Key Insights

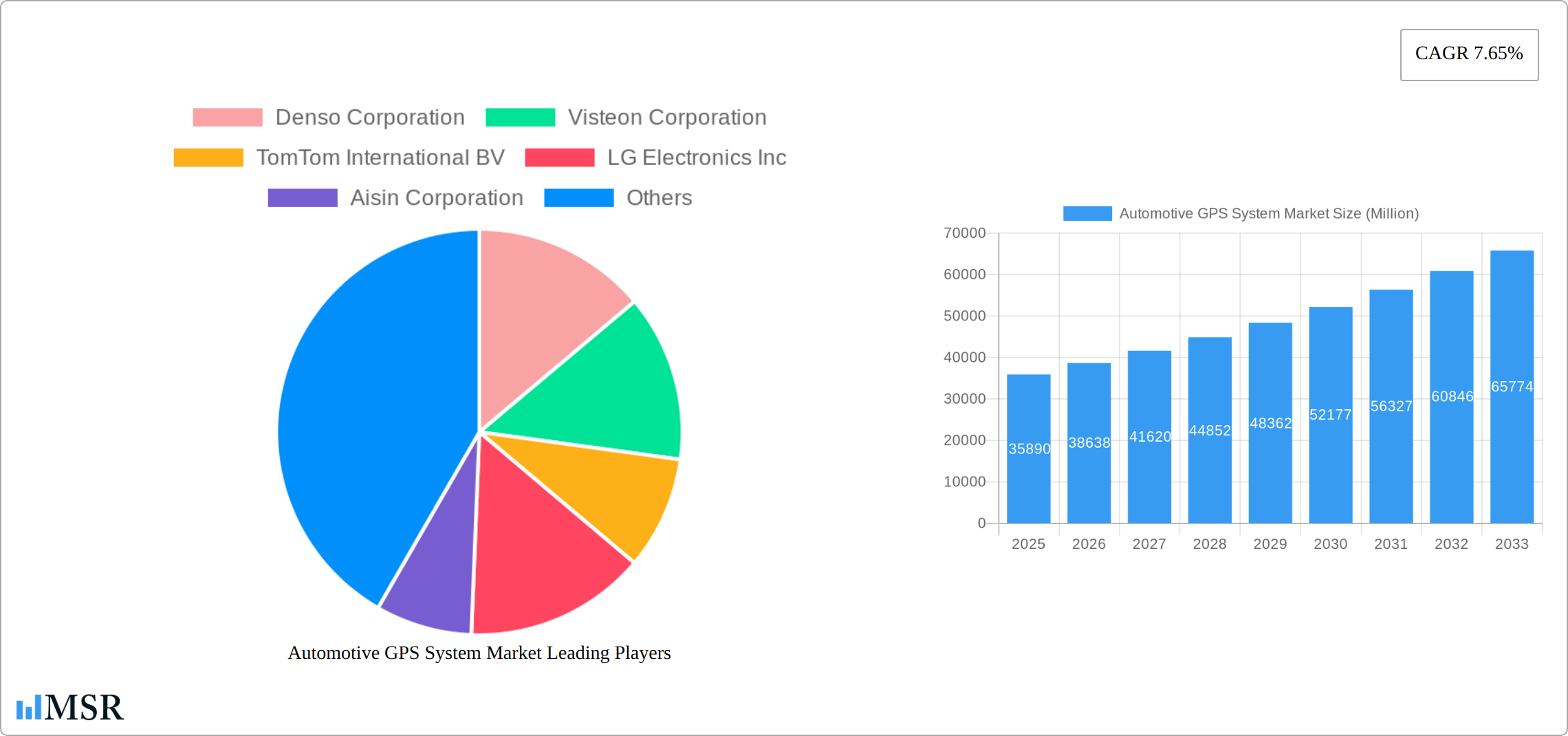

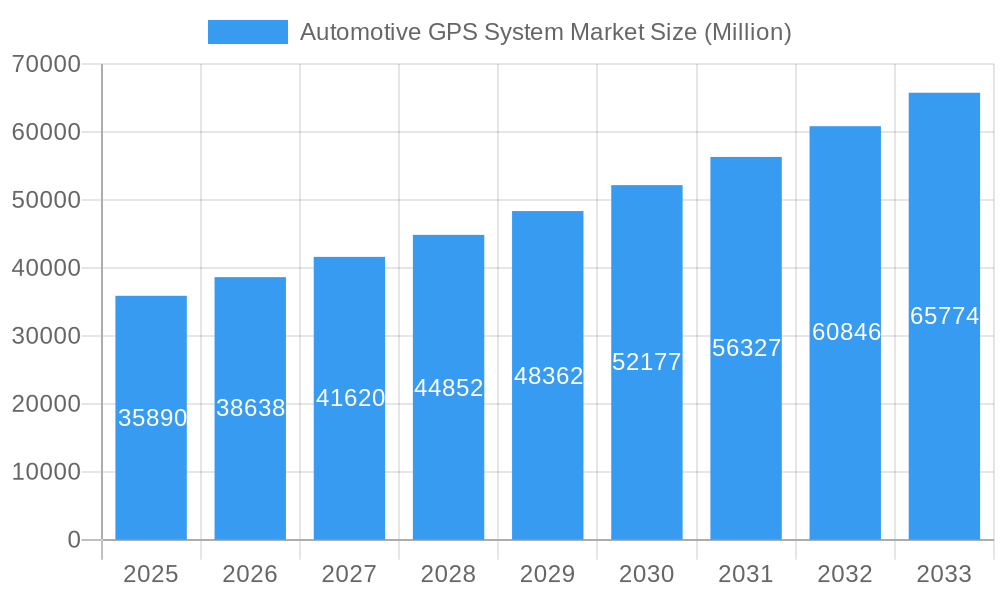

The automotive GPS system market, valued at $35.89 billion in 2025, is projected to experience robust growth, driven by increasing vehicle production, rising consumer demand for advanced navigation and infotainment features, and the integration of GPS technology with connected car services. The market's Compound Annual Growth Rate (CAGR) of 7.65% from 2019-2024 indicates a consistent upward trajectory, expected to continue throughout the forecast period (2025-2033). Key growth drivers include the proliferation of smartphones with advanced GPS capabilities, leading to increased consumer expectation for similar functionality in their vehicles. Furthermore, the integration of GPS systems with advanced driver-assistance systems (ADAS) and safety features, like emergency response systems, is fueling market expansion. The market is segmented by screen size (less than 6 inches, 6-10 inches, more than 10 inches), vehicle type (passenger cars, commercial vehicles), and sales channel (OEMs and aftermarket). The passenger car segment dominates due to higher vehicle production volume and consumer preference for integrated navigation systems. The OEM channel holds a significant market share, owing to the increasing incorporation of GPS navigation as a standard feature in new vehicles. Geographic regions like North America, Europe, and Asia Pacific represent major markets, driven by high vehicle ownership rates and strong consumer spending on automotive technology. However, market growth might face certain restraints, such as the increasing adoption of smartphone navigation apps and challenges related to map data accuracy and updates. Despite these challenges, the integration of GPS with other vehicle technologies and the development of more user-friendly interfaces are anticipated to stimulate growth and drive market expansion.

Automotive GPS System Market Market Size (In Billion)

Competitive landscape analysis reveals leading players such as Denso Corporation, Visteon Corporation, TomTom International BV, LG Electronics Inc., and others heavily influencing market strategies. These companies are focused on technological innovation, strategic partnerships, and geographic expansion to maintain their competitiveness. The development of advanced features like real-time traffic updates, voice recognition, and augmented reality navigation are key differentiators in this rapidly evolving market. The ongoing integration with broader vehicle connectivity and the introduction of sophisticated mapping technologies promise even stronger market performance in the coming years. The robust growth potential underscores the attractiveness of this sector for both established and emerging players.

Automotive GPS System Market Company Market Share

Automotive GPS System Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Automotive GPS System market, covering market size, growth drivers, key segments, leading players, and future trends. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, suppliers, and investors. With a projected market value of xx Million by 2033, understanding the market dynamics is crucial for strategic planning and success.

Automotive GPS System Market Market Concentration & Dynamics

The Automotive GPS System market exhibits a moderately concentrated landscape, with key players such as Denso Corporation, Visteon Corporation, and TomTom International BV holding significant market share. However, the market is also characterized by a dynamic competitive environment, driven by technological innovation, strategic partnerships, and mergers and acquisitions (M&A) activities. The estimated market size in 2025 is xx Million.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Innovation Ecosystems: Rapid advancements in mapping technology, artificial intelligence (AI), and connectivity are fueling innovation. The emergence of cloud-based navigation solutions significantly impacts the market.

- Regulatory Frameworks: Government regulations related to vehicle safety and emissions are indirectly influencing the adoption of advanced GPS systems.

- Substitute Products: Smartphone navigation apps pose a competitive challenge, but integrated in-vehicle systems offer superior functionality and user experience.

- End-User Trends: Growing demand for enhanced in-car infotainment features and the rising adoption of connected cars are boosting market growth.

- M&A Activities: The number of M&A deals in the Automotive GPS System market has increased in recent years, signaling consolidation and strategic expansion among leading players. An estimated xx M&A deals occurred between 2019 and 2024.

Automotive GPS System Market Industry Insights & Trends

The Automotive GPS System market is experiencing robust growth, driven by several factors. The global market size is estimated at xx Million in 2025, with a Compound Annual Growth Rate (CAGR) of xx% projected for the forecast period (2025-2033). The market's expansion is fueled by increasing vehicle production, rising disposable incomes in emerging economies, and growing demand for advanced driver-assistance systems (ADAS). Technological disruptions, such as the integration of AI and cloud-based services, are transforming the industry. Consumer behavior is shifting towards seamless connectivity and personalized in-car experiences, which drives the demand for sophisticated GPS systems. The integration of voice assistants, like Alexa, further enhances user experience and boosts market demand. Furthermore, the shift toward electric vehicles (EVs) and the need for efficient charging station navigation are further propelling the market.

Key Markets & Segments Leading Automotive GPS System Market

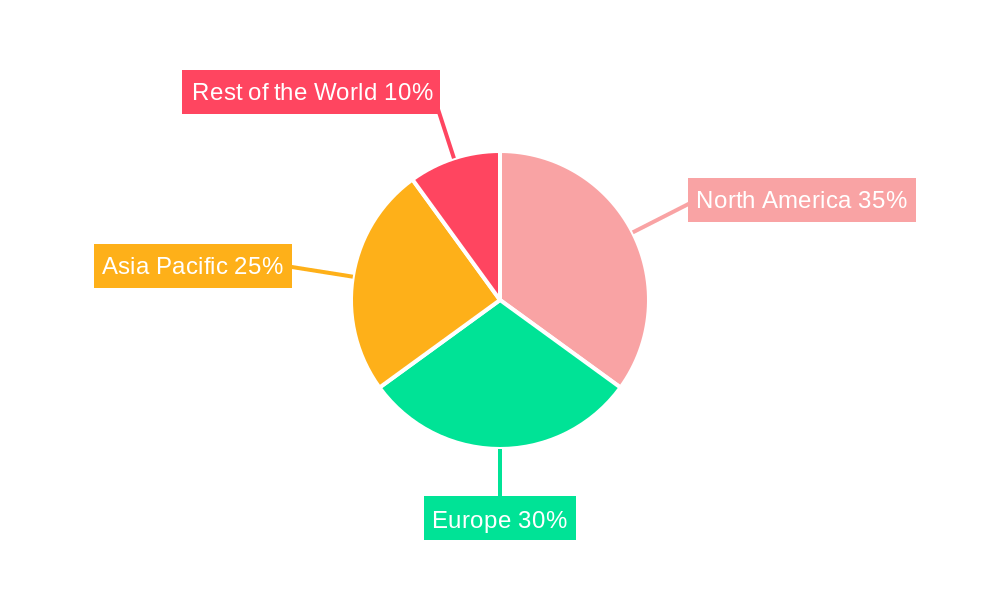

The Automotive GPS System market is geographically diverse, with significant growth observed across various regions. However, North America and Europe currently dominate the market. Within the segments:

- By Screen Size: The 6-10 inches screen size segment currently holds the largest market share, driven by its optimal balance of usability and cost-effectiveness. However, the "more than 10 inches" segment is projected to show the highest CAGR.

- By Vehicle Type: Passenger cars represent the largest segment, but the commercial vehicles segment is experiencing faster growth, driven by increasing fleet management and logistics requirements.

- By Sales Channel: Original Equipment Manufacturers (OEMs) dominate the sales channel, with a significantly larger market share than the aftermarket segment.

Drivers for Growth:

- Economic Growth: Rising disposable incomes, especially in developing economies, lead to increased car ownership and demand for advanced features.

- Infrastructure Development: Improved road infrastructure and expanding network coverage are supporting the adoption of GPS systems.

- Technological Advancements: Continuous innovation in navigation technology, such as cloud-based navigation and AI-powered features, drives market expansion.

Automotive GPS System Market Product Developments

Recent advancements in Automotive GPS systems are revolutionizing the driving experience. These include significantly enhanced 3D mapping capabilities with detailed points of interest, seamless integration with a broader spectrum of smartphone applications for unified digital ecosystems, and the widespread adoption of sophisticated cloud-based navigation platforms. These improvements empower users with hyper-accurate real-time traffic updates, predictive route optimization that anticipates potential delays, and highly responsive, natural language voice-activated controls. The paramount focus is on elevating the user experience through frictionless integration with an array of in-vehicle systems and delivering deeply personalized navigation journeys. Manufacturers are making substantial investments in developing intuitive user interfaces (UI) and superior user experiences (UX), thereby intensifying the market's competitive landscape and pushing the boundaries of automotive navigation technology.

Challenges in the Automotive GPS System Market Market

The Automotive GPS System market faces several challenges, including:

- High Initial Investment Costs: The development and integration of advanced GPS systems require significant upfront investments.

- Data Security and Privacy Concerns: The collection and use of user location data raise concerns regarding data privacy and security.

- Competition from Smartphone Navigation Apps: The availability of free or low-cost smartphone navigation apps poses a competitive threat.

- Supply Chain Disruptions: Global supply chain disruptions can affect the availability of components and impact production timelines.

Forces Driving Automotive GPS System Market Growth

Several powerful forces are propelling the growth trajectory of the Automotive GPS System market:

- Pervasive Technological Advancements: The strategic integration of Artificial Intelligence (AI), machine learning algorithms, and robust cloud-based services is exponentially enhancing navigation accuracy, providing hyper-localized real-time traffic intelligence, and enabling hyper-personalized route recommendations tailored to individual driving habits.

- Accelerating Vehicle Connectivity: The pervasive rise of connected cars, coupled with the widespread availability of high-speed internet access within vehicles, fundamentally enhances the functionality and real-time capabilities of GPS systems, enabling richer data exchange and more dynamic navigation.

- Proactive Government Initiatives: Evolving government regulations that champion vehicle safety enhancements and the widespread adoption of advanced driver-assistance systems (ADAS) indirectly but significantly stimulate the demand for sophisticated and integrated GPS systems that contribute to these safety goals.

Challenges in the Automotive GPS System Market Market

Long-term growth will be driven by continuous innovation in mapping technologies, the integration of advanced driver-assistance systems (ADAS), and partnerships between GPS system manufacturers and automotive OEMs. The expansion into new geographical markets, particularly in developing countries, also presents significant opportunities for growth.

Emerging Opportunities in Automotive GPS System Market

The horizon for the Automotive GPS System market is illuminated by exciting emerging opportunities. These include the transformative integration of augmented reality (AR) overlays within navigation interfaces, the sophisticated application of AI to deliver hyper-personalized user experiences, and the burgeoning demand for integrated in-car entertainment systems that inherently include robust GPS functionality. The groundbreaking integration of autonomous driving capabilities with advanced GPS systems represents a significant and transformative growth avenue. Moreover, the strategic expansion into specialized market segments such as commercial fleet management and diverse specialized vehicle applications offers further substantial avenues for market expansion and revenue generation.

Leading Players in the Automotive GPS System Market Sector

- Denso Corporation

- Visteon Corporation

- TomTom International BV

- LG Electronics Inc

- Aisin Corporation

- Garmin Ltd

- Mitsubishi Electric Corporation

- JVC Kenwood Corporation

- Harman International Industries

- Robert Bosch GmbH

- Faurecia Clarion Electronics Co Ltd

- Panasonic Holdings Corporation

Key Milestones in Automotive GPS System Market Industry

- April 2022: HERE Technologies partnered with Isuzu Trucks, integrating its navigation solution into Isuzu's new truck models. This highlights the growing demand for specialized GPS solutions in commercial vehicles.

- May 2022: Volvo Car USA integrated Google built-in features into its 2023 car lineup, demonstrating the trend towards deeper smartphone integration and advanced infotainment systems.

- January 2023: Mapbox partnered with Toyota Motor Europe, offering cloud-based navigation to improve deployment speed and user experience updates. This showcases the shift towards cloud-based solutions and continuous updates.

- August 2023: EVgo Inc. collaborated with Amazon to integrate Alexa into electric vehicle charging experiences. This signifies the increasing importance of seamless integration across various platforms and services.

Strategic Outlook for Automotive GPS System Market Market

The future of the Automotive GPS System market is bright, driven by continuous technological advancements, increasing vehicle connectivity, and the growing demand for personalized in-car experiences. Strategic partnerships and collaborations between technology companies and automotive manufacturers will play a crucial role in shaping the market's future. The expansion into new geographic regions and the development of innovative solutions for autonomous vehicles present significant growth opportunities. The market is poised for sustained growth, driven by both technological advancements and evolving consumer preferences.

Automotive GPS System Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Sales Channel

- 2.1. Original Equipment Manufacturers (OEMs)

- 2.2. Aftermarket

-

3. Screen Size

- 3.1. Less than 6 Inches

- 3.2. 6-10 Inches

- 3.3. More than 10 Inches

Automotive GPS System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive GPS System Market Regional Market Share

Geographic Coverage of Automotive GPS System Market

Automotive GPS System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shifting Preference of Consumers to Avail Private Medium of Transportation

- 3.3. Market Restrains

- 3.3.1. High Purchase and Installation Costs

- 3.4. Market Trends

- 3.4.1. Aftermarket Segment to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive GPS System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Original Equipment Manufacturers (OEMs)

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Screen Size

- 5.3.1. Less than 6 Inches

- 5.3.2. 6-10 Inches

- 5.3.3. More than 10 Inches

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive GPS System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. Original Equipment Manufacturers (OEMs)

- 6.2.2. Aftermarket

- 6.3. Market Analysis, Insights and Forecast - by Screen Size

- 6.3.1. Less than 6 Inches

- 6.3.2. 6-10 Inches

- 6.3.3. More than 10 Inches

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive GPS System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. Original Equipment Manufacturers (OEMs)

- 7.2.2. Aftermarket

- 7.3. Market Analysis, Insights and Forecast - by Screen Size

- 7.3.1. Less than 6 Inches

- 7.3.2. 6-10 Inches

- 7.3.3. More than 10 Inches

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive GPS System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. Original Equipment Manufacturers (OEMs)

- 8.2.2. Aftermarket

- 8.3. Market Analysis, Insights and Forecast - by Screen Size

- 8.3.1. Less than 6 Inches

- 8.3.2. 6-10 Inches

- 8.3.3. More than 10 Inches

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive GPS System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. Original Equipment Manufacturers (OEMs)

- 9.2.2. Aftermarket

- 9.3. Market Analysis, Insights and Forecast - by Screen Size

- 9.3.1. Less than 6 Inches

- 9.3.2. 6-10 Inches

- 9.3.3. More than 10 Inches

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Visteon Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 TomTom International BV

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LG Electronics Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Aisin Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Garmin Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mitsubishi Electric Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JVC Kenwood Corporatio

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Harman International Industries

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Robert Bosch GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Faurecia Clarion Electronics Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Panasonic Holdings Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: Global Automotive GPS System Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive GPS System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive GPS System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive GPS System Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 5: North America Automotive GPS System Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 6: North America Automotive GPS System Market Revenue (Million), by Screen Size 2025 & 2033

- Figure 7: North America Automotive GPS System Market Revenue Share (%), by Screen Size 2025 & 2033

- Figure 8: North America Automotive GPS System Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive GPS System Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive GPS System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive GPS System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive GPS System Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 13: Europe Automotive GPS System Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 14: Europe Automotive GPS System Market Revenue (Million), by Screen Size 2025 & 2033

- Figure 15: Europe Automotive GPS System Market Revenue Share (%), by Screen Size 2025 & 2033

- Figure 16: Europe Automotive GPS System Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive GPS System Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive GPS System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Automotive GPS System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Automotive GPS System Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 21: Asia Pacific Automotive GPS System Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 22: Asia Pacific Automotive GPS System Market Revenue (Million), by Screen Size 2025 & 2033

- Figure 23: Asia Pacific Automotive GPS System Market Revenue Share (%), by Screen Size 2025 & 2033

- Figure 24: Asia Pacific Automotive GPS System Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive GPS System Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive GPS System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Automotive GPS System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Automotive GPS System Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 29: Rest of the World Automotive GPS System Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 30: Rest of the World Automotive GPS System Market Revenue (Million), by Screen Size 2025 & 2033

- Figure 31: Rest of the World Automotive GPS System Market Revenue Share (%), by Screen Size 2025 & 2033

- Figure 32: Rest of the World Automotive GPS System Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive GPS System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive GPS System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive GPS System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 3: Global Automotive GPS System Market Revenue Million Forecast, by Screen Size 2020 & 2033

- Table 4: Global Automotive GPS System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive GPS System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive GPS System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 7: Global Automotive GPS System Market Revenue Million Forecast, by Screen Size 2020 & 2033

- Table 8: Global Automotive GPS System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive GPS System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Automotive GPS System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 14: Global Automotive GPS System Market Revenue Million Forecast, by Screen Size 2020 & 2033

- Table 15: Global Automotive GPS System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive GPS System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 22: Global Automotive GPS System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 23: Global Automotive GPS System Market Revenue Million Forecast, by Screen Size 2020 & 2033

- Table 24: Global Automotive GPS System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive GPS System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 31: Global Automotive GPS System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 32: Global Automotive GPS System Market Revenue Million Forecast, by Screen Size 2020 & 2033

- Table 33: Global Automotive GPS System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive GPS System Market?

The projected CAGR is approximately 7.65%.

2. Which companies are prominent players in the Automotive GPS System Market?

Key companies in the market include Denso Corporation, Visteon Corporation, TomTom International BV, LG Electronics Inc, Aisin Corporation, Garmin Ltd, Mitsubishi Electric Corporation, JVC Kenwood Corporatio, Harman International Industries, Robert Bosch GmbH, Faurecia Clarion Electronics Co Ltd, Panasonic Holdings Corporation.

3. What are the main segments of the Automotive GPS System Market?

The market segments include Vehicle Type, Sales Channel, Screen Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Shifting Preference of Consumers to Avail Private Medium of Transportation.

6. What are the notable trends driving market growth?

Aftermarket Segment to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Purchase and Installation Costs.

8. Can you provide examples of recent developments in the market?

August 2023: EVgo Inc. announced its collaboration with Amazon to launch an Alexa-enabled electric vehicle charging experience for customers. The PlugShare API integration creates a seamless charging experience for Alexa-enabled EVs, including Nissan ARIYA, Ford Mustang Mach-E, and F-150 Lightning. Through simple voice requests such as, ‘Alexa, find EV charging stations near me,’ customers can locate and drive to the nearest charging station, eliminating the need to stop and search for available stations manually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive GPS System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive GPS System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive GPS System Market?

To stay informed about further developments, trends, and reports in the Automotive GPS System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence