Key Insights

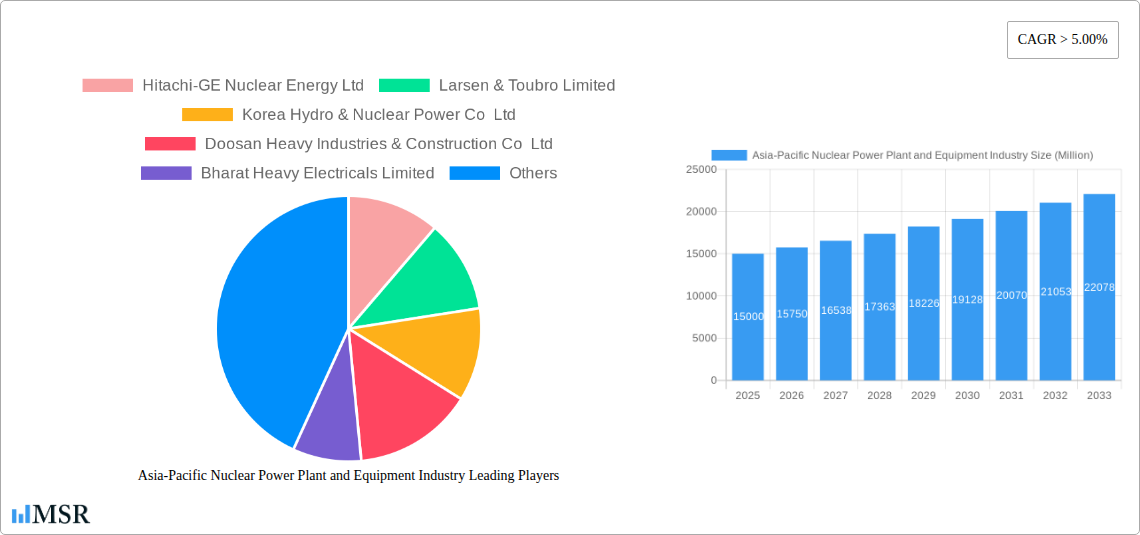

The Asia-Pacific nuclear power plant and equipment market is poised for substantial expansion, fueled by escalating energy requirements, a commitment to climate change mitigation, and the imperative for stable baseload power generation. With a projected compound annual growth rate (CAGR) of 3.5%, the market is estimated to reach 47.43 billion by the base year of 2025. This growth trajectory is underpinned by robust governmental backing for nuclear energy as a sustainable power source in key nations such as China, Japan, South Korea, and India. Furthermore, the necessity to modernize aging infrastructure and replace existing components is a significant market driver. Advances in reactor technology, particularly enhancements in safety and efficiency, are also contributing to market growth. The market is segmented by reactor type (Pressurized Water Reactor, Pressurized Heavy Water Reactor, Boiling Water Reactor, and Others) and carrier type (Island Equipment and Auxiliary Equipment). Major economies including China, Japan, South Korea, and India are instrumental in the market's advancement. Despite ongoing challenges related to regulatory frameworks and public perception of nuclear safety, the long-term outlook remains optimistic, driven by the increasing demand for reliable, low-carbon energy solutions.

Asia-Pacific Nuclear Power Plant and Equipment Industry Market Size (In Billion)

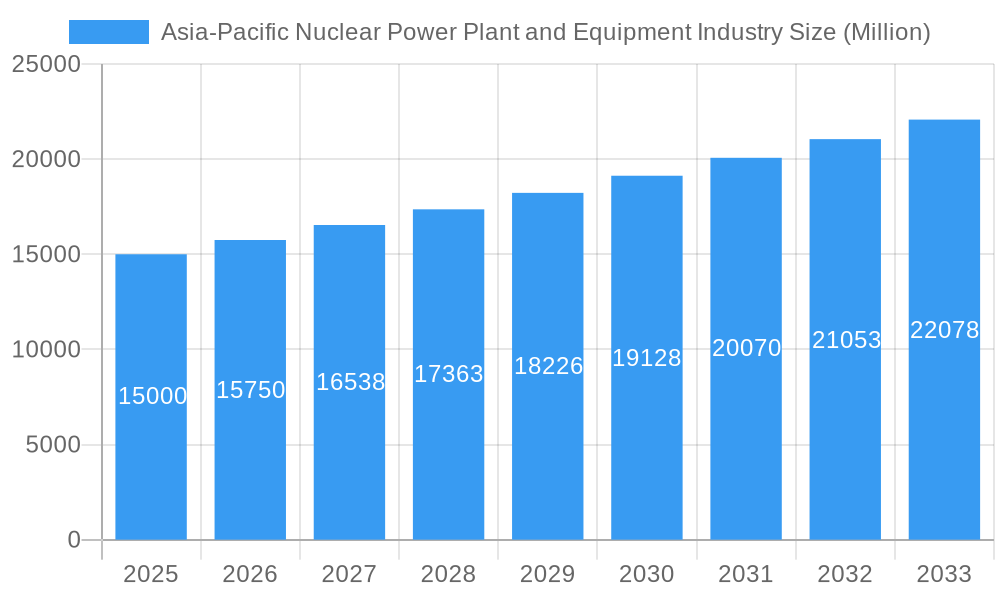

The competitive environment features a blend of global and regional industry leaders. Prominent entities such as Hitachi-GE Nuclear Energy Ltd, Larsen & Toubro Limited, Korea Hydro & Nuclear Power Co Ltd, Doosan Heavy Industries & Construction Co Ltd, Bharat Heavy Electricals Limited, China General Nuclear Power Corporation, Shanghai Electric Group Company Limited, Hindustan Construction Company Limited, and Mitsubishi Heavy Industries Ltd are actively shaping the market. Competition centers on technological innovation, proficient project execution, and competitive pricing. Future market expansion will be influenced by sustained investment in research and development, the successful deployment of novel reactor designs, and adaptive governmental policies and regulations. A persistent focus on enhancing safety protocols, optimizing operational efficiency, and reducing the overall cost of nuclear power generation is expected to propel further market development across the Asia-Pacific region.

Asia-Pacific Nuclear Power Plant and Equipment Industry Company Market Share

Asia-Pacific Nuclear Power Plant and Equipment Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific nuclear power plant and equipment industry, offering invaluable insights for stakeholders across the value chain. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report illuminates market dynamics, growth drivers, key players, and emerging opportunities. The report leverages extensive data analysis and expert insights to project a robust market outlook. Discover key trends, challenges, and strategic imperatives shaping the future of nuclear power in the Asia-Pacific region.

Asia-Pacific Nuclear Power Plant and Equipment Industry Market Concentration & Dynamics

The Asia-Pacific nuclear power plant and equipment market exhibits a moderately concentrated landscape, with several large players holding significant market share. Market concentration is influenced by factors such as government policies, technological advancements, and M&A activities. The region's innovation ecosystem is dynamic, with ongoing research and development in advanced reactor technologies, including Small Modular Reactors (SMRs). Stringent regulatory frameworks govern the sector, impacting investment decisions and project timelines. Substitute energy sources, such as renewable energy, exert competitive pressure. End-user trends, particularly towards cleaner and more efficient energy sources, significantly shape market demand.

- Market Share (2025 Estimate): China General Nuclear Power Corporation (xx%), Hitachi-GE Nuclear Energy Ltd (xx%), others (xx%). These figures are estimates due to the confidential nature of some company data.

- M&A Activity (2019-2024): xx major mergers and acquisitions were recorded during this period, primarily driven by expansion strategies and technological collaborations.

Asia-Pacific Nuclear Power Plant and Equipment Industry Industry Insights & Trends

The Asia-Pacific nuclear power plant and equipment market is projected to witness substantial growth, driven by increasing energy demand, aging infrastructure upgrades, and government support for nuclear power as a low-carbon energy source. Market size in 2025 is estimated at $XX Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. Technological disruptions, such as the development of advanced reactor designs (SMRs) and improved safety features, are reshaping the industry landscape. Growing awareness of climate change and the need for carbon-neutral energy sources is further fueling market expansion. Consumer behavior shifts towards sustainable energy solutions bolster this trend. However, factors like regulatory hurdles and public perception continue to influence the market's trajectory.

Key Markets & Segments Leading Asia-Pacific Nuclear Power Plant and Equipment Industry

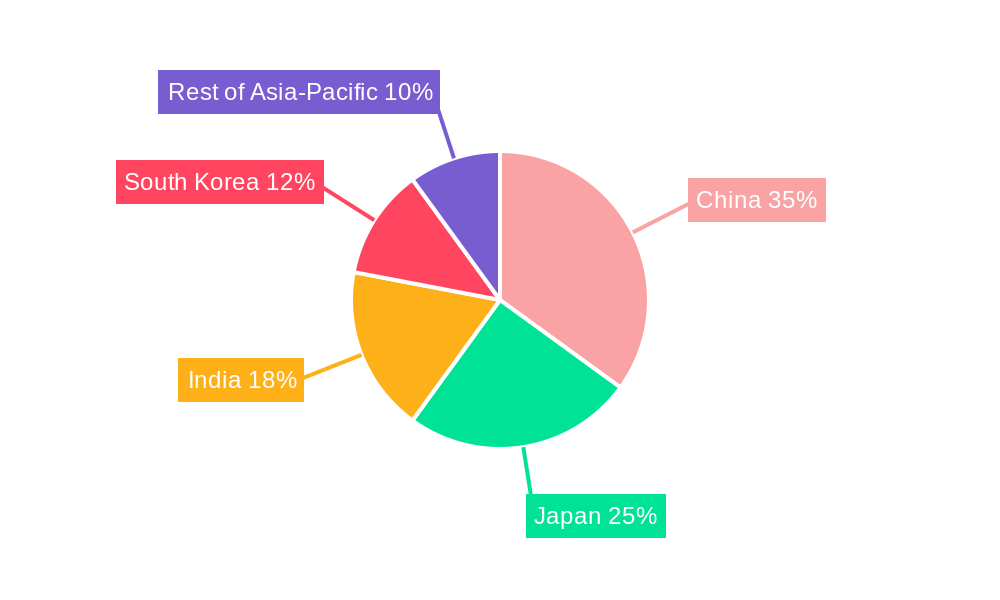

China holds the dominant position in the Asia-Pacific nuclear power plant and equipment market, driven by substantial investments in new nuclear power plants and a strong government commitment to nuclear energy. Other key markets include India, South Korea, and Japan.

Dominant Segments:

- Reactor Type: Pressurized Water Reactor (PWR) dominates the market due to its proven technology and scalability. However, the adoption of Pressurized Heavy Water Reactor (PHWR) and Boiling Water Reactor (BWR) technologies is also significant. Other reactor types, including SMRs, are emerging as promising segments with considerable future growth potential.

- Carrier Type: Island equipment constitutes a larger market share compared to auxiliary equipment, reflecting the substantial investment required for the primary nuclear power generation components.

Drivers:

- Economic Growth: Rapid economic expansion in several Asian countries fuels the demand for reliable and affordable energy.

- Infrastructure Development: Investments in new power generation capacity drive significant market growth.

- Energy Security: Reducing reliance on fossil fuels and ensuring energy independence are critical drivers for government policies.

- Environmental Concerns: The need to reduce carbon emissions is accelerating the adoption of nuclear power as a clean energy source.

Asia-Pacific Nuclear Power Plant and Equipment Industry Product Developments

Significant advancements are witnessed in reactor designs, focusing on enhanced safety, efficiency, and reduced waste generation. SMRs are gaining traction, offering greater flexibility and reduced capital costs compared to traditional large-scale reactors. Improved materials and manufacturing techniques are also leading to enhanced equipment performance and longevity. These innovations offer crucial competitive advantages to manufacturers in a market increasingly demanding efficient and reliable nuclear power solutions.

Challenges in the Asia-Pacific Nuclear Power Plant and Equipment Industry Market

The Asia-Pacific nuclear power plant and equipment market faces significant challenges, including stringent regulatory approvals, complex licensing procedures, and potential delays in project implementation. Supply chain disruptions and price volatility for critical materials pose considerable risks. Intense competition among established and emerging players adds further complexity to the market landscape. These factors could delay project timelines and impact overall market growth. Estimated cost overruns resulting from these factors are projected at $XX Million annually.

Forces Driving Asia-Pacific Nuclear Power Plant and Equipment Industry Growth

Strong government support for nuclear energy through favorable policies and financial incentives is a major growth driver. Technological advancements, particularly in SMRs and advanced reactor designs, enhance efficiency and reduce costs. Growing energy demand, coupled with environmental concerns, strengthens the impetus for nuclear power adoption. Strategic partnerships and collaborations between international players and domestic companies foster technology transfer and accelerate market expansion.

Long-Term Growth Catalysts in the Asia-Pacific Nuclear Power Plant and Equipment Industry

Continuous innovation in reactor technology, particularly the advancement of SMRs, promises substantial long-term growth. Strategic partnerships between governments and private sector players are crucial for attracting investment and accelerating project deployment. Expanding into new markets within the Asia-Pacific region and exploring export opportunities will drive future expansion.

Emerging Opportunities in Asia-Pacific Nuclear Power Plant and Equipment Industry

The increasing demand for renewable energy integration with nuclear power plants presents a substantial opportunity. The development and deployment of SMRs offer significant potential for smaller grids and remote locations. Advanced digital technologies, including AI and machine learning, enhance operations and maintenance, creating new market segments.

Leading Players in the Asia-Pacific Nuclear Power Plant and Equipment Industry Sector

- Hitachi-GE Nuclear Energy Ltd

- Larsen & Toubro Limited

- Korea Hydro & Nuclear Power Co Ltd

- Doosan Heavy Industries & Construction Co Ltd

- Bharat Heavy Electricals Limited

- China General Nuclear Power Corporation

- Shanghai Electric Group Company Limited

- Hindustan Construction Company Limited

- Mitsubishi Heavy Industries Ltd

Key Milestones in Asia-Pacific Nuclear Power Plant and Equipment Industry Industry

- July 2021: CNNC commences construction of the ACP100 SMR demonstration project in Hainan, China.

- May 2021: India's DAE announces plans to construct a research reactor via a public-private partnership.

- August 2021: CGN announces commercial operation of Unit 5 at the Hongyanhe plant, bringing China's commercial reactors to 51.

Strategic Outlook for Asia-Pacific Nuclear Power Plant and Equipment Industry Market

The Asia-Pacific nuclear power plant and equipment market holds substantial long-term growth potential, driven by factors such as increasing energy demand, environmental concerns, and government support. Strategic partnerships, technological innovations, and effective risk management will be crucial for capitalizing on future opportunities and navigating market challenges. The focus on SMR technology and enhanced safety features is expected to significantly reshape the market landscape over the next decade.

Asia-Pacific Nuclear Power Plant and Equipment Industry Segmentation

-

1. Reactor Type

- 1.1. Pressurized Water Reactor

- 1.2. Pressurized Heavy Water Reactor

- 1.3. Boiling Water Reactor

- 1.4. Other Reactors

-

2. Carrier Type

- 2.1. Island Equipment

- 2.2. Auxiliary Equipment

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia-Pacific Nuclear Power Plant and Equipment Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Nuclear Power Plant and Equipment Industry Regional Market Share

Geographic Coverage of Asia-Pacific Nuclear Power Plant and Equipment Industry

Asia-Pacific Nuclear Power Plant and Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Offshore Wind Energy Installation4.; Growing Imperative Toward Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Capital Investment

- 3.4. Market Trends

- 3.4.1. Pressurized Water Reactor (PWR) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 5.1.1. Pressurized Water Reactor

- 5.1.2. Pressurized Heavy Water Reactor

- 5.1.3. Boiling Water Reactor

- 5.1.4. Other Reactors

- 5.2. Market Analysis, Insights and Forecast - by Carrier Type

- 5.2.1. Island Equipment

- 5.2.2. Auxiliary Equipment

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6. China Asia-Pacific Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 6.1.1. Pressurized Water Reactor

- 6.1.2. Pressurized Heavy Water Reactor

- 6.1.3. Boiling Water Reactor

- 6.1.4. Other Reactors

- 6.2. Market Analysis, Insights and Forecast - by Carrier Type

- 6.2.1. Island Equipment

- 6.2.2. Auxiliary Equipment

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7. India Asia-Pacific Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 7.1.1. Pressurized Water Reactor

- 7.1.2. Pressurized Heavy Water Reactor

- 7.1.3. Boiling Water Reactor

- 7.1.4. Other Reactors

- 7.2. Market Analysis, Insights and Forecast - by Carrier Type

- 7.2.1. Island Equipment

- 7.2.2. Auxiliary Equipment

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8. Japan Asia-Pacific Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 8.1.1. Pressurized Water Reactor

- 8.1.2. Pressurized Heavy Water Reactor

- 8.1.3. Boiling Water Reactor

- 8.1.4. Other Reactors

- 8.2. Market Analysis, Insights and Forecast - by Carrier Type

- 8.2.1. Island Equipment

- 8.2.2. Auxiliary Equipment

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9. South Korea Asia-Pacific Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 9.1.1. Pressurized Water Reactor

- 9.1.2. Pressurized Heavy Water Reactor

- 9.1.3. Boiling Water Reactor

- 9.1.4. Other Reactors

- 9.2. Market Analysis, Insights and Forecast - by Carrier Type

- 9.2.1. Island Equipment

- 9.2.2. Auxiliary Equipment

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10. Rest of Asia Pacific Asia-Pacific Nuclear Power Plant and Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 10.1.1. Pressurized Water Reactor

- 10.1.2. Pressurized Heavy Water Reactor

- 10.1.3. Boiling Water Reactor

- 10.1.4. Other Reactors

- 10.2. Market Analysis, Insights and Forecast - by Carrier Type

- 10.2.1. Island Equipment

- 10.2.2. Auxiliary Equipment

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Reactor Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hitachi-GE Nuclear Energy Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Larsen & Toubro Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Korea Hydro & Nuclear Power Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Doosan Heavy Industries & Construction Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bharat Heavy Electricals Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China General Nuclear Power Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shanghai Electric Group Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hindustan Construction Company Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi Heavy Industries Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Hitachi-GE Nuclear Energy Ltd

List of Figures

- Figure 1: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Nuclear Power Plant and Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 2: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 3: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 4: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 5: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 10: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 11: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 12: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 13: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 18: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 19: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 20: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 21: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 26: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 27: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 28: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 29: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 34: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 35: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 36: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 37: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 42: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Reactor Type 2020 & 2033

- Table 43: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Carrier Type 2020 & 2033

- Table 44: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 45: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Nuclear Power Plant and Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Nuclear Power Plant and Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Nuclear Power Plant and Equipment Industry?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Asia-Pacific Nuclear Power Plant and Equipment Industry?

Key companies in the market include Hitachi-GE Nuclear Energy Ltd, Larsen & Toubro Limited, Korea Hydro & Nuclear Power Co Ltd, Doosan Heavy Industries & Construction Co Ltd, Bharat Heavy Electricals Limited, China General Nuclear Power Corporation, Shanghai Electric Group Company Limited, Hindustan Construction Company Limited, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Asia-Pacific Nuclear Power Plant and Equipment Industry?

The market segments include Reactor Type, Carrier Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.43 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Offshore Wind Energy Installation4.; Growing Imperative Toward Renewable Energy.

6. What are the notable trends driving market growth?

Pressurized Water Reactor (PWR) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Capital Investment.

8. Can you provide examples of recent developments in the market?

In July 2021, China National Nuclear Corporation (CNNC) commenced the construction of the ACP100 small modular reactor demonstration project at the Changjiang nuclear power plant on China's island province of Hainan. The project will be the world's first land-based commercial small modular reactor (SMR). The multi-purpose 125 MWe pressurized water reactor (PWR) is designed for electricity, heating, steam, and seawater desalination. The project is expected to enter commercial operation by the end of 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Nuclear Power Plant and Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Nuclear Power Plant and Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Nuclear Power Plant and Equipment Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Nuclear Power Plant and Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence