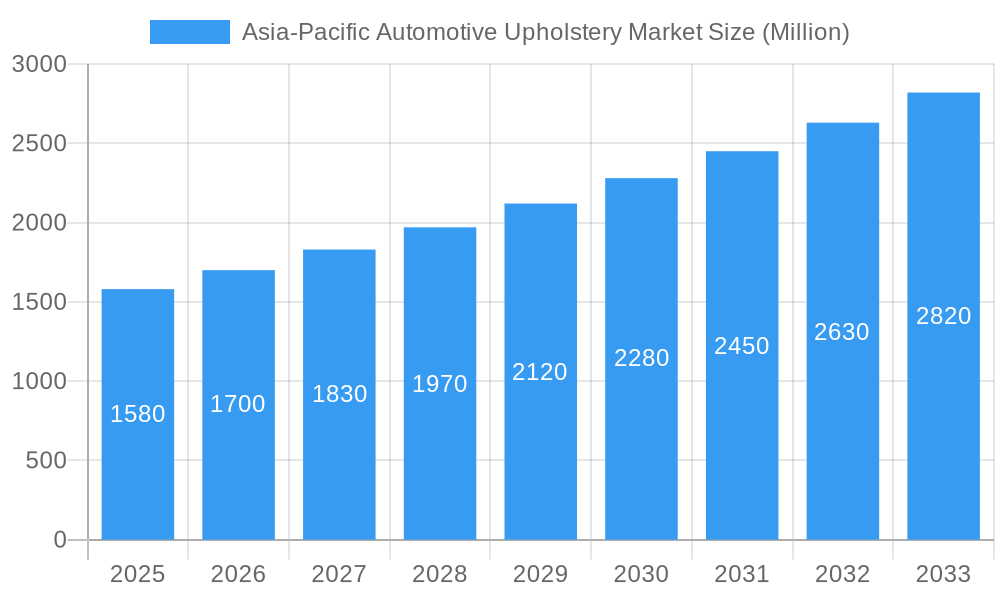

The Asia-Pacific automotive upholstery market is experiencing robust growth, projected to reach a market size of $1.58 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 7% through 2033. This expansion is driven by several key factors. Firstly, the region's burgeoning automotive industry, particularly in countries like China, India, and South Korea, fuels significant demand for automotive upholstery. Increased vehicle production, coupled with rising disposable incomes and a growing preference for enhanced vehicle interiors, are major contributors. Secondly, evolving consumer preferences towards comfort, luxury, and personalized interiors are driving demand for high-quality materials such as leather and specialized vinyl options. This trend is further amplified by the increasing popularity of SUVs and premium vehicles within the Asia-Pacific region. Finally, technological advancements in upholstery materials, focusing on durability, sustainability, and innovative designs, are contributing to market growth. This includes the development of lightweight, eco-friendly materials and the integration of advanced features such as heating and cooling functionalities.

Asia-Pacific Automotive Upholstery Market Market Size (In Billion)

However, challenges exist. Fluctuations in raw material prices, particularly for leather and certain synthetic materials, can impact profitability. Furthermore, stringent environmental regulations concerning volatile organic compounds (VOCs) in upholstery materials necessitate the adoption of eco-friendly alternatives, which might initially involve higher production costs. Competitive pressures from established players like Toyota Boshoku Corporation, Lear Corporation, and Adient PLC also necessitate continuous innovation and cost optimization strategies for market participants. Despite these challenges, the long-term outlook for the Asia-Pacific automotive upholstery market remains positive, fueled by continuous growth in vehicle production and a rising demand for high-quality, technologically advanced interiors. Segmentation by material type (leather, vinyl, others), sales channel (OEM, aftermarket), product type (dashboard, seats, etc.), and country provides a granular understanding of the market dynamics, enabling targeted business strategies.

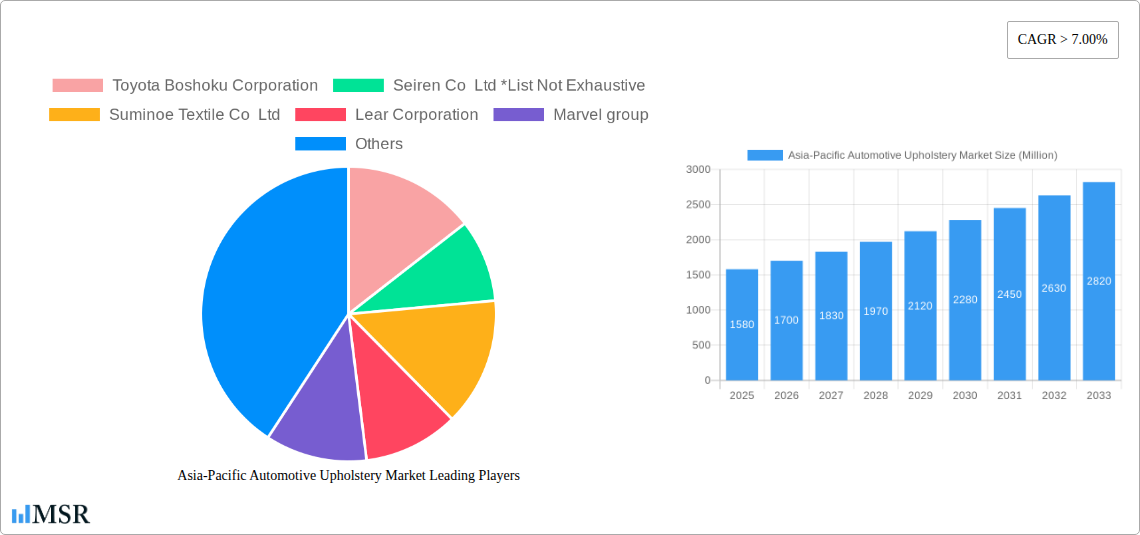

Asia-Pacific Automotive Upholstery Market Company Market Share

Asia-Pacific Automotive Upholstery Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific automotive upholstery market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market dynamics, trends, leading players, and future growth prospects. The market is segmented by material type (leather, vinyl, other materials), sales channel (OEM, aftermarket), product type (dashboard, seats, roof liners, door trim), and country (China, Japan, India, South Korea, Rest of Asia-Pacific). Expected to reach xx Million by 2033, this report is an essential resource for strategic decision-making.

Asia-Pacific Automotive Upholstery Market Market Concentration & Dynamics

The Asia-Pacific automotive upholstery market exhibits a moderately concentrated landscape, with key players such as Toyota Boshoku Corporation, Seiren Co Ltd, Suminoe Textile Co Ltd, Lear Corporation, Marvel group, Adient PLC, and Faurecia SE holding significant market share. However, the presence of several smaller players indicates a competitive environment. Innovation is driven by advancements in material technology, focusing on sustainability and enhanced comfort. Regulatory frameworks, including emission standards and safety regulations, significantly influence material choices and manufacturing processes. Substitute products, like advanced textiles and recycled materials, are gaining traction, impacting the market share of traditional leather and vinyl. End-user preferences are shifting towards eco-friendly and customizable options, shaping product development strategies. M&A activity remains moderate, with xx major deals recorded between 2019 and 2024, primarily focused on expanding product portfolios and geographical reach. Market share fluctuations are observed due to evolving consumer demands, technological advancements, and regional economic conditions.

- Market Concentration: Moderately concentrated, with top players holding xx% of market share.

- Innovation Ecosystem: Focus on sustainable, comfortable, and customizable materials.

- Regulatory Framework: Influence on material choices and manufacturing processes.

- Substitute Products: Growing adoption of eco-friendly alternatives.

- M&A Activity: xx major deals between 2019 and 2024.

Asia-Pacific Automotive Upholstery Market Industry Insights & Trends

The Asia-Pacific automotive upholstery market is poised for significant expansion, propelled by a confluence of escalating vehicle production, a growing middle class with increased purchasing power, and a discernible shift in consumer preference towards sophisticated and comfortable vehicle interiors. The market, estimated at [Insert Current Market Value Here] million in 2024, is projected to surge to [Insert Projected Market Value Here] million by 2033, demonstrating a compound annual growth rate (CAGR) of [Insert CAGR Here]% during the forecast period of 2025-2033.

Technological advancements are a key disrupter, with the integration of innovative smart materials and cutting-edge manufacturing techniques actively reshaping the industry landscape. Consumer behavior is evolving, showcasing a strong inclination towards personalized and environmentally conscious choices. This is evidenced by the rising demand for upholstery solutions crafted from vegan and recycled materials. The accelerating adoption of electric vehicles (EVs) also presents a unique opportunity, necessitating the development of lightweight and eco-friendly upholstery alternatives. Furthermore, the heightened emphasis on vehicle safety features is spurring the incorporation of high-performance and exceptionally durable upholstery materials. These dynamic factors are collectively shaping the vibrant and evolving Asia-Pacific automotive upholstery market.

Key Markets & Segments Leading Asia-Pacific Automotive Upholstery Market

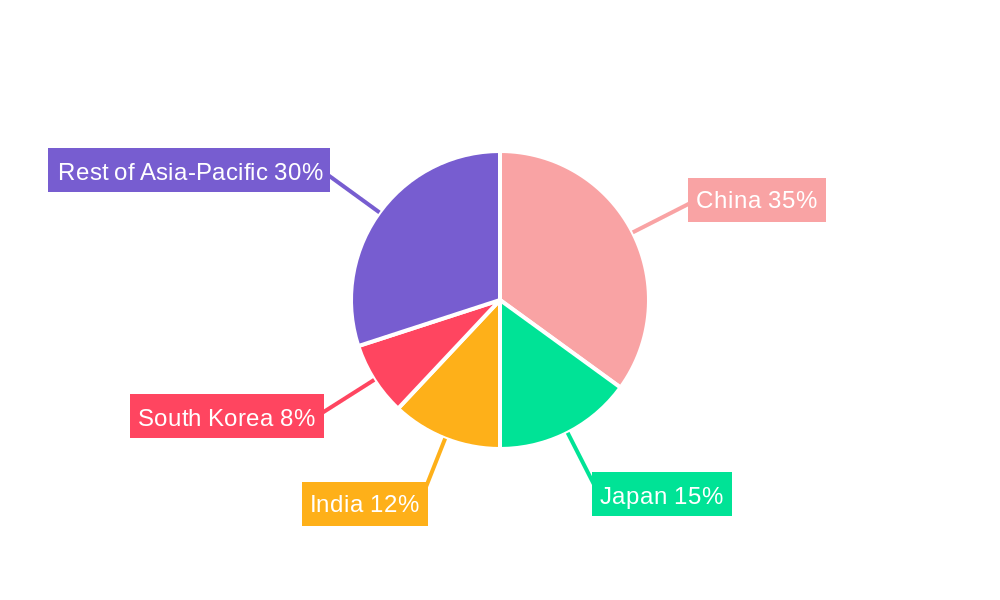

China stands as the undisputed leader in the Asia-Pacific automotive upholstery market, underpinned by its colossal automotive manufacturing capabilities and a rapidly expanding consumer base. Japan and South Korea also maintain substantial market presence, owing to their highly advanced and innovation-driven automotive sectors. India is emerging as a powerhouse of growth, fueled by robust economic expansion and a burgeoning automotive sales landscape.

- By Material Type: While leather continues to hold a dominant position, followed by vinyl, a notable surge in the adoption of other material types, including premium fabrics and advanced synthetic leathers, is reshaping the market dynamics.

- By Sales Channel: The Original Equipment Manufacturer (OEM) segment remains the primary driver, largely due to the sheer volume of vehicle production. However, the aftermarket segment is experiencing considerable growth, propelled by increasing demand for vehicle customization and repair services.

- By Product Type: Seat upholstery constitutes the largest segment. This is followed by substantial contributions from dashboard coverings, door trims, and roof liners.

-

By Country:

- China: Its preeminence is driven by massive automotive production volumes, a vast and growing consumer market, and consistently increasing vehicle sales.

- Japan: A mature automotive industry coupled with relentless pursuit of technological advancements solidifies its market position.

- India: Rapid economic development and a booming automotive sector are key catalysts for its growth.

- South Korea: Renowned for its sophisticated automotive technology and manufacturing prowess.

- Rest of Asia-Pacific: Consistent growth is observed, supported by steady regional economic development and increasing vehicle penetration.

Key Growth Drivers:

- Sustained economic growth, directly translating into increased demand for vehicles.

- Significant investments in infrastructure development, bolstering the automotive manufacturing ecosystem.

- Rising disposable incomes, empowering consumers to invest more in vehicle purchases and enhancements.

Asia-Pacific Automotive Upholstery Market Product Developments

Recent product innovations include the development of lightweight, sustainable materials with enhanced durability and comfort features. Advancements in material science enable the creation of leather-like alternatives that are vegan and environmentally friendly, addressing the growing demand for sustainable products. Integration of smart technologies, such as heating and cooling systems within the upholstery, is enhancing passenger comfort and driving product differentiation. These developments significantly impact market competitiveness by offering superior features and improved value propositions.

Challenges in the Asia-Pacific Automotive Upholstery Market Market

The Asia-Pacific automotive upholstery market faces challenges from fluctuating raw material prices, supply chain disruptions, and intense competition. Regulatory changes and stringent emission standards influence material choices and production processes, adding to operational complexity. Furthermore, the increasing adoption of sustainable materials can pose challenges related to cost optimization and performance consistency. These factors collectively impact profitability and market competitiveness.

Forces Driving Asia-Pacific Automotive Upholstery Market Growth

Technological advancements in material science and manufacturing processes are major drivers. Economic growth and increasing vehicle production in major markets such as China and India are fueling demand. Government initiatives promoting sustainable transportation and eco-friendly manufacturing processes further contribute to market expansion.

Challenges in the Asia-Pacific Automotive Upholstery Market Market

Long-term growth will be fueled by continued innovation in sustainable materials, strategic partnerships to expand supply chains, and market expansion into new vehicle segments (e.g., electric vehicles). The focus on enhancing product features and improving manufacturing efficiency will also be vital for sustained growth.

Emerging Opportunities in Asia-Pacific Automotive Upholstery Market

The market is brimming with promising opportunities, including the escalating consumer demand for highly personalized upholstery options, the accelerating adoption of intelligent and smart materials, and the significant expansion potential within the electric vehicle sector. A strong emphasis on sustainability, bespoke customization, and elevated passenger comfort will unlock new and lucrative avenues for market growth.

Leading Players in the Asia-Pacific Automotive Upholstery Market Sector

- Toyota Boshoku Corporation

- Seiren Co Ltd

- Suminoe Textile Co Ltd

- Lear Corporation

- Marvel group

- Adient PLC

- Faurecia SE

Key Milestones in Asia-Pacific Automotive Upholstery Market Industry

- September 2022: BMW Group's announcement of fully vegan interiors signals a shift towards sustainable materials.

- February 2023: Tata Motors' introduction of red upholstery in its Safari and Harrier SUVs highlights growing consumer preference for customization.

- March 2023: Lexus's LC 500h launch showcases advancements in interior design and material application.

Strategic Outlook for Asia-Pacific Automotive Upholstery Market Market

The Asia-Pacific automotive upholstery market presents significant long-term growth potential driven by increasing vehicle production, consumer preference for customized and sustainable interiors, and technological advancements. Strategic opportunities lie in developing innovative, eco-friendly materials, strengthening supply chain resilience, and capitalizing on the growing demand for electric and autonomous vehicles.

Asia-Pacific Automotive Upholstery Market Segmentation

-

1. Material Type

- 1.1. Leather

- 1.2. Vinyl

- 1.3. Other Material Types

-

2. Sales Channel Type

- 2.1. OEM

- 2.2. Aftermarket

-

3. Product Type

- 3.1. Dashboard

- 3.2. Seats

- 3.3. Roof Liners

- 3.4. Door Trim

Asia-Pacific Automotive Upholstery Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Automotive Upholstery Market Regional Market Share

Geographic Coverage of Asia-Pacific Automotive Upholstery Market

Asia-Pacific Automotive Upholstery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Passenger Car Sales Propelling Market Growth

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increase in Passenger Car Sales Propelling OEM Sales Channel Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Automotive Upholstery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Leather

- 5.1.2. Vinyl

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel Type

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Dashboard

- 5.3.2. Seats

- 5.3.3. Roof Liners

- 5.3.4. Door Trim

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Toyota Boshoku Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Seiren Co Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Suminoe Textile Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lear Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Marvel group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Adient PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Faurecia SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Toyota Boshoku Corporation

List of Figures

- Figure 1: Asia-Pacific Automotive Upholstery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Automotive Upholstery Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 3: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Sales Channel Type 2020 & 2033

- Table 7: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Asia-Pacific Automotive Upholstery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Automotive Upholstery Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Automotive Upholstery Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Asia-Pacific Automotive Upholstery Market?

Key companies in the market include Toyota Boshoku Corporation, Seiren Co Ltd *List Not Exhaustive, Suminoe Textile Co Ltd, Lear Corporation, Marvel group, Adient PLC, Faurecia SE.

3. What are the main segments of the Asia-Pacific Automotive Upholstery Market?

The market segments include Material Type, Sales Channel Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Passenger Car Sales Propelling Market Growth.

6. What are the notable trends driving market growth?

Increase in Passenger Car Sales Propelling OEM Sales Channel Growth.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

March 2023: Lexus introduced the LC 500h, a four-seat luxury coupe with high-end features. The controls in the center console are now oriented longitudinally, and the passenger side decoration panel has been harmonized with the instrument panel upholstery to emphasize the horizontal design idea.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Automotive Upholstery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Automotive Upholstery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Automotive Upholstery Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Automotive Upholstery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence