Key Insights

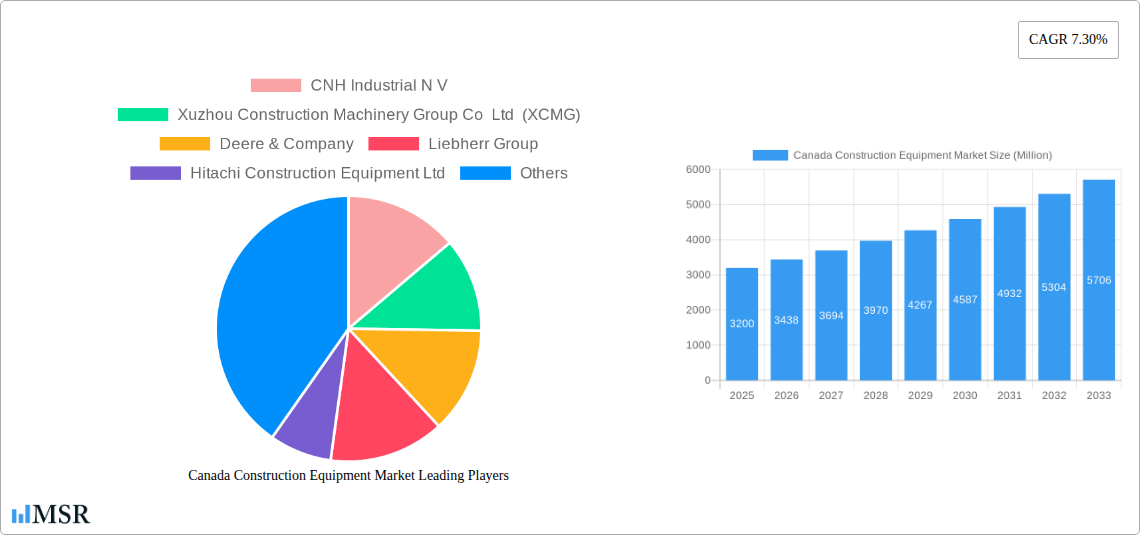

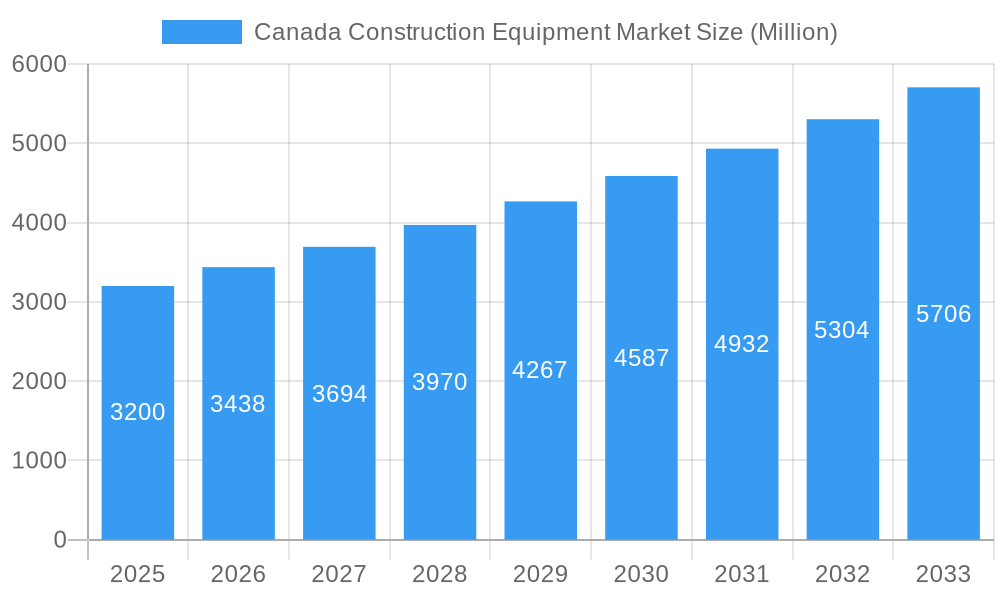

The Canada Construction Equipment Market is poised for robust growth, projected to reach a market size of $3.20 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.30% from 2025 to 2033. This expansion is fueled by several key drivers. Significant infrastructure development projects across Canada, particularly in urban areas and resource-rich provinces, are creating a high demand for construction equipment. Government investments in infrastructure modernization and expansion are further stimulating market growth. Additionally, the increasing adoption of technologically advanced equipment, such as electric and hybrid machines, contributes to the market's positive trajectory. These advancements offer enhanced efficiency, reduced emissions, and improved operational safety, making them attractive to construction companies. The market is segmented by machinery type (cranes, telescopic handlers, excavators, loaders and backhoes, motor graders, other machinery types) and propulsion (internal combustion engine, electric and hybrid), reflecting diverse operational needs and technological trends. Competition is fierce, with major players like CNH Industrial N.V., XCMG, Deere & Company, Liebherr Group, and Caterpillar Inc. vying for market share. Regional variations exist within Canada, with potentially higher growth rates in provinces experiencing substantial infrastructure projects or resource extraction activities.

Canada Construction Equipment Market Market Size (In Billion)

The market's growth, however, is not without its challenges. Fluctuations in commodity prices, particularly those impacting the mining and oil & gas sectors, can affect demand for construction equipment. Economic slowdowns or uncertainties can also lead to project delays or cancellations, thereby impacting market growth. Supply chain disruptions, while less prevalent than in recent years, still present a risk to timely equipment delivery and can impact profitability. Despite these constraints, the long-term outlook for the Canadian construction equipment market remains optimistic, driven by sustained investment in infrastructure, technological innovation, and increasing urbanization. The market is expected to see continued penetration of electric and hybrid models as environmental concerns and governmental regulations push towards more sustainable construction practices. This transition will likely shape future market dynamics and competition amongst the key players.

Canada Construction Equipment Market Company Market Share

Canada Construction Equipment Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canada construction equipment market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report uses 2025 as its estimated year and leverages data from the historical period of 2019-2024 to offer a robust and future-oriented perspective on market dynamics and growth. Key segments analyzed include machinery types (cranes, telescopic handlers, excavators, loaders and backhoes, motor graders, and other machinery) and propulsion types (internal combustion engine, electric, and hybrid). Leading players such as CNH Industrial N V, Xuzhou Construction Machinery Group Co Ltd (XCMG), Deere & Company, Liebherr Group, Hitachi Construction Equipment Ltd, JC Bamford Excavators Ltd (JCB), Caterpillar Inc, Komatsu Ltd, SANY Group, and AB Volvo are profiled, providing a detailed competitive landscape analysis. The report projects a market size of xx Million by 2033, with a CAGR of xx%.

Canada Construction Equipment Market Concentration & Dynamics

The Canadian construction equipment market exhibits a moderately concentrated structure, with a few major players holding significant market share. The market share distribution amongst the top 10 players is estimated at approximately xx%. Innovation ecosystems are developing, driven by investments in electric and hybrid technologies and automation. Regulatory frameworks, including environmental regulations and safety standards, significantly impact market dynamics. Substitute products, such as alternative construction methods, pose a limited challenge. End-user trends reflect a growing demand for sustainable and efficient equipment. M&A activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Share: Top 5 players hold approximately xx% of the market.

- M&A Activity: An average of xx M&A deals per year were observed during the historical period.

- Innovation: Focus on electric and autonomous equipment is driving innovation.

- Regulation: Stringent emission standards and safety regulations influence equipment choices.

Canada Construction Equipment Market Industry Insights & Trends

The Canadian construction equipment market is poised for substantial expansion, fueled by a confluence of robust infrastructure development initiatives, significant government and private sector investments, and a growing appetite for technological innovation. The ongoing push for modernizing critical infrastructure, coupled with the increasing adoption of advanced machinery, including a discernible shift towards electric and hybrid equipment, is significantly reshaping the market landscape. Evolving industry preferences for more sustainable, fuel-efficient, and technologically integrated solutions are further propelling demand. The market size, valued at approximately XX Million in 2025, is projected to ascend to XX Million by 2033, exhibiting a compelling Compound Annual Growth Rate (CAGR) of XX%. This upward trajectory underscores a dynamic and optimistic outlook for Canada's construction sector, with a heightened demand for sophisticated and cutting-edge construction machinery.

Key Markets & Segments Leading Canada Construction Equipment Market

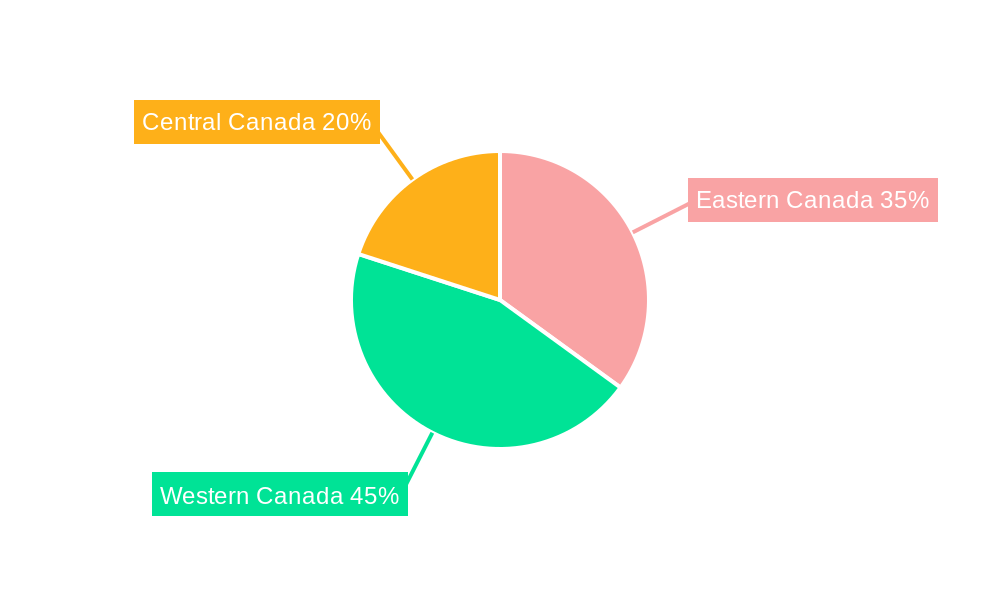

The Canadian construction equipment market shows robust growth across various segments. Excavator sales dominate the machinery segment, driven by the high demand for earthmoving equipment in infrastructure projects and mining activities. Similarly, internal combustion engine (ICE) powered equipment holds the largest market share in the propulsion segment due to the availability and affordability of this technology. The Ontario and British Columbia provinces show the highest demand for construction equipment, reflecting the robust construction activities in these regions.

- Dominant Machinery Type: Excavators, driven by infrastructure and mining activity.

- Dominant Propulsion Type: Internal Combustion Engine (ICE) due to current availability and cost-effectiveness.

- Key Regional Drivers: Strong infrastructure development in Ontario and British Columbia.

- Growth Drivers: Government investments in infrastructure, robust mining sector, and private sector construction projects.

Canada Construction Equipment Market Product Developments

Recent product developments emphasize increased efficiency, reduced emissions, and enhanced safety features. Manufacturers are actively introducing electric and hybrid models to meet environmental regulations and consumer preferences. Technological advancements, such as improved telematics systems and autonomous capabilities, are also enhancing the value proposition of construction equipment. This focus on innovation is driving competitive differentiation in the market.

Challenges in the Canada Construction Equipment Market Market

The long-term vitality of the Canadian construction equipment market will be significantly influenced by the continuous integration of pioneering technologies such as electrification and automation. These advancements are crucial for fostering more environmentally responsible and operationally efficient construction practices. Strategic alliances and collaborative ventures between equipment manufacturers and construction entities are imperative for optimizing equipment utilization, seamlessly integrating new technologies, and ensuring sustained market development. Exploring and penetrating new market segments, including the burgeoning renewable energy infrastructure development and the sophisticated demands of smart city projects, will also be pivotal for the market's enduring growth.

Forces Driving Canada Construction Equipment Market Growth

The market's robust growth is primarily underpinned by sustained and substantial investments in public and private infrastructure projects spanning the nation. Government-backed initiatives, including significant budgetary allocations towards infrastructure renewal and expansion, directly translate into heightened demand for construction equipment. Concurrently, technological advancements that enhance equipment efficiency, introduce automation capabilities, and improve operational safety offer compelling advantages for construction firms aiming to boost productivity and curtail operational expenses. Additionally, the burgeoning mining and energy sectors, with their inherent demand for heavy-duty machinery, are significant contributors to the market's expansion.

Challenges in the Canada Construction Equipment Market Market

The long-term vitality of the Canadian construction equipment market will be significantly influenced by the continuous integration of pioneering technologies such as electrification and automation. These advancements are crucial for fostering more environmentally responsible and operationally efficient construction practices. Strategic alliances and collaborative ventures between equipment manufacturers and construction entities are imperative for optimizing equipment utilization, seamlessly integrating new technologies, and ensuring sustained market development. Exploring and penetrating new market segments, including the burgeoning renewable energy infrastructure development and the sophisticated demands of smart city projects, will also be pivotal for the market's enduring growth.

Emerging Opportunities in Canada Construction Equipment Market

Emerging trends include a rising demand for environmentally friendly equipment, particularly electric and hybrid models. The increasing use of telematics and data analytics for improved fleet management and predictive maintenance presents a significant opportunity. Furthermore, growth in the renewable energy sector and increasing urbanization create new market segments for specialized construction equipment. The focus on sustainable construction practices will continue to shape demand for eco-friendly solutions.

Leading Players in the Canada Construction Equipment Market Sector

- CNH Industrial N V

- Xuzhou Construction Machinery Group Co Ltd (XCMG)

- Deere & Company

- Liebherr Group

- Hitachi Construction Equipment Ltd

- JC Bamford Excavators Ltd (JCB)

- Caterpillar Inc

- Komatsu Ltd

- SANY Group

- AB Volvo

Key Milestones in Canada Construction Equipment Market Industry

- June 2023: LiuGong introduced the 856H-E MAX Wheel Loader, signaling a push towards electric construction equipment.

- April 2022: Doosan Infracore North America introduced four next-generation -7-series mini excavators, enhancing the mini-excavator segment.

Strategic Outlook for Canada Construction Equipment Market Market

The Canadian construction equipment market exhibits considerable long-term growth potential, predominantly driven by ongoing infrastructure investments, rapid technological advancements, and an increasing commitment to sustainable construction methodologies. For manufacturers to effectively harness emerging opportunities and maintain a competitive advantage, strategic collaborations and dedicated investments in research and development will be paramount. The market is set on a trajectory of sustained expansion, with a pronounced emphasis on the development and deployment of electric, hybrid, and highly advanced, technologically integrated equipment solutions.

Canada Construction Equipment Market Segmentation

-

1. Machinery Type

- 1.1. Cranes

- 1.2. Telescopic Handlers

- 1.3. Excavators

- 1.4. Loaders and Backhoes

- 1.5. Motor Graders

- 1.6. Other Machinery Types

-

2. Propulsion

- 2.1. Internal Combustion Engine

- 2.2. Electric and Hybrid

Canada Construction Equipment Market Segmentation By Geography

- 1. Canada

Canada Construction Equipment Market Regional Market Share

Geographic Coverage of Canada Construction Equipment Market

Canada Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Infrastructure Activities Across the Country

- 3.3. Market Restrains

- 3.3.1. Rapid Expansion of Construction Equipment Rental Industry

- 3.4. Market Trends

- 3.4.1. Growing Infrastructure development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Telescopic Handlers

- 5.1.3. Excavators

- 5.1.4. Loaders and Backhoes

- 5.1.5. Motor Graders

- 5.1.6. Other Machinery Types

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric and Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CNH Industrial N V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xuzhou Construction Machinery Group Co Ltd (XCMG)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deere & Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Liebherr Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Construction Equipment Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JC Bamford Excavators Ltd (JCB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Caterpillar Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Komatsu Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SANY Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AB Volvo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CNH Industrial N V

List of Figures

- Figure 1: Canada Construction Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Construction Equipment Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 2: Canada Construction Equipment Market Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 3: Canada Construction Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Construction Equipment Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 5: Canada Construction Equipment Market Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 6: Canada Construction Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Construction Equipment Market?

The projected CAGR is approximately 7.30%.

2. Which companies are prominent players in the Canada Construction Equipment Market?

Key companies in the market include CNH Industrial N V, Xuzhou Construction Machinery Group Co Ltd (XCMG), Deere & Company, Liebherr Group, Hitachi Construction Equipment Ltd, JC Bamford Excavators Ltd (JCB, Caterpillar Inc, Komatsu Ltd, SANY Group, AB Volvo.

3. What are the main segments of the Canada Construction Equipment Market?

The market segments include Machinery Type, Propulsion.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Infrastructure Activities Across the Country.

6. What are the notable trends driving market growth?

Growing Infrastructure development.

7. Are there any restraints impacting market growth?

Rapid Expansion of Construction Equipment Rental Industry.

8. Can you provide examples of recent developments in the market?

June 2023: LiuGong introduced the 856H-E MAX Wheel Loader, which is part of the company's range of electric construction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Canada Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence