Key Insights

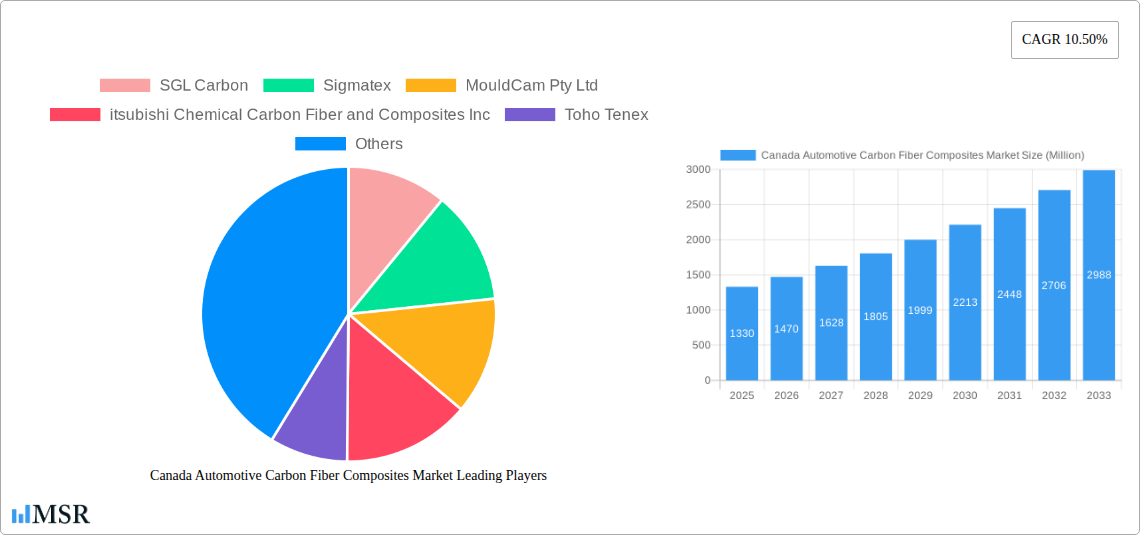

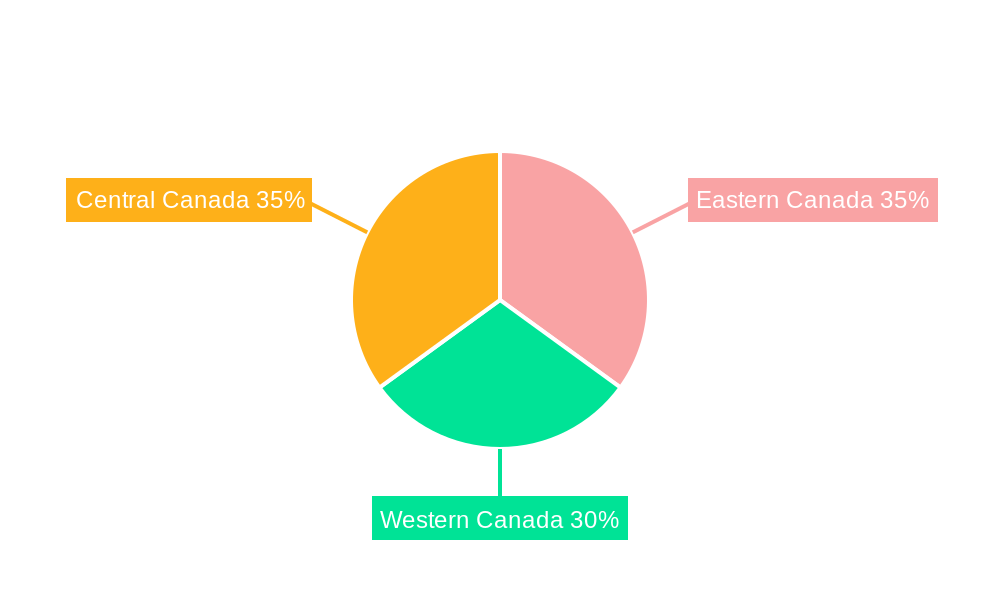

The Canada Automotive Carbon Fiber Composites market, valued at $1.33 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.50% from 2025 to 2033. This expansion is driven primarily by the increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions, aligning with global sustainability initiatives. The automotive industry's ongoing shift towards electric vehicles (EVs) further fuels this growth, as carbon fiber composites offer superior performance characteristics compared to traditional materials in EV battery packs and chassis components. Key application segments include structural assembly, powertrain components (e.g., drive shafts and engine parts), and both interior and exterior automotive parts where lightweighting and design flexibility are crucial. Growth is also fueled by advancements in manufacturing techniques, leading to cost reductions and improved production scalability for carbon fiber composites. While the market faces challenges related to the relatively high cost of carbon fiber compared to traditional materials, ongoing research and development aimed at reducing production costs and improving performance are mitigating these restraints. The regional breakdown within Canada shows significant potential across Eastern, Western, and Central Canada, reflecting the country's diverse automotive manufacturing landscape. Major players like SGL Carbon, Sigmatex, Toray Industries, and Hexcel Corporation are driving innovation and competition in the market.

Canada Automotive Carbon Fiber Composites Market Market Size (In Billion)

The continued investment in research and development, focused on improving the processing efficiency and reducing the cost of carbon fiber composites, is expected to be a major factor in the market’s future growth. The expanding electric vehicle market will further propel demand for these materials, as their lightweight and high-strength properties become increasingly important in battery pack design and chassis construction. Regional growth will likely be influenced by government policies supporting sustainable transportation and the presence of established automotive manufacturing clusters. Strategic partnerships and collaborations between material suppliers, automotive manufacturers, and technology providers will also play a pivotal role in shaping the future competitive landscape of the Canadian automotive carbon fiber composites market.

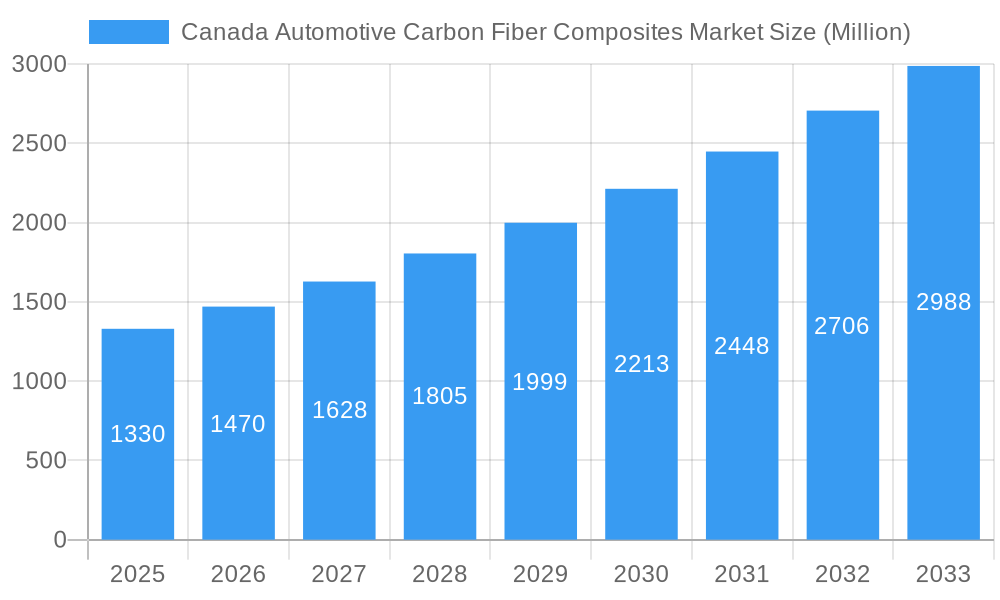

Canada Automotive Carbon Fiber Composites Market Company Market Share

Canada Automotive Carbon Fiber Composites Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canada Automotive Carbon Fiber Composites Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on the 2025-2033 forecast period, this report meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities within the Canadian automotive landscape. The report leverages robust data analysis and expert insights to provide a clear and actionable understanding of this rapidly evolving market. The base year for this analysis is 2025.

Canada Automotive Carbon Fiber Composites Market Market Concentration & Dynamics

The Canadian automotive carbon fiber composites market exhibits a moderately concentrated structure, with a few major players holding significant market share. The market share distribution, however, is dynamic, influenced by ongoing mergers and acquisitions (M&A) activities, technological advancements, and the entry of new players. Over the historical period (2019-2024), approximately xx M&A deals were recorded, signifying a level of consolidation within the sector. Innovation is crucial, with key players focusing on developing high-performance materials and manufacturing processes to cater to the growing demand for lightweight and fuel-efficient vehicles. The regulatory framework, particularly concerning environmental regulations and safety standards, significantly impacts market dynamics. Substitute products, such as advanced metal alloys and other lightweight materials, pose a degree of competitive pressure. End-user trends, driven by the increasing adoption of electric vehicles (EVs) and the push for sustainable mobility solutions, are a major catalyst for growth in carbon fiber composites adoption.

- Market Concentration: Moderately concentrated, with a few dominant players holding approximately xx% of the total market share.

- M&A Activity: xx deals recorded from 2019-2024, indicating a consolidating market.

- Innovation Ecosystem: Strong focus on R&D for high-performance materials and manufacturing processes.

- Regulatory Framework: Compliance with stringent safety and environmental standards is essential.

- Substitute Products: Competition from alternative lightweight materials, including advanced metal alloys.

- End-User Trends: Growing demand for EVs and sustainable mobility solutions drives market growth.

Canada Automotive Carbon Fiber Composites Market Industry Insights & Trends

The Canadian automotive carbon fiber composites market is experiencing robust growth, fueled by several key factors. The market size in 2025 is estimated at xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is largely driven by the increasing demand for lightweight vehicles, particularly in the EV sector, where carbon fiber composites offer significant advantages in terms of performance, efficiency, and range. Technological disruptions, such as advancements in manufacturing techniques and the development of new carbon fiber materials with enhanced properties, are accelerating market expansion. Evolving consumer preferences, particularly towards fuel-efficient and environmentally friendly vehicles, further bolster the demand for carbon fiber composites. The shift towards electric vehicles and stricter fuel efficiency standards are key growth drivers. The increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies also contribute to the growing demand for lightweight and high-strength materials like carbon fiber composites.

Key Markets & Segments Leading Canada Automotive Carbon Fiber Composites Market

Within the Canadian automotive carbon fiber composites market, the Structural Assembly segment currently holds the dominant position, followed by the Powertrain Component segment. This dominance is primarily attributable to the critical role of carbon fiber composites in enhancing vehicle structural integrity and reducing weight, thereby improving fuel efficiency and overall performance.

Drivers for Dominant Segments:

- Structural Assembly:

- Increasing demand for lightweight vehicles to improve fuel economy and reduce emissions.

- Growing adoption of advanced safety features that require high-strength materials.

- Technological advancements in manufacturing processes leading to cost reduction.

- Powertrain Component:

- Demand for lightweight and high-performance powertrain components in EVs and hybrid vehicles.

- Enhanced thermal management properties of carbon fiber composites in battery systems.

- Stringent emission regulations promoting the adoption of lightweight powertrains.

Dominance Analysis: The Structural Assembly segment's dominance stems from its essential role in vehicle safety and performance. The increasing adoption of EVs is further accelerating the demand for lighter and stronger vehicle bodies, boosting this segment's growth. The Powertrain segment follows, driven by the need for efficient and high-performance components in EVs and hybrid vehicles.

Canada Automotive Carbon Fiber Composites Market Product Developments

Recent advancements in carbon fiber composite technology have led to the development of materials with enhanced strength-to-weight ratios, improved durability, and enhanced resistance to environmental factors. These innovations are driving broader adoption across various automotive applications, improving vehicle performance, fuel efficiency, and safety. The integration of advanced manufacturing techniques, such as automated fiber placement and resin transfer molding, further enhances product quality and reduces production costs, bolstering the competitiveness of carbon fiber composites in the automotive sector. These advancements are key to unlocking significant cost reductions and accelerating wider market adoption.

Challenges in the Canada Automotive Carbon Fiber Composites Market Market

The Canadian automotive carbon fiber composites market faces several challenges, including the relatively high cost of carbon fiber materials compared to traditional materials, and the complexity of manufacturing processes. Supply chain disruptions can also lead to production delays and increased costs. Furthermore, intense competition from established players and the emergence of new entrants necessitates continuous innovation and cost optimization strategies. These factors collectively influence market growth and penetration. The high initial investment cost required for tooling and production equipment poses a considerable barrier to entry for smaller players.

Forces Driving Canada Automotive Carbon Fiber Composites Market Growth

Several factors are driving the growth of the Canadian automotive carbon fiber composites market. Firstly, the increasing demand for lightweight vehicles to enhance fuel efficiency and reduce emissions is a significant catalyst. Secondly, stringent government regulations promoting the adoption of eco-friendly vehicles are pushing the adoption of carbon fiber composites. Thirdly, technological advancements in carbon fiber production and processing are making them more cost-effective and accessible. Lastly, the rise of electric vehicles necessitates lighter weight components, further boosting demand.

Challenges in the Canada Automotive Carbon Fiber Composites Market Market

Long-term growth catalysts for the Canadian automotive carbon fiber composites market include continued technological advancements leading to cost reduction and enhanced performance, strategic partnerships between material suppliers and automotive manufacturers fostering innovation, and expansion into new automotive applications beyond existing segments. These initiatives will pave the way for sustainable growth and greater market penetration.

Emerging Opportunities in Canada Automotive Carbon Fiber Composites Market

Emerging opportunities include the exploration of new carbon fiber materials with improved properties, the development of innovative manufacturing processes to reduce costs, and the expansion into new automotive applications like battery casings and structural components for autonomous vehicles. Further market penetration is possible by focusing on niche applications within the automotive sector and adapting to the growing demand for sustainable and eco-friendly materials. The use of recycled carbon fiber is an emerging opportunity that could reduce material costs and environmental impact.

Leading Players in the Canada Automotive Carbon Fiber Composites Market Sector

- SGL Carbon

- Sigmatex

- MouldCam Pty Ltd

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Toho Tenex

- Nippon Sheet Glass Company Limited

- Toray Industries

- Hexcel Corporation

- Solva

Key Milestones in Canada Automotive Carbon Fiber Composites Market Industry

- February 2023: Tesla's launch of its new carbon-wrapped motor significantly impacted the industry, showcasing the potential for enhanced efficiency, performance, and battery life in EVs.

- June 2023: The University of British Columbia's breakthrough in transforming bitumen into carbon fiber offers a potential new, sustainable, and domestically sourced supply chain for the Canadian automotive industry.

Strategic Outlook for Canada Automotive Carbon Fiber Composites Market Market

The Canadian automotive carbon fiber composites market holds significant future potential. Continuous innovation in material science and manufacturing processes will be key to unlocking cost reductions and expanding applications. Strategic collaborations between material suppliers, automotive manufacturers, and research institutions will accelerate technological advancements and drive market growth. Capitalizing on the rising demand for EVs and the increasing focus on sustainability will be crucial for long-term success in this dynamic market.

Canada Automotive Carbon Fiber Composites Market Segmentation

-

1. Application Type

- 1.1. Structural Assembly

- 1.2. Powertrain Component

- 1.3. Interior

- 1.4. Exterior

- 1.5. Other Applications

Canada Automotive Carbon Fiber Composites Market Segmentation By Geography

- 1. Canada

Canada Automotive Carbon Fiber Composites Market Regional Market Share

Geographic Coverage of Canada Automotive Carbon Fiber Composites Market

Canada Automotive Carbon Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Interior is Projected to Grow at an Exponential Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Structural Assembly

- 5.1.2. Powertrain Component

- 5.1.3. Interior

- 5.1.4. Exterior

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGL Carbon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sigmatex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MouldCam Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 itsubishi Chemical Carbon Fiber and Composites Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toho Tenex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Sheet Glass Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toray Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hexcel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solva

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGL Carbon

List of Figures

- Figure 1: Canada Automotive Carbon Fiber Composites Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Carbon Fiber Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Carbon Fiber Composites Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the Canada Automotive Carbon Fiber Composites Market?

Key companies in the market include SGL Carbon, Sigmatex, MouldCam Pty Ltd, itsubishi Chemical Carbon Fiber and Composites Inc, Toho Tenex, Nippon Sheet Glass Company Limited, Toray Industries, Hexcel Corporation, Solva.

3. What are the main segments of the Canada Automotive Carbon Fiber Composites Market?

The market segments include Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Interior is Projected to Grow at an Exponential Rate.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

February 2023: Tesla's new carbon-wrapped motor made waves in the automotive industry, with many touting it as the world's most advanced motor. This innovative technology is expected to offer increased efficiency, improved performance, longer battery life, and environmental benefits for electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Carbon Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Carbon Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Carbon Fiber Composites Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Carbon Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence