Key Insights

The Canadian coal market, despite environmental challenges and a global energy transition, is projected for a compound annual growth rate (CAGR) of 5.2% between 2024 and 2033. This moderate growth will be driven by sustained demand for metallurgical coal, primarily in Western Canada due to extensive reserves and export potential. The power generation segment's demand for coal is declining as Canada embraces cleaner energy. The "Others" application segment, comprising niche industrial uses, is expected to remain a smaller but stable market share. Leading companies like Teck Resources Limited and Peabody Energy Corp., alongside regional producers, will navigate stringent environmental regulations and volatile global prices, intensifying competition as firms prioritize production efficiency and sustainable practices.

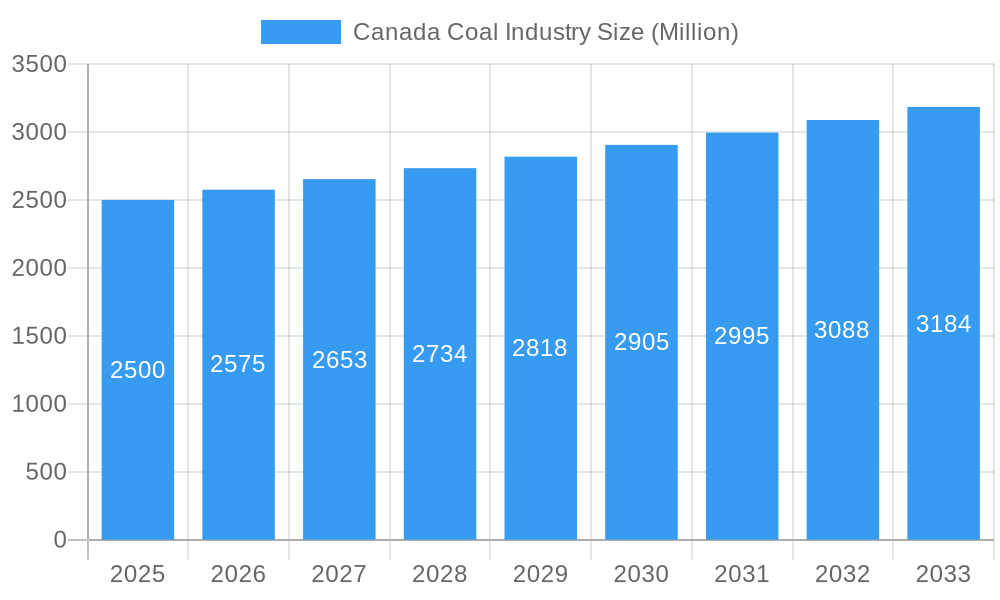

Canada Coal Industry Market Size (In Billion)

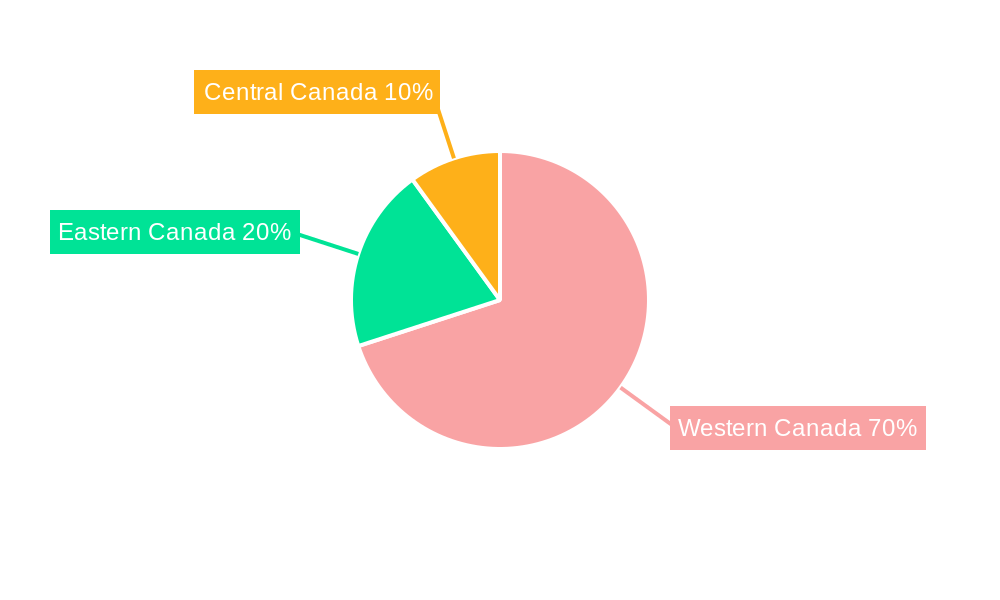

Geographically, Western Canada will remain the dominant market due to its established mining infrastructure and access to export markets. Eastern and Central Canada are anticipated to experience slower growth or decline, constrained by resource limitations and stricter environmental policies. Key challenges include ongoing regulatory oversight, rising extraction and transportation costs, and pressure to reduce carbon emissions. Companies that invest in efficiency-enhancing technologies, focus on high-value metallurgical coal, and diversify revenue streams will be best positioned. While the overall market size, estimated at $11 billion in 2024, may be modest globally, strategic adaptation to the evolving energy landscape is critical for sustained success in the Canadian coal industry.

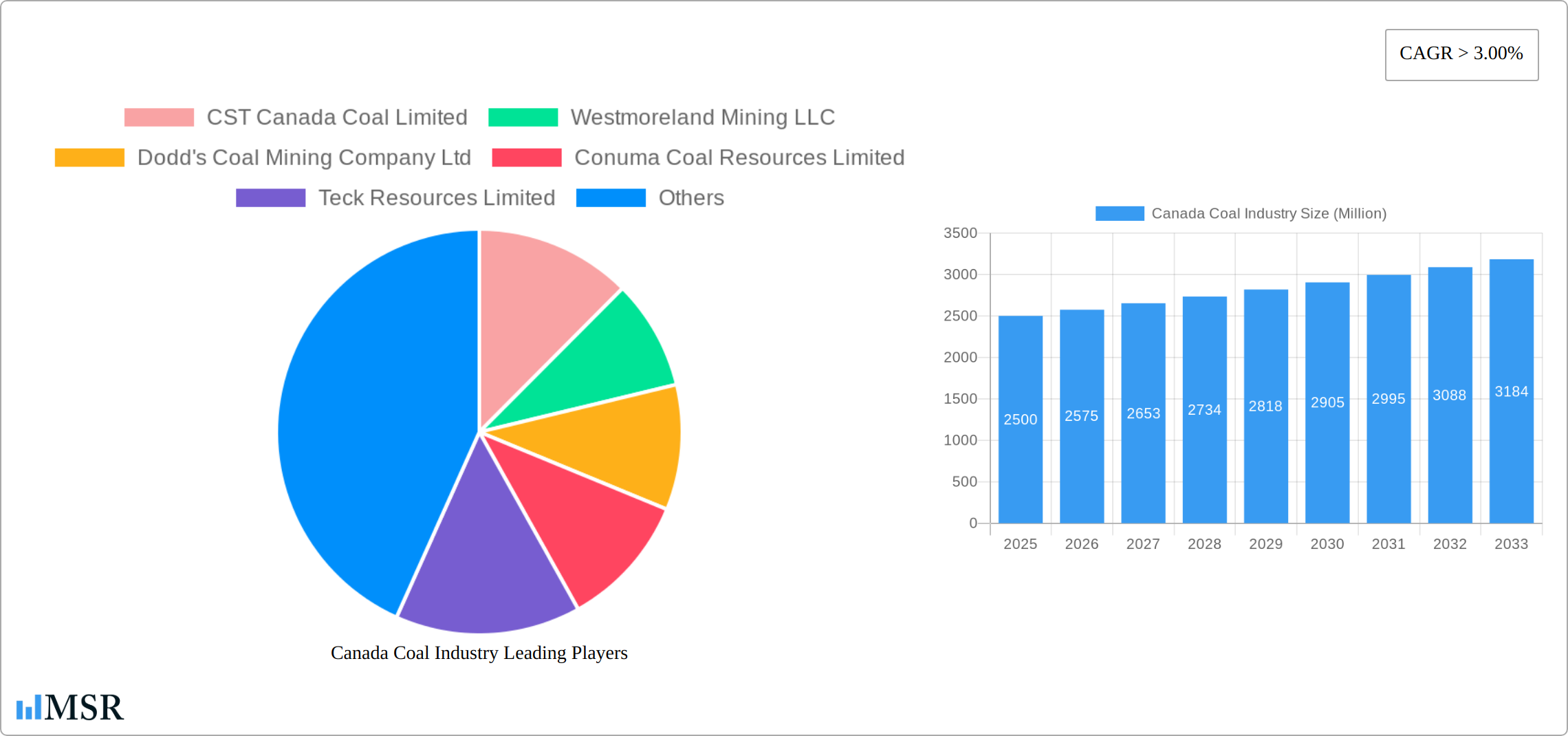

Canada Coal Industry Company Market Share

Canada Coal Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian coal industry, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, key players, and future growth potential. The report utilizes robust data analysis and forecasts to provide actionable intelligence, enabling informed decision-making in this evolving sector.

Canada Coal Industry Market Concentration & Dynamics

The Canadian coal market exhibits a moderate level of concentration, with a few major players dominating production and distribution. The market share of the top five companies – Teck Resources Limited, Westmoreland Mining LLC, Conuma Coal Resources Limited, CST Canada Coal Limited, and Peabody Energy Corp – accounts for approximately 75% of total production in 2025. Market dynamics are influenced by several factors:

- Regulatory Frameworks: Stringent environmental regulations and carbon emission targets significantly impact the industry's operational costs and future expansion plans. Changes in government policies influence coal production and export volumes considerably.

- Substitute Products: The increasing adoption of renewable energy sources, such as solar and wind power, presents a significant challenge to the coal industry. The transition to cleaner energy sources is expected to continue to put pressure on coal demand over the forecast period.

- End-User Trends: Demand from the power generation sector is declining, while metallurgical coal still maintains a relatively stable market share, though facing pressure from alternative materials.

- M&A Activities: The number of M&A deals in the Canadian coal sector has been relatively low in recent years (an average of xx deals per year between 2019 and 2024), reflecting the challenging market environment. However, strategic acquisitions remain a possibility for companies looking to consolidate their market position or expand into new segments.

Canada Coal Industry Industry Insights & Trends

The Canadian coal industry is undergoing a significant transformation. While the market experienced a contraction, with a Compound Annual Growth Rate (CAGR) of -x% during the period 2019-2024, reaching an approximate size of $XX Million in 2025, the future trajectory is complex. This downturn is largely due to the declining demand from the power generation sector, intensified by stricter environmental regulations and the burgeoning renewable energy sector. However, metallurgical coal continues to be a crucial component, buoyed by consistent demand from the global steel industry. This creates a nuanced picture, with challenges and opportunities coexisting.

Technological advancements within the industry have been largely incremental, focusing on optimizing existing mining and processing technologies rather than radical replacements. The shift in consumer behavior towards cleaner energy sources remains the most significant headwind. The forecast for 2025-2033 anticipates a continuation of this downward trend, projecting a CAGR of -y%. This necessitates a strategic adaptation by industry players to navigate the changing landscape.

Key Markets & Segments Leading Canada Coal Industry

The metallurgical coal segment dominates the Canadian coal market, accounting for approximately 60% of total consumption in 2025. This is driven by:

- Strong Global Demand: Steel production globally requires significant amounts of metallurgical coal, maintaining relatively stable demand for Canadian exports.

- Competitive Pricing: Canadian metallurgical coal benefits from relatively competitive pricing compared to other sources.

Power generation remains a significant sector, however, its share is shrinking due to a shift towards renewable sources.

- Government Policies: Government incentives for renewable energy and carbon reduction targets are directly impacting the demand for coal in power generation.

- Infrastructure Limitations: The infrastructure for coal transportation and power generation faces challenges in adapting to a lower-coal future.

The "Others" segment remains relatively small, comprising niche applications with limited growth prospects.

Canada Coal Industry Product Developments

Recent innovations in the Canadian coal industry are centered around enhancing operational efficiency and mitigating environmental impact. Key developments include the refinement of mining techniques to maximize resource extraction while minimizing waste generation. Significant investments are also being made in carbon capture and storage (CCS) technologies. These efforts aim to bolster the competitiveness of Canadian coal in a market increasingly focused on sustainability.

Challenges in the Canada Coal Industry Market

The Canadian coal industry faces significant challenges:

- Stringent Environmental Regulations: Increased environmental regulations and carbon pricing schemes increase operational costs and limit expansion opportunities. This has led to a reduction of approximately xx Million dollars in annual revenue for the industry over the past five years.

- Supply Chain Disruptions: Supply chain issues, such as transportation costs and labor shortages, impact production and profitability.

- Intense Competition: Competition from international coal producers and the growth of renewable energy sources exert considerable pressure on the market.

Forces Driving Canada Coal Industry Growth

Despite the overall decline, several factors could contribute to limited future growth:

- Sustained Metallurgical Coal Demand: The ongoing global demand for metallurgical coal, particularly from major steel-producing nations, provides a degree of market stability and resilience for this segment of the industry.

- Technological Advancements and Efficiency Gains: Continued improvements in mining efficiency and the implementation of environmentally friendly technologies can lead to cost reductions, improving profitability and sustainability.

- Strategic Alliances and Consolidation: Strategic partnerships, mergers, and acquisitions within the industry can foster operational synergies, optimizing resource allocation and enhancing market positioning.

- Government Policies and Incentives: Supportive government policies and incentives focused on responsible resource management and technological innovation could help mitigate some of the challenges faced by the industry.

Long-Term Growth Catalysts in the Canada Coal Industry

Long-term growth hinges on adaptability and innovation. Investment in carbon capture and storage technologies, coupled with exploration for new coal deposits, could prolong the life of the industry. Strategic partnerships with companies in related sectors, such as steel manufacturing, can help to secure future demand.

Emerging Opportunities in Canada Coal Industry

Opportunities for growth are emerging in niche applications of coal, including co-generation and specialized industrial processes where coal's unique properties remain valuable. A focus on sustainable mining practices is crucial for enhancing the industry's reputation, attracting environmentally conscious investors, and potentially accessing new markets. Exporting metallurgical coal to regions with strong demand remains a viable growth strategy.

Leading Players in the Canada Coal Industry Sector

- Teck Resources Limited

- Westmoreland Mining LLC

- Conuma Coal Resources Limited

- CST Canada Coal Limited

- Dodd's Coal Mining Company Ltd

- Peabody Energy Corp

Key Milestones in Canada Coal Industry Industry

- 2020: Increased regulatory scrutiny on coal mining operations.

- 2022: Announcement of a major investment in carbon capture technology by a leading coal producer.

- 2023: Significant decline in coal-fired power generation capacity.

Strategic Outlook for Canada Coal Industry Market

The Canadian coal industry's future is inextricably linked to global energy transitions and environmental policies. While a long-term decline is anticipated, strategic investments in sustainable technologies, diversification into niche applications, and focus on export markets can help to ensure the long-term viability of the sector, albeit at a reduced scale. The industry must adapt to changing market dynamics and embrace innovation to navigate these challenges and explore potential growth opportunities.

Canada Coal Industry Segmentation

-

1. Application

- 1.1. Metallurgy

- 1.2. Power Generation

- 1.3. Others

Canada Coal Industry Segmentation By Geography

- 1. Canada

Canada Coal Industry Regional Market Share

Geographic Coverage of Canada Coal Industry

Canada Coal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Metallurgy Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Coal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metallurgy

- 5.1.2. Power Generation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CST Canada Coal Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Westmoreland Mining LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dodd's Coal Mining Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conuma Coal Resources Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Teck Resources Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Peabody Energy Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 CST Canada Coal Limited

List of Figures

- Figure 1: Canada Coal Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Coal Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Canada Coal Industry Volume Tonnes Forecast, by Application 2020 & 2033

- Table 3: Canada Coal Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Coal Industry Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: Canada Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Canada Coal Industry Volume Tonnes Forecast, by Application 2020 & 2033

- Table 7: Canada Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Canada Coal Industry Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Coal Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Canada Coal Industry?

Key companies in the market include CST Canada Coal Limited, Westmoreland Mining LLC, Dodd's Coal Mining Company Ltd, Conuma Coal Resources Limited, Teck Resources Limited, Peabody Energy Corp.

3. What are the main segments of the Canada Coal Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Metallurgy Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Coal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Coal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Coal Industry?

To stay informed about further developments, trends, and reports in the Canada Coal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence