Key Insights

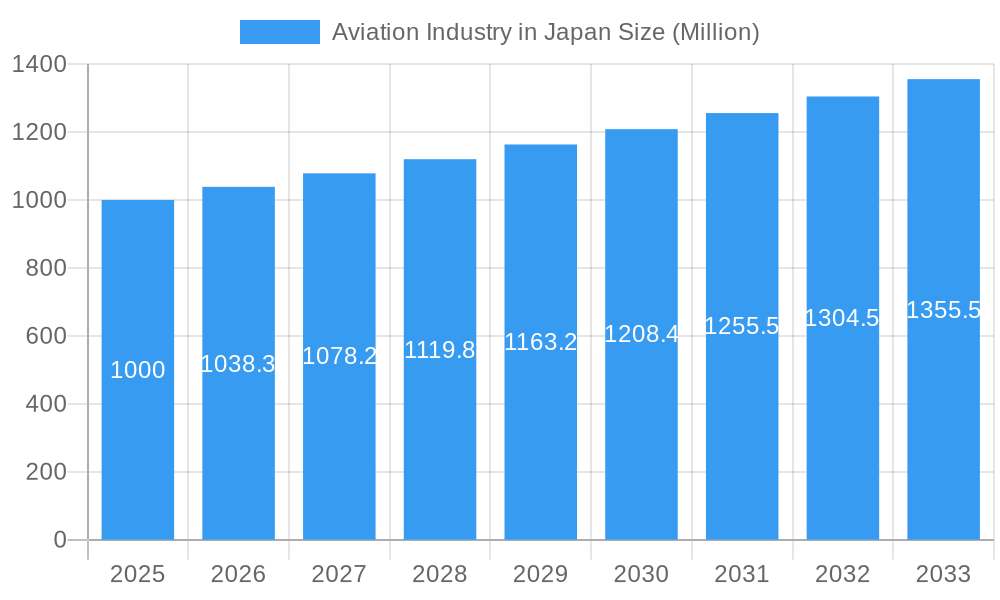

Japan's aviation industry, including commercial and other aviation sectors, demonstrates substantial market potential and robust growth. The market, valued at approximately $16.9 billion in 2024, is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% from 2024 to 2033. This expansion is driven by increasing domestic and international passenger traffic, a growing middle class with enhanced disposable income for air travel, and significant government investment in airport infrastructure upgrades, including Narita, Haneda, and Kansai International Airport. Fleet modernization efforts by Japanese airlines and rising demand for air freight services further bolster this positive growth trajectory. While fuel price volatility and potential economic downturns present challenges, the overall market outlook remains highly optimistic.

Aviation Industry in Japan Market Size (In Billion)

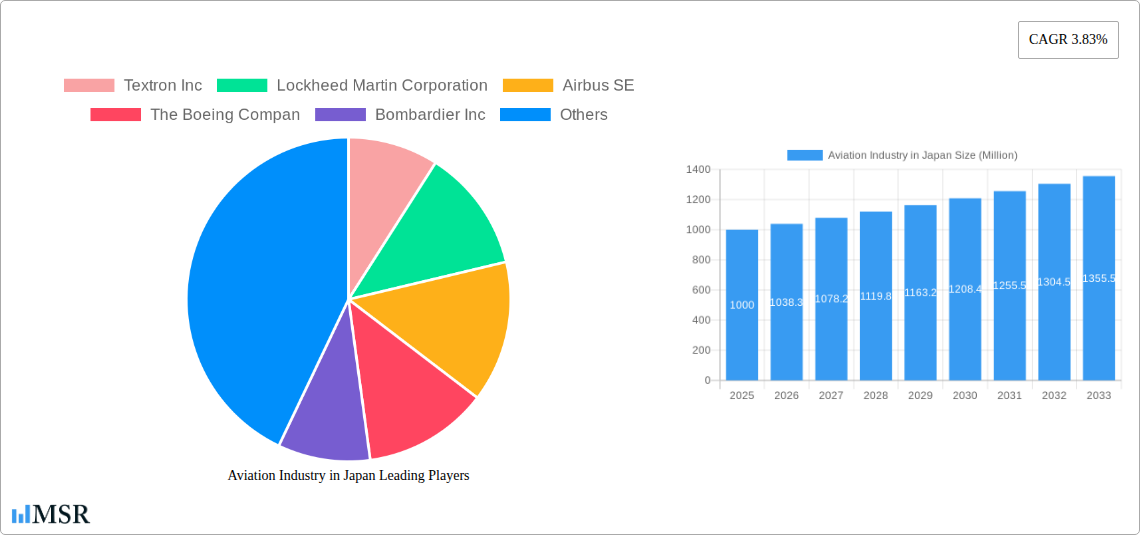

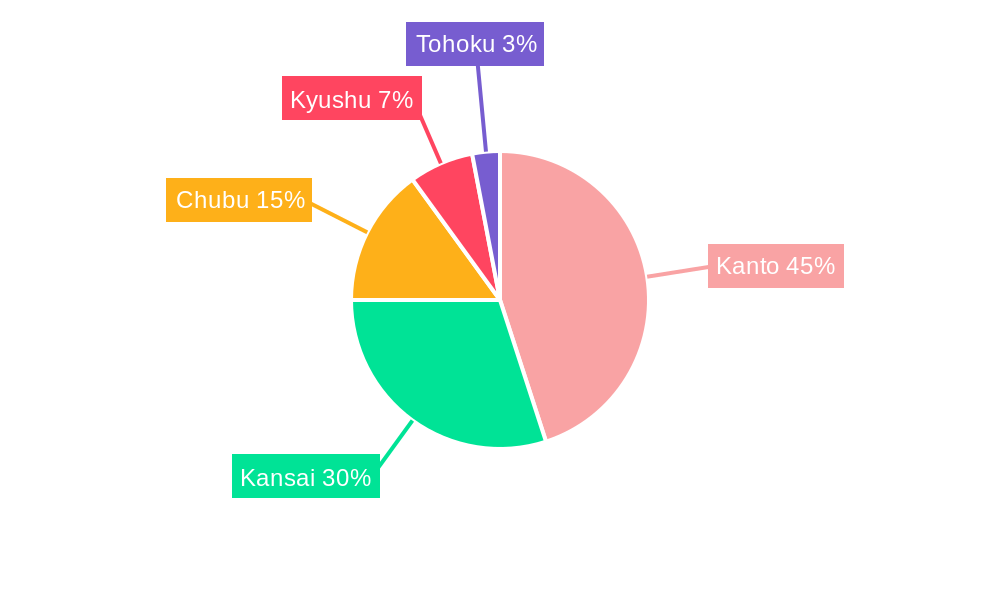

Market activity is predominantly concentrated in the Kanto (Tokyo) and Kansai (Osaka-Kobe-Kyoto) regions, home to Japan's largest and busiest airports. These regions command a substantial share of air travel. Emerging growth prospects are evident in the Chubu and Kyushu regions, benefiting from ongoing economic development and infrastructure enhancements. The market is primarily segmented into commercial aviation, with a growing "other" segment that includes general aviation, military aviation, and associated services. Leading industry participants such as Textron Inc, Lockheed Martin Corporation, Airbus SE, The Boeing Company, Bombardier Inc, ATR, and Kawasaki Heavy Industries Ltd. are key contributors to market development through aircraft manufacturing, MRO services, and related activities. The forecast period of 2024-2033 offers significant opportunities for continued expansion and innovation within the Japanese aviation sector.

Aviation Industry in Japan Company Market Share

Aviation Industry in Japan: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japanese aviation industry, covering market dynamics, key players, and future growth prospects. The study period spans 2019-2033, with 2025 serving as the base and estimated year. This report is invaluable for industry stakeholders, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector.

Aviation Industry in Japan Market Concentration & Dynamics

The Japanese aviation market exhibits a moderately concentrated structure, with a few major players dominating various segments. Market share data reveals that Boeing and Airbus hold significant positions in the commercial aviation segment, while Kawasaki Heavy Industries Ltd. plays a crucial role in domestic manufacturing and maintenance. The industry's innovative ecosystem is robust, with several research institutions and collaborations driving technological advancements. Japan's stringent regulatory framework, overseen by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), ensures high safety standards but can also pose challenges for new entrants. Substitute products, such as high-speed rail for shorter distances, exert some competitive pressure. End-user trends are increasingly focused on sustainability and efficiency, impacting aircraft demand and technological innovation. The M&A landscape has seen xx deals in the last five years, mostly focused on smaller companies being acquired by larger players aiming for market consolidation. The average market share of the top 3 players is estimated at 70% in 2025.

Aviation Industry in Japan Industry Insights & Trends

The Japanese aviation industry is projected to experience substantial growth during the forecast period (2025-2033). The market size in 2025 is estimated at $XX Million, with a compound annual growth rate (CAGR) of XX% predicted until 2033, driven by factors like rising disposable incomes, increased tourism, and government investments in airport infrastructure. Technological disruptions, such as the adoption of more fuel-efficient aircraft and advanced air mobility solutions, are reshaping the industry. Evolving consumer behaviors, including a preference for personalized travel experiences and increased focus on sustainability, are influencing airline strategies and operational models. Government policies focusing on decarbonization are pushing innovation in sustainable aviation fuel and electric/hybrid propulsion systems. The growth is also being supported by government initiatives to enhance airport infrastructure to manage the growing air travel.

Key Markets & Segments Leading Aviation Industry in Japan

Commercial Aviation: This segment dominates the Japanese aviation market, driven by robust economic growth, expanding tourism, and a well-developed air travel infrastructure. The rising middle class in Japan fuels increased demand for air travel both domestically and internationally. Major airports like Narita and Haneda in Tokyo serve as crucial hubs for this segment.

Others: This segment includes general aviation, military aviation, and maintenance, repair, and overhaul (MRO) services. The growth in this segment is spurred by government defense spending and increasing demand for specialized aviation services.

The dominance of commercial aviation is undeniable, contributing approximately xx% of the overall market revenue in 2025. The consistent growth in passenger traffic, supported by Japan's expanding economy and strategic location in the Asia-Pacific region, guarantees continued dominance.

Aviation Industry in Japan Product Developments

Significant product innovations are transforming the Japanese aviation landscape. Manufacturers are focusing on developing fuel-efficient aircraft, incorporating advanced technologies like AI-powered predictive maintenance, and integrating sustainable aviation fuels to meet environmental regulations and consumer demands for eco-friendly travel. These innovations provide competitive advantages by reducing operational costs and improving overall efficiency, enhancing the appeal to airlines and passengers.

Challenges in the Aviation Industry in Japan Market

The Japanese aviation industry faces various challenges including stringent regulatory hurdles that increase compliance costs, volatile fuel prices impacting operational profitability, and intense competition from both domestic and international players. Supply chain disruptions, particularly those observed after the pandemic, have also impacted operations and aircraft deliveries. These factors can significantly impact the overall market growth and profitability of businesses in the aviation industry.

Forces Driving Aviation Industry in Japan Growth

Several factors fuel the growth of the Japanese aviation industry. Technological advancements in aircraft design, engine efficiency, and air traffic management systems contribute significantly. Government support through airport infrastructure development and favorable policies promotes growth. The increase in both domestic and international tourism significantly expands the passenger market. Furthermore, the rising middle class contributes to higher discretionary spending enabling more people to afford air travel.

Long-Term Growth Catalysts in the Aviation Industry in Japan

Long-term growth will be driven by innovation in sustainable aviation fuels, development of next-generation aircraft technologies, strategic partnerships between manufacturers and airlines, and expansion into new regional markets within Asia. Government initiatives to improve the digital infrastructure of airports, improving the passenger experience will also contribute to the growth of the sector.

Emerging Opportunities in Aviation Industry in Japan

The rise of advanced air mobility (AAM), including urban air mobility (UAM), presents significant opportunities. Growth in cargo transport and the increasing demand for specialized aviation services offer further potential. The development of sustainable aviation technologies and focusing on passenger experience is critical in tapping the growth in the aviation sector.

Leading Players in the Aviation Industry in Japan Sector

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- Bombardier Inc

- ATR

- Kawasaki Heavy Industries Ltd

Key Milestones in Aviation Industry in Japan Industry

- November 2022: Boeing secured a contract to deliver two additional KC-46A Pegasus tankers to the Japan Air Self-Defense Force (JASDF), reinforcing its position in the military aviation segment.

- November 2022: Bell Textron Inc. signed an agreement to sell 10 Bell 505 helicopters to the Royal Jordanian Air Force, showcasing the global demand for its products.

- December 2022: Textron Inc.'s Bell unit won a US Army contract to supply next-generation helicopters, highlighting technological advancements and the company's competitive edge.

Strategic Outlook for Aviation Industry in Japan Market

The Japanese aviation market presents a significant growth opportunity over the next decade. Strategic partnerships, technological advancements, and increased focus on sustainability will be pivotal for success. Companies should prioritize investments in innovation, operational efficiency, and customer experience to capture market share in this dynamic and evolving sector.

Aviation Industry in Japan Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aviation

-

1.1.1. By Sub Aircraft Type

- 1.1.1.1. Freighter Aircraft

-

1.1.1.2. Passenger Aircraft

-

1.1.1.2.1. By Body Type

- 1.1.1.2.1.1. Narrowbody Aircraft

- 1.1.1.2.1.2. Widebody Aircraft

-

1.1.1.2.1. By Body Type

-

1.1.1. By Sub Aircraft Type

-

1.2. General Aviation

-

1.2.1. Business Jets

- 1.2.1.1. Large Jet

- 1.2.1.2. Light Jet

- 1.2.1.3. Mid-Size Jet

- 1.2.2. Piston Fixed-Wing Aircraft

- 1.2.3. Others

-

1.2.1. Business Jets

-

1.3. Military Aviation

- 1.3.1. Multi-Role Aircraft

- 1.3.2. Training Aircraft

- 1.3.3. Transport Aircraft

-

1.3.4. Rotorcraft

- 1.3.4.1. Multi-Mission Helicopter

- 1.3.4.2. Transport Helicopter

-

1.1. Commercial Aviation

Aviation Industry in Japan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aviation Industry in Japan Regional Market Share

Geographic Coverage of Aviation Industry in Japan

Aviation Industry in Japan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aviation

- 5.1.1.1. By Sub Aircraft Type

- 5.1.1.1.1. Freighter Aircraft

- 5.1.1.1.2. Passenger Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1.2.1.1. Narrowbody Aircraft

- 5.1.1.1.2.1.2. Widebody Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1. By Sub Aircraft Type

- 5.1.2. General Aviation

- 5.1.2.1. Business Jets

- 5.1.2.1.1. Large Jet

- 5.1.2.1.2. Light Jet

- 5.1.2.1.3. Mid-Size Jet

- 5.1.2.2. Piston Fixed-Wing Aircraft

- 5.1.2.3. Others

- 5.1.2.1. Business Jets

- 5.1.3. Military Aviation

- 5.1.3.1. Multi-Role Aircraft

- 5.1.3.2. Training Aircraft

- 5.1.3.3. Transport Aircraft

- 5.1.3.4. Rotorcraft

- 5.1.3.4.1. Multi-Mission Helicopter

- 5.1.3.4.2. Transport Helicopter

- 5.1.1. Commercial Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Commercial Aviation

- 6.1.1.1. By Sub Aircraft Type

- 6.1.1.1.1. Freighter Aircraft

- 6.1.1.1.2. Passenger Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1.2.1.1. Narrowbody Aircraft

- 6.1.1.1.2.1.2. Widebody Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1. By Sub Aircraft Type

- 6.1.2. General Aviation

- 6.1.2.1. Business Jets

- 6.1.2.1.1. Large Jet

- 6.1.2.1.2. Light Jet

- 6.1.2.1.3. Mid-Size Jet

- 6.1.2.2. Piston Fixed-Wing Aircraft

- 6.1.2.3. Others

- 6.1.2.1. Business Jets

- 6.1.3. Military Aviation

- 6.1.3.1. Multi-Role Aircraft

- 6.1.3.2. Training Aircraft

- 6.1.3.3. Transport Aircraft

- 6.1.3.4. Rotorcraft

- 6.1.3.4.1. Multi-Mission Helicopter

- 6.1.3.4.2. Transport Helicopter

- 6.1.1. Commercial Aviation

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. South America Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Commercial Aviation

- 7.1.1.1. By Sub Aircraft Type

- 7.1.1.1.1. Freighter Aircraft

- 7.1.1.1.2. Passenger Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1.2.1.1. Narrowbody Aircraft

- 7.1.1.1.2.1.2. Widebody Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1. By Sub Aircraft Type

- 7.1.2. General Aviation

- 7.1.2.1. Business Jets

- 7.1.2.1.1. Large Jet

- 7.1.2.1.2. Light Jet

- 7.1.2.1.3. Mid-Size Jet

- 7.1.2.2. Piston Fixed-Wing Aircraft

- 7.1.2.3. Others

- 7.1.2.1. Business Jets

- 7.1.3. Military Aviation

- 7.1.3.1. Multi-Role Aircraft

- 7.1.3.2. Training Aircraft

- 7.1.3.3. Transport Aircraft

- 7.1.3.4. Rotorcraft

- 7.1.3.4.1. Multi-Mission Helicopter

- 7.1.3.4.2. Transport Helicopter

- 7.1.1. Commercial Aviation

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Europe Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Commercial Aviation

- 8.1.1.1. By Sub Aircraft Type

- 8.1.1.1.1. Freighter Aircraft

- 8.1.1.1.2. Passenger Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1.2.1.1. Narrowbody Aircraft

- 8.1.1.1.2.1.2. Widebody Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1. By Sub Aircraft Type

- 8.1.2. General Aviation

- 8.1.2.1. Business Jets

- 8.1.2.1.1. Large Jet

- 8.1.2.1.2. Light Jet

- 8.1.2.1.3. Mid-Size Jet

- 8.1.2.2. Piston Fixed-Wing Aircraft

- 8.1.2.3. Others

- 8.1.2.1. Business Jets

- 8.1.3. Military Aviation

- 8.1.3.1. Multi-Role Aircraft

- 8.1.3.2. Training Aircraft

- 8.1.3.3. Transport Aircraft

- 8.1.3.4. Rotorcraft

- 8.1.3.4.1. Multi-Mission Helicopter

- 8.1.3.4.2. Transport Helicopter

- 8.1.1. Commercial Aviation

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Middle East & Africa Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Commercial Aviation

- 9.1.1.1. By Sub Aircraft Type

- 9.1.1.1.1. Freighter Aircraft

- 9.1.1.1.2. Passenger Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1.2.1.1. Narrowbody Aircraft

- 9.1.1.1.2.1.2. Widebody Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1. By Sub Aircraft Type

- 9.1.2. General Aviation

- 9.1.2.1. Business Jets

- 9.1.2.1.1. Large Jet

- 9.1.2.1.2. Light Jet

- 9.1.2.1.3. Mid-Size Jet

- 9.1.2.2. Piston Fixed-Wing Aircraft

- 9.1.2.3. Others

- 9.1.2.1. Business Jets

- 9.1.3. Military Aviation

- 9.1.3.1. Multi-Role Aircraft

- 9.1.3.2. Training Aircraft

- 9.1.3.3. Transport Aircraft

- 9.1.3.4. Rotorcraft

- 9.1.3.4.1. Multi-Mission Helicopter

- 9.1.3.4.2. Transport Helicopter

- 9.1.1. Commercial Aviation

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Asia Pacific Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Commercial Aviation

- 10.1.1.1. By Sub Aircraft Type

- 10.1.1.1.1. Freighter Aircraft

- 10.1.1.1.2. Passenger Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1.2.1.1. Narrowbody Aircraft

- 10.1.1.1.2.1.2. Widebody Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1. By Sub Aircraft Type

- 10.1.2. General Aviation

- 10.1.2.1. Business Jets

- 10.1.2.1.1. Large Jet

- 10.1.2.1.2. Light Jet

- 10.1.2.1.3. Mid-Size Jet

- 10.1.2.2. Piston Fixed-Wing Aircraft

- 10.1.2.3. Others

- 10.1.2.1. Business Jets

- 10.1.3. Military Aviation

- 10.1.3.1. Multi-Role Aircraft

- 10.1.3.2. Training Aircraft

- 10.1.3.3. Transport Aircraft

- 10.1.3.4. Rotorcraft

- 10.1.3.4.1. Multi-Mission Helicopter

- 10.1.3.4.2. Transport Helicopter

- 10.1.1. Commercial Aviation

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Airbus SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Boeing Compan

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bombardier Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ATR

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kawasaki Heavy Industries Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Aviation Industry in Japan Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 3: North America Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 4: North America Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 7: South America Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 8: South America Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 11: Europe Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 12: Europe Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 15: Middle East & Africa Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 16: Middle East & Africa Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 19: Asia Pacific Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 20: Asia Pacific Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 2: Global Aviation Industry in Japan Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 4: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 9: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 14: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 25: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 33: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Industry in Japan?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Aviation Industry in Japan?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, Bombardier Inc, ATR, Kawasaki Heavy Industries Ltd.

3. What are the main segments of the Aviation Industry in Japan?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.November 2022: Boeing was awarded a contract to deliver two additional KC-46A Pegasus tankers to the Japan Air Self-Defense Force (JASDF), bringing the total on contract for Japan to six.November 2022: Bell Textron Inc., a company of Textron Inc., forged an agreement to sell 10 Bell 505 helicopters to the Royal Jordanian Air Force (RJAF) at the Forces Exhibition and Conference. Combat Air Force (SOFEX) in Aqaba, Jordan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Industry in Japan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Industry in Japan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Industry in Japan?

To stay informed about further developments, trends, and reports in the Aviation Industry in Japan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence